My Final Project

Diunggah oleh

moss4uHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

My Final Project

Diunggah oleh

moss4uHak Cipta:

Format Tersedia

FMS

1

Comparison of Islamic and convention mutual icome funds of Pakistan

By

MUHAMMAD AKBAR

&

TAIMOOR KHAN

This report of the final project is submitted to the Department of Accounting &

Finance Faculty of Management Sciences International Islamic University

Islamabad,to fulfill theRequirementsOfthe degree

Master of Business Administration (finance).

FMS

2

Faculty of Management Sciences

International Islamic University Islamabad

PROJECT

REPORT

Ttile of Project:

Islamic and coventional mutual incom funds comparison

Submitted to:

Sir Zulfiqar Ali Shah

FMS

3

Submittedby:

MUHAMMAD AKBAR

(5925-FMS/MBA/S13)

TAIMOOR KHAN

(5723-FMS/MBA/S12)

FACULTY OF MANAGEMENT SCIENCES

INTERNATIONAL ISLAMIC UNIVERSITY ISLAMABAD

2014 copyright by Muhammad Akbar & Taimoor khan

All rights are reserved. No part of this final project report can be reproduced in any form without

the former sanction of the authors.

FMS

4

SUPERVISORS CERTIFICATE

This is certified that Mr. RIAZ AHMAD with (Reg No# 5681-FMS/MBA/S12)&

Mr.MUHAMMAD BILAL AFZALwith (Reg No#5723-FMS/MBA/S12)of MBA

havecompleted their final project report entitled Comparison of Conventional & Islamic

mutualIncome Fundsof Pakistan under my supervision. I have checked the report and found

itconfined work of the authors.

MR. IKRAM TOOR

SUPERVISOR

Assistant Professor IIUI

DR. SYED ZULFIQAR ALI SHAH

Head ofDepartment Accounting & Finance

Faculty of Management Sciences

International Islamic University Islamabad

FMS

5

BISMILLAH IR-REHMAN IR-RAHIM

FMS

6

By The Name of ALLAH who is most merciful and kind

Thanks to ALLAH Almighty the most merciful and beneficent,

Who gave usthe courage & talent to complete task assigned to us successfully.

Any achievement requires the efforts of a lot of people. This final project report

also is a result of the mutual effort. Although the report has been exclusively

prepared by us with the purpose of fulfilling the requirements of FINAL PROJECT of

MBA (Masters in Business Administration), there are numerous helping hands

behind it, who have guided us on our way.

FMS

7

Bundle of thanks to Mr. IKRAM TOORfor guiding us with attention and care.

He has taken pain to complete the project and makesessentialamendment

as and when it was needed.

We would also like to thank s our Institution and faculty members

Without whom this project would have been a distant reality.

We also extend our heartfelt thanks to

Our families and well-wishers.

RIAZ AHMAD M.BILAL AFZAL

5681-FMS/MBA/S12 5723-FMS/MBA/S12

FMS

8

This Final Project is lovingly dedicated to our respective parents who

have been our persistent source of motivation. They have given us the

determination and discipline to challenge any task with interest and

purpose. Without their support and love this project would not have been

made possible.

FMS

9

PROJECT SCOPE

This project covers few conventional and Islamic mutual fund companies selected from

the mutual fund industry of Pakistan. In this project we have analyzed Income Fund portion of

the mutual fund of the selected mutual fund companies. For the conventional we have selected

conventional Income Fund and for the Islamic we have selected Islamic Income Fund.

We have selected three conventional and three Islamic Income Funds from the selected

mutual funds companies. Through different ratios, vertical and horizontal analysis we have

examined their performance for three consecutive years. Significant analysis and results of the

companies has been discussed with necessary graphical and tabular demonstration of the specific

company.

FMS

10

PURPOSEAND SIGNIFICANCE OF THE PROJECT

The purpose of this project is to measure the performance of the selected conventional

and Islamic mutual income funds working and providing their services to investors in Pakistan.

Through a comparison of the selected mutual income funds working in our country we will be

able to select the best mutual income fund from the mutual fund industry of country. This project

is useful for the investors who want to invest in the mutual fund, and it provides basis for the

decision making regarding investment.

The performance of the Islamic mutual income fund has been evaluated and it indicated

good results and has provided good investment opportunities, so an investor who not wants to

indulge himself in the interest base profit and earning can benefit from this project. He can get a

lot from this project, as it includes the introduction about different Islamic mutual fund and

different Islamic mutual income fund working in Pakistan.

As interest is prohibited in Islam and Muslims must avoid it, so by investing in the

Islamic mutual income fund they can earn the profit and can also avoid fight with Allah

Almighty and this project can help them in their decision making.

FMS

11

EXECUTIVE SUMMARY

This project has coveredthe evaluation of the selected conventional and Islamic mutual

income funds from the mutual fund sector of Pakistan by using different techniques. Three

companiesfrom the conventional mutual income fund and three companies form the Islamic

mutual income fund were selected for the analysis. Different techniques have been applied with

the primary objective performance evaluation of the selected companies. In the start of the

project conventional and Islamic mutual funds have been discussed, and we have also provided a

detail view of the performance of mutual fund sector of Pakistan in the previous periods.

Detailed introductions of all the selected conventional and Islamic income funds

companies have been given the subsequent chapter. The Mission and the vision statement of the

selected companies have also been provided in the introduction of the companies. Some of the

major developments and the important milestones that havebeen achieved by the selected

companies are also the part of the project.

A theoretical background has been mentioned in summarized form in the subsequent

chapter.Different techniques which are used for the evaluation has been discussed with the

theoretical concepts, those techniques are the ratios, common size and trend analysis and in the

chaptertheir interpretation and importance has been highlighted.

In the ratios analysis part of the study we have calculated different ratios for both the

conventional and Islamic mutual income funds.The results have been represented both in

graphically and in the tabular form. A slight explanation and interpretation has been stated on the

basis of given results.

FMS

12

And at the last of the project, we have concluded all the results of the selected mutual

funds. We have highlighted the important aspects of all the findings and the overall performance

of the selected mutual funds.

TABLE OF CONTENTS:

The Page Number:

CHAPTER 01.18

INTRODUCTION:

Introduction to Mutual Fund.19

Mutual Fund Process.21

Brief History Of The Mutual Funds......22

The Mutual Funds Association Of Pakistan (MUFAP)...22

Types Mutual Funds..23

The Islamic Finance Industry............26

The Rise Of The Islamic Mutual Funds....27

So Why Islamic Funds......29

CHAPTER 02...............................................................................................30

INTRODUCTION TO CONVENTIONAL MUTUAL FUND COMPANIES:

1) ALFALAH GHP INVESTMENT MANAGEMENT LIMITED

Mission...31

Vision.........31

The Board of Directors of Management Company............31

FMS

13

The Audit Committee.................32

The Funds under Management...............32

2) ABL ASSET MANAGEMENT COMPANY LIMITED

Introduction........33

Management...33

Trustee........33

Profile of Directors.........33

3) AKD INVESTMENT MANAGEMENT LIMITED (AKDIML)

Mission...35

Company....35

Products and Services....35

Management of the Company....36

Financial Services......36

Distribution Network.........36

CHAPTER 0337

INTRODUCTION TO ISLAMIC MUTUAL FUND COMPANIES

1) AL-MEEZAN ISLAMIC INCOME FUND

Vision........38

Mission......38

Board of Directors.....38

Shariah Board........39

Meezan Islamic Income Fund...39

FMS

14

2) IGI ISLAMIC INCOME FUND

Vision........41

Mission......41

Values....41

The Board of Directors......42

Corporate Partners.....43

IGI Islamic Income Fund...........43

3) DAWOOD ISLAMIC INCOME FUND

Mission/Vision Statement.....44

Board of Directors.....45

Dawoodperks.....45

Shariah Board....45

Dawood Shariah Division Introduction.....45

CHAPTER 04..46

VETRICAL, TREND &RATIOS ANALYSIS OF THE SELECTED

CONVENTIONAL INCOME FUNDS:

COMMON SIZE ANALYSIS AND THE TREND ANALYSIS:

1) ALFALAH GHP INVESTMENT MANAGEMENT LIMITED:

Balance Sheet of Alfalah:

Common Size Analysis..48

Trend Analysis...49

FMS

15

Income Statement Alfalah:

Trend Analysis...50

2) ABL ASSET MANAGEMENT COMPANY LIMITED:

Balance Sheet of ABL:

Common Size Analysis..................53

Trend Analysis...............54

Income Statement ABL:

Common Size Analysis......55

Trend Analysis...........................57

3) AKD INVESTMENT MANAGEMENT LIMITED:

Balance Sheet of AKD:

Common Size Analysis...60

Trend Analysis........61

Income Statement AKD:

