Tcu Schedule Fees

Diunggah oleh

ggolani0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan2 halamantechcu schedule of fees

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Initechcu schedule of fees

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan2 halamanTcu Schedule Fees

Diunggah oleh

ggolanitechcu schedule of fees

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

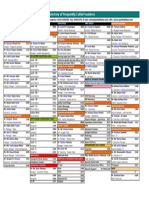

This Schedule of Fees and Charges supplements the

Member Handbook, Account Disclosures and Agreements,

and the Truth in Savings Disclosure.

ATM AND VISA CHECKCARD

Transactions on non-network ATMs

Replacement cards

Visa and Mastercard multi-currency transactions

International single-currency transactions

OTHER FEES

Signature guarantee

Duplicate statements

Rolled coin deposits

International wire transfers (outside the U.S.)

Response to legal process

Vehicle authorization letter (for travel outside of the U.S.)

Inactive Account fee

(Accounts inactive for 24 months or more)

Escheatment Process fee

Health Savings Account fee

IRA/HSA Closure/Transfer-out fee

HSA Transaction Adjustment fee

Current Address Research fee

Check Collection fee (International checks)

$1 per transaction may be charged on withdrawals,

share-to-share transfers, and balance inquiries.

*

$5 per card

1.0% of transaction amount

**

0.8% of transaction amount

**

$5 per signature

$2 per page

First 5 rolls are free, 10 per roll thereafter.

$38 for outgoing funds; $15 for incoming funds.

$20 (minimum)

$10 per letter

$5 per month, imposed beginning the 25th month

(excludes IRA and non-matured certificate accounts).

$2 for sending annual notice of possible escheatment

(for account balances above $50).

$2 monthly maintenance fee, if your monthly average balance

drops below $100. This fee is waived for the first six months.

HSA monthly maintenance fee does not take effect for six

months from account opening or until 12/1/2011 for accounts

opened prior to 6/1/2011.

$20 when an IRA/Roth IRA/HSA account is transferred to

another institution.

$20 per occurrence

$25 (minimum) per hour if the Credit Union has to seek out the

current address of a member. (Not to occur more than once per

12 months.)

$15 per-check collection fee for checks drawn on non-U.S.

financial institutions.

We reserve the right to change, add or delete fees at any time and upon notice when required by law. If you have any questions regarding any of the fees outlined in this schedule, please call us at (408) 451-9111 or (800) 553-0880. The information contained

in this fee schedule is effective as of November 1, 2011.

*Please note, using an ATMthat is not in the CO-OP or Allpoint network could result in fees fromthe owner of the ATM.

**For transactions initiated in foreign countries or currencies, any international service assessment or currency conversion fee imposed by Visa (or any other network) is added to the credit, debit, or ATMtransaction amount. B11.10-11.v1 10/11

TCU SchedofFees_for Oct r6.pdf 1 9/21/11 9:04 AM

*The total combined balances fromall your Tech CU accounts will determine your Rewards level. See a Tech CU representative for complete details.

**Overdraft protection is available only on checking accounts. Checking account holders can establish overdraft protection transfers froma Tech CUShare Savings Account or a Tech CUcredit line (credit approval required. ) If you have not established

an overdraft protection source with available funds or credit, Tech CU may at our discretion pay or return checks, automatic clearinghouse and online banking payments presented against insufficient funds and charge Returned NSF/Paid NSF Fee.

We will not pay ATMcash withdrawals or everyday debit card purchase transactions against insufficient funds at our discretion unless you opt in. Negative balances must be restored immediately on demand. Discretionary overdraft payment is not

available on new checking accounts, if any account owner is in default to Tech CU, or if there have been repeated overdrafts.

***Effective November 1, 2011.

FEES BY RELATIONSHIP REWARDS LEVEL

The deeper your relationship with Tech CU, the greater the benefits you will enjoy as a member. Tech CU offers three Relationship

Rewards levels, which are listed below along with fees associated with each level.

*

The Credit Union may impose the following fees, if necessary. If no specific amount can be stated, the method for determining

charges will be explained by a Tech CU representative. Certain fees are waived depending on your relationship with the Credit

Union. Please see the Relationship Rewards section for the aggregate balances needed to avoid certain fees.

