33 9488

Diunggah oleh

Mark ReinhardtJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

33 9488

Diunggah oleh

Mark ReinhardtHak Cipta:

Format Tersedia

UNITED STATES OF AMERICA

Before the

SECURITIES AND EXCHANGE COMMISSION

SECURITIES ACT OF 1933

Release No. 9488 / November 27, 2013

INVESTMENT ADVISERS ACT OF 1940

Release No. 3728 / November 27, 2013

INVESTMENT COMPANY ACT OF 1940

Release No. 30814 / November 27, 2013

ADMINISTRATIVE PROCEEDING

File No. 3-15629

In the Matter of

MARIE L. HUBER and

JESS E. JONES,

Respondents.

ORDER INSTITUTING

ADMINISTRATIVE AND CEASE-AND-

DESIST PROCEEDINGS PURSUANT

TO SECTION 8A OF THE SECURITIES

ACT OF 1933, SECTION 203(f) OF THE

INVESTMENT ADVISERS ACT OF

1940, AND SECTION 9(b) OF THE

INVESTMENT COMPANY ACT OF

1940, MAKING FINDINGS, AND

IMPOSING REMEDIAL SANCTIONS

AND A CEASE-AND-DESIST ORDER

I.

The Securities and Exchange Commission (Commission) deems it appropriate

and in the public interest that public administrative and cease-and-desist proceedings be,

and hereby are, instituted pursuant to Section 8A of the Securities Act of 1933 (Securities

Act), Section 203(f) of the Investment Advisers Act of 1940 (Advisers Act), and

Section 9(b) of the Investment Company Act of 1940, against Marie L. Huber (Huber)

and J ess E. J ones (J ones).

II.

In anticipation of the institution of these proceedings, Respondents have submitted

Offers of Settlement (the Offers) which the Commission has determined to accept.

Solely for the purpose of these proceedings and any other proceedings brought by or on

behalf of the Commission, or to which the Commission is a party, and without admitting or

denying the findings herein, except as to the Commissions jurisdiction over them and the

subject matter of these proceedings, which are admitted, Respondents consent to the entry

of this Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to

Section 8A of the Securities Act of 1933, Section 203(f) of the Investment Advisers Act of

2

1940, and Section 9(b) of the Investment Company Act of 1940, Making Findings, and

Imposing Remedial Sanctions and a Cease-and-Desist Order (Order), as set forth

below.

III.

On the basis of this Order and Respondents Offers the Commission finds that:

Respondents

1. Marie L. Huber, age 35, resides in Cambridge, Massachusetts. From

J anuary 2007 to February 2011, Huber was an analyst at Hedge Fund Adviser A. Huber

has not been associated with a registered investment adviser since that time. Huber has a

Bachelors degree in Biochemistry and a Masters degree in Bioscience Enterprise from

Cambridge University in the United Kingdom. Huber is not a registered adviser and does

not hold any securities licenses.

2. J ess E. J ones, age 34, resides in Reno, Nevada. From J une 2007 to

J anuary 2011, J ones was an analyst at Hedge Fund Adviser B. J oness focus was the

health care industry. J ones has a Bachelors degree from the University of Utah in Salt

Lake City, Utah, and an M.D. and a Masters Degree in Business Administration from

Columbia University in New York, New York. J ones is not a registered adviser and does

not hold any securities licenses.

Other Relevant Entities

1. Hedge Fund Adviser A (hereinafter referred to as HFA-A) is an

investment adviser that has been registered with the Commission since 2009. HFA-A is a

Delaware corporation with its principal office in New York, New York.

2. Hedge Fund Adviser B (hereinafter referred to as HFA-B) is

an investment adviser that has been registered with the Commission since 2006. HFA-B

is a Delaware corporation with its principal office in New York, New York.

3. Dendreon Corporation (Dendreon) is a Delaware corporation

with its principal office in Seattle, Washington. Dendreon is a biotechnology company

that developed and markets Provenge (Sipuleucel-T), which is an immunotherapy

treatment for late-stage prostate cancer. Provenge is Dendreons only commercialized

product. Dendreon has common stock registered with the Commission under Section

12(b) of the Exchange Act. The companys common stock (symbol DNDN) trades

on the NASDAQ Stock Market.

