Health Insurance

Diunggah oleh

darthvader0050 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

272 tayangan64 halaman123

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini123

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

272 tayangan64 halamanHealth Insurance

Diunggah oleh

darthvader005123

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 64

1

CHAPTER 1 INTRODUCTION TO INSURANCE

1.1 Meaning

Insurance is the equitable transfer of the risk of a loss, from one entity to

another in exchange for payment. It is a form of risk management primarily

used to hedge against the risk of a contingent, uncertain loss.

An insurer, or insurance carrier, is a company selling the insurance; the

insured, or policyholder, is the person or entity buying the insurance policy.

The amount to be charged for a certain amount of insurance coverage is

called the premium. Risk management, the practice of appraising and

controlling risk, has evolved as a discrete field of study and practice.

The transaction involves the insured assuming a guaranteed and known

relatively small loss in the form of payment to the insurer in exchange for

the insurer's promise to compensate (indemnify) the insured in the case of a

financial (personal) loss. The insured receives a contract, called the

insurance policy, which details the conditions and circumstances under

which the insured will be financially compensated.

2

How Insurance Works:

An insurer, or insurance carrier, is a company selling the insurance; the

insured, or policyholder, is the person or entity buying the insurance policy.

The amount to be charged for a certain amount of insurance coverage is

called the premium. The insurance company has to deal with the Risk

Management, the practice of appraising and controlling risk.

The transaction involves the insured assuming a guaranteed and known

relatively small loss in the form of payment to the insurer in exchange for

the insurer's promise to compensate (indemnify) the insured in the case of a

financial (personal) loss. The insured receives a contract, called the

insurance policy, which details the conditions and circumstances under

which the insured will be financially compensated.

3

1.2 History of insurance in India

The business of life insurance in India in its existing form started in India in

the year 1818 with the establishment of the Oriental Life Insurance

Company in Kolkatta.

Some of the important milestones in the Life Insurance Business in India

are:

1912: The Indian Assurance Companies Act enacted as the first statue

to regulate the Life Insurance business.

1928: The Indian Companies Act enacted to enable the government to

collect statistical information about Life Insurance.

1938: Earlier legislation consolidated and amended to by the

Insurance Act with the object of protecting the interest of the insuring

public.

1956: 245 Indian and Foreign Insurers and provident societies taken

over by the Central Government and Nationalized. LIC formed by an

Act of Parliament viz. LIC Act, 1956 with a capital contribution of

Rs.5 crore from the Government of India. The General Insurance

Business in India, on the other hand, can trace its roots to the Triton

Insurance Company Ltd., the first General Insurance Company

established in the year 1850 in Kolkatta by the British.

4

Some of the important milestones in the General Insurance Business in India

are:

1907: The Indian Mercantile Insurance Ltd., set up, the first company

to transact all classes of general insurance business.

1957: General Insurance Council, a wing of the Insurance Association

of India, frames a code of conduct for ensuring fair conduct and sound

business

practices.

1968: The Insurance Act amended to regulate investments and set

minimum solvency margins and the Tariff Advisory Committee set

up.

1972: The General Insurance Business (Nationalization) Act, 1972

nationalized the general insurance business in India with effect from

1st January 1973. 107 insurers amalgamated and grouped into four

companies viz. the National Insurance Company Ltd., the New India

Assurance Company Ltd., the Oriental Insurance Company Ltd., and

the United India Insurance Company Ltd. GIC incorporated as a

company. The funds generated by LIC and Public Sector General

Insurers are invested in the avenues that benefit the society. They

solely acted as public undertaking insurers and catered the life cover

and general risk cover of the public till the enactment of Insurance

Regulatory and Development Authority (IRDA) Act, 1999.

5

1.3 Development of Insurance as Industry:

The concept of insurance is almost as old as human society and over the

years, insurance industry matured into the form that we know today. In

ancient civilization, if someone's home burned down or met with any

disaster, the other members of the community would help together to rebuild

it. Everyone felt morally bound to help in case their home was the next to

burn. Similarly, humans have been managing risk for many years and in the

primitive times the insurance in such economies was agreements of mutual

aid. This type of insurance has survived to the present day in some countries

where a modern money economy with its financial instruments is not

widespread.

Early methods of transferring or distributing risk were practiced by Chinese

and Babylonian traders as long ago as the 3rd and 2nd millennia BC,

respectively. Chinese merchants travelling treacherous river rapids would

redistribute their wares across many vessels to limit the loss due to any

single vessel's capsizing.

The first written account of an insurance policy is found in the Code of

Hammurabi, in the 18th century BC, and was designed to forfeit debts owed

due to catastrophe. The Babylonians developed a system which was

practiced by early Mediterranean sailing merchants. If a merchant received a

loan to fund his shipment, he would pay the lender an additional sum in

exchange for the lender's guarantee to cancel the loan should the shipment

be stolen or lost at sea. Sailing merchants and caravans used this insurance

to protect themselves from the risks of pirates and treacherous natural

terrain. And early health insurance by organized guilds in ancient Greek and

6

Roman civilizations aided surviving members or helped to pay funeral

expenses.

Achaemenian monarchs of Ancient Persia were the first to insure their

people and made it official by registering the insuring process in

governmental notary offices. The insurance tradition was performed each

year where different ethnic groups presented gifts to the monarch. The

presents were assessed by the confidants of the court and this assessment

was registered in special offices. The purpose of registering was that

whenever the person who presented the gift registered by the court was in

trouble, the monarch and the court would help him.

A thousand years later, the inhabitants of Rhodes invented the concept of the

general average. Merchants whose goods were being shipped together would

pay a proportionally divided premium which would be used to reimburse

any merchant whose goods were deliberately jettisoned in order to lighten

the ship and save it from total loss.

Separate insurance contracts (i.e., insurance policies not bundled with loans

or other kinds of contracts) were invented in Genoa in the 14th century, as

were insurance pools backed by pledges of landed estates. These new

insurance contracts allowed insurance to be separated from investment, a

separation of roles that first proved useful in marine insurance. Insurance

became far more sophisticated in post-Renaissance Europe, and specialized

varieties developed.

The first insurance company in the United States underwrote fire insurance

and was formed in Charles Town (modern-day Charleston), South Carolina,

7

in 1732. Benjamin Franklin helped to popularize and make standard the

practice of insurance, particularly against fire in the form of perpetual

insurance.

In India, insurance has a deep-rooted history. It finds mention in the writings

of Manu ( Manusmrithi ), Yagnavalkya ( Dharmasastra ) and Kautilya (

Arthasastra ). The writings talk in terms of pooling of resources that could

be re-distributed in times of calamities such as fire, floods, epidemics and

famine. Insurance in India has evolved over time heavily drawing from other

countries, England in particular.

In the last century, the insurance industry adapted to changing lifestyle and

growth, introducing products such as automobile and health insurance. And

more recently, changing governmental regulations across the world have

impacted the regulations by which the insurance sector operates, enabling

other industries, including the banking industry, to offer similar insurance

products.

8

1.4 Functions of insurance

Provide protection: The primary function of insurance is to provide

protection against future risk, accidents and uncertainty. Insurance

cannot check the happening of the risk, but can certainly provide for

the losses of risk. Insurance is actually a protection against economic

loss, by sharing the risk with others.

Collective bearing of risk: Insurance is an instrument to share the

financial loss of few among many others. Insurance is a mean by

which few losses are shared among larger number of people.

