Case Study On Guil

Diunggah oleh

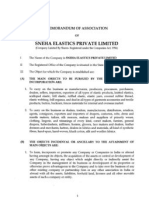

vineetH_Sl2000Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Case Study On Guil

Diunggah oleh

vineetH_Sl2000Hak Cipta:

Format Tersedia

Acknowledgement

It gives me great pleasure on bringing out the project report entitled, Marketing

strategy of GAIL (India) Ltd. for its products and identifying areas of

improvement.

I wish to express my sincere thanks to Mr. Partha Jana, GM,GAIL for his

valuable suggestions and unflinching support. He picked interest in me to handle the

project and encouraged my work every time. It would have been difficult for me to

complete the project without his expert and experienced views.

I also wish to express my sincere gratitude to Mr. P. !amkrishna,

"r.Manager(Mktg.) and the whole Marketing epartment for their thorough

support and cooperation throughout my training period. !heir invaluable knowledge

and advice guided me towards the completion of the project.

"inally, I would like to thank all my friends and associates whose suggestions

and criticism made a scope for the betterment of this report.

#itendra $umar

%&'()

!egistration #o. $%&$&&'((

*+',

"ynopsis

&)I, -India. ,imited is /avaratna %*0 under the administrative control of 1inistry of

%etroleum and /atural &as. It is primarily engaged in to /atural &as marketing and

transmission activities. !he company operates and maintains about 2,333 kilometers of &as

!ransmission pipelines in the western, southern, and eastern regions of India. &)I, -India.

,imited also offers various petrochemical products and services, which primarily include

films, injection molding, master batch, rote molding, and extrusion coating4 and produces

li5uefied petroleum gas and allied products, such as propane and pentane. In addition, it

offers telecommunications products and services4 supplies naphtha tankers4 and engages in

retail gas business that includes %iped /atural &as distribution, as well as +ompressed

/atural &as -+/&. distribution to transport sector.

Approach and Methodo)ogy

6 !he analysis is based on the study of the existing marketing practice at

&)I,.

6 +ollection of primary data7information regarding the marketing strategy in the form

of interviews.

6 +ollection of secondary data from reliable internet sites for competitor survey and

latest trends in gas marketing.

6 8eaching out to &)I,9s branch offices like &%!+, &!I to collect data about

&)I,9s current trends.

6 !he current market trend was compared to the historical data and then the

recommendations were given.

6 *tudying relevant official &)I, documents to understand the

organi:ational functioning.

Ana)ysis of GAIL

&)I, has ambitions to be a highly efficient integrated gas company, with interests

from field development and production, through national transmission and imports, to

distribution and allied industries such as petrochemicals. !hese ambitions are not

limited to India, as &)I, is building a portfolio of international upstream and

downstream gas assets. It dominates domestic infrastructure and gas purchasing from

domestic suppliers. ;ith huge potential for growth in Indian gas demand, &)I,

should be able to deliver sustained longterm revenues and earnings appreciation.

* +* ,-.I /* "-MMA!0

&)I, -India. ,imited, a /avartna +ompany is a central %*0 under the administrative

control of 1inistry of %etroleum and /atural &as, which was incorporated in <=2> for

transportation of /atural &as as core business. )s on date, &)I, is operating 2333 $ms of

&as %ipelines across India and has a market share of 2?@ in India. &)I, expanded its

business to ,%&, %etrochemicals, !elecom, +ity &as 'istribution, %ower and

Axploration of BilC &as. !urnover to the company for the year D3<3<<is 8s.ED,>?=

+rores.

In India there is demand of about D23 11*+1' of /atural &as and supply is about <=3

11*+' and there is demand supply gap of about =3 11*+1'. !herefore there is lot of

scope in the growth of /atural &as transportation business. Having a strong distribution

network or in &)I,9s case, a comprehensive pipeline network forms a vital part of its

marketing strategy.

!ype of business &)I, is in and the dynamic and forward approach of &)I, management

C working culture embedded into majority of various working level officers would

instill confidence in any stakeholders mind that &)I, will proactively modify

course7approach to excel in the upcoming competitive scenario in India.

.A1L* 23 ,2#.*#."

,hapter .it)e Page #o.

& Introduction E

$ 8eview of ,iterature 2

4 *tudy on &)I,

E.<. +ompany )nalysis <>

E.D. Indian /atural &as *ector F development C outlook <G

E.E. &lobal gas market overview <2

E.>. Anergy market overviewIndia <=

E.?. +ompetitive ,andscape D3

E.H. /atural gas demand DH

E.G. /atural gas marketing DG

E.2. +ontracts D2

E.=. &as pricing in India E?

E.<3.&as demand supply projection ?D

E.<<.&)I,9s pipeline network ?=

E.<D.%etrochemical marketing HD

E.<E.+ity gas distribution 2?

5 8esults C 'iscussion =D

' +onclusion C *cope of further work =H

6 8ecommendations for improvement ==

( 8eferences <3<

7 Anne8ures

Anne8ure & 9 &as transportation tariffs in India <3D

Anne8ure $ 9 &as 1anagement *ystem <32

Anne8ure 4 9 $ey conversion factors <<<

Anne8ure 5 9 ,ist of abbreviations used <<=

,hapter:&

Introduction

,ompany "napshot

&)I, -India. ,imited operates as a gas transmission and marketing company in

India. It primarily engages in natural gas marketing and transmission activities. !he

company operates and maintains approximately

2333 kilometers of regional pipelines in the western, southern, and eastern regions of

India. &)I, -India. also offers various petrochemical products and services, which

primarily include films, injection molding, master batch, rote molding, and extrusion

coating4 and produces li5uefied petroleum gas and allied products, such as propane

and pentane. In addition, it offers telecommunications products and services4

supplies naphtha tankers4 and engages in retail gas business that includes piped

natural gas distribution, as well as compressed natural gas fuel for transportation

purposes.

"urther, the company, through its joint venture, &ujarat *tate Anergy &eneration, ,td.,

produces power utili:ing natural gas. )dditionally, &)I, -India. engages in

exploration and production activities. It holds participation interests in <D

exploration blocks, including D /A,%I blocks,

H /A,%II blocks, D /A,%II blocks, and D "armin (locks. !hese blocks span from

on land to deep offshore in ;est +oast and Aast +oast of India. It also involves in

li5uefied natural gas import and re gasification, transportation of re gasified

li5uefied natural gas -8,/&., and marketing of 8,/&.

&)I, -India. has joint venture agreements with (harat %etroleum

+orporation ,imited4 &overnment of 'elhi4 (ritish &as %lc4 Indian Bil +orporation

,imited4 Hindustan %etroleum +orporation, ,td.4 &overnment of 1aharashtra4

and Bil and /atural &as +orporation ,imited.

!he company was formed in <=2> under the name &as )uthority of India

,imited and changed its name to &)I, -India. ,imited in D33D.

/ision, Mission and 2;<ectives of GAIL

,orporate /ision

(e the leading company in the natural gas and beyond with global focus, committed

to customer care, value creation for all stake holders and environmental

responsibility.

,orporate Mission

!o accelerate and optimi:e the effective and economic use of /atural &as and its

infrastructure to the benefit of national economy.

,orporate 2;<ectives

!he primary corporate objectives of the company areJ

6 !o focus on all aspects of the gas value chain including exploration,

production, transmission, extraction, processing, distribution of natural

gas and their related processes, products and leveraged services.

6 !o achieve all round excellence in endeavor towards services for the nature

and the people F !he 0ltimate +ustomer.

6 !o relentlessly strive to exceed the expectations of the customers, both

internal and external, and stakeholders by endeavoring to create superior value

through the use of bestinclass standards of operations, technologies and

practices related to safety, health and environment.

6 !o use technology stretched to its limit.

6 !oeenable all aspects of business as far as possible.

Gas Marketing

&)I, sells around ?< @ -excluding internal usage. of /atural &as sold in the

country. Bf this, EG@ is to the power sector and DH@ to the fertili:er sector.

&)I,Ks vast operations and projects includeJ

6 2333 kms of /atural &as highpressure trunk pipelines. )dding another

about ?333 $ms of /atural &as %ipelines in next > years, some are under

implementation.

6 !runk %ipelines with the capacity to carry <?? 11*+1' of /atural

&as across India. )dding another capacity of <E3 11*+1' in next > years.

6 *upplying nearly G3 million cubic meters of /atural &as per day as fuel to

power plants for generation of about ?D33 1; of power, as feedstock for gas

based fertili:er plants to produce about << 11!%) of urea and to over ?33

other small, medium and large industrial units to meet their energy and process

re5uirements.

6 &)I,9s D,233 km long Ha:iraIijaipur#agadishpur -HI#. pipeline and H<3

km 'ahejIijaipur pipeline -'I%,., between them, cater to all the gas based

power plants, fertili:er plants, and industries along the entire ;est/orth

corridor of India.

