E BL First Mutual Fund 2013 Annual

Diunggah oleh

Md Saiful Islam Khan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

75 tayangan12 halamanANNUAL REPORT 2013

Judul Asli

e Bl First Mutual Fund 2013 Annual

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniANNUAL REPORT 2013

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

75 tayangan12 halamanE BL First Mutual Fund 2013 Annual

Diunggah oleh

Md Saiful Islam KhanANNUAL REPORT 2013

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 12

AUDITORS'REPORT

AND AUDITED FINANCIAL STATEMENTS

OF

EBL FIRST MUTUAL FUND

FOR THE YEAR ENDED 30J UNE 2013

~~.09f. ~I~~-=i ~~ ~

t > t r : 1 " ~ ~ I~,;i(;; i (; J1

" -

M.J. ABEDIN & CO

CHARTERED ACCOUNTANTS

TelephoneOff: +880-2-8629771, 9666508

Fax: +880-2-9675340

E-mail: audit @mjabedin.com

mjabedinbd@gmail.com

WebSit e : www.mjabedin.com

Nat ional Plaza (3rd Floor)

109, Bir Ut t am c.a. Dat t a Road,

Dhaka-1205, Bangladesh

AUDITORS' REPORT

TO THE TRUSTEE OF

EBL FIRST MUTUAL FUND

Wehave audit ed t he accompanying financial st at ement s of EBL First Mut ual Fund (t he Fund) namely, BalanceSheet at

30J une 2013and t he relat ed Profit and Loss Account , St at ement of Changes in Equit y, Cash Flow St at ement and not es

t heret ofor t heyear ended 30J une2013.

Management 's responsibilit y for t he financial st at ement s

Management is responsible for t he preparat ion and fair present at ion of t hese financial st at ement s and for such int ernal

cont rol as management det ermines isnecessary t o enable t hepreparat ion of financial st at ement s t hat are freefrommat erial

misst at ement , whet her due t ofraud or error.

Audit ors' responsibilit y

Our responsibilit y is t o express an opinion on t hese financial st at ement s based on our audit . We conduct ed our audit in

accordance wit h Bangladesh St andards on Audit ing (BSAs). Those st andards require t hat we comply wit h et hical

requirement s and plan and perform t heaudit t o obt ain reasonable assurance about whet her t hefinancial st at ement s arefree

frommat erial misst at ement .

An audit involves performing procedures t o obt ain audit evidence about t he amount s and disclosures in t he financial

st at ement s. The procedures select ed depend on t he audit or's judgment , including t he assessment of t he risks of mat erial

misst at ement of t he financial st at ement s, whet her due t o fraud or error. In making t hose risk assessment s, t he audit or

considers int ernal cont rol relevant t o t he ent it y's preparat ion and fair present at ion of t he financial st at ement s in order t o

designaudit procedures t hat are appropriat e in t hecircumst ances, but not for t he purpose of expressing an opinion on t he

effect ivenessof t he appropriat eness of account ing policies used and t he reasonableness of account ing est imat es made by

management , as well as evaluat ing t heoverall present at ion of t hefinancial st at ement s.

Webelievet hat t heaudit evidence wehave obt ained issufficient and appropriat e t oprovide abasis for our audit opinion.

Opinion

Inour opinion, t hefinancial st at ement s prepared inaccordance Int ernat ional Account ing St andards/ Int ernat ional Financial

Report ingSt andards so far adopt ed by t he Inst it ut e of Chart ered Account ant s of Bangladesh as Bangladesh Account ing

St andards/Bangladesh Financial Report ing St andards giveat rueand fair view of t hest at e of t heFund's affairs as at 30J une

2013and of t heresult s of it s operat ions and it s cash flows for t heperiod t hen ended and comply wit h t he requirement s of

BangladeshSecurit ies and Exchange Commission (Mut ual Fund) Bidhimala (Rules) 2001, Trust Deed and ot her applicable

lawsand regulat ions.