Common Size Analysis...62

Trend Analysis........64

RATIOS ANALYSIS OF THE SELECTED CONVENTIONAL INCOME

FUNDS:

Return on assets:

Table= B.1 Return on assets.....67

Graph= B.1 Return on assets....67

FMS

16

Return on Equity:

Table= B.2Return on Equity.....68

Graph= B.2 Return on equity....68

Profit Margin:

Table= B.3Profit Margin.......69

Graph= B.3 Profit Margins...69

Net asset value per unit:

Table= B.4 Net asset value per unit......70

Graph= B.4 Net Asset Value per Unit......70

Earning per unit:

Table= B.5 Earning per unit.....71

Graph= B.5 Earning Per unit....71

Current ratio:

Table= B.6 Current ratio..72

Graph= B.6 Current Ratio....72

Net Working Capital Ratio:

Table= B.7Net Working Capital Ratio....73

Graph= B.7 Net Working Capital Ratios....73

Assets Turnover Ratio:

Table= B.8 Assets Turnover Ratio..74

Graph= B.8 Asset Turnover Ratios.....74

Account Receivable Turnover Ratio:

Table= B.9 A/C Receivable Turnover Ratios.....75

Graph= B.9 Account Receivable Turnover Ratios.....75

Debt to Equity Ratio:

FMS

17

Table= B.90 Debt to Equity Ratio......76

Graph= B.90 Debt to Equity Ratios....76

BEST CONVENTIONAL INCOME FUND..77

CHAPTER 05..78

RATIOS, VERTICAL& HORIZONTAL ANALYSIS OF THE SELECTED

ISLAMIC INCOME FUNDS:

Return on assets:

Table= 1.1 Return on assets...80

Graph= 1.1 Return on assets..80

Return on Equity:

Table= 1.2Return on Equity...81

Graph= 1.2 Return on equity......81

Profit Margin:

Table= 1.3Profit Margin.....82

Graph= 1.3 Profit Margins.....82

Net asset value per unit:

Table= 1.4 Net asset value per unit....83

Graph= 1.4 Net Asset Value per Unit....83

Earning per unit:

Table= 1.5 Earning per unit...84

Graph= 1.5 Earning Per unit..84

Current ratio:

FMS

18

Table= 1.6 Current ratio....85

Graph= 1.6 Current Ratio......85

Net Working Capital Ratio:

Table= 1.7Net Working Capital Ratio..86

Graph= 1.7 Net Working Capital Ratios..86

Assets Turnover Ratio:

Table= 1.8 Assets Turnover Ratio....87

Graph= 1.8 Asset Turnover Ratios...87

Account Receivable Turnover Ratio:

Table= 1.9 A/C Receivable Turnover Ratios...88

Graph= 1.9 Account Receivable Turnover Ratios.......88

Debt to Equity Ratio:

Table= 1.90 Debt to Equity Ratio........89

Graph= 1.90 Debt to Equity Ratios..89

BEST ISLAMIC INCOME FUND ..90

COMMON SIZE ANALYSIS AND THE TREND ANALYSIS:

1) AL-MEEZAN ISLAMIC INCOME FUND

BALANCE SHEET OF AL-MEEZAN:

Common Size Analysis....92

FMS

19

Trend Analysis.....93

Graphical Representation.....94

INCOME STATEMENT AL-MEEZAN:

Common Size Analysis....95

Trend Analysis.....97

Graphical Representation.........................98

2) IGI ISLAMIC INCOME FUND

BALANCE SHEET OF IGI:

Common Size Analysis.................100

Trend Analysis...............101

Graphical Representation..................102

INCOME STATEMENT IGI:

Common Size Analysis..103

Trend Analysis...........................105

Graphical Representation...................106

3) DAWOOD ISLAMIC INCOME FUND:

BALANCE SHEET OF DAWOOD:

Common Size Analysis..108

Trend Analysis.......109

Graphical Representation...110

INCOME STATEMENT DAWOOD:

Trend Analysis.......111

Graphical Representation...112

FMS

20

CHAPTER 06113

COMPARISION OF THE RESULTS OF THE CONVENTIONAL & ISLAMIC INCOME

FUNDS:

Results of Conventional Income Funds...114

Results of Islamic Income Funds.....115

The Best Income Fund among the Selected Income Funds.....115

CHAPTER 07...116

CONCLUSION AND RECOMMENDATION:

Conclusion and Recommendation....117

Recommendation..118

CHAPTER 08..119

REFERENCES:

Reference......120

FMS

21

FMS

22

FMS

23

INTRODUCTION TO MUTUAL FUND:

There are two methods of investment. Number first is the direct investment and the

second is the indirect investment. The Direct investment is one in which individuals invest by

themselves, and in the indirect investment the individual gives his / her money to a number of

institutions, companies etc. the direct investment is very suitable for those persons who have the

information,knowledge, and the expertise of moneyinvestment. But those investors who want to

invest his or her money and also want some return for their investment, but they have lack the

information and do not have the expertise to invest in different opportunities. So for those

investorsthe mutual funds are the best and the right option.

A mutual fund is a company that takes the money from many the people and invests in

the stocks, bonds or in the other assets. The combined companies of the stocks, bonds or the

other assets in the Fund are known as portfolio. Each investor who are investing in the fund owns

the shares, which represent a specific part of these companies

Mutual fund is the pool of money created by the individual investors and they give them

it to the professionals. Then the professionals are used to manage these funds and make a

portfolio of the assets, and they determine whether to invest in the stock market or debt market

according to their goal. Currently there are a number of closed-end and open - end mutual funds

which are operating in Pakistan. One of the oldest is NIT and the various funds which are

managed by the Investment Corporation of Pakistan (ICP). The largest numbers of listed

investment funds are twenty-six, which are managed by the ICP. There are about 11 closed-end

mutual funds operating in the private sector of the country.

FMS

24

Some of the analysts believe that the sector number of mutual funds, their paid-up capital

and the number of investors in these mutual funds are too small. The Mutual Investment Fund

Association of Pakistan (MUFAP) is the body that ensures the transparency and the high ethical

conduct and responsible for the growth of the mutual fund industry. In Pakistan, the first open -

end mutual fund was introduced in the year 1962 by the government. In 1966, the government

then created the Investment Corporation of Pakistan (ICP), which is offering a series of the

closed -end mutual funds. In the late 90's there was a growing tendency to run many privatebased

equity investment funds. In the year 2001 and 2007 there was a huge increase in the profitability,

but in the year 2008 due to the financial crisis the net asset value of those funds fell from 390

billion rupees to 187 corers in the year 2009.The performance of the mutual fund in the year

2008 to 2009 was at the worst state due to the financial crises, but after that the mutual fund

industry backed on its feet and the size of the fund increases by the day, due to theinterestof the

people and due to high returns offered by these mutual funds. The mutual fund industry has the

potential to grow even further and can provides the best opportunities for the investors, but also

very well for the economy of Pakistan.

In a graph below the performance of the open ended mutual fund has been shown, which

are providing a positive trend from the year 2009 to 2012.

FMS

25

FMS

26

MUTUAL FUND PROCESS:

The mutual fund process is given in the following diagram.

BRIEF HISTORY OF THE MUTUAL FUNDS:

The history of the mutual fund industry is very uncertain, because some of the historians

believe that the concept of the close end mutual was launched in the Netherlands in the year

1822 by King William,but the others believe that it was started by Dutch merchant Adrian van

Ketwich, who started his first investment Fund in the year 1774. Hehas given certainly an idea of

the diversification for the investors who love the minimal risk. He also gives his name to the

fund Ketwich,the Eendragt Maakt MAGT which gives the slogan that "unity creates strength,"

THE

INVESTORS

Fund

Manager

The Securities

The Returns

FMS

27

he provided these lines in a specific context that, when the different investors pool their money

in one place and then invests in the various types of different securities, then it reduces the risk

as it gives the idea of diversification. The Modern mutual fund was introduced in the

Massachusetts in year 1924. With the passage of time the number of mutual fund has been

increased day by day due to increasein the investor interest to invest in these funds and currently

there is about more than ten thousand mutual funds in the U.S. market alone.

THE MUTUAL FUNDS ASSOCIATION OF PAKISTAN (MUFAP):

Mutual Funds Association of Pakistan (MUFAP) is the trade body for the multi billion

rupees of the asset management industry of Pakistan. The members manage a wide variety of the

investment vehicles which includes stocks, bonds, money market instruments,the government

securities and the bank deposits. The role of MUFAP is to ensure the transparency, the high

ethical conduct and the growth of the mutual fund industry. It was formed in the year 1996 by

Zaigham Mahmood Rizvi, who was the former chairman and the founder member and it was

officially incorporated in the year 2001 as a public company limited by the guarantee without the

share capital. MUFAP has licensed by the Ministry of Commerce (the Directorate General of the

Trade Organizations). After the establishment of MUFAP in the year 1996, different private and

foreign firms were allowed to swim the public funds for the general public. This time also saw

the new heights scale performance of the stock market as a result of the positive government

policies and the incentives, a growth of more than 15 times the net assets of mutual funds in the

period 2000 2008 was recorded. The Mutual Funds are initially under the control of a judicial

body corporate (CLA) under his wing Securities. CLA is a division of the Ministry of Finance,

which was gradually transformed and made the independent as the Commission on the Securities

and Exchange Commission of Pakistan (SECP) within the framework of the Capital Market

Development (CMDP) initiative of the Asian Development Bank, conducted by Pakistan.

