Talbots Harvard Case Ans

Diunggah oleh

Christel YeoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Talbots Harvard Case Ans

Diunggah oleh

Christel YeoHak Cipta:

Format Tersedia

1.

If you were an accountant for Talbots, what specifically would be the relevant

accounting research question relating to the case.

Answer

As an accountant of Talbots, Inc my research is to find the ways how Goodwill will not be

impaired. As it decreases the value of Assets furthermore decrease sales and increase operating

loss. Simultaneously, have an impact on the shareholders dividend and investors interest.

2. What accounting standards must Talbots consider when answering the question?

Answer

While answering the question Talbots must consider AS!, SAS "#$, Goodwill and %ther

Intangible Assets.

In $&&" it mandated that accounting for goodwill will be based on the impairment model

using the two 'step process. %nce goodwill is impaired and written off, it can never

restore to its original carrying amount. I(S use impairment test for assets and goodwill.

If an impairment of goodwill is recogni)ed, that loss cannot be reversed .*owever, for the

other assets, impairment losses can be reversed and recogni)ed in the income statement

so long as the carrying amounts do not e+ceed the depreciated historical cost if the

impairment had not been recogni)ed.

SAS "#$ made two ma,or changes to goodwill accounting-

Amorti)ation of all goodwill ceased, regardless of when it originated. Goodwill is now

carried as an asset without reduction for periodic amorti)ation.

.ompanies are to assess goodwill for impairment at least annually. If goodwill is

impaired, its carrying amount is reduced and an impairment loss is recogni)ed.

3 What must be known, estimated, and assumed to answer the research question

Answer

To answer the research question the accountant must

irstly, determine the fair value of each reporting unit using a combination of a discounted

cash flow and a mar/et value approach.

The evaluation of goodwill requires significant estimates,

If the fair value of the reporting unit e+ceeds the carrying value of the net assets of

that reporting unit, goodwill is not impaired and no further testing is required.

If the carrying value of the nets assets assigned to the reporting unit e+ceeds the fair

value of the reporting unit then a second step is required to determine the impaired

fair value of the reporting unit0s goodwill, to be compared to the carrying value of the

reporting unit0s goodwill.

Secondly, 1aluing the tangible and intangible assets and liabilities of the impaired reporting

unit0s goodwill based on the residual of the summed identified tangible and intangible assets and

liabilities if the fair value is less than the carrying value, goodwill is considered impaired and its

carrying amount must be reduced by reducing income for that period. When the carrying amount

of any long lives asset is no longer recoverable, a company is required to write off the cost that

no longer has value.

Thirdly, AS!, SAS "#$ 2egal, regulatory, or contractual provisions li/e if an impairment of

goodwill is recogni)ed, that loss cannot be reversed .*owever, for the other assets, impairment

losses can be reversed and recogni)ed in the income

ourthly, 3ffects of obsolescence, demand, competition, and other economic factors.

ifthly, 3+pected actions of competitors and others may restrict present competitive advantages.

. !o you believe Talbots" accounting for goodwill in the case was appropriate? Why

or why not? Is it possible to arrive at an alternative accounting treatment of

goodwill based on your analysis?

Answer

In Talbots0 case accounting for goodwill is not appropriate li/e the company reviewed its

goodwill and trademar/s for impairment during the fourth quarter of $&&4 in addition to its

annual measurement date due to the wea/ sales and operating performance of the company. As a

result of the goodwill and trademar/ impairment test the company concluded that the carrying

amounts of the stores and 5irect mar/eting reporting units of the 6.6ill brand e+ceed its fair

value. The goodwill impairment charge of 7 "8#.& million was determined by comparing the

carrying value of goodwill of the reporting units with the implied fair value of goodwill of the

reporting units. The trademar/ impairment charge of 7 $9.: million before an income ta+ benefit

7 9.; million was determined by comparing the carrying value of the trademar/ with the estimate

fair value of the trademar/. With that the company believes that 6.6ill have potential future

growth.

