Labor Market

Diunggah oleh

Sheila JonesHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Labor Market

Diunggah oleh

Sheila JonesHak Cipta:

Format Tersedia

I Slovak Investment and Trade Development Agency

I www.sario.sk 1

LABOUR MARKET

I Slovak Investment and Trade Development Agency

I www.sario.sk 2

Contents

Contents ...................................................................................................................................... 2

1. Legal framework ....................................................................................................................... 3

1.1. Establishment of employment ............................................................................................... 3

1.2. Trial period ......................................................................................................................... 3

1.3. Termination of employment .................................................................................................. 3

1.4. Redundancy and severance payments .................................................................................... 4

2. Working hours .......................................................................................................................... 4

2.1. Overtime work .................................................................................................................... 4

2.2. Bonuses for overtime work ................................................................................................... 4

2.3. Wage for night work ............................................................................................................ 5

2.4. Wage for work during bank holidays ...................................................................................... 5

2.5. Vacation and time off ........................................................................................................... 5

2.6. Pension age ........................................................................................................................ 5

3. Employing foreigners ................................................................................................................. 7

4. Wages ..................................................................................................................................... 8

5. Labour productivity ................................................................................................................. 10

6. Unemployment ....................................................................................................................... 11

7. Education ............................................................................................................................... 12

7.1. University education in numbers.......................................................................................... 13

7.2. Language skills ................................................................................................................. 14

I Slovak Investment and Trade Development Agency

I www.sario.sk 3

1. Legal framework

Employer/employee relations are governed by the Labour Code, which regulates such matters as

establishment of employment, working hours, annual vacation, salary conditions, working conditions,

work safety and health regulations, obstructions at work, company social policy, agreements outside of

full time employment, collective and union relations.

1.1. Establishment of employment

The following types of employment contracts are possible according to the Labour Code:

Employment for a definite term (for up to three consecutive years)

Employment for an indefinite term

Employment for reduced working hours

Shared employment

Additional extra-employment agreements are possible:

Off-employment agreements

Specific task agreement

If the contract is for a definite term, this cannot exceed two years. Otherwise, the contract is deemed to

be of indefinite duration and can only be terminated on notice following the occurrence of a limited range

of termination events.

1.2. Trial period

The trial period agreed in the employment agreement is generaly three months but can be up to six

months for direct managerial positions of executive body or for a member of executive body and for

managing employee in direct leading position. During this period either party can cancel the contract at

any time and without having to state the reason.

1.3. Termination of employment

The Labour Code stipulates a notice period of one months if employee is working for the company for less

than 1 year and two months if employee is working for a company for over 1 year.

For terminating employment by written notice given by the employer or by the employee. The employee

does not have to state the reasons for leaving, but the employer can only terminate an employees

contract in compliance with conditions set out in the Labour Code. The notice period starts from the first

day of the following month following delivery of notice.

When notice is given by the company to the employee, one of the following reasons must be stated:

The company (or a part of the company) is being disbanded or transferred.

The employee is made redundant by a written resolution of the employer based on the

organizational changes.

The employee is not able to work for long-term health reasons.

The employee does not meet the preconditions for the job (e.g. there is unsatisfactory

performance of the employee).

Other serious reasons, e.g. substantial company restructuring.

If both parties agree, employment can be terminated at any time. If employment is terminated as a

result of organizational changes, cutbacks or his inability to work for health reasons, the employee has a

protection of at least a three-month termination period if he/she has been working for the employer for

more than five years.

I Slovak Investment and Trade Development Agency

I www.sario.sk 4

Furthermore, the company can terminate an employment contract immediately if:

The employee is convicted of an intentional criminal act

The employee seriously breaches work discipline

1.4. Redundancy and severance payments

The Labour Code provides for a severance payment of at least 1 month average earnings if an employee

works for a company for more than 2 years. A severance of two months average earnings apply in case

of employees with more than 5 years but less than 10 years of service with the employer, three moths

severance applies in case of employees working more than 10 years but less than 20 years for the

employer and four months severance applies in case of employees working for more than 20 years for

the employer.

If the employee agrees with the two-month notice period (three-month notice period for employees with

more than 5 years of service with the employer), the employer is not obliged to pay the severance

payment.

