UK Personal Income Tax

Diunggah oleh

Hoa ĐàoDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

UK Personal Income Tax

Diunggah oleh

Hoa ĐàoHak Cipta:

Format Tersedia

Worldwide personal tax guide 2013 2014

United Kingdom

Local information

Tax Authority HM Revenue and Customs (HMRC)

Website www.hmrc.gov.uk

Tax Year 6 April to 5 April

Tax Return due date

31 October (paper filing)

31 January (Electronic Filing)

Is joint filing possible No

Are tax return extensions possible No

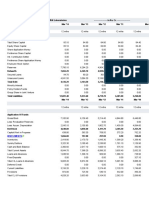

2013/2014 Income Tax Rates

Taxable Income Band National Income Tax Rates

1 - 32,010 20%

32,011 - 150,000 40%

150,001 + 45%

A tax free personal allowance of 9,440 is available to certain taxpayers. The personal allowance is

reduced by 1 for every 2 of adjusted net income over 100,000.

A 10% starting rate for savings income may be available

The rates for dividends are 10%, 32.5% and 37.5%

The rates for capital gains are 10%, 18% and 28%

This document has been prepared based on the legislation and practices of the country

concerned as of 1 July 2013 by EY and published in its Worldwide personal tax guide, 2013-14.

Tax legislation and administrative practices may change, and this document is a summary of

potential issues to consider. This document should not be used as a substitute for

professional tax advice which should be sought for the country of arrival and departure in

advance of moving in order to discuss your circumstances. It is your responsibility to disclose

your income to the tax authorities.

This information is provided by EY in accordance with their Terms and Conditions. Neither

HSBC nor EY accepts any responsibility for the accuracy of any of this information. By using

this information you are accepting the terms under which EY is making the content available

to you.

Who is liable?

The taxation of individuals in the United Kingdom is determined by residence and domicile status.

Tax residents are liable to U.K. tax on their worldwide income. However, some short-term residents

and individuals who are regarded as not domiciled in the United Kingdom may escape U.K. tax on

offshore income and capital gains if the funds are not remitted to the United Kingdom (this is known

as the remittance basis).

Non-residents are subject to tax on U.K.-source income, such as compensation attributable to U.K.

workdays and certain U.K.-source investment income.

Residence status for tax purposes

Effective from 6 April 2013, the U.K. applies a comprehensive statutory residence test (SRT) to

determine whether an individual is resident in the U.K. Professional advice should be obtained

regarding the new rules.

Different rules applied before 6 April 2013 and the residence position of someone arriving in the U.K.

before that date may or may not be subject to those rules under transitional provisions. Consequently,

professional advice should be obtained if relevant.

Under the SRT, any individual who has no prior connection with the U.K. and has not been U.K.

resident in the preceding 3 U.K. tax years is generally regarded as conclusively not resident if they

spend no more than 45 days in the U.K. in any U.K. tax year. Other tests may also apply under which

a taxpayer is regarded as conclusively non-resident, the most common of which is the test applying to

an individual who leaves the U.K. for full-time work abroad (FTWA). This term is now defined under

the SRT and is potentially very different from the previous practice.

An individual coming to the U.K. is likely to be regarded as conclusively U.K. tax resident if they

satisfy any of the following conditions:

They work full time (at least 35 hours per week on average) in the U.K. for a 365 day period,

with at least 75% of their workdays being U.K. workdays.

They have their only home or all their homes in the U.K., for a period of at least 91 days, and

at least 30 days of the 91 day period fall in the U.K. tax year concerned.

They spend at least 183 days in the U.K. in the U.K. tax year.

They meet the sufficient ties test.

Particular rules apply to individuals who have relevant jobs in international transport, such as air crew.

These rules exclude them from the FTWA and full-time working in the U.K. (FTWUK) tests.

A sufficient-ties test applies only if the individual is neither conclusively resident nor conclusively non-

resident under other parts of the SRT. 5 possible connection factors can apply to determine the extent

of the individuals connection to the U.K., and the more connection factors that an individual has, the

fewer days they may spend in the U.K. in a tax year without becoming U.K. tax resident. The following

are the 5 connection factors:

They have a U.K. substantive employment (at least 40 U.K. workdays).

They have U.K. accommodation.