All the insured contribute the premiums towards a fund and out of

which the persons exposed to a particular risk is paid.

Assessment of risk: Insurance determines the probable volume of

risk by evaluating various factors that give rise to risk. Risk is the

basis for determining the premium rate also.

Provide certainty: Insurance is a device, which helps to change from

uncertainty to certainty. Insurance is device whereby the uncertain

risks may be made more certain.

Small capital to cover larger risk: Insurance relieves the

businessmen from security investments, by paying small amount of

premium against larger risks and uncertainty.

Contributes towards the development of industries: Insurance

provides development opportunity to those larger industries having

more risks in their setting up. Even the financial institutions may be

prepared to give credit to sick industrial units which have insured their

assets including plant and machinery.

9

Means of savings and investment: Insurance serves as savings and

investment, insurance is a compulsory way of savings and it restricts

the unnecessary expenses by the insured's For the purpose of availing

income-tax exemptions also, people invest in insurance.

Source of Earning Foreign Exchange: Insurance is an international

business. The country can earn foreign exchange by way of issue of

marine insurance policies and various other ways.

Risk free trade: Insurance promotes exports insurance, which makes

the foreign trade risk free with the help of different types of policies

under marine insurance cover.

10

1.5 The Benefits of Insurance

What advantages does society gain from an insurance system's operation?

How do these benefits compare with the resources used? One of the greatest

benefits with which an insurance system rewards society is stability in

families. Insurance prevents families from experiencing the great hardships

caused by unexpected losses of property or the premature death of the family

income provider. Insurance allows families to continue their activities in a

much more normal fashion after a loss than would be the case if no

insurance existed.

Insurance is also very useful to businesses. Insurance aids the planning

process because the planner knows a property loss will not mean financial

ruin, and the future of a business cannot be destroyed by a fire or the death

of a key person.

Insurance facilitates credit transactions because creditors are more willing to

lend money if the debtor's death does not make collection of the loan

difficult or impossible. Likewise, lenders are more willing to make property

or real estate loans if they know a disaster cannot destroy the financial

security standing behind their loan.

An economist would give insurance system high marks because it functions

as an antimonopoly device. That is, if no insurance system were available,

only the largest businesses could sustain losses and remain in operation.

Without insurance, there would be a tendency toward monopoly in many

industries. For example, one of the nation's largest chains of grocery stores

could probably lose one of its stores in a fire and remain in business,

11

whereas a mom and pop grocery would probably have to close permanently

if an uninsured fire were to destroy its only store. Smaller chains of stores

could not sustain uninsured losses as well as the larger chains. Insurance

allows the smaller operators to pool their exposure to loss and thus remain

competitors in an industry.

Financiers recognize that insurance availability has a tendency to lower a

firm's cost of capital because both creditors and investors would charge

much more for the use of their money if it were subjected to the risks

associated with natural disasters in addition to business risks. In addition,

without insurance, firms would have to hold more money in relatively

nonproductive near cash reserves to protect themselves against the rainy day.

Insurance companies, and the organizations they support, contribute directly

to society's welfare in many ways relating to loss prevention and medical

research. Insurance companies are very important financial intermediaries.

Annually, life insurance companies collect billions of dollars in people's

savings and reinvest these amounts in the economy. Property insurers also

maintain billions of dollars in their reserve accounts that are invested in our

private enterprise economy. Insurers provide a useful service to savers by

evaluating and selecting sound investments. They also provide a service to

business firms and governmental units at the local, state, and federal levels,

In general, business and government borrowers do not find it practical to use

the small savings streams of individuals, but they can effectively use the

river of funds made available by insurance companies.

Benefits Health insurance is a type of insurance that helps the availability of

health insurance funds if participants develop health problems or illnesses.

12

All the needs of seeing a doctor, stay (care) in hospitals, drug costs in the

hospital until the operation, all that can be covered by insurance companies.

Generally these types of treatment or programs that are available are the

benefits of ambulatory (outpatient), benefit of inpatient care (inpatient),

labor benefits and dental benefits.

In general, the benefits of ambulatory (outpatient) are covered by insurance

companies is as consulting fees or general practitioner and specialists,

prescription medication costs, costs of preventive measures, the cost of

assistive devices required by doctors, and others. In the outpatient benefits

have maximum limits use of funds each year. While hospitalization benefits

that can be enjoyed by participants of health insurance is like the hospital

costs, lab fees, delivery fees, the cost of emergency service (emergency).

The benefits of preventive dental care, basic dental care, dental care

complex, and the installation of dentures.

Third-care benefits, namely outpatient, maternity and dental benefits are an

additional option that we can take the following basic program, which

benefits of hospitalization. So, we are not allowed to just take advantage of

outpatient care, childbirth or dental work alone without following the basic

program of hospitalization benefits.

The amount of premium to be paid and the amount of value in health

insurance is dependent on the health insurance program that we choose.

Various insurance companies have the types of programs and premiums vary

by the details of benefits also varies. Typically, insurance companies limit

the amount of the total cost that can be used per year.

13

How Insurance Benefits Society and the Economy

Providing Security: There is always a fear of sudden loss. There may

be a fire in factory, storm in the sea or loss of life .In all these cases it

becomes difficult to bear the loss. Insurance provides a cover against

any sudden loss.

Spreading Risk: The basic principal of insurance is to spread risk

among a large number of peoples. A large number of persons get the

insurance policies and pay premier to the insurer .whenever a loss

occurs, it is compensated out of fund to the insurer

Source for collecting funds: The premium is received regularly in

installments .Large funds are collected by way of premium. It helps in

collecting saving from a large number of persons. The funds can be

gainfully employed in industrial development of a country.

Encourage savings: Insurance does not only protect the risks but it

provides the investment channel too. Life insurance provides a mode

of investment. In case of fixed time policies, the insured gets lump

sum amount after the maturity of the policies.

Improving consumer and worker safety: Insurance makes

businesses and individuals more aware of the risks they face and

provides motivation to prevent losses. For example, insurers provide

premium discounts to safe drivers and to businesses that implement

effective worker safety programs.

14

Protecting consumer transactions: Most consumers have to borrow

money to buy homes and cars; lenders require insurance in order to

secure the loans they make for these purchases. Without insurance,

few people could obtain an auto loan or home mortgage.

Protecting business transactions: Without insurance, most businesses

would find that they could not operate. Insurance enables businesses

of all sizes and types to manage the risks that are an inherent part of

any business operation (e.g., signing contracts, financing and

expanding operations, manufacturing and distributing products,

providing services, hiring employees).

Providing recovery from catastrophes: Hurricanes, winter storms,

fires, and other disasters can cause tremendous, sudden loss to many

people all at once. Insurance coverage enables businesses to replace

inventories and rebuild buildings, and allows homeowners to repair

and rebuild homes and replace property.

15

CHAPTER 2 OVERVIEW OF INSURANCE IDUSTRY

2.1 Overview of Insurance

With largest number of life insurance policies in force in the world,

Insurance happens to be a mega opportunity in India. It's a business growing

at the rate of 15-20 per cent annually and presently is of the order of Rs 450

billion. Together with banking services, it adds about 7 per cent to the

country's GDP. Gross premium collection is nearly 2 per cent of GDP and

funds available with LIC for investments are 8 per cent of GDP.

