MM - Brazil - Fiscal - Book - Mastersaf 2 1

Diunggah oleh

guroyal0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

68 tayangan30 halamanJudul Asli

MM_Brazil_Fiscal_Book_Mastersaf 2 1.xlsx

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

68 tayangan30 halamanMM - Brazil - Fiscal - Book - Mastersaf 2 1

Diunggah oleh

guroyalHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 30

Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1. Normal Process

1.1.1. Reverse

1.1.1. Reverse

1.1.1. Reverse

1.1.1. Reverse

1.1.1. Reverse

1.1.1. Reverse

1.1.1. Reverse

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2. Tributary Substitution

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.2.1. Reverse

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1.3. Import for industrialization

1. Purchase for Industrialization

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.1. Goods Receipt in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.2. Symbolic Return of Goods in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.4.3. Consumption of Goods Received Before in Consignment

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.1. Outbound to Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.2. Symbolic Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5. Sub-contracting

1.4. Consignment

1.5.3. Physical Return of Industrialization

1.5.3. Physical Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.5.4. Return of Industrialization

1.6.1. Outbound Transfer

1.6.1. Outbound Transfer

1.6.1. Outbound Transfer

1.6.1. Outbound Transfer

1.6.1. Outbound Transfer

1.6.1. Outbound Transfer

1.6.2. Inbound Transfer

1.6.2. Inbound Transfer

1.6.2. Inbound Transfer

1.6.2. Inbound Transfer

1.6.2. Inbound Transfer

1.6.2. Inbound Transfer

1.7.1. Payment only

1.7.1. Payment only

1.7.1. Payment only

1.7.1. Payment only

1.7.1. Payment only

1.7.1. Payment only

1.7.2. Physical receiving

1.7.2. Physical receiving

1.7.2. Physical receiving

1.7.2. Physical receiving

1.7.2. Physical receiving

1.7.2. Physical receiving

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1. Purchase for Resale

2.1.1. Return

2.1.1. Return

2.1.1. Return

2.1.1. Return

2.1.1. Return

1.6. Interplant Transfers

1.7.PurchaseforIndustrializationFutureDelivery

2. Purchase for Resale

2.1.1. Return

2.2. Import for Resale

2.2. Import for Resale

2.2. Import for Resale

2.2. Import for Resale

2.2. Import for Resale

2.2. Import for Resale

2.2. Import for Resale

2.3.1. Outbound Transfer

2.3.1. Outbound Transfer

2.3.1. Outbound Transfer

2.3.1. Outbound Transfer

2.3.1. Outbound Transfer

2.3.1. Outbound Transfer

2.3.2. Inbound Transfer

2.3.2. Inbound Transfer

2.3.2. Inbound Transfer

2.3.2. Inbound Transfer

2.3.2. Inbound Transfer

2.3.2. Inbound Transfer

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1. Purchase for Consumption

3.1.1. Reverse

3.1.1. Reverse

3.1.1. Reverse

3.1.1. Reverse

3.1.1. Reverse

3.1.1. Reverse

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.PurchaseforConsumptionTributarySubstituition

3.2.1. Reverse

3.2.1. Reverse

3.2.1. Reverse

3.2.1. Reverse

2.3. Interplant Transfers

3. Purchase for Consumption

3.2.1. Reverse

3.2.1. Reverse

3.2.1. Reverse

3.3. Import for Consumption

3.3. Import for Consumption

3.3. Import for Consumption

3.3. Import for Consumption

3.3. Import for Consumption

3.3. Import for Consumption

3.3. Import for Consumption

3.4.1. Outbound transfer of consumption material

3.4.1. Outbound transfer of consumption material

3.4.1. Outbound transfer of consumption material

3.4.1. Outbound transfer of consumption material

3.4.1. Outbound transfer of consumption material

3.4.1. Outbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

3.4.2. Inbound transfer of consumption material

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.1. Freight

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.2.FreightTributarySubstitution

4.3. Communication

4.3. Communication

4.3. Communication

4.3. Communication

4.3. Communication

4.3. Communication

4.3. Communication

4.3. Communication

3.4. Transfer of consumption material

4. Service Purchase

4.3. Communication

4.3. Communication

4.4. Energy

4.4. Energy

4.4. Energy

4.4. Energy

4.4. Energy

4.4. Energy

4.4. Energy

4.4. Energy

4.5.1. Services with normal PIS and COFINS recovering, ISS W, IRRF W, INSS W and

accumulated PCC W.