!hey also provide access to their pipelines, to third parties, for the transmission of

/atural &as. +urrently &)I, transports about 2 11*+1' of /atural &as on behalf

of various shippers.

,ity Gas istri;ution

&)I, was the first company in India to pioneer +ity &as 'istribution project. In

addition to marketing /atural &as through !runk and 8egional !ransmission systems,

&)I, has formed joint venture companies to supply gas to households, commercial

users and the transport sector. ;ithin the short span of <3 years, &)I, has

expanded its +/& business from one company -1ahanagar &as ,td.. in India to eight

companies in India and four companies abroad.

&as supplied by &)I, to retail gas distributors serves more than G.3 ,akhs

automobiles as +ompressed /atural &as -+/&. and over G.?3 ,akhs households as

%iped /atural &as -%/&. in the cities of /ew 'elhi, 1umbai, Iadodara, Iijayawada,

Hyderabad, $anpur, )gra, ,ucknow, %une, $ota, *onepat, Indore, (areilly. &)I,Ks

+ity &as 'istribution initiatives are not confined to India. It has established its

presence in the +/& and +ity &as arenas in Agypt through e5uity participation in

"ayum &as, *hell +/& and /atgas4 and has ac5uired a stake in +hina &as Holding to

pursue +/& opportunities in mainland +hina. &)I, plans to develop +ity &as markets

worldwide in collaboration with global oil and gas majors.

Petrochemica)s

"or &)I,, petrochemicals were part of its master plan for vertical integration

and utili:ation of every fraction of natural gas &)I, uses natural gas as the

feedstock for the manufacture of H'%A7,,'%A. Instead of setting up its plant in

western India -1aharashtra and &ujarat. as was traditionally the case, they opted to

base it in northern India, looking at the large consumer base and demand for plastics.

In doing so, they were able to provide impetus to the regional petrochemical

downstream units to expand their production capacity in view of the proximity of

source of raw material.

In view of difficulties being faced by consumers in changing scenario of market

liberali:ation and opening up of economy to global competitions, &)I, has decided to

revise and modify in terms of gas supply agreements.

However, in the recent past it was further experienced that with the growing market

globali:ation and competition, further corrective and relief measures re5uired to be

extended to other terms and conditions, as the current policy and terms7conditions in

the gas supply contract being somewhat one sided is not able to address problems to

the actual position of gas supplies and market conditions.

%resently &)I, is the major player in natural gas supplies. However there are other

players who have come into the market of natural gas supplies. It would not be long

that these players streamlines their contractual terms and conditions which consumers

may feel to be more attractive. 'ue to years old policy being followed by different

functional groups as an inflexible set of rules to handle the grievances of the

customers, &)I,9s image is at stake.

!herefore &)I, needs to address the changing scenario in more proactive manner

and at same, address long pending customer grievances. !his is how &)I, can endure

competition.

Approach and Methodo)ogy

6 !he analysis is based on the study of the existing marketing practice at

&)I,.

6 +ollection of primary data7information regarding the marketing strategy

in the form of interviews.

6 +ollection of secondary data from reliable internet sites for competitor survey

and latest trends in gas marketing.

6 8eaching out to &)I,9s branch offices like &%!+, &!I to collect data about

&)I,9s current trends.

6 !he current market trends was compared to the historical data and then the

recommendations were given.

6 *tudying relevant official &)I, documents to understand the

organi:ational functioning.

,hapter:$

8eview of ,iterature

"r o m t h e 1 e m o r a n d u m o f 0 nd e r s t a n di n g b e t w ee n 1 o % C / & a n d

&)I, -Ind ia . ,td 32 3 =, i t wa s fou nd ou t th atJ

!he maximum realistic /atural &as 1arketing projections have been derived

based on domestic gas 7 8,/& availability trends during the year

D3323= C D33=<3 -anticipated.. !hese are as followsJ

Axcellent Iery &ood &ood "air %oor

!B!),-1arketing. 2G.33 2E.>G G=.>D G?.EG G<.ED

!B!),-!ransmission. <<>.2< <<3.G> <3?.E> ==.=> =>.?>

!he targets for natural gas will be subject to correction depending upon the actual

5uantity and 5uality of /atural &as received from B/&+ 7 BI, 7 #I 7 %etronet ,/&

,imited7*pot ,/&.

GAIL's Customer Satisfaction Index

+ustomer satisfaction Index aims to translate the customers feedback to improve

operational performance, product and service 5uality. "or the purpose of

calculating +*I, &)I,Ks activities have been divided into following five business

segmentsJ -i. /atural &as, -ii. %etrochemicals, -iii. ,i5uid Hydrocarbons, -iv. ,%&

!ransmission, -v. &)I,!A,

+*I "eedback form has been developed for each business segments product wise.

"eedback form is in the form of 5uestionnaires and is released through 5uarterly

campaigns. +ustomers fill in the feedback form online through internet access.

)verage Luarterly +*I of each (usiness area mentioned is calculated across &)I,.

;eighted average is then calculated based on the percentage contribution of each

(usiness area to &)I,Ks overall turnover. !his ;eighted )verage is reported

5uarterly as &)I,Ks over all +*I.

I n th e r e v ie w r e p or to f / o v e m b e r D 3 3 E b y ! + * ,th e b ac k g ro u n d s o f & ) I , 9 s ac tiv iti e s w e r e

p rov id e d a s f o ll o w sJ

&as )uthority of India ,imited -&)I,., one of IndiaKs leading %ublic *ector

Anterprises, is the largest gas transmission and marketing company in the +ountry.

!he activities of the company range from gas marketing and distribution through trunk

and regional systems, to retailing of natural gas to gas processing for production and

marketing of ,%&, ,i5uid Hydrocarbons and %etrochemicals.

!oday &)I, owns and operates over 2333 km of pipeline and has about 2?@

market share in the natural gas business in India. )lso, more than half of the total

0rea production in India is gasbased, out of which &)I, contributes more than

=3@, thus making a significant contribution to IndiaKs agriculture sector.

&)I, is one of the largest ,%& producers in India, with a li5uid hydrocarbon

production -including ,%&. exceeding < million tones per annum, and it operates the

countryKs largest &asbased ,%& extraction plant. &)I, has now introduced the

concept of ,%& pipelines in India, and is currently operating the worldKs longest

<,D?3 km exclusive ,%& pipeline from &ujarat in western India to ,oni near /ew

'elhi in /orth India. !he project cost is 8s <D.? billion.

&)I, also possesses a vast telecommunication network, which contributes

significantly to the high level of system reliability of operations, online real time

communication and monitoring higher productivity. &)I, project offices have

been set up at the places where the plants, complexes etc. are located.

"or the past five years the company has been winning the KAxcellent %erformance

)wardK from the Indian &overnment. &)I, has its Head5uarters at /ew 'elhi

and the various branch and project offices are located all over India.

&)I, is diversifying in new business areas like wind and solar power and actively

scouting for opportunities in gas based power generation projects. &)I, successfully

commissioned a wind energy power project of >.? 1; capacity in $utch 'istrict of

&ujarat for captive consumption at +ompany9s installations at &andhar, *amakhiali

and $andla in &ujarat. &)I, is planning to set up over <<? 1; of wind based

renewable power projects at investment of nearly 8s G33 crore in various states.

#e= 1usiness Initiatives

&)I, has been reorienting its business approaches and strategies in view of the

emerging competition and entry of formidable national and international players.

&)I,, therefore, is primarily focusing on three major aspects as its short7medium term

strategyJ

6 *ourcing of gas.

6 Axpansion of existing markets and development of new markets

6 Axpansion of existing pipeline infrastructure as well as

development of new pipeline facilities

6 ;ind power projects

2perationa) *8ce))ence

Bperations and 1aintenance of plant and e5uipment plays a pivotal role in the

growth and development of an industry. In the &as Industry where millions of cubic

meters of gas per day are transported through crosscountry pipelines, Bperations and

1aintenance -BC1. assume significant importance. BC1 of pipelines and plants

helps ensure a highly reliable and operationally safe system, providing not only un

interrupted supply of gas to consumers, but also maximi:ing the throughput.

&)I,Ks emphasis is not only on maximi:ing production and sale of natural gas but

also to achieve this with least consumption of energy. Avery effort is centered on

energyefficient operation of the plants, machinery and processes.

!he BC1 arm of &)I, is constantly making efforts to improve upon its performance

in this area. )vailability of the bestdedicated telecommunication7*+)') facilities in

the country has been fully utili:ed for online monitoring of machine7process

parameters along the pipeline. Bbserve, 'etect, )naly:e, +ompare and Improve are the

watchwords for operations on daytoday basis.

8e v ie w i n g t h e In f r a l i n e j o u r n a l J / at u r a l g a s i n I nd i a D 3 3 G , i t w a s f o u n d

t h a t &)I , i s a b o u t t o l a y f i v e n e w / a t u r a l & a s p i p e l i n e s , t h e y a r e J

<. 'adri(awana/angal.