Yet, nearly 80 per cent of Indian population is without life insurance cover

while health insurance and non-life insurance continues to be below

international standards. And this part of the population is also subject to

weak social security and pension systems with hardly any old age income

security. This it is an indicator that growth potential for the insurance sector

is immense.

A well-developed and evolved insurance sector is needed for economic

development as it provides long term funds for infrastructure development

and at the same time strengthens the risk taking ability. It is estimated that

over the next ten years India would require investments of the order of one

trillion US dollar. The Insurance sector, to some extent, can enable

investments in infrastructure development to sustain economic growth of the

country. Insurance is a federal subject in India. There are two legislations

that govern the sector- The Insurance Act- 1938 and the IRDA Act- 1999.

16

In India, insurance is generally considered as a tax-saving device instead of

its other implied long term financial benefits. Indian people are prone to

investing in properties and gold followed by bank deposits. They selectively

invest in shares also but the percentage is very small. Even to this day, Life

Insurance Corporation of India dominates Indian insurance sector. With the

entry of private sector players backed by foreign expertise, Indian insurance

market has become more vibrant.

Insurance Sector Reforms

In 1993, Malhotra Committee- headed by former Finance Secretary and RBI

Governor R.N. Malhotra- was formed to evaluate the Indian insurance

industry and recommend its future direction. The Malhotra committee was

set up with the objective of complementing the reforms initiated in the

financial sector. The reforms were aimed at creating a more efficient and

competitive financial system suitable for the requirements of the economy

keeping in mind the structural changes currently underway and recognizing

that insurance is an important part of the overall financial system where it

was necessary to address the need for similar reforms. In 1994, the

committee submitted the report and some of the key recommendations

included:

i) Structure

Government should take over the holdings of GIC and its subsidiaries so that

these subsidiaries can act as independent corporations. All the insurance

companies should be given greater freedom to operate.

17

ii) Competition

Private Companies with a minimum paid up capital of Rs.1bn should be

allowed to enter the sector. No Company should deal in both Life and

General Insurance through a single entity. Foreign companies may be

allowed to enter the industry in collaboration with the domestic companies.

Postal Life Insurance should be allowed to operate in the rural market. Only

one State Level Life Insurance Company should be allowed to operate in

each state.

iii) Regulatory Body

The Insurance Act should be changed. An Insurance Regulatory body should

be set up. Controller of Insurance- a part of the Finance Ministry- should be

made independent

iv) Investments

Mandatory Investments of LIC Life Fund in government securities to be

reduced from 75% to 50%. GIC and its subsidiaries are not to hold more

than 5% in any company (there current holdings to be brought down to this

level over a period of time)

v) Customer Service

LIC should pay interest on delays in payments beyond 30 days. Insurance

companies must be encouraged to set up unit linked pension plans.

Computerization of operations and updating of technology to be carried out

in the insurance industry

18

The committee emphasized that in order to improve the customer services

and increase the coverage of insurance policies, industry should be opened

up to competition. But at the same time, the committee felt the need to

exercise caution as any failure on the part of new players could ruin the

public confidence in the industry.

The committee felt the need to provide greater autonomy to insurance

companies in order to improve their performance and enable them to act as

independent companies with economic motives. For this purpose, it had

proposed setting up an independent regulatory body- The Insurance

Regulatory and Development Authority.

Reforms in the Insurance sector were initiated with the passage of the IRDA

Bill in Parliament in December 1999. The IRDA since its incorporation as a

statutory body in April 2000 has fastidiously stuck to its schedule of framing

regulations and registering the private sector insurance companies. Since

being set up as an independent statutory body the IRDA has put in a

framework of globally compatible regulations. The other decision taken

simultaneously to provide the supporting systems to the insurance sector and

in particular the life insurance companies was the launch of the IRDA online

service for issue and renewal of licenses to agents. The approval of

institutions for imparting training to agents has also ensured that the

insurance companies would have a trained workforce of insurance agents in

place to sell their products.

19

Present Scenario

The Government of India liberalized the insurance sector in March 2000

with the passage of the Insurance Regulatory and Development Authority

(IRDA) Bill, lifting all entry restrictions for private players and allowing

foreign players to enter the market with some limits on direct foreign

ownership. Under the current guidelines, there is a 26 percent equity cap for

foreign partners in an insurance company. There is a proposal to increase

this limit to 49 percent.

The opening up of the sector is likely to lead to greater spread and deepening

of insurance in India and this may also include restructuring and revitalizing

of the public sector companies. In the private sector 12 life insurance and 8

general insurance companies have been registered. A host of private

Insurance companies operating in both life and non-life segments have

started selling their insurance policies since 2001.

Non-Life Insurance Market

In December 2000, the GIC subsidiaries were restructured as independent

insurance companies. At the same time, GIC was converted into a national

re-insurer. In July 2002, Parliament passed a bill, de-linking the four

subsidiaries from GIC.

Presently there are 12 general insurance companies with 4 public sector

companies and 8 private insurers. Although the public sector companies still

dominate the general insurance business, the private players are slowly

gaining a foothold. According to estimates, private insurance companies

have a 10 percent share of the market, up from 4 percent in 2001. In the first

20

half of 2002, the private companies booked premiums worth Rs 6.34 billion.

Most of the new entrants reported losses in the first year of their operation in

2001.

Insurance, like project finance, is extended by a consortium. Normally one

insurer takes the lead, shouldering about 40-50 per cent of the risk and

receiving a proportionate percentage of the premium. The other companies

share the remaining risk and premium. The policies are renewed usually on

an annual basis through the invitation of bids.

Of late, with IPP projects fizzling out, the insurance companies are turning

once again to old hands such as NTPC, NHPC and BSES for business.

Re-insurance business

The balance risk is re-insured with other insurers. In effect, therefore, re-

insurance is insurer's insurance. It forms the backbone of the insurance

business. It helps to provide a better spread of risk in the international

market, allows primary insurers to accept risks beyond their capacity settle

accumulated losses arising from catastrophic events and still maintain their

financial stability.

Life Insurance Market

The Life Insurance market in India is an underdeveloped market that was

only tapped by the state owned LIC till the entry of private insurers. The

penetration of life insurance products was 19 percent of the total 400 million

of the insurable population. The state owned LIC sold insurance as a tax

instrument, not as a product giving protection. Most customers were under-

21

insured with no flexibility or transparency in the products. With the entry of

the private insurers the rules of the game have changed.

The growing popularity of the private insurers shows in other ways. They

are coining money in new niches that they have introduced. The state owned

companies still dominate segments like endowments and money back

policies. But in the annuity or pension products business, the private insurers

have already wrested over 33 percent of the market. And in the popular unit-

linked insurance schemes they have a virtual monopoly, with over 90

percent of the customers.

With an annual growth rate of 15-20% and the largest number of life

insurance policies in force, the potential of the Indian insurance industry is

huge. Total value of the Indian insurance market (2004-05) is estimated at

Rs. 450 billion (US$10 billion). According to government sources, the

insurance and banking services' contribution to the country's gross domestic

product (GDP) is 7% out of which the gross premium collection forms a

significant part. The funds available with the state-owned Life Insurance

Corporation (LIC) for investments are 8% of GDP.

The year 1999 saw a revolution in the Indian insurance sector, as major

structural changes took place with the ending of government monopoly and

the passage of the Insurance Regulatory and Development Authority (IRDA)

Bill, lifting all entry restrictions for private players and allowing foreign

players to enter the market with some limits on direct foreign ownership.

