I. Objective: Trend Analysis, Bumn Financial Scoring, and Dupont Formula

Diunggah oleh

ChrisNagaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

I. Objective: Trend Analysis, Bumn Financial Scoring, and Dupont Formula

Diunggah oleh

ChrisNagaHak Cipta:

Format Tersedia

Christoper

I. Objective

BambangSupriyatno is an investor with a moderate risk profile and has to be sure whether he is

investing on the right stocks. Currently Bambang has been considering in investing a big amount of

money on Krakatau Steels stock, which is known as the largest steel manufacturer in Southeast Asia. To

make sure that he is investing on the right place, he intends to do a background check on the PT

Krakatau Steel Tbk.

PT Krakatau Steel Tbk, which has been building a loyal relationship with its customers for more than 20

years, took a big step in November 2010 by officially listed in BEI (Bursa Efek Indonesia) with a stock

code KRAS. But there has been conflicts going on during IPO that the sharing price was claimed too

low. People were outraged by the fact that the price was only Rp 850,- per share. Mustafa Abubakar, the

Ministry of State Owned Enterprise, and the underwriter denotes the price of its initial public offering of

shares of PT Krakatau Steel is already optimal. Harry M Supoyo as the President Director of PT

MandiriSekuritas said that the stock pricing Krakatau Steel cannot only be seen from the absolute value,

and that the stock prices of Steel producers should also be compared with similar companies.

Because of that, Bambang decides to compare it to the financial performance of PT GunawanDianjaya

Steel and PT Jaya Pari Steel as the steel companies which were already settled in BEI before PT Krakatau

Steel.

II. Analysis

Bambang use several methods to assess the financial performance of each company. There are

Trend Analysis, BUMN Financial Scoring, and DuPont Formula.

CAGR

..

DuPont System

Based on the DuPont system, the highest ROE is PT Gunawan Dianjaya and the lowest is PT Jaya Pari

Steel.

- PT Gunawan Dianjaya has the highest ROE and PT Jaya Pari Steel has the lowest.

- Krakatau Steel has the highest equity multiplier and Jaya Pari Steel has the lowest. This does not

mean that Krakatau is the best choice because it may have high liability or it takes on more debt.

- PT Gunawan Dianjaya has the highest total asset turnover. This means that it can make use of its

assets effectively.

- PT Gunawan Dianjaya also has the highest profit margin ratio. This means that it can get profit

the most out of its revenues.

Christoper

Based on those facts, PT Gunawan Dianjaya could be the best choice for Moodys, but he needs to

analyze deeper by using five-step calculation of DuPont system because of different accounting practice

that used by each company.

BUMN Financial Scoring

Based on BUMN Financial Scoring, PT Gunawan Dianjaya and PT Krakatau Steel both get AA rating. But if

we look on the scoring, we can conclude that PT Gunawan Dianjaya (score: 60.5) is better than PT

Krakatau Steel (score: 58).

Anda mungkin juga menyukai

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingDari EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingBelum ada peringkat

- Krakatau Steel A ReportDokumen6 halamanKrakatau Steel A ReportSoniaKasellaBelum ada peringkat

- Krakatau Steel (A) AnalysisDokumen11 halamanKrakatau Steel (A) Analysisheda kaleniaBelum ada peringkat

- Krakatau Steel ADokumen13 halamanKrakatau Steel ALeloulanBelum ada peringkat

- Syndicate 5 - Krakatau Steel ADokumen19 halamanSyndicate 5 - Krakatau Steel AEdlyn Valmai Devina SBelum ada peringkat

- Analisis Krakatau Steel (B)Dokumen6 halamanAnalisis Krakatau Steel (B)JonathanSomba100% (1)

- Krakatau Steel A Study Cases Financial M PDFDokumen8 halamanKrakatau Steel A Study Cases Financial M PDFZulkifli SaidBelum ada peringkat

- CASE Krakatau Steel (A)Dokumen20 halamanCASE Krakatau Steel (A)Ariq LoupiasBelum ada peringkat

- A Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURDokumen80 halamanA Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURrammi13180% (1)

- Ccmi 201510Dokumen23 halamanCcmi 201510adiBelum ada peringkat

- A Study On Financial Performance Based On Ratio AnalysisDokumen80 halamanA Study On Financial Performance Based On Ratio Analysiskhushboo1111Belum ada peringkat