They have more than 90 days present in the U.K. in either of the preceding 2 U.K. tax years.

They have U.K.-resident family (spouse, civil partner or minor children).

They have been U.K. tax resident in any of the 3 preceding U.K. tax years, they have spent

more days in the U.K. than in any other country.

An individual who has not been tax resident in the U.K. in any one of the preceding 3 tax years does

not become a U.K. resident in the following circumstances:

They spend up to 120 days in the U.K. and have 2 connection factors.

They spend up to 90 days in the U.K. and have 3 connection factors.

They spend up to 45 days in the U.K. and have 4 connection factors.

Complex statutory definitions apply in all cases. A day is usually counted if the individual is in the U.K.

at midnight but an additional rule can also apply if the individual has 3 U.K. connection factors, has

been U.K. tax resident during any of the preceding 3 U.K. tax years and has more than 30 days in the

U.K. when they are in the U.K. during the day but absent at midnight.

Before the introduction of the SRT, the U.K. had a concept of ordinary residence that applied for

income tax and capital gains tax purposes. However, this concept has been abolished, effective from

6 April 2013, other than in relation to individuals who were already resident but not ordinarily resident

in the U.K. These individuals are subject to transitional rules.

In principle, residence is determined for a tax year as a whole. As a result, an individual is either

resident for the entire year or non-resident for the entire year even if they arrive in or leave the United

Kingdom during the tax year.

Under the SRT a taxpayer who is U.K. tax resident may be eligible for split-year treatment in certain

circumstances. If the conditions are met, income and gains of the overseas part of the U.K. tax year

concerned are generally not subject to U.K. tax.

Under English law, an individuals domicile is the country considered to be their permanent home,

even though they may be currently resident in another country. It may be a domicile of origin, choice

or dependency.

Domicile status affects how an individuals offshore income and/or capital gains are taxed. A non-

U.K.-domiciled individual can have their offshore income and/or offshore capital gains taxed on either

the remittance basis or the arising basis. An individual who is taxable on the arising basis is subject to

U.K. tax on their worldwide income and capital gains, regardless of where they arise.

An individual who is taxed on the remittance basis can potentially keep certain of their foreign income

and gains outside the scope of U.K. tax by having them paid offshore and not subsequently remitting

them to or enjoying them in the United Kingdom. Remittance is widely defined to include direct and

indirect remittance, and professional advice should be obtained as to when the remittance basis may

be claimed.

Up to 5 April 2013, the remittance basis was available to the following individuals:

Resident but not ordinarily resident individuals

Non domiciled individuals

Following the abolition of ordinary residence effective from the 2013-14 tax year, the remittance basis

is available to resident but non-U.K. domiciled individuals only.

As a result of the complexities of the remittance basis rules, and the potential interaction with double

tax treaties, professional advice should be sought from the outset.

Income subject to tax

Employment income - An employee is prima facie taxed on all remuneration and benefits from

employment received during a tax year ending on 5 April (the receipts basis). An employee is

taxable not only on basic salary but also on most perquisites or benefits in kind.

All salaries and fees earned by directors are taxable as employment income. Directors and

employees earning at an annual rate of 8,500 or more in a tax year, including benefits and

expenses, are assessed on a wider range of benefits in kind than other employees.

Individuals who are resident are taxed on their worldwide employment income.

Until 5 April 2013 (2012-13 U.K. tax year), tax relief on remuneration for days spent working outside

the U.K. was available only to individuals who were resident but not ordinarily resident. Effective from

6 April 2013, a new form of overseas workdays relief is potentially available.

This is available for U.K. tax residents who are non-domiciled, if they have not been U.K. tax resident

throughout the preceding 3 U.K. tax years and if the remittance basis is claimed and the remuneration

related to those overseas workdays is both paid and retained offshore.

Overseas workdays relief is likely to apply to the U.K. tax year in which the individual first becomes

U.K. tax resident and to the 2 subsequent U.K. tax years. Overseas workdays relief may also apply to

individuals who were already resident in the U.K. at 6 April 2013 if they were regarded as ordinarily

resident and if they had not been U.K. tax resident throughout the preceding 3 U.K. tax years.

In addition, the earnings of non-U.K. domiciled individuals from separate employment with a non-

resident employer for which all of the duties are performed wholly outside the U.K. may be taxed on

the remittance basis if the individuals elect to be taxed on the remittance basis, or if the remittance

basis applies automatically.