Though the focus of this market research report is on the potential growth on

the Indian Insurance Sector, it also talks about the market size, market

22

segmentation, and key developments in the market after 1999. The report

gives an instant overview of the Indian non-life insurance market, and

covers fire, marine, and other non-life insurance. The data is supplied in both

graphical and tabular format for ease of interpretation and analysis. This

report also provides company profiles of the major private insurance

companies.

Just like other forms of insurance, for your car and your home, health

insurance helps relieve the burden of unexpected events: you put away a

little in case you need a lot later. You and your family's health should be of

the highest priority.

Every year, the cost of healthcare increases dramatically. Simple same-day

surgeries, required tests and emergency attention can add up to thousands of

dollars or more.

The overall benefits of health insurance are obvious. You won't be avoiding

the doctor because it costs too much. The hospital bills won't be piling upon

your desk waiting for attention. Your health insurance will provide the help

and care you demand. Also, if you drive a car, health insurance will work

cooperatively with your auto insurance in case of an accident.

There are many health insurance companies available, offering

various types of plans. We are capable to get you the best plan and

coverage to suit your needs.

Using this comprehensive tutorial, you can find out about different

types of health insurance, choosing a policy, and much more.

23

2.2 Innovations in insurance

Several insurance folk who, between them, have more than a hundred years

experience of the sector, were kind enough to provide a considerable amount

of feedback regarding this article. Rather than revise the original I thought it

would be helpful if I summarised what they had to say as a postscript.

There were ten key points which I have put in alphabetical order: you will

have your own view of their relative importance.

1. Actuaries influence

2. Branding

3. Complex distribution

4. Customer engagement

5. Execution

6. Fast follower

7. Knowing V/s doing

8. Mixed message

9. Performance message

10. Pricing

24

1. Actuaries influence. Only a numpty could claim that we could have an

insurance industry without actuarial science at its heart. But do actuaries

dominant the industry to its detriment? Does the professions particular

group think stifle non-analytic thinking? Perhaps the actuarial exams

should encourage different ways of looking at the same issue in much the

same way as the Accountancy training involves current cost, historic cost

and replacement cost accounting?

2. Branding. Organisations with strong brands seem to tune in intuitively to

emotional intelligence, the value of intangible assets, and business renewal

(updating the core brand proposition in response to changing market

conditions). In the insurance sector branding is weak and too often confused

with name recognition. This marketing-naive mindset will inevitably see

innovation as a low business priority.

3. Complex distribution. Ignore how we got here but the fact is that today

our distribution models are so complex that they discourage innovation

because of the perceived free-rider risk.

4. Customer engagement. Once upon a time the market capitalisations of

Unilever and Procter & Gamble comfortably exceeded those of the

supermarkets. Not anymore. Retailers are bathed daily in large amounts of

data that are transformed, with varying degrees of success, in to information

and insight. Retailers are plugged in to their consumers behaviour and

theyve the service cultures to match. That is valuable. Insurers have nothing

like this degree of engagement with their consumers. This, in turn,

25

encourages slow learning and discourages innovation because it cant be

done fast enough or confidently enough.

5. Execution. We can view innovation as Insight + Execution. Not only

does the insurance sector underperform when it comes to the Insight

element, but the Execution skills may be seen as a handicap also, because in

the insurance sector execution is focused on compliance and getting it right

first time, whereas retailers, for example, can execute quickly and well

enough and act on the results.

6. Fast follower. This strategy has a respectable history in the insurance

sector and is not career threatening. Being innovative, on the other hand, can

easily be seen as sticking-ones-neck-out and asking for trouble.

7. Knowing vs Doing. Theres an irony here. The industry (along with

Government) is assigning a good deal of time and resource to making

consumers more financially capable in the belief that there is a big gap

between what consumers actually know about finance and what we need to

know. In fact the important gap is not between not-knowing and knowing; it

is between knowing and doing. And the same is true when it comes to

innovation in the insurance sector. The industry knows what to do. It knows

that shareholders, customers, employees and the wider community would

benefit if it became more innovative. But it chooses not to. There are higher

priorities. There are habits to change. The costs and pain are immediate. The

benefits are deferred.

26

8. Mixed messages. There are mixed messages not only between the

industry and its customers but also within the industry itself. We sell

promises. With some products the consumer can be confident that he or she

can collect on that promise pretty much a hundred percent of the time. But

not with all products. Mixed message number 1. In financial services, we

implicitly criticise consumers for being financially feckless yet at the same

time put more effort in to selling products that promote fecklessness (e.g.

credit cards, loans, overdrafts) and less effort in to those that reward the

behaviours we say are good (e.g. savings, pensions, or protection). Mixed

message number 2. This lack of clarity doesnt encourage innovation.

9. Performance measurement. You wake up tomorrow to find that you are

the CEO of an insurance company. Consider what you will find in your in

tray. Consider your corporate business agenda and priorities. Consider your

corporate culture. Consider the performance measures that will drive the

company regarding business-as-usual items such as advertising, capital

adequacy, claims management, compliance, customer service, employee

engagement, improved Governance, investor relations, and reducing

operational risk. Where is innovation going to add most value? How

confident can you be that the benefits of developing innovation as a

corporate competence will outweigh the direct costs, opportunity costs, and

risks?

27

10. Pricing. In our marketing we over focus on price and then complain

when consumers do. We complain too about commoditisation when

aggregators and our promotion campaigns encourage it. We also seem to

feel that our industry is significantly different to other industries and that (a)

what applies to them does not apply to us and that (b) innovation is an

example of this. But who are we kidding?

28

CHAPTER 3 HEALTH INSURANCE

3.1 Health insurance

Health insurance is insurance against the risk of incurring medical

expenses among individuals. By estimating the overall risk of health care

and health system expenses among a targeted group, an insurer can develop

a routine finance structure, such as a monthly premium or payroll tax, to

ensure that money is available to pay for the health care benefits specified in

the insurance agreement. The benefit is administered by a central

organization such as a government agency, private business, or not-for-profit

entity. The term health insurance (popularly known as Medical Insurance or

Mediclaim) is a type of insurance that covers your medical expenses.The

concept of health insurance is new in India but its awareness is growing fast.

Health insurance comes in handy in case of severe emergencies. Life is

unpredictable, insurance can make it safe and secure from bearing huge

financial loss. A health insurance policy is a contract between an insurance

company and an individual. Sometimes it is associated with covering

disability and custodial needs. The contract is renewable annually.

Health insurance is available to both individual and groups. However,

premium for individual policy is costlier than that of the group policy. An

individual is the owner of his personal policy. Whereas in group plans, the

sponsor is the owner of the policy and the registered members are covered

by the policy. You can take advantage of group health insurance to

overcome the shortage of your individual insurance. People with no policy

or are uninsurable due to one or the other reason can take good advantage of

the group plans and be covered.

29

However, before buying a health insurance policy, plan your requirements

carefully. It will save you from buying a policy which might not be

appropriate for you and can also be expensive.

A health insurance policy is:

1) a contract between an insurance provider (e.g. an insurance company or a

government) and an individual or his/her sponsor (e.g. an employer or a

community organization). The contract can be renewable (e.g. annually,

monthly) or lifelong in the case of private insurance, or be mandatory for all

citizens in the case of national plans. The type and amount of health care

costs that will be covered by the health insurance provider are specified in

writing, in a member contract or "Evidence of Coverage" booklet for private

insurance, or in a national health policy for public insurance.

