2550Mv 2

Diunggah oleh

Angel BartonJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2550Mv 2

Diunggah oleh

Angel BartonHak Cipta:

Format Tersedia

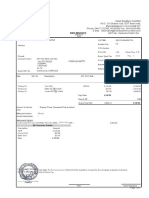

(To be filled up by the BIR)

DLN: PSIC:

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1

For the Month of (MM/YYYY)

2 Amended 3 Number of sheets

Return Yes No attached

Part I B a c k g r o u n d I n f o r m a t i o n

4 TIN 5 RDO 6 Line of Business

Code

7

Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name 8 Telephone Number

9 Registered Address 10 Zip Code

11 Are you availing of tax relief under Special Law

If yes, specify

or International Tax Treaty?

Yes No

Part II Computation of Tax (Attach additional sheets, if necessary)

Sales/Receipts for the Month (Exclusive of VAT)

12 Vatable Sales/Receipt- Private (Sch.1) 12B

13 Sales to Government 13B

14 Zero Rated Sales/Receipts

15 Exempt Sales/Receipts

16 Total Sales/Receipts and Output Tax Due 16B

17 Less: Allowable Input Tax

17A Input Tax Carried Over from Previous Period 17A

17B Input Tax Deferred on Capital Goods Exceeding P1Million from Previous Period 17B

17C Transitional Input Tax 17C

17D Presumptive Input Tax 17D

17E Others 17E

17F Total (Sum of Item 17A,17B,17C,17D &17E) 17F

18 Current Transactions Purchases

18A/B Purchase of Capital Goods not exceeding P1Million (see sch.2) 18A 18B

18C/D Purchase of Capital Goods exceeding P1Million (see sch.3) 18C 18D

18E/F Domestic Purchases of Goods Other than Capital Goods 18E 18F

18G/H Importation of Goods Other than Capital Goods 18G 18H

18I/J Domestic Purchase of Services 18 I 18J

18K/L Services rendered by Non-residents 18K 18L

18M Purchases Not Qualified for Input Tax 18M

18N/O Others 18N 18O

18P Total Current Purchases (Sum of Item 18A,18C,18E,18G,18I,18K,18M&18N) 18P

19 Total Available Input Tax (Sum of Item 17F,18B,18D,18F,18H,18J,18L & 18O) 19

20 Less: Deductions from Input Tax

20A Input Tax on Purchases of Capital Goods exceeding P1Million

deferred for the succeeding period (Sch.3) 20A

20B Input Tax on Sale to Govt. closed to expense (Sch.4) 20B

20C Input Tax allocable to Exempt Sales (Sch.5) 20C

20D VAT Refund/TCC claimed 20D

20E Others 20E

20F Total (Sum of Item 20A,20B,20C,20D & 20E ) 20F

21 Total Allowable Input Tax (Item19 less Item 20F) 21

22 Net VAT Payable (Item 16B less Item 21) 22

23 Less: Tax Credits/Payments

23A Creditable Value-Added Tax Withheld (Sch. 6) 23A

23B Advance Payments for Sugar and Flour Industries (Sch.7) 23B

23C VATwithheld on Sales to Government (Sch.8) 23C

23D VAT paid in return previously filed, if this is an amended return 23D

23E Advance Payments made (please attach proof of payments - BIR Form No. 0605) 23E

23F Others 23F

23G Total Tax Credits/Payments (Sum of Item 23A,23B,23C, 23D, 23E & 23F) 23G

24 Tax Still Payable/(Overpayment) (Item 22 less Item 23G) 24

25 Add: Penalties Surcharge Interest Compromise

25A 25B 25C 25D

26 Total Amount Payable/(Overpayment) (Sum of Item 24 and 25D) 26

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

27 MARIA TERRESA S. MARQUEZ 28

Tax Agent Acc. No./Atty's Roll No.(if applicable)

Part III Details of Payment

Drawee Bank/ Date

Particulars Agency Number MM DD YYYY Amount

29 Cash/Bank 29A 29B 29C 29D

Debit Memo................................................................................