4.5.1. Services with normal PIS and COFINS recovering, ISS W, IRRF W, INSS W and

accumulated PCC W.

4.5.1. Services with normal PIS and COFINS recovering, ISS W, IRRF W, INSS W and

accumulated PCC W.

4.5.1. Services with normal PIS and COFINS recovering, ISS W, IRRF W, INSS W and

accumulated PCC W.

4.5.1. Services with normal PIS and COFINS recovering, ISS W, IRRF W, INSS W and

accumulated PCC W.

4.5.2. Services with normal PIS and COFINS recovering, IRRF W, INSS W and accumulated

PCC W.

4.5.2. Services with normal PIS and COFINS recovering, IRRF W, INSS W and accumulated

PCC W.

4.5.2. Services with normal PIS and COFINS recovering, IRRF W, INSS W and accumulated

PCC W.

4.5.3. Services with normal PIS and COFINS recovering, IRRF W and accumulated PCC W.

4.5.3. Services with normal PIS and COFINS recovering, IRRF W and accumulated PCC W.

4.5.3. Services with normal PIS and COFINS recovering, IRRF W and accumulated PCC W.

4.5.4. Services with normal PIS and COFINS recovering and, IRRF W.

4.5.5. Services with normal PIS and COFINS recovering, INSS W and accumulated PCC W.

4.5.6. Services with normal PIS and COFINS recovering and INSS W.

4.5.7. Services with normal PIS and COFINS recovering and accumulated PCC W.

4.5.8. Services with normal PIS and COFINS recovering and accumulated ISS W.

4.5.9. Services with ISS W, IRRF W, INSS W and accumulated PCC W.

4.5.9. Services with ISS W, IRRF W, INSS W and accumulated PCC W.

4.5.9. Services with ISS W, IRRF W, INSS W and accumulated PCC W.

4.5.10.ServiceswithISS,INSSW,IRRFWMedicalinsuranceandRPA.

4.5. General Services Purchasing

4.5.10.ServiceswithISS,INSSW,IRRFWMedicalinsuranceandRPA.

4.5.10.ServiceswithISS,INSSW,IRRFWMedicalinsuranceandRPA.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1. Purchase Fixed Assets.

5.1.1. Return

5.1.1. Return

5.1.1. Return

5.1.1. Return

5.1.1. Return

5.1.1. Return

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.PurchaseFixedAssetsTributarySubstitution

5.2.1. Return

5.2.1. Return

5.2.1. Return

5.2.1. Return

5.2.1. Return

5.2.1. Return

5.2.1. Return

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.3. Import for Fixed Assets.

5.4.1. Outbound transfer of fixed assets

5.4.1. Outbound transfer of fixed assets

5.4.1. Outbound transfer of fixed assets

5.4.1. Outbound transfer of fixed assets

5.4.1. Outbound transfer of fixed assets

5.4.1. Outbound transfer of fixed assets

5.4.2. Inbound transfer of fixed assets

5.4.2. Inbound transfer of fixed assets

5.4. Transfer of Fixed Assets.

5. Purchase Fixed Assets

5.4.2. Inbound transfer of fixed assets

5.4.2. Inbound transfer of fixed assets

5.4.2. Inbound transfer of fixed assets

5.4.2. Inbound transfer of fixed assets

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.1. Receive of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

5.5.2. Return of Fixed Asset sent for usage outside company

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.1. ICMS Credit Receipt

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.2. Outbound to Warehouse

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.3. Warehouse Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.4. Warehouse Symbolic Return