CHECKING AND MONEY MARKET PLUS ACCOUNTS

Eligibility for fee waivers on

Interest Checking and Insured

Investment Accounts

Returned Check Deposit

Returned Automated Clearing House

(ACH) Item

Stop Payments

Official Check Refund/Replacement

Copies of Checks

Temporary Checks

eCheck

Checking Account Reinstatement

Non-member Check Cashing

Excess Withdrawal Fee

(Money Market Plus Only)

Determined by the average daily balance, which is calculated by adding the balance in

the account at the end of each day together and dividing by the number of days in the

statement cycle.

$25. Charged if a check you deposit at Tech CU is lawfully returned unpaid by the

institution on which it is drawn.

$10. Charged if you originate an ACH payment at Tech CU, and another institution

returns it.

$15 per request. Charged if you ask us to stop payment on a check or series of checks

drawn on your Tech CU checking account, or to stop an ACH payment.

$15. Charged if you ask us to refund or replace a check drawn on Tech CU that has

been lost, stolen or destroyed.

First two personal or official check copies free per statement period, then $2 per check

copy up to 10. If you request more than 10 checks in a statement period, a $25 per

hour research fee (1 hour minimum) is also charged. Personal check copies are

available free at Online Banking.

$2 for 4 checks.

$10 per transaction.

$50. Charged if your Tech CU checking account has been closed due to misuse,

negative balance or other breach of agreement with Tech CU.

$10. Charged to non-members who cash checks written on Tech CU personal or

business accounts.

$10 per month in which more than 6 check/debit card/point-of-sale withdrawals occur.

PREMIER ($100,000+ balance)

Returned NSF/Paid NSF** Fee$28 no maximum

Verification of Deposit and Account Verification Letter Fee$10

Check Orders2 free boxes per year, then standard fee

***

PREFERRED PLUS ($25,000$99,999.99 balance)

Returned NSF/Paid NSF

**

Fee$28 no maximum

Verification of Deposit and Account Verification Letter Fee$10

Account Research Fee$25 (minimum)/hour

Domestic Outgoing and Incoming Wire Transfer Fee$20 for outgoing and $15 for incoming

Check Orders2 free boxes of Tech CU Logo per year, then standard fee

***

Insured Investment Savings Monthly Fee$6, waived with average daily balance of $2,500

PREFERRED (balance less than $25,000)

Returned NSF/Paid NSF

**

Fee$28 no maximum

Verification of Deposit and Account Verification Letter Fee$10

Account Research Fee$25 (minimum)/hour

Domestic Outgoing and Incoming Wire Transfer Fee$20 for outgoing and $15 for incoming

Check OrdersStandard Fee

Insured Investment Savings Monthly Fee$6, waived with average daily balance of $2,500

Interest Checking Monthly Fee$6, waived with average daily balance of $1,500 in Interest Checking, with

$2,500 average daily balance in an Insured Investment Savings, or with monthly Direct Deposit

Non-Tech CU ATM TransactionsFree at CO-OP and Allpoint ATMs, 5 free per month at other ATMs, then $1 each

Share Savings Monthly Fee$3, waived with $100 minimum average daily balance or other Tech CU services

Money Orders$5

Official Checks$5, waived with combined balance of at least $5,000

Travelers Cheques for Two Fee$5 per $1,000

Travelers Cheques Fee$2 per $1,000

TCU SchedofFees_for Oct r6.pdf 2 9/21/11 9:04 AM

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Haematology Notes - 3rd EdDokumen100 halamanHaematology Notes - 3rd EdSally Brit100% (1)

- EcR - 1 Leading and Lagging IndicatorsDokumen10 halamanEcR - 1 Leading and Lagging IndicatorsMiloš ĐukićBelum ada peringkat

- The Reassess Your Chess Workbook PDFDokumen220 halamanThe Reassess Your Chess Workbook PDFOscar Iván Bahamón83% (6)

- Chapter 5Dokumen16 halamanChapter 5Ankit GuptaBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- PT6 Training ManualDokumen64 halamanPT6 Training ManualAnderson Guimarães100% (2)

