Basic Features Descriptions: 2. Takafulink Series Product Features

Diunggah oleh

dikirDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Basic Features Descriptions: 2. Takafulink Series Product Features

Diunggah oleh

dikirHak Cipta:

Format Tersedia

Takafulink Series

2

2. TAKAFULINK SERIES PRODUCT FEATURES

Basic Features Descriptions

1. Death Benefit

Pays the Basic Sum Covered plus the Participant Investment Account (PIA).

The certificate shall terminate upon payment of the Death Benefit.

2. Total & Permanent Disability

(TPD)

The TPD Benefit payable prior to age 65 shall be the Sum Covered plus the PIA.

The certificate shall terminate upon payment of the Death Benefit.

3. Maturity Benefit

Takafulink Pays the Maturity Benefit following the Person Covereds 80

th

birthday which

is equal to the Participant Investment Account.

The PIA value is linked to the performance of MAA Takaful Shariah Fund.

The certificate shall terminate upon payment by the Takaful Operator of the

Maturity Benefit.

Takafulink Education Pays the Maturity Benefit following the Person Covereds 25

th

birthday which

is equal to the Participant Investment Account.

The PIA value is linked to the performance of MAA Takaful Shariah Fund.

The certificate shall terminate upon payment by the Takaful Operator of the

Maturity Benefit.

Takafulink Hajj Pays the Maturity Benefit following the Person Covereds 80

th

birthday which

is equal to the Participant Investment Account.

The PIA value is linked to the performance of MAA Takaful Shariah Fund.

The certificate shall terminate upon payment by the Takaful Operator of the

Maturity Benefit.

Takafulink Wanita Pays the Maturity Benefit following the Person Covereds 80

th

birthday which

is equal to the Participant Investment Account.

The PIA value is linked to the performance of MAA Takaful Shariah Fund.

The certificate shall terminate upon payment by the Takaful Operator of the

Maturity Benefit.

Takafulink Series

3

Basic Features

Descriptions

4. Contribution Pause

The participants may opt to stop paying contributions and still enjoy the benefits of basic takaful as long

as there is sufficient PIA fund value to pay for Participant Risk Investment Account (PRIA) Contribution.

Commission is not paid during contribution pause.

Allocation Year DOES NOT move during contribution pause.

5. Surrender Value

Full Surrender may be made by redeeming units in PIA fund.

The surrender value of the certificate is the PIA fund value less any indebtedness.

The PIA fund value is not guaranteed and depends on the investment performance of the funds.

The certificate shall terminate upon payment by the Takaful Operator of the Surrender Benefit.

6. Contribution Re-direction

The choices of funds into which the contribution are directed can be changed without any fees.

Changes will take effect at the due date of the next modal regular contribution payment.

7. Conversion Option to

Takafulink

At the Maturity Date, the Person Covered has the option to continue the certificate with Takafulink Plan,

without any evidence of coverability.

This option must be exercised within (60) days of the Maturity Date of Takafulink for a Sum Covered

which is no greater than that under the original plan, otherwise evidence of coverability will be required.

8. Changes in Contribution

Amount

Change of contribution may be made subject to the minimum contribution and minimum and maximum

sum covered requirements.

Changes will take effect on the due date of the next modal regular contribution.

9. Changes in Sum Covered

Changes of sum covered may be made subject to minimum and maximum sum covered requirement.

Changes which exceed Non-Medical Limits will subject to underwriting requirement.

Changes will take effect on the due date of the next Tabarru.

2. TAKAFULINK SERIES PRODUCT FEATURES

Takafulink Series

4

Basic Features

Descriptions

10. MTOP Irregular one off top-up is allowed at certificate inception and at any time thereafter.

Minimum RM1, 000.

No Takaful Coverage.

95% Contribution Allocation.

Investment Fund may differ from the Basic Plan.

Credit Card charges will be at the prevailing rate.

Each Top-Up will incur a service charge of RM25 per transaction.

Please use MAA Takaful Additional Contribution (Top-Up) Application Form.

2.75% commission for every top-up.

11. Fund Switching Units may be switched to any other funds at anytime.

The minimum value of units that may be switched is RM500; or the entire units holding in that fund (s),

whichever is lower.

One free switching per year and thereafter with a processing fee of RM50.

The unused free switch cannot be carried forward to the next year.

12. Partial Withdrawal Partial Withdrawal may be made at any time subject to a minimum amount and minimum balance of PIA

fund value.