- Group 2 - Krakatau Steel EVA AnalysisDokumen5 halamanGroup 2 - Krakatau Steel EVA AnalysisYudhatama MohamadBelum ada peringkat

- Its India Operations Year in The Current Financial YearDokumen2 halamanIts India Operations Year in The Current Financial YearChirag BragBelum ada peringkat

- Equinomics ResearchDokumen18 halamanEquinomics ResearchIndraniBelum ada peringkat

- Coal India IPO NewsDokumen6 halamanCoal India IPO News2771683Belum ada peringkat

- Krakatau Steel (B)Dokumen13 halamanKrakatau Steel (B)Fadhila HanifBelum ada peringkat

- Adrian Ova Triandi, Ilona Kirana Saradela Financial Ratio Analysis and Altman Z Score ModelDokumen12 halamanAdrian Ova Triandi, Ilona Kirana Saradela Financial Ratio Analysis and Altman Z Score ModelAdrian Ova TriandiBelum ada peringkat

- A Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURDokumen80 halamanA Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURnawazBelum ada peringkat

- The Effect of EVA, Leverage, and Liquidity On The Stock PriceDokumen18 halamanThe Effect of EVA, Leverage, and Liquidity On The Stock PriceBila NanaBelum ada peringkat

- TL Analysis (348 and 482)Dokumen3 halamanTL Analysis (348 and 482)PressesIndiaBelum ada peringkat

- Hindustan Construction CompanyDokumen18 halamanHindustan Construction CompanySudipta BoseBelum ada peringkat

- Jurnal Manajemen: Jurnal Manajemen Volume 6 Nomor 1 (2020) P - Issn: 2301-6256 Januari - Juni 2020 E - Issn: 2615-1928Dokumen10 halamanJurnal Manajemen: Jurnal Manajemen Volume 6 Nomor 1 (2020) P - Issn: 2301-6256 Januari - Juni 2020 E - Issn: 2615-1928EvaaBelum ada peringkat

- Portfolio Strategy of Pangeran Group Using BCG Matrix: Journal of Business and ManagementDokumen7 halamanPortfolio Strategy of Pangeran Group Using BCG Matrix: Journal of Business and Managementmahdi choudhuryBelum ada peringkat

- 7917 20013 1 SMDokumen6 halaman7917 20013 1 SMAchmad Mahdum GumelarBelum ada peringkat

- 27th June, 2005Dokumen43 halaman27th June, 2005agr_belaBelum ada peringkat

- Analisis Proyeksi Arus Kas Untuk Menentukan Hasil Dalam Penilaian Keputusan Kelayakan InvestasiDokumen12 halamanAnalisis Proyeksi Arus Kas Untuk Menentukan Hasil Dalam Penilaian Keputusan Kelayakan InvestasiAulia RahmaBelum ada peringkat

- Thesun 2009-10-28 Page14 Masteel Clinches Rm120mil Deal With Aussie FirmDokumen1 halamanThesun 2009-10-28 Page14 Masteel Clinches Rm120mil Deal With Aussie FirmImpulsive collectorBelum ada peringkat

- Press Release - 28 Jan 12Dokumen4 halamanPress Release - 28 Jan 12Herina SoetionoBelum ada peringkat

- Jurnal Capital BudgetingDokumen8 halamanJurnal Capital BudgetingNely SofwaBelum ada peringkat

- 1 PBDokumen7 halaman1 PBGerryBelum ada peringkat

- Analisis Financial Distress Menggunakan Metode Altman Z-Score Pada PT. Golden Plantation Tbk. Periode 2014-2018Dokumen20 halamanAnalisis Financial Distress Menggunakan Metode Altman Z-Score Pada PT. Golden Plantation Tbk. Periode 2014-2018Adhim AfitrahBelum ada peringkat

- Asadyawan Putra, Prof. Dr. Agus Suman, SE., DEADokumen19 halamanAsadyawan Putra, Prof. Dr. Agus Suman, SE., DEAAsadyawan PutraBelum ada peringkat

- Jurnal KebijakanDokumen13 halamanJurnal Kebijakanfika dewilestariBelum ada peringkat

- Sales Forecast For Bhushan Steel LimitedDokumen31 halamanSales Forecast For Bhushan Steel LimitedOmkar HandeBelum ada peringkat

- TheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bDokumen1 halamanTheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bImpulsive collectorBelum ada peringkat

- ONGC Board Approved Mou With GSPC For Gas BlockDokumen2 halamanONGC Board Approved Mou With GSPC For Gas BlockDynamic LevelsBelum ada peringkat

- Investment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDDokumen23 halamanInvestment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDNarnolia Securities LimitedBelum ada peringkat

- RHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Dokumen3 halamanRHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Rhb InvestBelum ada peringkat

- BSRM Credit Rating ReportDokumen1 halamanBSRM Credit Rating ReportRadioactivekhanBelum ada peringkat

- Contoh Jurnal Case Study SBM ItbDokumen24 halamanContoh Jurnal Case Study SBM ItbBrewsonBelum ada peringkat

- 251-Article Text-353-1-10-20230424Dokumen10 halaman251-Article Text-353-1-10-20230424Memory KurniamanBelum ada peringkat

- Accountant TPIA Analysis Muhammad Reza HandyansyahDokumen4 halamanAccountant TPIA Analysis Muhammad Reza HandyansyahMuhammad Reza HandyansyahBelum ada peringkat

- 1 PBDokumen15 halaman1 PBFadia AnandaBelum ada peringkat

- PT Pembangunan Jaya Ancol TBK Swot Analysis BacDokumen14 halamanPT Pembangunan Jaya Ancol TBK Swot Analysis BacSabrina PutriBelum ada peringkat

- Steel IndustryDokumen31 halamanSteel IndustrypracashBelum ada peringkat

- 2 Steel1 PDFDokumen17 halaman2 Steel1 PDFSindhu GBelum ada peringkat

- Investment Feasibility Study of PT Hardaya MiningDokumen7 halamanInvestment Feasibility Study of PT Hardaya MiningGbenga AdewumiBelum ada peringkat

- TechnoFunda - PowerGridDokumen3 halamanTechnoFunda - PowerGridparchure123Belum ada peringkat

- Proposal For Monitoring Agent: SP AdvisoryDokumen11 halamanProposal For Monitoring Agent: SP AdvisoryHary AntoBelum ada peringkat

- Borneo Brother Company Profile + TradingDokumen11 halamanBorneo Brother Company Profile + TradingWilly AriefBelum ada peringkat

- Strategi Pengembangan Dan Analisis Swot Pada Pt. Garuda Indonesia TBKDokumen15 halamanStrategi Pengembangan Dan Analisis Swot Pada Pt. Garuda Indonesia TBKpuspa ningsihBelum ada peringkat

- IEA Report: 9th December, 2016Dokumen26 halamanIEA Report: 9th December, 2016narnoliaBelum ada peringkat

- Taking A BreatherDokumen4 halamanTaking A Breatherlaloo01Belum ada peringkat

- Dividend Stocks For Outgoing FY21Dokumen2 halamanDividend Stocks For Outgoing FY21Ahmad ShahBelum ada peringkat

- Jaiprakash Associates LTD.: Company UpdateDokumen2 halamanJaiprakash Associates LTD.: Company Updateprince1900Belum ada peringkat

- 16350GROUP XV Executive Summary On BCML ValuationDokumen5 halaman16350GROUP XV Executive Summary On BCML ValuationShi LohBelum ada peringkat

- BBAC4413 ATP Sep 2020 FE Answer Booklet - LIM JEI YIN - B170219BDokumen9 halamanBBAC4413 ATP Sep 2020 FE Answer Booklet - LIM JEI YIN - B170219BLIM JEI XEE BACC18B-1Belum ada peringkat

- Strategi Pengembangan Dan Analisis Swot Pada Pt. Garuda Indonesia TBKDokumen12 halamanStrategi Pengembangan Dan Analisis Swot Pada Pt. Garuda Indonesia TBKtedzmedicalBelum ada peringkat

- 1 PBDokumen6 halaman1 PBMohammad MultazamBelum ada peringkat

- Report On Quantitative Reporting Templates - PDF - ENDokumen89 halamanReport On Quantitative Reporting Templates - PDF - ENrox_dumitruBelum ada peringkat

- Midterm ReviewerDokumen188 halamanMidterm ReviewerChad FerninBelum ada peringkat