2) Insurance coverage is provided by an employer-sponsored self-funded

ERISA plan. The company generally advertises that they have one of the big

insurance companies. However, in an ERISA case, that insurance company

"doesn't engage in the act of insurance", they just administer it. Therefore

ERISA plans are not subject to state laws. ERISA plans are governed by

federal law under the jurisdiction of the US Department of Labor (USDOL).

The specific benefits or coverage details are found in the Summary Plan

Description (SPD). An appeal must go through the insurance company, then

to the Employer's Plan Fiduciary. If still required, the Fiduciarys decision

can be brought to the USDOL to review for ERISA compliance, and then

file a lawsuit in federal court.

30

The individual insured person's obligations may take several forms:

Premium: The amount the policy-holder or his sponsor (e.g. an

employer) pays to the health plan to purchase health coverage.

Deductible: The amount that the insured must pay out-of-pocket

before the health insurer pays its share. For example, policy-holders

might have to pay a $500 deductible per year, before any of their

health care is covered by the health insurer. It may take several

doctor's visits or prescription refills before the insured person reaches

the deductible and the insurance company starts to pay for care

however, most policies do not apply co-pays for doctor's visits or

prescriptions against your deductible.

Co-payment: The amount that the insured person must pay out of

pocket before the health insurer pays for a particular visit or service.

For example, an insured person might pay a $45 co-payment for a

doctor's visit, or to obtain a prescription. A co-payment must be paid

each time a particular service is obtained.

Coinsurance: Instead of, or in addition to, paying a fixed amount up

front (a co-payment), the co-insurance is a percentage of the total cost

that insured person may also pay. For example, the member might

have to pay 20% of the cost of a surgery over and above a co-

payment, while the insurance company pays the other 80%. If there is

an upper limit on coinsurance, the policy-holder could end up owing

very little, or a great deal, depending on the actual costs of the

services they obtain.

31

Exclusions: Not all services are covered. The insured are generally

expected to pay the full cost of non-covered services out of their own

pockets.

Coverage limits: Some health insurance policies only pay for health

care up to a certain dollar amount. The insured person may be

expected to pay any charges in excess of the health plan's maximum

payment for a specific service. In addition, some insurance company

schemes have annual or lifetime coverage maxima. In these cases, the

health plan will stop payment when they reach the benefit maximum,

and the policy-holder must pay all remaining costs.

Out-of-pocket maxima: Similar to coverage limits, except that in this

case, the insured person's payment obligation ends when they reach

the out-of-pocket maximum, and health insurance pays all further

covered costs. Out-of-pocket maxima can be limited to a specific

benefit category (such as prescription drugs) or can apply to all

coverage provided during a specific benefit year.

Capitation: An amount paid by an insurer to a health care provider, for

which the provider agrees to treat all members of the insurer.

In-Network Provider: (U.S. term) A health care provider on a list of

providers preselected by the insurer. The insurer will offer discounted

coinsurance or co-payments, or additional benefits, to a plan member

to see an in-network provider. Generally, providers in network are

providers who have a contract with the insurer to accept rates further

discounted from the "usual and customary" charges the insurer pays to

out-of-network providers.

32

Prior Authorization: A certification or authorization that an insurer

provides prior to medical service occurring. Obtaining an

authorization means that the insurer is obligated to pay for the service,

assuming it matches what was authorized. Many smaller, routine

services do not require authorization.

Explanation of Benefits: A document that may be sent by an insurer to

a patient explaining what was covered for a medical service, and how

payment amount and patient responsibility amount were determined.

33

3.2 Benefits of health plans

The utility of your cover depends not only on its features, but also how well

you are able to utilise them. Read on to understand such benefits.

1. Daily hospital cash allowance

All health policies take care of the cost of hospitalisation. However, what

about the expenses incurred on, say, food or refreshments? Or, the money

spent by your family while commuting between hospital and home? After

all, even these add up to a substantial amount. Well, the solution lies within

your policy in the form of Daily Hospital Cash Allowance. Check if your

policy offers this pre-fixed, per-day cash hand-outs.

"This sum is handed over without the insured having to produce any bill to

support the claim, no questions asked," says Sanjay Datta, head,

underwriting & claims, ICICI Lombard.

2. Convalescence benefit

Hospitalisation costs apart, some companies also take care of the insured's

recovery expenses. Also termed as recuperating benefit, this feature

promises a lump sum in case of a prolonged stay at the hospital. "The

duration of prolonged stay usually varies between 7 and 10 days among

policies.

This benefit is usually provided to ensure supplementary costs due to the

stay in hospital, such as a loss of income for the number of days in hospital,"

says Antony Jacob, CEO, Apollo Munich. "Associated costs, such as

compassionate visits by family members, are also covered to some extent."

34

In case of some policies, the post-hospitalisation stage could be treated as

the recuperating period. You need to be aware of the eligible benefit amount

and period, which are usually pre-defined.

3. Alternative treatment

The recent Insurance Regulatory and Development Authority (Irda) draft

guidelines may nudge all companies into covering non-allopathic forms of

treatment, like Ayurveda, Unani and Homeopathy, but some of them do so

even today. For instance, New India Assurance undertakes to reimburse 25%

of such expenses, provided the treatment is taken at a government hospital.

The proposed norms seek to let insurers to pay for these expenses even if the

treatment has been availed at any institute that is either recognised by the

government, accredited by Quality Council of India/National Accreditation

Board on Health or any other suitable institution.

4. Treatment taken at home

The general impression of health insurance covers is that their scope is

restricted to hospitalisation or day-care procedures. However, many policies

widen their coverage ambit to include domiciliary treatment, too. That is,

treatment undergone at home as per doctor's advice. Primarily, this would be

because the patient is unable to visit a hospital. "Here, the insured may be

asked to submit bills from the doctor's clinic.

The pay-out is percentage or value-based," says Datta. The amount and the

number of days for which the benefit period is payable is capped in terms of

percentage of the sum insured or absolute amount. For instance, your policy

35

wordings could make it clear that the benefit is restricted to 10% of the sum

insured or Rs 25,000, whichever is lower.

5. Other Benefits

Doctor services

Hospital services, including inpatient serviceswhen you have to

stay overnight in the hospitaland outpatient services, such as minor

surgery in a surgery center

Many laboratory tests

Diagnostic services, like X-rays and mammograms

Preventive and routine care, like vaccinations and regular checkups

Mental health care for some serious problems

Emergency and urgent careeven if you are outside your health

plan's service area

Rehabilitation therapy, such as physical, occupational and speech

therapy

Some home health or nursing home care after a hospital stay

36

3.3 Disadvantages of health insurance

1. Increased Costs and Labor

In keeping up with the stringent provisions of HIPAA the businesses that

manage your healthcare have to bear increased expenditure on computers

and software for adhering with all the privacy requirements. The paperwork

also increases significantly to comply with the Act due to provisions of

portability etc. Furthermore the businesses have to keep readjusting their

policies according to amendments in the Act and may also have to hire

people and provide adequate training to work within the purview of HIPAA.

