Succession Case Digest Art. 863-1044 (Compiled)

Diunggah oleh

Charmaine MejiaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Succession Case Digest Art. 863-1044 (Compiled)

Diunggah oleh

Charmaine MejiaHak Cipta:

Format Tersedia

RAMIREZ V.

RAMIREZ (1982)

TESTATE ESTATE OF JOSE EUGENIO RAMIREZ, MARIA LUISA PALACIOS,

Administratrix, petitioner-appellee,

vs.

MARCELLE D. VDA. DE RAMIREZ, ET AL., oppositors, JORGE and ROBERTO

RAMIREZ, legatees, oppositors- appellants.

DOCTRINE: Some commentators of the Civil Code have expressed the opinion that a

fideicommissary substitution is in fact a disguised case of successive institutions. This is because

both the first and the second heirs inherit from the testator and not from one another. The

beneficial use and possession of the inheritance are first given to the first heir for a lifetime at

most, and thereafter transferred to the second heir. The law requires that the first and second

heirs must be one degree apart from each other. This limitation became the objective of two

divergent views. One view holds that the one degree apart rule refers to one transfer. Ramirez

settled the controversy by holding the more restrictive view.

In an obiter, the Court opined that the constitutional prohibition against alien ownership

of land does not permit an alien to acquire the same by testamentary succession. Would such a

ruling apply to a case where the foreign beneficiary is both a testamentary and a compulsory

heir?

FACTS: Jose Eugenio Ramirez, a Filipino national, died in Spain on December 11, 1964, with

only a widow as compulsory heir. His will was admitted to probate by the CFI of Manila

1. The widow Marcelle is a French who lives in Paris, while the companion Wanda is an

Austrian who lives in Spain

2. The administratrix submitted a project of partition as follows: the property of the

deceased is to be divided into two parts. One part shall go to the widow en pleno

dominio in satisfaction of her legitimee; the other part or free portion shall go to Jorge

and Roberto Ramirez en nuda propriedad. Furthermore, 1/3 of the free portion is

charged with the widows usufruct and the remaining 2/3 with a usufruct in favor of

Wanda.

3. Jorge and Roberto opposed the project of partition on the ground that the

fideicommissary substitutions are invalid because the first heirs are not related to the

second heirs or substitutes within the first degree, as provided in Art. 863 of the Civil

Code.

ISSUE: WON the fideicommissary substitutions are invalid.

HELD: Yes, the appellants are correct in their claim that it is void.

The substitutes (Juan Pablo Jankowski and Horace V. Ramirez) are not related to Wanda, the

heir originally instituted. Art. 863 of the Civil Code validates a fideicommissary substitution

provided such substitution does not go beyond one degree from the heir originally instituted.

The word degree was construed as generation and this interpretation has been followed in the

present Code, by providing that the substitution shall not go beyond one degree from the heir

originally instituted. The Code this clearly indicates that the second heir must be related to and

be one generation from the first heir. It follows that the fideicommissary can only be either a

child or a parent of the first heir. These are the only relatives who are one generation or degree

from the fiduciary.

There is no absolute duty imposed on Wanda to transmit the usufruct to the substitutes as

required by Arts. 865 and 867 of the Civil Code. In fact, the appellee admits that the testator

contradicts the establishment of a fideicommissary substitution when he permits the properties of

the subject of the usufruct to be sold upon mutual agreement of the usufructuaries and the naked

owners.

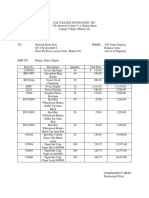

The Court ordered to distribute the estate of Jose Eugenio Ramirez as follows:

thereof to his widow as her legitime;

thereof which is the free portion to Roberto and Jorge Ramirez in naked ownership and the

usufruct to Wanda de Wrobleski with a simple substitution in favor of Juan Pablo Jankowski and

Horace V. Ramirez.

VDA. DE MAPA V COURT OF APPEALS

G.R. No. L-38972 September 28, 1987

PAZ GARCIA vda. de MAPA, * SEGUNDO MAPA, PRISCILLA M. MONZON,

TERESA MAPA, IGNACIO SALAZAR AND JOSE SALAZAR, petitioners,

vs.

COURT OF APPEALS, LUIS HIDROSOLLO and TEODORO HIDROSOLLO, in their

own behalf and as Joint Administrators of the testate estate of LudovicoHidrosollo, and

VICTORIA ** HIDROSOLLO, CORAZON HIDROSOLLO, ROSARIO HIDROSOLLO

and MAGDALENA HIDROSOLLO, respondents.

Doctrine:

Mapa resolved a dispute between two sides of a family with respect to the interpretation of a

testamentary disposition obligating the surviving husband to deliver to the nephews and nieces

(both on the side of the deceased and on his side) the residue of the entire estate. Claimants

advance the theory that the obligation of the surviving husband constituted either (a) an express

trust, or (b) an institution subject to a fideicommissary substitution. It will be noted that if the

testamentary disposition were to be treated as a fideicommissary substitution, the substitution

would have been void since the second heirs are not related to the first heir within the first degree

by consanguinity, as required in Ramirez v Ramirez, infra. If the substitution were to be declared

void, the surviving husband would have inherited the residue of the estate free and clear of any

condition or encumbrance. Consequently, upon his demise, the nephews and nieces comiong

from the side fo the deceased wife would be excluded from participating in the distribution of the

properties. It is worthwhile noting that the properties in question were largely from the estate of

the deceased wife.

If equity were to be taken into account, the decision of the Supreme Court would seem to

be correct. However, the decision fail to argue convincingly that the testatrix indeed intended to

constitute a trust.

FACTS:

1. The petitioners in this case are nephews and nieces of the late Concepcion Mapa de

Hidrosollo (Concepcion) while the respondents are the nephews and nieces of the late

LudovicoHidrosollo (Ludovido), husband of Concepcion. Ludovico died later than Concepcion.

2. On Jan. 16, 1965, the petitioner, Paz Garcia vda. deMapa (Paz) instituted before the CFI-

Manila a civil case to recover from the estate of the late Lucovico the properties left by the late

Concepcion. In her Last Will and Testament, Concepcion instituted Ludovico as universal heir to

the residue of her estate with the obligation as trustee to hold the same in trust for petitioners, her

nephews and nieces. Ludovico, however died, without fulfilling the obligation so that the estate

of Concepcion formed part of the estate of Ludovico.

3. The petitioners prayed that judgment be rendered either:

a. declaring a trust to have been created in their favor and their co-beneficiaries over the

residue of the estate of Concepcion and ordering the respondents, Luis and TeodoroHidrosollo,

as administrators, to turn over to the petitioners 6/13 of the properties of Ludovico to them OR

b. declare that the fideicommissary substitution with Ludovico as first heir and the

petitioners and their co-beneficiaries as fideicommissaries be null and void and that Concepcion

died intestate, and declaring them to be Concepcions only heirs to the residue of her estate and

ordering the administrators of Ludovicos estate to turn over Concepcions properties.

4. The respondents alleged that Ludovico, being the surviving spousebecame the universal heir

when Concepcion died without descendants or ascendants; and that as such universal heir,

Ludovico stepped into the rights, title and claims of the deceased Concepcion, so that the

controverted properties became part of his own estate.

5. The lower court ruled that a trust had been created in favor of the petitioners and their co-

beneficiaries and ordered the administrators of the estate of Ludovico to reconvey the properties

to them.

6. When the respondents appealed to the CA, the decision was reversed. According to the CA,

neither trust nor a fideicommissary substitution was created in Concepcions will. And even if a

trust had been created, the claim for reconveyance was barred by final judgment, i.e. the order

denying their motion to intervene in the proceedings which settled Ludovicos estate.

ISSUE: WON a trust was created in favor of the petitioners?

HELD: YES.

1. In Concepcions will, Ludovico was instituted as the sole and universal heir to the rest of the

properties not covered by the legacies. In addition, Ludovico was charged with the obligation to

deliver the rest of the estate in equal parts to the nephews and nieces of both Concepcion and

Ludovico.