Wefurt her report t hat :

(a) wehave obt ained all t he informat ion and explanat ions which t o t he best of our knowledge and belief were necessary

for t hepurpose of our audit and made due verificat ion t hereof;

(b) inour opinion, proper books of account as required bylaw have been kept by t heFund so far as it appeared fromour

examinat ion of t hosebooks.

(c) t heBalanceSheet and Profit and LossAccount along wit h t henot es t heret o dealt wit h by t his report are inagreement

wit h t hebooks of account .

(d) t heinvest ment was made as per Rule56of Bangladesh Securit ies and Exchange Commission (Mut ual Fund) Bidhirnala

(Rules)2001and

(e) t heexpendit ure incurred and payment s made werefor t hepurpose of t heFund's business for t heperiod.

Dat ed, Dhaka

13August 2013

M. J . ABEDIN &CO

Chart ered Account ant s

An independent member firm of.

MOORE STEPHENS

INTERNATIONAL LIMITED

I

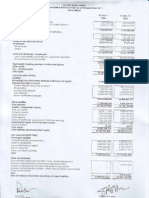

EBL FIRST MUTUAL FUND

St at ement of Financial Posit ion ( Balance Sheet )

As at 30 J une 2013

I Not es I

Amount in Taka

30-J un-13

II

30-J un-12

ASSETS

List ed Securit ies - at cost 3.00 682,687,834 649,682,522

Non-List ed Securit ies - at cost 4.00 119,713,637 74,991,414

Ot her Receivables 5.00 5,655,796 5,006,983

Advances and Deposit s 6.00 2,557,605 6,331,106

Cash and Cash Equivalent s 7.00 443,935,614 569,219,790

Preliminary and Issue Expenses 8.00 20,599,409 24,035,257

Tot al Asset s 1,275,149,895 1,329,267,072

eAPIT AL AND LIABILITIES

Share Holders Equit y 1,216,547,466 1,262,442,093

Capit al Fund 9.00 1,000,000,000 1,000,000,000

Dividend Equalizat ion Reserve 50,000,000 50,000,000

Market Risk Reserve 102,721,485 108,419,844

Ret ained Earnings 63,825,981 104,022,249

Current Liabilit ies and Provisions 10.00 58,602,429 66,824,979

Tot al Capit al and Liabilit ies 1,275,149,895 1,329,267,072

Net asset value (NAV) per unit :

At Cost

At Market Value

11.00

12.00

12.17

11.14

12.62

11.54

The accompanying not es form an int egral part of t his financial st at ement .

Trust ee Asset Manager

As per our separat e report of even dat e

annexed

Dat ed, Dhaka

13August 2013

M. J . ABEDIN & CO

Chart ered Account ant s

2

EBL FIRST MUTUAL FUND

St at ement of Comprehensive Income ( Revenue Account )

For t he year ended 30J une 2013

Amount in Taka

2013

INCOME

Dividend Income

Int erest on Bank Deposit s and Bonds

Net Income on Sale of Market able Securit ies

Tot al Income

12,777,280

60,784,109

101,822,085

13,368,551

63,683,455

158,666

13.00

14.00

175,383,474 77,210,672

EXPENSES

16,312,171 20,063,144

3,356,600 3,376,931

1,190,000 1,190,000

12,117 443,089

1,000,000 1,000,000

535,745 759,357

249,621 228,113

49,150 31,350

67,544 64,245

332,351 1,224,248

Management Fee

Amort izat ion of Preliminary &Issue Expenses

Annual List ing Fee Wit h BSEC and St ock Exchanges

CDBL Expenses

Trust ee Fee

Cust odian Fee

Publicat ion Expenses

Audit Fee Including Vat

Bank Charges

Ot her Expenses

Tot al Expenses

Provision against Invest ment -adjust ment / (expense)

Net Profit before Tax

Income Tax expenses

Net Profit aft er Tax Transferred t o Ret ained Earnings

(23,105,299)

5,698,359

(28,380,477)

(53,519,844)

93,483,153

5,200,000

59,803,732

59,803,732 98,683,153

Earnings Per Unit 0.99 15.00 0.60

Theaccompanying not es form an int egral part of t his financial st at ement .