Background

1. On April 29, 2010, the Food and Drug Administration (FDA)

approved Provenge for the treatment of late-stage prostate cancer. In early J une 2010, the

FDA released documents related to its decision to approve Provenge (the FDA

3

documents). After reviewing and analyzing the FDA documents, Huber concluded that

the Provenge treatment was hastening the death of patients. In J une 2010, Huber began

drafting a report for HFA-A, entitled Provenge PhIII Trials The Alternative Explanation

of Survival Results (hereinafter referred to as the Alternative Explanation), which set

forth her analysis.

1

Huber shared her draft report with a number of individuals, including

Respondent, J ess J ones.

2. During the period of J une 17, 2010 through J uly 12, 2010, Huber

purchased $125,431 in J uly Dendreon put options and $110,627 in August put options.

2

Huber also purchased put options in her mothers account, and shared her analysis with

friends and family who subsequently traded in Dendreon securities. The J uly put options

that Huber purchased were set to expire on J uly 17, 2010, and had strike prices ranging

from $10 to $30. All of the put options were out-of-the-money and most of them had

strike prices of $25 or less. Dendreon common stock was selling in the low to mid $30s

at the time. During the same period, J ones purchased $3,095 in J uly Dendreon put

options and $36,651 in August put options. The put options that J ones purchased were

also out-of-the-money and had strike prices ranging from $21 to $30. In addition, J ones

advised family and friends to purchase Dendreon put options.

3

3. On J une 30, 2010, the Centers for Medicare & Medicaid Services

(CMS) opened a national coverage analysis for Provenge, and requested public

comments concerning the efficacy of Provenge and whether it should be covered by

Medicare and/or Medicaid. Huber encouraged HFA-A to submit the report she prepared

on Provenge to CMS. In early J uly 2010, HFA-A had not yet determined when to submit

the Alternative Explanation to CMS in response to the request for comments. As the J uly

17, 2010 put option expiration date neared, Respondents were concerned that HFA-A was

not going to submit the report to the CMS website prior to the expiration of their put

options. As a result, Respondents arranged to disseminate the Alternative Explanation on

their own prior to option expiration.

4. On J uly 12, 2010, Huber gave J ones a flash drive which contained

documents relating to the Alternative Explanation, including copies of the Alternative

Explanation, a distribution list of email addresses, and a version of the email text that J ones

subsequently used to disseminate the report.

4

1

A version of the Alternative Explanation was subsequently published in the J ournal of the National

Cancer Institute on February 22, 2012. The findings in this Order do not address the conclusions set forth in

the Alternative Explanation.

2

Huber did not receive approval for these trades as required by HFA-As trading policies.

3

J ones did not receive approval for these trades as required by HFA-Bs trading policies.

4

That evening, J ones created an email account using the name Aaron Adams and Dendreons ticker

symbol DNDN (aa.adams.dndn@gmail.com) and sent emails attaching the Alternative Explanation to

seven individuals in the financial community. Those emails contained the following message: Thought you

guys might want to see this before everyone else . . . [.] The following day, on J uly 13, J ones anonymously

posted the Alternative Explanation on the Pharmalot blog and the Yahoo! DNDN Message Board.

4

5. On the evening of J uly 14, 2010, J ones created an email account

using the name J onathan White and Dendreons ticker symbol DNDN

(jon.white.dndn@gmail.com) and sent emails attaching the Alternative Explanation to

more than 450 email addresses from a distribution list that Huber had provided. Most of

the email recipients were affiliated with the medical and pharmaceutical industries, and

approximately 15 of the recipients were in the financial industry. The J onathan White

emails contained the following text, the substance of which was contained on the flash

drive which Huber provided to J ones:

BCC list: 500 members of the medical, scientific, regulatory, and

legal communities

Dear Colleague,

The document attached . . . was written by a group of scientists and

physicians whose concern for their safety has forced them into

hiding. In it they postulate a design flaw in the Provenge PhIII trials

with potentially profound implications. Those who previously

voiced legitimate scientific concerns regarding this drug had their

lives threatened, were forced to employ body-guards and have been

traumatized into silence. Every dissenting voice is squashed. This

fear extended to the FDA reviewers, who stated if it doesnt get

approved this time, there will be bloodshed. It is our constitutional

right to express our opinions. If money and power can scare

dissenters into silence, it is a sad day indeed for our nation and for

humankind.

