Final Test Deposit - Murabahah

Diunggah oleh

Nor Syahidah0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

61 tayangan13 halamanFinal test deposit - murabahah

Judul Asli

Final test deposit - murabahah

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniFinal test deposit - murabahah

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

61 tayangan13 halamanFinal Test Deposit - Murabahah

Diunggah oleh

Nor SyahidahFinal test deposit - murabahah

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 13

1

Murabahah is an alternative to interest-based financial transactions assumes importance

only when it is transacted on a deferred payment basis.This therefore, calls for a study of

the concept of postponement of payment in Murabahah. The terms of payment in the

classical Murabahah did not necessarily involve credit; they could be either cash or credit.

It may, however be pointed out that the legality of postponement of payment is one of the

general features of lawful sales term Bai Muajjal or Bai Bithaman Ajil (BBA) which

refers to sale of goods or property against deferred payment. Bunched with the

Murabahah, BBA would mean sale with an agreed profit margin over the cost price along

with deferred payment.

The complex type of contractual arrangement could create a number of issues relating to

the sale contract, credit price and legal implications of combining promise and agency with

the actual Murabahah contract. There are about 10 issues and controversies of BBA

contract that have been discussed in the class. Discuss any five (5) of them.

Murabahah means mark up sale. It is a sale contract in which the object of sale is sold at a price

equivalent to the cost price and profit margin. If the cost price equals $300 and the profit margin

equals $100, the murabahah price equals $400. Murabahah nowadays has been associated with

credit sale and this is totally not accurate.

There are two types of murabahah:

Cash murabahah a sale contract where the seller sells a commodity with a price equal to

the cost price and a profit margin. The purchased is settle in cash

Credit murabahah a credit salewith purchases settle by installment payments. The price

is equal to cash murabahah prices but a premium is added over the profit margin to reflect

time value of money. In Malaysia, short term credit murabahah is simply called

murabahah with payment payable lump sum. A long term credit murabahah is known as

al bai bithaman ajil.

BBA contract is a sale contract in which the payment of the price is deferred and payable at a

certain particular time in the future. BBA also referred to as the sale and purchase transaction for

the financing of an asset in a deferred and installment basis with a pre-agreed payment period.

BBA is employed by the bank to provide medium to long term financing to the clients who

intend to acquire following items: houses, land, motor vehicle, consumer good, shares and etc.

two main purpose of financing intended in the practice BBA are to finance the acquisition of an

asset and to provide liquidity.

2

BBA Financing

1. Sign 2 document simultaneously

In BBA agreement, both party bank and cusomer required to sign Property Purchase

Agreement (PPA) to secure ownership before executing the Property Sale

Agreement(PSA). But the problem is this two agreements is sign simultaneously

between customer and Islamic bank.

This practices is invalid because in contract of exchange(muawadat), the same

individual cannot become an agent or representative of two different parties at the

same time(simultaneously). However, the bank can appoint the customer as its agent

or representative to purchase a house for himself. This act will lead to fraud because

probably the house does not exist and the application of BBA financing is merely to

acquire cash as a debt or loan.

2. The absence of Iwad

Interest is prohibited in Islam because it is seen as an unjustified means of profit and

wealth creation since the exchange of an equivalent for a higher non equivalent does

not require the creditor to hold market and systematic risks as the loans are

collatarized and secured by a third party guarantee. The creditor provides practically

no-value-added service to the debtor. For this reason, the Shariah requires all

legitimate exchange to contain Iwad an equivalent counter. According to Ibn al-

1. Customer identifies the

asset to be acquired

2. Bank purchases the

assets from owner on

cash basis

Bank

Customer

Owner of asset

3. Bank sells the asset to the customer

at a selling price + profit margin

4. The customer

repays the bank by

installments

3

Arabi, he said that every increase which is without Iwad or an equal counter value is

riba. Iwad is therefore the basic trait or condition sine qua non of a lawful(halal)

sale. This is because a sale is necessarily an exchange of a value against an equivalent

value. It is mean that the price a consumer pays must be compensated with an

equitable return that he enjoys from the purchase.

Based on BBA transaction, the issue concern here is the availability of iwad(counter

value). According to Rosly, the Quran sanctions that trade (al-bay) because the profit

generated from trading incorporates risk-taking whereas the contractual profit from

loan transaction (riba) is risk free. In furthers, assert that al-bay implies the existence

of iwad required by the Shariah to be lawful profit in Islam. Three elements of iwad

that should exist are risk (ghrum), work, effort(ikhtiyar) and liability(daman). Iwad is

the necessary requirement to be fulfilled in trading as it injects a sense of equity and

justice into a business which makes it moral superior to an interest-bearing system.