Trust ee Asset Manager

As per our separat e report of even dat e

annexed

Dat ed, Dhaka

13August 2013

M. J . ABEDIN & CO

Chart ered Account ant s

3

EBL FIRST MUTUAL FUND

St at ement of Changes in Equit y

For t he year ended 30J une 2013

Amount in Taka

Provision

Capit al Ret ained

Against Dividend

Tot al

Part iculars

Fund Earnings

Erosion of Equalizat ion

Equit y

Market able Reserve

Invest ment s

Balanceat 30J une 2012 1,000,000,000 104,022,249 108,419,844 50,000,000 1,262,442,093

Dividendfor 2011-12 (100,000,000) (100,000,000)

Earningsduring t he year 59,803,732 59,803,732

DividendEqualizat ion Reserve

Market RiskReserve (5,698,359) 5,698,359

Balanceat 30J une 2013 1,000,000,000 63,825,981 102,721,485 50,000,000 1,216,547,466

4

EBL FIRST MUTUAL FUND

St at ement of cash flows

for t he year ended 30J une 2013

Amount in Taka

2013

II

2012

A. Cash flows from Operat ing Act ivit ies

Int erest on Bank Deposit s 63,461,443 60,700,774

Dividend Income 11,901,941 13,413,637

Advances and Deposit s 3,773,502 720,972

Expenses (27,892,000) (26,134,241)

Net cash from Operat ing Act ivit ies 51,244,886 48,701,142

B . Cash flows from Invest ing Act ivit ies

Invest ment inShares &Securit ies (31,806,839) 127,507,784

Advance for IPO 0

Invest ment in Bond (44,722,223) (9,991,414)

Net Cash out flows from Invest ing Act ivit ies (76,529,062) 117,516,370

C.

Cash flows from Financing Act ivit ies

Dividend paid (100,000,000) (146,416,250)

Net cash used in Financing Act ivit ies (100,000,000) (146,416,250)

Net cash flows (A+B+C) (125,284,176) 19,801,261

Cash&Cash Equivalent s at t he Beginning of t heperiod 569,219,790 549,418,528

Cash & Cash Equivalent s at t he end of t he period 443,935,614 569,219,790

5

EBL FIRST MUTUAL FUND

Not es t o t he Financial St at ement s

As at and for t he year ended 30J une 2013

1.00 Int roduct ion

EBL First Mut ual Fund (here-in-aft er referred t o t he "Fund") was const it ut ed t hrough a

Trust Deed signed on 05 April 2009 bet ween East ern Bank Limit ed (EBL) as 'Sponsor' and

t he Invest ment Corporat ion of Bangladesh (ICB) as "Trust ee" under t he Trust Act 1882 and

Regist rst ion Act 1908. The Fund was regist ered wit h t he Bangladesh Securit ies and

Exchange Commission (BSEC) on 19 April 2009 under t he Bangladesh Securit ies and

Exchange Commission (Mut ual Fund) Rules 2001. The operat ions of t he Fund was

commenced on 19August 2009by list ing wit h Dhaka and Chit t agong St ock Exchanges.

The Invest ment Corporat ion of Bangladesh (ICB) is cust odian of t he Fund and RACE

Management PCL manages t he operat ion of t he Fund as Fund Manager.

1.01 Closure of Books of Account of t he Fund

TheFund has been closing it s books of account as at 30J une each year.

1.02 Object ives

The object ive of EBL First Mut ual Fund is t o earn superior risk adjust ed ret urn by

maint aining a diversified invest ment port folio and provide at t ract ive dividend payment s t o

t heunit holders.

2.00 Significant Account ing Policies

2.01 Basis of Account ing

These financial st at ement s have been prepared under hist orical cost convent ion in

accordance wit h t he Int ernat ional Account ing St andards (IASs)jInt ernat ional Financial

Report ing St andards (IFRSs), applicable t o t he Fund so far adopt ed by t he Inst it ut e of

Chart ered Account ant s of Bangladesh as Bangladesh Account ing St andards

(BASs)jBangladesh Financial Report ing St andards. The disclosures of informat ion made in

accordance wit h t he requirement s of Trust Deed, Securit ies and Exchange Rules 1987 and

ot her applicable Rules and regulat ions.