D. +hainsa&urgaon#hajjhar

E. #agdishpurHaldia

>. 'abhol(angalore

?. $ochi$ootanad(angalore71angalore.

Implementation7+onstruction activities have begun in above mentioned

pipelines in phases except #agdishpurHaldia %ipeline.

,hapter:4

"tudy on GAIL

4.&. ,ompany Ana)ysis

&)I, has ambitions to be a highly efficient integrated gas company, with interests from

field development and production, through national transmission and imports, to

distribution and allied industries such as petrochemicals. !hese ambitions are not

limited to India, as &)I, is building a portfolio of international upstream and

downstream gas assets. It dominates domestic infrastructure and gas purchasing from

domestic suppliers. ;ith huge potential for growth in Indian gas demand, &)I,

should be able to deliver sustained longterm revenues and earnings appreciation.

">2. Ana)ysis

6 "trengthsJ

<. +ontrols gas transmission infrastructure4

D. 'ominates gas processing4

E. 1ajor petrochemicals involvement4

>. &rowing international portfolio4

?. *hare of ,/& import projects.

6 >eaknessesJ

<. ,imited financial or operational freedom4

D. +ost and efficiency disadvantages4

E. ,ack of upstream gas exposure.

6 2pportunitiesJ

<. %otential for efficiency gains4

D. !ransmission system upgrading7expansion4

E. %etrochemicals capacity expansion4

>. *trong domestic energy demand growth.

6 .hreatsJ

<. 8ising investment re5uirement4

D. +hanges in national energy policy.

Market Position

*taterun &)I, is responsible for the operation of IndiaKs largest gas transmission

network -at 2,333km. and a <,DH=km ,%& pipeline. !he firm is also one of IndiaKs most

active foreign investors. &)I, owns and operates seven gas processing facilities with

an aggregate production capacity of

<.Emn !%) of ,%&, %ropane, %entane and *odium (en:ene %hosphate -*(%..

&)I, operates the countryKs largest gasfired petrochemicals complex, with an

installed %olyethylene -%A. capacity of ><3,333 !%). &)I, is setting up another %etro

+hemical +omplex through subsidiary in )ssam with an installed capacity of

D23,333 !%). !he firm holds stakes in +ompressed /atural &as -+/&. projects in

1umbai, 'elhi, $anpur, %une, (areilly, ,ucknow, )gra, 0jjain, 'ewas, $ota and

)ndhra %radesh as well as two projects in Agypt and one project in +hina. &)I, is a

partner in a <?H 1; gasfired power plant operated by the &ujarat *tate Anergy

&eneration ,td, as well as the %etronet ,/& consortium that will deliver ,/& to the

Indian market. Bver the past few years, &)I, has diversified into the domestic

AC% sector, holding stakes in << blocks in India and one in 1yanmar.

"trategy

In a recent interview with a news agency, &)I, stated that it planned to invest

I/8?bn during the next five years to purchase e5uity stakes in foreign gas companies

and overseas exploration work. !he Indian firm is interested in picking up an e5uity

stake in AgyptKs #i)e /a))ey ,orporation and exploration concessions in (ra:il, the

%hilippines and 1yanmar. &)I, is also exploring the viability of a subsea gas pipeline

link between an offshore gas field in 1yanmar to India.

Latest eve)opments

#uly D33G saw &)I, declare its interest in buying an e5uity stake in the 0*M<3bn !rans

*aharan pipeline. !he planned >,E33km gas pipeline, which will run from /igeria

through /iger and )lgeria, will have a capacity of D3

E3 bcm and is scheduled to come on stream in D3<?. &)I,Ks representatives have

already met officials from /igeria and )lgeria in (russels to discuss involvement in the

project. &)I, has also signed a deal with B/&+ to pool resources to maximi:e output,

transportation and marketing of gas.

&)I, was due to ink a deal with *hell to gain access to *hellKs Ha:ira ,/& terminal for

import purposes on a toll basis. !he two firms plan to build a 0*M<3mn pipeline that

will connect the terminal to &)I,Ks 'ahej0ran pipeline, thereby rendering Ha:ira a

part of &)I,Ks nationwide gas grid, the largest transmission network in the country.

(oth sides stand to benefit from the proposed project, with India having facilitated

access to gas imports and *hell gaining access to &)I,Ks domestic gas clients,

especially those in the northern markets.

4.$. India #atura) Gas "ector 9 eve)opment and 2ut)ook

6 'eregulation of domestic gas prices has been gradually gathering

momentum with the &oI, after a delay of nearly five years, effecting an

increase in prices in #uly D33? for core sector consumers and deregulating

prices for other consumers. 8,/& has also been successfully marketed by

the offtakers, and private7#I producers have been able to revise prices upwards.

(ecause of these developments, nearly ?3@ of the market today is buying gas at

market determined ratesNa significant change when compared with the scenario

in the recent past.

6 !he price of 8,/& supplied by %,,, the main supplier in the Indian markets

at present, is also expected to undergo a significant change beginning #anuary

D33=, when the currently existing cap is lifted and prices get gradually aligned

with the #++ prices. !he incremental ,/& to be sourced in the Indian market is

also expected to be available at higher prices than contracted hitherto, given the

tight demandsupply levels for ,/& current and envisaged in the global market.

6 8egulatory policies governing the gas sector are with the appointment of the

regulator under the %/&8(.

4.4. G)o;a) Gas Market 2vervie=

6 !he world had <2<.>H trillion cubic meters -tcm. of proven natural gas

reserves at endD33H, according to the (% *tatistical 8eview of ;orld Anergy,

#une D33G. 0nlike oil, where H<@ of global proven reserves are located in the

1iddle Aast, there is a broader distribution of gas reserves across the globe, with

><@ situated in the 1iddle Aast and E?@ in Aurope and Aurasia. !he )sia

%acific and )frica regions have 2@ each of the remainder, with /orth )merica

and ,atin )merica each holding >@.

6 &lobal gas consumption has grown by nearly DG@ over <==HD33H,

compared with oil demand growth of <G@ over the same period.

6 /atural gas is used for several purposes and applications. !he two principal

sources of demand are the industrial and residential sectors, which accounted for

E?@ and EE@ of global gas consumption in D33?, according to the International

Anergy )gency -IA).. 'emand from the commercial and public services sectors

accounts for around <E@, <3@ is used as feedstock for the petrochemicals

industry and around H@ is used in transportation.

6 In addition, as investment in li5uefied natural gas -,/&. increases and the global

,/& trade develops, the gas market may begin to look more like the oil market

over time.

6 !he worldwide trend observed over recent years of a shift from oil to gas

fired power stations, the growing use of gas in enhanced oil recovery -AB8.

processes and unconventional oil production, and global efforts to reduce gas

flaring will underpin rising demand.

4.5. *nergy Market 2vervie=9 India

6 India is the worldKs fifthbiggest energy consumer and continues to grow rapidly.

It is the thirdbiggest global coal producer, but has limited supplies of oil and

natural gas.

6 Bil accounts for about E?@ of IndiaKs total energy consumption, with its share

of the mix having risen from E3@ earlier this decade. IndiaKs ?.H=bn bbl of proven

oil reserves -(% *tatistical 8eview of ;orld Anergy, #une

D33G. represent just 3.?@ of the worldKs total, with 1umbai High being the

biggest producing field. !he 'ecember Bil C &as #ournal survey reports

reserves lower at ?.HDbn bbl. IndiaKs average oil production level -total li5uids.

for D33H was 23G,333b7d.

6 In terms of natural gas, India accounts for 3.>@ of global reserves and just over

<@ of production. )gain, most of the gas resides in 1umbai High. 1ajor natural

gas discoveries by a number of domestic companies hold significant medium to

longterm potential, with !e)iance Industries, 2i) ? #atura) Gas ,orporation

-B/&+. and Gu<arat "tate Petro)eum -&*%+. all reporting significant

deepwater finds.

6 !he oil and gas sector is dominated by stateowned enterprises, although

the government has taken steps in recent years to deregulate the industry and

encourage greater foreign participation.

6 IndiaKs stateowned B/&+ is the largest oil company, dominating the up stream

sector and accounting for roughly three5uarters of the countryKs oil output during

D33H, according to Indian government estimates.

6 !he Indian government has introduced policies aimed at increasing

domestic oil production and oil exploration activity. )s part of this effort, the

1inistry of %etroleum and /atural &as crafted the /ew Axploration ,icensing

%olicy -/A,%. in D333, which permits foreign companies to hold <33@ e5uity

ownership in oil and gas projects. Iery few oil fields are currently being

operated by IB+s.