2. While the word trust does not appear in the will, it was the testatrixs intent to create one, as

clearly demonstrated by the stipulations in the will. In designating Ludovico as the sole and

universal heir with the obligation to deliver the properties to the nephews and nieces,

Concepcion intended that legal title should vest in Ludovico, and in significantly referring to the

petitoners and their co-beneficiaries as beneficatios, she intended that the beneficial or

equitable interest in the properties should repose in them.

3. According to the Supreme Court, these designations, coupled with the other provisions

concerning co-ownership and joint administration of the properties, as well as the other

conditions imposed by the testatrix, effectively created a trust in favor of the parties over the

properties referred to in the will.

4. As Concepcions surviving spouse, Ludovico, is however entitled to of her estate as his

legitime. Thus, the trust created by Concepcion should be effective only on the free portion of

her estate.

Dispositive:WHEREFORE, the decision of the Court of Appeals in CA G.R. No. 40448-A is

hereby reversed. Private respondents Luis and TeodoroHidrosollo or their successors as

administrators of the estate of LudovicoHidrosollo are hereby ordered to deliver to petitioners

their lawful shares in the trust constituted over the freeportion of the estate of Concepcion

Mapa. Said Luis and TeodoroHidrosollo or their successors are further ordered to render an

accounting of the income of the properties pertaining to petitioners and to deliver to the latter the

net proceeds of such income.

CONSOLACION FLORENTINO DE CRISOLOGO V. MANUEL SINGSON, 4 SCRA 491

(1962)

FACTS: Dona Leona Singson died testate, leaving a property in Ilocos Sur to her brothers

(Evaristo, Manuel and Dionisio Crisologo) and her niece, petitioner Consolacion Florentino.

1. Petitioners filed an action for partition against respondent Manuel Singson in connection

with a property located in Ilocos Sur. They alleged that the subject property was co-

owned in share by both parties (Consolacion and Manuel) by virtue of the probated

will of the testator Dona Leona Singson.

2. Singson, on the other hand, contended that Consolacion was a mere usufructuary and not

a co-owner of the property, and hence, was not entitled to demand partition

ISSUE: WON the testamentary disposition in the testators will provided for sustitucion vulgar

(vulgar substitution) or for a sustitucion fideicomisaria (fideicommissary substitution)

HELD: The last will of the decedent established a mere vulgar substitution, the substitution

Consolacion Florentino by the brothers of the testatrix to be effective upon the death of

Consolacion, whether it happens before or after that of the testatrix.

A careful perusal of the testamentary clause shows that the substitution is not expressly made of

the fideicommissary kind, nor does not contain a clear statement that Consolacion, during her

lifetime, shall only enjoy usufructuary rights over the property bequeathed to her, since naked

ownership was vested to the brothers of the testatrix. The provision in question merely provides

that upon Consolacions death, whether this happens before or after that of the testatrix, her share

shall belong to the brothers of the testatrix.

DISTINCTION BETWEEN VULGAR SUBSTITUTION AND FIDEICOMMISSARY

SUBSTITUTION

If the clause in the will created a vulgar substitution, the result would be that Consolacion, upon

the death of the testatrix, becomes the owner of the undivided of the property. But if the clause

provided for a fideicommissary substitution, Consolacion acquires only usufructuary rights over

the pro-indiviso share.

In fideicommissary substitution, the fiduciary does not acquire full ownership of the property

bequeathed by the will, but mere usufructuary rights thereon until the time came for him to

deliver said property to the fideicommissary; it is obvious that the nude ownership is passed to

another person other than the fideicommissary.

To constitute fideicommissary substitution, there must be an obligation imposed on the first heir

(fiduciary heir) to preserve and transmit to another (fideicommissary heir) the whole or part of

the estate bequeathed to him, upon his death or upon the happening of a particular event. For

this reason, Art 785 Old Civil Code provides that a fideicommissary substitution shall have no

effect unless it is made expressly either by giving it such name, or by imposing upon the first

heir the absolute obligation to deliver the inheritance to a substitute or second heir.

RODRIGUEZ v COURT OF APPEALS

No. L-287334, 28 March 1969

27 SCRA 546

A testamentary disposition prohibiting the alienation of the hereditary estate for a period exceeding

twenty years is void. However, the Court has ruled that the nullity refers not to the prohibition to

alienate, but to the prohibition in excess of the first twenty years.

Justice Fernando made a cryptic statement in the penultimate paragraph of the decision. He

opined that the intestate heirs may never even have the right to challenge the question provision of

the will which created the trust. Is he suggesting that the said intestate heirs (first cousin of the

testatrix) must survive the twenty year period in order to have the personality, at that time, to

challenge the trust? If so, is there a suggestion that the successional right of the intestate heirs would

ripen only if they survive the period? This point is important for two reasons: (a) the first cousins

are relatives of the testatrix within the fifth degree, and beyond which relationship with the testatrix

is no longer recognized by law; (b) the said first cousins, assuming they do not survive the twenty-

year period, cannot, under the present law, be represented by their own respective descendants.

FACTS:

The disputed clause reads thus:

[Clausula Decima o Pang Sampu]. Ipinaguutos ko na ang mga pag-aaring

nasasabi sa Clausulang ito ay pangangasiwaan sa habang panahon, at ito nga ang

ipagbubukas ng "Fideicomiso" sa Juzgado sa pagkatapos na maayos ang naiwanan

kong pag-aari. Ang pangangasiwaang pag-aari ay ang mga sumusunod: x x x.

Ang lahat ng pag-aaring nasasabi sa Clausulang ito (hindi kasama ang "generator"

at "automobile") hindi maisasanla o maipagbibili kailan man, maliban sa pag-

aaring nasa Quezon Boulevard, Maynila, na maaring isanla kung walang pondo na

gagamitin sa ipagpapaigi o ipagpapagawa ng panibago at alinsunod sa kaayusang

hinihingi ng panahon.

ISSUE:

WON the testamentary disposition prohibiting alienation after the twenty-year period IS void.

HELD:

In the language of a Civil Code provision:

If a testamentary disposition admits of different interpretations, in case of doubt,

that interpretation by which the disposition is to be operative shall be preferred.

Nor is this all. A later article of the Civil Code equally calls for observance. Thus:

The words of a will are to receive an interpretation which will give to every

expression some effect, rather than one which will render any of the expressions

inoperative; and of two modes of interpreting a will, that is to be preferred which

will prevent intestacy.

Moreover, so compelling is the principle that intestacy should be avoided and the wishes of the

testator allowed to prevail that we could even vary the language of the will for the purpose of giving

it effect. Thus:

Where the testator's intention is manifest from the context of the will and

surrounding circumstances, but is obscured by inapt and inaccurate modes of

expression, the language will be subordinated to the intention, and in order to give

effect to such intention, as far as possible, the court may depart from the strict

wording and read a word or phrase in a sense different from that which is ordinarily

attributed to it, and for such purpose may mould or change the language of the will,

such as restricting its application or supplying omitted words or phrases.

A more recent reiteration of such an attitude is found in an opinion by former Chief Justice

Paras. Thus:

As a closing observation, it is not for us to discover the motives of Oliva Villapana

in leaving her properties to the person named in the will, and omitting therefrom the

oppositors-appellees. Suffice it to state that the trial court itself found the will to

have been executed free from falsification, fraud, trickery or undue influence, with

Oliva having testamentary capacity; and in such a situation it becomes our duty to

give expression to her will.

Nothing can be clearer, therefore, than that petitioners could not challenge the provision in question.

It had no right to vindicate. Such a right may never arise. The twenty-year period is still with us.

What would transpire thereafter is still locked up in the inscrutable future, beyond the power of

mere mortals to foretell. At any rate, we cannot anticipate. Nor should we. We do not possess the

power either of conferring a cause of action to a party when, under the circumstances disclosed, it

had none.