It is not possible to arrive at an alternative accounting treatment of goodwill as inancial

Accounting Standard !oard , SAS "#$ mandatory declared instead of deducting the value of

goodwill annually over a period of ma+imal #& years the companies are now required to

determine the fair value of the reporting unitsby using present value of future cash flow and

compare it to their carrying value I.e.boo/ value of assets plus goodwill minus liabilities. If the

fair value is less than carrying cost <impaired= the goodwill value needs to be reduced so the fair

value is equal to carrying value. In income statement, the impairment loss is reported as a

separate line item and in balance sheet ,new ad,usted value of goodwill is reported

When the business is threatened with insolvency investors will frequently deduct the goodwill

from anycomputation of residual equity because it will probable have no resale value.

Anda mungkin juga menyukai

- T8 RevivalDokumen6 halamanT8 RevivalSumit AggarwalBelum ada peringkat

- Category CaptaincyDokumen9 halamanCategory CaptaincycmoreblrBelum ada peringkat

- Ccbe CASE Presentation: Group 2Dokumen13 halamanCcbe CASE Presentation: Group 2Rakesh SethyBelum ada peringkat

- Sec-A - Group 8 - SecureNowDokumen7 halamanSec-A - Group 8 - SecureNowPuneet GargBelum ada peringkat

- Digital Media ProDokumen10 halamanDigital Media Protamish gupta100% (1)

- Case Analysis Topic - Working Capital Management & ROI Case - An Irate Distributor Submitted by - Srishti Joshi (PGFC1934)Dokumen5 halamanCase Analysis Topic - Working Capital Management & ROI Case - An Irate Distributor Submitted by - Srishti Joshi (PGFC1934)Surbhi SabharwalBelum ada peringkat

- Altius Excel DSDokumen6 halamanAltius Excel DSShreya Gupta0% (1)

- Capsim Core 2018 - Competition - Free 2018Dokumen60 halamanCapsim Core 2018 - Competition - Free 2018ADITI SONIBelum ada peringkat

- G1 - Treks N Rapids CaseDokumen6 halamanG1 - Treks N Rapids CaseGeetika JainBelum ada peringkat

- Cloudstrat Case StudyDokumen10 halamanCloudstrat Case StudyAbhirami PromodBelum ada peringkat

- CarlsbergDokumen14 halamanCarlsbergRohit PantBelum ada peringkat

- Case Analysis On PURIteen - Group No. 3Dokumen2 halamanCase Analysis On PURIteen - Group No. 3PravendraSingh100% (1)

- Jakson Evolution of A Brand - Section A - Group 10Dokumen4 halamanJakson Evolution of A Brand - Section A - Group 10RAVI RAJBelum ada peringkat

- Emirates Airline Success Behind Solid GrowthDokumen1 halamanEmirates Airline Success Behind Solid GrowthChRehanAliBelum ada peringkat

- STAMYPOR MANAGEMENT OF INNOVATIONDokumen15 halamanSTAMYPOR MANAGEMENT OF INNOVATIONrockysanjitBelum ada peringkat

- Garanti Payment Systems:: Digital Transformation StrategyDokumen12 halamanGaranti Payment Systems:: Digital Transformation StrategySwarnajit SahaBelum ada peringkat

- Activity 11 PDFDokumen5 halamanActivity 11 PDFgabrielaBelum ada peringkat

- The Multiunit EnterpriseDokumen4 halamanThe Multiunit EnterpriseRia AgustrianaBelum ada peringkat

- CAPSIM Capstone Strategy 2016Dokumen21 halamanCAPSIM Capstone Strategy 2016Khanh MaiBelum ada peringkat

- Wilkerson Company Case Numerical Approach SolutionDokumen3 halamanWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroBelum ada peringkat

- Newell Case StudyDokumen1 halamanNewell Case StudyNaina AgrawalBelum ada peringkat