FMS

28

In the graph given below there is a positive trend in the total net asset of the open ended

mutual funds but a negative trend in the closed ended mutual fund of Pakistani mutual fund

sector.

DIFFERENT TYPES OF MUTUAL FUNDS:

On the structure of mutual funds are classified as open-end fund and closed-end fund.

OPEN-END FUNDS:

Open-end funds are the public offer and there is no limit to authorize the capital and the

shares are bought and sold at the outlet of the company. If a person wants to sell these shares

then the daily rates will be calculated in terms of the net asset value (NAV), and if a person

wants redemption of these actions,then he will buy it at a price based on the net asset value. The

Net asset value can be calculated by subtracting the liabilities from the total fund assets.

The Value of Net Assets = Total Assets Liabilities / No of Shares Outstanding

FMS

29

CLOSED FUND:

Close funds offer the shares through the IPO (Initial Public Offering). This fund operates

as the joint stock company and shares are then traded on the secondary market. If a person wants

to strip and then he can go to the exchange. There is one difference from the open end fund is

that the fund is closely limit to authorize capital approved by ACCP. Here, the prices are

determined by the market forces Fund (supply and demand). Different Rules for the Mutual

Funds operating in Pakistan.

These rules govern mutual funds in Pakistan include:

1. The Investment companies and the investment advisers rules 1971. (Government gated

mutual funds).

2. The Asset Management Companies Regulations 1995. (Regulated open-end mutual

funds).

TYPES OF MUTUAL FUNDS:

With respect to objectives there are various kinds of funds,

Money Market Fund

Income Fund

Islamic Fund

Asset Allocation Fund

Growth Fund

MONEY MARKET:

The money market funds are invested in the short-term securities issued by the

government or the corporations such as T-bills and the commercial paper, whose life is less than

a year, and they are the most liquid instruments.

FMS

30

EQUITY INCOME:

The main objective of the equity fund is to obtain high income depending on the risk

means that if the funds are invested in the risky securities issued by a corporation then the return

will be high, but if it is invested in a non- risky securities issued by the government,the return

will be lower than the risky securityreturn.

ISLAMIC FUNDS:

As the name indicates,the Islamic funds will be invested in thosesecurities that are in

accordance with the Sharia principles, these funds are not invested in those securities that bear

the interest.

ASSET ALLOCATION FUNDS:

The asset allocation funds are invested in the different securities in order to diversify or

minimize the risk. A type of portfolio is created for this purpose where risk is minimal. These

funds are designed for those investors who do not want to take the maximum risk.

EQUITY GROWTH:

The main purpose of equity growth funds is to increase the principal amount invested,

and a long-term investment can be from 3 to 5 years.

ADVANTAGES OF MUTUAL FUNDS:

DIVERSIFICATION:

FMS

31

The greatest advantage of the mutual fund is the diversification which means to minimize

the risk. Mutual funds have a quality of diversification because the fund is invested in various

assets.

LIQUIDITY:

The second quality of a mutual fund is its liquidity, because at any moment a person can sell

their shares at net asset value (open-ended) and can get money back.

PROFESSIONAL MANAGEMENT:

Professional management is also one of the important advantages of the mutual funds.

Mutual funds have their own experts who can professionally manage the portfolio in the best

way.

LOW INVESTMENT:

Mutual fund can be very helpful for those investors who have small amount of money for

investment. Mutual funds provide opportunities for those investors, and they can invest a

minimum amount in these funds.

LOW TRANSACTION COST:

The transaction cost is low because a mutual fund invests collectively large number of

funds in different securities. If individual investors buy and sell shares than the value of the

transaction is high.

THE ISLAMIC FINANCE INDUSTRY:

The Islamic finance industry over the past three decades has diversified itself from the

banking to the other sectors as well and now it includes the institutions such as the Islamic banks,

the Islamic insurance companies and the Islamic mutual funds. The growth has been impressive

FMS

32

over the last decade, despite of the crisis that hit the global financial markets during this period

of time.

The Islamic mutual fund industry has also enjoyed the success in attracting the

investment funds from the Muslim investors, as well as from the non-Muslim investors because

of their impressive results. The Islamic mutual fund industry has grown by leaps and bounds

throughout the world and in Pakistan as well. In PakistanCurrently, there are 15 AMCs (Asset

Management Companies) of the Islamic mutual funds. There are about 29 open- end funds,

which are Islamic in the open category end funds. In addition, there are 18 voluntary pension

funds and the one closed -ended fund as well.

Islamic principles compliment the growth gross capital formation or productive

capacity of the economy through the promotion of entrepreneurship in the manufacturing

sector.Taking the business risk is the basis of the Islamic economics. Effective institutions are

required to comply the financial intermediation that promote an entrepreneurial culture, and get

around with it.

There are currently no Islamic Investment Bank in Pakistan and not Islamic venture

capital fund. Mudarabah companies that have been around since the 1980s, are in such dubious

ways that even the scholars of Islamic Sharia counseling mutual funds consider investing in these

companies are not relevant from the point of view of the Islamic principles . In the voluntary

pension funds, there are as many as the number of Islamic funds conventional means.

It is to show that, in addition to the banking, there is so much space in the alternative

financial institutional structure where the Islamic institutions can lead, not follow. The key to

that is equity based financial intermediation capture currently debt-based financial

intermediation, which is the circularly associated with banking. But, while Islamic banks

maintain the higher spreads compared to the conventional banks and have most of their products

related to interest rates, there is still a long way.

FMS

33

THE RISE OF THE ISLAMIC MUTUAL FUNDS:

Although in general the mutual fund industry has expanded at a remarkable 52 percent

for the fiscal year ended in June 2012, its growth has decreased by 10.4 percent for the 10

months ending April 30, 2013.

Much of the decline can be attributed to a reduction of the 14.9 per cent in the assets

under management (AUM) of conventional mutual funds, against the positive growth of 17.4

percent in those Islamic mutual funds.

With the Islamic investment funds accounted for more than 17 percent of the total

industry in mutual funds, a total of 39 funds and more than Rs61 billion AUM , it is realistic to

say that , if you have not created a segment , it has been steadily picking up the momentum.

Although the Islamic funds continue to perform steadily butthere are number of problems

to spoil its way.

Lack of the awareness of the mutual funds and the understanding of Shariah investments

and their benefits, industry prevented from performing to its growth potential. General

impression that prevails in that profit from the Islamic funds is less than that offered by their

conventional counterparts.

Another important question arises in the connection with the non- standardization and

lack of the uniform interpretation of Sharia councils through because of the difference in the

sects, along with the fragmentation of these cards on individual institutions.

This often leads to the conflicts between different views of the Sharia scholars, and leads

to a lengthy approval process of the new products that will be launched.

While Shariah Advisory Council is under the development by the Commission ofthe

Securities and Exchange Commission of Pakistan (SECP), there was no separate regulatory body

to oversee the Islamic mutual funds industry until now.

FMS

34

Another serious problem facing by the industry is the lack of variety of the financial

instruments in the mutual funds, which hinders investment and product diversification of Islamic

asset management companies (AMCs).

Currently, Islamic investment funds face the limited investment destinations, especially

for the short-term debt securities, as the majority of the short-term debt instruments in the market

are interest.

In this respect, the support from the regulatory authorities to implement and to improve

asset classes such as the real estate investment trusts,the private equity funds and other liquid

products that are needed to expand the scope of Islamic funds industry.

In addition, a limited distribution network constrains the growth of Islamic mutual funds

and their accessibility to retail investors. There is lack of the interest by banks for the sale of

mutual funds.

SO WHY ISLAMIC FUNDS:

There are the two reasons that why you should go with the Islamic mutual funds.

1. It provides arelatively high rate of return in the private sector.

2. It is Halal.

FMS

35

FMS

36

FMS

37

1) ALFALAH GHP INVESTMENT MANAGEMENT LIMITED

Alfalah GHP INVESTMENT MANAGEMENT LIMITED:

The Alfalah GHP Investment Management Limited Is authorized by the Securities and

Exchange Commission of Pakistan (SECP), pay services provide the Asset Management and the

Investment Advisory pay retail , the Business and Institutional Investors ACCORDING NBFC

Rules 2003 .