I call upon you to read this argument and make your own

independent, critical assessment of its merits. If you see the merit of

the concerns it voices, I call upon you to express those views to the

FDA and CMS (Leslye Fitterman, PHD;

Leslye.fitterman3@cms.hhs.gov) who have been trusted with the

power of protecting the American public.

In my personal opinion (and that of select esteemed colleagues) that

a legitimate concern has been raised, which is that the immune cells

that are explicitly removed from placebo patients in the Provenge

trials could have significantly compromised these patients and their

ability to fight their cancer. This possibility must be explored as an

alternative explanation for these trial results, because if it is right, it

implies that Provenge treatment is harmful to patients because of all

the immune cells that are lost during this treatment, and not

prolonging life at all!

If any of you reach the same independent assessment of this piece as

I do, it is our moral obligation to have a voices heard and demand

this matter is investigated. We must stand up against those that

5

wish to use the power of the sword to threaten legitimate scientific

discourse and concern for patient safety. We cannot allow the big

money invested in this drug to feed on the fear and desperation of

cancer patients and their families to co-opt their voice to silence

those very people that are trying to protect them.

Sincerely,

A concerned physician, scientist and citizen

p.s. Scientific progress since 1999, when the FDA agreed to the

design of these trials, has significantly increased our understanding

of immune aging. Now that we know that the aged immune system

cannot replace lost cells in the way that the youthful immune system

can, we should identify the possible mistakes of our earlier

ignorance. We infected thousands of people with HIV and Hepatitis

C through blood infusions before we discovered that these are

blood-bourn pathogens. We gave thalidomide to thousands of

pregnant women before we understood that this was causing birth

defects. We used epo to drive hemoglobin levels to unhealthy levels

until we learned that this is harmful. We make mistakes, and

scientific progress reveals those mistakes. The sooner we rectify

earlier mistakes, the sooner we curtail the unintentional harm we are

causing.

6. On J uly 14, 2010, Dendreon shares closed at $33.99 on volume of

4,042,300. On J uly 15, 2010, after the J onathan White emails were sent, Dendreon

shares fell 7.2% intraday ($31.54) and closed down 4.5% ($32.45).

5

Trading volume on

J uly 15 was 9,084,700, nearly double the average volume for the three trading days before

and after J uly 15. That day, Huber sold 376 J uly put option contracts with strike prices of

$27 and $30 for total proceeds of $2,841, and J ones sold 50 August put option contracts

with a strike price of $28 for proceeds of $8,522. However, Huber and J ones suffered

significant trading losses because the vast majority of their put option contracts remained

unsold or unexercised because they were so far out-of-the-money.

7. On J uly 14, Huber told her boss at HFA-A that there had been a

leak of the Alternative Explanation. Huber told her boss and colleagues that she did not

know who leaked the Alternative Explanation, but that given the leak, HFA-A should

quickly submit to CMS as public comment the most up-to-date version of the report. On

J uly 15, 2010, on HFA-As behalf, outside counsel submitted the Alternative Explanation

to CMS on behalf of an unidentified client, and CMS posted the report on its website as

part of the public comments.

6

5

On J uly 15, the pharmaceutical sector was slightly up (0.1%), and the DJ IA, S&P 500, and

NASDAQ were flat (<0.001%).