RABADILLA v COURT OF APPEALS (2000

Johnny S. Rabadilla, petitioner, vs. Court of Appeals and Maria Marlena Coscoluella Y

Belleza Villacarlos, respondents

DOCTRINE: Rabadilla distinguished between a conditional institution and a modal institution, It

also discussed the various forms of substitution of heirs.

Justice Purisima concluded that in case of doubt, the institution must be deemed modal and

not conditional. Following his discussion, he noted that while a modal institution obliges, it does not

suspend the effectivity of the institution. On the other hand, a conditional institution suspends the

efficacy of the institution, although it does not impose any obligation on the instituted heir.

One question that should probably be asked is: what happens to the mortgage in favor of

PNB and RPB upon the cancellation of the title of the property in the names of the heirs of Dr.

Rabadilla? If the mortgage is to be honored, the heirs of Aleja Belleza will receive the property

subject to the encumbrance. On the other hand, if the mortgage is to be cancelled, PNB and RBP

will be prejudiced.

FACTS: In a codicil (a supplement to a will; an appendix) of Aleja Belleza, Dr. Jorge Rabadilla

was instituted devisee of a 511, 855 sqm. lot in Bacolod. With the obligation to deliver 100

piculs of sugar to private respondent Maria Marlena Coscoluella Y Belleza Villacarlos every year

during her lifetime.

1. The codicil provides that the obligation is imposed not only on the instituted heir but also to

his successors-in-interest and that in case of failure to deliver, private respondent shall seize

the property and turn it over to the testatrixs near descendants.

2. Dr. Rabadilla died and was survived by his wife and children, one of whom is herein

petitioner.

3. Private respondent file a complaint with the RTC praying for the reconveyance of the

subject property to the surviving heirs of the testatrix. She alleged that the heirs failed to

comply with the provisions on the codicil: (a) The lot was mortgaged to PNB and RPB in

disregard of the testatrixs specific instruction to sell, lease, or mortgage only to the near

descendants and sister of the testatrix; (b) Defendants-heirs failed to comply with their

obligation to deliver 100 piculs of sugar to private respondent from sugar crop years 1985

up to the filing of the complaint, despite repeated demands; (c) the banks failed to comply

with the Codicil which provide s that in case of the sale, lease or mortgage of the property,

the buyer, lessee, or mortgagee shall likewise have the obligation to deliver 100 piculs of

sugar per crop year to private respondent.

4. During the pre-trial, a compromise agreement was concluded between the private

respondent and Alan Azurin, son-in-law of petitioner who was lessee of the property and

acting as attorney-in-fact of defendant heirs. The lessee of the property assumed the delivery

of 100 piculs of sugar to private respondent; however, only partial delivery was made.

5. The trial court dismissed the complaint for lack of cause of action stating that, While there

may be the non-performance of the command as mandated, exaction from them (the

petitioners), simply because they are the children of Jorge Rabadilla, the title holder/owner

of the lot in question, does not warrant the filing of the present complaint.

6. The CA, reversed the decision and held that the institution of Dr. Rabadilla is in the nature

of modal institution and a cause of action in favor of private respondent arose when

petitioner failed to comply with their obligation under the codicil, and in ordering the

reversion of Lot 1392 to the estate of the testatrix.

ISSUE: WON private respondent has a legally demandable right against the petitioner, as one of the

compulsory heirs of Dr. Rabadilla

HELD: Yes

The CA found that the private respondent had a cause of action against the petitioner. The

disquisition made on modal institution was, precisely, to stress that the private respondent had a

legally demandable right against the petitioner pursuant to subject Codicil.

The institution of an heir in the manner prescribed in Article 882 is what is known in the law of

succession as an institucion sub modo or a modal institution. In a modal institution, the testator

states (1) the object of the institution, (2) the purpose or application of the property left by the

testator, or (3) the charge imposed by the testator upon the heir. A mode imposes an obligation

upon the heir or legatee but it does not affect the efficacy of his right to succession. On the other

hand, in a conditional testamentary disposition, the condition must happen or be fulfilled in order

for the heir to be entitled to succeed the testator. The condition suspends but does not obligate; and

the mode obligates but does not suspend. To some extent, it is similar to a resolutory condition.

In the case at bar, the testatrix imposed an obligation on the said instituted heir and his successors-

in-interest to deliver one hundred piculs of sugar to the herein private respondent, Marlena

Coscolluela Belleza, during the lifetime of the latter. However, the testatrix did not make Dr. Jorge

Rabadillas inheritance and the effectivity of his institution as a devisee, dependent on the

performance of the said obligation. It is clear, though, that should the obligation be not complied

with, the property shall be turned over to the testatrixs near descendants. The manner of institution

of Dr. Jorge Rabadilla under subject Codicil is evidently modal in nature because it imposes a

charge upon the instituted heir without, however, affecting the efficacy of such institution.

Since testamentary dispositions are generally acts of liberality, an obligation imposed upon the heir

should not be considered a condition unless it clearly appears from the Will itself that such was the

intention of the testator. In case of doubt, the institution should be considered as modal and not

conditional.

REGINA FRANCISCO AND ZENAIDA PASCUAL, petitioners, vs. AIDA FRANCISCO-

ALFONSO, respondent

[G.R. No. 138774. March 8, 2001]

Doctrine:

The legitime is a portion of the estate of the deceased person which is reserved by law for

the compulsory heirs. An attempt to deprive a compulsory heir of the legitime by way of a

simulated sale will not be tolerated. The simulated sale will be set aside.

In this case, the simulation of sale was proved by the fact that neither of the two buyers of

the property had sufficient financial resources to justify their acquisition of the property by

way of a cash purchase. And because the decedent had no property other than those

parcels of land which he allegedly sold to his illegitimate daughters, the simulation of said

sale resulted in the dissipation of his assets and the deprivation of the legitimate daughter

of her legitime.

The second reason proferred by the Supreme Court in sustaining the Court of Appeals is

erroneous. The Courts reasoning was: even if the sale was not simulated, the same violated

Aidas legitime. Therefore, the sale is void. The reasoning is flawed. If the sale was bona

fide in that consideration was indeed paid, then Aida would have no cause to complain,

because her father Gregorio, in his lifetime had every right to dispose the land for valuable

consideration. Aidas legitime will have to be determined at the time of death of Gregorio,

at which time, the land had already been validly sold.

The Courts argument seems to suggest that the simulated sale was Gregorios way of

depriving Aida of her rightful participation in the distribution of his estate. However, there

is nothing in the decision that would seem to prove that intent. Indeed, the decision states

that Gregorio confided to Aida that the titles to the property were in the possession of

Regina Francisco and ZenaidaPascual. There is no indication that he admitted to having

fraudulently sold the property to the latter. The inference is that the titles were merely

entrusted to Regina and Zenaida. Consequently, I fail to appreciate the Courts suggestion

that the transfer of the property to Regina and Zenaida was Gregorios way to transfer the

property to his illegitimate daughters at the expense of his legitimate daughter.

In any event, there is merit to the nullification of the sale based on the first theory that the

sale was simulated. I do not believe that the second reason proferred by the Court is

correct, nor did it support the conclusion.

Facts:

1. The petitioners in this case, Regina Francisco (Regina) and ZenaidaPascual (Zenaida) are the

illegitimate daughters of the late Gregorio Francisco with his common law wife, Julia Mendoza,

with whom he begot 7 children.

2. The respondent, Aida Francisco-Alfonso (Aida), is the only daughter of Gregorio Francisco

with his wife, Cirila de la Cruz. Both Gregorio and Cirila are now deceased.

3. Gregorio Francisco (hereafter Gregorio) owned two parcels of residential land, situated in

Barangay Lolomboy, Bocaue, Bulacan. When Gregorio was confined in a hospital in 1990, he

confided to his daughter Aida that the certificates of title of his property were in the possession

of Regina Francisco and ZenaidaPascual.