Tax is normally deducted from employment income at source under the Pay-As-You-Earn (PAYE)

system.

Self-employment income - Self-employment income includes income from a trade, profession or

vocation. Whether a person is considered to be employed or self-employed is determined by the

individuals particular circumstances and as a matter of fact.

Tax is charged on the profits or gains of trades, professions and vocations carried out wholly or partly

in the United Kingdom by U.K. residents. A business carried out wholly overseas by a U.K. resident

individual is regarded as foreign income and, consequently, may be taxed on a remittance basis if the

individual is eligible to claim the remittance basis and elects to be taxed on the remittance basis.

A non-resident individual is charged on any business exercised within the United Kingdom, or on the

part of the trade carried on in the U.K. if the trade is carried on partly in the U.K. and partly overseas.

Trading losses may be offset against a taxpayers total taxable income in both the year the loss is

incurred and in the preceding year. If the current-year loss cannot be fully offset against the current or

preceding-year trading loss, the balance can be used to offset capital gains for that year (after the

current-year capital loss has been used). Special rules provide for the carry back of losses incurred in

early trading years. In addition, a taxpayer may carry forward unused trading losses to offset future

income from the same trade. Special rules apply at the cessation of an individuals trade or business.

Investment income - Income from most investments in the United Kingdom is received after tax is

withheld or paid at source wholly or in part. Savings income, such as U.K. bank and building society

interest, and interest distributions from U.K. unit trusts, is taxable income in the year of receipt, and

tax at the basic rate (20%) is normally deducted at source. The final rate of tax applicable on savings

income depends on the level of income aggregated with other income.

Tax paid at source is taken into account when the final tax liability is calculated. Consequently, if an

individuals tax liability on savings income is higher than the tax deducted at source, additional tax is

payable.

U.K. dividends carry a non-refundable 10% notional tax credit. A similar treatment applies to

dividends from non-U.K. companies. Like savings income, the tax rate applicable to U.K. dividends

depends on the level of income aggregated with other income.

Effective from 6 April 2008, foreign dividends remitted to the United Kingdom by an individual claiming

or entitled to benefit from the remittance basis are taxed at a higher rate of tax of 40% or 45% rather

than 32.5% or 37.5%, respectively.

Any income from U.K. leased property is taxed at the rates applicable to earned income (20%, 40%

and 45%). The property income subject to income tax is the net profit from rentals after deduction of

qualifying expenses, such as mortgage interest, repairs and maintenance. The net profit is calculated

in accordance with U.K. rules even if the rental income arises from foreign leased property and is

taxed on the remittance basis. Leasing agents for non-resident landlords should withhold the basic tax

rate of 20%, unless HMRC issues a direction not to withhold tax.

If an individual has more than one rental property, all profits and losses in the year are pooled

together to give an overall profit or loss for the year. Any property loss can be carried forward and set

against property income from a U.K. property business in future tax years. A property loss may not be

carried back to a previous tax year.

U.K.-domiciled individuals are usually liable to U.K. tax on their investment income from U.K. sources,

regardless of their residence position.

Individuals who are not domiciled in the United Kingdom are also usually liable to U.K. tax on

investment income from U.K. sources, regardless of their residence position. However, they may

claim to have their investment income from any non-U.K. source income taxed on the remittance

basis.

Non-resident individuals are liable to U.K. tax on investment income only if it is from a U.K. source.

Stock options and share-based incentive schemes - Detailed, complicated legislation applies to

the taxation of share incentives provided to employees by their employers. The legislation applies to

securities, which includes, but is not limited to, shares in the employer company. The application

depends on the specific plan rules. As a result, professional advice should be sought on the

implications of this law in any particular case.

Different rules apply for approved and unapproved schemes.

Capital gains tax

An individual who is resident and domiciled in the U.K. is taxed on gains arising on disposals of

assets located anywhere in the world. However, an individual not domiciled in the United Kingdom

who elects to be taxed on the remittance basis for that year is taxed on disposals of overseas assets

only if the proceeds are remitted to the United Kingdom. In this case, the gain element of the sale

proceeds is regarded as being remitted ahead of the capital. All individuals who are subject to U.K.

capital gains tax (CGT) are entitled to an annual CGT exemption, but this is lost if the remittance

basis is claimed.

