Assessment of Working Capital Requirements Form # II: Operating

Diunggah oleh

Suzanne DavisJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Assessment of Working Capital Requirements Form # II: Operating

Diunggah oleh

Suzanne DavisHak Cipta:

Format Tersedia

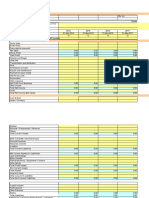

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS

FORM # II : OPERATING STATEMENT (Rs. in Lakhs)

2006-07 2007-08 2008-09 2009-10 2010-11

S.No Particulars Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

1. GROSS SALES

(i) Sales 490.74 567.09 766.63 843.90 1265.85

(ii) Other Income 119.39 175.01 201.77 236.94 355.41

Total 610.13 742.10 968.40 1080.84 1621.26

2. (III) Excise Duty 53.81 73.29 69.63 52.96 79.44

3. NET SALES ( 1 - 2 ) 556.32 668.81 898.77 1027.88 1541.82

4. % age rise ( + ) or fall ( - ) in Net Sales as 0.00 0.00 0.00 0.00 0.00

compared to previous year

5. COST OF SALES

(i) Raw Materials ( including Stores and other

used in the process of manufacture

(a) Imported 0.00 0.00 0.00 0.00 0.00

(b) Indigenous 302.81 340.34 534.04 572.00 858.00

(ii) Other Spares

(a) Imported 0.00 0.00 0.00 0.00 0.00

(b) Indigenous 13.14 18.28 35.37 33.20 49.80

(iii) Power and Fuel 47.64 53.96 54.52 35.00 52.50

(iv) Direct Labour 15.74 15.86 17.80 22.00 33.00

(v) Repairs & Maintainence 61.05 61.95 71.80 136.00 204.00

(vi) Depreciation 18.59 18.31 19.56 20.00 30.00

(vii) SUB - TOTAL ( Items (i) to (vi) 458.97 508.70 733.09 818.20 1227.30

(viii) Add : Opening Stock-in-Process 11.40 12.74 11.45 5.18 0.58

Sub-Total 470.37 521.44 744.54 823.38 1227.88

(ix) Deduct : Closing Stock-in-Process 12.74 11.45 5.18 0.58 0.00

(x) COST OF PRODUCTION 457.63 509.99 739.36 822.80 1227.88

Form # II Operating Statement Cont…. (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

(ix) Add: Opening Stocks of WIP & Finished Goods 11.82 40.22 30.09 34.07 46.84

Sub-Total 469.45 550.21 769.45 856.87 1274.72

(xii) Deduct: Closing Stocks of WIP & Finished Goods 40.22 30.09 34.07 46.84 55.24

(xiii) Sub - Total ( Total of Cost of Sales ) 429.23 520.12 735.38 810.03 1219.48