RM50 per withdrawal, subject to a minimum withdrawal amount of RM500.

Minimum Investment balance that must be maintained across all funds in PIA is RM1, 000.

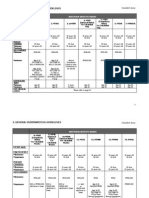

13. Allocation of Contribution

Certificate

Year

% of Contribution

(Agency Force)

% of Contribution

(Biro Angkasa)

1 40% 38%

2 50% 48%

3 70% 68%

4 70% 68%

5 85% 83%

6 90% 88%

Thereafter 100% 98%

2. TAKAFULINK SERIES PRODUCT FEATURES

Takafulink Series

5

Basic Features

Descriptions

14. Certificate Fee RM5 Monthly

15. Wakalah Tharawat Fee

The PIA fund is subject to a 1%-1.5% of Net Asset Value (NAV) as Wakalah Tharawat Fee.

16. Minimum Regular Contribution

MODE MINIMUM MODAL CONTRIBUTION

Monthly RM50

Quarterly RM150

Semi Annual RM300

Annually RM600

17. Maximum Regular

Contribution

No Maximum Limit but subject to underwriting approval

18. Product Codes

DISTRIBUTION CHANNEL TAKAFULINK TAKAFULINK

EDUCATION

TAKAFULINK

HAJJ

TAKAFULINK

WANITA

MAA Takaful Agent MTL1 MTED1 MTHAJ MTWAN

Biro Angkasa MTLP1 MTEDP1 MTHAJP MTWANP

Worksite MTLW1 MTEDW1 MTHAJW MWANW

2. TAKAFULINK SERIES PRODUCT FEATURES

Takafulink Series

6

Basic features Description

19. Basic Commission

(For 20 years term certificate)

20. Entry Age (Last Birthday)

TAKAFULINK

SERIES

BASIC PLAN MINIMUM MAXIMUM

MTL1 Person Covered 30 days Age 69

Participant Age 18 No Limit

MTED1 Person Covered 30 days Age 69

Participant Age 18 No Limit

MTHAJ Person Covered 30 days Age 69

Participant Age 18 No Limit

MTWAN Person Covered Age 16 Age 69

Participant Age 18 No Limit

CERTIFICATE YEAR

1 2 3 4 5 6 TOTAL

Consultant 25% 25% 17% 17% 15% 15% 114%

Exec. Consultant 3.5% - - - - - 3.5%

Managing Consultant 5.4% 7.5% 4% - - - 20.9%

Chief Managing

Consultant

6.1% 7.5% 4% 4% - - 21.6%

2. TAKAFULINK SERIES PRODUCT FEATURES

Takafulink Series

7

Basic features Description

21. Expiry Age

TAKAFULINK SERIES PLAN EXPIRY

MTL1 Basic Up to Age 80

MTED1 Basic Up to Age 25

MTHAJ Basic Up to Age 80

MTWAN Basic Up to Age 80

22. Minimum & Maximum Sum

Covered Multiple Factors

Age

Sum Covered Multiple (SCM) Factors

Minimum SCM Factors Maximum SCM Factors

0 16 60

No Limit, subject to

Underwriting Approval

17 25 55

26 35 50

36 45 35

46 55 25

56 69 15

Example:

Age: 30, Male.

Annual Contribution: RM1,200

So, Minimum Sum Covered: RM1,200 x 50 (Min. SCM Factors) = RM60,000

2. TAKAFULINK SERIES PRODUCT FEATURES

Anda mungkin juga menyukai

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsDari EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsBelum ada peringkat

- The Exciting World of Indian Mutual FundsDari EverandThe Exciting World of Indian Mutual FundsPenilaian: 5 dari 5 bintang5/5 (1)

- RkriDokumen19 halamanRkriKalai Vani KarthiBelum ada peringkat

- Mr. Basit HassanDokumen4 halamanMr. Basit HassanBasit Hassan QureshiBelum ada peringkat

- 2025 Membership Info Non-Core - ENGLISH (11-01-2023)Dokumen16 halaman2025 Membership Info Non-Core - ENGLISH (11-01-2023)neotheuniverseBelum ada peringkat

- 2025 Membership Info Global - ENGLISH (11!01!2023)Dokumen16 halaman2025 Membership Info Global - ENGLISH (11!01!2023)ravi.rnrfreedomBelum ada peringkat

- PruBSN Platinum Brochure EngDokumen10 halamanPruBSN Platinum Brochure EngfaizahBelum ada peringkat