2. Working hours

The weekly working time is 40 hours, excluding breaks (min. 30 minutes), which are not paid. One 30-

minute break has to be provided if the employees working time is longer than 6 hours. Additional breaks

may be arranged between the employer and the employee or the employer and a trade union.

Shifts: Employees who work alternatively on two shifts can work a maximum of 38 and hours per

week. Employees who alternatively work on three shifts or on a continuous basis can work a maximum of

37 and hours each week.

2.1. Overtime work

Overtime work shall not exceed on average 8 hours per week during not more than four consecutive

months, unless the employer agrees to a longer period with the representatives of the employees;

however, this period shall not be longer than 12 consecutive months. The maximum amount of overtime

work that an employer may request from an employee in any calendar year shall be 150 hours.

2.2. Bonuses for overtime work

The employee is entitled to his normal wage plus a special bonus equal to at least 25% of his average

salary for overtime hours worked (working on Saturday is also considered as overtime work). If the

employer and the employee agree to leave as a consideration for the overtime work, the employee shall

be entitled to one hour of leave for one hour of overtime work; with no entitlement to any special bonus.

In a collective agreement, an employer may agree on a set of employees with whom it is possible to

agree that potential overtime will be included in their pay, up to a maximum total of 150 hours per year.

If the collective agreement does not define such a set of employees pursuant to the first sentence, the

employer may agree with managers and with employees responsible for planning, systems, creative,

methodological or commercial activities, employees who direct, organise or coordinate complex processes

or an extensive set of highly complex equipment, that their pay will include overtime, though not more

than 150 hours per year.

I Slovak Investment and Trade Development Agency

I www.sario.sk 5

2.3. Wage for night work

The term night work means work performed between 10.00 p.m. and 5.00 a.m. With regard to night

work, the employee shall be entitled to a special bonus for each hour of the night work of at least 20% of

the minimum wage claim stipulated in 120 of the Labour Code.

2.4. Wage for work during bank holidays

As a consideration for work performed during bank holidays (15 days in the year), the employee shall be

entitled to his normal wage, plus a special bonus of at least 50% of his average earnings (Sundays are

also considered bank holidays in this respect). If the employer and the employee agree on leave as a

consideration for work performed during bank holidays, the employee shall be entitled to one hour of

leave for one hour of work during bank holidays; with no entitlement to any special bonus.

Bank holidays in Slovakia

1 January New Years Day

6 January Epiphany

March/April, exact date varies Good Friday

March/April, exact date varies Easter Monday

1 May Labour Day

8 May Victory over Fascism

5 July St. Cyril and St. Method

29 August Slovak National Uprising

1 September Constitution Day

15 September Our Lady of Sorrows

1 November All Saints Day

17 November Velvet Revolution Day

24 December Christmas Eve

25 December Christmas Day

26 December St. Stephens (Boxing) Day

2.5. Vacation and time off

In addition to public holidays, employees are entitled to at least 20 days of paid vacation. If an employee

reaches 33 years of age this period increases to at least 25 days.

2.6. Pension age

The pension age for both men and women is 62 years of age in general. Pensioners can still work if they

wish to.

I Slovak Investment and Trade Development Agency

I www.sario.sk 6

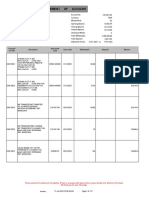

Comparison among V4 countries

The following table compares various aspects of the Slovak labour market with the neighbouring

countries. All these countries belong into the European Union and therefore the law is similar. The

maximum probation period is 3 months for all.

Minimum wage ()

Minimum

age of

employees

Maximum

overtime ordered

by employer

Maximum

overtime agreed

with employee

Statutory holiday

(days/year)

Slovakia 337,70 15

8 hours/week,

150 hours/year

400 hours/year

20 (25 after the age

of 33)

Hungary

335,37

(98 000HUF)

16

8 hours/week,

200 hours/year

300 hours/year

20 (max. 30 at age

of 45+)

Poland

381,17

(1,600 PLN)

18

8 hours/week,

150 hours/year

Collective labor

agreement or

employment

contract

20 (26 after 10

years of

employment)

Czech

Republic

317,9

(8,000 CZK)

15

8 hours/week,

150 hours/year

416 hours/year

20 (25 after 15

years of

employment)

Source: SARIO, 2013, at average exchange rates for 1st of February 2013

I Slovak Investment and Trade Development Agency

I www.sario.sk 7

3. Employing foreigners

Before arriving in the territory of the Slovak Republic, a foreigner who is from a non-EU member state

has to apply in writing to the appropriate Office of Labour, Social Affairs, and Family for a work permit,

either by himself/herself or through the future employer or through the legal person or natural person to

whom he/she should be posted to perform work. A foreigner from an EU member state does not need a

work permit. The appropriate Office of Labour, Social Affairs, and Family issuing the work permit is the

office of territorial competence at the work location of the foreigner.