6. Selling, General & Administrative Expenses 76.89 86.27 94.14 120.00 180.00

Salaries and Allowances 0.00 0.00 0.00 0.00 0.00

7. SUB - TOTAL ( 5 + 6 ) 506.12 606.39 829.52 930.03 1399.48

8. Operating Profit before Interest ( 3 - 7 ) 50.20 62.42 69.25 97.85 142.34

9. Interest 21.36 24.81 27.86 40.00 50.00

10. Operating Profit after Interest ( 8 - 9 ) 28.84 37.61 41.39 57.85 92.34

11. (i) Add Other Non-Operating Income

a) Other Income 1.10 0.09 8.83 0.20 0.30

Sub - Total ( Income ) 1.10 0.09 8.83 0.20 0.30

(ii) Deduct Other Non-Operating Expences

a) Preliminary Expenses Written Off 0.00 0.00 0.00 0.00 0.00

b) Others 0.00 0.00 0.00 0.00 0.00

Sub - Total ( Expenses ) 0.00 0.00 0.00 0.00 0.00

(iii) Net of other Non-Operating Income/Expenses 1.10 0.09 8.83 0.20 0.30

12. Profit before Tax / ( Loss ) 10 + 11(iii) 29.94 37.70 50.22 58.05 92.64

13. Provision for Taxes & deffered tax liabity 11.24 13.07 16.28 19.73 31.49

14. Net Profit / ( Loss ) { 12 -13 } 18.70 24.63 33.94 38.32 61.15

15. (a) Equity Dividend Paid including Dividend tax 8.53 8.75 8.75 8.75 8.75

(b) Dividend Rate 0.00 0.00 0.00 0.00 0.00

16. Retained Profit ( 14 - 15 ) 10.17 15.88 25.19 29.57 52.40

17. Retained Profit / Net Profit ( % age ) 54.39 64.47 74.22 77.17 85.69

###

FORM # III ANALYSIS OF BALANCE SHEET (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

CUR ENT LIABILITIES

1. Short Term Borrowings from Banks ( excluding

Bills Purchased Discounted

(i) From Applicant Bank 152.62 164.03 171.33 200.00 300.00

(ii) From Other Banks 0.00 0.00 0.00 0.00 0.00

(iii) ( of which Bills Purchased & Discounted ) 0.00 0.00 0.00 0.00 0.00

SUB - TOTAL ( A ) 152.62 164.03 171.33 200.00 300.00

2. Short Term Borrowings from others 0.00 0.00 0.00 0.00 0.00

3. Sundry Creditors ( Trade ) 57.97 91.73 98.48 23.80 35.80

4. Advance Payments from Customers / 0.00 10.81 0.26 0.50 1.00

Deposits from Dealers 0.00 0.00 0.00 0.00 0.00

5. Provision for Taxation(Including dividend tax) 13.29 15.89 18.89 21.47 33.23

6. Dividend Payable / Proposed Dividend 7.48 7.48 7.48 7.48 7.48

7. Other Statutory Liabilities ( due within one year ) 0.81 1.25 1.25 9.60 9.60

8. Deposits / Installments of Term Loan / DPG's / 0.00 0.00 0.00 0.00 0.00

Debentures, etc. ( due within one year ) 0.00 0.00 0.00 0.00 0.00

9. Other Current Liabilities & Provisions

Liabilities for capital goods 0.00 0.00 0.00 0.00 0.00

Liabilities for expenses 60.53 81.75 165.47 100.00 110.00

Others 0.00 0.00 0.00 0.00 0.00

SUB - TOTAL ( B ) 140.08 208.91 291.83 162.85 197.11

10. TOTAL CURRENT LIABILITIES 292.70 372.94 463.16 362.85 497.11

( Total of Items # 1 to 9 )

FORM # III ANALYSIS OF BALANCE SHEET

(Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

TERM LIABILITIES

11. Debentures ( not maturing within one year ) 0.00 0.00 0.00 0.00 0.00

12. Preference Shares 0.00 0.00 0.00 0.00 0.00

( Redeemable after one year )

13. Term Loans ( excluding installments payable

within one year ) 21.56 10.67 137.17 120.00 200.00

14. Hire Purchase Loan ( excluding

installments due within one year ) 0.00 0.00 0.00 0.00 0.00

15. Term Deposits ( Repayable after one year ) 0.00 0.00 0.00 0.00 0.00

16. Other Term Liabilities

Liabilities for Capital Goods 0.00 0.00 0.00 0.00 0.00

Unsecured Loans from shareholders 0.00 0.00 0.00 0.00 0.00

Unsecured Loans from Others 0.00 0.00 0.00 10.00 0.00

17. TOTAL TERM LIABILITIES

( Total of Items # 11 to 16 ) 21.56 10.67 137.17 130.00 200.00

18. TOTAL OUTSIDE LIABILITIES 314.26 383.61 600.33 492.85 697.11

(Item 10 plus item 17)

NET WORTH

19. Ordinary Share Capital 74.81 74.81 74.81 74.81 74.81

20. General Reserve 14.61 16.92 20.32 23.72 27.12

21. Revaluation Reserve 0.00 0.00 0.00 0.00 0.00

22. Sales Tax Subsidy 0.00 0.00 0.00 0.00 0.00

Deffered Tax Liability 0.00 0.00 0.00 0.00 0.00

23. Surplus (+) or Deficit (-) in profit and loss Account 35.18 48.75 70.54 96.71 145.71

24. NET WORTH 124.60 140.48 165.67 195.24 247.64

25. TOTAL IABILITIES 438.86 524.09 766.00 688.09 944.75

( Total Items # 18 + 24 )