Effective from 6 April 2013, individuals who leave the United Kingdom during the year and who are

considered resident before departure and who qualify for split-year treatment are not normally

chargeable to CGT on gains realised in the non-resident part of the tax year. However, individuals

who, on departure, had been resident in the U.K. for 4 out of 7 of the preceding U.K. tax years remain

subject to temporary non-residence rules if their period of absence from the U.K. does not last for at

least 5 years.

475If the temporary non-residence rules apply, gains derived on the disposal of assets owned before

departure that are sold during the period of non-residence are subject to CGT in the U.K. tax year in

which the taxpayer returns to the U.K. and resumes tax residence (year of arrival). Gains on the

disposal of assets acquired in a period of non-residence and sold while the individual is still non-

resident are not subject to U.K. CGT. Likewise, individuals who arrive in the U.K. during the year, who

are considered resident, who are eligible for split-year treatment and who are not subject to temporary

non-residence rules are normally taxed only on gains realised after the date on which they are treated

as becoming U.K. tax resident under the split-year provisions.

Various reliefs are available for CGT. The most common relief is main residence relief, which exempts

all or part of a gain that arises on a property that an individual has used as their only or main home, if

certain conditions are met.

Entrepreneurs relief is a relief available to taxpayers who sell or give away their businesses. This

relief aims to reduce the rate of capital gains tax on qualifying disposals to 10%. Gains are eligible for

entrepreneurs relief up to a maximum lifetime limit, which is currently 10 million.

Many other reliefs are available, including rollover relief and gift relief.

The annual exemption for the 2013-14 tax year is 10,900. This exemption is forfeited if a claim for

the remittance basis is made for the tax year.

Chargeable gains are taxed at 18% or 28% depending upon the level of the individuals total income

and capital gains.

Capital losses are automatically deducted from capital gains in the same year. Any allowable unused

capital losses may be carried forward indefinitely to relieve future gains.

Inheritance and gift tax

Inheritance tax (IHT) may be levied on the estate of a deceased person who was domiciled in the

United Kingdom or who was not domiciled in the United Kingdom, but owned assets situated there.

An individual who does not have a U.K. domicile for IHT purposes is taxed only on U.K.-located

assets. For IHT purposes, the concept of domicile is extended to include residence in the United

Kingdom for substantial periods (currently defined as residence in the United Kingdom in any 17 of

the last 20 U.K. tax years).

IHT is levied on the probate (confirmed) value of an individuals estate at death. If the deceased was

domiciled in the United Kingdom for IHT purposes, the taxable estate includes worldwide assets;

otherwise, it includes only U.K. assets.

IHT is also levied on gifts made by the deceased within 7 years prior to death.

Various exemptions and reliefs are available.

To prevent double taxation, the United Kingdom has entered into inheritance tax treaties with 10

countries.

Social security

In general, National Insurance contributions are payable on the earnings of individuals who work in

the United Kingdom. Special arrangements apply to individuals working temporarily in or outside of

the United Kingdom. Under certain conditions, an employee is exempt from contributions for the first

52 weeks of employment in the United Kingdom.

The contribution for an employed individual is made in 2 parts a primary contribution from the

employee and a secondary contribution from the employer. For 201314, the employee contribution is

payable at a rate of 12% on weekly earnings between 149 and 797 and at a rate of 2% on weekly

earnings in excess of 797.

Employers must also pay National Insurance contributions on the provision of taxable benefits in kind

(for example, employer-provided car or housing).

Different rules apply to self-employed individuals. For 201314, a weekly contribution of 2.70 is due

if annual profits are expected to exceed 5,725. In addition, a self-employed individual must make a

profit-related contribution on business profits or gains, which is collected together with income tax.

The 201314 profit-related contribution rates are 9% on annual profits ranging from 7,755 to 41,450

and 2% on annual profits in excess of 41,450. Non-resident self-employed individuals are not subject

to profit-related contributions.

Tax filing and payment procedures

Income tax and social security contributions on cash earnings are normally collected under the Pay-

As-You-Earn (PAYE) system. All employers must use the PAYE system to deduct tax and social

security contributions from wages or salaries.

