Maximizing Shareholder Value Through Optimal Dividend and Buyback Policy

Diunggah oleh

RichBrook70 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

200 tayangan2 halamanThis document discusses various factors a firm considers when determining its dividend payout policy, including perceptions among investors, cash flows, and tax implications. It analyzes the pros and cons of different policies like only paying dividends, only share buybacks, or a combination. For the specific firm Linear Technology, the document models the impacts of different policies on its share price and earnings per share. It determines that using some cash for buybacks and some for a special dividend would maximize shareholder value while reducing risk, but this policy may not be as attractive as solely buybacks if tax reforms are delayed.

Deskripsi Asli:

DIVI

Judul Asli

Session 19 - Dividend Policy @ Linear Tech

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document discusses various factors a firm considers when determining its dividend payout policy, including perceptions among investors, cash flows, and tax implications. It analyzes the pros and cons of different policies like only paying dividends, only share buybacks, or a combination. For the specific firm Linear Technology, the document models the impacts of different policies on its share price and earnings per share. It determines that using some cash for buybacks and some for a special dividend would maximize shareholder value while reducing risk, but this policy may not be as attractive as solely buybacks if tax reforms are delayed.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

200 tayangan2 halamanMaximizing Shareholder Value Through Optimal Dividend and Buyback Policy

Diunggah oleh

RichBrook7This document discusses various factors a firm considers when determining its dividend payout policy, including perceptions among investors, cash flows, and tax implications. It analyzes the pros and cons of different policies like only paying dividends, only share buybacks, or a combination. For the specific firm Linear Technology, the document models the impacts of different policies on its share price and earnings per share. It determines that using some cash for buybacks and some for a special dividend would maximize shareholder value while reducing risk, but this policy may not be as attractive as solely buybacks if tax reforms are delayed.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

1. Purpose of mgmt. debating on the amount of dividend to be paid, corresponding to Q3 FY2003.

To create a positive perception of its growth prospects among the investors.

It is a sign of strong positive cash flows, profitability of the firm.

So firms remain cautious about their payout ratio, to sustain long run payments.

Ultimately, to maximize the shareholders value.

2. Findings of Academic research: A positive link between dividend yields & future returns.

Probably because paying out dividends increases tax burden on the firm.

This encourages management to make better investment with the cash available.

3. Incentivized to pay dividend only when firm is confident of the future.

So that investors will be sure of receiving regular dividends even during downturns.

As during that time, external interest rates fall significantly, even 1% dividend looks great.

Propels to increase the market-book ratio relative to non-paying ones.

Many Mutual Funds companies & Euro investment firms prefer stocks with regular dividends.

4. Restraint from Executive level employees.

These days technology companies follow a variable cost structure.

By making ESOPs as a considerable portion of their compensation & pay as per earnings.

So, those guys will try to exercise their options only when the stock price is at higher levels.

They will not be interested in the incentive of dividend payment.

As that exercise creates dilution, firms will buyback the shares to offset that effect.

5. It will not pay dividends if there are not enough cash earnings (after offsetting dilution).

Paying dividends without buybacks will hurt its EPS, though it provides cash to investors.

6. Restraint generated from own dividend payment policy during downturns (along with Iraq war).

For paying dividends, firms need cash reserves.

During economic slowdowns, interest rates will be pretty low; ruling out short term investments

In order to maintain cash position even at that time, firms will tend to buyback shares.

7. Restraint to dividend payout ratio from its strategic growth pursuit (Analog semiconductors).

Looking out for opportunities in Asia while being cautious about bottomline margin.

Investment in R&D ($102mn in FY2001), retaining talent, building fabrication facilities ($200mn).

8. In the wake of the tax reforms, institutional investors welcome dividend payment.

As it reduces the equity resik premium associated with the stock.

Corporate scandals like ENRON and WORLDCOM have reinforced this notion.

9. If the tax rates are expected to be constant atleast for a complete financial year.

Institutional investors would rather prefer buyback than dividend payments (to prevent tax).