6.5.1. Lending / Leasing entry

6.5.1. Lending / Leasing entry

6.5. Lending / Leasing Entry

5.5.FixedAssetsoutsidecompanyoperations

6. Other operations

6.5.1. Lending / Leasing entry

6.5.1. Lending / Leasing entry

6.5.1. Lending / Leasing entry

6.5.1. Lending / Leasing entry

6.5.2. Lending / Leasing return

6.5.2. Lending / Leasing return

6.5.2. Lending / Leasing return

6.5.2. Lending / Leasing return

6.5.2. Lending / Leasing return

6.5.2. Lending / Leasing return

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

7. Freebie Entry

8. Free Samples Receipt

8. Free Samples Receipt

8. Free Samples Receipt

8. Free Samples Receipt

8. Free Samples Receipt

8. Free Samples Receipt

8. Free Samples Receipt

9.1.1. Demonstration Entry

9.1.1. Demonstration Entry

9.1.1. Demonstration Entry

9.1.1. Demonstration Entry

9.1.1. Demonstration Entry

9.1.1. Demonstration Entry

9.1.2. Demonstration Return

9.1.2. Demonstration Return

9.1.2. Demonstration Return

9.1.2. Demonstration Return

9.1.2. Demonstration Return

9.1.2. Demonstration Return

9.1.2. Demonstration Return

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.1. Outbound to repair

10.1.2. Return from Repair

9. Demonstration

10. Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

10.1.2. Return from Repair

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.1. Receive of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