2. Misinterpretations and Restrictions:

The elaborate privacy rules of HIPAA can often come in the way during

emergency situations as such private information can be dispensed only to

certain entities and that too for a short period. Furthermore any

misinterpretation of the provisions may impede or slow down the passing of

information. For example, healthcare companies might find it difficult to get

information about a person from hospitals. Fear of the law can also affect

research work carried out by doctors.

3. Electronic Format:

HIPAA urges widespread use of electronic formats to store, process and

share information. Such systems must huge spending and considerable

maintenance costs then. Also since such medium is susceptible to attacks,

the security measures have to be constantly updated to keep the data safe

against unauthorized access, corruption and stealing.

37

4. Cost:

Health insurance can be very costly even for those that have a health

insurance plan through their employers. This cost can sometimes be so

expensive that the person may struggle to make payments. This is

problematic for those that have a low income or are self-employed. Families

may also have a great deal of difficulty affording coverage for the entire

family because of the cost. In addition, even if someone is able to afford

health insurance, they may not be able to afford the co-pays. Some health

insurance plans have high co-pays that can be costly to a person with an

average or low income level. In the end, the total cost has to be carefully

weighed by the person considering health insurance.

5. Medical Coverage:

Actual medical coverage can also be a disadvantage to some people with

health insurance. The medical coverage may not be enough to sufficiently

cover the cost of tests, surgeries and procedures that need to be done. This

can leave the person paying high bills for medical services and may even

cause some people to refuse medical care that they need. This can lead to an

exacerbation of illness or even death, which can end up costing the person,

the person's family, taxpayers and even the government more money.

38

6. Pre-Existing Exclusion:

If a person enrolls in a new group health insurance plan, they may be asked

if they have any pre-existing conditions. According to

Healthinsuranceinfo.net, which is provided through the Georgetown

University Health Policy Institute, some people that have a pre-existing

illness have to undergo a waiting period if changing employers. In addition,

after enrolling in a new group health insurance plan, if a claim is made

during the first year, the insurance company has the right to "look back" to

see if this was due to a pre-existing condition. If it was, the insurance

company may refuse to pay for any charges related to this "pre-existing

condition." This may be in effect for up to 18 months and can be quite

expensive for someone with a serious illness.

39

CHAPTER 4 INTRODUCTION OF IFFCO TOKIO

COMPANY

4.1 Iffco Tokio General Insurance

Profile

Iff-Tokio General Insurance (ITGI) was incorporated on 4th December 2000

with a vision of being industry leader by building customer satisfaction

through fairness, transparency, and quick response. It is a joint venture

between the Indian Farmers Fertilizer Co-operative (IFFCO) and its

associates and Tokio Marine and Nichido Fire Group, the largest listed

insurance group in Japan.

IFFCO Tokio General Insurance has Pan India presence with 65 'Strategic

Business Units' and a wide network of over 120 Lateral Spread Centres and

255 Bima Kendras. It offers a wide range of uniquely customized policies

covering a wide range of customers, from farmers to some of India's largest

automobile manufacturers. From a modest Rs 213 Crores of GWP (Gross

Written Premium) in 2001-02 it has achieved an impressive Rs 2248.16

Crores in 2011-12, thereby becoming one of India's leading private players.

IFFCO Tokio General Insurance has got the Technical Support for

underwriting and reinsurance from Tokio Marine and on Risk Management

from Tokio Risk Consulting (TRC). It is the first company in India to

underwrite mega policies for a fertilizer and an automobile company. This

comprehensive policy is based on international rates and optimizes the

premium outflow for clients even as it offers a one-stop, all-risk cover. Other

than the conventional products, it has been able to come out with niche

40

products like Credit Insurance, Fine Arts Insurance, P & I Insurance, Errors

& Omissions Policy for the IT Sector etc. At the same time it has steadfastly

carried out its rural centric initiatives by launching products like Sankat

Haran Bima Yojana, Mausam Bima Yojana, Mahila Suraksha Bima Yojana

and Janata Bima Yojana for the masses. It's pioneering work using

technology like RFID(Radio Frequency Identification Device) and NDVI

(Normalised Difference Vegetation Index) have made it possible to offer

Cattle and Weather insurance to the rural population at large.

It is also the only insurance company in the country to have a 100%-owned

distribution channel to service its retail customers called IFFCO-TOKIO

Insurance Services Ltd (ITIS). It finds special mention in the 'Capgemini

World Insurance Report- 2009' as an innovative distribution channel. Today,

ITIS has a highly motivated workforce of over 1500 employees in over 350

towns.

As a customer focused company, it conducts bi-annual customer satisfaction

surveys through independent agencies to gauge its operational efficiencies.

This is backed by a robust IT infrastructure, which has enabled, among other

things, speedy settlement of claims.

Subsidiaries

IFFCO-Tokio Insurance Services Limited (ITIS) is a wholly owned

subsidiary and a retail marketing arm of ITGI. It was incorporated on 1st

August 2003. Developing of retail and personal lines has been the major

focus of the company along with spreading into Tier II & III towns and

developing co-operative initiatives for ITGI.

41

At present, ITIS has more than 120 Lateral Spread Centres (LSC) and 255

Bima Kendras (BK) with an employee base of over 1500. Through these two

models, ITGI has extended its network to Tier II & III towns. Bima Kendras

are manned by one or two persons and are usually located in Cooperative

societies which act as the nodal point for sales and service.

IFFCO-Tokio Insurance Services imparts intensive training to its staff by

virtue of its unique online training system as well as classroom training. The

online training system - Gurukul is an interactive training tool which can be

accessed by any employee over internet. It has over 200 modules which

imparts training on insurance products, processes as well as soft skills.

ITIS aspires to become an effective Corporate Agent and gradually diversify

into life and financial products to become a one stop shop for all financial

products.

42

4.2 Micro Insurance by the Iffco-Tokio

The focus of Micro insurance is on the low income segment ignored by

mainstream commercial & social insurance schemes. It may be described as

a "back to basics" campaign. It is characterised by low premium and low

coverage limits. Each policy generates a "micro" financial transaction.

However, the risks are not "micro" to the households which experience

them. Low Income people are exposed to numerous perils. They live in

continuous uncertainty about whether and when a loss might occur. Poverty

and vulnerability reinforce each other in a viciously escalating downward

spiral.

Developing countries lack an effective social protection mechanism to

systematically reach the vast majority of the population which is engaged in

the informal economy. By offering cost-effective risk-hedging instruments,

micro insurance strives to provide some coverage to the excluded. It is thus

integral to any poverty reduction strategy.

By linking multiple small units into larger structures, micro insurance pools

the risk and creates networks that enable better governance. This gives easy

access to reinsurance and helps to generate data which can help in product

design and development.

India will merit a special mention in the history of microinsurance. It

became the first country to have a special regulation on the subject. IRDA

made it mandatory for all formal insurance companies to extend their

activities to rural & social sectors. As former IRDA Chairmnn, Mr C.S. Rao

43

put it succinctly, "IRDA made serving the poor compulsory for insurers in

India."

Iffco Tokio's micro-insurance initiatives are driven by the vision of its parent

company IFFCO which seeks to improve the quality of life of the Indian

farmer. Rather than merely downscaling existing products, it has leveraged

IFFCO's experience of the rural market to craft a product basket designed

specifically for the agricultural sector.

Some of the products are : -

Janta Bima Yojna- This is a comprehensive customized policy offering a

personal accident cover to the insured and his spouse on a floater basis and a

fire & allied perils and burglary cover to the building(house) and its

contents. Three options of Sum insured ( ranging from Rs. 12,500 to Rs

30,000 for the property section and Rs. 15,000 TO Rs .50,000 for the

personal accident section and premium payable ( ranging from Rs 100 to Rs

250), are offered. The policy can be taken on an individual or group basis.

Jan Swasthya Bima Yojna- This group health policy covers hospitalization

expenses, in case hospitalization is necessitated following an accident or

disease. The Sum insured ranges from Rs. 15000 to Rs. 30000 in multiples

of Rs. 5000.

Jan Kalyan Bima This provides comprehensive protection against loss or

damage to the property insured by Fire and allied perils and burglary &

house breaking. It also covers risks of Personal accident and 10 Critical

illnesses. The sum assured is Rs 50,000

44

Jan Suraksha Bima- This is a Personal accident policy for Self Help

Groups providing coverage against death, permanent total disablement,

permanent partial disablement and temporary total disablement resulting out

of an accident.

Mahila Suraksha Bima Yojna- The coverage is same as that of Jan

Suraksha Bima Yojna and is meant for women Self Help Groups only.

Pashudhan Bima Yojna- is a cattle insurance policy applicable to

indigenous, cross breeds and exotic breeds of cattle, covering the death of

the animal due to accident, disease, surgical operations , strike , riot and civil

commotion (SRCC), terrorism and earthquake.

Barish bima Yojna (BBY) - This is an Index based Weather Insurance

Product for Kharif (monsoon) crops like Jowar, paddy, soyabean, cotton etc.

which provides cover for financial losses arising due to deficient or excess

rainfall. The cover is operative during the monsoon months i.e. July to

September/ June to September/ July to October. The maximum Sum Insured

under the micro version of this policy is Rs. 30000/-.

Mausam Bima Yojna (MBY) - The policy provides cover for Rabi crops

like Wheat, Mustard, Potato etc. against financial losses arising due to

adverse weather perils- Temperature, Humidity and Unseasonal Rainfall

during the Rabi season. The maximum Sum Insured under the micro version

of this policy is Rs. 30000/-.

45

Micro insurance is still in its infancy. Problems include high transaction

costs, inappropriate distribution systems, product design issues especially

related to the irregular cash flows of the low income market and lack of data

to interpret the vulnerabilities of the poor. The challenge is to promote an

insurance culture in the low income group and simultaneously develop an

appropriate business model that creates a profitable & sustainable market at

the "bottom of the pyramid." This will help to realise the immense potential

of the vast, underserved market of low income households.

46

4.3 The IFFCO Tokio Edge:

The business model for this segment thrives on technological and channel

innovations to overcome the challenges, and achieve sustainable profitable

growth.

Optimizing IT for touching India's Hinterland:

Radio Frequency Tagging (RFID):

Animal identification is a critical challenge while deciding the claims

for livestock insurance. Instead of depending on the traditional use of

the metallic and plastic tags, which result in high moral hazard,

IFFCO Tokio has innovatively used the latest RFID tagging for

animal identification and fair and fast claim settlement.

This method involves the use of a transponder and transreceiver for

accurate animal identification, which eliminates of the chances of

fraudulent claims. So far more than 10000 animals have been insured

by this method.

Use of automated weather stations:

In the weather insurance business, the conventional use of weather

data obtained from rain gauges or observatories had problems of

delays and manual interference. To combat this, IFFCO Tokio has

started using data from automated weather stations (AWS), that

,besides providing timely and accurate data to the insurer, also

provides daily data and short term weather forecasts to the associated

47

farmers. It facilitates faster claim settlement , and better client

interface by providing Agro-advisory services.

Insurance bundled with fertilizer purchase

To solve the challenges of accessibility, awareness and distribution;

IFFCO and IFFCO Tokio came up with the unique idea of providing a

Personal accident insurance cover bundled with the purchase of

fertilizers from IFFCO or IPL.

To keep the procedure simple the sales receipt itself acts as the policy

document and can be produced for settlement of claims under the

policy.

Counting on the reach of the promoter (IFFCO) Our parent company IFFCO

is the world's largest fertilizer cooperative with nation-wide network of

about 40000 cooperative societies. We have sought to leverage its brand

value, client database and distribution channel to penetrate the rural and

social segment. Most of our one man offices called Bima Kendras are in the

premises of a cooperative

48

4.4 Specialty Insurance

IFFCO-TOKIO provides a wide variety of policies that are customized to

your needs.

For your convenience, we have grouped them. To access information on any

of the policies, simply click on the link you want.

Credit Insurance Policy

Multi Modal transport (MTO) Insurance Policy

Marine Hull & Machinery Insurance Policy

Jeweller's Block Insurance Policy

Barish Bima Yojna (Weather Insurance) Policy

Sagar Bandhu Bima Policy Insurance Policy

Aviation Insurance Policy

Errors and Omissions (Technology) Insurance Policy

Fine Art Insurance Policy Private Collectors

Fine Art Insurance Policy Art Dealers & Gallery Owners

49

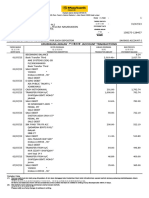

CHAPTER 5 HEALTH INSURANCE IN IFFCO TOKIO

Health Insurance Policies Provided by Iffco tokio

Source: By Researcher

Policies

Individual

Medishield

Insurance

Policy

Swasthya

Kavach (Family

Health

Insurance)

Policy

Swasthya

Kavach (Family

Health

Insurance)

Policy

Critical illness

policy

50

5.1 Individual Medishield Insurance Policy

What does the policy cover?

In the unfortunate event of you or your family members meeting with an

illness or accident resulting in hospitalisation, our Health Insurance gives

you a cash free hospitalisation in more than 3000 hospitals across India. Our

Health Insurance also reimburses the expenses during Pre - Hospitalisation

and Post - Hospitalisation stages of treatment.

Pre-Hospitalisation:

Medical expense incurred 60 days prior to the hospitalization is

reimbursed.

Hospitalisation:

All expenses including the following reimbursed:

Room and board, doctors' fee, intensive care unit charges,

nursing expenses, surgical fees, operating theatre

expenses, anesthesia and oxygen administration expenses,

Room, boarding & nursing expenses for normal room/ICU

limited to 1% /2.5% of basic sum insured per day respectively.

Post-Hospitalisation:

Once discharged from hospital, the policy shall pay for medical

expenses related to the hospitalisation, for a period of 60 days

after discharge.

51

Hospital Daily Allowance:

In addition to hospital expenses, a daily hospital allowance will

be paid for the period of hospitalisation.

Emergency Assistance Service:

In the event of an emergency, assistance services like medical

consultation, evaluation and referral, emergency medical

evacuation, care for minor children etc are provided.

Local Ambulance Service:

In the event of an emergency, cover is provided for expenses

incurred on ambulance services to the nearest hospital where

Emergency Health facilities are available.

General Health Check-up:

You will be reimbursed the expenses incurred for general health

examination (once in a block of 4 claims free years)

Cumulative bonus:

You will be provided with a 5% extra sum insured for every

claims free year subject to a maximum of 50% of capital sum

insured.