FORM # III ANALYSIS OF BALANCE SHEET (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

CURRENT ASSETS

26. Cash and Bank Balances 0.58 0.60 0.32 1.14 1.31

27. Investments ( other than Long Term Investments)

i) Government 0.00 0.00 0.00 0.00 0.00

ii) Fixed deposits with Banks 0.00 0.00 0.00 0.00 0.00

28. i) Receivables other than deferred &

Bills purchased and Discounted by Banks 130.91 181.87 182.40 180.10 270.20

ii) Export receivables ( including Bills Purchased

Discounted by Banks ) 0.00 0.00 0.00 0.00 0.00

29. Installments of deferred Receivables

( due within one year ) 0.00 0.00 0.00 0.00 0.00

30. Inventory :

i) Raw Materials ( including Stores and other

items used in the process of manufacture )

a) Imported 0.00 0.00

b) Indigenous 25.18 27.39 20.83 47.70 71.50

ii) Stocks-in-Process 12.74 11.45 5.18 55.20 82.80

iii) Finished Goods 40.22 30.09 34.07 44.10 61.10

iv) Other Consumable Spares

a) Imported 0.00 0.00 0.00 0.00 0.00

b) Indigenous 0.00 0.00 0.00 0.00 0.00

c) Other C/A 0.00 0.00 0.00 0.00 0.00

31. Advances to Suppliers of Raw Materials

and Stores and for Job work 46.04 25.83 32.92 40.00 50.00

32. Advance Payment of Taxes 6.00 8.00 5.50 10.00 15.00

33. Other Current Assets

a) Margins for L.C's and guarantees 0.00 0.00 0.00 0.00 0.00

b) Loans and Advances 32.62 17.84 39.54 70.00 80.00

34. TOTAL CURRENT ASSETS

( Total of Items # 26 to 33 ) 294.29 303.07 320.76 448.24 631.90

FORM # III ANALYSIS OF BALANCE SHEET (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

FIXED ASSETS Actuals Actuals Actuals Year Year

Estimates Projections

35. Gross Block

( Land, Building & Machinery, Work-in-Progress ) 216.52 233.75 261.10 261.10 401.10

36. Depreciation to date 87.32 105.63 125.19 145.19 175.19

37. NET BLOCK ( Item # 35 - Item # 36 ) 129.20 128.12 135.91 115.91 225.91

38. Investment / Book Debts / Advances / Deposits

which are not Current Assets

I) a) Investments in Subsidiary Companies /

Affiliates 0.00 0.00 0.00 0.00 0.00

b) Others 0.00 0.00 0.00 0.00 0.00

II) Advances to Suppliers of Capital Goods

and Contract - Capital work in progress 0.00 64.54 269.41 80.00 43.00

III) Deferred tax asset 9.07 10.61 11.94 11.94 11.94

IV) Others - Deposits 6.30 17.75 27.98 32.00 32.00

FD with Bank 0.00 0.00 0.00 0.00 0.00

39. Non-Consumable Stores and Spares 0.00 0.00 0.00 0.00 0.00

40. Other Non-Current Assets including 0.00 0.00 0.00 0.00 0.00

due from Directors

41. TOTAL OTHER NON - CURRENT ASSETS 15.37 92.90 309.33 123.94 86.94

42. Intangible Assets ( Patents, Goodwill,

Preliminary Expenses, Doubtful Debts not 0.00 0.00 0.00 0.00 0.00

provided for & deposits etc. )