4. After Gregorio died on July 20, 1990,

3

Aida inquired about the certificates of title from her

half sisters. They informed her that Gregorio had sold the land to them on August 15, 1983. After

verification, Aida learned that there was indeed a deed of absolute sale in favor of Regina

Francisco and ZenaidaPascual. Thus, on August 15, 1983, Gregorio executed a

"KasulatansaGanapnaBilihan (Kasulatan), whereby for P25,000.00, he sold the two parcels of

land to Regina Francisco and ZenaidaPascual. By virtue of the sale, the Register of Deeds of

Bulacan issued TCT No. T-59.585 to Regina Francisco and TCT T-59.586 to Zenaida Pascual.

4

5. On April 1, 1991, Aida filed with the Regional Trial Court, Bulacan a complaint against

petitioners for annulment of sale with damages.

5

She alleged that the signature of her late father,

Gregorio Francisco, on the KasulatansaGanapnaBilihan dated August 15, 1983, was a forgery.

6. In their joint answer to the complaint, petitioners denied the alleged forgery or simulation of

the deed of sale. After due proceedings, on July 21, 1994, the trial court rendered a decision

dismissing the complaint of Aida and sustaining the validity of the Kasulatan and the sale.

7. Upon the appeal of Aida, the CA reversed the trial court.

ISSUE:May a legitimate daughter be deprived of her share in the estate of her deceased father by

a simulated contract transferring the property of her father to his illegitimate children?

HELD: No. A legitimate daughter may not be deprived of her share.

1. First: The kasulatan was simulated. There was no consideration for the contract of sale.

Felicitas de la Cruz, a family friend of the Franciscos, testified that ZenaidaPascual and Regina

Francisco did not have any source of income in 1983, when they bought the property, until the

time when Felicitas testified in 1991.

15

As proof of income, however, ZenaidaPascual testified that she was engaged in operating a

canteen, working as cashier in Mayon Night Club as well as buying and selling RTW (Ready to

Wear) items in August of 1983 and prior thereto.

Zenaida alleged that she paid her father the amount of P10,000.00. She did not withdraw money

from her bank account at the Rural Bank of Meycauayan, Bulacan, to pay for the property. She

had personal savings other than those deposited in the bank. Her gross earnings from the RTW

for three years was P9,000.00, and she earned P50.00 a night at the club.

16

Regina Francisco, on the other hand, was a market vendor, selling nilugaw, earning a net income

of P300.00 a day in 1983. She bought the property from the deceased for P15,000.00.

17

She had

no other source of income.

We find it incredible that engaging in buy and sell could raise the amount of P10,000.00, or that

earnings in selling goto could save enough to pay P15,000.00, in cash for the land.

The testimonies of petitioners were incredible considering their inconsistent statements as to

whether there was consideration for the sale and also as to whether the property was bought

below or above its supposed market value. They could not even present a single witness to

the kasulatan that would prove receipt of the purchase price.

Since there was no cause or consideration for the sale, the same was a simulation and hence, null

and void.

18

2. Second: Even if the kasulatan was not simulated, it still violated the Civil Code

19

provisions

insofar as the transaction affected respondent's legitime. The sale was executed in 1983, when

the applicable law was the Civil Code, not the Family Code.

Obviously, the sale was Gregorio's way to transfer the property to his illegitimate daughters

20

at

the expense of his legitimate daughter. The sale was executed to prevent respondent Alfonso

from claiming her legitime and rightful share in said property. Before his death, Gregorio had a

change of heart and informed his daughter about the titles to the property.

According to Article 888, Civil Code:

"The legitime of legitimate children and descendants consists of one-half of the hereditary estate

of the father and of the mother.

"The latter may freely dispose of the remaining half subject to the rights of illegitimate children

and of the surviving spouse as hereinafter provided."

Gregorio Francisco did not own any other property. If indeed the parcels of land involved were

the only property left by their father, the sale in fact would deprive respondent of her share in her

father's estate. By law, she is entitled to half of the estate of her father as his only legitimate

child.

21

The legal heirs of the late Gregorio Francisco must be determined in proper testate or intestate

proceedings for settlement of the estate. His compulsory heir can not be deprived of her share in

the estate save by disinheritance as prescribed by law.

22

Dispositive: WHEREFORE, the petition is hereby DENIED. The decision of the Court of

Appeals in CA-G. R. CV No. 48545 is AFFIRMED, in toto.

JUAN CASTRO V. COURT OF APPEALS AND BENITA NAVAL, 173 SCRA 656 (1989)

FACTS: Petitioners Juan and Feliciana Castro are the brother and sister of the decedent

Eustaquio Castro while respondent Benita Naval is the only child of Eustaquio. Petitioners as

forced heirs of the decedent Eustaquio, filed an action for partition of properties against

respondent Benita. During the trial, the parties agreed that the issue to be resolved was the status

of Benita as an acknowledged child of the decedent

1. To support her claim, Benita presented her birth certificate which the decedent filed for

registration

2. It appears that Benitas mother, Pricola, was married to Felix de Maya in 1913. However,

Pricola ran away with Eustaquio and lived as husband and wife until her death in 1924.

3. Eustaquio, at the time she lived with Precola, was a widower and was free to marry

Pricola. As a result of their cohabitation, Benita was born in 1919. After the death of her

mother, Benita continued to live with her father.

4. The trial court ruled that Benita is the acknowledged and recognized daughter of the

decedent, and as such is entitled to participate in the partition of properties left by the

decedent.

5. On appeal, CA affirmed the trial court decision and held that Eustaquios recognition of

Benita is voluntary recognition i.e., made in a public document. While Benitas mother

was married to another person, the rule in recognition is that if it is made by only one of

the parents, it will be presumed that the is natural if the parent recognizing it had the legal

capacity to contract marriage at the time of conception

ISSUE: WON Benita is the acknowledged and recognized illegitimate child of Eustaquio Castro

HELD: Yes. Under the Civil Code, illegitimate children are those who are conceived and born

out of wedlock are classified into:

1. Natural, whether actual or by fiction, are those who were born outside of lawful wedlock

of parents who, at the time of the conception of the child, were not disqualified by any

impediment to marry each other

2. Spurious, whether incestuous, adulterous or illicit, are those born of parents who, at the

time of conception, were disqualified to marry each other on account of certain legal

impediments.

Since Eustaquio was a widower when Benita was conceived, Benita then is a natural child.

However, from the viewpoint of her mother, Benita was her spurious child.

Under the Civil Code, for an illegitimate child other than natural to inherit, she must first be

recognized voluntarily by court action. This arises from a legal principle that an unrecognized

spurious child like a natural child, has no rights from her parents or to their estate because her

rights spring not from the filiation or blood relationship but from the childs acknowledgment by

the parent. In other words, the rights of an illegitimate child arose not because she was the true or

real child of her parents but because under the law, she had been recognized or acknowledged as

such a child.

The Civil Code provides for two kinds of acknowledgmentvoluntary and compulsory. Said

provisions apply to both natural and spurious children. Art 131 Old Civil Code provides for

voluntary acknowledgment; it states that The acknowledgment of a natural child must be made

in the record of birth, in a will or in some other public document.

Strictly speaking, a birth certificate to be sufficient for purposes of recognizing a child must be

signed by the father and mother jointly and if the father refuses, by the mother alone otherwise

she may be penalized.

The more liberal provisions of the new Family Code are applied considering the facts and

equities of this case.

1. Benita Castro Naval is unquestionably the daughter of the late Eustaquio Castro who was

qualified to legally marry when she was conceived and born. From her birth on March

27, 1919 until the father's death on August 22, 1961 or for 42 years, Benita lived with her

father and enjoyed the love and care that a parent bestows on an only child. This was

admitted by the plaintiffs

2. The rule on separating the legitimate from the illegitimate family is of no special

relevance here because Benita and her mother Pricola Maregmen were the only

immediate family of Eustaquio. There are no legitimate children born of a legitimate wife

contesting the inheritance of Benita.