Bring the merger with the ALFALAH GHP relationships significant force of IGI Funds

with the customer and the fund management. IGI Funds Limited merged with and IN Alfalah

GHP Investment Management Limited and the Rights of All the Organizations manage the

placement of the Collective Separated and Accounts (SMA) sera transferred to the Alfalah GHP

Investment Management Limited.

Alfalah GHP vise various float of mutual funds in time period of June who seek to invest

in various asset classes such as the equities, money market, etc.

MISSION:

Mission of Alfalah GHP Income Multiplier Fund is to provide sustainable returns,

consistent and inflation protected investment in instruments and Income Money Market

VISION:

FMS

38

Vision of Alfalah GHP Income Multiplier Fund is to impose Investment vehicle of

setting for Investors who are seeking sustainable returns, consistent and inflation protected on the

long term through investments in the securities Income and the Money Market and other

securities.

The Board of Directors of Management Company:

Mr. Abdul Aziz Anis

Mr. Shahid Hosain Kazi

Mr. Hanspeter Beier

Mr. Shakil Sadiq

Mr. Shahab Bin Shahid

The Audit Committee:

Mr. Shahab Bin Shahid

Mr. Shahid Hosain Kazi

Mr. Shakil Sadiq

The Fund Manager:

Mr. Zeeshan Khalil

The Trustee:

Central Depository Company of Pakistan

The Bankers to Fund:

Bank Alfalah Limited

FMS

39

Faysal Bank Limited

The Registrar:

Alfalah GHP Investment Management Limited

The Distributor:

Bank Alfalah Limited

The Funds under Management:

The ALFALAH GHP VALUE FUND (AGVF)

TheALFALAH GHP INCOME MULTIPLIER FUND (AGIMF)

TheALFALAH GHP ISLAMIC FUND (AGIF)

TheALFALAH GHP ALPHA FUND (AGAF)

TheALFALAH GHP CASH FUND (AGCF)

2) ABL ASSET MANAGEMENT COMPANY LIMITED

ABL Asset Management Company Limited (ABL AMC):

ABL AMC is a subsidiary of Allied Bank Limited (ABL). It has a paid up capital of Rs.

500 million,it is the second startup Pakistani asset managementcompany.

The ABL AMC plans is to become world class Asset Management Company, to provide

innovative solutions for the managing assets for its institutional and the retail investors.

FMS

40

The company is authorized to undertake the asset management services and the

investment advice and is planned to establish the highest standards of integrity and the quality

service through the professional management of mutual funds.

PROFILE OF DIRECTORS:

Sheikh Mukhtar Ahmed:

Sheikh Mukhtar Ahmed has begun his professional career after migrating from the India

at the time of the independence of Pakistan in the year 1947 and contributed to the industrial and

commercial growth in Pakistan throughhis entrepreneurial skills and the business acumen. He

has 55 years of experience in the creation and the successful management of the various

industrial and the financial companies.. He joined the Allied Council Bank in 2004 and the

Council ABLAMC in 2008.

Khawaja Mohammad Almas:

Khawaja Mohammad Almas began his career with Allied Bank in the year 1983 and has

29 years of the banking experience. He has completed MBA from IBA Punjab University in the

year 1982 and professional qualification (DAIBP) in the year 1986. Now he is the Chief

Commercial & Retail Banking Group ABL Group.

Mr. Jawaid Iqbal:

Mr. Jawaid Iqbal CFA is the head of Corporate and Investment Banking Group at the

Allied Bank Limited. He has done Master of Business Administration (MBA) degrees from

Charter Institute banker, UK and CFA from CFA Institute, USA. He is now the president of the

CFA Association of Pakistan.

Mr. Farid Ahmed Khan, CFAis theCEOof the fund.

Syed Khalid Husain is the Head of Business Development.

FMS

41

Mr. Saqib Morning ACA, APA is the Chief Financial Officer and the Company

Secretary of the fund.

Mr. Muhammad Imran is the Chief Investment Officer of the fund.

Mr. Mubeen Ashraf Bhimani is the Chief Internal Auditor of the fund.

Syed Mehdi Hassan is the Head of RS & Operations of the fund.

Mr. Wali Muhammad Hassan is the Head of Information Technology of the fund.

Mr. Abid Jamal is the Director of Research of the fund.

Mr. Hammad Ali Abbas is the Senior Research Analyst of the fund.

Mr. Kamran Aziz CFA is the Fund manager of the fund.

3) AKD INVESTMENT MANAGEMENT LIMITED (AKDIML)

FMS

42

AKDIML is the maximum value of the investment services provider in Pakistan. They

currently manage one of the oldest mutual funds in the country. They have several innovative

financial instruments to be launched. They specialize in the custom design for high net worth,

client investment plans.

MISSION:

Mission of AKDIML is to provide the investors with access to the investment

opportunities through the introduction of the innovative financial products, offering performance

and to provide consistent risk adjusted return.

COMPANY:

AKDIML is a subsidiary of Aqeel Karim Dhedhi Securities (Private) Limited (AKD). They

focused on the enabling customers to enjoy the experience of fund managers. The management

team manages a fund of the oldest mutual funds Golden Arrow in the market and also developing

a range of advanced financial instruments.

PARENT:

AKD Securities is the leading securities company providing the financial services to a large and

diverse group of the institutional clients and the foreign and local individuals. It is the broker top

sales and trading and it is a leader in the breeding and venture capital in the underwriting, market

making, and in the mergers and acquisitions in the country.

PRODUCTS AND SERVICES:

Mutual Funds:

AKD Income Fund (AKDIF):

The AKD Income Fund is essentially a dedicated fund that focuses primarily on an asset

class that is fixed income securities and instruments.

FMS

43

Management of the company:

Faisal Bengaliis theCEOof the company.Bengali has the Master in Business

Administration from Rice University, USA.

AKD Group:

It is a dynamic group not only provides the financial services to the entire range, but it

also has interests in other sectors.

FINANCIAL SERVICES:

AKD Securities (Pvt) Limited

The Leading brokerage house in country. Trades about 8 % of the daily volume traded on

the KSE.

The Recipient of Certified Financial Analysts Association of Pakistan (CFAAP) Award

in the year 2006 for the Best Securities House in Pakistan.

It is the pioneers in the providing a platform for online trading through its subsidiary,

It is the pioneers of the venture capital in Pakistan launched in 2000.

It is the First NBFC license Venture Capital Company in Pakistan.

Distribution Network:

AKD Investment Management Ltd.

AKD Securities

Bank of Punjab

Interbank

Access to Financial Services (Pvt ) Ltd

FMS

44

FMS

45

FMS

46

1) MEEZAN ISLAMIC INCOME FUND

Al Meezan Investment Management Limited (Al Meezan):

The Al Meezan Investment Management Limited (Al Meezan) is dedicated to providing

investment solutions according to Sharia Meezan Bank (MBL) and Pak Kuwait Investment

Company (PKIC) is a joint venture. They have open and closed-end mutual funds; provide

investment advisory and the discretionary management of institutional as well as the high net

worth individuals (HNWIs) files, both developing and managing floats, specializes in the

investment.

Al Meezan was established in the year of 1995 as a joint venture between,

Pakistan Kuwait Investment Company (PKIC),

National Investment (Trust) Limited ,

Vision:

Vision of the company is to promote professional fund management through

development and implementation of Shariah compliant investment products, policies and

practices designed to meet the investment objectives of the investors.

Mission:

Mission of the company is to be the leading Shariah compliant asset management

company by providing quality service to the institutional and individual investors utilizing

FMS

47

modern techniques of the portfolio management, proactive asset allocation and the prudent

security selection by maintaining high standards of the ethical and professional conduct.

Board of Directors:

The Board of Directors comprises of the renowned professionals and is chaired by Mr. Ariful

Islam, who is the Chief Operating Officer of Meezan Bank Limited. The Board members

include:

Mr. Ariful Islam (Chairman):

Mr. P. Ahmed: Head of Product Liability (Asset Management and Insurance)

Mr. Salman Sarwar Butt

Mr. Tasnim Ul Haq Farooqui

Mr. FAROOQUI L.L.M from Karachi is University (1986).

Shariah Board:

The company is veryspecific about providing Halal and Riba-Free investment opportunities.

For all the operations and investments, they draw Shariah Advisory from the Shariah

Supervisory Board of the Meezan Bank Limited, including the following Islamic scholars:

Justice (Retd.) Mufti Muhammad Taqi Usmani (Chairman)

Dr. Imran Ashraf Usmani (Pakistan)

FMS

48

Dr. Abdul Sattar Abu Guddah (Saudi Arabia)

Sheikh Essam M. Ishaq (Bahrain)

Meezan Islamic Income Fund:

The Meezan Islamic Income Fund (MIIF) is the Pakistans first Shariah Compliant open

end mutual fund which is in the category of Income Fund.