2.02 Market able Invest ment

(a) Invest ment is recorded in t he Balance Sheet at cost .

(b) Value of list ed securit ies is disclosed at closing quot ed market prices prevailed at 30

J une 2013 on an aggregat e port folio basis as per requirement of Bangladesh Securit ies

and Exchange Commission (Mut ual Fund) Bidhimala (Rules) 2001.

6

2.03 Market Risk Reserve

The difference bet ween cost of invest ment and t he value of invest ment on agreegat ed

port folio basis is shown as Market Risk Reserve. For 2012-2013Market Risk Reserve st ood at

Tk. 102,721,485.

2.04 Dividend Equalizat ion Reserve

The fund maint ains Dividend Equalizat ion Reserve by appropriat ing a port ion of Ret ained

Earning.

2.05 Revenue Recognit ion

a) Gains/losses arising on sale of invest ment are included in t he Profit and Loss Account

on t he dat e at which t he t ransact ion t akes place.

b) Cash dividend is recognised when t he shareholders' right t o receive payment is

est ablished.

c) Int erest income isrecognised on t ime proport ion basis.

2.06 Taxat ion

As per SRO No. 333/Rule/Income Tax/2011 t he income of mut ual fund has been exempt ed

fromt ax.

2.07 Preliminary and Issue Expenses

Preliminary and issue expenses represent expendit ure incurred prior t o commencement of

operat ions and est ablishment of t he Fund. These cost s are amort ised wit hin t en years' t enure

asper Trust Deed.

2.08 Dividend Policy

Pursuant t o t he Bangladesh Securit ies and Exchange Commission (Mut ual Fund) Rules 2001,

t he Fund is required t o dist ribut e it s profit by way of dividend eit her in cash or bonus

unit s/ st ock dividend ( reinvest ment ) or bot h t o t he holders of t he unit s aft er t he closing of

t he annual account s an amount t hat shall not be less t han sevent y percent (70%) of annual

profit earned during t he year.

2.09 Management Fee

Management fee is charged as per t he Trust Deed and under t he proVISIOns of t he

Bangladesh Securit ies and Exchange Commission (Mut ual Fund) Rules 2001.

7

2.10 Trust ee Fee

TheTrust ee is ent it led t o get an annual Trust eeship fee of Taka 1,000,000 only payable semi-

annually during t he lifeof t he fund.

2.11 Cust odian Fee

Invest ment Corporat ion of Bangladesh (ICB) is ent it led t o receive cust odian fee @ 0.10%on

t hebalance of securit ies calculat ed on average mont h end value each year.

2.12 Annual Fee t o BSEC

The Fund is required t o pay annual feeeach year @ 0.10%of t he fund size t o t he Bangladesh

Securit ies and Exchange Commission (BSEC) in t erms of t he Bangladesh Securit ies and

Exchange Commission (Mut ual Fund) Rules 2001.

2.13 Earnings Per Unit

Earnings per unit has been calculat ed in accordance wit h Bangladesh Account ing St andard -

33"Earnings per Share" and shown on t he face of profit &loss account .

2.14 General

Figures appearing in t hese financial st at ement s have been rounded off t o nearest Taka.