- KUPres 7 Nov 2010Dokumen63 halamanKUPres 7 Nov 2010Hasan Irfan SiddiquiBelum ada peringkat

- QT Nil P 0281201503151442615Dokumen51 halamanQT Nil P 0281201503151442615Dinesh MuruganBelum ada peringkat

- rm4800 550kDokumen28 halamanrm4800 550kDwayne OngBelum ada peringkat

- Mutual FundsDokumen23 halamanMutual FundsrohiniganuBelum ada peringkat

- 2024 Membership Info Non-Core - ENGLISH (11-3-2022)Dokumen16 halaman2024 Membership Info Non-Core - ENGLISH (11-3-2022)neotheuniverseBelum ada peringkat

- NPS PPT - HDFC BankDokumen17 halamanNPS PPT - HDFC BankPankaj Kothari100% (1)

- Rea T: Protection That Builds Your Wealth For Future GenerationDokumen18 halamanRea T: Protection That Builds Your Wealth For Future GenerationDato SBelum ada peringkat

- Miss Soo QTNDokumen41 halamanMiss Soo QTNHong Siong ShinBelum ada peringkat

- Health Invest PrimerDokumen16 halamanHealth Invest PrimerArt WadsilangBelum ada peringkat

- Introduction To Takaful - 2011 445 1Dokumen4 halamanIntroduction To Takaful - 2011 445 1Zahid AzizBelum ada peringkat

- QT Nil P 0281201412122056697Dokumen18 halamanQT Nil P 0281201412122056697Sarath KumarBelum ada peringkat

- P 09 P Smallcap PKF - EngDokumen5 halamanP 09 P Smallcap PKF - EngherbertBelum ada peringkat

- Offer FFFDokumen102 halamanOffer FFFKapil RewarBelum ada peringkat

- CGTMSE Presentation FinalDokumen30 halamanCGTMSE Presentation FinalVishal Chaudhari100% (1)

- VIP OnepagerDokumen2 halamanVIP Onepagerkarthik.vBelum ada peringkat

- MoneyWorks Proposal38yoDokumen5 halamanMoneyWorks Proposal38yoMorg ActusBelum ada peringkat

- 2024 Membership Info - GlobalDokumen16 halaman2024 Membership Info - GlobalhuihudsonBelum ada peringkat

- 7 Myths of Structured ProductsDokumen18 halaman7 Myths of Structured Productsrohanghalla6052Belum ada peringkat

- Policy OwnerDokumen4 halamanPolicy OwnerRichard GuillermoBelum ada peringkat

- Presenting .: UTI - Unit Linked Insurance PlanDokumen21 halamanPresenting .: UTI - Unit Linked Insurance PlanSudipto MajumderBelum ada peringkat

- Investment in Equities Versus Investment in Mutual FundDokumen37 halamanInvestment in Equities Versus Investment in Mutual FundBob PanjabiBelum ada peringkat

- FAQs - MO India Excellence Fund - AIF Mid To MegaDokumen4 halamanFAQs - MO India Excellence Fund - AIF Mid To MegaSandyBelum ada peringkat

- Enrich RezekiDokumen6 halamanEnrich RezekiBig DaddyCoolBelum ada peringkat

- Sharekhan's Top SIP Fund PicksDokumen4 halamanSharekhan's Top SIP Fund PicksrajdeeppawarBelum ada peringkat

- LifeStage Wealth BrochureDokumen10 halamanLifeStage Wealth BrochureNaren LokBelum ada peringkat

- Kotak Gold Fund SIDDokumen30 halamanKotak Gold Fund SIDsabyasachi_paulBelum ada peringkat

- JuanDelaCruz AxeleratorDokumen8 halamanJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraBelum ada peringkat

- LifeXL PDFDokumen6 halamanLifeXL PDFJoydeep Kar0% (1)

- PRUretirement GrowthDokumen32 halamanPRUretirement GrowthlongcyBelum ada peringkat

- Power Point EPFDokumen54 halamanPower Point EPFMujibuneesah BahardinBelum ada peringkat

- Quote en My Mttakafulink003 1461858518108Dokumen19 halamanQuote en My Mttakafulink003 1461858518108matnezkhairiBelum ada peringkat

- Vision of TataDokumen17 halamanVision of TataGyanendra GoshwamiBelum ada peringkat

- Vision of TataDokumen17 halamanVision of TataGyanendra GoshwamiBelum ada peringkat