There is no risk taking in the current BBA financing and hence does not merit the the

Quranic concept of bay. Daman (liability) should also exist in a trading transaction

whereby the supplier provides guarantees on the good sold. But in the current BBA

financing, customer is forced to face the financial burden of paying for the house

even before it is completed as he engaged in a debt contract with the bank at the

outset. By ignoring the concept of iwad, the BBA contract is not seen as conforming

to the maqasid al-shariah that removes hardship and preventing harm(daf al-darar) in

the economic sphere, thereby leaving the welfare of people unprotected.

3. House made under construction

In BBA financing for house under construction, the property that is transacted is not

in existence yet. This might contradict the ruling on the existence oF subject matter in

a sale contract. If the opinion of the majority of jurist is to be applied, the BBA

facility on property under construction is not allowed.

Even if the opinion of ibn Tamiyyah and Ibn al-Qayyim that allows the selling of

non-existent subject matters is to be followed, one central issue still remains their

opinion in allowing the selling of non-existent subject matter based on the near

certainty of delivery. Hence, they maintain that even though the subject matter does

not exist during the time of conclusion, the contract is still valid provided that the

parties to the contract are confident that the delivery is possible at the future agreed

time. But if take the opinion as a consideration, the new problem will occur when the

delay in delivery and will caused a lot of trouble to the house buyers

4. Beneficial ownership

A contract of sale in Islamic law require

4

In BBA, the seller namely the bank is required to hold ownership before any asset

sale is made, so the profit generated from murabahah and BBA is halal as the sale

fulfills the requirement of ownership and by virtue of the asset, he is exposed to

market risk(ghorm). As the seller of the property, the bank is requested by the

shariah to hold ownership of the property and to carry all liabilities arising there from

including defects. But current BBA practices show that the banks acts as merely a

financier not as a seller and exempts itself from all liabilities of ownership. This is of

course ignores the shariah principles of al-ghrum bil ghunm( no reward without risk),

ikhtiyar (value-addition or effort) and al-kharaj bi daman(any benefit must be

accompanied with liability there by rendering the BBA profit to be implicated with

riba.

5. Delay and Delinquencies

For house pending completion or delay, where the transaction involves the

application, normally the purchaser or borrower may pay some portion of the price as

deposit. However, on payment of the deposit and on the execution of the sale and

purchase agreement with the developer, the purchaser applies for a housing

loan(BBA) from an Islamic bank to finance the balance purchase price and this will

effect by PPA and PSA as well a other document.

In issue relate to house pending completion, the issue of ownership of the purported

uncompleted house is still unresolved. In other words, the ownership is not a full

(milk ghair al-tam) and unconditional ownership but an incomplete ownership

(equitable or beneficial ownership). Incomplete ownership would not give any

absolute power or authority to the purchaser or borrower to sell the purported house

to Islamic bank even though his ownership of the house is still incomplete in order to

get the housing loan from Islamic bank, on the condition that the actual owner has

agreed to such an undertaking. This is not acceptable in Islamic law as the ownership

of the purchaser over the house is still incomplete which can justify the selling of the

house by the purchaser to the bank and for the bank to re-sell the house to purchaser.

Question 2 (25 marks)

Compare and Contrast between Bai Al-Inah and Bai Al-Tawarruq.

5

Bai inah

Inah is the sale of an item at profit on deferred payment for its subsequent buyback by the

original. Bai inah also refer to trading whereby the seller sells his assets to the buyer at an agreed

selling price to be paid by the buyer at a later date. After that , the buyer immediately sells back

the assets to the seller at a cash price lower than the agreed sellind price.

The majority of Islamic jurisy state that there are three forms of trading categorized as bai inah

whereby it can be concluded that all the assets sold come from the financier. The financier will

sell a product to the buyer at an agreed price to be paid later. The financier then immediately

buys back the asset at a cash price lower than the deferred selling price.

Majority of the opinion said that bai inah was not permissible because it was the zariah(way) or

hilah(legal excuse) to legitimate riba. The hanafi mazhab was of the oopinion that bai inah was

permissible only if it involves a third party which act as an intermediary between the seller and

buyer. The Maliki and Hanbali mazhab was rejected bai inah and considered it valid. This

opinion is based on the opinion sad zariah that is aimed at preventing practices that could lead to

forbidden acts in like riba.

Bai tawarruq

Tawarruq means selling something on deferred basis and then buying it back in cash at a lower

prices than the deferred price. For example someone sells his commodity at a price that is

already known to be paid by the deferred payment. He then buys it at a lesser price than the

deferred price, it is known because of obtaining the money for sahib al-inah because al-ain is the

present property from the money.