In other words, they expect special dividends if the firms cash reserves are huge.

10. Few feel dividend policy as cos acceptance of the fact that investors can gain more elsewhere.

11. Lets see the policies of its benchmark competitors.

Intel, Maxim & Microsoft have all been following regular stock splits.

Maxim & Linear have got many similarities, along with institutional investors.

Microsoft promised to shift towards dividends after settling its legal claim worth $1.1 billion.

Linears position is 7

th

in terms of market capitalization on Philadelphia SOP index.

12. Keeping in mind its objective of maximizing shareholders value:

For long term relationship maintenance with investors who are concerned about bottomline.

Share price of Linear Technologu at the end of Q3 FY2003 was $30.87.

Market Cap at the end of Q3 FY2003 was (312.4*30.87) $9643.79 million.

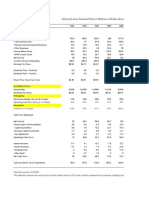

Net Cash Flow during Q1-Q3 of FY2003: $13.2 mn; (POR)2002 = 54/197.6 = 27.33%

Total Cash & Short-term investments till Q3 FY2003: $1565.2 million.

EPS during Q1-Q3: 170.6/312.4 = 0.546

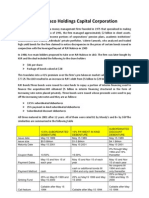

13. If the cash flow is used to buyback shares:

No. of shares bought back = 13.2 mn / 30.87 = 427,600

No. of New shares = 312.4 0.4276 = 311.97 mn

As share price remains constant, new Market Cap = 311.97 * 30.87 = $960.588 million

Post buyback EPS = 170.6/311.97 = 0.547

Change in EPS (post B.back) = 0.00075; Change in Market Cap (post B.back) = $13.2 million.

As Market Cap is reducing with this option, the only buyback policy is ruled out.

14. If the cash reserves are used to declare special dividend (Let us assume special DPS to be $2.5)

So, 2.5 * 312.4 million = $781 million has to be taken out of their cash reserves.

Share price will fall by $2.5 and the new share price (30.87 2.5) = $28.37

Change in EPS (post BB) = 0; Change in Market Cap (post BB) = -(311.92 mn * 2.5) = -$779.81 mn.

As Market Cap is reducing with this option, the only special dividend policy is also ruled out.

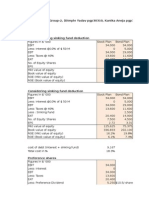

15. If part of the cash reserves are used to buyback & the other part to declare special dividend:

Let us assume that $500 million each is used for Dividend Payments & Share Buybacks.

For a guy holding 100 shares of LTC, now 5.18 shares will be bought back.

The guys initial stock value = $3087

Cash obtained from buyback = 5.18 * 30.87 = $159.91

Now, cash earned from dividends declared for remaining 94.82 shares = $160.06

Ex-dividend date value of the stocks held = 94.82 * (30.87 1.688) = $2767.04

The guys new share capital value = 159.6 + 160.06 + 2767.04 = $3087

As the shareholders value remains the same, while holders risk premium associated with LTC is

reduced, the part buyback part divident payment policy is most welcome.

But if Bushs 2003 tax reforms are delayed, this may not be as attractive as that of the BB policy.

Anda mungkin juga menyukai

- Pacific Grove Spice Company Case Write UpDokumen3 halamanPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Dividend Decision at Linear TechnologyDokumen8 halamanDividend Decision at Linear TechnologyNikhilaBelum ada peringkat

- Loewen Group CaseDokumen2 halamanLoewen Group CaseSu_NeilBelum ada peringkat

- Kohler CompanyDokumen3 halamanKohler CompanyDuncan BakerBelum ada peringkat

- OM Scott Case AnalysisDokumen20 halamanOM Scott Case AnalysissushilkhannaBelum ada peringkat