6 !he Indian 2i) ,orporation -IB+. is the largest stateowned company in the

downstream segment, operating <3 of IndiaKs <G refineries and controlling about

three5uarters of the domestic oil transportation network. !e)iance Industries, a

private Indian firm, opened IndiaKs first privately owned refinery in <===, and has

gained a considerable market share.

6 !here is a focus on greater gas, nuclear and hydro use in the energy mix,

although coal will continue to dominate during the forecast period to D3<<.

4.'. ,ompetitive Landscape

$ey players India Bil and &as *ector

6 B/&+ ,imited

6 Bil India ,imited

6 Indian Bil +orporation ,imited

6 (harat %etroleum +orporation ,imited

6 Hindustan %etroleum +orporation ,imited

6 +hennai %etroleum +orporation ,imited

6 1angalore 8efinery and %etrochemicals ,imited

6 $ochi 8efinery ,imited

6 +airn Anergy

6 8eliance Industries ,imited

6 %etronet ,/& ,imited

6 *hell

6 &ujarat *tate %etroleum +orporation

"he)):"ummary

*hell India is active in lubricants, ,%&, petrochemicals and solar energy. It has moved

into the ,/& business and has also received permission to set up a network of D,333

service stations. (harat *hell ,td -(*,. is a ?<J>= #I that produces and markets a

range of *hellbranded lubricants in India through (%+,Ks retail outlets, authori:ed

dealers and to industrial customers. (%+, agreed to sell its >=@ stake to *hell in

"ebruary D33G. *hell &as -,%&. distributes ,%& in western and central India, while

*hell *olar markets solar powered home lighting units in rural districts of *outh India.

*hell has also opened the 0*MH33mn ,/& terminal in Ha:ira, &ujarat. +apacity will be

doubled to ?mn tpa in two yearsK time and there is scope for a further expansion to <3mn

tpa if the market continues to expand. However, volumes have so far been below

expectations as the government seeks to secure cheaper ,/& contracts.

Petronet L#G:"ummary

%etronet ,/& was set up by the government of India to import ,/& and set up

domestic ,/& terminals. !he companyKs major shareholders include &)I,, B/&+,

IB+, (%+, and Ga@ de "rance. !he #I signed a D?year *%) with !as Laffan L#G

Ltd -8asgas. in <=== for the import of G.?mn tpa of ,/& starting in D33>. %etronetKs

first ,/& terminal, a ?mn tpa facility located in 'ahej, &uj arat, started up operations in

#anuary D33?. !he #I is also planning to construct a second D.?mn tpa terminal in

$ochi, $erala, but the project has been delayed until the end of D3<3. !he key partners in

%etronet are reportedly seeking to sell their interests or seek a winding up of the %etronet

India business.

G"P,: "ummary

In )ugust D33G, Gu<arat "tate Petro)eum ,orporation -&*%+. published a shortlist of

eight IB+s that are interested in ac5uiring a D3E3@ stake in $& B*/D33<73Ethe

'een 'ayal blockin the $rishna&odavari -$&. basin. &*%+, whollyowned by the

&ujarat state government, discovered gas in the $& basin in #une D33?, where it

estimates gas reserves to be around ?HHbcm, alongside un5ualified volumes of

crude oil. !his is the second time &*%+ has shortlisted a number of IB+s to ac5uire an

interest in the project. +urrently, &*%+ holds an 23@ interest in the field, with +anadaKs

Geog)o;a) !esources and IndiaKs Ju;i)ant *npro owning the remainder.

2#G,

" t re n g t h s

6 0nrivalled exploration portfolio4

6 ,eadership in domestic oil and gas supply4

6 &rowing downstream oil presence4

6 &rowing international portfolio.

> e a k n e s s e s

6 ,imited financial or operational freedom4

6 +ost and efficiency disadvantages4

6 'eclining output from mature assets.

2 p p o r t un it ie s

6 Huge cost cutting potential4

6 Higher recovery rates from existing fields4

6 0ntapped domestic oil and gas potential4

6 *trong domestic energy demand growth.

. h r e at s

6 8ising investment re5uirement4

6 ,ongterm decline in oil production4

6 +hanges in national energy policy.

Market Position

B/&+ is the Indian governmentKs main upstream vehicle in what is a largely state

controlled oil and gas sector. !he government owns G>.<>@ of the company, which

accounts for approximately H< @ of IndiaKs crude oil output and

G< @ of natural gas production. It is also diversifying into refining and oil distribution,

while attempting to build an international upstream asset base. B/&+ now owns

2=@of 1angalore 8efinery and %etrochemicals ,td -18%,., which operates an

<=>,333b7d refinery in southwestern $arnataka *tate. !he company has received

authorisation to open a network of H33 service stations, while 18%, was granted

approval in "ebruary D33> to set up ?33 retail outlets. It is E3@ partner to +airn India in

the important new 8ajasthan oil discoveries and has made substantial gas discoveries in

recent months, located mainly offshore in the $& basin.

Aindustan Petro)eum ,orporation Ltd (AP,L)

" t re n gt h s

6 *trong refining and distribution position4

6 *ubstantial retail expansion planned.

>eaknesses

6 ,imited financial or operational freedom4

6 +ost and efficiency disadvantages4

6 ,ack of full integration benefits.

2pportunities

6 *ubstantial cost cutting potential4

6 8efinery upgrading7expansion4

6 Axtension of retail network4

6 *trong domestic energy demand growth.

. h r e at s

6 8ising investment re5uirement4

6 "uels competition from IB+s and Indian groups4

6 +hanges in national energy policy.

Market Position

H%+, is the second largest integrated refining and marketing group in India,

accounting for around DD@of the countryKs refining capacity. !he 1umbai refinery has an

installed capacity of ?.?mn tpa, while the Iisakhapatnam facility has a

G.?mn tpa -<?D,333b7d. capacity. It has a minority stake in the =mn tpa 18%,, although

it recently agreed to sell its stake to the unitKs majority owner B/&+, and also has an

interest in the %etronet ,/& consortium. %roducts are distributed throughout a network

of approximately G,=3= retail outlets.

Indian 2i) ,orporation Limited (I2,L)

" t re n g t h s

6 +ountryKs biggest oil refiner4

6 ,eading fuels distributor4

6 1ajority owner of oil infrastructure.

> e a k n e s s e s

6 ,imited financial or operational freedom4

6 +ost and efficiency disadvantages4

6 ,ack of integration benefits.

2 p p o r t un it ie s

6 *ubstantial cost cutting potential4

6 8efinery upgrading7expansion4

6 Axtension of retail network4

6 *trong domestic energy demand growth.

. h r e a t s

6 8ising investment re5uirement4

6 "uels competition from IB+s and Indian groups

6 +hanges in national energy policy.

Market Position

*taterun IB+ is the countryKs largest commercial enterprise. It holds a E3@ share of the

refinery sector, the countryKs largest retail and oil pipeline networks and a ?H@share of

the fuels segment. !he company owns and operates <3 of the countryKs <? refineries

with a total processing capacity of <.Dmn b7d, e5ual to an approximate >3@ market share.

It also operates the countryKs largest retail network of over 2,333 service stations,

=D aviation fuel stations and G2 ,%& bottling plants, which are served by <2D bulk

storage terminals, installations and depots. 1arket share in the fuels segment is

approximately ?H@, with the inclusion of the D,GH? service stations belonging to its

affiliate I(%. IB+ also operates the countryKs largest network of crude and product

pipelines -G,333km. with a total transport capacity of >E.>?mn tpa.

,ompetitors in the petrochemica)s ;usiness are9

<. 8eliance %etrochemicals

D. Haldia %etrochemicals ,td.

E. Imports

4.6. Gas "upp)y And emand

In terms of natural gas, the region in D33G consumed an estimated >><bcm, with demand

of HGGbcm targeted for D3<D, representing the strongest growth globally -H?.DG@

between D33H and D3<D.. %roduction of an estimated E?3bcm in D33G should reach

?3<bcm in D3<D, but implies net imports rising from an estimated

=<bcm per annum in D33G to <GHbcm in D3<D. !his is in spite of many )sian gas

producers being major exporters. #apanKs share of gas consumption in D33G was an

estimated <=.2>@, while its share of production is minimal. (y D3<D, its share of gas

consumption is forecast to be <?.EG@.

4.(. #atura) Gas Marketing

/atural gas marketing is a relatively new addition to the natural gas industry, beginning

in the mid<=23Ks. %rior to the deregulation of the natural gas commodity market and

the introduction of open access for everyone to natural gas pipelines, there was no

role for natural gas marketers. %roducers sold to pipelines, who sold to local distribution

companies and other large volume natural gas users. ,ocal distribution companies sold

the natural gas purchased from the pipelines to retail end users, including commercial

and residential customers. %rice regulation at all levels of this supply chain left no

place for others to buy and sell natural gas. However, with the newly accessible

competitive markets introduced gradually over the past fifteen years, natural gas

marketing has become an integral component of the natural gas industry. In fact,

the first marketers were a direct result of interstate pipelines attempting to recoup losses

associated with long term contracts entered into as a result of the oversupply

problems of the early <=23s.