43. TOTAL ASSETS ( Total of Items # 34,37,41& 42) 438.86 524.09 766.00 688.09 944.75

44. TANGIBLE NET WORTH ( Items # 24 - 42 ) 124.60 140.48 165.67 195.24 247.64

45. NET WORKING CAPITAL

( Items # [ ( 17 + 24 ) - ( 37+ 41 + 42 ) ] 1.59 -69.87 -142.40 85.39 134.79

46. CURRENT RATIO { Item # 34 / 10 } 1.01 0.81 0.69 1.24 1.27

47. TOTAL OUTSIDE LIABILITIES

TANGIBLE NET WORTH { Items # 18 / 44 ) 2.52 2.73 3.62 2.52 2.82

48. Total Term Liabilities / Tangible Net Worth 0.17 0.08 0.83 0.67 0.81

FORM # IV COMPARATIVE STATEMENT OF CURRENT ASSETS (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

A CURRENT ASSETS

1. Raw Materials ( Including Stores & Other

Items used in the Process of Manufacture )

(a) Imported : 0.00 0.00 0.00 0.00 0.00

Months' Consumption

(b) Indigenous : 25.18 27.39 20.83 47.70 71.50

Months' Consumption (1.00) (0.97) (0.47) (1.00) (1.00)

2. Other Consumable Spares, ( excluding those

included in 1 above )

(a) Imported : 0.00 0.00 0.00 0.00 0.00

Months' Consumption

(b) Indigenous : 0.00 0.00 0.00 0.00 0.00

Months' Consumption 0.00 0.00 0.00 0.00 0.00

3. Stock-in-Process 12.74 11.45 5.18 55.20 82.80

Months Cost of Production 0.00 0.00 0.08 0.81 0.81

4. Finished Goods 40.22 30.09 34.07 44.10 61.10

Months Cost of Sales (1.12) (0.69) (0.56) (0.65) (0.60)

5. Receivables other that Export deferred rec'bles

( including purchased and discounted by Banks) 130.91 181.87 182.40 180.10 270.20

Months Domestic Sales (3.20) (3.85) (2.86) (2.56) (2.56)

6. Export Receivables ( Including Bills Purchased & Disctd) 0.00 0.00 0.00 0.00 0.00

Months' Export Sales

7. Advances to Suppliers of Raw Materials,

Stores and Consumables 46.04 25.83 32.92 40.00 50.00

8. Other Current Assets including Cash and Bank

balances, Deposits, Advance payment of Taxes 39.20 26.44 45.36 81.14 96.31

and Margins for LC's and guarantees.

9. Total Current Assets

( To Agree with Item # 34 in Form # 3 ) 294.29 303.07 320.76 448.24 631.91

294.29 303.07 320.76 448.24 631.90

FORM # IV COMPARITIVE STATEMENT OF CURRENT LIABILITIES (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

B. CURRENT LIABILITIES

( Other than Bank Borrowings for working capital)

10. Creditors for Purchases of Raw Materials,

Stores and Spares 57.97 91.73 98.48 23.80 35.80

0.00 0.00 0.00 0.00 0.00

11. Advances from Customers 0.00 10.81 0.26 0.50 1.00

12. Statutory Liabilities 13.29 15.89 18.89 21.47 33.23

13. Other Current Liabilities 68.82 90.48 174.20 117.08 127.08

Other Provisions 0.00 0.00 0.00 0.00 0.00

Installments of Term loans

14. TOTAL 140.08 208.91 291.83 162.85 197.11

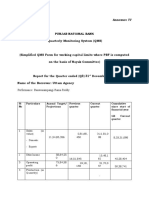

Computation Of Maximum Permissible Bank Finance for Working Capital (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

1. Total Current Assets

( Item # 9 in Form # IV ) 294.29 303.07 320.76 448.24 631.91

2. Other Current Liabilities 140.08 208.91 291.83 162.85 197.11

( Other than Bank Borrowings )

( Item # 14 in Form IV )

3. Working Capital Gap ( WCG ) 154.21 94.16 28.93 285.39 434.80

( Item # 1 - Item # 2 )

4. Minimum stipulated Net Working Capital ie 25%

of WCG / 25% of Total Current Assets as to case

may be depending upon the method of lending being 38.55 23.54 7.23 71.35 108.70

applied ( Export Receivables to be excluded under

both methods )