- (02a) +SKE+Offer+Document CleanDokumen267 halaman(02a) +SKE+Offer+Document CleanInvest StockBelum ada peringkat

- ICICIdirect NewTelecomPolicy2011 SectorUpdateDokumen3 halamanICICIdirect NewTelecomPolicy2011 SectorUpdateSoodamany Ponnu PandianBelum ada peringkat

- LT Emerging Business FundDokumen2 halamanLT Emerging Business FundSankalp BaliarsinghBelum ada peringkat

- Investor Presentation (Company Update)Dokumen26 halamanInvestor Presentation (Company Update)Shyam SunderBelum ada peringkat

- Takaful MalaysiaDokumen10 halamanTakaful MalaysiaskbtblogBelum ada peringkat

- Old Mutual PortfolioDokumen12 halamanOld Mutual PortfolioshabsuBelum ada peringkat

- Sharekhan's Top SIP Fund PicksDokumen4 halamanSharekhan's Top SIP Fund PicksLaharii MerugumallaBelum ada peringkat

- Product Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredDokumen2 halamanProduct Disclosure Sheet: Sun Cover-I: Dd/mm/yyyy Person CoveredNasuha MusaBelum ada peringkat

- Tax SavingDokumen17 halamanTax SavingKbBelum ada peringkat

- What Is A Mutual Fund ?: 3-Tier Structure of Mutual Funds & Other MF ConstituentsDokumen9 halamanWhat Is A Mutual Fund ?: 3-Tier Structure of Mutual Funds & Other MF Constituentskk ppBelum ada peringkat

- Appendices: Takafulink SeriesDokumen23 halamanAppendices: Takafulink SeriesdikirBelum ada peringkat

- 7 Steps To Success in Selling Life InsuranceDokumen140 halaman7 Steps To Success in Selling Life InsurancePraveen Chaturvedi60% (5)

- 2019 Membership Info - GlobalDokumen14 halaman2019 Membership Info - GlobalhuihudsonBelum ada peringkat

- Startup India: Budget AnnouncementsDokumen4 halamanStartup India: Budget AnnouncementsYash MaheshwariBelum ada peringkat

- Taxation Ce2Dokumen10 halamanTaxation Ce2Ratnesh PalBelum ada peringkat

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDokumen19 halamanPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinBelum ada peringkat

- Supergrowth PDFDokumen9 halamanSupergrowth PDFXavier Alexen AseronBelum ada peringkat

- SME Smart ScoreDokumen35 halamanSME Smart Scoremevrick_guyBelum ada peringkat

- 2020 Membership Info - Global (8!5!2019)Dokumen16 halaman2020 Membership Info - Global (8!5!2019)Jenefer AntoBelum ada peringkat

- Products and Services: ZTBL Locker FacilityDokumen4 halamanProducts and Services: ZTBL Locker FacilityAzhar MehmoodBelum ada peringkat

- Page 9Dokumen7 halamanPage 9dikirBelum ada peringkat

- Appendices: Takafulink SeriesDokumen23 halamanAppendices: Takafulink SeriesdikirBelum ada peringkat

- Maa Takaful Shariah Investment - Linked FundsDokumen3 halamanMaa Takaful Shariah Investment - Linked FundsdikirBelum ada peringkat

- Page 5Dokumen15 halamanPage 5dikirBelum ada peringkat

- General Underwriting Guidelines: Additional Benefits/RidersDokumen5 halamanGeneral Underwriting Guidelines: Additional Benefits/RidersdikirBelum ada peringkat

- Protection Benefits: Wakalah Tharawat FeeDokumen1 halamanProtection Benefits: Wakalah Tharawat FeedikirBelum ada peringkat

- Page 1Dokumen1 halamanPage 1dikirBelum ada peringkat

- A Lump Sum Investment of RM 100,000 With Interest Compound Yearly, Accumulates The Amount Indicated at The Respective YearsDokumen1 halamanA Lump Sum Investment of RM 100,000 With Interest Compound Yearly, Accumulates The Amount Indicated at The Respective YearsdikirBelum ada peringkat

- Developing The Business Idea: True-False QuestionsDokumen12 halamanDeveloping The Business Idea: True-False QuestionsjenovaBelum ada peringkat

- Chap016 Managerial ControlDokumen40 halamanChap016 Managerial ControlHussain Ali Y AlqaroosBelum ada peringkat

- Wa0001.Dokumen4 halamanWa0001.lajwang27Belum ada peringkat

- Petron Terminal PaperDokumen19 halamanPetron Terminal PaperKamper DanBelum ada peringkat