11.1.2. Return of Packaging

12.1.1. Receive of Returnable Packaging

12.1.1. Receive of Returnable Packaging

12.1.1. Receive of Returnable Packaging

12.1.1. Receive of Returnable Packaging

12.1.1. Receive of Returnable Packaging

12.1.1. Receive of Returnable Packaging

12.1.2. Return of Returnable Packaging

12.1.2. Return of Returnable Packaging

12.1.2. Return of Returnable Packaging

12.1.2. Return of Returnable Packaging

12.1.2. Return of Returnable Packaging

12.1.2. Return of Returnable Packaging

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

13. Other Receipts

12. Returnable Packaging

11. Packaging

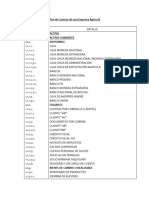

Segmento de Nota Fiscal NF Type

1E

4E

1E

4E

YI

1. Purchase for Industrialization

Nota fiscal de Compra para industrializao

Nota fiscal de Saida de Devoluo de compra para

industrializao

Nota fiscal de Compra para industrializao em

operao com mercadoria sujeita ao regime de

substituio tributria

Nota de saida de Devoluo de compra para

comercializao em operao com mercadoria sujeita

ao regime de substituio tributria

Nota de Compra para industrializao importao

Nota de Saida de Remessa para industrializao por

encomenda

Nota de Entrada de Retorno de mercadoria remetida

para industrializao por encomenda

Nota de Entrada de mercadoria remetida para

industrializao e no aplicada no referido processo

1.5. Sub-contracting

1.4. Consignment

Nota de Entrada de mercadoria recebida em

consignao mercantil ou industrial

Nota de Saida Devoluo simblica de mercadoria

vendida ou utilizada em processo industrial, recebida

anteriormente em consignao mercantil ou

industrial

Nota de Compra para industrializao de mercadoria

recebida anteriormente em consignao industrial

1S

1R

2Y

2X

1G

1R

Nota de Saida de Devoluo de compra para

comercializao

Nota de Compra para comercializao

Nota de Entrada de mercadoria remetida para

industrializao e no aplicada no referido processo

Nota de Entrada de Industrializao efetuada por

outra empresa

1.6. Interplant Transfers

Nota de Saida de Transferncia de produo do

estabelecimento

Nota de entrada de Transferncia para

industrializao

1.7.PurchaseforIndustrializationFutureDelivery

Nota de Entrada de Lanamento efetuado a ttulo de

simples faturamento decorrente de compra para

recebimento futuro

Nota de Compra para comercializao originada de

encomenda para recebimento futuro

2. Purchase for Resale

1S

1E

1G

1R

1X

1R

1E

4E

Nota de Compra de mercadoria para uso ou consumo

cuja mercadoria est sujeita ao regime de

substituio tributria

Nota de saida de Devoluo de mercadoria destinada

ao uso ou consumo, em operao com mercadoria

sujeita ao regime de substituio tributria

Nota de Saida de Devoluo de compra para

comercializao

Nota de Compra para comercializao importao

2.3. Interplant Transfers

3. Purchase for Consumption

Nota de Saida de Transferncia de produo do

estabelecimento

Nota de entrada de Transferncia para

industrializao

Nota de Compra de material para uso ou consumo

Nota de saida Devoluo de compra de material de

uso ou consumo

1R

1E

4E

1E

4E

4E

YI

1G

Nota de saida de Devoluo de mercadoria destinada

ao uso ou consumo, em operao com mercadoria

sujeita ao regime de substituio tributria

Nota de Compra de material para uso ou consumo

importacao

3.4. Transfer of consumption material

Nota de saida de Transferncia de material de uso ou

consumo

Nota de entrada de Transferncia de material para

uso ou consumo

Nota de entrada de Aquisio de servio de

transporte por estabelecimento industrial

no existe cfop

Nota de entrada de Aquisio de servio de

comunicao por estabelecimento industrial

4. Service Purchase

4E

YI

1G

1R

1C

1C

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

Nota de compra de prestacao de servios

4.5. General Services Purchasing

Nota de entrada de Aquisio de servio de

comunicao por estabelecimento industrial

Nota de Compra de energia eltrica por

estabelecimento industrial

Nota de compra de prestacao de servios Z1

Z1

Z1

Z1

Z1

Z1

Z1

Z1

Z1

5.4. Transfer of Fixed Assets.

Nota de saida de Transferncia de bem do ativo

imobilizado

Nota de entrada de Transferncia de bem do ativo

imobilizado

Nota de Compra de bem para o ativo imobilizado

Nota de compra de prestacao de servios

5. Purchase Fixed Assets

Nota de Compra de bem para o ativo imobilizado

Nota de saida de Devoluo de compra de bem para

o ativo imobilizado

Nota de Compra de bem para o ativo imobilizado cuja

mercadoria est sujeita ao regime de substituio

tributria

Nota de saida Devoluo de bem do ativo

imobilizado, em operao com mercadoria sujeita ao

regime de substituio tributria

Z1

1E

1E

1E

4E

1E

1G

1R

Nota de Entrada de bem por conta de contrato de

comodato

6.5. Lending / Leasing Entry

Nota de entrada de Transferncia de bem do ativo

imobilizado

5.5.FixedAssetsoutsidecompanyoperations

Nota de saida Entrada de bem do ativo imobilizado

de terceiro, remetido para uso no estabelecimento

Nota de saida Devoluo de bem do ativo imobilizado

de terceiro, recebido para uso no estabelecimento