5. Actual / Projected net working Capital 1.59 -69.87 -142.40 85.39 134.79

( Item # 45 in Form # III )

6. Item # 3 Minus Item # 4 115.66 70.62 21.70 214.04 326.10

7. Item # 3 Minus Item # 5 152.62 164.03 171.33 200.00 300.00

8. MAXIMUM PERMISSIBLE BANK FINANCE 115.66 70.62 21.70 200.00 300.00

( Item # 6 or Item # 7 whichever is lower )

9 NWC TO TCA ( % ) 0.54 -23.05 -44.39 19.05 21.33

10 Bank Finance to TCA ( % ) 39.30 23.30 6.76 44.62 47.48

11 Sundry Creditors to TCA ( % ) 19.70 30.27 30.70 5.31 5.67

12 Other Current Liabilities to TCA ( % ) 23.39 29.85 54.31 26.12 20.11

13 Inventories to Net Sales ( days ) 51.27 37.62 24.40 52.20 50.99

14 Receivables to Gross Sales ( days ) 97.37 117.06 86.84 77.90 77.91

15 Sundry Creditors to Purchases ( days ) 69.88 98.38 67.31 15.19 15.23

FORM # VI

FUND FLOW STATEMENT

1 SOURCES (Rs. in Lakhs)

S.No Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

a) Net Profit after Tax 15.88 25.19 29.57 52.40

b) Depreciation 18.31 19.56 20.00 30.00

c) Increase in Capital 0.00 0.00 0.00 0.00

Increase in Deffered tax liability 0.00 0.00 0.00 0.00

d) B/F reserves 0.00 0.00 0.00 0.00

e) Increase in Term Liabilities -10.89 126.50 -7.17 70.00

e) Decrease in

i) Fixed Assets ( Depreciation to date ) 0.00 0.00 0.00 0.00

ii) Other Non-Current Assets 0.00 0.00 0.00 0.00

g) Total 23.30 171.25 42.40 152.40

2 USES (Rs. in Lakhs)

Particulars 2006-07 2007-08 2008-09 2009-10 2010-11

Audited Audited Audited Current Next

Actuals Actuals Actuals Year Year

Estimates Projections

a) Net Loss 0.00 0.00 0.00 0.00

b) Decrease in Term Liabilities 0.00 0.00 0.00 0.00

Decrease in unsecured loans 0.00 0.00 0.00 0.00

c) Increase in

i) Fixed Assets 17.23 27.35 0.00 140.00

ii) Non current assets 77.53 216.43 -185.39 -37.00

d) Dividend Payments 0.00 0.00 0.00 0.00

e) Decrease in liability for capital goods 0.00 0.00 0.00 0.00

g) TOTAL 94.76 243.78 -185.39 103.00

a) Long Term Surplus ( + ) / Deficit ( - )

b) ( Item # 1 Minus Item # 2 ) -71.46 -72.53 227.79 49.40

c) Increase / Decrease in Current Assets

d) * ( as per details given below ) 8.78 17.69 127.48 183.66

e) Increase or Decrease in Current Liabilities

f) other than Bank Borrowings 68.83 82.92 -128.98 34.26

g) Increase / Decrease in Working Capital Gap -60.05 -65.23 256.46 149.41

h) Net Surplus ( + ) / Deficit ( - ) -11.41 -7.30 -28.67 -100.00

I) Increase / Decrease in Bank Borrowings 11.41 7.30 28.67 100.00

INCREASE / DECREASE IN NET SALES 131.97 226.30 112.44 540.42

0.00 0.00 0.00 0.00 0.00

Anda mungkin juga menyukai

- Sadguru Construction Cma 16-17 To 2020-21Dokumen8 halamanSadguru Construction Cma 16-17 To 2020-21vdtaudit 1Belum ada peringkat

- Project Report Dary FarmDokumen7 halamanProject Report Dary FarmAbdul Hakim ShaikhBelum ada peringkat

- Financial Statement AnalysisDokumen36 halamanFinancial Statement AnalysisPramod GuptaBelum ada peringkat