- OverHead ClassificationDokumen17 halamanOverHead ClassificationKookie12Belum ada peringkat

- Sustainability 11 03240 v2Dokumen26 halamanSustainability 11 03240 v2MD. MAHMUDUR RAHMAN FAHIMBelum ada peringkat

- Mini Case 16 - ΑντιγραφήDokumen4 halamanMini Case 16 - Αντιγραφήpspsps12 pspsps112Belum ada peringkat

- A Case Study of Netflix Vs BlockbusterDokumen6 halamanA Case Study of Netflix Vs BlockbusterCarlos kengaBelum ada peringkat

- Mazars 2020 Financial StatementsDokumen41 halamanMazars 2020 Financial StatementsJason BramwellBelum ada peringkat

- Financial Management NotesDokumen6 halamanFinancial Management NotesRAVI SONKARBelum ada peringkat

- I HousingDokumen8 halamanI Housingamahle NeneBelum ada peringkat

- Final Accounts 1Dokumen25 halamanFinal Accounts 1ken philipsBelum ada peringkat

- What Is The MUR (Mauritius Rupee) ?Dokumen3 halamanWhat Is The MUR (Mauritius Rupee) ?Jonhmark AniñonBelum ada peringkat

- Chapter2 AdvocatesDokumen40 halamanChapter2 Advocatesaymane dibBelum ada peringkat

- Risk, Return, and The Security Market Line: B. Unsystematic C. D. Unsystematic E. FDokumen15 halamanRisk, Return, and The Security Market Line: B. Unsystematic C. D. Unsystematic E. FTú Anh Nguyễn ThịBelum ada peringkat

- Economics Unit 2Dokumen20 halamanEconomics Unit 2ppriyasonuBelum ada peringkat

- Perla - Econ 201 Chapter 1 - 4Dokumen111 halamanPerla - Econ 201 Chapter 1 - 4Nana NsiahBelum ada peringkat

- XPV White Paper A New Agenda For WaterDokumen34 halamanXPV White Paper A New Agenda For WaterDũng MạnhBelum ada peringkat

- Lakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisDokumen4 halamanLakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisKHOO TAT SHERN DEXTONBelum ada peringkat

- APC Partner Direct Team CLA Contest For Jun'23Dokumen17 halamanAPC Partner Direct Team CLA Contest For Jun'23menakaBelum ada peringkat

- Homework 1B - G6Dokumen4 halamanHomework 1B - G6CHUA JO ENBelum ada peringkat

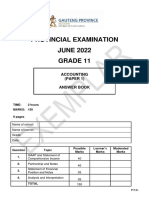

- Gr11 ACC P1 (ENG) June 2022 Answer BookDokumen9 halamanGr11 ACC P1 (ENG) June 2022 Answer BooklemogangBelum ada peringkat

- Bank - Reconciliatio Statement PowerpointDokumen61 halamanBank - Reconciliatio Statement PowerpointLoida Yare LauritoBelum ada peringkat

- 34 - Neha Sabharwal - Panacea BiotechDokumen10 halaman34 - Neha Sabharwal - Panacea Biotechrajat_singlaBelum ada peringkat

- Radio One - For ClassDokumen26 halamanRadio One - For ClassRicha ChauhanBelum ada peringkat

- 2nd Year 1st TermDokumen272 halaman2nd Year 1st TermArman Yeghiazaryan0% (1)

- D5F Societe Des Produits Nestle SA VDokumen3 halamanD5F Societe Des Produits Nestle SA Vmaximum jicaBelum ada peringkat

- Chopra Scm7ge Inppt 06Dokumen74 halamanChopra Scm7ge Inppt 06Natasha BataynehBelum ada peringkat

- Afrm Exam NotesDokumen8 halamanAfrm Exam NotesSoumiya MuthurajaBelum ada peringkat

- Combined Business Studies in The National Curriculum: Key Stage 3 (Grade 7 and 8)Dokumen46 halamanCombined Business Studies in The National Curriculum: Key Stage 3 (Grade 7 and 8)Mohamed Luban AboobakuruBelum ada peringkat

- Indian Startup Funding Lab3Dokumen15 halamanIndian Startup Funding Lab3Commerce ConferenceBelum ada peringkat

- Excersie ETDokumen2 halamanExcersie ETdaoviethung29Belum ada peringkat