6

The submission contained a disclosure stating that the report was prepared by an investment adviser

which may from time to time have a long or short interest in companies that are directly or indirectly affected by

6

8. The text of the J uly 14 J onathan White emails omitted to state

material facts necessary to make the statements made not misleading. The emails stated

that the Alternative Explanation was written by a group of scientists and physicians and

was signed A concerned physician, scientist and citizen. These statements were

materially misleading because the Respondents were hedge fund analysts who held

Dendreon put option contracts that were about to expire. These facts were material

because investors would have considered the identity, motive, and financial self-interest

of Respondents important to assessing the report and any decision to buy or sell the

securities of Dendreon.

9. Section 17(a)(2) of the Securities Act prohibits any person, in the

offer or sale of any securities, to obtain money or property by means of any untrue

statement of a material fact or any omission to state a material fact necessary in order to

make the statements made, in light of the circumstances under which they were made, not

misleading. As a result of the conduct described above,

7

Respondents willfully

8

violated Section 17(a)(2) of the Securities Act.

IV.

In view of the foregoing, the Commission deems it appropriate and in the public

interest to impose the sanctions agreed to in Respondents Offers.

Accordingly, pursuant to Section 8A of the Securities Act, Section 203(f) of the

Advisers Act, and Section 9(b) of the Investment Company Act, it is hereby ORDERED

that:

A. Respondents Huber and J ones cease and desist from committing or causing

any violations and any future violations of Section 17(a)(2) of the Securities Act.

B. Respondents Huber and J ones be, and hereby are suspended for six months

from association with any broker, dealer, investment adviser, municipal securities dealer,

or transfer agent, and prohibited for six months from serving or acting as an employee,

officer, director, member of an advisory board, investment adviser or depositor of, or

principal underwriter for, a registered investment company or affiliated person of such

investment adviser, depositor, or principal underwriter.

C. Respondents Huber and J ones shall each, within 10 days of the entry of this

the matters referred to in this paper. The findings in this Order do not address this disclosure.

7

The Respondents conduct described above was, at a minimum, negligent. Negligent conduct can

violate Section 17(a)(2). See, e.g., SEC v. Hughes Capital Corp., 124 F.3d 449, 453-54 (3d Cir. 1997).

8

A willful violation of the securities laws means merely that the person charged with the duty

knows what he is doing. It does not mean that, in addition, he must suppose that he is breaking the law.

Wonsover v. SEC, 205 F.3d 408, 414 (D.C. Cir. 2000) (quoting Hughes v. SEC,

174 F.2d 969, 977 (D.C. Cir. 1949)).

7

Order, pay a civil money penalty in the amount of $25,000 to the United States Treasury.

If timely payment is not made, additional interest shall accrue pursuant to 31 U.S.C. 3717.

Payment must be made in one of the following ways:

(1) Respondent may make direct payment from a bank account via Pay.gov through

the SEC website at http://www.sec.gov/about/offices/ofm.htm; or

(2) Respondent may pay by certified check, bank cashiers check, or United States

postal money order, made payable to the Securities and Exchange Commission and

hand-delivered or mailed to:

Enterprise Services Center

Accounts Receivable Branch

HQ Bldg., Room 181, AMZ-341

6500 South MacArthur Boulevard

Oklahoma City, OK 73169

Payments by check or money order must be accompanied by a cover letter

identifying them as a Respondent in these proceedings, and the file number of these

proceedings; a copy of the cover letter and check or money order must be sent to Brian O.

Quinn, Assistant Director, Division of Enforcement, Securities and Exchange Commission,

100 F St., NE, Washington, DC 20549-5030.

By the Commission.

Elizabeth M. Murphy

Secretary

Anda mungkin juga menyukai

- Patrol LP Scenario04 July2021Dokumen24 halamanPatrol LP Scenario04 July2021Mark ReinhardtBelum ada peringkat

- Patrol LP Scenario03 July2021Dokumen25 halamanPatrol LP Scenario03 July2021Mark ReinhardtBelum ada peringkat

- 20200206press Release IPC E 18 15Dokumen1 halaman20200206press Release IPC E 18 15Mark ReinhardtBelum ada peringkat

- The First Rules of Los Angeles Police DepartmentDokumen1 halamanThe First Rules of Los Angeles Police DepartmentMark ReinhardtBelum ada peringkat