- Samantha Seetaram IENG3003 Assignment1Dokumen15 halamanSamantha Seetaram IENG3003 Assignment1Samantha SeetaramBelum ada peringkat

- Striders: Running Away or Towards The Growth (Group 8)Dokumen1 halamanStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniBelum ada peringkat

- Shobhit Saxena - CSTR - Assignment IDokumen4 halamanShobhit Saxena - CSTR - Assignment IShobhit SaxenaBelum ada peringkat

- Tata Motors: Can the Turnaround Plan Improve PerformanceDokumen16 halamanTata Motors: Can the Turnaround Plan Improve PerformanceMehdi BelabyadBelum ada peringkat

- Online Marketing at Big Skinny: Submitted by Group - 6Dokumen2 halamanOnline Marketing at Big Skinny: Submitted by Group - 6Saumadeep GuharayBelum ada peringkat

- Age Experience in SF Overall Work Ex Region Positives NegativesDokumen6 halamanAge Experience in SF Overall Work Ex Region Positives NegativesireneBelum ada peringkat

- Group 6 - Transforming Luxury Distribution in AsiaDokumen5 halamanGroup 6 - Transforming Luxury Distribution in AsiaAnsh LakhmaniBelum ada peringkat

- Tire City Case 1Dokumen28 halamanTire City Case 1Srikanth VasantadaBelum ada peringkat

- Uniliver in Brazil Essay PDFDokumen21 halamanUniliver in Brazil Essay PDFpawangadiya1210Belum ada peringkat

- Victoria Project TemplateDokumen15 halamanVictoria Project TemplateAbhijit KoundinyaBelum ada peringkat

- Sol MicrosoftDokumen2 halamanSol MicrosoftShakir HaroonBelum ada peringkat

- The Power of Direct Sales Growth Through Motivation and TrainingDokumen8 halamanThe Power of Direct Sales Growth Through Motivation and TrainingSaurabh PalBelum ada peringkat

- Does Employee Appearance Impact Customer BehaviorDokumen4 halamanDoes Employee Appearance Impact Customer BehaviorUnushka ShresthaBelum ada peringkat

- Turnaround Plan For Linens N ThingsDokumen15 halamanTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- Group 9 - SDMDokumen50 halamanGroup 9 - SDMPRASHANT KUMARBelum ada peringkat

- Dewdrop Soap Market Research Agencies ComparisonDokumen1 halamanDewdrop Soap Market Research Agencies ComparisonShyamal VermaBelum ada peringkat

- Classic Pen Case CMADokumen2 halamanClassic Pen Case CMARheaPradhanBelum ada peringkat

- AkilAfzal ZR2001040 FinalDokumen4 halamanAkilAfzal ZR2001040 FinalAkil AfzalBelum ada peringkat

- QMDokumen87 halamanQMjyotisagar talukdarBelum ada peringkat

- Endeavour Twoplise LTDDokumen4 halamanEndeavour Twoplise LTDHafiz WaqasBelum ada peringkat

- Report 2Dokumen4 halamanReport 2Trang PhamBelum ada peringkat

- Lucent's Supply Chain Changes in AsiaDokumen9 halamanLucent's Supply Chain Changes in AsiaAndy VibgyorBelum ada peringkat

- Oversight Systems AnswersDokumen4 halamanOversight Systems AnswersRitika SharmaBelum ada peringkat

- Was Konka's Internationalization Success Attributable To The Export Mode of Internationalization? Our Position - YesDokumen3 halamanWas Konka's Internationalization Success Attributable To The Export Mode of Internationalization? Our Position - YesMUDIT YAGNIK 23Belum ada peringkat

- IPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr IssueDokumen4 halamanIPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr Issuechinna rao100% (1)

- OSTR Assignment #3Dokumen4 halamanOSTR Assignment #3SrishtiBelum ada peringkat

- Case Study CavinkareDokumen3 halamanCase Study CavinkareKshitiz112Belum ada peringkat

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDokumen5 halamanBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedBelum ada peringkat