8

3.00 List ed Securit ies - at cost

Ordinary Shares

Sect or/Cat egory

Bank

Cement

Corporat e Bond

Engineering

Foodand Allied

Fuel and Power

Insurance

Miscellaneous

IT

Mut ual Funds

BFI

Pharma

Tannery

Telecommunicat ion

Text ile

Servicesand Real Est at i

Travel &Leiser

1,539,453

207,266

1,306

252,285

9,050

1,923,880

54,585

6,552

9,787

15,465,550

725,116

706,605

50,900

34,800

14,143

9,225

421,480

Cost

64,358,695

36,698,134

977,672

35,548,825

4,376,686

129,861,805

8,567,409

2,798,699

479,657

196,304,204

87,489,665

58,300,589

18,433,729

3,097,880

723,348

1,296,388

33,374,449

Amount s in Taka

as at

30-J un-13

II

30-J un-12

682,687,834 649,682,522

682,687,834 649,682,522

Amount in Taka

Market Difference Cost -2012

44,640,229 (19,718,466) 64,358,276

41,107,518 4,409,384 36,698,134

1,090,510 112,838 1,692,589

21,029,747 (14,519,078) 35,548,825

9,640,965 5,264,279 4,376,686

108,333,650 (21,528,155) 129,861,805

6,529,864 (2,037,545) 9,697,372

2,025,944 (772,755) 2,798,653

204,548 (275,109) 479,657

164,002,641 (32,301,563) 195,809,858

70,397,007 (17,092,658) 87,486,405

39,714,198 (18,586,391) 57,322,917

16,329,110 (2,104,619) 18,433,729

6,225,720 3,127,840 3,097,880

339,072 (384,276) 723,348

264,758 (1,031,630) 1,296,388

48,090,868 14,716,419

579,966,349 (102,721,485) 649,682,522 21,431,983

4.00 Non-List ed Securit ies-at cost

PrimeBank Bond

BankAsia Zero Coupon Bond

Farmers Bank Lt d.

5.00 Ot her Receivables

This ismade-up as follows:

a) Dividend receivables

ACI Formulat ion Lt d.

ACI Lt d.

Pubali Bank Lt d.

PRIMETEX

KPCL

Unique Hot el

Bat aShoe Co BD Lt d.

BGIC

Confidence Cement

MJ L BD. LTD.

Padma Oil Co. Lt d.

Pragat i Insurance Lt d.

Reckit t Benkiser BD Lt d.

Renat a Lt d

Square Text ile lt d.

b) Accrued Int erest

Prime Bank Bond

Bank Aisa Bond

682,687,834

65,000,000

9,991,414

44,722,223

65,000,000

9,991,414

119,713,637 74,991,414

2,301,742 835,133

83,250 55,500

46,320 31,600

121 -

11,000 -

34,875 -

1,053,700 -

- 177,450

- 2,116

2,760 2,300

1,036,840 540,960

12,500 12,500

1,295 2,355

17,250 9,200

222 -

1,609 1,152

3,254,387 3,032,375

2,949,041

305,346

9

as at

Amount s in Taka

30-J un-13 II 30-J un-12

99,667 c) Ot her Receivable for Sale Proceeds of Securit ies

EBL Securit ies

PHP St ocks and Securit ies

1,139,475

861

1

98,806

L-_-:-::-::-::--::-:-::c-'

5,655,796

1,122,278

17,196

5,006,983

6.00 Advances and Deposit s

Advance Securit y deposit

Advance BSEC Annual Fees

Advance DSE Annual Fees

Advance CSE Annual Fees

Advance Income Tax

500,000

1,000,000

47,500

47,500

962,605

2,557,605

7.00 Cash and Cash Equivalent s

Bankbalance wit h SND account

Bankbalance wit h Dividend account

FixedDeposit Receipt

379,711,427

64,224,187

443,935,614

8.00 Preliminary &Issue Expenses

Opening Balance

Int erest income from escrow account

Amort izat ion of Preliminary Expenses

500,000

47,500

47,500

5,736,106

6,331,106

392,968,881

63,583,750

112,667,159

569,219,790

24,035,257 27,413,412

(79,248) (1,224)

(3,356,600) _-----'(......:3,_37_6"-, 9 _ 3 1 ...L )

20,599,409 24,035,257

Theunit s are list ed wit h t he Dhaka &Chit t agong St ock Exchanges and quot ed at Tk.9.50 and'Tk.9.50

respect ively on balance sheet dat e.