Although expense reimbursements and many noncash benefits are not directly subject to withholding,

they must be reported to HMRC by employers after the end of the tax year and by employees on their

tax returns.

The United Kingdom has a self-assessment tax system. Under the self-assessment system,

individuals who receive a tax return from HMRC may choose to have HMRC calculate and assess

their tax liability or to calculate and assess the tax due themselves.

If tax is due as calculated on the return, it must be paid by 31 January following the end of the tax

year. Provisional on account payments of tax on income not subject to withholding are usually

payable in 2 instalments, on 31 January in the tax year and on the following 31 July.

Each instalment must equal 50% of the previous years income tax liability not withheld at source.

Interest is automatically charged on tax not paid by the due dates. Further penalties apply for late

payment of tax and late submission of tax returns.

Double tax relief and tax treaties

If income is doubly taxed in 2 or more countries, relief for double taxation is available through a

foreign tax credit or exemption. The relief usually takes the form of a foreign tax credit if an individual

is resident in the United Kingdom for the purpose of a double tax treaty and if any foreign taxes paid

on doubly taxed income can be taken as credit against the U.K. tax liability on the same source of

income. The credit that can be claimed is limited to the lesser of the foreign taxes paid or the amount

of equivalent U.K. tax on the doubly taxed income. In the absence of a treaty with the country

imposing the foreign tax, unilateral relief may be claimed under U.K. domestic law.

If an individual is resident in a country with which the United Kingdom has entered into a double tax

treaty, a claim may be made in the United Kingdom to exempt the income subject to tax in both

countries if the treaty contains the relevant articles.

The United Kingdom has entered into double tax treaties with many countries covering taxes on

income and capital gains.

Anda mungkin juga menyukai

- Moving Taxpayers Off PaperDokumen11 halamanMoving Taxpayers Off PaperajismandegarBelum ada peringkat

- Benefits Guide Current PDFDokumen32 halamanBenefits Guide Current PDFzachBelum ada peringkat

- Samuel Debebe: Payroll Register For The Period From Jan 1, 2016 To Jan 31, 2016Dokumen2 halamanSamuel Debebe: Payroll Register For The Period From Jan 1, 2016 To Jan 31, 2016samuel debebeBelum ada peringkat

- Free Australia Personal Income Tax Calculator v1.0.2017Dokumen7 halamanFree Australia Personal Income Tax Calculator v1.0.2017Minh Nguyen Vo NhatBelum ada peringkat

- UFCW 1776 2012 Financials Wendell YoungDokumen38 halamanUFCW 1776 2012 Financials Wendell YoungbobguzzardiBelum ada peringkat

- General Payroll, Employment and DeductionsDokumen6 halamanGeneral Payroll, Employment and DeductionsJosh LeBlancBelum ada peringkat

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Dokumen1 halamanFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanBelum ada peringkat

- Tax Calculator FormulaDokumen5 halamanTax Calculator FormulaLizaBelum ada peringkat

- Profit and Loss Statement TemplateDokumen6 halamanProfit and Loss Statement TemplateyashveerBelum ada peringkat

- TC Transcontinental Benefits Guide 2020 HourlyDokumen31 halamanTC Transcontinental Benefits Guide 2020 HourlyMike SloopBelum ada peringkat

- Sample Business Registration FormDokumen4 halamanSample Business Registration FormErwin De RamaBelum ada peringkat

- Worked Example Financial StatementDokumen2 halamanWorked Example Financial StatementNayaz EmamaulleeBelum ada peringkat

- Enrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Dokumen6 halamanEnrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Bob471372Belum ada peringkat

- WWW Scribd ComDokumen195 halamanWWW Scribd Compxtan2Belum ada peringkat

- White Paper on Workplace Pension Automatic Enrolment ProcessDokumen23 halamanWhite Paper on Workplace Pension Automatic Enrolment Processdsgandhi6006Belum ada peringkat

- TaxWorks Manual 2012Dokumen256 halamanTaxWorks Manual 2012chintankumar_patelBelum ada peringkat

- ADP082511Dokumen4 halamanADP082511frontroyalBelum ada peringkat

- Change Investments AussuperDokumen2 halamanChange Investments AussuperSusi RamadhaniBelum ada peringkat