- B2B Marketing - Jyoti - Sagar - P19052Dokumen5 halamanB2B Marketing - Jyoti - Sagar - P19052JYOTI TALUKDARBelum ada peringkat

- Beta Management Company SummaryDokumen8 halamanBeta Management Company Summarysabohi83% (6)

- Assignment 2 Group 4BDokumen5 halamanAssignment 2 Group 4BBhumika VishnoiBelum ada peringkat

- Group 2 - Shodh Case Analysis - MKT504Dokumen6 halamanGroup 2 - Shodh Case Analysis - MKT504Arpita GuptaBelum ada peringkat

- Shiva Tourist DhabaDokumen7 halamanShiva Tourist DhabaChaitanya JethaniBelum ada peringkat

- Icrosoft Canada Sales AND Product Management Working TogetherDokumen7 halamanIcrosoft Canada Sales AND Product Management Working TogetherManoj TyagiBelum ada peringkat

- Group 10 - Sec BDokumen10 halamanGroup 10 - Sec BAshishKushwahaBelum ada peringkat

- NLP 2019-20Dokumen36 halamanNLP 2019-20Akshay TyagiBelum ada peringkat

- What Is A Balance SheetDokumen11 halamanWhat Is A Balance SheetkimringineBelum ada peringkat

- Topic 3 SolutionsDokumen13 halamanTopic 3 SolutionsLiang BochengBelum ada peringkat

- Unit 4 - Measuring and Reporting Financial Performance (Continued) Non Current Tangible AssetsDokumen4 halamanUnit 4 - Measuring and Reporting Financial Performance (Continued) Non Current Tangible AssetsMisu NguyenBelum ada peringkat

- Modes of presentation of acute myocardial infarctionDokumen4 halamanModes of presentation of acute myocardial infarctionChristel YeoBelum ada peringkat

- Workbook 1-1-3 PDFDokumen10 halamanWorkbook 1-1-3 PDFChristel YeoBelum ada peringkat

- Multiple CamScanner Scans in One DocumentDokumen16 halamanMultiple CamScanner Scans in One DocumentChristel YeoBelum ada peringkat

- Workbook 1-1-3 PDFDokumen10 halamanWorkbook 1-1-3 PDFChristel YeoBelum ada peringkat

- Active Fund Managers Are Closet Index Huggers - FT - 12mar2014Dokumen2 halamanActive Fund Managers Are Closet Index Huggers - FT - 12mar2014Christel YeoBelum ada peringkat

- Beethoven eDokumen36 halamanBeethoven ealineprier100% (1)

- Types and Costs of Financial Capital ExplainedDokumen18 halamanTypes and Costs of Financial Capital ExplainedChristel YeoBelum ada peringkat

- Shout To The LordDokumen2 halamanShout To The LordbinchacBelum ada peringkat

- 1-1-3 PDFDokumen16 halaman1-1-3 PDFChristel YeoBelum ada peringkat

- Workbook 1-1-3Dokumen10 halamanWorkbook 1-1-3Christel YeoBelum ada peringkat

- Corporate Governance of Different Entities PDFDokumen41 halamanCorporate Governance of Different Entities PDFChristel YeoBelum ada peringkat

- McKinsey Problem Solving Test - Practice TestBDokumen28 halamanMcKinsey Problem Solving Test - Practice TestBproyecto20132014Belum ada peringkat

- SABR Model PDFDokumen25 halamanSABR Model PDFRohit Sinha100% (1)

- PWC Managing Innovation Pharma PDFDokumen20 halamanPWC Managing Innovation Pharma PDFChristel YeoBelum ada peringkat

- Eight Key Trends Driving MA in AgribusinessDokumen16 halamanEight Key Trends Driving MA in AgribusinessChristel YeoBelum ada peringkat

- Mckinsey Problem Solving TestDokumen0 halamanMckinsey Problem Solving TestAgnes Tan Lay Hong100% (2)