!he role of natural gas marketers is 5uite complex, and does not fit exactly into any one

spot in the natural gas supply chain. 1arketers may be affiliates of producers,

pipelines, and local utilities, or may be separate business entities unaffiliated with

any other players in the natural gas industry. 1arketers, in whatever form, find buyers

for natural gas, ensure secure supplies of natural gas in the market, and provide a

pathway for natural gas to reach the enduser.

Assentially, marketers are primarily concerned with selling natural gas, either to

resellers -other marketers and distribution companies., or end users. Bn average, most

natural gas can have three to four separate owners before it actually reaches the end

user. In addition to the buying and selling of natural gas, marketers use their

expertise in financial instruments and markets to both reduce their exposure to risks

inherent to commodities, and earn money through speculating as to future market

movements.

4.7. ,ontracts

%hysical trading contracts are negotiated between buyers and sellers. !here exist

numerous types of physical trading contracts, but most share some standard

specifications including specifying the buyer and seller, the price, the amount of

natural gas to be sold -usually expressed in a volume per day., the receipt and delivery

point, the tenure of the contract -usually expressed in number of days, beginning on

a specified day., and other terms and conditions. !he special terms and conditions

usually outline such things as the payment dates, 5uality specifications for the natural

gas to be sold, and any other specifications agreed to by both parties.

At GAIL, there are three different types of contracts for the Gas to be marketed:

<. )%1 +ontract

D. 8,/& +ontract

E. %1! +ontract

PM. contract:3eatures

*),A )/' %08+H)*A B" &)*

*ellers agree to deliver, on a 'aily basis, to the (uyer one hundred percent -<33@.

of the 'eliverable Iolume of *ales &as at the 'elivery %oint and the (uyer,

provided the &as is made available and tendered for delivery by the *ellers, agrees

to take and purchase, on a 'aily basis, one hundred percent -<33@. of the

'eliverable Iolume of *ales &as provided, however, that *ellers, at *ellers9 sole

discretion

!he 'eliverable Iolume on the date of execution of this +ontract is <G.E

11*+1' e5uivalent to OH<G,2?G 11(!07 'ayP which 'eliverable Iolume

shall vary every Luarter based on the 'elivery %rofile. !he use of 11*+1' in

this +lause D.<-c. is for the purpose of reference only.

Aach of the *ellers shall, severally sell their respective %articipating Interest

share of *ales &as to the (uyer in the 5uantities set forth in this +ontract and the

(uyer shall purchase from each *eller that *eller9s %articipating Interest share of

*ales &as and pay for such *ales &as in accordance with the terms of this

+ontract.

'uring the +ontract %eriod, if there is any )dditional &as from the %anna

1ukta and 1id C *outh !apti "ields that becomes available for sale then the

*ellers shall use reasonable endeavours to sell and deliver such )dditional &as

to the (uyer and the (uyer shall use reasonable endeavours to purchase and

receive the same, at the 'elivery %oint at the *ales &as %rice.

Bn any 'ay, the (uyer may nominate for delivery at the 'elivery %oint a 5uantity

of *ales &as up to the 'eliverable Iolume.

In the event that the *ellers are compelled to shutdown the *ellers9 "acilities

or curtail production for reasons arising out of the (uyer9s inability to take *ales

&as at the 'elivery %oint due to any unforeseen circumstance or an event of

"orce 1ajeure, then the *ellers shall not only be discharged of its obligation to

deliver /ominated 'aily Luantity on such 'ay-s.

Buarter)y .ake or Pay Buantity

6 "or each Luarter there shall be a Luarterly !ake or %ay Luantity.

6 !he aggregate of 'eliverable Iolume for each 'ay in the Luarter4 less Luarterly

*hortfall Luantity for that Luarter4 less !he 5uantities of *ales &as which the

*ellers were prevented from supplying or the (uyer was prevented from receiving

*ales &as due to "orce 1ajeure during that Luarter4 less !he 5uantities of *ales

&as which the *ellers were prevented from supplying or the (uyer was prevented

from receiving *ales &as due to %lanned 1aintenance during that Luarter4 less !he

5uantities of *ales &as which the (uyer rejects as being Bff *pecification &as.

Buarter)y .ake or Pay 2;)igation

If in any Luarter the ac t u a l 5uantity of *ales &as including 1ake 0p &as less

)dditional &as taken by the (uyer -the Actua) Buarter)y Buantity or ABB.

is less than the Luarterly !ake or %ay Luantity -such deficit being the eficit

Buantity., the (uyer shall pay to the *ellers an amount e5ual toJ -Luarterly !ake or

%ay Luantity Q *ales &as %rice. minus -)LL Q *ales &as %rice. "or the purposes of

calculation of Luarterly !ake or %ay obligation, the applicable *ales &as %rice shall be

the !apti &as %rice.

P!I,* A# 1ILLI#G

!he (uyer shall pay each of the *ellers for each 11(!0 of &as on /HI basis

delivered and taken hereunder from the 1id C *outh !apti "ields, a price calculated on

a Luarterly basis of the 1id C *outh !apti %*+ -the !apti &as %rice., which is

incorporated by reference in this +ontract, at a price not exceeding 0*

M?.?G711(!0 being the ceiling price under the terms of the 1id and *outh

!apti %*+ and price not exceeding 0*

M?.GE711(!0 under the terms of the %anna1ukta %*+.

!he *ales &as %rice is calculated excluding taxes and levies. !he (uyer shall

reimburse each of the *ellers any tax -inclusive of sales tax and7or I)!. payable

by each of the *ellers to the &overnment, a *tate &overnment or local authority, on

account of the sale and 7or transfer of title of *ales &as to the (uyer at the 'elivery

%oint. "or the avoidance of doubt, royalty payments under the %*+s shall be

borne by the *ellers. )ll costs downstream of the 'elivery %oint shall be borne by

the (uyer.

32!,* MAJ*-!*

8 e li e f J If by reason of "orce 1ajeure, the *ellers or the (uyer are7is rendered

unable wholly or in part to carry out their or its obligations under this +ontract, then

the liability for failure to meet the obligations of the %arty concerned, as long as and to

the extent that the obligations are affected by such "orce 1ajeure, shall be excused.

If such event or series of events of "orce 1ajeure is not remedied or mitigated

pursuant to discussions between the *ellers and (uyer within E3

'ays of the meeting between the *ellers and the (uyer, then the +ontract may be

terminated at the discretion of the %arty not claiming "orce 1ajeure, following a E3

days notice prior to termination, which notice may only be given after E3 'ays of the

aforesaid meeting.

' u t y to 1 i ti g a t e A ff ec t s o f " o r c e 1 a j e u r e J ) %arty claiming "orce 1ajeure shall

exercise reasonable diligence to seek to overcome the "orce 1ajeure event and to

mitigate its effect on the performance of its obligations under this +ontract and

resume performance of obligations as soon as practicable once the effect of the event

of "orce 1ajeure ceases to exist. !he %arty affected shall promptly notify the other

%arties as soon as the "orce 1ajeure event has been removed and no longer prevents it

from complying with the obligations, which have been suspended and shall thereafter

resume compliance with such obligations as soon as possible.

"-"P*#"I2# A# .*!MI#A.I2#

!he *ellers have not received from the (uyer due payment in accordance with the

terms of this +ontract towards the *ales &as and7or the Luarterly !ake or %ay

Luantity in full -and not merely in part. within the periods specified. I" )/R B" !HA

%)8!IA* +ommits any breach of a material term of this +ontract, and, if that breach is

capable of remedy, fails to remedy that breach within thirty -E3. 'ays of notification

from the *ellers of that breach. "ails to pay to the *ellers a sum due and payable

under this +ontract, within E3 'ays from the date it was due for payment. (ecomes

insolvent or bankrupt or makes a composition or arrangements with its creditors.

1erges with another entity where the surviving entity has not assumed in full the

(uyer9s rights and obligations under the +ontract.

APM ,ontract: 3eatures

6 In this type of contract, the prices of gas transmission are regulated by the

government of India.

6 *hipper pays the transmission charges every fortnight.

6 *hipper also pays the charges towards spur line.

6 !he authori:ed and the unauthori:ed overrun charges are also payable for a

fortnight.

6 )s for billing and payment, the transporter shall deliver electronically, an

invoice as soon as possible to the shipper.

6 "orce 1ajeure remains the same as the %1! +ontract.

6 !hese contracts last for more than <3 years.

6 0ntil the termination of the agreement, the amount of the bank guarantee

as mentioned above shall be as per the amount given in the exhibit for respective

contract years and the shipper shall renew the bank guarantee <? days before its

expiry.

!:L#G ,ontract: 3eatures

6 Aither party may propose to extend the agreement beyond the basic period by

giving notice one year prior to the expiry of the agreement.