The application for issuing a work permit has to be accompanied by the employers promissory statement

to employ the foreigner.

The appropriate Office of Labour, Social Affairs, and Family may grant the foreigner a work permit,

providing that the vacancy could not be filled by a job seeker in the register of job seekers. In issuing the

work permit the Office shall consider the labour market situation. There is no legal claim to the issuance

of a work permit.

A work permit is also required for a foreigner

a) employed by an employer whose domicile or site of organisational unit with labour law personality is

outside of the territory of the Slovak Republic and posted by that employer to perform work in the

territory of the Slovak Republic, based on a contract concluded with a legal person or with a natural

person;

b) who is going to be employed in a border area of the Slovak Republic, who would return at least once a

week to the state of his/her permanent residence neighbouring the Slovak Republic; a border area of the

Slovak Republic is defined as the territory of a district neighbouring the state borders.

Issuance of a work permit is not required for a foreigner who is a partner of a business company,

or the authorized body of a business company, or a member of the authorized body of a business

company performing an activity on behalf of the business company in the territory of the Slovak

Republic, or who was assigned to perform activities in the territory of the Slovak Republic within the

framework of services of an employer whose domicile is in another EU member state.

Validity of the work permit shall expire upon lapse of the period of issuance, upon termination of the

employment before lapse of the period of validity of the work permit, upon lapse of validity of the

residence permit issued to the foreigner, or upon expiry of the residence permit for other reasons, etc.

The appropriate Office of Labour, Social Affairs, and Family issues the work permit with a two-year

validity at most; with six-month validity in any one calendar year at most in the case of seasonal work,

in which case a period of at least six months shall separate two individual employments in the territory of

the Slovak Republic.

The employer is obliged to inform the Office in writing about the commencement and termination of the

employment of an EU citizen and his/her family members and about the commencement and termination

of the employment of the foreigner who is not required to submit a work permit within seven working

days of the commencement and termination of employment. The employer is obliged to inform the Office

in writing within seven days, of the fact that the foreigner who had been granted a work permit either did

not commence the employment or his/her employment finished before the expiration of the employment

period specified in the work permit. Furthermore, the employer is obliged to inform the police about the

termination of the employment of the foreigner from a third country (other than EEA member state).

Valid from January 1, 2010, certain cathegories of foreigners do not have to possess a temporary

residence permit for the purpose of employment for up to 90 days from the day of entering to Slovakia.

Consequently, they will be allowed to begin their employment immediately after entering Slovakia if they

hold the pertinent work permit. This measure is for employees sent by their employers to Slovakia for

a short-term period, or employees of strategic investors.

I Slovak Investment and Trade Development Agency

I www.sario.sk 8

4. Wages

The average monthly salary is still low compared to those paid in Western Europe and slightly lower than

in Poland, Hungary and Czech Republic. In 2011, the average gross wage was 786 per month, excl.

obligatory social security contributions. In 2010, the average gross wage grew slightly by 3,2% from

769 per month. The minimum monthly wage in 2011 was 317 and changed to 327,20 in 2012.

Wage growth since 2002-2011 has been following:

9,3%

6,3%

10,2%

9,2%

8,6%

7,4%

8,1%

3,0%

3,2%

2,20%

0,0%

2,0%

4,0%

6,0%

8,0%

10,0%

12,0%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Sou

rce: The Statistical Office of the Slovak Republic, www.statistics.sk, 2012, Sario calculations, www.sario.sk, 2012

Social security contributions in Slovakia cover all the contributions in which there are no extra or hidden

costs for the employer. The employer has to pay the social security costs for his employee in the amount

of 35.2% on top of gross salary. The employee pays for himself the social security costs of 13.4%. The

contributions in Slovakia are upwardly limited. Everything earned above this figure is not subject to social

security payments.

