Leave Travel Assistance Policy

Diunggah oleh

jitu20febJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Leave Travel Assistance Policy

Diunggah oleh

jitu20febHak Cipta:

Format Tersedia

Leave Travel Assistance Policy

OBJECTIVE:

With a view to enable employees to take time off from their work and to enjoy a holiday with their

family the !ompany has provided a poli!y for reimb"rsin# the travel e$penses in!"rred by the

employee alon# with his%her family members&

'CO(E:

This poli!y is appli!able to eli#ible employees of the !ompany&

)*TE O+ CO,,E-CE,E-T:

This poli!y will !ome into effe!t from .st 'eptember /001&

E2I3IBI2IT4:

This poli!y is appli!able to permanent employees of (2 and above !adre who have opted for 2T*

as part of their salary and their families&

The word 5family6 shall in!l"de 7i8 spo"se and !hildren9 7ii8 dependent parents and 7iii8 brothers

and sisters who are wholly dependent on the employee&

9 E$emption from ta$ is available to only two !hildren of an individ"al after .st O!tober :;&

<owever this restri!tion does not apply in respe!t of !hildren born before .st O!tober :; and

also in respe!t of m"ltiple births after first !hild&

Employees !an avail the option of !ombinin# 2T* for two years in a blo!k of fo"r years 7for e#=

/00/=01 /00>=/00: et!&8 and take them to#ether& In !ase the employee avails 2T* every year

the 2T* wo"ld be s"bje!ted to ta$ as per In!ome Ta$ r"les and re#"lations&

POLICY

2T* is appli!able when the employee is pro!eedin# on leave to any pla!e in India&

The 2T* shall be the amo"nt a!t"ally in!"rred on "ndertakin# s"!h travel s"bje!t to the followin#

!onditions namely:

Where the jo"rney is performed by air an amo"nt not e$!eedin# the air e!onomy fare of

the national !arrier by the shortest ro"te to the pla!e of destination&

Where pla!es of ori#in of jo"rney and destination are !onne!ted by rail and the jo"rney is

performed by any mode of transport other than by air an amo"nt not e$!eedin# the air=

!onditioned first !lass rail fare by the shortest ro"te to the pla!e of destination&

Where the pla!es of ori#in of jo"rney and destination or part thereof are not !onne!ted by

rail the amo"nt e$emption for shall be:

Where a re!o#ni?ed p"bli! transport system e$ists an amo"nt not e$!eedin# the .st

!lass or del"$e !lass fare as the !ase may be on s"!h transport by the shortest ro"te to

the pla!e of destination&

Where no re!o#ni?ed p"bli! transport system e$ists an amo"nt e@"ivalent to the air=

!onditioned first !lass fare for the distan!e of the jo"rney by the shortest ro"te as if the

jo"rney has been performed by rail&

PROCEDURE FOR AVAILING LTA

*n employee availin# 2T* shall s"bmit his%her re@"est for leave to the san!tionin# a"thority at

least .1 days in advan!e& 'an!tion of leave sho"ld not be ass"med for 2T*& 2T* will be payable

only when an employee a!t"ally pro!eeds on leave for a minim"m period of 1 workin# days

san!tioned in advan!e as per the leave r"les in for!e& When the 2T* leave !ommen!es at the end

of the year and ends in the -ew 4ear the 2T* will be treated as it is availed for the year in whi!h

the leave !ommen!ed& The employee shall s"bmit the !laim form alon# with s"pportin# ti!kets

within one week on res"min# d"ty from 2T*& In !ase an employee fails to s"bmit the de!laration

of travel as re@"ired the 2T* !laim shall be liable to in!ome ta$ whi!h will be ded"!ted from

salary and responsibility of satisfyin# Company%IT a"thorities rest with the employee !on!erned

re#ardin# e$emption of the same for I T p"rposes&

In !ase an employee is not able to avail leave after #ettin# san!tion for 2T* d"e to work

e$i#en!ies his%her eli#ible family members will be allowed to take the advanta#e of the poli!y&

<owever the 2T* amo"nt re!eived by the employee will be liable to in!ome ta$ and the same will

be ded"!ted from salary at so"r!e&

2T* payment will be !onsidered as per prevalent IT re#"lations s"bje!t to employee f"rnishin#

ne!essary information%proof&

AB*-TB, O+ BE-E+IT

*s per terms of appointment letter&

C2*I, +OC,*T

* simple re@"est letter to <C%+inan!e alon# with s"pportin# do!"ments for reimb"rsement&