- Toy World - ExhibitsDokumen9 halamanToy World - Exhibitsakhilkrishnan007Belum ada peringkat

- Business Finance: Quarter 4 - Module 1 The Different Types of InvestmentsDokumen22 halamanBusiness Finance: Quarter 4 - Module 1 The Different Types of Investmentsrandy magbudhi71% (7)

- Airthread Connections Case Work SheetDokumen45 halamanAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Jones Electrical Faces Cash Shortfall Despite ProfitsDokumen5 halamanJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliBelum ada peringkat

- Kohler Co. (A)Dokumen18 halamanKohler Co. (A)Juan Manuel GonzalezBelum ada peringkat

- Facebook IPO Valuation AnalysisDokumen13 halamanFacebook IPO Valuation AnalysisMegha BepariBelum ada peringkat

- Ust SolutionDokumen3 halamanUst SolutionAdeel_Akram_Ch_9271Belum ada peringkat

- Sun Microsystems Financials and ValuationDokumen6 halamanSun Microsystems Financials and ValuationJasdeep SinghBelum ada peringkat

- BBBY Case ExerciseDokumen7 halamanBBBY Case ExerciseSue McGinnisBelum ada peringkat

- Buckeye Bank CaseDokumen7 halamanBuckeye Bank CasePulkit Mathur0% (2)

- Term Paper - Dividend PolicyDokumen33 halamanTerm Paper - Dividend Policyjeromefamadico100% (1)

- FINS5513 Security Valuation and Portfolio Selection Sample ExamDokumen8 halamanFINS5513 Security Valuation and Portfolio Selection Sample Examoniiizuka100% (1)

- Food or Restaurant POS PDFDokumen18 halamanFood or Restaurant POS PDFMohd KamranBelum ada peringkat

- BRANCH ACCOUNTING INSIGHTSDokumen59 halamanBRANCH ACCOUNTING INSIGHTSrhadityaBelum ada peringkat

- LinearDokumen6 halamanLinearjackedup211Belum ada peringkat

- Linear Technology Dividend Policy and Shareholder ValueDokumen4 halamanLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghBelum ada peringkat

- Dividend Policy at Linear Technology - Case Analysis - G05Dokumen2 halamanDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- Linear TechnologyDokumen4 halamanLinear TechnologySatyajeet Sahoo100% (2)

- Dividend Policy at Linear TechnologyDokumen9 halamanDividend Policy at Linear TechnologySAHILBelum ada peringkat

- Questions - Linear Technologies CaseDokumen1 halamanQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDokumen11 halamanUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Annualized Net Income GrowthDokumen25 halamanAnnualized Net Income GrowthAdarsh Chhajed0% (2)

- Case Study - Linear Tech - Christopher Taylor - SampleDokumen9 halamanCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Belum ada peringkat

- Linear Technology's dividend policy decision: pay dividends or repurchase sharesDokumen6 halamanLinear Technology's dividend policy decision: pay dividends or repurchase sharesprashantkumarsinha007100% (1)

- Continental Carriers Debt vs EquityDokumen10 halamanContinental Carriers Debt vs Equitynipun9143Belum ada peringkat

- Debt Policy at Ust IncDokumen18 halamanDebt Policy at Ust InctutenkhamenBelum ada peringkat

- Case StudyDokumen10 halamanCase StudyEvelyn VillafrancaBelum ada peringkat

- SpyderDokumen3 halamanSpyderHello100% (1)

- USTDokumen4 halamanUSTJames JeffersonBelum ada peringkat

- AirThread Valuation SheetDokumen11 halamanAirThread Valuation SheetAngsuman BhanjdeoBelum ada peringkat

- Teuer Furniture Case AnalysisDokumen3 halamanTeuer Furniture Case AnalysisPankaj KumarBelum ada peringkat

- Oracle's Acquisition of Sun MicrosystemsDokumen12 halamanOracle's Acquisition of Sun MicrosystemsVarun Rana50% (2)