The objective of this MIIF is to provide Halal and the consistent stream of income with

long-term capital preservation in a Shariah Compliant manner. It also provides the potential to

the investors for capital gains as well as the regular income by investing in a diversified portfolio

of the good quality Islamic Instruments such as Sukuks, Certificate of the Islamic Investments,

Musharika and the Morabaha instruments, the Shariah-compliant spread transactions, and other

Islamic income products.

The MII Fund meets the requirement of a large number of investors both for institutional

and individual, who have desire of Shariah-Compliant investment opportunities but also want to

avoid the risk of direct exposure to the stock market.

The Features of MIIF are:

It provide capital preservation through practical fund management,

It is Halal and consistent stream of income which is strictly monitored and approved by

the Shariah Advisors,

It provides an opportunity to start investment with minimum Rs. 5,000/ and then invest at

a regular intervals with subsequent investment amount as low as Rs. 1,000/- .

Its units are readily cashable throughout the year,

Investment in MIIF enables a person to get tax benefit up to Rs. 100,000/- in the case of

salaried person or up to Rs 125,000/- in the case of non-salaried person on the

FMS

49

investmentsup to Rs. 500,000/- under the applicable tax laws, if the investment is held for

a period of one year.

It provides diversification of the portfolio resulting in lower risk and competitive return

on investment.

FMS

50

1) IGI ISLAMIC INCOME FUND

IGI ISLAMIC INCOME FUND:

It is established in the year 2006, it is a company of the IGI Financial Services and

Packages Limited group. Company is authorized by the Securities and Exchange Commission of

Pakistan (SECP) to provide the investment advisory services and the asset management under

the NBFC Rules, 2003.

IGI Funds is committed to providing the quality services to the institutional and retail

clients using the modern techniques of the portfolio management, asset allocation and the

security selection, by maintaining high standards of ethics and professional conduct.

Pacra has assigned Management Quality Rating of AM3 + with a stable outlook to the

IGI Funds Limited, which shows that the IGI Funds Limited meets the high investment

management norms and standards of the industry.

VISION:

Vision of IGI Funds Limited is to be a trusted provider of solutions and services for the

fund management focus on the best serving the interests of clients' investments.

MISSION:

FMS

51

Mission of the company is to provide solutions to the investment needs of the customers

who adhere to the highest ethical standards by meeting the long-term goals and the short-term

needs, to attract and retain the talent that shares the core values of integrity,and excellence.

Values:

Integrity,

Professionalism,

Focus on Sustainable Growth.

The Board of Directors:

Javed Hamid:

Chairman IGI Funds Limited

Muhammad Asif Saad

(Independent)

Director

Abid Naqvi (Independent)

Director

Khalid Yacob

Director

FMS

52

Alman A. Aslam (Independent)

Director

Corporate Partners:

Trustee:

IGI Funds Limited has appointed the Central Depository Company of Pakistan Limited

(CDC) to act as a trustee for the existing funds in the 2003 regulations, NBFC.

Registrar:

For all the open-ended funds offered by IGI Funds Limited Registrar will manage the in-house

services and strives to provide support services to the unprecedented unity.

Auditors;

KPMG Taseer Hadi & Co is the external auditors of all five funds.

FMS

53

IGI offer the following Funds:

IGI Aggressive Income Fund

IGI Islamic Income Fund

IGI Stock Fund

IGI Income Fund

IGI Money Market Fund

IGI Islamic Income Fund:

The IGI Islamic Income Fund seeks, through a combination of the current income and

long term capital appreciation, which provide a stable return with a reasonable investment risk in

a Shariah compliant manner.

The investment policy of the Fund is to select instruments from within the specified

Shariah compliant Permitted investments and invest in the Offer Document asset classes.

The Pakistan Credit Rating Agency (PACRA) has assigned a (A + (f)) rating to IGI Islamic

Income Fund.

FMS

54

3) DAWOOD ISLAMIC INCOME FUND

Dawood Capital Management Limited (DCM):

The Dawood Capital Management Limited (DCM) commitment is to bring the best social

responsibility priorities in Pakistan based leading asset Management Company.

It has 25% stake in Asian Development Bank (ADB) was established jointly by the truly

international, and they are development oriented. The DCM venture capital financing for

Pakistan Venture Capital Limited (PVCL), started business operations on the 1 January of 1993

FMS

55

and the first Dawood Group took over the management in the year 1999 and has worked in

collaboration with the ADB.

The DCM Asset Management and the Investment Advisory Company NBFC

(Establishment and Regulations)Rules 2003 under the Securities and Exchange Commission of

Pakistan (SECP) has both license in good standing.

The DCM has always been a pioneer and became the country's 1st listed asset

management company. Today, the have company open-end and closed-end Dawood Income

Fund and the First Dawood Investment Fund managers, and soon the David Cash Fund is

launching an open end.

The DCM always with Dawood Global Foundation BABYFUND through a partnership

of women and the children through the work of its container was given back to the community a

terrific and was LADIESFUND initiatives.

Mission/Vision Statement:

Mission and vision of the company is to be the Prominent Funds Manager That Adds

Value for the Stakeholders through an Innovative and Responsible Management.

Board of Directors:

FMS

56

Mrs. Shafqat Sultana:

Independent Director & Chairperson

Ms. Tara Uzra Dawood:

Chief Executive Officer

Mr. S. Shabahat Hussain:

Director

DAWOODPERKS:

The DCM investors are part of the family. The DCM family has now grown to include the joint

promotions with various enterprises including the boutiques, salons, book stores and an array of

the products.

DCM Shariah Division Introduction:

The DCM Shariah Division is an independent structure within the asset management

company to provide a world class specialized shariah investment services to the clients. These

include personalized Shariah Investment Advisory Services as well as the mutual funds including

the Dawood Islamic Fund.

The DCM CEO Tara Uzra Dawood minored in the Shariah finance and legal systems as

part of her Doctorate in Juridical Sciences from the Harvard Law School. All the investments

and elements of this Shariah Division are also overseen by the well-known scholar on the

Shariah Board.

Shariah Board

Mufti Muneeb ur Rehman (Chairperson)

FMS

57

Mufti Syed Sabir Husain

Mufti Syed Zahid Siraj

FMS

58

VERTICAL/ COMMON SIZE ANALYSIS AND THE HORIZONTAL /

TREND ANALYSIS:

1) ALFALAH GHP INVESTMENT MANAGEMENT LIMITED

BALANCE SHEET OF ALFALAH:

Common Size Analysis

Trend Analysis

INCOME STATEMENT ALFALAH:

Common Size Analysis

Trend Analysis:

FMS

59

Alfalah GHP Investment Management Company Limited.

Income Multiplier Fund Balance Sheet Common size Analysis:

TableA-3.1: Balance Sheet Common Size Analysis of Alfalah

ASSETS 2010 2011 2012

Bank Balances 11% 5% 10%

Investments 87% 85% 82%

The Profit Receivables 1% 9% 7%

The Security deposits. &The other Receivable. 1% 1% 1%

The Prelim. Exp. & The Floating costs 0% 0% 0%

Total Assets 100% 100% 100%

FMS

60

LIABILITIES

The Payable to The Alfalah GHP IM Ltd. 13% 6% 6%

Payable to The CDC, Pakistan 2% 1% 1%

Payable to The SECP 5% 6% 4%

The Accrued Exp &The other Liabilities 79% 87% 88%

Total Liabilities 100% 100% 100%

The Common Size analysis of the balance sheet of Alfalah Income Multiplier Funddepicts

different scenario over different time period. In Financial Year of 2010 the total investments

were 87% of the total asset value which went slightly down ward over the next two periods of

FY2011 and FY2012 to 85% and 82% respectively.

Bank balance of Alfalah Income Multiplier Fund decreased from FY 2010 where it

was about 11% of the total asset to 5% in FY2011 and then increased to 10% in FY 2012.

Total Liabilities of the company increased from FY 2010 where it was about 0.8% of the

total asset to 1.6% in FY 2011 and it also increased in FY 2012 which is about 1.8% of

the total assets value.

Net Assets of the company decreased from FY 2010 where it was about 99.2% of the

total asset value and it increased to 98.4% in FY2011 and it again slightly decreased in

FY 2012 to 98.2% of the total asset value.

Alfalah GHP Investment Management Company Limited.