- Inbound 5872742177753206235Dokumen42 halamanInbound 5872742177753206235allizzzonBelum ada peringkat

- Reset Office Email Password in 3 Easy StepsDokumen4 halamanReset Office Email Password in 3 Easy StepsJojoBelum ada peringkat

- Request for a Business NumberDokumen5 halamanRequest for a Business Numberrouzbeh1797Belum ada peringkat

- UK Skilled Worker Visa Sponsorship Near MeDokumen11 halamanUK Skilled Worker Visa Sponsorship Near MeshravaniBelum ada peringkat

- 078 Federal Income TaxDokumen67 halaman078 Federal Income Taxcitygirl518Belum ada peringkat

- Justin OsburnDokumen3 halamanJustin OsburnJustinOsburnBelum ada peringkat

- Us W-2 2015 PDFDokumen7 halamanUs W-2 2015 PDFkevsBelum ada peringkat

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDokumen2 halamanAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Payroll Check ExplainedDokumen3 halamanPayroll Check Explainedfriendresh1708Belum ada peringkat

- MDL - Sales Report (May 1 2022 - May 31 2022)Dokumen4 halamanMDL - Sales Report (May 1 2022 - May 31 2022)Eric TalaidBelum ada peringkat

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDokumen3 halamanWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHBelum ada peringkat

- View Completed FormsDokumen10 halamanView Completed FormsRui FariaBelum ada peringkat

- Application For A Social Insurance Number Information Guide For ApplicantsDokumen7 halamanApplication For A Social Insurance Number Information Guide For ApplicantsTHEBOSS09480Belum ada peringkat

- Lan Yuye Brock OfferDokumen4 halamanLan Yuye Brock Offerapi-384261979100% (1)

- Payments 2019 RD - PA.SVDokumen1.658 halamanPayments 2019 RD - PA.SVMarco GuardadoBelum ada peringkat

- Mobey Forum Whitepaper - The MPOS Impact PDFDokumen32 halamanMobey Forum Whitepaper - The MPOS Impact PDFDeo ValenstinoBelum ada peringkat

- Pay SlipDokumen1 halamanPay SlipDana YelyaraBelum ada peringkat

- U3 RHD GVT ZW50 LU1 UODg 4 X1 My SU5 EXz Y1 XZ Iw NDM0 MZ JF MJ Y0 XZ Iw MTYw NJ MW X3 G 0 MJ Q4 NJC 2 MC5 W ZGYt NJ Aw Yj FH MTIt ZJ FM OS00 YTgz LTLJ MM Yt N2 Yw ZJK 5 YWIw NTRKDokumen13 halamanU3 RHD GVT ZW50 LU1 UODg 4 X1 My SU5 EXz Y1 XZ Iw NDM0 MZ JF MJ Y0 XZ Iw MTYw NJ MW X3 G 0 MJ Q4 NJC 2 MC5 W ZGYt NJ Aw Yj FH MTIt ZJ FM OS00 YTgz LTLJ MM Yt N2 Yw ZJK 5 YWIw NTRKKiran PratapaBelum ada peringkat

- Claims For Fare AllowanceDokumen8 halamanClaims For Fare Allowance*jezzaBelum ada peringkat

- Config Bot SuporteDokumen13 halamanConfig Bot SuporterockergastBelum ada peringkat

- TruthAboutTrucking EbookDokumen68 halamanTruthAboutTrucking EbookprimeeternalBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen15 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- RE Property Management Appointment 547 DenmDokumen17 halamanRE Property Management Appointment 547 DenmBolboBelum ada peringkat

- P6 ATX UK Summary Notes FA 2019Dokumen58 halamanP6 ATX UK Summary Notes FA 2019Mujeeb Don-The Fallen-Angel100% (1)

- Corporate Contract 2023Dokumen3 halamanCorporate Contract 2023Philippe GreinerBelum ada peringkat

- 2015 Noa Elena - 1Dokumen1 halaman2015 Noa Elena - 1Ded MarozBelum ada peringkat

- MSN BalacesheetsDokumen16 halamanMSN BalacesheetsnawazBelum ada peringkat

- Window LoginDokumen6 halamanWindow LoginAmit RajBelum ada peringkat

- 562DirectDepositForm NPSConnect SignedDokumen2 halaman562DirectDepositForm NPSConnect SignedYounanOrahaBelum ada peringkat