Average monthly wage and labour costs in EUR throughout 2011:

Slovakia

2011

Czech Republic

2011

Poland

2011

Hungary

2011

Average monthly wage in 786 EUR 987 (23,984 CZK) 803 (3.399,52 PLN) 771 (223,634 HUF)

Social Security paid by

employer

35.2% 34% 17.48% to 20.41% 27%+ 1.5%

Monthly total labour costs 1,062 1,322 943 967 998,44

* exchange rate (as of May 15

th

2012) EUR 1 = 25.4503695CZK

** exchange rate (as of May 15

th

2012) EUR 1 = 295.387112HUF

*** exchange rate (as of May 15

th

2012) EUR 1 = 4.34127912PLN

Source: National Statistical offices of Czech Republic, Hungary, Poland, Slovakia, 2012

Regional and sectoral differences

There are significant regional and sectoral differences in wage levels within Slovakia. In 2011, the highest

average monthly salary was in Bratislava region at 1001 , while the lowest of 608 was in Preov

region.

I Slovak Investment and Trade Development Agency

I www.sario.sk 9

Regional average monthly wage levels in 2011:

BA Bratislava

NR Nitra

TT Trnava

TN Trenin

ZA ilina

BB Banska Bystrica

KE Koice

PO - Poprad

Source: Statistical Office of the Slovak Republic, www.statistics.sk, 2012

In 2011, the highest average monthly salaries were in information and communication sector ( 1,576)

followed by financial and insurance services ( 1,545), electricity and gas supply ( 1,372). The lowest

salaries were in accomodation and food services ( 508 ), civil construction ( 603) and agriculture (

620).

1001

BA

735

TT

687

TN

662

NR

652

BB

707

ZA

608

PO

726

KE

I Slovak Investment and Trade Development Agency

I www.sario.sk 10

5. Labour productivity

Labour productivity is expressed as GDP per hour worked. It is intended to give a picture of the

productivity of national economies expressed in relation to the European Union (EU-15) average. Figures

are being expressed in Purchasing Power Standards (PPS) allowing meaningful volume comparisons of

GDP between countries. When evaluating labour productivity as GDP per person employed incl. both full-

time, part-time employed.

In Slovakia, labour productivity expressed both as per hour worked and per employee reaches steadily

the highest volumes in comparison with the Czech Republic, Poland, Hungary, Romania and Bulgaria,

proving the highest labour productivity throughout the past 8 years. (Data for 2012 are not yet

available).

Labour productivity per hour worked as percentage of Euro 15 average:

0

10

20

30

40

50

60

70

80

2002 2003 2004 2005 2006 2007 2008 2009 2010

Slovakia Hungary Czech Republic

Poland Romania Bulgaria

Source: Eurostat, www.epp.eurostat.ec.europa.eu, 2011, EU 15 = 100

I Slovak Investment and Trade Development Agency

I www.sario.sk 11

6. Unemployment

In years of economic upturn the unemployment was falling gradually till 2008 where this positive trend

stopped just under 10%. Because of the economic crisis, some companies were forced to discharge

employees and thus total unemployment rose to 12.1% in 2009, and 14.4% in 2010. In 2011 however,

there was a turning point and unemployment rate started to decrease by almost 1 percentage point to

13.5%.

Development of unemployment since 2004-1Q2012:

Unemployment Rate %

17,8%

15,2%

14,3%

11,6%

10,4%

8,4%

7,7%

11,4%

12,5%

13,2%

5%

7%

9%

11%

13%

15%

17%

19%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: Statistical Office of the Slovak Republic, www.statistics.sk, 2012

Also the unemployment level differs according to region. The lowest level of unemployment in 2011 was

in Bratislava region at level of 5,40%, the highest in Bansk Bystrica (19,83%), Preov (18,95%) and

Koice (18,76%) regions.

Development of regional unemployment:

Source: Regdat, www.regdat.sk, 2012, Upsvar, www.upsvar.sk, 2012

0%

5%

10%

15%

20%

25%

30%

2004 2005 2006 2007 2008 2009 2010 2011

Bratislava Trnava Trenn Nitra ilina Bansk Bystrica Preov Koice

I Slovak Investment and Trade Development Agency

I www.sario.sk 12

7. Education

Slovakia reaches one of the highest shares of workforce with the secondary, higher and the university

education among all the European countries. Furthermore, the share of people with a university

education is on the rise.

Education level in Slovakia:

6,75%

40,39%

37,17%

15,68%

0,01%

No education

Elementary school

Secondary General School

Secondary Vocational School

University education

Source: Statistical Office of the Slovak Republic, www.statistics.sk, 2010-2011

The workforce of more than 2.3 million has a strong tradition in engineering and mechanical production.

Foreign companies frequently praise the motivation and abilities of Slovakias workers who also possess

good language and computer skills.

I Slovak Investment and Trade Development Agency

I www.sario.sk 13

7.1. University education in numbers

There are 35 universities in Slovakia spread all over the country. In the academic year 2010/2011, there

were 204 158 students enrolled at Slovak universities and 69 978 graduated (both data include Bachelor

and Master studies). There are two reasons behind these large numbers: the baby boom in the 1980s

and a high percentage of secondary school graduates that enrol in universities. Slovakia is among the top

countries in the world of secondary school graduates attending university.

The subject of studies is following:

0

10 000

20 000

30 000

40 000

50 000

60 000

70 000

80 000

90 000

economy health IT natural

sciences

other social

sciences

technical

students graduates

Source: The Institute for Information and Prognosis in Education, www.uips.sk, 2011, SARIO calculations, 2012

I Slovak Investment and Trade Development Agency

I www.sario.sk 14

University studies of technical subjects are concentrated mainly in Trenn, ilina, Zvolen, Koice and

Bratislava. Economy is studied mainly in Bratislava, Komrno and ilina.

Distribution of study subjects, according to number of students in Slovakia:

Note: IT is involved also in technical studies. Due to the methodology of statistics result of the Institute for

Information and Prognosis in Education, it was not possible to put it as separate category.

Source: The Institute for Information and Prognosis in Education, www.uips.sk, 2012, SARIO calculations, 2012

Secondary schools

Slovakia has a well established system of specialised training and vocational schools. To accommodate

the changing requirements on the labour market, secondary schools are being given a higher degree of

control in creating their own educational programmes to meet the current needs of the local industry.

7.2. Language skills

Slovakia is an export-oriented economy that can offer a workforce with a high degree of language skills.

The foreign language most often spoken is English. The proximity to Austria and Germany has resulted in

German being the second most-spoken foreign language. The result has been the inflow of multilingual

contact centres and shared services centres.

Slovaks are taught a foreign language mostly already at primary schools and later on deepen their

language knowledge (or start learning a language) at secondary schools.

The most common foreign languages taught at Slovak secondary schools include:

English

85.76%

German

60.84%

French

7.93%

Russian

7.56%

Spanish

2.99%

Italian

0.72%

Source: The Institute for Information and Prognosis in Education, www.uips.sk, 2010, SARIO calculations, 2011

Bratislava

73 505

Trnava

19 196

Nitra

23 307

Trenn

10 211

ilina

18 543

Martin

1 039

Ruomberok

9 060

Zvolen

4 952

Bansk Bystrica

17 794

Preov

11 864

Koice

28 707

Komrno

2358

Economy

IT

Technical studies

Other

I Slovak Investment and Trade Development Agency

I www.sario.sk 15

Slovak Investment

and Trade Development Agency

Trnavsk cesta 100

821 01 Bratislava

Slovak Republic

Tel: +421 2 58 260 100

Fax: +421 2 58 260 109

E-mail: invest@sario.sk

www.sario.sk

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Concepts of HR AuditDokumen3 halamanConcepts of HR AuditRaktim KakatiBelum ada peringkat

- Employment-Related Letters: Well-Displayed, Easy-To-ReadDokumen4 halamanEmployment-Related Letters: Well-Displayed, Easy-To-ReadAira Mae Hernandez CabaBelum ada peringkat

- Business Model Canvas GuideDokumen28 halamanBusiness Model Canvas GuideFlorence Reyes100% (1)

- Create A Festival Event Poster and Visual Suite For People Who Work at Universal MusicDokumen1 halamanCreate A Festival Event Poster and Visual Suite For People Who Work at Universal Musicapi-660520917Belum ada peringkat

- Partnership Formation and Capital AccountsDokumen13 halamanPartnership Formation and Capital AccountsKristine BlancaBelum ada peringkat