Tawarruq technically is the purchasing of a commodity on credit by the mutawarriq and selling it

to a person other than the initially sell for a lower price on cash. Actually tawarruq is a sale

contract whereby a buyer buys an asset from a seller on deferred payment and subsequently sells

the assets to the third party for cash with a price lesser than the deferred price. This transaction

calls tawarruq because when the buyer purchases the asset on deferred terms, it is not the buyers

intention to utilize the benefit from the purchased asset rather to facilitate him to attain liquidity.

There have three forms of tawarruq :

- The person in need of cash purchases a commodity on credit and sells it to another for

cash without any party being aware of his need or intention.

- The person in need requests for a loan from a trader who excuses himself from lending to

him but is willing to sell a commodity to him on credit for its cash price. The mutawarriq

then sells it at any possible price be it more than the purchase price or less.

- The third form is similar to the second except that the trader sells the commodity to the

mutawarriq for a price higher than its market value against the delay in payment.

6

Difference between Tawarruq an Inah

Tawarruq

Bay inah

The different between tawarruq and inah is that in inah, one who requires liquidity purchases an

asset from a seller on credit thereafter sells it on cash basis at a price lower than the purchase

price to the seller himself. Tawarruq in the other hand, indicates an instance where a personwho

needs liquidity purchases an asset from somenone on credit and thereafter sells it usually for a

lower price to aperson other than the original seller that is to a third party.

For bay inah transaction, the term inah used because the particular asset purchased had found its

way back to the original seller and according to some jurist, this fact strongly indicates that the

Bank

Customer

1

2

3

4

1. Sold on deferred

payment at agreed

price

2. customer pays

cost +markup on

deferred term

4. bank pay spot

price for the assets.

Customer get cash

3. resell the asset to

bank

7

asset had been utilized merely as a hibah or legal strategy for earning riba on the basis of which

the ruled the transaction prohibited. Different for tawarruq transaction, because it involves three

party and not buy back to same person, so the structure does not give ready indication of a hilah

adopted solely for circumventing riba. Since the asset in this case does not return to the original

vendor and is sold to a thir party, many have regarded the structure valid and acceptable.

Although bai inah is accepted in Malaysia, but it has not been accepted as shariah compliant

financing instrument in middle east as it is considered a legal fiction in that there is a buy back of

the goods on the part of seller therefore the sale and purchase transaction is merely to create a

debt obligation which is no different from or tends to lead to riba. But for tawarruq transaction,

its acceptable both in Malaysia and the Middle East.

However, the Fiqh Academy of the Organisation of Islamic Conference ("OIC Fiqh Academy"),

has, by its Resolution No. 179 (19/5) at its 19

th

Session held on 26-30 April 2009, held that

although classical tawarruq is permissible (so long as it complies with the requirements of sale

transactions), organised tawarruq and reverse tawarruq are not permissible.

Question 3 (25 marks)

Bank B offers Islamic Banking services to its customers. One of the services it offers is its

Islamic Investment Account. The bank refers to you to certify that its practices in the

Islamic Investment Account are Shariah compliant. The practice is as follow:

1. The bank guarantees that whatever happens the capital invested by the customer will

be refunded in full.

8

It is not shariah compliant because in mudharabah transaction, the profit and loss should be

bear by both party or by the capital provider and it not a loan transaction to guarantee the

loss. The current practice in Malaysia is to use partnership (mudarabah) as the underlying

contract in the Islamic investment account. Mudarabah is a contract of profit sharing

whereby the customer is the investor / capital provider and the bank is manager. The

customer and the bank will be sharing the profit according to certain ratio or percentage

agreed at the time of the contract. The financial loss, if any, will be borne by the customer as

capital provider.

In Malaysia, the practice is to have two types of Islamic investment account, the General

Investment Account (GIA), and the Special Investment Account (SIA). In GIA, the

mudarabah arrangement is of a general mandate (mudarabah mutlaqah) and the ratio of

profit sharing is more or less uniform / standard, advertised as a ready package between the

bank and the customer. In GIA, the minimum investment amount is lower than the SIA. In

SIA, the mudarabah arrangement is of a specific mandate (mudarabah muqayyadah), for

e.g., the customer can place restrictions to the bank as to the type of dealing, or project that

the bank can enter into with the capital. The ratio of profit sharing can be negotiated

between the customer and the bank. The minimum investment amount is higher than the

GIA.

The loss of the agent(mudharib) is by way of expended time and effort for which he will not

be given any remuneration. There is no restriction on the number of persons giving funds for

business or nay restriction on the working partners. Any ambiguity or ignorance regarding

capital or ratio of profit makes the contract invalid. If a mudharabah contract becomes

invalid for any reason the mudharib will be working for the necessary period as wage-earner

and will get ujratul-mithl(fair pay) for his job. He will not be given any share of the profit.