- Reon Energy limited Trial Balance As At DEC 31st, 2015Dokumen41 halamanReon Energy limited Trial Balance As At DEC 31st, 2015Zeeshan Haider RizviBelum ada peringkat

- Opt-Out FormDokumen3 halamanOpt-Out FormAggregate DataBelum ada peringkat

- Accounting TerminologyDokumen71 halamanAccounting TerminologyBiplob K. SannyasiBelum ada peringkat

- FCI Application DetailsDokumen1 halamanFCI Application DetailsMaheswaraReddyBelum ada peringkat

- Exemption Certificate - SalesDokumen2 halamanExemption Certificate - SalesExecutive F&ADADUBelum ada peringkat

- Hema PayslipsDokumen3 halamanHema PayslipsRajesh pvkBelum ada peringkat

- NRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous AffairsDokumen12 halamanNRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous Affairsbackch9011Belum ada peringkat

- Company Name: Employee Name: Designation: Month: Year: Earnings DeductionsDokumen1 halamanCompany Name: Employee Name: Designation: Month: Year: Earnings Deductionsnivrutti bhamareBelum ada peringkat

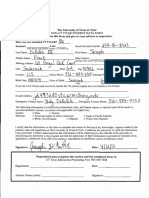

- Non-UT Tyler Student Data FormDokumen5 halamanNon-UT Tyler Student Data FormGeoffrey Ortiz100% (1)

- Apply for Canadian Startup VisaDokumen88 halamanApply for Canadian Startup VisaShashikanth RamamurthyBelum ada peringkat

- 2020 Taxpayer Planning Determining Alien Tax StatusDokumen2 halaman2020 Taxpayer Planning Determining Alien Tax Statuselnara safronovaBelum ada peringkat

- Tax For EveryoneDokumen7 halamanTax For EveryoneDang FloresBelum ada peringkat

- New FolderDokumen11 halamanNew FolderHoa ĐàoBelum ada peringkat

- E Awb Quick Reference Guide Freight ForwarderDokumen2 halamanE Awb Quick Reference Guide Freight ForwarderHoa Đào0% (1)

- Intellectual Assets and Value CreationDokumen35 halamanIntellectual Assets and Value CreationHoa ĐàoBelum ada peringkat

- New IATA Air Waybill Conditions of Contract Effective 1july2010 2Dokumen2 halamanNew IATA Air Waybill Conditions of Contract Effective 1july2010 2Hoa ĐàoBelum ada peringkat

- Chapter 4Dokumen60 halamanChapter 4Hoa ĐàoBelum ada peringkat

- FDI in Developing Countries-NP PDFDokumen37 halamanFDI in Developing Countries-NP PDFDeepakBV109Belum ada peringkat

- Foreign Direct Investment Vietnam OverviewDokumen20 halamanForeign Direct Investment Vietnam OverviewHuyềnTrang NguyễnBelum ada peringkat

- MPRA Paper 1921Dokumen68 halamanMPRA Paper 1921Hoa ĐàoBelum ada peringkat

- VIIR PrintDokumen196 halamanVIIR PrintHoa ĐàoBelum ada peringkat

- Intl Ivmt - G4 - DTUE.1 PresentationDokumen13 halamanIntl Ivmt - G4 - DTUE.1 PresentationHoa ĐàoBelum ada peringkat

- MuellerDokumen18 halamanMuellerHoa ĐàoBelum ada peringkat

- Aptir2668 Chap3Dokumen16 halamanAptir2668 Chap3Hoa ĐàoBelum ada peringkat

- B NC INternational InvestmentDokumen17 halamanB NC INternational InvestmentHoa ĐàoBelum ada peringkat

- Atplrecruitmentselectioncasestudy 130717112853 Phpapp02Dokumen3 halamanAtplrecruitmentselectioncasestudy 130717112853 Phpapp02Hoa Đào0% (1)

- Welcome To Admin - Staff PageDokumen2 halamanWelcome To Admin - Staff PageDominic Isaac AcelajadoBelum ada peringkat

- CIM - 5100 - 47 Safety and Environmental HEalth ManualDokumen384 halamanCIM - 5100 - 47 Safety and Environmental HEalth Manualantilia100% (1)