6. Other operations

Nota de entrada Recebimento, por transferncia, de

crdito de ICMS

Nota de saida de Retorno de mercadoria depositada

em depsito fechado ou armazm geral

Nota de entrada de Retorno de mercadoria remetida

para depsito fechado ou armazm geral

Nota de entrada de Retorno simblico de mercadoria

remetida para depsito fechado ou armazm geral

YC

YS

YR

YQ

Y6

1R

1G

1R

Nota de Entrada de bem por conta de contrato de

comodato

Nota de saida de Remessa de bem por conta de

contrato de comodato

Nota de Entrada de bonificao, doao ou brinde

Nota de Entrada de amostra grtis

9. Demonstration

Nota de Entrada de mercadoria ou bem recebido

para demonstrao

Nota de entrada Retorno de mercadoria ou bem

remetido para demonstrao

10. Repair

Nota de saida de mercadoria ou bem remetido para

conserto ou reparo

Nota de entrada de Retorno de mercadoria ou bem

remetido para conserto ou reparo

Y6

Y7

1E

1E

1E

4E

Nota de saida de Remessa de vasilhame ou sacaria

12. Returnable Packaging

Nota de Entrada de Retorno de vasilhame ou sacaria

Nota de saida de Devoluo de vasilhame ou sacaria

Nota de saida Outra entrada de mercadoria ou

prestao de servio no especificada

Nota de Entrada de vasilhame ou sacaria

Nota de entrada de Retorno de mercadoria ou bem

remetido para conserto ou reparo

11. Packaging

YU

YV

1E

4E

YT

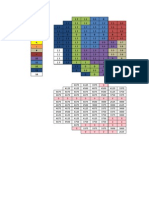

Fiscal Information

ICMS could be exempt for vendors with a special fiscal category, named National Simple, if the plant is Camaari, and for

a special list of materials.

CFOP: 1.101 / 2.101

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: SUSPENSAO DE IPI NO INCISO II, PARAGRAFO 7 DO ART 29 DA LEI N. 19.637 DE 30/12/2002

Legal text ICMS: Empresa optante pelo Simples Nacional Inf complementares com direito credito do ICMS lei

NF example - Regular vendor

Return of raw materials coming from the vendor.

CFOP: 5.201/6.201

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

PIS / COFINS with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: IPI suspenso conforme Art. 5 lei 9826/99

Legal text ICMS: Dont exist

This process is very close of the normal purchase for industrialization. The attention point is the earliest payment of the

ICMS tax to the government. It happens only for some specific materials and operations.

CFOP: 1.401/2.401

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example

Return of raw materials coming from the vendor.

CFOP: 5.410 / 6.410

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

Brazilians government has a special taxation for import process. If Brazil doesnt have any similar product of the imported

item, ICMS will be 4%, if not, normal taxation. There are also some exceptions involved in this process.

CFOP: 3.101

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF). Could vary between 1,65% and 7,6%, 1,65%

and 8,6%, 2,3% and 10,8%, and 2,3% and 11,8% respective, accordingly the NCM.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Deferred ICMS when materials are legally released inside state.

NF example 18% ICMS

NF example 12% ICMS

The consignment is an agreement between a consignee and consignor for the storage, transfer and use of the commodity.

The consignmee may take goods from the consignment stock for use or resale subject to payment to the consignor

agreeably to the terms bargained in the consignment agreement. The unsold goods will normally be returned by the

consignee to the consignor. Currently, this kind of purchase is used only for oil, but they business area are studying to apply

this process for other many goods. It is separated in three steps:

CFOP: 1.917/2.917

IPI Suspended.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conforme Art. 5 lei 9826/99

Legal text ICMS: Dont exist

NF example

This CFOP should be used for a symbolic return to the vendor.

CFOP: 5.919/6.9.19

IPI Exempt.

ICMS Basic table (J_1BTXIC1).

PIS/COFINS - Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: ART. 501 A 504 DO DEC. 7512/10-RIPI

Legal text ICMS: NFE. EMITIDA CONF. ANEXO IX DO DEC. EST. 43.080/02-RICMS MG

NF Example

This CFOP should be used after the consumption of oil in the industrialization process.

CFOP: 1.111/2.111

IPI Exempt.

ICMS Exempt.

PIS/COFINS - Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example

The sub-contracting process is used for many items in Cooper Standard Brazil, and comprehends an agreement between

two companies to fulfill an external industrialization issue for a noncore business process. It is separated in four steps:

CFOP: 5.901 / 6.901

IPI Suspended.

ICMS Suspended

PIS / COFINS Exempt.

Legal text IPI: IPI SUSPENSO ART.42 INC. VI DEC. 4544/02 RIPI.

Legal text ICMS: ICMS SUSPENSO CONF. ART. 19, ITEM I DO ANEXO III DO DEC. 43.080/2002.

NF example Varginha

NF example Camaari

CFOP: 1.902/2.902

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Art 19 Inc. V dec. 43080/02.

Must refer the bill to NF.

NF example

CFOP: 1.903/2.903

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.124/2.124

IPI Suspended.