30 Check 30A 30B 30C 30D

31 Tax Debit

Memo ..............

32 Others 32A 32B 32C 32D

Machine Validation (if filed with an accredited agent bank)/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

Receiving Office/AAB

and Date of Receipt

(RO's Signature/

Bank Teller's Initial)

Date of Expiry TIN of Signatory

Stamp of

(Signature Over Printed Name)

TIN of Signatory Title/Position of Signatory

Authorized Representative/Taxpayer

(Signature Over Printed Name)

Date of Issuance

Title/Position of Signatory

Output Tax Due for the Month

Treasurer/Assistant Treasurer President/Vice President/Principal Officer/Accredited Tax Agent/

12A

13A

14

15

16A

041

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

BIR Form No.

September 2005 (ENCS)

Monthly Percentage

Tax Return

2551M

RESTAURANT 008 555 098

FOUR CHEFS CUISINE VENTURE, INC. 9424282

08 2 0 1 4

31A

31C 31B

1,930,308.61

1,930,308.61 231,637.03

231,637.03

Unit E-312 3/F SM Megamall Bldg E Edsa Wack Wack Mandaluyong city

6,898.22

1,814,490.09 224,738.81

1,814,490.09

224,738.81

224,738.81

6,898.22

6,898.22

Computation of Tax (Attach additional sheets, if necessary)

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Receiving Office/AAB

and Date of Receipt

(RO's Signature/

Bank Teller's Initial)

Stamp of

Output Tax Due for the Month

September 2005 (ENCS)

2551M

231,637.03

231,637.03

6,898.22

224,738.81

224,738.81

224,738.81

6,898.22

6,898.22

BIR Form 2550M - February 2007 (ENCS) Page 2

Schedule 1

To Item 12A/B

Schedule 2

Total (To Item 18A/B)

Schedule 3

A) Purchases/Importations This Period

Allowable Input Balance of Input Tax

Tax for the Period to be carried to

Purchased (D) divided by (F) Next Period

(D)

Total (To Item 18C/D)

B) Purchases/Importations Previous Period

Allowable Input Balance of Input Tax

Tax for the Period to be carried to

Purchased (D) divided by (F) Next Period

(D)

Total

C) Total Input Tax Deferred for future period from current and previous purchases (To Item 20A)

Schedule 4

Input Tax directly attributable to sale to government

Add: Ratable portion of Input Tax not directly attributable

to any activity:

Total Input Tax attributable to sale to government

Less: Standard Input Tax to sale to government

Input Tax on Sale to Govt. closed to expense (To Item 20B)

Schedule 5

Input Tax directly attributable to exempt sale

Add: Ratable portion of Input Tax not directly attributable

to any activity:

Total Input Tax attributable to exempt sale (To Item 20C)

Schedule 6

Applied

Current mo.

Total (To Item 23A)

Schedule 7

Official Receipt Applied

Total (To Item 23B)

Schedule 8

Applied

Current mo.

Total (To Item 23C)

(H)

Covered

VAT Withheld on Sales to Government (Attach additional sheets, if necessary)

Period Name of Withholding Agent Income Payment Total Tax Withheld

Period Name of Withholding Agent Income Payment

(B) (G)

Recognized Life (In

Months)

Balance of Input

Tax from

Previous Period

Remaining Life

(Net of VAT)

Taxable sales to government

Total Sales

Amount of Input Tax not

directly attributable

x

Covered Number

(D) less (G)

directly attributable

Est. Life

(in months)

Tax Withheld Claimed as Tax Credit (Attach additional sheets, if necessary)

(A)

(Net of VAT)

Input Tax Attributable to Exempt Sales

Description

Industries Covered by VAT

Covered

Period

Date

(B) (A)

Purchases/Importation of Capital Goods (Aggregate Amount Not Exceeding P1 Million) (Attach additional sheet, if necessary)

Amount

(C)

Schedule of Sales/Receipts and Output Tax (Attach additional sheet, if necessary)

Output Tax

For the Period

Amount of Sales/Receipts

For the Period

A T C

(C ) (B)

Amount

(D)

Recognized Life

Input Tax

Amount

Useful life or 60 mos.