- Case Study 1Dokumen6 halamanCase Study 1FLORELY LUNABelum ada peringkat

- St. Theresa's School of Novaliches Foundation, Et Al. vs. NLRC, Et Al, G.R. No. 122955, Apr. 15, 1998Dokumen3 halamanSt. Theresa's School of Novaliches Foundation, Et Al. vs. NLRC, Et Al, G.R. No. 122955, Apr. 15, 1998JoeyBoyCruzBelum ada peringkat

- Types of Employee Dismissal TerminationsDokumen2 halamanTypes of Employee Dismissal TerminationsHau Seng LiewBelum ada peringkat

- Stellar Industrial V NLRCDokumen2 halamanStellar Industrial V NLRCGem AusteroBelum ada peringkat

- Agreement ManpowerDokumen9 halamanAgreement ManpowerEdgardo ZafraBelum ada peringkat

- Southwest Airlines Discrimination CaseDokumen7 halamanSouthwest Airlines Discrimination CaseKeith ShellyBelum ada peringkat

- Breaking The Silence: The Hidden Injuries of Neo-Liberal AcademiaDokumen21 halamanBreaking The Silence: The Hidden Injuries of Neo-Liberal AcademiaGiulia PalladiniBelum ada peringkat

- The 10 Commandments For Career SuccessDokumen17 halamanThe 10 Commandments For Career Successmantel_feathersonBelum ada peringkat

- Rural-Urban Migration ModelDokumen5 halamanRural-Urban Migration ModelSilviaBelum ada peringkat

- Reward StrategiesDokumen35 halamanReward Strategiesamruta.salunke4786100% (6)

- Evaluation of Training & RetrainingDokumen3 halamanEvaluation of Training & RetrainingNischal ChhabriaBelum ada peringkat

- 10 Best Practices: of A Best Company To Work ForDokumen19 halaman10 Best Practices: of A Best Company To Work ForLorena BoandăBelum ada peringkat

- Job Description: Ranger CoordinatorDokumen5 halamanJob Description: Ranger Coordinatorapi-252212846Belum ada peringkat

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2023Dokumen48 halamanSpesifikasi Kaedah Pengiraan Berkomputer PCB 2023Annie LimBelum ada peringkat

- Sixth Punjab Pay Commission Complete Report FinalDokumen171 halamanSixth Punjab Pay Commission Complete Report Finalarvindchopra3kBelum ada peringkat

- (1999) Oshagbemi - Academics and Their Managers A Comparative Study in Job SatisfactionDokumen16 halaman(1999) Oshagbemi - Academics and Their Managers A Comparative Study in Job SatisfactionKodok BodoBelum ada peringkat

- A Driving Force in The Knowledge EconomyDokumen10 halamanA Driving Force in The Knowledge EconomyeapinedoBelum ada peringkat

- Hbo Finals ReviewerDokumen6 halamanHbo Finals ReviewerMargaveth P. BalbinBelum ada peringkat

- ASTD ModelDokumen1 halamanASTD ModelShubham BhatewaraBelum ada peringkat

- Journal HRM Bank IndiaDokumen6 halamanJournal HRM Bank IndiaFikri EfendiBelum ada peringkat

- ISO 9001 Quality Manual SampleDokumen65 halamanISO 9001 Quality Manual SampleNicko Arya DharmaBelum ada peringkat

- 2019 MGMC Award Application SummaryDokumen61 halaman2019 MGMC Award Application SummaryNATTIDA BANNOBBelum ada peringkat

- When Salaries Are Not SecretDokumen2 halamanWhen Salaries Are Not Secretgollasrinivas100% (1)

- Competency Mapping Evolution GuideDokumen67 halamanCompetency Mapping Evolution GuideRajeshree JadhavBelum ada peringkat

- Wage Salary AdministrationDokumen16 halamanWage Salary Administrationpgundecha100% (1)

- Explore Islamabad's Luxury Serena HotelDokumen10 halamanExplore Islamabad's Luxury Serena HotelNBBelum ada peringkat

- SITXFIN003 - Case Study Part 1Dokumen5 halamanSITXFIN003 - Case Study Part 1detailed trickzBelum ada peringkat

- Press Brake BendingDokumen12 halamanPress Brake BendingGopu PushpangadhanBelum ada peringkat