52

Benefits under Section - 80D:

Premium upto Rs. 35,000 is eligible for deductions under

Section 80D of Income Tax Act, 1961. However there are sub-

limits within this over-all limit. Premium upto Rs 15,000 is

eligible for tax deduction for self, spouse and dependant

children. Additionally, premium upto Rs 20,000 is eligible for

tax relief or parents health cover if they are senior citizens

(otherwise Rs 15,000 is eligible)

ITGI's Medishield policy ensures comprehensive coverage by offering value

added features, at a nominal increase in premium, like:

Critical illness extension:

You will be covered for 10 named critical illness for double the

basic cover sum insured at 40% of the basic cover premium

53

What does the policy not cover?

Diseases, which have been in existence at the inception of the policy

Illness that commenced during the first 30 days of inception of the

first policy.

Cataracts, Benign Prostatic Hypertrophy, Hysterectomy for

Menorrhagia or Fibromyoma, Hernia, Hydrocele, Fistula in anus,

Piles, Sinusitis and related disorders, in the first year of insurance.

However, on renewal, these exclusions shall not apply. For a complete

list of exclusions, refer to the policy.

Medishield (Individual Plan) covers

Hospitalisation

Pre-hospitalisation

Post - Hospitalisation.

Emergency Assistance Service

Local Ambulance Service.

Family discount is available (5% for 2 people, 10% for 3 or more

people).

Benefits / rates given in the leaflet are indicative Maximum

Entry Age: 5- 55 years (medical reports required above 45 years of

age)

Rates inclusive of service tax.

54

5.2 Swasthya Kavach (Family Health Insurance) Policy

What does the policy cover?

In the unfortunate event of you or your family members meeting with an

illness or accident resulting in hospitalisation, our Swasthya Kavach (Family

Health) Policy gives protection cover for you and your family for any injury

or disease related contingencies like hospitalization, medical expenses,

surgical expenses, organ transplantation, etc. The Policy also offers unique

Critical Illness Coverage (Optional) for the family and is available under two

variants- Base plan and Wider Plan and covers the following:

Pre-Hospitalisation:

Medical expenses incurred 30 days prior to the hospitalization

are reimbursed.

Hospitalisation:

All expenses including the following reimbursed:

Room and board, doctors' fee, intensive care unit charges,

nursing expenses, surgical fees, operating theatre expenses,

anesthesia and oxygen administration expenses. Room expenses

for normal room/ICU limited to 1% /2% of sum insured per day

for Base Plan and 1.5%/2.5% of basic sum insured for Wider

Plan respectively. There are also restrictions on other hospital

expenses in accordance with the room rent under the Base Plan.

55

Post-Hospitalisation:

Once discharged from hospital, the policy shall pay for medical

expenses related to the hospitalisation, for a period of 30 days

after discharge subject to specified limits under Base Plan and

60 days after discharge under wider plan.

Day care surgeries:

The policy covers 121 defined day care surgeries that requires

less than 24 hours hospitalisation and ordinarily fall outside the

scope of most health insurance policies.

Hospital Daily Allowance:

In addition to hospital expenses, a daily allowance will be paid

for the period of hospitalisation.

Emergency Assistance Service:

In the event of an emergency, assistance services like medical

consultation, evaluation and referral, emergency medical

evacuation, care for minor children etc are provided.

Local Ambulance Service:

In the event of an emergency, cover is provided for expenses

incurred on ambulance services to the nearest hospital where

Emergency Health facilities are available.

56

General Health Check-up:

You will be reimbursed the expenses incurred for general health

examination (once in a block of 4 claims free years)

Applicable only under Wider Plan

Cumulative bonus :

You will be provided with a 5% extra sum insured for every

claims free year subject to a maximum of 50% of capital sum

insured- Applicable only under Wider Plan

Benefits under Section - 80D:

Premium upto Rs. 15,000 is eligible for self, spouse and

dependant children with deductions under Section 80D of

Income Tax Act, 1961.

ITGIs Swasthya Kavach Policy ensures comprehensive coverage by

offering value added features, at a nominal increase in premium, like:

Critical illness extension for family:

You will be covered for 10 named critical illness for double the

basic cover sum insured. 10 Critical Illness include: Paralytic

Stroke, Cancer, Renal Failure, Coronary Artery Disease, Major

Injuries, End Stage Liver Disease, Major Burns, Coma, Major

Organ Transplant and Multiple Sclerosis

57

What does the policy not cover?

Diseases, which have been in existence at the inception of the policy

Illness that commenced during the first 30 days of inception of the

first policy.

During the first year of the Policy, the expenses on treatment of

diseases such as Tonsillitis/ Adenoids, Gastric or Duodenal Ulcer, any

type of Cyst/ Nodules/ Polyps, any type of Breast lumps.

During the first two continuous years of the insurance with us, the

expenses on treatment of diseases such as Cataract, Benign Prostatic

Hypertrophy, Hysterectomy for Menorrhagia or Fibromyoma, Hernia,

Hydrocele, Fistula in anus, Piles, Sinusitis, Choletithiasis and

Cholecystectomy, Inter- vertebral Disc Prolapse (other than caused by

an accident), Osteoarthritis, Varicose Veins / Varicose Ulcers etc.

Naturopathy, acupuncture, magnetic treatment, alternative medicines,

etc

Under the Base Plan, during the first two continuous years of the

Policy, the expenses on treatment of diseases such as Renal Failure,

Heart Diseases, any type of Carcinoma/Sarcoma/Blood Cancer.

58

5.3 Group Personal Accident Insurance policy

FFCO TOKIO'S GROUP PERSONAL ACCIDENT POLICY accident

policy is available to provide for payment of compensation in the event of

members of your group:

Sustaining injury, disablement (permanent total, permanent partial and

temporary total) or death arising out of accident

Exclusions

Self injury, suicide, venereal disease or insanity

Influence of intoxicating liquor or drugs

Death due to pregnancy or childbirth

Breach of law with criminal intent

War and nuclear group of perils

On duty with armed forces

We Must Note

That group policies can be given to firm, company, association and

clubs on named as well as unnamed basis where all members must be

included

That group discount is allowed on size of group at inception of the

policy

Additions and deletions can be done during currency of policy for

people joining and leaving

The cover is normally available on 24 hour coverage basis

59

We can offer you discount if you restrict the cover to your employees

for on duty cover only or for off- duty cover only

Other benefits like expenses for ambu1ance charges, damage to

clothes, loss of employment, expenses for carriage of dead body are

admissible- following an accident subject to a limit

Education fund for dependent child is admissible in case death or

permanent total disablement

Documents required for settlement of claims

Claim form

Doctors report, bills in case of temporary/permanent disablement

Police report/post mortem report in case of accidental death

Leave certificate from employer in case of temporary disablement

60

5.4 Critical illness policy

At a time of increasing cost of living, the expenses for medical treatment

have gone up substantially. Particularly if any person contracts a major

disease (critical illness), then he/she has to spend a huge sum of money for

treatment, which most people can ill afford.

Although you cannot prevent the occurrence of serious ailments and

accidents, you can take steps to ensure that the same does not result in

financial ruin for you and your family. ITGI's Critical Illness Insurance

Policy provides just the right kind of cover for such situations at a very

affordable price.

A complete protector

The standard medical cover available in the market is perceived to be rather

expensive for the common man. Normal hospitalization while also involving

a financial strain, can even then be sustained by an average person. but

treatment for critical illness, while saving the person's life could cripple him

financially. By paying a fraction of the normal premium required to be paid

for a full fledged medical cover, complete protection can be taken through