- XLS EngDokumen26 halamanXLS EngcellgadizBelum ada peringkat

- Linear Technology Case - Ashmita SrivastavaDokumen4 halamanLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Nestle and Alcon - The Value of ADokumen33 halamanNestle and Alcon - The Value of Akjpcs120% (1)

- Blaine Kitchenware IncDokumen4 halamanBlaine Kitchenware IncUmair ahmedBelum ada peringkat

- Toy WorldDokumen4 halamanToy WorldDhirendra Kumar Sahu100% (1)

- CF Report Emi Group PLC (Final)Dokumen11 halamanCF Report Emi Group PLC (Final)CaterpillarBelum ada peringkat

- case-UST IncDokumen10 halamancase-UST Incnipun9143Belum ada peringkat

- UST IncDokumen16 halamanUST IncNur 'AtiqahBelum ada peringkat

- RJR Nabisco Holdings Capital CorporationDokumen3 halamanRJR Nabisco Holdings Capital CorporationManogana RasaBelum ada peringkat

- Hill Country Snack Foods CompanyDokumen14 halamanHill Country Snack Foods CompanyVeni GuptaBelum ada peringkat

- Cooper Case SolutionsDokumen6 halamanCooper Case SolutionsDarshan Salgia100% (1)

- Linear Tech's Dividend PolicyDokumen4 halamanLinear Tech's Dividend PolicyRishabh KothariBelum ada peringkat

- Jones Electrical DistributionDokumen4 halamanJones Electrical Distributioncagc333Belum ada peringkat

- Tire City's Warehouse Expansion PlansDokumen3 halamanTire City's Warehouse Expansion PlansenypurwaningsihBelum ada peringkat

- Dell Working CapitalDokumen7 halamanDell Working CapitalARJUN M KBelum ada peringkat

- Apple Cash Case StudyDokumen2 halamanApple Cash Case StudyJanice JingBelum ada peringkat

- Hampton Machine Tool CompanyDokumen5 halamanHampton Machine Tool Companydownloadsking100% (1)

- Spyder Active SportsDokumen12 halamanSpyder Active SportsShubham SharmaBelum ada peringkat

- Continental CarriersDokumen6 halamanContinental CarriersVishwas Nandan100% (1)

- Investment Banking: Individual Assignment 2Dokumen5 halamanInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- FM II Chapter 1Dokumen23 halamanFM II Chapter 1Amanuel AbebawBelum ada peringkat

- CH 18: Dividend PolicyDokumen55 halamanCH 18: Dividend PolicySaba MalikBelum ada peringkat

- Dividend PolicyDokumen70 halamanDividend Policyluv silenceBelum ada peringkat

- Dividend Policy: e As Cost of Equity in TheDokumen43 halamanDividend Policy: e As Cost of Equity in TheVelayudham ThiyagarajanBelum ada peringkat

- Dividend Month Premium in The Korean Stock MarketDokumen34 halamanDividend Month Premium in The Korean Stock Market찰리 가라사대Belum ada peringkat

- AC 16-11 Accounting-G1Dokumen5 halamanAC 16-11 Accounting-G1faris prasetyoBelum ada peringkat

- Dividend Decision ExplainedDokumen8 halamanDividend Decision ExplainedVishal TanwarBelum ada peringkat

- Dividend Decisions3Dokumen13 halamanDividend Decisions3PUTTU GURU PRASAD SENGUNTHA MUDALIARBelum ada peringkat

- Answers To FAQ's in MarketingDokumen29 halamanAnswers To FAQ's in MarketingRichBrook7Belum ada peringkat

- Rural Retail Channel MGMTDokumen8 halamanRural Retail Channel MGMTAnuja BhattacharjeeBelum ada peringkat

- Rural MKTG of FMCGsDokumen9 halamanRural MKTG of FMCGsRichBrook7Belum ada peringkat

- Questions: PoliticsDokumen2 halamanQuestions: PoliticsRichBrook7Belum ada peringkat