1,216,547,466 1,262,442,093

100,000,000 __ 10_0-,-,0--:0-=,,0'--.,.00-::-0

12.17 12.62

1,113,825,981 1,154,022,295

100,000,000 _---=.10c:....:0c.:...:,0c..:..00..:..:.,0c:....:0c..:..0

11.14 11.54

9.00 Capit al Fund

Paidup capit al

100,000,000unit s @ Tk 10 each fully paid in cash 1,000,000,000

10.00 Current Liabilit ies and Provisions

Management Fee

Uncleared Dividend

Cust odian Fee

Audit Fee

COBLCharges

Payable t o Sundry securit ies

Wit hholding Taxes (V AT & TAX) Payable

Publicat ion Expenses

Post age &Currier expense

17,400

56,085,337

535,745

36,000

142,748

1,654,965

100,000

30,234

58,602,429

11.00 Net Asset Value per Unit at cost

Net Asset Value

umber of Unit s

NAV Per Unit at Cost

12.00 Net Asset Value per unit at market value

et asset value

umber of unit s

AV per unit at market value

10

1,000,000,000

63,583,750

759,357

27,000

9,232

142,748

2,172,657

100,000

30,234

66,824,979

~~~~- -

I

I

I

I

I

I

I Amount in Taka I

I for t he year I

2013 II 2012

13.00 Int erest on Bank Deposit s and Bonds

Int erest Income from SND Account

Int erest Income from Fixed Deposit Receipt

Int erest Income from Corpot at e Bond

53,855,000

2,131,445

7,697,010

63,683,455

14.00 Net Income on Sale of Market able Securit ies

Bank

Ceramic

Corporat e Bond

Food and Allied

Fuel and Power

Insurance

Miscellaneous

Pharma

Text ile

158,666

158,666

15.00 Earnings Per Unit

Net profit for t he year

Number of Unit s

Earnings Per Unit

59,803,732

100,000,000

16.00 Post Closing Event s

Following event s have occurred since t he balance sheet dat e:

(a) The Trust ee recommended 10%dividend in t he form of Re-Invest ment unit s.

27,891,861

24,110,867

8,781,382

60,784,109

20,636,956

1,002,675

985,200

2,898,023

9,243,396

19,669,142

433,504

42,022,239

4,930,951

101,822,085

98,683,153

100,000,000

0.60 0.99

(b) Except for t he fact st at ed above, no circumst ances have arisen since t he balance sheet dat e

which would require adjust ment t o, or disclosure in, t he financial st at ement s or not es t heret o.

17.00 Comparat ive Figures

Cert ain comparat ive figures have been reclassified from st at ement s previously present ed t o conform

t ot he present at ion adopt ed during t he year ended 30J une 2013

18.00 Approval of t he Financial St at ement s

These financial st at ement s were aut horized for issue in accordance wit h a resolut ion of t he Fund's

board of Trust ee on 13 August , 2013.

~

Ih~

Trust ee Asset Manager

Dat ed, Dhaka

13August 2013

11

--

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Corporate Finance Cheat SheetDokumen3 halamanCorporate Finance Cheat Sheetdiscreetmike50Belum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Chapter 11. Foreign Currency RiskDokumen16 halamanChapter 11. Foreign Currency RiskHastings KapalaBelum ada peringkat

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDokumen135 halamanCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Equity Note - Padma Oil Company LTDDokumen2 halamanEquity Note - Padma Oil Company LTDMd Saiful Islam KhanBelum ada peringkat

- Hinds - Playing Monopoly With The DevilDokumen296 halamanHinds - Playing Monopoly With The DevilAndres MallcottBelum ada peringkat

- Maceda Law - Default ExplainedDokumen6 halamanMaceda Law - Default ExplainedQuin BalboaBelum ada peringkat

- Investment Management Final Project.Dokumen30 halamanInvestment Management Final Project.Eshita NaiduBelum ada peringkat