- Female Reproductive System Histology IDokumen5 halamanFemale Reproductive System Histology ISolomon Seth SallforsBelum ada peringkat

- Space Analysis in Orthodontic: University of GlasgowDokumen16 halamanSpace Analysis in Orthodontic: University of GlasgowNizam Muhamad100% (1)

- ItilDokumen11 halamanItilNarendar P100% (2)

- Zygomatic Complex FracturesDokumen128 halamanZygomatic Complex FracturesTarun KashyapBelum ada peringkat

- Affidavit of Consent For Shared Parental AuthorityDokumen2 halamanAffidavit of Consent For Shared Parental AuthorityTet LegaspiBelum ada peringkat

- Spec BoilerDokumen9 halamanSpec BoilerAchmad MakmuriBelum ada peringkat

- COVID 19 Impacts On The Construction IndustryDokumen46 halamanCOVID 19 Impacts On The Construction IndustryAlemayehu DargeBelum ada peringkat

- Continuations PsDokumen28 halamanContinuations PsggolaniBelum ada peringkat

- BeaverDokumen14 halamanBeaverggolaniBelum ada peringkat

- BW Patterns GeometricalDokumen15 halamanBW Patterns GeometricalggolaniBelum ada peringkat

- Gurbani Halla BolDokumen2 halamanGurbani Halla BolggolaniBelum ada peringkat

- Behavioural FinanceDokumen2 halamanBehavioural FinanceggolaniBelum ada peringkat

- Gurbani Halla BolDokumen2 halamanGurbani Halla BolggolaniBelum ada peringkat

- E-Brouchure Carnation ResidencyDokumen14 halamanE-Brouchure Carnation ResidencyggolaniBelum ada peringkat

- The Girls Center: 2023 Workout CalendarDokumen17 halamanThe Girls Center: 2023 Workout Calendark4270621Belum ada peringkat

- 2-D Motion Based Real Time Wireless Interaction System For Disabled PatientsDokumen5 halaman2-D Motion Based Real Time Wireless Interaction System For Disabled PatientsSantalum AlbumBelum ada peringkat

- OC - PlumberDokumen6 halamanOC - Plumbertakuva03Belum ada peringkat

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDokumen1 halamanDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoBelum ada peringkat

- Laboratorio 1Dokumen6 halamanLaboratorio 1Marlon DiazBelum ada peringkat

- 2.1. Pharmacological Therapeutics. 2.2. Basic Cardiac Life Support (BCLS) and Advanced Cardiac Life Support (ACLS) in Neonates and ChildDokumen3 halaman2.1. Pharmacological Therapeutics. 2.2. Basic Cardiac Life Support (BCLS) and Advanced Cardiac Life Support (ACLS) in Neonates and Childclint xavier odangoBelum ada peringkat

- Consumer Behaviour: Group ProjectDokumen5 halamanConsumer Behaviour: Group ProjectAanchal MahajanBelum ada peringkat

- Human Capital FormationDokumen9 halamanHuman Capital Formationtannu singh67% (6)

- Comm Part For A320Dokumen1 halamanComm Part For A320ODOSBelum ada peringkat

- EcoLettsandSOM, Dulvy Et Al 2004Dokumen25 halamanEcoLettsandSOM, Dulvy Et Al 2004Nestor TorresBelum ada peringkat

- Past The Shallows EssayDokumen2 halamanPast The Shallows EssaycaitlinBelum ada peringkat

- 2 English Course BDokumen8 halaman2 English Course BAnjana27Belum ada peringkat

- Formularium ApotekDokumen12 halamanFormularium ApotekNurul Evi kurniatiBelum ada peringkat

- XDokumen266 halamanXTrần Thanh PhongBelum ada peringkat

- SVIMS-No Que-2Dokumen1 halamanSVIMS-No Que-2LikhithaReddy100% (1)

- WSAWLD002Dokumen29 halamanWSAWLD002Nc BeanBelum ada peringkat

- OilDokumen8 halamanOilwuacbekirBelum ada peringkat

- Medpet Pigeon ProductsDokumen54 halamanMedpet Pigeon ProductsJay Casem67% (3)

- Iso 28000Dokumen11 halamanIso 28000Aida FatmawatiBelum ada peringkat