The comany reserves the ri!ht to amen"#$ith"ra$ the olicy at anytime $itho%t

assi!nin! any reason $hatsoever& The %tility an" interretation o' the olicy $ill (e at the

sole "iscretion o' the )ana!ement

Tax deduction allowed on LTA

Tax deduction allowed on LTA

Leave travel assistance (LTA) is generally paid as a part of the remuneration of

employees. With some proper planning, an employee can save some tax through this

mode.

The LTA amount is received from the employer towards a journey within ndia. LTA is

eligi!le for deduction under the ncome Tax Act su!ject to compliance with specified

conditions. Section 10 of the Income Tax Act specifies that in the case of an individual,

the amount of any travel concession or assistance received !y him is exempt.

t should !e received from his employer for himself and his family. "e should !e

proceeding on leave to travel to any place in ndia. The exemption is availa!le to an

individual for two journeys in a !loc# of four calendar years commencing from the

calendar year $%&'. The current !loc# is calendar years ((anuary to )ecem!er) *++' to

*++%.

Where such travel concession or assistance is not availed of !y the individual during any

such !loc# of four calendar years, it may !e carried forward. ,uch amount of travel

concession or assistance can !e availed of !y the individual during the first calendar year

of the immediately succeeding !loc# of four calendar years, and is eligi!le for exemption.

Any fixed sum paid !y the employer to the employee !y way of LTA on the !asis of a

self-declaration !y the employee is not exempt from tax. n order to claim the exemption,

he must produce original proofs for expenses, i.e., the tic#ets, !ills etc.

The tax !enefit is for actual fare only. "otel, food, sight seeing, local conveyance etc are

not allowed. .or the purposes of this exemption, /family/ means the spouse and children

of the individual, and parents, !rothers and sisters who are mainly dependent on the

individual. n case the journey is !y air, an amount not exceeding the economy fare of the

national carrier !y the shortest route to the place of destination is ta#en. n case the place

of origin of journey and destination are connected !y rail, and the journey is !y any other

mode of transport other than !y air, an amount not exceeding the air conditioned first

class rail fare !y the shortest route to the place of destination is ta#en. Where the place of

origin of journey and destination are not connected !y rail, the amount eligi!le for

exemption is - where a recognised pu!lic transport system exists, an amount not

exceeding the first class or deluxe class fare, on such transport, !y the shortest route to

the destination, and where no recognised pu!lic transport system exists, an amount

e0uivalent to the air conditioned first class rail fare, for the distance of the journey, !y the

shortest route. The amount exempt will not exceed the amount of expenses actually

incurred for the travel. The exemption is availa!le for a maximum of two children of an

individual. The journey should !e in ndia only. The exemption is availa!le for the

farthest place !y shortest route when a circular journey is underta#en.

The amount exempted under ,ection $+ will !e the amount actually incurred on the

travel.

Anda mungkin juga menyukai

- Relocation PolicyDokumen8 halamanRelocation Policyashish.the7353Belum ada peringkat

- LEAVE TRAVEL ALLOWANCE POLICYDokumen6 halamanLEAVE TRAVEL ALLOWANCE POLICYVipin SinghBelum ada peringkat

- GENERAL TERMS AND CONDITIONS OF RAILWAY E-TICKETINGDokumen1 halamanGENERAL TERMS AND CONDITIONS OF RAILWAY E-TICKETINGZakir QureshiBelum ada peringkat

- EE SC16 PackageDokumen1 halamanEE SC16 Packagedynamic2004Belum ada peringkat

- Not 0032014 2162014Dokumen5 halamanNot 0032014 2162014Basil Baby-PisharathuBelum ada peringkat

- Appointment Letter Temporary EmployeeDokumen2 halamanAppointment Letter Temporary EmployeeShrish TiwariBelum ada peringkat

- Note On Salary TaxDokumen10 halamanNote On Salary TaxnatarajevBelum ada peringkat

- Lta GuidelineDokumen2 halamanLta Guidelinevenkatesh8919chBelum ada peringkat

- Hmip Contract Terms and Agreement SneiDokumen5 halamanHmip Contract Terms and Agreement SneiMa2nk AsepBelum ada peringkat