3. It was Eustaquio himself who had the birth of Benita reported and registered. There is no

indication in the records that Eustaquio should have known in 1919 that apart from

reporting the birth of a child, he should also have signed the certificate and seen to it that

it was preserved for 60 years

4. It was Eustaquio who gave away Benita during her wedding to Cipriano Naval. The

couple continued to live with the father even after the wedding and until the latter's death.

5. The certificate of baptism and the picture of the Castro family during the wake for

Eustaquio may not be sufficient proof of recognition under the Civil Code but they add to

the equities of this case favoring the petitioner.

Art 175 FC provides that "Illegitimate children may establish their illegitimate filiation in the

same way and on the same evidence as legitimate children." Art 172 and 173 FC on establishing

filiation provide:

Art. 172. The filiation of legitimate children is established by any of the

following:

(1) The record of birth appearing in the civil register or a final judgment; or

(2) An admission of legitimate filiation in a public document or a private

handwritten instrument and signed by the parent concerned.

In the absence of the foregoing evidence, the legitimate filiation shall be proved

by:

(1) The open and continuous possession of the status of a legitimate child; or

(2) Any other means allowed by the Rules of Court and special laws.

Art. 173. The action to claim legitimacy may be brought by the child during his or

her lifetime and shall be transmitted to the heirs should the child die during

minority or in a state of insanity. In these cases, the heirs shall have a period of

five years within which to institute the action.

The action already commenced by the child shall survive notwithstanding the

death of either or both of the parties.

There can be no dispute that Benita Castro enjoyed the open and continuous possession of the

status of an illegitimate child of Eustaquio Castro and that the action of Benita in defending her

status in this case is similar to an "action to claim legitimacy" brought during her lifetime.

TAYAG v COURT OF APPEALS

G.R. No. 95229, 9 June 1992

209 SCRA 665

On facts nearly identical with those of Castro v Court of Appeals, supra, the Supreme Court arrived

at a diametrically opposed conclusion. It is therefore important to distinguish between these two

cases.

FACTS:

Petitioner submits that Article 175 of the Family Code applies in which case the complaint should

have been filed during the lifetime of the putative father, failing which the same must be dismissed

on the ground of prescription. Private respondent, however, insists that Article 285 of the Civil Code

is controlling and, since the alleged parent died during the minority of the child, the action for

filiation may be filed within four years from the attainment of majority of the minor child.

ISSUE:

WON it is correct to apply the provisions of Article 285 of the Civil Code and in holding that

private respondent's cause of action has not yet prescribed.

HELD: Yes.

Article 256 of the Family Code states that "[t]his Code shall have retroactive effect insofar as it does

not prejudice or impair vested or acquired rights in accordance with the Civil Code or other laws."

It becomes essential, therefore, to determine whether the right of the minor child to file an action for

recognition is a vested right or not.

Under the circumstances obtaining in the case at bar, we hold that the right of action of the

minor child has been vested by the filing of the complaint in court under the regime of the Civil

Code and prior to the effectivity of the Family Code. We herein adopt our ruling in the recent case

of Republic of the Philippines v Court of Appeals, et al., where we held that the fact of filing of the

petition already vested in the petitioner her right to file it, and to have the same proceed to final

adjudication in accordance with the law in force at the time, and such right can no longer be

prejudiced or impaired by the enactment of a new law.

Even assuming ex gratia argumenti that the provisions of the Family Code in question is

procedural in nature, the rule that a statutory change in matters of procedure may affect pending

actions and proceedings, unless the language of the act excludes them from its operations, is not so

pervasive that it may be used to validate or invalidate proceedings taken before it goes into effect,

since procedure must be governed by the law regulating it at the time the question of procedure

arises especially where vested rights may be prejudiced. Accordingly, Article 175 of the Family

Code finds no proper application to the instant case since it will ineluctably affect adversely a right

of private respondent and, consequentially, of the minor child she represents, both of which have

been vested with the filing of the complaint in court. The trial court is, therefore, correct in applying

the provisions of Article 285 of the Civil Code and in holding that private respondent's cause of

action has not yet prescribed.

BARITUA VS. COURT OF APPEALS (1990)

Jose Baritua and Edgar Bitancor, petitioners,

vs.

Honorable Court of Appeals, Nicolas Nacario and Victoria Ronda Nacario, respondents

DOCTRINE: While legitimate parents are considered as compulsory heirs of their legitimate child,

the parents are secondary compulsory heirs and inherit only in default of legitimate children and

decendants of the deceased. Thus, the legitimate parents have no right to demand indemnification

for the death of their deceased child, and such right to indemnification properly belongs to the

latter's descendants and/or spouse.

FACTS: On November 7, 1979, the tricycle driven by Bienvenido Nacario along the national

highway at Camarines Sur met an accident with a bus driven by petitioner Edgar Bitancor and

owned and operated by petitioner Jose Baritua.

2. Bienvenido and his passenger died due to the accident and the tricycle was damaged.

2. On March 27, 1980, extra-judicial settlement were negotiated by the petitioners and the

bus insurer with Bienvenido Nacarios widow, Alicia Nacario where she received P18,500. After the

settlement, Aliciaexecuted on March 27, 1980 a Release of Claim in favour of petitioners and the bus

insurer, releasing and forever discharging them from all actions, claims, and demands

arising from the accident.

2. About one year and ten months from the date of accident, Bienvenidos parent, private

respondents herein, filed a complaint for damages against petitioners. Private respondents

alleged that during the vigil for their deceased son, petitioners through their

representatives promised them that as extra- judicial settlement, they shall be indemnified

for the death of their son, for funeral expenses incurred, and for the damage to the tricycle

which they only loaned to the victim. Petitioners, however, reneged on their promise and

instead negotiated and settled their obligations with the long estranged wife of private

respondents late son.

2. The trial court dismissed the complaint. However, on appeal, the decision was reversed

by the Court of Appeals. The CA ruled that the release executed by Alicia Baracena Vda.

De Nacario did not discharge the liability of the petitioners because the case was

instituted by the private respondents in their own capacity and not as heirs,

representatives, successors, and assigns of Alicia.

ISSUE: Whether or not petitioners are still liable to pay the damages to private respondents

despite the agreement of extrajudicial settlement between petitioners and the victims wife.

HELD: No, petitioners are no longer liable to private respondents.

Alicia and her son with the deceased are the successors in interest referred to in the law as the

persons authorized to receive payment. The Civil Code states:

Article 887. The following are compulsory heirs:

1. Legitimate children and descendants, with respect to their legitimate parents

and ascendants;

2. In default of the foregoing, legitimate parents and ascendants, with respect

to their legitimate children and descendants;

3. The widow or widower;

4. Acknowledged natural children and natural children by legal fiction;

5. Other illegitimate children referred to in Article 287.

Compulsory heirs named in nos. 3, 4 and 5 are not excluded by those in nos. 1 and

2. Neither do they exclude one another.

It is patently clear that the parents of the deceased succeed only when the latter dies without a

legitimate descendant. On the other hand, the surviving spouse concurs with all classes of heirs. As

it has been established that Bienvenido was married to Alicia and that they begot a child, the private

respondents are not successors-in-interest of Bienvenido; they are not compulsory heirs. The

petitioners therefore acted correctly in settling their obligation with Alicia as the widow of

Bienvenido and as the natural guardian of their lone child. This is so even if Alicia has been

estranged from Bienvenido. Mere estrangement is not a legal ground for the disqualification of a

surviving spouse as an heir of the deceased spouse.

ALICE REYES VAN DORN, petitioner,

vs.

HON. MANUEL V. ROMILLO, JR., as Presiding Judge of Branch CX, Regional Trial

Court of the National Capital Region Pasay City and RICHARD UPTON respondents.

Doctrine:

A foreign divorce validly obtained by a foreign national in a foreign court against his Filipino

spouse produces effects in the Philippines. Van Dorn suggests that the divorce decree should

likewise terminate the status of the foreign party as a "compulsory heir" of the former Filipino

spouse. It must be noted, however, that the dictum of the court in this respect is merely an obiter

inasmuch as heirship was not an issue in this case.