6 !he agreement duration is generally for <3 years.

6 *eller and buyer are aware that gas under this agreement and other gas can be

supplied through the same pipeline in a commingled form.

6 "or each contract year, there is )nnual !ake or %ay Luantity

-)!B%L. which will be taken and paid for or paid for if not taken by the buyer.

6 !he )!B%L shall be =3@ of the annual contracted 5uantity.

6 !he buyer shall during each contract year, pay for the )ctual 5uantity of gas

taken or for =3@ of )!B%L for the relevant contract year.

6 !he price of the gas includes basic custom duty, purchase tax and exclusive

of all other taxes, duties and statutory levies. *ales tax, entry tax, any other taxes

and duties shall be payable from time to time.

6 !he buyer has to pay to the seller within E business days after the receipt

of the fortnightly payment statement or seven days for the )!B% whichever is

applicable.

6 !ermination occurs if buyer fails to pay a sum for sixty days or fails to take gas

for a continuous period of three month.

6 !he same occurs if the seller fails to supply gas for a period of three months.

In a nutshell, the variables which actually distinguish the contracts areJ

<. /ame of the contract.

D. +ontract effective date.

E. +ontract expiry date.

>. *upply pressure

?. *hut down

H. !%! charges

G. (illing

2. %ayment duration

4.C. Gas Pricing In India

#atura) Gas Pricing

<. )t present, there are broadly two pricing regimes for gas in the country,

i.e., gas priced under )%1 and non)%1 or free market gas. !he price of )%1

gas is set by the &overnment. )s regards non )%17free market gas, this could

also be broadly divided into two categories, namely, imported ,/& and gas

produced from #I fields. ;hile the price of ,/& imported under term contracts

is governed by the *%) between the ,/& seller and the buyer, the spot cargoes

are purchased on mutually agreeable commercial terms. )s regards #I gas,

its pricing is governed in terms of the %*+ provisions. )t present, out of the total

gas supply of =? 11*+1' in the country, approx. ?? 11*+1' is )%1 gas

and rest is non)%1 gas -D3 11*+1' #I gas and D3 11*+1' 8,/&..

)%1 gas, which comes from the existing fields of B/&+ and BI, given to

them on nomination basis by the &overnment, is on the decline4 while it forms

about H3@ of the total gas available at present, its share is likely to come

down to around <?D3@ by D3<<<D while the 5uantities under 8,/& and #I

production will go up.

D. 1ackground of APM Gas Pricing

$.& Gas Pricing Prior to &CC(

It was decided by the &overnment to fix the prices of natural gas on cost plus

methodology in <=2H the price of natural gap was fixed at 8s.<>3371*+1 by

&overnment w.e.f. E3<<=2G. *ubse5uently, on the recommendation of the

committee under the chairpersonship of 'r. Iijay , $elkar, the price of natural

gas was revised to 8s.l,??371*+1, w.e.f. <<<==D, with provision to increase

the gas price by 8s. <3371*+1 p.a. up to 8s. <2?371*+1 by <==?.

$.$ Gas Pricing >.*.3 %&.&%.&CC(

D.D.< Bn the recommendations of an expert committee on /atural &as pricing

under the +hairmanship of *hri !.,. *ankar, the &overnment decided to shift

gas pricing methodology from cost plus basis to import parity pricing.

)ccordingly, the following pricing mechanism was put into effect from Bctober

<, <==G.

D.D.D !he gas prices were linked to the cheapest alternative li5uid fuelJ

"uel Bil basket -)verage of four fuel oils, vi:.. +argoes "B(, 1ed basis,

Italy -<@ sulphur.4 +argoes +I", /A; basis )8) -<@ *ulphur.4 *ingapore,

"B(, H*"B <23 cst -E.?@ surplus.4 and )rab gulf, "B(, H*"B, <23 cst

-E.?@ sulphur.. with progressively

increased fuel oil parity as given belowJ

0ear D of 3ue) 2i) Parity (2ther

than #.*.)

<==G=2 ??@

<==2== H?@

<===D333 G?@

D.D.E !he +onsumer %rice was, however, subject to a ceiling of 8s.D,2?3 per

1*+1 and a floor of 8s.D,<?3 per 1*+1. !he consumer price of gas was

intended to be reviewed after E years with a view to achieve <33@ "uel Bil

%arity pricing over >th and ?th year, i.e. in D3333< and D33<3D. However,

this did not happen and the price of 8s.D,2?371*+1 continued till

E3.3H.D33?, which was about

E>@ of the then fuel oil prices.

$.4 Pricing Mechanism =.e.f. %&.%(.$%%'.

D.E.< !he consumer price was revised to 8s.E,D3371*+1 for the following

categories of consumers. It was also decided that all the )%1 gas

-estimated at around ?? 11*+1'. will be supplied to only these

categories.

a. %ower sector consumers

b. "ertili:ers sector consumers

c. +onsumers covered under court orders

d. +onsumers having allocations of less than 3.3? 11*+1'.

D.E.D It was decided that the price of gas supplied to small consumers and

transport sector -+/&. would be increased over the next E to ? years to the

level of the market price. ;ith effect from 3H.3H.D33H, the )%1 gas price to

small consumers and +/& sector has been increased to 8s.>H32 7 1*+1.

D.E.E It was decided that the gas price to the consumers other than those

stated in para D.E.<, which were hitherto getting gas at )%1 price through

&)I, network, would be market determined.

*8isting Producer Price ? ,onsumer Price

1ajority of &as produced by B/&+, known as )%1 gas, is currently sold to

&)I, of the price regulated by the &overnment. This price at which ONGC sells

gas to GAIL is known as producer price !he price of this gas does not vary state

wise7offshore areas, instead varies for /orth Aast +onsumers and &eneral

+onsumers -other than /orth Aast +onsumers.. The price at which GAIL sells

the gas procured from ONGC! is called consumer price

E. Pricing of !:L#G

) contract was signed with 8asgas, Latar for supply of ? 11!%) ,/&

-e5uivalent to about <2 11*+1'P by %etronet ,/& ,imited and supplies

were commenced from )pril D33>. !he price for ,/& has been linked to

#++ crude oil under an agreed formula. However, the "B( price for the period

up to 'ecember D332 has been agreed at a constant price of MD.?E711(!0.

!his price translates to 8,/& price of ME.2H711(!0 ex'ahej terminal.

In order to make the price of 8,/& affordable, A&o1 has decided in the

meeting held on <<.<.3G for pooling of prices of ? 11!%) 8,/&

presently being imported from Latar with the price of new 8,/& being

imported on term contract basis. !his 1inistry accordingly issued orders on

H.E.3G, in consultation with 1inistry of ,aw, in compliance with the decision of

A&o1. !he pool price ex 'ahej of 8,/& for various consumers would

be about 0*M

>.=D711(!0.

>. Pricing of Gas under Pre:#*LP Production "haring ,ontracts : PM.

and !avva J/ Gas

>.< %roduction *haring +ontracts were executed by &BI with 8avva consortium

and %1! consortium on Bctober D2, <==> and 'ecember

<D, <==> respectively. %*+s contain the following pricing provisionsJ -in

M711(!0.

-<@ *ulphur.4 *ingapore, "B(,

H*"B <23 est -E.?@ surplus.4 )rab

gulf, "B(, H*"B, <23 est -E.?@

sulphur..

8avva %rice linked to average of "uel Bil

for preceding <D months -E@7E.?@

*ulphur residual fuel oil of

*ingapore, "B(. 8otterdam (arge

and 1ed "B(.

<.G? E.33 )prK=G

>.D In terms of %*+ for %1!, the ceiling prices are to be revised to

<?3@ of =3@ ".B. basket -average of the preceding <2 months., after

G years from the date of first supply. !hus, the revision was due w.e.f. #une D33>

for !apti and "ebruary D33? for %anna 1ukta. !he %1! gas prices have

since been revised. ;hile %1! sells >.2 11*+1' of gas themselves for

the balance 5uantity of about H 11*+1', &)I, paid S ME.2H711(!0

during D33?3H and is paying S

M>.G?711(!0 w.e.f <.>.3H based on countermatching the price offered by

prospective consumers in response to the bid floated by the consortium.

However, this gas is being supplied by &)I, to power and fertili:ers sector

consumers along H(# at )%1 price and adjustments being made through the gas

pool account mechanism in terms of the pricing order of D3.H.D33?. !his pricing

order states that owing to the existing supply linkages and operational

re5uirements, it may well happen that the customers entitled for )%1 gas get

physical supplies of gas produced by the joint venture or from suppliers other

than B/&+7BI, at market price and vice versa. ;ith a view to operationalise

the aforesaid decision, the &as %ool )ccount mechanism would be

utili:ed, with the inflow into the pool account coming from )%1 gas sales to

consumers not entitled for )%1 gas at market price and outflow would be for

purchase of non)%1 gas to supply to the consumers entitled for gas at )%1

price. !his arrangement would be subject to the ceiling of existing available

)%1 gas from B/&+ and BI, -about ?? 11*+1'..