- Not 0032014 1172014Dokumen3 halamanNot 0032014 1172014Basil Baby-PisharathuBelum ada peringkat

- Turkish Airlines First Officer RequirementsDokumen5 halamanTurkish Airlines First Officer RequirementsLin CYBelum ada peringkat

- Equipment Rental ContractDokumen6 halamanEquipment Rental ContractCatherine MalenyaBelum ada peringkat

- Foreign Travel Ruels: 1. TitleDokumen5 halamanForeign Travel Ruels: 1. TitleAnonymous cakUUIxSBelum ada peringkat

- Declare premiums due after cutoffDokumen3 halamanDeclare premiums due after cutoffNeil CruzBelum ada peringkat

- Travelling Allowance Rules of Coal India LimitedDokumen12 halamanTravelling Allowance Rules of Coal India LimitedTowshif SkBelum ada peringkat

- Ead Proforma Surty Undertaking1Dokumen3 halamanEad Proforma Surty Undertaking1Muhammad Faisal KhanBelum ada peringkat

- Lta, Telephone & Professional Development GuidelinesDokumen1 halamanLta, Telephone & Professional Development GuidelinesMani Shankar RajanBelum ada peringkat

- Notes On LTA, Car Lease and Home InternetDokumen3 halamanNotes On LTA, Car Lease and Home InternetRiu TypoBelum ada peringkat

- LEAVE TRAVEL CONCESSION RULESDokumen27 halamanLEAVE TRAVEL CONCESSION RULESShiv ShivaBelum ada peringkat

- Government of India Ministry of Finance Department of Revenue Central Board of Excise & Customs NotificationDokumen5 halamanGovernment of India Ministry of Finance Department of Revenue Central Board of Excise & Customs Notificationpatelpratik1972Belum ada peringkat

- Malaysian Labour LWDokumen11 halamanMalaysian Labour LWMiyYenBelum ada peringkat

- Crisostomo vs. CADokumen4 halamanCrisostomo vs. CAGuillermo Olivo IIIBelum ada peringkat

- Lion Air eTicket Itinerary Receipt for Jakarta to Medan FlightDokumen2 halamanLion Air eTicket Itinerary Receipt for Jakarta to Medan FlightGeri FirmansahBelum ada peringkat

- PEACE Personal Services Contractor 2011 - MS 744a Attachment E-2 (Combined LT PSC Template) After Nov 21 2011Dokumen20 halamanPEACE Personal Services Contractor 2011 - MS 744a Attachment E-2 (Combined LT PSC Template) After Nov 21 2011Accessible Journal Media: Peace Corps DocumentsBelum ada peringkat

- Menu of This Website. The ISSB Buses Will Be Available at Respective Railway Stations/ General Bus Stands. YouDokumen5 halamanMenu of This Website. The ISSB Buses Will Be Available at Respective Railway Stations/ General Bus Stands. YouRabia SajjadBelum ada peringkat

- Kindly Find Below Our Quote For Sale of EURO/GBP Currency/Travelers Cheque/Travel CardDokumen6 halamanKindly Find Below Our Quote For Sale of EURO/GBP Currency/Travelers Cheque/Travel CardDhruv MishraBelum ada peringkat

- APPOINTMENT LETTER - ApprovedDokumen3 halamanAPPOINTMENT LETTER - ApprovedMohammed OmerBelum ada peringkat

- Public Service Commission, Uttar PradeshDokumen5 halamanPublic Service Commission, Uttar PradeshDrPankaj YaduvanshiBelum ada peringkat

- Appg 2014 AdmissionsDokumen33 halamanAppg 2014 AdmissionsPrasad DvssrBelum ada peringkat

- Terms and ConditionsDokumen7 halamanTerms and ConditionsdctravelexpertsBelum ada peringkat

- SEZ Act 2006 Analysis Special Economic Zones Provisions ProceduresDokumen9 halamanSEZ Act 2006 Analysis Special Economic Zones Provisions ProceduresSri Harsha KothapalliBelum ada peringkat

- 04 - APX Booking Request FormDokumen2 halaman04 - APX Booking Request FormRavi SalimathBelum ada peringkat