FMS

61

Income Multiplier Fund Balance Sheet Trend Analysis:

TableA-3.2: Balance Sheet TrendAnalysis of Alfalah

ASSETS 2010 2011 2012

Bank Balances 100% -79% 88%

Investments 100% -53% -13%

The Profit Receivables 100% 324% -33%

The Security deposits. &The other Receivable. 100% -8% -28%

Prelim. Exp. &The Floating costs 100% -51% -

The Receivables against The Sale & Maturity of The Investments

Total Assets 100% -51% -11%

LIABILITIES

Payable to The Alfalah GHP IM Ltd. 100% -56% 10%

Payable to The CDC, Pakistan 100% -52% 0%

Payable to The SECP 100% 16% -28%

The Accrued Exp & other Liabilities 100% 8% 2%

Total Liabilities 100% -2% 1%

NET ASSETS 100% -52% -11%

No. of The Units in Issue 100% -53% -4%

The Net Asset Value per Unit 100% 2% -7%

The Trend Analysis of the balance sheet of Alfalah Income Multiplier Funddepicts different

scenario over different time period. A positive trend has been noted in the Profits Receivables of

the company in the Financial Year of 2011 shows a huge increase of 324% and in 2012 it shows

a slight decrease of 33%.

FMS

62

Bank balance of Alfalah Income Multiplier Fundhave shown a negative trend in the FY

2011 with a decrease of 79% but showed a positive trend in FY2012 by registering an

increase of 88% in that year.

Total Assets of the company have shown a negative trend as well for the FY 2011 which

decreased by 51% and the downward trend continued in the next year but the magnitude

of the decrease reduced to 11%.

Total Liabilities of the company have shown a mixed trend in both years, in the FY 2011

it decreased by 2% and in Fy2012 total Liabilities increased by 1%.

Net Assets of the companyhave shown a negative trend in the FY 2011 by decreasing by

52% as well as same trend in FY 2012 but decline reduced to 11%.

Alfalah GHP Investment Management Company Limited.

Income Multiplier Fund Income Statement Trend Analysis:

TableA-3.3:Income StatementTrendAnalysis of Alfalah

INCOME 2010 2011 2012

Capital gain/loss on The investment sale 100% -83% 72%

The Income from The Govt. Securities 100% -18% 57%

Income from reverse transaction. 100% 491% -60%

Income from The Term Fin. Cert./Sukuk 100% -23% 149%

The Profit on bank accounts 100% -18% -75%

Reversal in invest value 100% 2794% 61%

The Unrealized inc/dec in The invest value 100% 179% -234%

FMS

63

The Impairment in Held for sale The invest 100% 301% -247%

Total Income 100% -322% -157%

EXPENSES

The Salaries of Alfalah GHP IM Ltd. 100% 16% -28%

Salaries of CDC 100% 18% -18%

The Annual fees - SECP 100% 16% -28%

Brokerage & other costs 100% -38% -79%

Bank Charges 100% -86% 73%

The Auditor's salaries 100% 31% -15%

Amortization 100% 101% -4%

Legal Charges 100% 296% -59%

Printing charges 100% 69% -17%

Listing Fees etc. 100% 88% -14%

Worker Welfare Fund 100% -93%

The Total Operating Expenses 100% -17% -19%

Net Operating Loss 100% 95% -1406%

Net gain/loss on unit sales/redem. 100% 176517% -98%

The Net Income before Tax 100% -181% -199%

Taxation

The Comprehensive Income for the year 100% -181% -199%

The Trend Analysis of the Income statement of Alfalah Income Multiplier

Fundillustratesvarious scenarios over different time period. A mixed trend has been noted in the

term finance certificate of the company in the Financial Year of 2011 it saw a slight decrease of

18% and in FY2012 its value increased by 57%.

FMS

64

Bank Balance of Alfalah Income Multiplier Fundhad shown a negative trend in the FY

2011 and 2012, which decreased by 18% in 2011 and 75% in 2012.

Total Income of the company has shown a discouraging trend in the FY 2011which

decreased by 322% and downward trend continues in FY2012 as income again decreased

by 157% in that year.

Total expenses of the company had shown a positive trend in the FY 2011which

decreased by 17% and in FY2012 it showed a decreasing trend too and it decreased by

19% in that year.

Net income of Alfalah Income Multiplier Fundhad shown a negative trend in both the

FY 2011and FY 2012 which decreased by181%and199% respectively.

FMS

65

VERTICAL/ COMMON SIZE ANALYSIS AND THE HORIZONTAL /

TREND ANALYSIS:

2) ABL ASSET MANAGEMENT COMPANY LIMITED

BALANCE SHEET OF ABL:

Common Size Analysis

Trend Analysis

INCOME STATEMENT ABL:

Common Size Analysis

Trend Analysis:

FMS

66

ABL Assets Management Company Limited.

ABL Income Fund Balance Sheet Common Size Analysis:

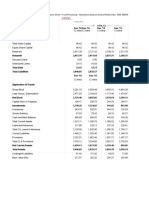

TableA-1.1: Balance Sheet Common size analysis of ABL

ASSETS 2010 2011 2012

Bank Balances 8% 20% 22%

Investments 91% 79% 77%

The Profit Receivables 1% 0% 0%

TheSecurity deposit. &Theother Receivable. 0% 0% 0%

ThePrelim. Exp. & Floating costs 0% 0% 0%

FMS

67

Receivables against TheSale & Maturity of Investments

Total Assets 100% 100% 100%

LIABILITIES

ThePayable to AMC 11% 7% 17%

ThePayable to CDC, Pakistan 1% 0% 1%

Payable to SECP 5% 4% 10%

TheDividend Payable 64% 55% -

Payable against TheRedemption 18% 3% -

TheAccrued Exp & other Liabilities 1% 30% 71%

Total Liabilities 100% 100% 100%

In the above shown table, the Vertical or Common size analysis of balance sheet of ABL

Income Fund is calculated in which each item of the balance sheet is shown as a proportion of

the specific component of the same balance sheet. The vertical analysis of the balance sheet of

ABL Income Fund depicts different scenarios over different time periods.In Financial Year

2010 the total investments were about 91% of the total assets which went slightly down ward

over the next period of 2011to 79% and in FY2012 it was calculated77% of the total assets.

Balance with the banks of ABL Income Fundshowed an increase from FY 2010 where it

was about 8% of the total assets to 20% in FY2011 and continued upward trend in FY

2012 and is about 22% of the total assets value.

Total Liabilities of the company increase in FY 2010 from 1.70% of the total asset to

2.21% of total assets value in FY2011 however it decreased in FY 2012 and its value

showed downward trend and changed to 10.1% of the total assets value.

Net Assets of the company slightly decreased from FY 2010 where it was about 98.3% of

the total assets value to 97.8% in FY2011 and it again increased in FY 2012 and is about

98.9% of the total assets value.

FMS

68

ABL Assets Management Company Limited.

ABL Income Fund Balance Sheet Trend Analysis:

TableA-1.2: Balance Sheet Trend analysis of ABL

ASSETS 2010 2011 2012

Bank Balances 100% 52% -17%

Investments 100% -49% -25%

Profit Receivables 100% -66% -26%

TheSecurity depo. & other Recei. 100% 775% 1436%

Prelim. Exp. & Floating costs 100% -31% -45%

TheReceivablesagainst Sale &TheMaturity of Investments

Total Assets 100% -41% -23%

LIABILITIES

Payable to AMC 100% -49% -16%

ThePayable to CDC, Pakistan 100% -56% -15%

Payable to SECP 100% -30% -18%

Dividend Payable 100% -34% -

ThePayable against Redemption 100% -88% -

TheAccrued Exp &Theother Liabilities 100% 1840% -16%

Total Liabilities 100% -24% -65%

NET ASSETS 100% -42% -22%

TheNo. of Units in Issue 100% -42% -23%

TheNet Asset Value per Unit 100% 0% 0%

FMS

69

Horizontalor Trend Analysis of balance sheet of ABL Income Fundisemployed to calculate the

particular trend of the balance sheet over different time period.For calculating the trend we have

taken FY2010 as base year and any changes over time in all items of the balance sheets of

subsequent years were calculated using the base year and trend in reference to base year has been

calculated which is shown as above. The Trend Analysis of the balance sheet of ABL Income

Fundportraysvarious scenarios over different time period.

Balance with the banks of ABL Income Fund have shown a positive trend in the FY

2011 which increased about 52% but it have shown a negative trend in the FY 2012 when

it decreased about 17% .

Total Assets of ABL Income Fundhad shown a negative trend in the FY 2011 and 2012

which decreased about 41% and 23% in FY 2011 and FY 2012 respectively.

Total Liabilities of the company had also shown a negative trend in the FY 2011 and FY

2012 as it showed a decline of 24% and 65% in FY2011 and FY2912 respectively.

Net Assets of ABL Income Fund had shown a negative trend too as its values shown a

decrease of 42% in FY 2011 and 22% in FY2012 respectively.

ABL Assets Management Company Limited.