- Practice Incentives Practice Closure or Withdrawal: When To Use This Form Filling in This FormDokumen3 halamanPractice Incentives Practice Closure or Withdrawal: When To Use This Form Filling in This Formshaka biasaBelum ada peringkat

- Book 7Dokumen2 halamanBook 7Actg SolmanBelum ada peringkat

- Global Space Industry Dynamics 2017Dokumen32 halamanGlobal Space Industry Dynamics 2017Kamalanathan KasparBelum ada peringkat

- CUSTOMER - STATEMENT - OF - ACCT - ONLINE - F12 (8) - RepairedDokumen171 halamanCUSTOMER - STATEMENT - OF - ACCT - ONLINE - F12 (8) - RepairedGeorge Ricky HawkinsBelum ada peringkat

- Module 8 Unit 23Dokumen47 halamanModule 8 Unit 23VIGNESH RKBelum ada peringkat

- Organization and Management E-Book PDFDokumen4 halamanOrganization and Management E-Book PDFDomingo ManzoBelum ada peringkat

- Strategic Audit and SWOT Analysis of a CorporationDokumen8 halamanStrategic Audit and SWOT Analysis of a CorporationAJ Louise IbanezBelum ada peringkat

- Shadow Economy, Corruption and Economic Growth - An Analysis of BRICS CountriesDokumen8 halamanShadow Economy, Corruption and Economic Growth - An Analysis of BRICS CountriesNiken HervinaBelum ada peringkat

- Equipment Installation Reports EN VersionDokumen8 halamanEquipment Installation Reports EN VersionHaythem Ben Zid100% (1)

- A. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectDokumen5 halamanA. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectJere Mae MarananBelum ada peringkat

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokumen79 halamanIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeJhoni LieBelum ada peringkat

- Unit 1 CH 1 & 2 SAHAS Pamphlet EditedDokumen39 halamanUnit 1 CH 1 & 2 SAHAS Pamphlet EditedDhrumil DesaiBelum ada peringkat

- ALTER IGs For LSIsDokumen44 halamanALTER IGs For LSIsRyan LimbagBelum ada peringkat

- ICAB Advance Level Strategic Business Management Study Manual Case & Worked ExampleDokumen88 halamanICAB Advance Level Strategic Business Management Study Manual Case & Worked ExampleOptimal Management SolutionBelum ada peringkat

- IC LENDING INVESTORS CORPORATION SUPPLEMENTARY SCHEDULEDokumen3 halamanIC LENDING INVESTORS CORPORATION SUPPLEMENTARY SCHEDULEjonely kantimBelum ada peringkat

- Economics Revision 2: Section B: Short Answer Questions Question One: Circular Flow ModelDokumen6 halamanEconomics Revision 2: Section B: Short Answer Questions Question One: Circular Flow ModelSean CalvinBelum ada peringkat

- Revised Corporation Code (RA No. 11232) - Title V - BylawsDokumen3 halamanRevised Corporation Code (RA No. 11232) - Title V - Bylawsshella vienBelum ada peringkat

- Database Design & Development - Docx 88Dokumen23 halamanDatabase Design & Development - Docx 88Isuru TharakaBelum ada peringkat

- Curriculum Vitae For Mpho MenyatsoDokumen8 halamanCurriculum Vitae For Mpho MenyatsoMpho Menyatso0% (1)

- Dole Standard ContractDokumen3 halamanDole Standard ContractJanice Domogan77% (35)

- PublicationDokumen65 halamanPublicationmohammed ahmedBelum ada peringkat

- The Business Process Model and Notation of Open Innovation: The Process of Developing Medical InstrumentDokumen15 halamanThe Business Process Model and Notation of Open Innovation: The Process of Developing Medical InstrumentVivianBelum ada peringkat

- Instructor's Introduction: Dr. Kamran MoosaDokumen1 halamanInstructor's Introduction: Dr. Kamran MoosasohaibBelum ada peringkat

- TVL EMPOWERMENT TECHNOLOGIES-Q4-M6 - JANETH PINEDADokumen15 halamanTVL EMPOWERMENT TECHNOLOGIES-Q4-M6 - JANETH PINEDAKlaris Reyes88% (8)

- Field Engineer Job Description With CTC DetailsDokumen2 halamanField Engineer Job Description With CTC DetailsParag SinghBelum ada peringkat