- Academic OneFile - Document - The Burma Road Myanmar's EconomyDokumen2 halamanAcademic OneFile - Document - The Burma Road Myanmar's EconomyChristel YeoBelum ada peringkat

- Corp Gov Sample Qns PDFDokumen74 halamanCorp Gov Sample Qns PDFChristel YeoBelum ada peringkat

- 2016 2017-Sem2-FIN3101 Detailed Course Schedule PDFDokumen6 halaman2016 2017-Sem2-FIN3101 Detailed Course Schedule PDFChristel Yeo100% (1)

- 1011sem1 Acc3602Dokumen4 halaman1011sem1 Acc3602Christel YeoBelum ada peringkat

- A Presentation On Water in SingaporeDokumen10 halamanA Presentation On Water in SingaporeChristel YeoBelum ada peringkat

- 2009 Valuation Handbook A UBS GuideDokumen112 halaman2009 Valuation Handbook A UBS Guidealmasy99100% (4)

- Getting the GIC Scholarship: My ExperienceDokumen3 halamanGetting the GIC Scholarship: My ExperienceChristel YeoBelum ada peringkat

- Restricted Diet: DR Leong Lai Peng S14-06-03 Food Science and Technology ProgrammeDokumen75 halamanRestricted Diet: DR Leong Lai Peng S14-06-03 Food Science and Technology ProgrammeChristel YeoBelum ada peringkat

- Haydn Sonata in C (URTEXT)Dokumen16 halamanHaydn Sonata in C (URTEXT)Christel Yeo0% (1)

- Study Questions For Week 3 Tutorial 2015 2016Dokumen1 halamanStudy Questions For Week 3 Tutorial 2015 2016Christel YeoBelum ada peringkat

- Circle Pattern Template For Macaron Piping 3.5 CM (1 In) DiameterDokumen1 halamanCircle Pattern Template For Macaron Piping 3.5 CM (1 In) DiameterChristel YeoBelum ada peringkat

- Restricted Diet: DR Leong Lai Peng S14-06-03 Food Science and Technology ProgrammeDokumen75 halamanRestricted Diet: DR Leong Lai Peng S14-06-03 Food Science and Technology ProgrammeChristel YeoBelum ada peringkat

- Songs For The Deaf: Parental Advisory EdDokumen5 halamanSongs For The Deaf: Parental Advisory EdTinta CafeBelum ada peringkat

- Appendix Preterism-2 PDFDokumen8 halamanAppendix Preterism-2 PDFEnrique RamosBelum ada peringkat

- Subwoofer Box 6.5 Inch Subwoofer Ported Box Pipe9Dokumen2 halamanSubwoofer Box 6.5 Inch Subwoofer Ported Box Pipe9Arif Kurniawan HidayatBelum ada peringkat

- Autism and Autism Spectrum Disorder Medical Hypothesis For Parasites Influencing AutismDokumen3 halamanAutism and Autism Spectrum Disorder Medical Hypothesis For Parasites Influencing AutismCATHYBelum ada peringkat

- Zoomorphology: Morphology and Function of The Tube Feet of (Echinodermata: Crinoidea)Dokumen13 halamanZoomorphology: Morphology and Function of The Tube Feet of (Echinodermata: Crinoidea)Indra SatriaBelum ada peringkat

- Mohammad Akib Nawaz - Scharffen BergerDokumen2 halamanMohammad Akib Nawaz - Scharffen BergerShatakkshi SinghBelum ada peringkat

- 100 PML's Tips and TricksDokumen28 halaman100 PML's Tips and TricksPrashant Prakash Uparkar100% (5)

- Answer Following Questions: TH THDokumen5 halamanAnswer Following Questions: TH THravi3754Belum ada peringkat

- Python Programming For Beginners 2 Books in 1 B0B7QPFY8KDokumen243 halamanPython Programming For Beginners 2 Books in 1 B0B7QPFY8KVaradaraju ThirunavukkarasanBelum ada peringkat