- 2001 Pre-Week TaxDokumen65 halaman2001 Pre-Week TaxAlexandRheaVillahermosaBelum ada peringkat

- Central Power Distribution Company of A. P. Limited: Memo No - CGM (HRD) /GM (IR&L) /AS (IR) /PO (IR) /588-J3/10, dt17-04-2012Dokumen8 halamanCentral Power Distribution Company of A. P. Limited: Memo No - CGM (HRD) /GM (IR&L) /AS (IR) /PO (IR) /588-J3/10, dt17-04-2012penusilaBelum ada peringkat

- Eurojust Application - Form - ENDokumen8 halamanEurojust Application - Form - ENFoinikas CiaoBelum ada peringkat

- EO No. 248Dokumen9 halamanEO No. 248Gabriel GonzalezBelum ada peringkat

- 2013notification SAIL Bhilai Steel Plant Operator Cum Technician TraineeDokumen6 halaman2013notification SAIL Bhilai Steel Plant Operator Cum Technician Traineeprasadpra17Belum ada peringkat

- Applications For Visa For Family Reunion For SpousesDokumen2 halamanApplications For Visa For Family Reunion For SpousesArijit BarikBelum ada peringkat

- Gazette Date: 13/06/2014 Last Date: 16/07/2014 Category No: 293/2014Dokumen2 halamanGazette Date: 13/06/2014 Last Date: 16/07/2014 Category No: 293/2014Basil Baby-PisharathuBelum ada peringkat

- WWW - Payment.irctc - Co.in Cgi-Bin Bv60.Dll Irctc ServicesDokumen1 halamanWWW - Payment.irctc - Co.in Cgi-Bin Bv60.Dll Irctc ServiceshappyraamBelum ada peringkat

- Oracle Solution Services India Pvt Limited., LTA CLAIM / DECLARATION FORMDokumen1 halamanOracle Solution Services India Pvt Limited., LTA CLAIM / DECLARATION FORMsmohammedsaadBelum ada peringkat

- Income TaxDokumen10 halamanIncome TaxSanda ZahariaBelum ada peringkat

- Taxation ProjectDokumen12 halamanTaxation ProjectVeronicaBelum ada peringkat

- SET O Form 04-14Dokumen87 halamanSET O Form 04-14nischal009Belum ada peringkat

- Section 10Dokumen42 halamanSection 10Mrigendra MishraBelum ada peringkat

- From The Airport To The City CenterDokumen3 halamanFrom The Airport To The City Centersoledad1672Belum ada peringkat

- Guest Lecturer invitation letter templateDokumen2 halamanGuest Lecturer invitation letter templateArizfaBelum ada peringkat

- Enquiry regarding refugee status determination and immigration enforcement vacanciesDokumen13 halamanEnquiry regarding refugee status determination and immigration enforcement vacanciesManzini MbongeniBelum ada peringkat

- Lion Air Group Gets Special Flight Exemption During PandemicDokumen11 halamanLion Air Group Gets Special Flight Exemption During PandemicFerryBelum ada peringkat

- SBI LFC Circular PDFDokumen10 halamanSBI LFC Circular PDFGuru SrinivasanBelum ada peringkat

- AED MEDICAL RESIDENCY PROGRAM TERMSDokumen5 halamanAED MEDICAL RESIDENCY PROGRAM TERMSNavin ChandarBelum ada peringkat

- Pcs Travel Entitlements CalculatorDokumen6 halamanPcs Travel Entitlements Calculatortroy_banksBelum ada peringkat

- Extending Qualification Period for BFP and BMP AppointmentsDokumen6 halamanExtending Qualification Period for BFP and BMP Appointmentsmidzbeauty100% (2)

- United Pass Travel Guide 2015 - Edited July 2015Dokumen4 halamanUnited Pass Travel Guide 2015 - Edited July 2015taptico100% (1)

- Apply online for District Soil Conservation Unit posts before April 16Dokumen3 halamanApply online for District Soil Conservation Unit posts before April 16Basil Baby-PisharathuBelum ada peringkat

- Infosys Limited: Serial Number: SE Candidate ID: 60936354 Employee No: Year: FY 2014 - 2015Dokumen6 halamanInfosys Limited: Serial Number: SE Candidate ID: 60936354 Employee No: Year: FY 2014 - 2015Bobby ChithariBelum ada peringkat