J/ Price formu)a 3)oor

Price

,ei)ing

Price

,ommencement

of gas supp)ies

%1! %rice linked to a basket of

international average of

preceding <D months "uel Bil

prices -+argoes "B(, 1ed

basis, Italy -<@ sulphur.4

+argoes +I", /A; basis )8)

D.<< E.<< #uneK=G!apti

"ebK=2%anna

1ukta

>.E In case of 8avva, the revision of ceiling price is due after ? years from the

date of supply and the revised ceiling price is to be negotiated between the

(uyer and the *eller in good faith. !he price revision for 8avva was due w.e.f.

)pril D33D. !he price revision has been effected w.e.f. #uly <, D33? and

&)I, has been paying S

ME.?3711(!0 since then. !he share of this gas going to )%1 consumers is

being charged by &)I, at )%1 price, with adjustment through gas pool account

mechanism. !he total 5uantity of this gas is around < 11*+1'.

!he following table sums up the prices of some of the most important fields in

the country -mostly shortterm and in small 5uantities.J

Prevai)ing gas prices under various P",s (Ju)y $%%()

!he prevailing prices as per signed contracts under various %*+s areJ

#ame of

1uyer

Appro8imate Euantity Price 1asis

Panna:Mukta ? .apti

&)I,

?.G 11*+1' from

<.>.D33?

M E.2H711(!0 "ixed %rice

? 11*+1' from M >.G?711(!0

<.>.D33H for D years

&*%+,

&&+,,

I%+,, 8II

>.H 11*+1' from

<.>.D33? to 1arch D33H M >.32711(!0 "ixed %rice

&*%+,

&&+,,

I%+,, 8I,

<.2 11*+1' from

<.>.D33H to 1arch D332 M ?.G3711(!0 "ixed %rice

!orrent

%ower

3.= 11*+1' from /ew

revised plan of development

-/8%B'. &as scheduled

from *eptember D33G -total

expected gas production from

/8%B' is ?.?

11*+1'.

M >.G? 11(!0 "ixed %rice

80I0/,

<.? 11*+1' from /8%B'

&as scheduled from

*eptember D33G

M >.H3711(!0 "ixed %rice

&&+,

<.H? 11*+1' from

/8%B' &as scheduled from

*eptember D33G

M ?.G3711(!0 "ixed %rice

!avva

&)I,

<.<3 11*+1' from existing

discoveries of 8avva

< 11*+1' from

*atellite field

M E.?3711(!0

effective from <st

#uly D33G

M >.E3711(!0

effective from

*eptember D33H

"ixed %rice

Lakshmi ? Gauri

&*%+ 3.<? 11*+1'

M ?.?3711(!0

#uneK3G

"ixed %rice

&%A+ 3.= 11*+1'

M>.G?711(!0

/ovK3H

"ixed %rice

&&+, 3.? 11*+1'

M >.H3711(!0

#uneK3H

"loor price is

M

E.<<711(!0

and ceiling is

M

>.H3711(!0

%rice linked

up with =?@

crude basket and

?@ with /aptha

(heema

+(B//

D33373D

3.E 11*+1'

M >.?371+" which is

e5uivalent to

M>.?3711(!0

"ixed %rice

!he only long term contract in the country was the G year contract

with %anna 1ukta !apti fields as detailed belowJ

Gas price

(-"F

mm;tu)

.erms of sa)e

#ature

of Gas

price

Buantity

(MM",M)

,ontract term

(uyer J &)I,

-for various power,

fertili:er and

industrial users.

D.<< to E.<< "loor

D.<<

+apE.<<

<3 G years -upto

D33>3?.

It said that as can be seen, from the above tables, gas prices are much lower for

long term contracts and with larger volumes than short term contracts with small

5uantities.

?. Pricing of Gas >ith !eference to #*LP Provisions9

)s per the provisions of %*+ under /A,%, the price of natural gas for sale to

consumers shall be market driven. %rior approval of 1o%/& has to be

obtained for the formula or the basis on which the price is fixed. It has been

provided that the +ontractor shall sell all /atural &as produced and saved

from the +ontract )rea by armslength transactions.

Gas Poo) Account

In <==D, the &overnment established the &as %ool )ccount in order to encourage the

development of the gas industry in India and to compensate the companies involved

in the exploration, development and marketing of gas for the low margins on the

development and sale of gas at prices fixed by oil ministry. !he landfall price and

producer price is credited to the gas pool account. &)I, maintains the &as %ool

)ccount on behalf of the government.

0nder the current pricing mechanism, &)I, collects 8s. D.? billion every year from

natural gas consumers on behalf of the gas pool account. !his sum is used for the

following purposesJ

i. %ayment of higher international gas prices for the new jointventure companies4

ii. +ompensation to Bil India ,imited -BI,. for subsidi:ing prices in the /orthAast4

iii. +ompensation to &)I,7BI, for increases in operating cost4 and

iv. Axploration and development of smaller fields.

!he balance is transferred to the +entral Axche5uer. &as %ool )ccount has now been

dismantled.

2ptions for gas pricing po)icy

!he %roduction *haring +ontracts -%*+s. provide for pricing of gas on the basis of sale

on armslength basis. !he role of the &overnment is to approve the valuation of gas

for the purpose of determining &overnment take. In order to provide transparency in

approving valuations, the &overnment formed a +ommittee in )ugust D33H to

formulate guidelines for approving natural gas price formula 7 basis for giving

&overnment approval under the %roduction *haring +ontracts.

!he +ommittee was headed by #oint *ecretary C "inancial )dvisor, 1inistry of

%etroleum C /atural &as and had 'irector &eneral, 'irectorate &eneral Hydrocarbons

and concerned #oint *ecretaries as other members. !he +ommittee held extensive

consultations with various stakeholders, including the producers as well as the

consumers, besides other expert organi:ations, before finali:ing its report. !he

+ommittee has recommended that in all situations where a price discovery through

competitive bidding is possible, there should be no need to apply any other principle

for valuation of gas. Bnce a marketdetermined price has been discovered between the

suppliers and customers through a transparent competitive bidding process, there should

be no need for the &overnment to interfere with the same.

"urther, it has said that in the absence of a market determined price discovered

through a transparent bidding process, where valuation of gas has to be necessarily done

by &overnment, it may be done based on the price in the most recent competitively

determined contract in the region duly indexed to the present. Indexation is to be done

as per provisions of the market determined reference contract, as each market

determined contract sets out various terms and conditions of supply, including

the price review mechanism.

!he +ommittee has noted that each contract, normally, has a price review clause every

five years. If the price stands reviewed as per the reference contract, that may become

the new reference price. "or interim periods, the +ommittee has recommended that

indexation may be linked to percentage increase in price of cheapest li5uid fuel, i.e.,

"urnace Bil -"B., which is not only the cheapest li5uid fuel but has also shown

least price volatility in recent years. It was of the view that the above valuation may be

applied only when actual supply has commenced and the price has not been discovered

through the market mechanism. However, if the actual price, at which any producer

supplies to any consumer, is higher than the one arrived at by the above methodology,

then the higher price is to be reckoned for &overnment take. It would be ideal if the

+ommitteeKs approach had never to be applied, but if the eventuality does arise, '&

'&H and 'irector, %%)+ will do the calculations based on +ommitteeKs

recommendations. It would be '&HKs responsibility to ensure that the %roducer remits

the &overnmentKs take accordingly.

!he &overnment has since issued orders for constitution of an Ampowered &roup of

1inisters to consider issues pertaining to pricing of natural gas produced in the country.

!he A&o1 has held two meetings, which were inconclusive. ) subcommittee of

senior brass from the 1inistries of "inance, ,aw, %ower, %etroleum, %lanning

+ommission and A)+ is currently looking into the pricing formula proposed by

8I, for pricing its gas for 'H block in $& basin. !he recommendation of this sub

committee are likely to be submitted shortly to the A&o1, expected to meet on

*eptember <D, D33G.

Issues re)ated to supp)y and pricing of natura) gas (Ju)y $%%()

6 /atural &as meets only 2.?@ of the total energy re5uirement of the country

as against ?H@ share of coal. !he country has natural gas reserve of EG !+"

which is about is 3.H@ of the world natural gas reserve. !he fertili:er and power

sectors are the major consumers of natural gas used in the country. ;hile G=@ of

the gas re5uirement of the fertili:ers plants is being met presently, another G.GE

11*+1' of gas is re5uired for meeting the shortage of existing gas

based plants. "or conversion of /aphtha and "B7,*H* based fertili:er units,

about >3 11*+1' would be re5uired. !hus, the total re5uirement for the

fertili:er sector would be about 2H 11*+1'. )gainst the projected demand of

gas of DG=.>E 11*+1' in D3<<<D, total conservative estimate of supply is

<=<.>D 11*+1', leaving shortfall of about 22 11*+1'. !his would need

to be met through imports and expeditious action on the exploration and

development of discoveries in the domestic area.