- Tipe Tubuh (Somatotype) Dengan Sindrom Metabolik Pada Wanita Dewasa Non-Obesitas Usia 25-40 TahunDokumen9 halamanTipe Tubuh (Somatotype) Dengan Sindrom Metabolik Pada Wanita Dewasa Non-Obesitas Usia 25-40 TahunJessica Ester ExaudiaBelum ada peringkat

- Electromagnetic Spectrum 1 QP PDFDokumen13 halamanElectromagnetic Spectrum 1 QP PDFWai HponeBelum ada peringkat

- Scrap Reduction Improvement: Roop Polymers LimitedDokumen5 halamanScrap Reduction Improvement: Roop Polymers Limitedmani01kandanBelum ada peringkat

- Revised New PTLLS Assignment 1 Levels 3 and 4 Nov 2011Dokumen3 halamanRevised New PTLLS Assignment 1 Levels 3 and 4 Nov 2011dave_perry189218Belum ada peringkat

- FT 180aDokumen60 halamanFT 180aRobert/YG2AKR75% (4)

- Pushover Analysis As Per EC8Dokumen23 halamanPushover Analysis As Per EC8mihaitimofteBelum ada peringkat

- VERTICAL CYLINDRICAL VESSEL WITH FLANGED FLAT TOP AND BOTTOMDokumen1 halamanVERTICAL CYLINDRICAL VESSEL WITH FLANGED FLAT TOP AND BOTTOMsandesh sadvilkarBelum ada peringkat

- Introductory Algebra 12th Edition Bittinger Test BankDokumen26 halamanIntroductory Algebra 12th Edition Bittinger Test BankStephanieMckayeqwr100% (57)

- The Works of Lord Byron, Vol. 3 - Hebrew Melodies, PoemsDokumen361 halamanThe Works of Lord Byron, Vol. 3 - Hebrew Melodies, Poemszpervan1Belum ada peringkat

- RADIALL - RP66393 Plug With Backshell CapDokumen1 halamanRADIALL - RP66393 Plug With Backshell CapIlaiarajaBelum ada peringkat

- Why Filipinos Are PoorDokumen2 halamanWhy Filipinos Are PoorAzee OdtohanBelum ada peringkat

- Relevant CostingDokumen5 halamanRelevant CostingRechelleBelum ada peringkat

- Kofax Digital Mailroom Webinar IDC Slides v4Dokumen16 halamanKofax Digital Mailroom Webinar IDC Slides v4hteran28100% (2)

- Importance of Bus Rapid Transit Systems (BRTSDokumen7 halamanImportance of Bus Rapid Transit Systems (BRTSAnshuman SharmaBelum ada peringkat

- Newspaper ChaseDokumen10 halamanNewspaper Chasefi3sudirmanBelum ada peringkat

- Lessons From Nothing - Activities For Language Teaching With Limited Time and Resources (Cambridge Handbooks For Language Teachers) 2Dokumen121 halamanLessons From Nothing - Activities For Language Teaching With Limited Time and Resources (Cambridge Handbooks For Language Teachers) 2Ryan Ryan100% (1)

- Listening Test 2 BACH 3 Eva 19-20Dokumen2 halamanListening Test 2 BACH 3 Eva 19-20Maria Jose Fuentes DiazBelum ada peringkat

- DIY Mini CNC Laser EngraverDokumen194 halamanDIY Mini CNC Laser EngraverPier DanBelum ada peringkat

- Osce Top TipsDokumen20 halamanOsce Top TipsNeace Dee FacunBelum ada peringkat

- Oracle AcademyDokumen16 halamanOracle AcademyCristina - Elena CiortBelum ada peringkat

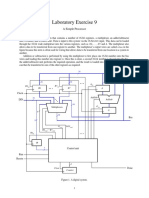

- Laboratory Exercise 9: A Simple ProcessorDokumen8 halamanLaboratory Exercise 9: A Simple ProcessorhxchBelum ada peringkat