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDari Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsBelum ada peringkat

- An Aviator's Field Guide to Owning an Airplane: Practical insights for successful aircraft ownershipDari EverandAn Aviator's Field Guide to Owning an Airplane: Practical insights for successful aircraft ownershipPenilaian: 5 dari 5 bintang5/5 (1)

- Mail MergeDokumen5 halamanMail Mergejitu20febBelum ada peringkat

- Account Statement From 1 Nov 2016 To 15 Apr 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen6 halamanAccount Statement From 1 Nov 2016 To 15 Apr 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancejitu20febBelum ada peringkat

- Free Business ProposalDokumen6 halamanFree Business Proposaljitu20febBelum ada peringkat

- 360 Performance Appraisal Format1 204Dokumen5 halaman360 Performance Appraisal Format1 204jitu20febBelum ada peringkat

- Implementing 360 degree appraisalsDokumen5 halamanImplementing 360 degree appraisalsjitu20febBelum ada peringkat

- Cbse I To XDokumen15 halamanCbse I To Xjitu20febBelum ada peringkat

- TataDokumen2 halamanTatajitu20febBelum ada peringkat

- A 2 950Dokumen48 halamanA 2 950jitu20febBelum ada peringkat

- EarthquakesDokumen15 halamanEarthquakesPriya SharmaBelum ada peringkat

- DATE:-01/06/07: Mr. Manish KhandelwalDokumen5 halamanDATE:-01/06/07: Mr. Manish Khandelwaljitu20febBelum ada peringkat

- A To Z On TrainingDokumen34 halamanA To Z On Trainingmathew007100% (3)

- 360 Degree Appr Format 277Dokumen2 halaman360 Degree Appr Format 277jitu20febBelum ada peringkat

- Fabia Scout Vs SwiftDokumen10 halamanFabia Scout Vs Swiftjitu20febBelum ada peringkat

- InductionDokumen3 halamanInductionjitu20febBelum ada peringkat

- Appointment Letter With Bond - Blank 110Dokumen6 halamanAppointment Letter With Bond - Blank 110yashelectron67% (3)

- Performance Evaluation FormDokumen3 halamanPerformance Evaluation Formjitu20febBelum ada peringkat

- Sub:-Appointment Letter For The Position of Sales ExecutiveDokumen3 halamanSub:-Appointment Letter For The Position of Sales Executivejitu20febBelum ada peringkat

- Induction KitDokumen15 halamanInduction Kitjitu20febBelum ada peringkat

- Miss or MsDokumen1 halamanMiss or Msjitu20febBelum ada peringkat

- Email Etiquette: 1. Start With A SalutationDokumen10 halamanEmail Etiquette: 1. Start With A Salutationjitu20febBelum ada peringkat

- Key ResponsibilityDokumen6 halamanKey Responsibilityjitu20febBelum ada peringkat

- Induction ReportDokumen1 halamanInduction Reportjitu20febBelum ada peringkat

- Reference LetterDokumen1 halamanReference Letterjitu20febBelum ada peringkat

- Exit Interview Form 551Dokumen5 halamanExit Interview Form 551jitu20febBelum ada peringkat

- PHD DataVizChallenge ArtiDokumen1 halamanPHD DataVizChallenge Artijitu20febBelum ada peringkat

- Epf All DetailsDokumen29 halamanEpf All DetailsarshiyashaikhBelum ada peringkat

- CarDokumen2 halamanCarjitu20febBelum ada peringkat

- Employee Engagement ActivitiesDokumen34 halamanEmployee Engagement Activitiesvicnagda0% (1)

- Training GamesDokumen24 halamanTraining Gamesjitu20febBelum ada peringkat

- H Im 81eDokumen28 halamanH Im 81eMaria DazaBelum ada peringkat

- Chrysler ManualDokumen38 halamanChrysler ManualJavi Chito0% (1)

- POWER TRUCK-manualDokumen28 halamanPOWER TRUCK-manualYathawan Nair ThamutharamBelum ada peringkat

- A Comparative Study of Effect of Motorcycle Volume On Capacity of Four Lane Urban Roads in India and ThailandDokumen11 halamanA Comparative Study of Effect of Motorcycle Volume On Capacity of Four Lane Urban Roads in India and ThailandManu BkBelum ada peringkat