Loss if any, has to be borne by the financier. Loss means erosion of capital and no profit can

be recognized or claimed unless the capital of mudharabah is maintained intact. The

distribution of profit depends on the final result of the operations at the time of physical or

constructive liquidation of the mudharabah. Reserves can be compensated by the profit of

the future operation of the joint business or the reserves created in the past. If loss has

occurred in some transactions and profit has been realized in some others, the profit can be

used to offset the loss at the first instance then the remainder if ant shall be distributed

between the parties according to the agreed ratio.

2. The bank indicates a rate of potential profit based on its previous track record, but

clearly states that it is only an indicative rate and may change according to actual

profit made.

Yes, it is Shariah compliant because the indicative rate it just only the benchmark, not a real

use rate in the transaction.

In order to attract public attention to invest in one of these investment accounts, Islamic

banks will make known their indicative rate of return. The public must not be confused with

9

the rate and misjudged it as similar as the conventional interest rate(which is fixed from the

beginning).

The rate is only analytical and prediction based which is normally in accordance to the

banks previous performance. Hence, the bank is not obligated to pay out the profit based on

the indicative rate but the effective rate or the actual rate of return at time of maturity of the

bank will conclude the actual amount of the profit which will be distributed to the investors.

The indicative rate is dissimilar to interest rate as conventional bank is obliged to pay out

exactly as advertised(whether the bank makes profit or not it make no difference) and all

money which is placed in the conventional accounts are based on loans whereas funds

which are put into an Islamic account are based on the mudharabah investment contract

which is approved by Shariah. No actual profit rate can be determined upfront otherwise it

will be considered as riba.

An indicative rate was introduce as an indicator to investors and depositors who want to

invest or deposit their money in Islamic banking institution. The indicative rate uses profit

rate declared by every Islamic banking institution for assets they hold aas the basis of

computation. In mudharabah contract, the actual profits distributed will only be known after

the contract has matured based on a pr-agreed profit sharing. In the context of Islamic

banking in Malaysia, generally most of the investment portfolios are in the form of fixed

return such as financing based on bai bithaman ajil concept and investment in securities

based on bay dayn concept.

The council in its 9

th

meeting held on 25

th

February 1999 resolved that the use of indicative

profit rate in mudharabah contract in Islamic banking is permissible subject to the following

conditions:

1. The Islamic banking indicative profit rate is only regarded as a reference of the expected

return that would be received.

2. If the actual profit rate received by Islamic banking at the time the contract mature is

different from the indicative profit rate agreed at the inception of the contract the profit

rate paid to the investor must be based on the actual profit rate.

3. The bank caused an advertisement to be put at the banks windows saying: Open an

investment account with us and get a free Nokia 8210.

Yes,it is shariah compliant. The bank who provide investment account can put

advertisement to their customer in order to attract interest from the public. But if in amanah

contract like qard, bank cannot give advertisement to the customer with clear ways or not.

10

4. The bank also refuses investment from certain individuals and companies whose

income is questionable.

Yes, it is shariah compliant because the bank must make sure all their source of fund is clear

from prohibited elements.

The value of money and property determined from how they get in and how they expense it.

It is become prohibited from the hukmi not hissi. The haram elements not transferred to

another part.

Resolution from Shariah Advisory Council Bank Negara Malaysia:

SAC at the meeting datet 27 April 2006 has been decide that Islamic financial institution are

allowed to accept applications without need to investigate wether the customer is legitimate

source of funda, illegal or mixed with the lawful and lawful sources.

Although there are no restrictions for financial institutions to establish internal screening to

ensure that funding receives is based on Shariah.

Question 4 (25 marks)

There are several natures of risks in the case of Ijarah practicing in Islamic Banks. The

natures of risk are as follows:

i. The bank has purchased the asset as per the undertaking by the customer, but the

latter refuses to take the asset on lease.

A binding promise to lease should be obtained drom the customer at the time of booking

or purchase the asset by the bank. Hamish Jidduyah also should be taken from the client.

11

The bank can sell the asset in the open market and the actual loss can be recovered from

the Hamish Jiddiyah.

The transfer of ownership in all the above forms should be independent of the ijarah

contract and not an integral part of the transaction as a whole. The promise should be

unilateral and binding on the promisor and the other party must have the option not to

proceed. A new contract should be drawn up because ownership will not transfer merely

by virtue of the earlier promise. In ijarah transaction has separate documentation giving

the assets as gift contigent upo the condition that the remaining installments are paid, th

ownership will be transferred to the lessee if the condition is fulfilled without any other

document being singed.

ii. The customer may default in payment of the due rental. The bank might not be able

to recover even its investment; the asset is taken back, but it does not cover the loss.