(whichever is shorter)

(E)

Date

Purchased

Description

Date

Purchases/Importation of Capital Goods (Aggregate Amount Exceeds P1 Million) (Attach additional sheet, if necessary)

Est. Life

(in months)

Input Tax

(Cx12%)

Description

(Net of VAT)

Amount Paid

(C ) (E) (F)

Schedule of Advance Payment (Attach additional sheets, if necessary)

Taxable exempt sale

x

Amount of Input Tax not

Total Sales

(A)

Current mo.

(In Months)

(D) less (G)

(H)

Input Tax Attributable to Sale to Government

Name of Taxpayer Name of Miller

(F) (G)

Total Tax Withheld

BIR Form 2550M - February 2007 (ENCS) Page 3

INDUSTRIES COVERED BY VAT

1. Mining and Quarrying 4. Lending Investors/Dealer In securites/ 8.6 Other Franchise

2. Manufacturing Pawnshops/Pre-need Co./ 9. Real Estate, Renting &

2.1 Tobacco 5. Construction Business Activity

2.2 Alcohol 6. Wholesale & Retail 9.1 Sale of Real Property

2.3 Petroleum 7. Hotel & Restaurants 9.2 Lease of Real Property

2.4 Automobiles 7.1 Hotels, Motels 9.3 Sale/Lease of Intangible Property

2.5 Non-Essentials (Excisable Goods) 7.2 Restaurants, Caterers 10. Compulsory Social Security

2.6 Cement 8. Transport Storage and Communications Public Administration & Defense

2.7 Food Products and Beverages 8.1 Land Transport-Cargo 11. Other Community Social and

2.8 Pharmaceuticals 8.2 Water Transport-Cargo Personal Service Activity

2.9 Flour 8.2.1 Domestic Ocean Going Vessels 12. Others:

2.10 Sugar 8.2.2 Inter Island Shipping Vessels 12.1 Storage & Warehousing

2.11 Pesticides 8.3 Air Transport-Cargo 12.2 Business Services

2.12 Others (General) 8.4 Telephone & Telegraph (In General)

3. Non Life Insurance 8.5 Radio/TV Broadcasting 12.3 Importation of Goods

VH 010

VB105

VP 102

VB 010

VB108

VI 010 VB 111

VB109

VS 010 VB 107

VB 102

VC 010

VB101

VP 101

VD 010

VB106

VT 010

VM 130

ATC

VQ010

VM 040

VM 120

VM 110

ALPHANUMERIC TAX CODES (ATC)

VM 020

VM 150

INDUSTRIES COVERED BY VAT INDUSTRIES COVERED BY VAT ATC

VM 030

VM 140

VM 050

VB 113

VM 160

ATC

VB 112

VP 100

VM 100

VM 010

VB100

BIR Form 2550M - February 2007 (ENCS) Page 2

Balance of Input Tax

to be carried to

Next Period

Balance of Input Tax

to be carried to

Next Period

Applied

Current mo.

Applied

Applied

Current mo.

(H)

VAT Withheld on Sales to Government (Attach additional sheets, if necessary)

(D) less (G)

Tax Withheld Claimed as Tax Credit (Attach additional sheets, if necessary)

Purchases/Importation of Capital Goods (Aggregate Amount Not Exceeding P1 Million) (Attach additional sheet, if necessary)

Output Tax

For the Period

(D)

Input Tax

Schedule of Advance Payment (Attach additional sheets, if necessary)

Current mo.