- Short Course in Ship Hydrostatics and StabilityDokumen1 halamanShort Course in Ship Hydrostatics and StabilitywebwebwebwebBelum ada peringkat

- List of Auto in Rajahmundry - PythondealsDokumen5 halamanList of Auto in Rajahmundry - PythondealsManoj Digi LoansBelum ada peringkat

- USSBS Report 64, The Effect of Air Action On Japanese Ground Army Logistics, OCRDokumen112 halamanUSSBS Report 64, The Effect of Air Action On Japanese Ground Army Logistics, OCRJapanAirRaidsBelum ada peringkat

- 1111 RAIM ATMC Nov.11Dokumen29 halaman1111 RAIM ATMC Nov.11PhongLanBelum ada peringkat

- Bonding Systems For The Track SuperstructureDokumen6 halamanBonding Systems For The Track Superstructurepetronela.12Belum ada peringkat

- Inputs For Design of Flexible PavementsDokumen46 halamanInputs For Design of Flexible PavementsMadhavpokale100% (2)

- An Analysis of Modernistic Characteristics in The Short StoryDokumen4 halamanAn Analysis of Modernistic Characteristics in The Short StoryMei XingBelum ada peringkat

- Bus Ticket TS4D43900748Dokumen5 halamanBus Ticket TS4D43900748Shivam YadavBelum ada peringkat

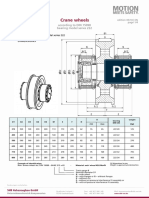

- Datasheet Crane Wheels DIN15090Dokumen4 halamanDatasheet Crane Wheels DIN15090ayavuzbvsBelum ada peringkat

- Station Design Idiom 2Dokumen225 halamanStation Design Idiom 2Maksym HolovkoBelum ada peringkat

- Brand Audit of DHLDokumen33 halamanBrand Audit of DHLAyesha Khalid100% (1)

- 29-48 Delco RemyDokumen184 halaman29-48 Delco Remybigjl71100% (3)

- Safety Inspection Checklist For Shipboard OperationsDokumen4 halamanSafety Inspection Checklist For Shipboard OperationsIonescu Eda100% (1)

- 31FL5541Dokumen56 halaman31FL5541Sunthron SomchaiBelum ada peringkat

- Global Logistics - New Directions in Supply Chain Management, 6th EditionDokumen28 halamanGlobal Logistics - New Directions in Supply Chain Management, 6th EditionChanchal SharmaBelum ada peringkat

- Simple Magazine #9Dokumen4 halamanSimple Magazine #9Ngôn ngữ AnhBelum ada peringkat

- Ecuador Bike Rental by Sleipner, A New Option in EcuadorDokumen2 halamanEcuador Bike Rental by Sleipner, A New Option in EcuadorPR.comBelum ada peringkat

- Sparkle Travel Policy-India-100619 PDFDokumen1 halamanSparkle Travel Policy-India-100619 PDFKandula RajuBelum ada peringkat

- 72 Elderly-Drivers Can StudentDokumen5 halaman72 Elderly-Drivers Can StudentTamara MoralesBelum ada peringkat

- Demag SafeControl ensures safety and precision for cranesDokumen9 halamanDemag SafeControl ensures safety and precision for cranesPramuda SirodzBelum ada peringkat

- Mechanic Repair Maintenance of Light Vehicles.163153836Dokumen23 halamanMechanic Repair Maintenance of Light Vehicles.163153836swami061009Belum ada peringkat

- Bunker Calculations (Daily Consumption HO 42 T FW 12t)Dokumen2 halamanBunker Calculations (Daily Consumption HO 42 T FW 12t)bittu692Belum ada peringkat

- BMW 7-Series Project Process ChangesDokumen27 halamanBMW 7-Series Project Process ChangesSambit RoyBelum ada peringkat

- State of The Nation Address President Museveni June 6, 2019Dokumen46 halamanState of The Nation Address President Museveni June 6, 2019The Independent Magazine100% (2)

- Multifunctional Parking-Major ProjectDokumen6 halamanMultifunctional Parking-Major ProjectShreenidhi JoshiBelum ada peringkat

- Wolter Jetfan Broschuere English 2017 PDFDokumen15 halamanWolter Jetfan Broschuere English 2017 PDFViệt Đặng XuânBelum ada peringkat