- Assignment 2 Front SheetDokumen12 halamanAssignment 2 Front SheetHuy DươngBelum ada peringkat

- Marginalism and IncrementalismDokumen4 halamanMarginalism and Incrementalismyai giniBelum ada peringkat

- Club Amigos Caravan Park:: Contact Persons: Pieter and Sonja Van WykDokumen2 halamanClub Amigos Caravan Park:: Contact Persons: Pieter and Sonja Van WykRobBelum ada peringkat

- Singapore Property Weekly Issue 59Dokumen17 halamanSingapore Property Weekly Issue 59Propwise.sgBelum ada peringkat

- Lesson 2 ONLINEDokumen10 halamanLesson 2 ONLINEFrancis Dave Nagum Mabborang IIBelum ada peringkat

- Barringer Ent6 03Dokumen41 halamanBarringer Ent6 03ghufran almazBelum ada peringkat

- World Bank: Selection OF ConsultantDokumen30 halamanWorld Bank: Selection OF ConsultantRadhai senthil kumaranBelum ada peringkat

- Pulp, Paper, and Packaging in The Next Decade: Transformational ChangeDokumen11 halamanPulp, Paper, and Packaging in The Next Decade: Transformational ChangeegBelum ada peringkat

- Globalization's Wrong TurnDokumen8 halamanGlobalization's Wrong TurnAna TamaritBelum ada peringkat

- Tugas Bisnis Internasional Case of Unilever Goes East Airlangga Kusuma Agung 19012010335 K012Dokumen3 halamanTugas Bisnis Internasional Case of Unilever Goes East Airlangga Kusuma Agung 19012010335 K012Airlangga Kusuma Agung Manajemen100% (1)

- Public: Alliances Transform AidDokumen7 halamanPublic: Alliances Transform AidVanesa JuarezBelum ada peringkat

- Evergreen Event Driven Marketing PDFDokumen2 halamanEvergreen Event Driven Marketing PDFEricBelum ada peringkat

- Workman Define-Award 569 Od 2013Dokumen40 halamanWorkman Define-Award 569 Od 2013shazuarni ahmadBelum ada peringkat

- Economics PDFDokumen44 halamanEconomics PDFyesuBelum ada peringkat

- Global Marketing Plan For American Express: Bahrain: David CappsDokumen14 halamanGlobal Marketing Plan For American Express: Bahrain: David Cappsdcapps_7Belum ada peringkat

- Final AssignmentDokumen20 halamanFinal AssignmentTabish KhanBelum ada peringkat

- AC Exam PDF - 2020 (Dec 1, 2019-Mar 31, 2020) by AffairsCloud-1 PDFDokumen135 halamanAC Exam PDF - 2020 (Dec 1, 2019-Mar 31, 2020) by AffairsCloud-1 PDFShivam AnandBelum ada peringkat

- Problems 123Dokumen52 halamanProblems 123Dharani RiteshBelum ada peringkat

- Schumpeter's Theory of Economic Development - EconomicsDokumen24 halamanSchumpeter's Theory of Economic Development - EconomicsreggydevvyBelum ada peringkat

- 6 - Working Capital ManagementDokumen4 halaman6 - Working Capital ManagementChristian LimBelum ada peringkat

- Handstar Incl Case SolutionDokumen3 halamanHandstar Incl Case SolutionKundan Kumar100% (1)

- Adb Loan Disbursement Handbook PDFDokumen140 halamanAdb Loan Disbursement Handbook PDFMunir AhmadBelum ada peringkat

- RT Unification Shareholder CircularDokumen357 halamanRT Unification Shareholder CircularLeon Vara brianBelum ada peringkat

- Meeting The Challenges of Global Climate Change and Food Security Through Innovative Maize Research. Proceedings of The National Maize Workshop of Ethiopia, 3 Addis Ababa, Ethiopia 18-20 April, 2011Dokumen300 halamanMeeting The Challenges of Global Climate Change and Food Security Through Innovative Maize Research. Proceedings of The National Maize Workshop of Ethiopia, 3 Addis Ababa, Ethiopia 18-20 April, 2011International Maize and Wheat Improvement CenterBelum ada peringkat

- Kel691 XLS EngDokumen10 halamanKel691 XLS EngSuyash DeepBelum ada peringkat

- Bba 312 FM Home Test Jan19 FTDokumen3 halamanBba 312 FM Home Test Jan19 FTDivine DanielBelum ada peringkat