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Dokumen80 halamanSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtBelum ada peringkat

- A Bill: 117 Congress 1 SDokumen22 halamanA Bill: 117 Congress 1 SMark ReinhardtBelum ada peringkat

- 20221230final Order No 35651Dokumen5 halaman20221230final Order No 35651Mark ReinhardtBelum ada peringkat

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDokumen185 halamanMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtBelum ada peringkat

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDokumen27 halamanWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtBelum ada peringkat

- H0001Dokumen2 halamanH0001Mark ReinhardtBelum ada peringkat

- Crime Scene Manual Rev3Dokumen153 halamanCrime Scene Manual Rev3Mark ReinhardtBelum ada peringkat

- Transitioning Coal Plants To Nuclear PowerDokumen43 halamanTransitioning Coal Plants To Nuclear PowerMark ReinhardtBelum ada peringkat

- A Bill: 116 Congress 2 SDokumen15 halamanA Bill: 116 Congress 2 SMark ReinhardtBelum ada peringkat

- Affidavit Writing Made EasyDokumen6 halamanAffidavit Writing Made EasyMark ReinhardtBelum ada peringkat

- HJR003Dokumen1 halamanHJR003Mark ReinhardtBelum ada peringkat

- Idaho H0098 2021 SessionDokumen4 halamanIdaho H0098 2021 SessionMark ReinhardtBelum ada peringkat

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDokumen11 halamanCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtBelum ada peringkat

- Bills 113s987rsDokumen44 halamanBills 113s987rsMark ReinhardtBelum ada peringkat

- NIYSVADokumen15 halamanNIYSVAMark ReinhardtBelum ada peringkat

- NIYSUTDokumen4 halamanNIYSUTMark ReinhardtBelum ada peringkat

- NIYSWADokumen17 halamanNIYSWAMark ReinhardtBelum ada peringkat

- NIYSTXDokumen19 halamanNIYSTXMark ReinhardtBelum ada peringkat

- NIYSSCDokumen11 halamanNIYSSCMark ReinhardtBelum ada peringkat

- NIYSTNDokumen5 halamanNIYSTNMark ReinhardtBelum ada peringkat

- NIYSWIDokumen8 halamanNIYSWIMark ReinhardtBelum ada peringkat

- NIYSPADokumen8 halamanNIYSPAMark ReinhardtBelum ada peringkat

- NIYSVTDokumen4 halamanNIYSVTMark ReinhardtBelum ada peringkat

- NIYSSDDokumen4 halamanNIYSSDMark ReinhardtBelum ada peringkat

- NIYSRIDokumen9 halamanNIYSRIMark ReinhardtBelum ada peringkat

- NIYSPRDokumen7 halamanNIYSPRMark ReinhardtBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

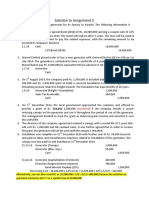

- CHAPTER 2 FINANCIAL ANALYSIS AND PLANNINGDokumen85 halamanCHAPTER 2 FINANCIAL ANALYSIS AND PLANNINGTarekegn DemiseBelum ada peringkat

- WEC13 01 Que 20220111Dokumen32 halamanWEC13 01 Que 20220111Mike JACKSONBelum ada peringkat

- Mindanao Island 5.1 (PPT 1) Group 2Dokumen40 halamanMindanao Island 5.1 (PPT 1) Group 2Aldrin Gabriel BahitBelum ada peringkat

- Institutional Framework FOR International Business: Business R. M. JoshiDokumen45 halamanInstitutional Framework FOR International Business: Business R. M. JoshiIshrat SonuBelum ada peringkat

- Trinity College - Academic Calendar - 2009-2010Dokumen3 halamanTrinity College - Academic Calendar - 2009-2010roman_danBelum ada peringkat

- No. 49 "Jehovah Will Treat His Loyal One in A Special Way"Dokumen5 halamanNo. 49 "Jehovah Will Treat His Loyal One in A Special Way"api-517901424Belum ada peringkat