6 Bn the gas pricing front, the 1o%C/& informed that the system of

<33@ &overnment controlled pricing mechanism is being replaced by free

market pricing through deregulation. (efore <==G &overnment fixed the price

of natural gas on cost plus methodology. *hri !.,.

*hankar +ommittee recommended to shift gas pricing methodology from cost

plus basis to import parity pricing. However, consumer price continued to be

regulated at E>@ of then fuel oil prices till D33?. !he pricing mechanism of gas

under pre/A,% production sharing contract is determined by linking it to a

basket of international average of preceding <D month fuel oil prices with a

floor and ceiling.

6 0nder /A,% regime, the contractor makes an upfront commitment of risk

money without any liability on the &overnment. !he full development cost is

recoverable in the event of discovery. !he cost recovery limit and profit

petroleum sharing split are biddable parameters. !he management committee

works as approval body for the development plan submitted by the contractor.

%rofit share is determine by pretax investment multiple -%!I1. formula which

rewards the &overnment only at higher levels of revenues.

6 0nder the %roduction *haring +ontract -%*+., the contractor is free to market

gas in the domestic market subject to the policy of the &overnment on gas

utili:ation. )rticle D<.H.< allows contractor to sell all natural gas from the

contract area at arms length prices to the benefits of parties to the contract.

0nder )rticle D<.H.E, the &overnment has the right to approve the gas price

formula keeping in view the prevailing gas pricing policy including the policy, if

any, on linkage of gas prices with li5uid fuels. 1inistry of %etroleum C

/atural &as have drawn up a set of guidelines for approving gas price7 formula

for the purpose of determining &overnment take under /A,% contracts. !hese

provide for valuation based on the most recent competitively determined

price in the region duly indexed to the present.

6 $&';/=27E %*+ provides for the &overnment to take its share of profit

petroleum in cash or kind by exercising such an option on an annual basis. *o

far the &overnment has not exercised its option to take any gas in kind

separately and entire profit petroleum has flowed to the &overnment in cash

in all %*+s. In case the &overnment decides to take its share in kind, the

following issues would need to be settled firstJ

i. !he &overnment would have to designate a &overnment nominee,

ii. !he price of such gas would have to be at par with the price of gas fixed

by the contractor in order to avoid financial losses accruing in the

consolidated fund of India,

iii. In view of the uncertainty in estimation of profit gas, the &overnment

nominee may have to keep its infrastructure idle in the years when profit

gas level fluctuates to a lower level.

6 1inistry of %ower stated that the construction of pipeline is linked to the

production centre unlike the transmission part in the power sector which is

insulated from the power production entities. )s opposed to tariff based bidding

in the power sector, the producer linkage for the construction of pipeline makes

the system monopolistic. In reply, 1inistry of %etroleum and /atural &as stated

that the risk taking is discouraged by providing advance tieup with producer

agencies before granting /B+ for the construction of pipeline. However, the

tariff for transportation would be regulated.

6 'epartment of "ertili:er stated that the &ovt. had directed that fertili:er

sector should get priority in natural gas allocation. !he &ovt. had also approved

the conversion of nongas based fertili:er plants to gas based. It added that

India could emerge as the potential hub for urea manufacture, which would

re5uire additional =? 11*+1' of gas by the year D3<<<D. It also suggested

that certain e5uali:ation of gas prices would be necessary so that fertili:er

availability at all places could be ensured.

6 %lanning +ommission en5uired whether the Indian fertili:er

companies would be able to compete in the international market as they

function under protected environment. It also opined that the freight

e5uali:ation for natural gas may not be possible. In reply to his 5uery on

optimal production profile, '&H informed that the production profile

determine the 5uantum of output technically possible over the life cycle of the

source and the contractor cannot change the production without prior approval.

6 '&H informed that the yearwise activity and development plan are approved

by the 1anagement +ommittee. '&H also undertakes audit of the technical plan,

production profile and costs.

6 It was observed that 1inistry of %etroleum and /atural &as should firm up

demand and supply projections and draw up action plans with timelines for

ensuring that the projected supplies become available. !hese may be included in

the revised agenda note for A++ along with issues, if any, re5uiring decisions. It

was also observed that the following issues would re5uire further discussions

with stakeholders before firming up the recommendations on pricing

formula7basis for the gas from $&';/=27E J

i. the %*+ stipulation relating to +)%AT, the system of approval of the

developmental plan, production profile, technical plan, the system of audit by

the &overnment and the need to make the system more transparent4

ii. the details and methodology for the administration of the provisions of %*+

providing sale of natural gas produced from the contract area at competitive

arms length prices4

iii. the gas utili:ation and pricing policy4

iv. the gas price formula and steps of the bid process submitted by 17s 8eliance

India ,td to the 1inistry for their approval including the rule for market

clearing4

v. ;hether to exercise the option for taking profit gas in kind or cash U

!he +onsumer %rice of /atural &as, 8,/& and HI# 7 'I%, 7 '0%, !ransmission

!ariff and 1arketing 1argin, adopted for computing the financial targets are given in

the following tableJ

(!s.FG222 ",M)

Item Price

'omestic &as )%1 ED33

'omestic &as )%1 -V?3333 *+1' etc.. >H32

'omestic &as 1arket 'riven G?=H

'omestic &as /A 8egion )%1 <=D3

'omestic &as /A 8egion -*mall +onsumers. DGH?

'omestic &as /A 8egion 1arket 'riven ED33

%anna 1ukta !apti #I &as G?=H

8avva #I &as ??=G

8avva *atellite H2GG

8,/& -%ooled. Butside &ujarat 2DED

8,/& -%ooled. Inside &ujarat G=<?

!ransmission !ariff -HI# 7 'I%,. =?>

!ransmission !ariff -'0%,. <3EG

1arketing 1argin 8,/& -,eveli:ed. DD>

4.&%. Gas emand "upp)y Pro<ection

Petrochemica)sF!efineriesFInterna) ,onsumption and "ponge IronF"tee) and

other industries !he current demand as per the industry estimates in the

%etrochemicals78efineries and Internal +onsumption -of &as Industries. sectors is

about D?.EG 11*+1' in D33?3H. )n annual growth rate of about G percent is

assumed during the TI plan period, which would result in a demand of EE.D?

11*+1' by the terminal year of the TI %lan.

*imilarly, the sponge iron7steel sector is also expected to grow at the same rate of G

percent from the current level of H 11*+1', reaching a level of

G.2H 11*+1' by the terminal year of the TI plan.

!he demand from various sectors has been compiled in the 8eport by

;orking &roup as given belowJ

"ector >ise Gas emand Pro<ections ($%%(:$%&$)

$%%(:%7 $%%7:%C $%%C:&% $%&%:&& $%&&:&$

%ower G=.G3 =<.D3 <3D.G3 <<>.D3 <DH.?G

"ertili:er ><.3D >D.2= ??.=3 GH.DH GH.DH

+ity &as <D.32 <D.=E <E.2E <>.23 <?.2E

Industrial <?.33 <H.3? <G.<G <2.E2 <=.HH

%etrochemicals78efineries7Internal

+onsumption

D?.EG DG.<? D=.3? E<.32 EE.D?

*ponge iron7*teel H.33 H.>D H.2G G.E? G.2H

.ota) &(C.&( &C6.65 $$'.'$ $6$.%( $(C.54

&5%

&$%

&%%

7%

6%

5%

$%

%

$%%(:

%7

$%%7:

%C

$%%C:

&%

$%&%:

&&

$%&&:

&$

Po=er

3erti)e@e

r

,ity Gas

Industri

a)

Petrochemica)sF!

efi neries

"ponge ironF"tee)

2vera)) Gas "upp)y pro<ections during +I P)an

!he supply projected by B/&+ and BI, in the %lan period is expected to fall

from ?G.D2 11*+1' in D33G32 to ?<.32 11*+1' in D3<<<D. *upply from

%rivate players7#Is is expected to increase from DE.DH 11*+1' to about

?G.DD 11*+1' in D3<<<D. !his increase from private players, considered in

the ;orking &roup report, is primarily due to the >3 11*+1' gas supply

addition from 8I, from D3323= onwards. '&H had then projected expected

additional supplies of D3, E3 and >3 11*+1' from 8I, fields in D33=<3,

D3<3<< and D3<<<D respectively and ?> 11*+1' from &*%+ in each of the

above years. However, later '&H has increased the expected availability of natural

gas from $& '7H blocks to 23 11*+1'. '&H has also indicated that the

anticipated availability of gas from &*%+ fields would be >.? 11*+1' by D3<<

<D.