- The Real Economy: Table 2.1 Sectoral GDP GrowthDokumen4 halamanThe Real Economy: Table 2.1 Sectoral GDP GrowthMd Saiful Islam KhanBelum ada peringkat

- 1476783934daily Market Commentary - October 18 2016Dokumen2 halaman1476783934daily Market Commentary - October 18 2016Md Saiful Islam KhanBelum ada peringkat

- Beximco Hy2014Dokumen2 halamanBeximco Hy2014Md Saiful Islam KhanBelum ada peringkat

- JF Asia New Frontiers: Fund ObjectiveDokumen1 halamanJF Asia New Frontiers: Fund ObjectiveMd Saiful Islam KhanBelum ada peringkat

- 3rd Quarter Financial Statements 2011Dokumen8 halaman3rd Quarter Financial Statements 2011Md Saiful Islam KhanBelum ada peringkat

- Fundamental 1Dokumen2 halamanFundamental 1Md Saiful Islam KhanBelum ada peringkat

- Foreign Currency Convertible Bonds FinalDokumen15 halamanForeign Currency Convertible Bonds FinalGautam JainBelum ada peringkat

- Chap 12 PDFDokumen89 halamanChap 12 PDFNgơTiênSinhBelum ada peringkat

- Liquidation of PartnershipDokumen10 halamanLiquidation of PartnershipCrislyn DacdacBelum ada peringkat

- Nguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)Dokumen7 halamanNguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)duyBelum ada peringkat

- Mindmap Chapter 13 Capital BudgetingDokumen1 halamanMindmap Chapter 13 Capital BudgetingSimon ErickBelum ada peringkat

- Annual Report 2012 3Dokumen263 halamanAnnual Report 2012 3Ali Asghar0% (1)

- Daily Fund Report-PCSO Daily ReportDokumen2 halamanDaily Fund Report-PCSO Daily ReportFranz Thelen Lozano CariñoBelum ada peringkat

- Daily Report Aout 2013 YdeDokumen78 halamanDaily Report Aout 2013 Ydeguymanuel20025387Belum ada peringkat

- Solutions Paper - TVMDokumen4 halamanSolutions Paper - TVMsanchita mukherjeeBelum ada peringkat

- Capital Asset Pricing ModelDokumen11 halamanCapital Asset Pricing ModelrichaBelum ada peringkat

- BOB PO General Awareness Question PaperDokumen6 halamanBOB PO General Awareness Question Paperkapeed_supBelum ada peringkat

- Summative Gen Math 1 KeyDokumen4 halamanSummative Gen Math 1 KeyJohn Mar CeaBelum ada peringkat

- PF Form 19 10 - CDokumen4 halamanPF Form 19 10 - CMadhaw KumarBelum ada peringkat

- 0002 T en - Ar.enDokumen33 halaman0002 T en - Ar.enriyasudheenmhBelum ada peringkat

- Governmental Accounting Test QuestionsDokumen2 halamanGovernmental Accounting Test QuestionstcsaulsBelum ada peringkat

- Developing The Asian Markets For Non-Performing Assets - India's ExperienceDokumen32 halamanDeveloping The Asian Markets For Non-Performing Assets - India's ExperienceRAJESH MAHTO 2058Belum ada peringkat

- Biju Expence DetailsDokumen2 halamanBiju Expence Detailsinfo kattatBelum ada peringkat

- Sample ProblemsDokumen6 halamanSample ProblemsLyndon AsisBelum ada peringkat

- Transcript 1820115Dokumen2 halamanTranscript 1820115Wasifa Tahsin AraniBelum ada peringkat

- Concepts & Conventions in AccountingDokumen5 halamanConcepts & Conventions in Accountingpratz dhakateBelum ada peringkat

- Shriram Transport Finance CoDokumen17 halamanShriram Transport Finance Conikp_patilBelum ada peringkat

- Advantages of Demat AccountDokumen2 halamanAdvantages of Demat Accountsnehachandan91Belum ada peringkat

- Purchase in The Open MarketDokumen11 halamanPurchase in The Open MarketAshishBelum ada peringkat

- Disbursement Voucher: Appendix 32Dokumen9 halamanDisbursement Voucher: Appendix 32Kieron Ivan Mendoza GutierrezBelum ada peringkat