- Denmark Trans Fats LawDokumen2 halamanDenmark Trans Fats LawPerwaiz KhanBelum ada peringkat

- Lopez-Wui, Glenda S. 2004. "The Poor On Trial in The Philippine Justice System." Ateneo Law Journal 49 (4) - 1118-41Dokumen25 halamanLopez-Wui, Glenda S. 2004. "The Poor On Trial in The Philippine Justice System." Ateneo Law Journal 49 (4) - 1118-41Dan JethroBelum ada peringkat

- GhostwritingDokumen6 halamanGhostwritingUdaipur IndiaBelum ada peringkat

- Assignment 2 SolutionDokumen4 halamanAssignment 2 SolutionSobhia Kamal100% (1)

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Dokumen3 halamanAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Justia.comBelum ada peringkat

- COMPLETING YOUR IRC FORM C TAX RETURNDokumen31 halamanCOMPLETING YOUR IRC FORM C TAX RETURNDanielBelum ada peringkat

- The Little Girl and The Cigarette by Benoit DuteurtreDokumen15 halamanThe Little Girl and The Cigarette by Benoit DuteurtreMelville HouseBelum ada peringkat

- Bwff1013 Foundations of Finance Quiz #3Dokumen8 halamanBwff1013 Foundations of Finance Quiz #3tivaashiniBelum ada peringkat

- Bestway Cement Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormDokumen8 halamanBestway Cement Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormMuzzamilBelum ada peringkat

- Release Vehicle Motion Philippines Theft CaseDokumen3 halamanRelease Vehicle Motion Philippines Theft Caseczabina fatima delicaBelum ada peringkat

- Bank StatementDokumen2 halamanBank StatementZakaria EL MAMOUNBelum ada peringkat

- Bridal ContractDokumen5 halamanBridal ContractStacey MarieBelum ada peringkat

- Marxist Theory of Citizenship - Anthony GiddensDokumen4 halamanMarxist Theory of Citizenship - Anthony GiddensRamita UdayashankarBelum ada peringkat

- Tax 3 Mid Term 2016-2017 - RawDokumen16 halamanTax 3 Mid Term 2016-2017 - RawPandaBelum ada peringkat

- Partnership Liability for Debts IncurredDokumen12 halamanPartnership Liability for Debts IncurredDennis VelasquezBelum ada peringkat

- John Hankinson AffidavitDokumen16 halamanJohn Hankinson AffidavitRtrForumBelum ada peringkat

- Philippine Citizenship Denied Due to Absence After Filing PetitionDokumen6 halamanPhilippine Citizenship Denied Due to Absence After Filing Petitionalyssa bianca orbisoBelum ada peringkat

- Denatured Fuel Ethanol For Blending With Gasolines For Use As Automotive Spark-Ignition Engine FuelDokumen9 halamanDenatured Fuel Ethanol For Blending With Gasolines For Use As Automotive Spark-Ignition Engine FuelAchintya SamantaBelum ada peringkat

- Co-Operative Act (No. 14 of 2005)Dokumen45 halamanCo-Operative Act (No. 14 of 2005)MozitomBelum ada peringkat

- Sentence Correction - English Aptitude MCQ Questions and Answers Page-3 Section-1 - 1603796318303Dokumen4 halamanSentence Correction - English Aptitude MCQ Questions and Answers Page-3 Section-1 - 1603796318303LikeBelum ada peringkat

- 2011 Veterans' Hall of Fame Award RecipientsDokumen46 halaman2011 Veterans' Hall of Fame Award RecipientsNew York SenateBelum ada peringkat

- FM ReportDokumen2 halamanFM Reportcaiden dumpBelum ada peringkat

- Chief Affidavit of Petitioner M.v.O.P.222 of 2013Dokumen4 halamanChief Affidavit of Petitioner M.v.O.P.222 of 2013Vemula Venkata PavankumarBelum ada peringkat

- Sample Resignation LetterDokumen15 halamanSample Resignation LetterJohnson Mallibago71% (7)