- Project Report: Name and Address:-Of The ApplicantDokumen10 halamanProject Report: Name and Address:-Of The Applicantakki_6551Belum ada peringkat

- CMA Data in Excel FormatDokumen18 halamanCMA Data in Excel FormatKaushik Chattoraj0% (1)

- Cma For Less Than 1 Crore With CalculationDokumen18 halamanCma For Less Than 1 Crore With Calculationchirag desaiBelum ada peringkat

- CMA Data For Bank Loan ProposalDokumen29 halamanCMA Data For Bank Loan Proposalshardaashish0055% (11)

- EMI CALCULATOR BREAKDOWNDokumen20 halamanEMI CALCULATOR BREAKDOWNSheru Shri100% (1)

- Bank of India Fund BasedDokumen33 halamanBank of India Fund Basedhariram v choudharyBelum ada peringkat

- Annexure II-IV Forms Operating Statement Analysis Balance SheetDokumen21 halamanAnnexure II-IV Forms Operating Statement Analysis Balance SheetShushant ShekharBelum ada peringkat

- Project Report PDFDokumen13 halamanProject Report PDFMan KumaBelum ada peringkat

- Cash Budget Model Cash Budget Model - Case Study: InflowsDokumen1 halamanCash Budget Model Cash Budget Model - Case Study: Inflowsayu nailil kiromahBelum ada peringkat

- PNB Process NoteDokumen36 halamanPNB Process NotePawan BagrechaBelum ada peringkat

- Project Report On General StoreDokumen10 halamanProject Report On General StoreApplication's ManagerBelum ada peringkat

- Project Report-TemplateDokumen24 halamanProject Report-TemplateKrishnan NamboothiriBelum ada peringkat

- Project Report For DairyDokumen20 halamanProject Report For DairyKaushik KansaraBelum ada peringkat

- Project Report Mandap DecorationDokumen17 halamanProject Report Mandap Decorationkushal chopda100% (1)

- Goods and Service Tax (GST)Dokumen19 halamanGoods and Service Tax (GST)Saurabh Kumar SharmaBelum ada peringkat

- Hire Purchase Lease Financing - Part 2Dokumen38 halamanHire Purchase Lease Financing - Part 2KomalBelum ada peringkat

- Detailed Project Report for Khushi Mandap DecoratorsDokumen50 halamanDetailed Project Report for Khushi Mandap DecoratorsNeha Marathe100% (1)

- Machine Project Costs and FinancingDokumen9 halamanMachine Project Costs and FinancingManish AgarwalBelum ada peringkat

- Schedule Depreciation TaxDokumen3 halamanSchedule Depreciation TaxAditya GowdaBelum ada peringkat

- GST in India: An overview of the Goods and Services TaxDokumen57 halamanGST in India: An overview of the Goods and Services Taxmurali140Belum ada peringkat

- Zemini Agro Land Developers Project ReportDokumen29 halamanZemini Agro Land Developers Project ReportsudhirsenBelum ada peringkat

- CMA FormatDokumen10 halamanCMA Formatcvrao0480% (5)

- Balance Sheet of Tata Communications: - in Rs. Cr.Dokumen24 halamanBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaBelum ada peringkat

- Annexure IV Simplified QMSDokumen2 halamanAnnexure IV Simplified QMSIndra Nag Prasad0% (2)

- General Shop - 5 LakhsDokumen6 halamanGeneral Shop - 5 LakhsShyamal DuttaBelum ada peringkat

- CMA FormatDokumen14 halamanCMA FormatSuresh KumarBelum ada peringkat

- GST Billing Software Project ReportDokumen20 halamanGST Billing Software Project Reportjambakajimba0% (2)

- Sample Project Report - PLUMBINGDokumen2 halamanSample Project Report - PLUMBINGVirendra ChavdaBelum ada peringkat

- Loan Amortization Schedule - LDokumen8 halamanLoan Amortization Schedule - Lrizwan6261Belum ada peringkat