- Finance Question Asked in InterviewDokumen3 halamanFinance Question Asked in InterviewRichBrook7Belum ada peringkat

- July 2021Dokumen14 halamanJuly 2021RkkvanjBelum ada peringkat

- Import Firecrackers Business PlanDokumen13 halamanImport Firecrackers Business PlanBloomy AlexBelum ada peringkat

- Module 5 Statement of Cash FlowsDokumen11 halamanModule 5 Statement of Cash FlowsGAZA MARY ANGELINEBelum ada peringkat

- Wa0013Dokumen54 halamanWa0013Maria AbrahamBelum ada peringkat

- CA Power of Attny Form and Info 187-68.200Dokumen29 halamanCA Power of Attny Form and Info 187-68.200JugyBelum ada peringkat

- Summer Internship Project ReportDokumen58 halamanSummer Internship Project ReportArjun Gami67% (3)

- Employee Stock Option SchemesDokumen6 halamanEmployee Stock Option SchemeskrishnithyanBelum ada peringkat

- MarketshomeworkDokumen2 halamanMarketshomeworkMae BawaganBelum ada peringkat

- Dai24 Yuho EDokumen293 halamanDai24 Yuho ERayhan AlfansaBelum ada peringkat

- Ahluwalia, M. S. (2019)Dokumen17 halamanAhluwalia, M. S. (2019)rnjn mhta.Belum ada peringkat

- Indian Capital Markets notes-BBA 3rd MDU PDFDokumen35 halamanIndian Capital Markets notes-BBA 3rd MDU PDFShruti Shree100% (4)

- Sekuritas Hibrida: Utang Konvertibel: Convertible DebtDokumen10 halamanSekuritas Hibrida: Utang Konvertibel: Convertible DebtErna hkBelum ada peringkat

- Jasleen Kaur Report NewDokumen85 halamanJasleen Kaur Report NewDaman Deep Singh ArnejaBelum ada peringkat

- Solved Vaughn Inc. Began Operations in January 2018 And: Questions-And-Answers Vaug..Dokumen7 halamanSolved Vaughn Inc. Began Operations in January 2018 And: Questions-And-Answers Vaug..maria evangelistaBelum ada peringkat

- Strategic Analysis - YUM! BrandDokumen19 halamanStrategic Analysis - YUM! Brandpolobook3782100% (2)

- Valuation of Bonds and Stocks ExercisesDokumen8 halamanValuation of Bonds and Stocks ExercisesRoderica RegorisBelum ada peringkat

- CORP-Full CASES-5Dokumen268 halamanCORP-Full CASES-5Mae de DiosBelum ada peringkat

- Fabozzi CH 01 Intro HW AnswersDokumen4 halamanFabozzi CH 01 Intro HW AnswersCorisytBelum ada peringkat

- Corporation-Bylaws - More FunctionalDokumen12 halamanCorporation-Bylaws - More Functionalstada0Belum ada peringkat

- LBO Model Cash Flow AnalysisDokumen38 halamanLBO Model Cash Flow AnalysisBobbyNicholsBelum ada peringkat

- Capital Market in IndiaDokumen33 halamanCapital Market in IndiaAnonymous Rz2JhIBelum ada peringkat

- CME-1 General Securities Part 1 - Securities Regulations 30-4-2015Dokumen116 halamanCME-1 General Securities Part 1 - Securities Regulations 30-4-2015JeezBelum ada peringkat

- Kenya Restrictive Trade Practices ActDokumen52 halamanKenya Restrictive Trade Practices ActNelsonMoseMBelum ada peringkat

- Siochi Fishery Enterprises, Inc., Et Al.v. BPI G.R. No. 193872Dokumen12 halamanSiochi Fishery Enterprises, Inc., Et Al.v. BPI G.R. No. 193872jeesup9Belum ada peringkat

- 51938bos41633 p1qDokumen5 halaman51938bos41633 p1qAman GuptaBelum ada peringkat