FACTS:

1. The basic background facts are that petitioner, Alice Reyes Van Dorn (Van Dorn) is a citizen

of the Philippines while private respondent, Richard Upton (Upton), is a citizen of the United

States; that they were married in Hongkong in 1972; that, after the marriage, they established

their residence in the Philippines; that they begot two children born on April 4, 1973 and

December 18, 1975, respectively; that the parties were divorced in Nevada, United States, in

1982; and that petitioner has re-married also in Nevada, this time to Theodore Van Dorn.

2. Upton filed a suit against petitioner in Civil Case in the RTC- in Pasay City, stating that

petitioner's business in Ermita, Manila, (the Galleon Shop, for short), is conjugal property of the

parties, and asking that petitioner be ordered to render an accounting of that business, and that he

be declared with right to manage the conjugal property. Petitioner moved to dismiss the case on

the ground that the cause of action is barred by previous judgment in the divorce proceedings

before the Nevada Court wherein respondent had acknowledged that he and petitioner had "no

community property" as of June 11, 1982.

3. The RTC denied the Motion to Dismiss in the mentioned case on the ground that the property

involved is located in the Philippines so that the Divorce Decree has no bearing in the case. The

denial is now the subject of this certiorari proceeding.

4. Van Dorn contends that respondent is estopped from laying claim on the alleged conjugal

property because of the representation he made in the divorce proceedings before the American

Court that they had no community of property; that the Galleon Shop was not established

through conjugal funds, and that respondent's claim is barred by prior judgment.

5. For his part, Upton avers that the Divorce Decree issued by the Nevada Court cannot prevail

over the prohibitive laws of the Philippines and its declared national policy; that the acts and

declaration of a foreign Court cannot, especially if the same is contrary to public policy, divest

Philippine Courts of jurisdiction to entertain matters within its jurisdiction.

ISSUE:

1. WON the divorce obtained in the Nevada Court is valid with regards to the parties. YES

2. WON Upton may still claim a right to the Galleon Shop business established in the

Philippines. NO

HELD:

Validity of Divorce:

1. There can be no question as to the validity of that Nevada divorce in any of the States of the

United States. The decree is binding on private respondent as an American citizen. For instance,

private respondent cannot sue petitioner, as her husband, in any State of the Union. What he is

contending in this case is that the divorce is not valid and binding in this jurisdiction, the same

being contrary to local law and public policy.

2. It is true that owing to the nationality principle embodied in Article 15 of the Civil

Code, only Philippine nationals are covered by the policy against absolute divorces the same

being considered contrary to our concept of public police and morality. However, aliens may

obtain divorces abroad, which may be recognized in the Philippines, provided they are valid

according to their national law

3. Thus, pursuant to his national law, private respondent is no longer the husband of petitioner.

He would have no standing to sue in the case below as petitioner's husband entitled to exercise

control over conjugal assets. As he is bound by the Decision of his own country's Court, which

validly exercised jurisdiction over him, and whose decision he does not repudiate, he is estopped

by his own representation before said Court from asserting his right over the alleged conjugal

property.

To maintain, as private respondent does, that, under our laws, petitioner has to be considered still

married to private respondent and still subject to a wife's obligations under Article 109, et. seq.

of the Civil Code cannot be just. Petitioner should not be obliged to live together with, observe

respect and fidelity, and render support to private respondent. The latter should not continue to

be one of her heirs with possible rights to conjugal property. She should not be discriminated

against in her own country if the ends of justice are to be served.

Claim to the Galleon Shop property

1. Pursuant to the national law of the husband, he does not have any standing in court to pursue

any conjugal assets of the marriage. By his own action, such American husband should not

continue to be an heir with possible rights to the conjugal property. The Filipina should not be

discriminated against in her own country if the ends of justice are to be served.

Dispositive Portion:

WHEREFORE, the Petition is granted, and respondent Judge is hereby ordered to dismiss the

Complaint filed in Civil Case No. 1075-P of his Court.

INTESTATE ESTATE OF PETRA ROSALES, IRENEA ROSALES V. FORTUNATO

ROSALES ET AL, 148 SCRA 69 (1987)

FACTS: In 1971, Petra Rosales died intestate. She was survived by her husband (Fortunato

Rosales) and two children: Magna Acebes and Antonio Rosales. Another child, Carterio,

predeceased her, leaving a child respondent Macikequerox and his widow, petitioner Irenea

Rosales.

1. Magna Acebes instituted the proceedings for the settlement of the estate and was

thereafter appointed as administratrix.

2. The trial court issued an order declaring the following as legal heirs of the decedent and

prescribed their respective shares of the estate:

a. Fortunato (husband) share

b. Magna Acebes (daughter)

c. Antonio(son)

d. Macikequerox (grandson)

3. Petitioner Irenea opposed the order and insisted on getting a share of the estate in her

capacity as the surviving spouse of the late Carterio Rosales, son of the decedent Petra.

Petitioner claimed that she is a compulsory heir of her mother-in-law together with her

son

ISSUE: WON the widow (petitioner Irenea) whose husband predeceased his mother can inherit

from her mother-in-law

HELD: No. Intestate or legal heirs are classified in to 2 groups: those who inherit by their own

right, and those who inherit by right of representation. These are provided in Art 980, 981, 982

and 999 NCC.

There is no provision in the Civil Code which states that a widow (surviving spouse) is an

intestate heir of her mother-in-law. The entire Code is devoid of any provision which entitles her

to inherit for her mother-in-law either by her own right or by right of representation. The

provisions of the Code which relate to the order of intestate succession enumerate with

meticulous exactitude the intestate heirs of a decedent, with the State as the final intestate heir.

If the legislature intended to make the surviving spouse an intestate heir of her parent-in-law, it

would have so provided in the Code.

Petitioner argues that she is a compulsory heir in accordance with Art 887 NCC. This provisions

refers to the estate of the deceased spouse in which case the surviving spouse is a compulsory

heir. It does not apply to the estate of a parent-in-law. In Lachenal v. Salas, the SC held that the

surviving spouse is considered a third person in connection with the estate of the parent-in-law.

Moreover, Art 999 confirms that the estate contemplated therein is the estate of the deceased

spouse. The estate which is the subject matter of the intestate proceedings in this case is that of

the deceased Petra Rosales, the mother-in-law of the petitioner. It is from the estate of Petra that

Macikequerox draws a share of the inheritance by the right of representation as provided by Art

981.

Art 971 explicitly states that Macikequerox is called to succession by law because of his blood

relationship. He does not succeed his father, Carterio who predeceased his mother, but his

grandmother whom his father would have succeeded. Thus, petitioner cannot assert the same

right of representation as she has no filiation by blood with her mother-in-law.

Petitioner argues that at the time of the death of her husband he had an inchoate or contingent

right to the properties of Petra Rosales as compulsory heir. However this right was extinguished

by his death which is why his son succeeded from Petra by right of representation.

PADURA vs. BALDOVINO

No. L-11960

December 27, 1958

FACTS: The lower court rendered judgment declaring all the reservees (without distinction)

co-owners, pro-indiviso, in equal shares of the parcel of land subject matter of the suit.

ISSUE: In a case of reserve troncal where the only reservatorios (reserves) surviving the

reservista and belonging to the line of origin, are nephews of the half blood and the others are

nephews of the whole blood, should the reserved properties be apportioned among them equally

or should the nephews of the whole blood take a share twice as large as that of the nephews of

the half blood?

HELD: The restrictive interpretation is the more imperative in view of the New Civil Codes

hostility to successional reservas and reversions, as exemplified by the suppression of the

reserve vindal and the reversion legalof the Code of 1889 (Arts. 812 and 968-980).

There is a third point that deserves consideration. Even during the reservistas lifetime, the

reservatarios, who are ultimate acquirers of the property, can already assert the right to prevent

thereservista from doing anything that might frustrate their reversionary right; and for this

purpose they can compel the annotation of their right in the Registry of Property even while the

reservista is alive (Ley Hipotecaria de Ultamar, Arts. 168, 199: Edroso vs. Sablan, 25 Phil. 295).

This right is incompatible with the mere expectancy that corresponds to the natural heirs of the

reservista. It is likewise clear that the reservable property is no part of the estate of the

reservista, who may not dispose of them by will, so long as there are reservatarios existing

(Arroyo vs. Gerona, 58 Phil. 237). The latter, therefore, do not inherit from the reservista but

from the descendant prepositus, of whom the reservatarios are the heirs mortis causa, subject of

the condition that they must survive the reservista (Sanchez Roman, Vol. Tomo 2, p. 286:

Manresa, Commentaries, Vol. 6, 6

th

Ed., pp274, 310). Had the nephews of whole and half blood

succeeded the prepositus directly, those of full- blood would undoubtedly receive a double share

compared to those of half blood (Arts. 1008 and 1006, jam cit.), why then should the latter

receive equal shares simply because the transmission of the property was delayed by interregnum

of the reserve? The decedent (causante), the heirs and their relationship being the same, there is

no cogent reason why the hereditary portions should vary.

It should be stated, in justice to the trial court, that its opinion is supported by distinguished

commentators of the Civil Code of 1889, among them Sanchez Roman (Estudios, Vol. 6, Tomo

2, p.1008) and MuciusScaevola (Codigo Civil, Vol. 14, p.342). The reason given by these

authors is that the reservatarios are called by law to take the reservable property because they

belong to the line of origin; and not because of their relationship. But the argument, if logically

pursued, would lead to the conclusion that the property should pass to any and all reservatarios,

as a class and in equal shares, regardless of line and degrees. In truth, such as the theory of

reserve integral (14 Scaevola, Cod. Civ., p. 332 et seq.). But as we have seen, the Supreme Court

of Spain and of the Philippines have rejected that view, and consider that the reservable property

should be succeeded to by the reservatario who is nearest in degree, according to the basic rules

of intestacy.

EDROSO VS. SABLAN (1913)

Marcelina Edroso, petitioner-appellant,

vs.

Pablo and Basilio Sablan, opponents-appellees

DOCTRINE: A reservor's right to the reservable property is not just usufructuary in nature. The

reservor, having inherited the reservable property from the prepositus, acquires ownership thereof,

subject to a resolutory condition. Thus, a reservor has a registrable title to the property, and may

institute land registration proceedings in the appropriate case.

It must be noted, however, that during the registration proceedings, the reservees should

intervene solely for the purpose of ensuring that the reservable nature of the property is properly

inscribed in the title. Otherwise, a clean title issued pursuant to a decree of registration, may in the

proper case extinguish the reserva.

Mariano Ma. Rita

Victoriano Marcelina

Pedro

FACTS: Spouses Marcelina Edroso and Victoriano Sablan had a son named, Pedro

who inherited two parcels of land upon the death of his father.

1. Subsequently, Pedro died,unmarried and without issue, the two parcels of land passed

through inheritance tohi s mot her . Hence t he her edi t ar y t i t l e wher eupon i s

bas ed t he appl i cat i on f or registration of her ownership.

2. The two uncles of Pedro, Pablo and Basilio Sablan (legitimate brothers of

Victoriano) opposed the registration claiming that either the registration be denied or

if granted to her, the right reserved by law to them be recorded in the

registration of each parcel.

3. The Court of Land Registration denied the registration holding that the land in

question partake of the nature of property required by law to be reserved and that

in such a case application could only be presented jointly in the names of the

mother and the said two uncles. Hence, this appeal.

ISSUE: Whet her or not t he pr oper t y i n ques t i on i s i n t he nat ur e of a

r es er vabl e property.

HELD:

A very definite conclusion of law is that the hereditary title is one without a valuable consideration

(gratuitous title), and it is so characterized in article 968 of the Civil Code, for he who acquires by

inheritance gives nothing in return for what he receives; and a very definite conclusion of law also is

that the uncles are within the third degree of blood relationship.

Marcelina Edroso, ascendant of Pedro Sablan, inherited from him these two parcels of land which

he had acquired without a valuable consideration - that is, by inheritance from another ascendant,

his father Victoriano. Having acquired them by operation of law, she is obligated to reserve them

intact for the claimants, who are uncles or relatives within the third degree and belong to the line of

Mariano Sablan and Maria Rita Fernandez, whence the lands proceeded. The trial court's ruling that

they partake of the nature of property required by law to be reserved is therefore in accordance with

the law.

The person required by article 811 to reserve the right, has, beyond any doubt at all, the rights of use

and usufruct. He has, moreover, for the reasons set forth, the legal title and dominion, although

under a condition subsequent. Clearly, he has, under an express provision of the law, the right to

dispose of the property reserved, and to dispose of is to alienate, although under a condition. He has

the right to recover it, because he is the one who possesses or should possess it and have title to it,

although a limited and recoverable one. In a word, the legal title and dominion, even though under a

condition reside in him while he lives. After the right required by law to be reserved has been

assured, he can do anything that a genuine owner can do.

On the other hadnt, the relatives within the third degree in whose favor of the rightis reserved

cannot dispose of the property, first because it is no way, either actuallyor constructively or

formally, in their possession; and moreover, because they haveno title of ownership or of the fee

simple which they can transmit to another, on thehypothesis that only when the person who must

reserve the right should die beforethem will they acquire it.

The SC reverse the judgment appealed from, and in lieu thereof decide and declare that the

applicant is entitled to register in her own name the two parcels of land which are the subject matter

of the application, recording in the registration the right required by article 811 to be reserved to

either or both of the opponents, Pablo Sablan and Basilio Sablan, should they survive her.

CONSTANCIO SIENES, ET AL., plaintiffs-appellants,

vs.

FIDEL ESPARCIA, ET AL., defendants-appellees.

SIENES v ESPARCIA

Doctrine:

The reserva creates a double resolutory condition: (1) the death of the reservor, and (2)

the survival of the reservee at the time of the death of the reservor. While the decision refers to

the first as a resolutory condition, it would seem more likely that the same is a term. In any

event, the case confirms that either the reservor or any of the reservees may alienate the

reservable property, and the final outcome of the sales will be determined by the timeliness or

untimeliness of the death of the seller. It is important to distinguish the sales referred to herein

from the concept of a double sale which is regulated in Article 1544 of the Civil Code.

The subject matter of the two sales referred to herein must be clarified. It would seem

fairly clear that the reservor sold the reservable land in question, since at the time of the said sale,

she was the registered owner of the property and in fact in possession thereof. The sale executed

by the reservees may be viewed from a different perspective. Since the reservor was still alive at

the time of the said sale, it would seem that the reservees could not have validly sold the same

parcel of land, which obviously was not theirs. If the said sale were to refer to the parcel of land,

then the sale should properly be construed as a conditional sale - the condition being the survival

of the seller-reservees upon the death of the reservor. Upon the other hand, it is also possible to

construed this sale of the reservees as a sale of their inchoate right to acquire the property. Hence

the subject matter of the sale would not be the reservable land, but the rights of the reservees

thereto, which is conditional.

FACTS:

1. Lot 3368 originally belonged to SaturninoYaeso (origin). With his first wife, Teresa Reales,

he had 4 children, named Agaton, Fernando, Paulina and Cipriana.

2. With his second wife, Andrea Gutang, he had an only son named Francisco (propositus).

3. Upon Yaesos death, said lot was left to Francisco and title was issued in his name. Because

Francisco was then a minor, his mother administered the property for him and declared it in her

name for taxation purposes.

4. When Francisco died, single and without any descendant, his mother, Andrea Gutang

(reservista) as sole heir, executed an extrajudicial settlement and sale of the property in favor of

the Sps. ConstancioSienes and GenovevaSilay (Sps. Sienes).

5. Thereafter, the Sps. Sienes demanded from Paulina Yaeso and her husband, Jose Esparcia, the

surrender of the original certificate of title (which was in their possession). The latter refused.

6. Cipriana and Paulina Yaeso (reservatorios), the surviving half-sisters of Francisco as such,

declared the property in their name and subsequently executed a deed of sale in favor of the Sps.

Fidel Esparcia and Paulina Sienes (Sps. Esparcia), who in turn, declared it in their name for tax

purposes and thereafter secured title in their name.

7. ConstancioSienes then filed an action asking for the nullification of the sale executed by

Paulina and Cipriana, the reconveyance of the lot and damages and cost of suit.

8. Fidel Esparcia countered that they did not know any information regarding the sale by Andrea

Gutang in favor of the Sps. Sienes, and that if such sale was made, the same was void since

Andrea had no right to dispose of the property.

9. The trial court declared that the sale of Andrea Gutang to Sps. Sienes was void and that the

sale by Paulina and CiprianaYaeso to the Sps. Esparcia was also void. The land in question was

reservable property and therefore, the reservista Andrea Gutang, was under obligation to reserve

it for the benefit of relatives within the third degree belonging to the line from which said

property came, if any, survived her.

10. The records show that the lone reserve surviving was CiprianaYaeso.

ISSUE:

WON the lot in question is reservable property and if so, whether the reservoir or the reserve can

alienate the same

HELD: Yes, the lot is reservable property.

1. On Franciscos death, unmarried and without descendants, the property was inherited by his

mother, Andrea Gutang, who was under obligation to reserve it for the benefit of relatives within

the third degree belonging to the line from which said property came, if any, survived her.

2. Being reservable property, the reserve creates two resolutory conditions:

a. the death of the ascendant obliged to reserve and

b. the survival, at the time of his death, of relatives within the third degree belonging

to the line from which the property came.

In connection with this, the court has held that the reservista (reservor) has the legal title and

dominion to the reservable property but subject to a resolutory condition. Hence, he may

alienate the same but subject to reservation, said alienation transmitting only the revocable and

conditional ownership of the reservista, the right acquired by the transferee being revoked or

resolved by the survival of reservatorios (reserves) at the time of the death of the reservista .

3. In the present case, inasmuch as when the reservista, Andrea Gutang died, CiprianaYaeso was

still alive, the conclusion becomes inescapable that the previous sale made by the former in favor

of appellants became of no legal effect and the reservable property passed in exclusive

ownership to Cipriana.

4. On the other hand, the sale executed by the sisters, Paulina and CiprianaYaeso, in favor of the

Sps. Esparcia was subject to a similar resolutory condition. While it may be true that the sale

was made by Cipriana and her sister prior to the death of Andrea, it became effective because of

the occurrence of the resolutory condition.

RICARDO LACERNA V. AGATONA PAURILLO VDA DE CORCINO, 1 SCRA 1226

DOCTRINE: The reserva applies only where the property sought to be reserved was acquired by

operation of law by an ascendant from a descendant who in turn, acquired it by gratuitous title from

another ascendant, brother or sister. Thus, where the disputed property was acquired by a

descendant from an ascendant, there is yet no reserva because there has yet to be a second

transmission of the property to another line by operation of law.

FACTS: Bonifacia Lacerna died in 1932, leaving 3 parcels of land to her only son, Juan

Marbebe. Juan Marbebe died single and intestate in 1943. An action was then filed by the

plaintiffs Ricardo Lacerna et al (Juan Marbebes cousins) for the recovery of 3 parcels of land

from respondent Agatona vda de Corcino (sister of Bonifacia).

1. Agatona claimed that she held the disputed lands under a power of attorney executed by

Juan Marbebe in her favor and that she is entitled to succeed Juan in the same manner as

the plaintiffs since she was Juans aunt.

2. Jacoba Marbebe filed an intervention alleging that she is the half-sister of Juan and as

such, she is entitled, by succession, to the properties in question.

3. It appears that Bonifacia had a sister (Agatona) and 2 brothers: Catalino (who was

survived by 3 children) and Marcelo (who was survived by his 7 children). On the other

hand, Jacoba is the daughter of Bonifacias husband from his 1

st

marriage and is the half-

sister of Juan.

4. The trial court held in favor of Jacoba.

5. Plaintiffs contend that pursuant to Art 891 establishing a reserve troncal, the properties in

dispute should pass to the heirs of the deceased within the third degree, who belong to the

line from which the properties came. Since the properties were inherited by Juan from his

mother Bonifacia, they should go to his nearest relative within the third degree on the

maternal line, to which the plaintiffs belong.

6. Jacoba avers that brothers and sisters exclude all other collateral relatives in the order of

intestate sucession, and as Juans half-sister, she has a better right then the plaintiffs to

inherit his properties

ISSUE: WON the parcels of land were subject to reserve troncal

HELD: No. The main flaw in the plaintiffs theory is that it assumes that said properties are

subject to reserva troncal under Art 891 NCC when such is NOT the case.

Art 891 is not applicable since the conditions set forth by the article is that the ascendant inherits

from the descendant which is not the case here. The lands in dispute were inherited by a

DESCENDANT, Juan Marbebe, from an ASCENDANT, his mother Bonifacia. The transmission

of lands by inheritance was therefore in accordance with the order prescribed for intestate

succession, pursuant to which, a sister, even if by a half-sister, in the absence of other sisters or

brothers, or of children of sisters or brothers, excludes all other collateral relatives regardless of

whether or not the latter belong to the line from which the property of the deceased came.

Reserva troncal contemplates three transfers:

(1) From the descendant to the ascendant or brother or sister to the prepositus by gratuitous

title

(2) From the prepositus to another ascendant (the reservoir)by operation of law; and

(3) Upon the reservors death, from the prepositus to the reservees (if they are still alive)

by theory of delayed intestacy

The first two are the most important with respect to this case. While admittedly, Juan received

the properties by gratuitous title from his mother, when he died without a will, the property was

not transferred to an ascendant of Juan. His nearest heir was his half-sister Jacoba. Thus the

second transfer, contemplated by the rules on the reserva never took place. No reserva troncal

was created. Therefore, the property will pass to Jacoba under the rules of intestate succession.

SOLIVIO v COURT OF APPEALS

G.R. No. 83484, 12 February 1990

182 SCRA 119

The reservor can never be a descendant of the supposed prepositus. Thus, where properties were

inherited from a mother (origin) by a daughter (as prepositus), which properties were later inherited

by her son, the son holds the properties subject to no reservation in favor of any relative, since this

case is not contemplated by Article 891 which establishes the reserva troncal. In addition, the

reserva applies only if the prepositus dies without issue.

Concordia . . . . . Esteban Sr. Salustia . . . . . . Celedonia

Esteban, Jr.

FACTS:

This case involves the estate of the late novelist, Esteban Javellana, Jr., author of the first post-war

Filipino novel "Without Seeing the Dawn," who died a bachelor, without descendants, ascendants,

brothers, sisters, nephews or nieces. His only surviving relatives are: (1) his maternal aunt,

petitioner Celedonia Solivio, the spinster half-sister of his mother, Salustia Solivio; and (2) the

private respondent, Concordia Javellana-Villanueva, sister of his deceased father, Esteban Javellana,

Sr.

He was a posthumous child. His father died barely ten (10) months after his marriage in

December 1916 to Salustia Solivio and four months before Esteban, Jr. was born.

Salustia and her sister, Celedonia (daughter of Engracio Solivio and his second wife Josefa

Fernandez), a teacher in the Iloilo Provincial High School, brought up Esteban, Jr.

Salustia brought to her marriage paraphernal properties which she had inherited from her

mother, Gregoria Celo, Engracio Solivio's first wife, but no conjugal property was acquired during

her short-lived marriage to Esteban, Sr.

On October 11, 1959, Salustia died, leaving all her properties to her only child, Esteban, Jr.,

including a house and lot in La Paz, Iloilo City, where she, her son, and her sister lived. In due time,

the titles to all these properties were transferred in the name of Esteban, Jr.

During his lifetime, Esteban, Jr. had, more than once, expressed to his aunt Celedonia and

some close friends his plan to place his estate in a foundation to honor his mother and to help poor