- From A MILLION HITS To A Webby Honoree BackgroundDokumen4 halamanFrom A MILLION HITS To A Webby Honoree BackgroundTanmoy ChakrabortyBelum ada peringkat

- How To Assess Working Capital RequirementDokumen34 halamanHow To Assess Working Capital RequirementChennakesava RamakrishnaBelum ada peringkat

- Capm HDFC BankDokumen8 halamanCapm HDFC BankSushree SmitaBelum ada peringkat

- COMPARISON OF QUARRY COSTSDokumen111 halamanCOMPARISON OF QUARRY COSTSmaddumasooriyaBelum ada peringkat

- Proj Fin Quest Paper 1Dokumen2 halamanProj Fin Quest Paper 1Sunil PeerojiBelum ada peringkat

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLADokumen30 halamanGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaBelum ada peringkat

- Term Loan and Project AppraisalDokumen18 halamanTerm Loan and Project Appraisalpratiknr99100% (7)

- CMA DataDokumen35 halamanCMA Dataashishy99Belum ada peringkat

- Prepare financial statements and cash flow statementDokumen4 halamanPrepare financial statements and cash flow statementrishi dhungel100% (1)

- DPR For Walnut ProcessingDokumen74 halamanDPR For Walnut ProcessingMohd touseefBelum ada peringkat

- Dairy ProjectDokumen8 halamanDairy ProjectPraveen SinghBelum ada peringkat

- Executive SummaryDokumen7 halamanExecutive SummaryHirdayraj Saroj100% (1)

- MIS Financials Format XlsMISDokumen78 halamanMIS Financials Format XlsMISarajamani78100% (1)

- GST Chart Book by CA Pranav ChandakDokumen54 halamanGST Chart Book by CA Pranav ChandakAman AhujaBelum ada peringkat

- BHEL Valuation of CompanyDokumen23 halamanBHEL Valuation of CompanyVishalBelum ada peringkat

- Goods and Service Tax (GST)Dokumen17 halamanGoods and Service Tax (GST)Manav SethiBelum ada peringkat

- Petrol Pump Project ReportDokumen3 halamanPetrol Pump Project ReportShubham50% (2)

- Chapter 5 GST - ProblemsDokumen10 halamanChapter 5 GST - Problemsbalaji RBelum ada peringkat

- SEZ PresentationDokumen18 halamanSEZ Presentationvinunair79Belum ada peringkat

- Project Report For Manufacturing & Trading of Embroidery SareeDokumen11 halamanProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALBelum ada peringkat

- Sample CMA DataDokumen38 halamanSample CMA DatalinujoshyBelum ada peringkat

- GST Oct 17Dokumen23 halamanGST Oct 17himanBelum ada peringkat

- Project Reports For Start Up BusinessDokumen17 halamanProject Reports For Start Up BusinessraviBelum ada peringkat

- Working Capital AssessmentDokumen11 halamanWorking Capital AssessmentRK SharmaBelum ada peringkat

- Form - I: Assessment of Working Capital Requirements: Part A-Operating StatementDokumen14 halamanForm - I: Assessment of Working Capital Requirements: Part A-Operating StatementMonilBelum ada peringkat

- CMA Case StudyDokumen15 halamanCMA Case Studyyajur_nagiBelum ada peringkat

- 01 02 03 04 05 06 MergedDokumen22 halaman01 02 03 04 05 06 MergedAkshay SaneparaBelum ada peringkat

- Cma SreekumarDokumen35 halamanCma Sreekumarapi-19728905Belum ada peringkat

- Chapter 6 Financial AssetsDokumen6 halamanChapter 6 Financial AssetsJoyce Mae D. FloresBelum ada peringkat

- Aqa Econ2 QP Jan13Dokumen16 halamanAqa Econ2 QP Jan13api-247036342Belum ada peringkat

- MadRiverUnion 01 25 17editionDokumen14 halamanMadRiverUnion 01 25 17editionMad River UnionBelum ada peringkat

- The Effect of Capital Flight On Nigerian EconomyDokumen127 halamanThe Effect of Capital Flight On Nigerian EconomyAdewole Aliu OlusolaBelum ada peringkat