ABL Income Fund Income Statement Common Size Analysis:

Table A-1.3:Income statement Common size analysis of ABL

INCOME 2010 2011 2012

Capital gain/loss on investment sale 0% 0% 2%

Income from TheGovt. Securities 23% 57% 67%

Income from TheTerm deposit. Receipts 42% 25% 10%

Income from Thecertificate of Invest. 9% 0% -

Income from C.O.D's 0% 2% 0%

Income from The Letters of placement 8% 4% 1%

Income from The reverse repur. transac. 5% 6% 1%

FMS

70

Income from TheTerm Fin. Cert./Sukuk - 0% 8%

Profit on Thebank accounts 1% 6% 7%

Dividend Income - - 3%

Held for trading 0% 0% 0%

Total Income 100% 100% 100%

EXPENSES

Salaries of AMC 12% 12% 11%

TheSalaries of CDC 1% 1% 1%

Annual fees SECP 1% 1% 1%

Brokerage &Theother costs 0% 0% 0%

Bank Charges 0% 0% 0%

Auditor's salaries 0% 0% 0%

Amortization 0% 0% 0%

ThePrinting charges 0% 0% 0%

Listing Fees etc. 0% 0% 0%

Rating Fees etc. 0% 0% 0%

Other expenses 0% 0% 0%

TheTotal Operating Expenses 14% 14% 15%

Net Operating Income 86% 86% 85%

Net gain/loss on The unit sales/redem. -3% -9% 5%

TheWorker's welfare fund 0% -2% -2%

Net Income before Tax 82% 76% 88%

Taxation 0% 0% 0%

TheComprehensive Income for the year 82% 76% 88%

FMS

71

The TrendAnalysis of the Income Statement of ABL Income Fund shows different scenarios

over different time period.In Financial Year of 2010 the total income from Govt. securities

was23% of the Total Income which gradually increased over the next two periods of 2011to 57%

and 67% in FY2012respectively.

The ABL Income Fund did not pay the dividends in FY2010 and FY 2011. It started

paying dividends in FY2012 in which it was 3% of the Total Income from the fund.

Unrealized gain on the re-measurement of the investments of Al-Meezan Islamic income

fund increased from FY 2010 where it was about 65.3 percent of the total income to 87.3

percent in FY 2011 and it also increased in FY 2012 which is about 97.4 percent of the

total income.

Total expenses of ABL Income Fund was 14% in FY 2010 whereas it continued to

remain at the same level of 14% until FY2011 and then it slightly increased to 15% of the

total Income of the fund in FY2012.

The Net Income for the financial years 2011 of ABL Income Fund was 82% of the Total

Income and in FY2011 it decreased and was 76% of the total income. However, in

FY2012 it rose again to 88% of the total income of that year.

FMS

72

ABL Assets Management Company Limited.

ABL Income Fund Income StatementTrend Analysis:

Table A-1.4:Income statementTrendAnalysis of ABL

INCOME 2010 2011 2012

Capital gain/loss on investment sale 100% 440% 3432%

Income Thefrom Govt. Securities 100% 82% 82%

Income Thefrom Term deposit. Receipts 100% -56% -86%

Income Thefrom certificate of Invest. 100% -98%

Income Thefrom C.O.D's 100% 289% -32%

Income Thefrom Letters of placement 100% -64% -88%

Income Thefrom reverse repur. transac. 100% -2% -84%

Profit on bank accounts 100% 231% 226%

Held for trading 100% 73% 132%

Total Income 100% -26% -37%

EXPENSES

FMS

73

TheSalaries of AMC 100% -30% -43%

Salaries of CDC 100% -33% -49%

TheAnnual fees SECP 100% -28% -41%

TheBrokerage & other costs 100% 51% 141%

Bank Charges 100% -31% -31%

Auditor's salaries 100% -9% -1%

Amortization 100% 0% 0%

ThePrinting charges 100% -14% -58%

Listing Fees etc. 100% 0% 0%

Rating Fees etc. 100% 6% 14%

TheOther expenses 100% 2133% 4067%

Total Operating Expenses 100% -29% -33%

TheNet Operating Income 100% -25% -38%

TheNet gain/loss on Theunit sales/redem. 100% -95% 186%

TheWorker's welfare fund 100% -976% -950%

Net Income before Tax 100% -32% -33%

Taxation 0% 0% 0%

TheComprehensive Income for the year 100% -32% -33%

The Trend Analysis of the Income statement of ABL Income Fund shows different scenario

over different time period. A positive trend has been noted in the Income from the Govt.

securities for the company in the Financial Years of 2010, 2011 and 2012, which grows at a rate

of more than 80% for both of the FY2011 and FY2012.

Dividend income of ABL Income Fund had shown no trend at all because the company

did not paid any dividend in FY2010 and FY2011. It started to pay dividend in FY2012

FMS

74

for the first time in its history which is a good sign of company growth and have positive

impact on it s image among investors.

Profits from bank accounts a significant increase in FY2011 and FY2012 as compared

with FY2010. The company had shown a positive trend in the FY 2011 and its bank

accounts profits increased by 231% and in FY2012 its income from bank accounts rose

by 226% respectively.

Total Income of ABL Income Fundhad shown a downward trend in the FY 2011which

decreased by 26% and 37% in FY 2012 respectively.

Total expenses of the company have shown anencouraging trend in the FY 2011 lowered

by 29% and 33% in FY2012 respectively.

Net income of ABL Income Fundhad shown a negative trend in the FY 2011which

lowered by 32% and which further lowered by almost the same ratio by 33% in FY2012.

FMS

75

VERTICAL/ COMMON SIZE ANALYSIS AND THE HORIZONTAL /

TREND ANALYSIS:

3) AKD INVESTMENT MANAGEMENT LIMITED

BALANCE SHEET OF AKD:

Common Size Analysis

Trend Analysis

INCOME STATEMENT AKD:

Common Size Analysis

Trend Analysis:

FMS

76

AKD Investment Management Company Limited.

AKD Aggressive Income Fund Balance Sheet Common Size Analysis:

TableA-2.1: Balance Sheet Common Size Analysis of AKD

ASSETS 2010 2011 2012

Bank Balances 7% 6% 5%

Investments 62% 81% 48%

The Profit Receivables 2% 2% 5%

Security depo. &The other Recei. 1% 1% 1%

Prelim. Exp. &The Floating costs 0% 0% -

Receivables against Sale &The Maturity of The Investments 29% 7% 12%

Recei. against MTS 0% 3% 29%

Total Assets 100% 100% 100%

LIABILITIES

Payable to The AKD IMC Ltd. 39% 5% 77%

FMS

77

Payable to The CDC, Pakistan 2% 1% 0%

Payable to The SECP 11% 3% 2%

Payable against TheRedemption 16% 71% 0%

Accrued Exp &Theother Liabilities 32% 20% 20%

Total Liabilities 100% 100% 100%

The Vertical analysis of the balance sheet of AKD Aggressive Income Fund depicts different

scenario over different time period.In Financial Year of 2010 the total investments were about

62% of the total assets which went upward over the next period of FY2011 it was about 81%

while again in FY2012 in goes down to 48% of the total assets value.

Bank Balance of AKD Aggressive Income Fund showed slight downward trend,in FY

2010 it was about 7% of the total asset to 6% percent in FY2012 and it also decreased in

FY 2012 too and was 5%.

Total Liabilities of the company increased from FY2010 where it was about 0.8% of the

total asset to 2.4% in FY 2011 and it further increased in FY2012 to 3.8% of the total

asset.

Net Assets of the company slight decrease from FY 2010 where it was about 99.2% of

the total asset to 97.6% in FY2011 and it again decreased very slightly in FY 2012 and

net assets were about 96.2% of the total asset.

AKD Investment Management Company Limited.

AKD Aggressive Income Fund Balance Sheet Trend Analysis:

Table A-2.2: Balance Sheet Trend Analysis of AKD

FMS

78

ASSETS 2010 2011 2012

Bank Balances 100% -23% -2%

Investments 100% 15% -38%

TheProfit Receivables 100% -2% 149%

Security depo. &Theother Recei. 100% 11% 0%

Prelim. Exp. & Floating costs 100% -57% -

Receivables against TheSale & Maturity of Investments 100% -78% 68%

Recei. Against TheMTS 100% 1344900% 851%

Total Assets 100% -12% 5%

LIABILITIES

Payable to TheAKD IMC Ltd. 100% -64% 2338%

Payable to TheCDC, Pakistan 100% -21% 16%

Payable to TheSECP 100% -18% -3%

ThePayable against Redemption 100% 1090% -100%

Accrued Exp &Theother Liabilities 100% 65% 70%

Total Liabilities 100% 168% 66%

NET ASSETS 100% -14% 3%

No. of TheUnits in Issue 100% -17% 1%

TheNet Asset Value per Unit 100% 4% 2%

The Trend Analysis of the balance sheet of AKD Aggressive Income Fund depicts different

scenario over different time period. An overall positive trend has been noted in the Profit

Receivables, in the Financial Year of 2011 in showed slight decrease of 2% but in FY 2012 there

is a huge positive increase trend and Profit Receivables increased by 149%.