An undertaking should be obtained from the customer to pay a certain amount to charity in

the case of late payment of rental. This amount will go to the charity account. Any actual

loss can be recovered from Hamisah Jiddiyah. Securitization or collateral can also be

realized.

Rental in respect of any lease contract when it becomes due takes the form of a debt

payable by the lessee. It will be subject to all rules prescribed for a debt. Therefore, a

charge from the lessee on the agreed rental would be riba prohibited by the shariah and

this could exploit this aspect and cause loss to the lessor by willful default. To provide a

deterrent, Shariah scholar allow that a donation or nay amount of penalty payable to

charity can be provided in the lease agreement, the amount of donation can vary according

to the period of default and can be calculated on a percentage per annum basis. Any

amount charged over and above the agreed rental must not become a part of the income of

the lessor and has to be given to charity. As this late payment penalty cannot become part

of the income of lessor banks, it is advisable that a suitable clause be incorporated in the

lease agreement to the effect that in cases of willful default, the bank will take possession

of the leased asset or enforce the collateral to recover its dues.

iii. Asset risk of major maintenance/destruction.

This risk can be managed through a takaful facility. Ijarah financing are subject to risks

related to real market risks arising from potential changes in asset pricing and in

maintenance and insurance or takaful costs and to the ability and desirability of the

lessess to pay the rental installments. In the case of total destruction of the asset, the

customer or sukuk holders will suffer the loss to the extent of their pro rata ownership.

Hence, ijarah sukuk may generate a quasi-fixed return since there might be default or

some unexpected expenses that could not be envisaged in advance. As such, the amount of

12

rent given in the contractual relationship represented by ijarah sukuk represents a

maximum return subject to deduction on account of unexpected expenses.

The primary issue in this problem is regard in determining the effects of loss or damage

To the asset. It is usually stipulated in the agreement that the lessee will be provided with

a copy of the policy and he will observe the conditions of the policy. If the asset is

destroyed and there is a lack observance of the conditions of the takaful policy that has

barred the lessor from recovery, the lessee is held liable. If the claim paid by the takaful

company is less than the loss incurred by the Islamic bank, the remainder of the loss

cannot be charged to the lessee and the bank itself should bear the loss.

iv. The lessee may use the asset carelessly, requiring the bank to bear major

maintenance expenditure.

A trust receipt should be obtained from the customer to bind him to use the asset as a

trustee. It may be mentioned in the trust receipt that loss due to negligence of the customer

shall be borne by the customer himself.

If the leased asset is damaged to the extent that it is no more able to give usufruct, the

contract of ijarah is terminated. Similarly in the case of an impediment to achieving the

normally expected objective of the contract, the lessee can terminate the contract. In this

situation, the parties may adjust the rental to avoid injustice to the lessee, keeping in mind

the partial damage to the asset and possibility of beneficial use. If an unidentified unit of

asset is leased, the contract will not terminate and the lessor will be required to replace it

with another asset of the agreed specifications.

If the leased asset is totally destroyed, the ijarah contract concluded on a identified asset is

terminated. The leased asset is held by the lessess in a fiduciary capacity on behalf of the

lessor , he will be held liable for any damage or destruction of the leased asset due to

misconduct or negligence.

v. Sale of asset at maturity the customer may not buy.

Only those assets should be leased that have sufficient resale value that the bank could sell

them in the market. Alternatively, a separate promise to purchase at the end of the lease

term can be obtained from the customer. The client can conveys his requirement and

enters into MOU for stipulating the overall structure of the deal. The bank can takes an

undertaking from the lessee along with some earnest money(Hamish Jiddiyah) to ensure

that the client is serious in his dealing and will take the asset on lesser when purchased by

the bank.

13

Anda mungkin juga menyukai

- Difference On Bba and MMDokumen1 halamanDifference On Bba and MMJelena CientaBelum ada peringkat

- The Concept of Bai Bithaman Ajil BBA PDFDokumen2 halamanThe Concept of Bai Bithaman Ajil BBA PDFNurul AinBelum ada peringkat

- Challenges in Murabahah Financin1Dokumen7 halamanChallenges in Murabahah Financin1Ayu Syahirah IzzahBelum ada peringkat

- Cases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsDokumen6 halamanCases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsMuhammad DenialBelum ada peringkat

- Group OneDokumen14 halamanGroup OneOmer WarsamehBelum ada peringkat

- Rajiv ShahDokumen32 halamanRajiv ShahRajiv ShahBelum ada peringkat

- MudarabahDokumen9 halamanMudarabahgzelle444100% (1)

- Credit Risk Issue in Partnership Contract The Case of MusyarakahDokumen28 halamanCredit Risk Issue in Partnership Contract The Case of MusyarakahhisyamstarkBelum ada peringkat

- Ibf Case StudyDokumen17 halamanIbf Case StudyAyesha HamidBelum ada peringkat

- Istisna: Financier's Rejection of Goods in IstisnaDokumen6 halamanIstisna: Financier's Rejection of Goods in Istisnaaqsa khanBelum ada peringkat

- Screening of Sukuk Bonds As Islamic Interbank and Investment ToolDokumen44 halamanScreening of Sukuk Bonds As Islamic Interbank and Investment Tooleaboulola100% (1)

- Hire Purchase FULL N FINALDokumen12 halamanHire Purchase FULL N FINALAmyt KadamBelum ada peringkat

- Other ServicesDokumen15 halamanOther ServicesMahyuddin KhalidBelum ada peringkat

- Letter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsDokumen54 halamanLetter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsGreeshma SinghBelum ada peringkat

- Islamic Mode of Finance IstisnaDokumen15 halamanIslamic Mode of Finance IstisnaMuhammad Asif100% (2)

- Issues and Chalenge of Bay Al InahDokumen3 halamanIssues and Chalenge of Bay Al InahFikri Ridzuan100% (1)

- Read MeDokumen15 halamanRead MeSau Fen ChanBelum ada peringkat

- Contracts in Islamic Commercial LawDokumen22 halamanContracts in Islamic Commercial Lawaribic_1Belum ada peringkat

- Bba 4 Semester (Morning) SESSION 2014-2018 Submitted byDokumen11 halamanBba 4 Semester (Morning) SESSION 2014-2018 Submitted byAnonymous qBJv2A8RABelum ada peringkat

- Assessments - mbb4013 Principles and Practices of Islamic BankingDokumen7 halamanAssessments - mbb4013 Principles and Practices of Islamic BankingFafaBelum ada peringkat

- Difference Between Takaful and Conventional InsurencaaaaaaaaaaaDokumen6 halamanDifference Between Takaful and Conventional InsurencaaaaaaaaaaaAyesha ShafiBelum ada peringkat

- Lecture 10 (A) - Al IJARAHDokumen39 halamanLecture 10 (A) - Al IJARAHAngela MaymayBelum ada peringkat

- Ujrah Based Credit Card: Innovation in Islamic Banking ProductsDokumen2 halamanUjrah Based Credit Card: Innovation in Islamic Banking ProductsJumadi Kadir100% (1)

- 05 MurabahahDokumen17 halaman05 MurabahahNur IskandarBelum ada peringkat

- GroupAssign HirePurchaseDokumen14 halamanGroupAssign HirePurchasechomel2u100% (1)

- ArticleonLetterofCredit Part-IIDokumen3 halamanArticleonLetterofCredit Part-IIessakiBelum ada peringkat

- 9120200105-Cement-Contract - India - draft-SINGAPORE-MAGDokumen26 halaman9120200105-Cement-Contract - India - draft-SINGAPORE-MAGHarish PurohitBelum ada peringkat

- Group Member 1: Abeer AzharDokumen30 halamanGroup Member 1: Abeer Azharbeer beerBelum ada peringkat

- Murabaha - Application (Trade Finance)Dokumen72 halamanMurabaha - Application (Trade Finance)Riz Khan100% (2)

- Draft IM - PAL Onshore Bond-05Jul2020Dokumen94 halamanDraft IM - PAL Onshore Bond-05Jul2020Zahed IbrahimBelum ada peringkat

- External Commercial BorrowingDokumen14 halamanExternal Commercial BorrowingKK SinghBelum ada peringkat

- Islamic BK CH 3 PDFDokumen27 halamanIslamic BK CH 3 PDFAA BB MMBelum ada peringkat

- Act 382 Sale of Goods Act 1957Dokumen32 halamanAct 382 Sale of Goods Act 1957Adam Haida & CoBelum ada peringkat

- Slidebusinesslaw 160930132004Dokumen19 halamanSlidebusinesslaw 160930132004Rishindran Paramanathan100% (1)

- Essentials of Islamic Finance: Final Quiz Fall 2012 AnswersDokumen2 halamanEssentials of Islamic Finance: Final Quiz Fall 2012 Answersshan100% (1)

- Rubber Glove20101001Time To Put Your Gloves Back OnDokumen9 halamanRubber Glove20101001Time To Put Your Gloves Back OnTodd BenuBelum ada peringkat

- Ijarah 4 Month-CompleteDokumen62 halamanIjarah 4 Month-CompleteHasan Irfan SiddiquiBelum ada peringkat

- Bai Al UrbunDokumen8 halamanBai Al UrbunSiti Hajar Ghazali100% (2)

- Diminishing Musharakah ConceptDokumen26 halamanDiminishing Musharakah ConceptHasan Irfan SiddiquiBelum ada peringkat

- APC-LOI For Iranian Winter GasoilDokumen4 halamanAPC-LOI For Iranian Winter GasoilAlexanderBelum ada peringkat

- Theories of Muamalat ContractsDokumen5 halamanTheories of Muamalat Contractssyifa aina0% (1)

- Affin Bank V Zulkifli Abdullah (Brief Case - Syazwani)Dokumen5 halamanAffin Bank V Zulkifli Abdullah (Brief Case - Syazwani)Syaz SenoritasBelum ada peringkat

- 14-Salam and IstisnaDokumen5 halaman14-Salam and Istisna✬ SHANZA MALIK ✬Belum ada peringkat

- Assignment - Commercial LawDokumen15 halamanAssignment - Commercial LawNURKHAIRUNNISABelum ada peringkat

- Diminishing Musharaka IjarahBasedDokumen22 halamanDiminishing Musharaka IjarahBasedArsalan AqeeqBelum ada peringkat

- Hire Purchase & LeasingDokumen67 halamanHire Purchase & LeasingImran AliBelum ada peringkat

- IBAZ Code of Professional ConductDokumen26 halamanIBAZ Code of Professional ConductTakunda RusereBelum ada peringkat

- Production Function Short RunDokumen15 halamanProduction Function Short RunShahrul NizamBelum ada peringkat

- Takaful and Conventional InsuranceDokumen7 halamanTakaful and Conventional Insurancezoom05tsaleem123Belum ada peringkat

- Lease FinancingDokumen2 halamanLease FinancingDinesh GodhaniBelum ada peringkat

- Bank of Uganda Releases Agent Banking RegulationsDokumen2 halamanBank of Uganda Releases Agent Banking RegulationspokechoBelum ada peringkat

- Islamic Financial System Principles and Operations PDF 401 500Dokumen100 halamanIslamic Financial System Principles and Operations PDF 401 500Asdelina R100% (1)

- Fiqh For Economist 2: Name: Nor Farhain Binti Sarmin MATRIC NO: 1229128Dokumen12 halamanFiqh For Economist 2: Name: Nor Farhain Binti Sarmin MATRIC NO: 1229128Farhain SarminBelum ada peringkat

- Salmabad, Kingdom of Bahrain College of Administrative and Financial Sciences Project Work InstructionsDokumen8 halamanSalmabad, Kingdom of Bahrain College of Administrative and Financial Sciences Project Work InstructionshamzaBelum ada peringkat

- Sale of Goods Act 1957: Property in Goods or Title in Goods Means The OwnershipDokumen32 halamanSale of Goods Act 1957: Property in Goods or Title in Goods Means The Ownershipnatsu lolBelum ada peringkat

- Bank Guarantee-I (Bg-I) / Counter Guarantee-I (Cg-I) ApplicationDokumen2 halamanBank Guarantee-I (Bg-I) / Counter Guarantee-I (Cg-I) ApplicationAzref MhdBelum ada peringkat

- Keyman InsuranceDokumen4 halamanKeyman InsuranceAnonymous gCE3zvIBelum ada peringkat

- FINANCE MANAGEMENT FIN420 CHP 11Dokumen30 halamanFINANCE MANAGEMENT FIN420 CHP 11Yanty IbrahimBelum ada peringkat

- Insurance and Risk Management: The Definitive Australian GuideDari EverandInsurance and Risk Management: The Definitive Australian GuideBelum ada peringkat

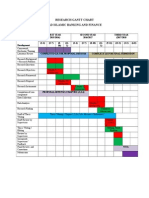

- Research Gantt ChartDokumen1 halamanResearch Gantt ChartNor SyahidahBelum ada peringkat

- Conjunctive Adverbs and The Relation They IndicateDokumen4 halamanConjunctive Adverbs and The Relation They IndicateNor SyahidahBelum ada peringkat

- Solvency and Capital AdequacyDokumen19 halamanSolvency and Capital AdequacyNor SyahidahBelum ada peringkat

- Economic in FiguresDokumen66 halamanEconomic in FiguresNor SyahidahBelum ada peringkat

- Tesco: by Gediminas SumylaDokumen11 halamanTesco: by Gediminas SumylaBharat SahniBelum ada peringkat

- Islamic BankingDokumen9 halamanIslamic BankingNor SyahidahBelum ada peringkat

- Advanced Build-It Rev2Dokumen8 halamanAdvanced Build-It Rev2Nor SyahidahBelum ada peringkat

- Room & BoardDokumen17 halamanRoom & BoardNor SyahidahBelum ada peringkat

- Arthur Andersen Case PDFDokumen12 halamanArthur Andersen Case PDFwindow805Belum ada peringkat

- JD 1-Moral Values: Kathrina Lana S. LanajaDokumen2 halamanJD 1-Moral Values: Kathrina Lana S. LanajaBrigitte YambaBelum ada peringkat

- Cash Flow StatementDokumen11 halamanCash Flow StatementDuke CyraxBelum ada peringkat

- Macroeconomics 10th Edition Colander Test BankDokumen45 halamanMacroeconomics 10th Edition Colander Test Bankmichaellopezxsnbiejrgt100% (36)

- 140933Dokumen86 halaman140933D27Belum ada peringkat

- Passbolt On AlmaLinux 9Dokumen12 halamanPassbolt On AlmaLinux 9Xuân Lâm HuỳnhBelum ada peringkat

- Special Topics in Income TaxationDokumen78 halamanSpecial Topics in Income TaxationPantas DiwaBelum ada peringkat

- GMS Arrivals Checklist Non Tank 24 Feb 2022Dokumen68 halamanGMS Arrivals Checklist Non Tank 24 Feb 2022Oleg Frul100% (1)

- A Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsDokumen290 halamanA Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsAbdul SalamBelum ada peringkat

- 2021 TaxReturnDokumen11 halaman2021 TaxReturnHa AlBelum ada peringkat

- Labour and Industrial Law: Multiple Choice QuestionsDokumen130 halamanLabour and Industrial Law: Multiple Choice QuestionsShubham SaneBelum ada peringkat

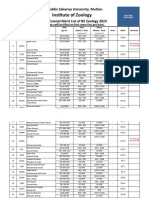

- 5953-6th Merit List BS Zool 31-8-2023Dokumen22 halaman5953-6th Merit List BS Zool 31-8-2023Muhammad AttiqBelum ada peringkat

- Opposition To Motion To DismissDokumen24 halamanOpposition To Motion To DismissAnonymous 7nOdcABelum ada peringkat

- Share INTRODUCTION TO CRIMINOLOGYDokumen9 halamanShare INTRODUCTION TO CRIMINOLOGYDonbert AgpaoaBelum ada peringkat

- Payroll AuditDokumen11 halamanPayroll AuditJerad KotiBelum ada peringkat

- Nichols V Governor Kathy Hochul (2022-02301)Dokumen3 halamanNichols V Governor Kathy Hochul (2022-02301)Luke ParsnowBelum ada peringkat

- Advintek CP 1Dokumen6 halamanAdvintek CP 1mpathygdBelum ada peringkat

- Department of Education: Republic of The PhilippinesDokumen6 halamanDepartment of Education: Republic of The PhilippinesRoderick MalubagBelum ada peringkat

- Samuel Newton v. Weber CountyDokumen25 halamanSamuel Newton v. Weber CountyThe Salt Lake TribuneBelum ada peringkat

- Knecht Vs UCCDokumen2 halamanKnecht Vs UCCXing Keet LuBelum ada peringkat

- Case 1 - Masters and Associates - Sasot GroupDokumen10 halamanCase 1 - Masters and Associates - Sasot GroupRobin Venturina100% (1)

- Sworn Statement - TemarioDokumen1 halamanSworn Statement - Temariozyphora grace trillanesBelum ada peringkat

- Home Energy Loan Program (HELP) Guide and FAQ, City of Penticton, XXXXDokumen4 halamanHome Energy Loan Program (HELP) Guide and FAQ, City of Penticton, XXXXIvanJBelum ada peringkat

- Family Worship PDF - by Kerry PtacekDokumen85 halamanFamily Worship PDF - by Kerry PtacekLeo100% (1)

- Anatolia Cultural FoundationDokumen110 halamanAnatolia Cultural FoundationStewart Bell100% (3)

- Questa Sim Qrun UserDokumen50 halamanQuesta Sim Qrun UsertungnguyenBelum ada peringkat

- Cunanan V CA and BasaranDokumen6 halamanCunanan V CA and BasaranMarielle ReynosoBelum ada peringkat

- BS-300 Service Manual (v1.3)Dokumen115 halamanBS-300 Service Manual (v1.3)Phan QuanBelum ada peringkat

- Dasa SandhiDokumen1 halamanDasa SandhishivasudhakarBelum ada peringkat

- UCO Amended ComplaintDokumen56 halamanUCO Amended ComplaintKFOR100% (1)