(D) less (G)

(H)

BIR Form 2550M - February 2007 (ENCS) Page 3

VH 010

VP 102

VB 010

VI 010

VS 010

VP 101

VD 010

ALPHANUMERIC TAX CODES (ATC)

ATC

VB 112

VP 100

Anda mungkin juga menyukai

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Front Office AccountingDokumen9 halamanFront Office AccountingIga Asti AstriaBelum ada peringkat

- Introduction to GST Bill: A Case StudyDokumen13 halamanIntroduction to GST Bill: A Case Studypravas naikBelum ada peringkat

- Business Taxation: History of Income Tax Law in PakistanDokumen26 halamanBusiness Taxation: History of Income Tax Law in PakistanMUHAMMAD UMARBelum ada peringkat

- Banking Section OverviewDokumen2 halamanBanking Section Overviewarpitgupta100% (1)

- First Data Annual Report 2011Dokumen178 halamanFirst Data Annual Report 2011SteveMastersBelum ada peringkat

- Laikipia UniversityDokumen2 halamanLaikipia UniversityWilson KindaBelum ada peringkat

- Proc No. 307-2002 Excise TaxDokumen15 halamanProc No. 307-2002 Excise Taxcsyena28225Belum ada peringkat

- SeafarersDokumen2 halamanSeafarersJEZRELL E. ENRICOSOBelum ada peringkat

- Ram BillDokumen1 halamanRam BillHarish Babu N KBelum ada peringkat

- Tax InvoiceDokumen1 halamanTax InvoiceM. Sadiq. A. PachapuriBelum ada peringkat

- Midterm exam principles of accountingDokumen7 halamanMidterm exam principles of accountingYến Hoàng HảiBelum ada peringkat

- Invoice 20220222 0957352Dokumen1 halamanInvoice 20220222 0957352Refiloe MakeneteBelum ada peringkat

- Mshs Request For Communication Expenses Jan To June 2021Dokumen3 halamanMshs Request For Communication Expenses Jan To June 2021alexBelum ada peringkat

- Bar Exam Questions Income TaxationDokumen11 halamanBar Exam Questions Income TaxationG.B. SevillaBelum ada peringkat

- TNG Ewallet TransactionsDokumen6 halamanTNG Ewallet Transactionsjpn-wp-putrajaya-cm23Belum ada peringkat

- Burgum Hate Rural AmericaDokumen4 halamanBurgum Hate Rural AmericaRob PortBelum ada peringkat

- PDFDokumen2 halamanPDFShashi RayappagariBelum ada peringkat

- Conveyancing Fees From May 2017 Tables of CostsDokumen18 halamanConveyancing Fees From May 2017 Tables of CostsGervase Danashree MunienBelum ada peringkat

- Bmtax CompilationDokumen50 halamanBmtax CompilationMarco Alexander O. AgtagBelum ada peringkat

- Alcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFDokumen3 halamanAlcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFJuralexBelum ada peringkat

- ANSYS Explicit STR (Autodyn Part 1) PDFDokumen3 halamanANSYS Explicit STR (Autodyn Part 1) PDFnguyenhBelum ada peringkat

- Service Tax Concept and ChargeDokumen23 halamanService Tax Concept and ChargeLyraa ArHiBelum ada peringkat

- Say Good Bye To Physical Cash and Welcome To Central Bank Digital CurrencyDokumen44 halamanSay Good Bye To Physical Cash and Welcome To Central Bank Digital CurrencyJohn TaskinsoyBelum ada peringkat

- Implications of Rera and GST On Builders and DevelopersDokumen52 halamanImplications of Rera and GST On Builders and DevelopersPratik Umakant MashaleBelum ada peringkat

- RMC 78-2022Dokumen3 halamanRMC 78-2022Ian PalmaBelum ada peringkat

- DMC College Accounting Lessons, Tests, Grades 2016-2017Dokumen3 halamanDMC College Accounting Lessons, Tests, Grades 2016-2017HURLY BALANCARBelum ada peringkat

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Dokumen2 halamanCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisBelum ada peringkat

- Citi rent cashbackDokumen3 halamanCiti rent cashbackdwarakanath4Belum ada peringkat

- SalQuo BARSQ394Dokumen1 halamanSalQuo BARSQ394Qatar Pride 2022Belum ada peringkat

- Army Welfare Housing Organisation (Awho) Kashmir House, Rajaji Marg, New Delhi - 110011 WebsiteDokumen4 halamanArmy Welfare Housing Organisation (Awho) Kashmir House, Rajaji Marg, New Delhi - 110011 Websitesaurabhkr1989Belum ada peringkat