FMS

79

Bank Balance of AKD Aggressive Income Fundhave shown a negative trend in the FY

2011 it decreased by 23% and its downward trend slowed in FY2012 and it slightly

decreased by 2%.

Total Assets of the company had shown a negative trend in the FY 2011 with a decrease

in total assets value of 12% but inFY2012 total assets value increased by 5%.

Total Liabilities of the company have shown a negative trend in the FY 2011& 2012and

in FY 2011 its total liabilitiesincreased by 168% while in FY2012 its total liabilities

increased by 66%.

Net Assets of AKD Aggressive Income Fund have shown a negative trend in the FY

2011 with a decrease in value of 14% but in FY 2012 it has shown a positive trend with

an increase of 3% in the value of net assets.

AKD Investment Management Company Limited.

AKD Aggressive Income Fund Income Statement Common Size Analysis:

Table A-2.3: Income StatementCommon Size Analysis of AKD

INCOME 2010 2011 2012

Capital gain/loss on investment sale -2% 0% 0%

Income from Govt. Securities 2% 15% 17%

Income from Term deposit. Receipts 4% 3% 32%

Income from certificate of Invest. 32% 11% 0%

Income from Letters of placement 4% 6% 0%

Income from Term Fin. Cert./Sukuk 77% 52% 46%

Profit on bank accounts 8% 8% 6%

Unrealized inc/dec. on re-evaluation of invest. -25% 4% -2%

Total Income 100% 100% 100%

EXPENSES

Salaries of AKD IMC Ltd. 14% 11% 12%

FMS

80

Salaries of CDC 2% 1% 1%

Annual fees - SECP 1% 1% 1%

Brokerage & other costs 0% 0% 0%

Bank Charges 0% 0% 0%

Auditor's salaries 1% 1% 1%

Amortization 1% 1% 1%

Legal Charges 0% 0% 0%

Printing charges 0% 0% 0%

Listing Fees etc. 0% 1% 3%

Worker Welfare Fund 1% 1% 1%

Impairment loss on Invest. 9% 16% 1%

Total Operating Expenses 29% 33% 24%

Net Operating Income 71% 67% 76%

Net gain/loss on unit sales/redem. -12% -9% -4%

Comprehensive Income for the year 68% 71% 77%

The vertical analysis of the Income Statement of AKD Aggressive Income Fund portrays

different scenario over different time period.In Financial Year of 2010 the total Profit on the

Govt. Securities was 2% of the total income which increased over the next period of 2011to 15%

and in FY2012 it was again slightly increased to 17%.

Income on Sukuk of AKD Aggressive Income Fund decreased from FY 2010 where it

was about 72% of the total income to 52% in FY 2011 and it decreased further in FY

2012 to 46% of the total income of that year.

FMS

81

Total expenses of IGI Islamic income fund increased from FY 2010 where it was about

29% of the total income to 33% in FY 2011 but it decreased in FY 2012 to about 24% of

the total income of FY2012.

The Net income for the different financial years of AKD Aggressive Income Fund

increased from FY 2010 where it was about 68% of the total income to 71% in FY 2011

and it further increased in FY 2012 to about 77% of the total income of that year.

FMS

82

AKD Investment Management Company Limited.

AKD Aggressive Income Fund Income Statement Trend Analysis:

Table A-2.4: Income StatementTrend Analysis of AKD

INCOME 2010 2011 2012

Capital gain/loss on investment sale 100% 115% 4%

Income from the Govt. Securities 100% 647% 0%

Income from theTerm deposit. Receipts 100% -30% 874%

Income from thecertificate of Invest. 100% -66% -99%

Income from theLetters of placement 100% 58% -

Income from theTerm Fin. Cert./Sukuk 100% -31% -24%

FMS

83

theProfit on bank accounts 100% 6% -35%

Unrealized inc/dec. on there-evaluation of investment 100% 117% -148%

Total Income 100% 2% -14%

EXPENSES

Salaries of theAKD IMC Ltd. 100% -18% -4%

Salaries of the CDC 100% -24% -12%

theAnnual fees - SECP 100% -18% -3%

Brokerage & other costs 100% -73% 4%

Bank Charges 100% 42% 149%

Auditor's salaries 100% 3% 2%

Amortization 100% 0% -25%

Legal Charges 100% -14% 5%

thePrinting charges 100% -7% 13%

Listing Fees etc. 100% 123% 264%

Worker Welfare Fund 100% -1% 7%

theImpairment loss on Invest. 100% 91% -97%

Total Operating Expenses 100% 18% -38%

Net Operating Income 100% -5% -2%

Net gain/loss on theunit sales/redem. 100% 22% -59%

Net Income 100% -1% 6%

Unrealized increase/decrease on theinvestment re-measurement 100% 909% -71%

theComprehensive Income for the year 100% 7% -8%

FMS

84

The Trend Analysis of the Income statement of AKD Aggressive Income Fund depicts different

scenario over different time period. A positive trend has been noted in the profits on the term

deposit receipts of the company in the Financial Year of 2011 and 2012, which is about 30%

decrease in 2011 and about 900% increase in FY2012.

Income from SukukAKD Aggressive Income Fund has shown a downward negative

trend with31% decline inFY2011 and 24% decline in the FY 2012.

Total Income of the company has shown a positive trend in the FY 2011with a 2%

increase and a negative trend in 14% decrease in FY 2012.

Total expenses of the company have shown a downward trend in the FY 2011 with 18%

increase and upward trend in FY2012 with a 38% decrease in total expenses of that year.

Net income of AKD Aggressive Income Fund had shown a slight negative trend in the

FY 2011with 1% decrease in Net Income for the year but in FY2012 it showed a positive

trend with a 6% increase in Net Income of the year.

FMS

85

RATIOS ANALYSIS OF CONVENTIONAL MUTUAL INCOME FUNDS:

Return on assets:

Table= B.1 Return on assets

Graph= B.1 Return on assets

Return on Equity:

Table= B.2Return on Equity

Graph= B.2 Return on equity

Profit Margin:

Table= B.3Profit Margin

Graph= B.3 Profit Margins

Net asset value per unit:

Table= B.4 Net asset value per unit

Graph= B.4 Net Asset Value per Unit

Earning per unit:

FMS

86

Table= B.5 Earning per unit

Graph= B.5 Earning Per unit

Current ratio:

Table= B.6 Current ratio

Graph= B.6 Current Ratio

Net Working Capital Ratio:

Table= B.7Net Working Capital Ratio

Graph= B.7 Net Working Capital Ratios

Assets Turnover Ratio:

Table= B.8 Assets Turnover Ratio

Graph= B.8 Asset Turnover Ratios

Account Receivable Turnover Ratio:

Table= B.9 A/C Receivable Turnover Ratio

Graph= B.9 Account Receivable Turnover Ratios

Debt to Equity Ratio:

Table= B.90 Debt to Equity Ratio

Graph= B.90 Debt to Equity Ratios

FMS

87

Return on assets:

Return on asset for the selected Conventional mutual income funds are given in the following table B.1,

which show that Alfalah have the highest return on asset among the selected Conventional income funds in the first

two years and in the third year ABL have highest return on asset.

Table= B.1 Return on assets: 2010 2011 2012

ABL's IF 11.17% 9.66% 14.40%

AKD's AIF 8.43% 9.64% 9.33%

Alfalah GHP' IMF 19.51% 15.69% 6.57%

Graphical Representation:

In graph B.1 we have shown the ratios of return on asset for the selected Conventional

income funds in different time period starting from 2010 and goes to 2012. This also shows that

Alfalah have the highest return on asset among the selected Conventional income funds in the first two years and in

the third year ABL have highest return on asset.

Graph= B.1 Return on assets:

FMS

88

Return on Equity:

Return on equity for the selected Conventional mutual income funds are given in the following table B.2,

which show that Alfalah have the highest return on equity among the selected Conventional income funds in the first

year but in the second and third year ABL have highest return on equity.

Table= B.2Return on Equity: 2010 2011 2012

ABL's IF 12.20% 16.16% 21.13%

AKD's AIF 4.92% 9.27% 6.92%

Alfalah GHP' IMF 19.66% 15.83% 6.64%

Graphical Representation:

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

2010 2011 2012

Return on Asset

ABL's IF

AKD's AIF

Alfalah GHP' IMF

FMS

89

In graph B.2 we have shown the ratios of return on equity for the selected Conventional

income funds in different time period starting from 2010 and goes to 2012. This also shows

Alfalah have the highest return on equity among the selected Conventional income funds in the first year but in the

second and third year ABL have highest return on equity.

Graph= B.2 Return on equity:

Profit Margin: