CASE Business Planning

Diunggah oleh

XiamMarieCortezHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CASE Business Planning

Diunggah oleh

XiamMarieCortezHak Cipta:

Format Tersedia

CASE

The Cooking Hut Company (CHC), a local retailer of a wide variety of kitchen and dining room

items such as coffee makers, silverware, and tale linens would like you to help in the udgeting

process! The company rents a retail store in a midsi"eed community near #enver! CHC$s

management prepares a continuous udget to aid financial and operating decisions! %or

simplicity, the planning hori"on is only four months, April through &uly! 'n the past, sales have

increased during this season! However, the company$s collections have always lagged well

ehind its sales! As a result, the company has often found itself pressed to come up with cash

for purchases, employee wages, and other operating outlays! To help meet this cash s(uee"e,

CHC has used short)term loans from local anks, paying them ack when cash comes in! CHC

plans to keep on using this system!

E*hiit +), is the closing alance sheet for the fiscal year ending -arch ./, ,001! Sales in

-arch were 230,000! -onthly sales are forecasted as follows4 April 250,0006 -ay 270,0006

&une 280,0006 &uly 250,0006 August, 230,000! -anagement e*pects future sales collections to

follow past e*perience4 809 of the sales should e in cash and 309 on credit! All credit

accounts are collected in the month following the sales! :ncollectile accounts are negligile

and thus ignored! Also we will ignore all local, state, and federal ta*es for this case! ;ecause

deliveries from suppliers and customer demands are uncertain, at the end of each month, CHC

wants to have on hand a asic inventory of items valued at 2,0,000 plus 709 of the e*pected

cost of goods sold for the following month! The cost of merchandise sold averages +09 of

sales! The purchase terms availale to CHC are net, .0 days! CHC pays for each month$s

purchases as follows4 509 during that month and 509 during the ne*t month!

CHC pays wages and commissions semi monthly, half a month after they are earned! They are

divided into two portions4 monthly fi*ed wages of 2,,500 and commissions, e(ual to /59 of

sales, which we will assume are uniform throughout each month!

'n addition to uying new fi*tures for 2.,000 cash in April, CHC$s other monthly e*penses are as

follows4

-iscellaneous e*penses 59 of sales, paid as incurred

<ent 2,,000, paid as incurred

'nsurance 2,00 e*piration per month

#epreciation, including new fi*tures 2500 per month

The company wants a minimum of 2/0,000 as a cash alance at the end of each month! =e will

assume that CHC can orrow or repay loans in multiples of 2/,000! -anagement plans to

orrow no more cash than necessary and to repay as promptly as possile! Assume orrowing

occurs at the eginning and repayment at the end fo the months in (uestion! 'nterest is paid,

under the terms of this credit arrangement, when the related loan is repaid! The interest rate is

/79 per year!

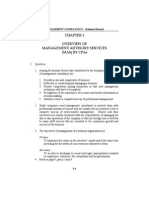

E*hiit +),

The Cooking Hut Company

;alance Sheet -arch ./, ,001

Assets

Current Assets

Cash 2/0,000

Accounts receivale /8,000

-erchandise 'nventory 37,000

:ne*pired insurance /,700 2+5,700

>lant Assets

E(uipment, fi*tures 2.+,000

Accumulated depreciation /,,700 ,3,,00

Total assets 2/00,000

?iailities @ Awners$ E(uity

Current ?iailities

Accounts payale 2/8,700

Accrued wages and commission payale 3,,50 2,/,050

Awners$ e(uity +7,150

Total liailities and owners$ e(uity 2/00,000

<e(uired4 >repare the operating and financial udget which includes sales udget, purchases,

cost of goods sold, operating e*penses, cash udget, udgeted income statement and

udgeted alance sheet for the months in (uestion! ('ncome statement is prepared for the four

months ended &uly ./, ,001 while ;alance sheet is for &uly ./, ,001)!

Anda mungkin juga menyukai

- Case BalancedDokumen1 halamanCase BalancedXiamMarieCortezBelum ada peringkat

- Illustrative Problem On Master BudgetingDokumen13 halamanIllustrative Problem On Master BudgetingSumendra Shrestha84% (19)

- Chapter 02 - Sir. KairusDokumen2 halamanChapter 02 - Sir. KairusNami Tsuruoka100% (2)

- Chapter 01 - Management Consultancy by CabreraDokumen2 halamanChapter 01 - Management Consultancy by Cabrerarogienelr75% (8)

- FINANCIAL FORECASTING SOLUTIONSDokumen4 halamanFINANCIAL FORECASTING SOLUTIONSlou-924100% (4)

- Chapter 1 Advanced Acctg. SolmanDokumen20 halamanChapter 1 Advanced Acctg. SolmanLaraBelum ada peringkat

- Chapter 6advacDokumen17 halamanChapter 6advacXiamMarieCortezBelum ada peringkat

- Multiple Choice Answers and Solutions: Aquino Locsin David HizonDokumen26 halamanMultiple Choice Answers and Solutions: Aquino Locsin David HizonclaudettegasendoBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Delivery Advice - 20200306 - 074955 PDFDokumen1 halamanDelivery Advice - 20200306 - 074955 PDFRaphael Baterna ManigsacaBelum ada peringkat

- Topic 11 - Revenue From Contract With Customers (IFRS 15) - SVDokumen56 halamanTopic 11 - Revenue From Contract With Customers (IFRS 15) - SVHONG NGUYEN THI KIMBelum ada peringkat

- Linden Community PlanDokumen112 halamanLinden Community PlanNeighborhood Design CenterBelum ada peringkat

- Measuring and Evaluating Your Omnichannel Customer ExperienceDokumen26 halamanMeasuring and Evaluating Your Omnichannel Customer ExperienceMoises VillanuevaBelum ada peringkat

- Ikea-Case-Analysis 2Dokumen10 halamanIkea-Case-Analysis 2Nicole ClianoBelum ada peringkat

- GO-Ceries: A Unique 3-in-1 SupermarketDokumen29 halamanGO-Ceries: A Unique 3-in-1 SupermarketHershey ReyesBelum ada peringkat

- TMForum-Telco Revenue Growth BenchmarkDokumen86 halamanTMForum-Telco Revenue Growth BenchmarkHasan Mukti100% (1)

- Indian Online Buyer Study: Factors Influencing Purchase BehaviorDokumen3 halamanIndian Online Buyer Study: Factors Influencing Purchase BehaviorWayne Vernon D'cruzeBelum ada peringkat

- Report On Pepsi Unit 16Dokumen12 halamanReport On Pepsi Unit 16Arif KhanBelum ada peringkat

- MarketingPlan NikeDokumen32 halamanMarketingPlan NikeZIA UL REHMANBelum ada peringkat

- Challenges and Opportunities in Agri MarketingDokumen13 halamanChallenges and Opportunities in Agri MarketingAnonymous 8SNpyX100% (2)

- European Retail Parks - November 2021Dokumen9 halamanEuropean Retail Parks - November 2021Catalina Muriel Sánchez MonsalvesBelum ada peringkat

- E-Book For Order ProcessesDokumen36 halamanE-Book For Order ProcessesTrần Thị Quỳnh NhiBelum ada peringkat

- Monopoly Case Study: Amazon: Exercise Sheet 7Dokumen4 halamanMonopoly Case Study: Amazon: Exercise Sheet 7Joel ComanBelum ada peringkat

- Public Toilets Ebook by BTADokumen56 halamanPublic Toilets Ebook by BTAMuhammad HelmiBelum ada peringkat

- Cambodia, Laos and Myanmar Food and Drink Report - Q4 2020Dokumen84 halamanCambodia, Laos and Myanmar Food and Drink Report - Q4 2020Nicholas ChiaBelum ada peringkat

- jgNS8h ContentServer PDFDokumen24 halamanjgNS8h ContentServer PDFjames koshaBelum ada peringkat

- ESL Shopping Reading Conversation PassageDokumen2 halamanESL Shopping Reading Conversation PassageKUGESELVINACHAPPANBelum ada peringkat

- Pra VeenDokumen71 halamanPra Veen04 G.V. YESHWANTHBelum ada peringkat

- Vanderlande Is The Global Market Leader For ValueDokumen7 halamanVanderlande Is The Global Market Leader For ValueNainish MishraBelum ada peringkat

- Tanishq Jewellery Market Research (Archive) - ManagementParadise (1) .Com - Your MBA Online Degree Program and Management Students FDokumen22 halamanTanishq Jewellery Market Research (Archive) - ManagementParadise (1) .Com - Your MBA Online Degree Program and Management Students Ffarhad10_1Belum ada peringkat

- Assignment: Operation Research Topic: Inventory Control Group MembersDokumen12 halamanAssignment: Operation Research Topic: Inventory Control Group Memberszohaib biagBelum ada peringkat

- Syllabi of B.voc. (Retail Management) 2014-15Dokumen38 halamanSyllabi of B.voc. (Retail Management) 2014-15Bikalpa BoraBelum ada peringkat

- Physical Distribution Case StudyDokumen5 halamanPhysical Distribution Case Studykapooranukaran100% (1)

- Chapter 7 Basic Acctg (Merchandising)Dokumen59 halamanChapter 7 Basic Acctg (Merchandising)Jamez Zen BronzBelum ada peringkat

- Retail Medical Shop Pharmacy Store POS Billing Accounting Inventory Stock Management Software SystemDokumen4 halamanRetail Medical Shop Pharmacy Store POS Billing Accounting Inventory Stock Management Software SystemAjit BilalBelum ada peringkat

- Chapter 11Dokumen36 halamanChapter 11Shanelle Jacobs0% (1)

- Project Management ModuleDokumen42 halamanProject Management Modulewanyusoff62100% (1)

- SMEDA Pickle Production, Processing, Packaging & Marketing PDFDokumen32 halamanSMEDA Pickle Production, Processing, Packaging & Marketing PDFAfnan TariqBelum ada peringkat

- CASE 7 - Roger's ChocolateDokumen9 halamanCASE 7 - Roger's Chocolateterjun rustia100% (1)