- Ie Business SchoolDokumen6 halamanIe Business SchoolGtvtavoBelum ada peringkat

- Pakistan's Economic Freedom Declines as Debt Burdens GrowDokumen2 halamanPakistan's Economic Freedom Declines as Debt Burdens Growziad khanBelum ada peringkat

- GlobalizationDokumen11 halamanGlobalizationAlmagamingyt 2002Belum ada peringkat

- Topic 4 Interest Rates Eco531Dokumen60 halamanTopic 4 Interest Rates Eco531Hafiz akbarBelum ada peringkat

- Analysis of L&T's Dividend Policy and Project QualityDokumen39 halamanAnalysis of L&T's Dividend Policy and Project QualityAmber GuptaBelum ada peringkat

- Block L - Salary-Based Budgeting Worksheet 8 - Sheet1Dokumen2 halamanBlock L - Salary-Based Budgeting Worksheet 8 - Sheet1api-49586045967% (3)

- Chp. Test Answerts Econ 2301Dokumen13 halamanChp. Test Answerts Econ 2301Derek Whiting50% (2)

- ECS1601 Study NotesDokumen20 halamanECS1601 Study NotesedwilljonasBelum ada peringkat

- GCC Aviation ReportDokumen44 halamanGCC Aviation Reportabraham.promosevenBelum ada peringkat

- Analyze Government Financial PerformanceDokumen16 halamanAnalyze Government Financial Performancetrinhbang100% (1)

- Exercises For Teaching The Analytic Hierarchy Proc PDFDokumen14 halamanExercises For Teaching The Analytic Hierarchy Proc PDFMa' RionBelum ada peringkat

- Changes in Accounting Policy XXX XXX Prior Period Errors XXX XXX Other Adjustments XXX XXXDokumen1 halamanChanges in Accounting Policy XXX XXX Prior Period Errors XXX XXX Other Adjustments XXX XXXMark Ronnier VedañaBelum ada peringkat

- Budget2019 20Dokumen152 halamanBudget2019 20Uffq SemabBelum ada peringkat

- Summit Bank Annual Report 2012Dokumen200 halamanSummit Bank Annual Report 2012AAqsam0% (1)

- Chinese Hegemony Warrants A Worldwide BoycottDokumen36 halamanChinese Hegemony Warrants A Worldwide Boycottvijender AtriBelum ada peringkat

- Untitled 9Dokumen24 halamanUntitled 9Ersin Tukenmez100% (1)

- Unit 5 Centre-State Financial Relations-I1: StructureDokumen15 halamanUnit 5 Centre-State Financial Relations-I1: StructureAjay PrakashBelum ada peringkat

- 00 IntroDokumen254 halaman00 IntroTatenda MadzingiraBelum ada peringkat

- Uppcs Current 2024Dokumen41 halamanUppcs Current 2024varshayadav231020Belum ada peringkat

- 2009 - Banca Mondiala - Analize Si Recomandari StrategiceDokumen92 halaman2009 - Banca Mondiala - Analize Si Recomandari StrategiceBalaniscu BogdanBelum ada peringkat

- Problems of Indian Economy, PPTDokumen16 halamanProblems of Indian Economy, PPTRicha GargBelum ada peringkat

- WSP Philippines WSS Turning Finance Into Service For The Future PDFDokumen90 halamanWSP Philippines WSS Turning Finance Into Service For The Future PDFKarl GutierrezBelum ada peringkat

- Review of Common Exam IIDokumen24 halamanReview of Common Exam IIPlatelet SongBelum ada peringkat

- April - Current Affairs - 2018Dokumen23 halamanApril - Current Affairs - 2018arijitlgspBelum ada peringkat

- Government Spending, Public Debt and Economic Growth in KenyaDokumen12 halamanGovernment Spending, Public Debt and Economic Growth in KenyaResearch ParkBelum ada peringkat

- Note Taking Book Rozan PDFDokumen59 halamanNote Taking Book Rozan PDFKemal Reha Istıl90% (30)