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Return of industrialization and services together

NF example Return from Simples Nacional vendor

The interplant transfers are used to send and receive goods between plants under same company code. It is separated in

CFOP: 5.151 / 6.151

IPI Suspended.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.151 / 2.151

IPI Suspended.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

The future delivery is a different way to deal with vendors. There are two steps at this scenario:

CFOP: 1.922 / 2.922

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.117 / 2.117

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist. When buying goods for resell these parts to the after marked (concessionrias) then IPI must be calculated. For this case

the customer sends a separated purchase order. The material and the customer are the same as in regular sales operation

were IPI normally is exempt.

CFOP: 1.102/2.102

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example - Simples Nacional vendor

CFOP: 5.202/6.202

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM.

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 3.102

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Only products

The interplant transfers are used to send and receive goods between plants under same company code. It is separated in

CFOP: 5.151 / 6.151

IPI Suspended.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.151 / 2.151

IPI Suspended.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

This process is used for specific procurement, which doesnt need to be controlled in stock, like office materials, for

CFOP: 1.556/2.556

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Different tax rate of 6% for SP and MG, and 10% for BA. Exempt if Vendor is National

Simple, plant is Camaari, or special NCM.

PIS / COFINS Exempt.

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

NF example

CFOP: 5.556 / 6.556

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Different tax rate of 6% for SP and MG, and 10% for BA. Exempt if Vendor is National

Simple, plant is Camaari, or special NCM.

PIS / COFINS Exempt.

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

CFOP: 1.407/2.407

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Different tax rate of 6% for SP and MG, and 10% for BA. Exempt if Vendor is National

Simple, plant is Camaari, or special NCM.

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Exempt.

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

CFOP: 5.413 / 6.413

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Different tax rate of 6% for SP and MG, and 10% for BA. Exempt if Vendor is National

Simple, plant is Camaari, or special NCM.

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Exempt.

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

CFOP: 3.556

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example

This process is used for specific procurement, which doesnt need to be controlled in stock, like maintenance materials, for

CFOP: 5.557/6.557

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.557/2.557

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

The communication purchase has a special taxation, as described below:

CFOP: 1.352/2.352 or 1.360/2.360 if ICMS ST incidence

IPI: Exempt.

ICMS Basic table (J_1BTXIC1). Exempt if inside estate. Different tax rate for technical parts freight (6% MG/SP and

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Only for industrialization, sales processes).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Inside estate

NF example Outside estate

The communication purchase has a special taxation, as described below:

CFOP 1.360/2.360

IPI: Exempt.

ICMS Exempt if inside estate / Basic table (J_1BTXIC1) (Only for industrialization, sales and asset processes).

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Only for industrialization, sales processes).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Outside estate with tributary substitution

The communication purchase has a special taxation, as described below. The percentage of ICMS changes according to the

CFOP: 1.302/2.302

IPI: Exempt.

ICMS Basic table (J_1BTXIC1). Exempt if billing of interests and fines.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example ICMS 25%

NF example ICMS 28%

NF example ICMS 29%

The energy purchase has a special taxation, as described below:

CFOP: 1.252/2.252

IPI: Exempt.

ICMS Basic table (J_1BTXIC1) (Only 98,75% bounded to industrialization process).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF).

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example

These operations are used for purchasing of many different types of services required by the business. None of them have

CFOP (Brazilian Fiscal Operation Code), but there is another code - the Service Code which is responsible to determine all

taxation involved. List of Services Codes

The following cases will drive us along the different combination of taxes for each process:

ISS tax rate should be withheld at invoice receiving, and obey the values contained at ISS table, provided by the

government.

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

PCC tax rate of 4,65% should be withheld at the payment moment.

NF example Page 3 NF 7026

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

PCC tax rate of 4,65% should be withheld at the payment moment.

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

PCC tax rate of 4,65% should be withheld at the payment moment.

NF example Page 11 NF 1177

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

NF example Page 1 NF 1135

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

government.

PCC tax rate of 4,65% should be withheld at the payment moment.

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

NF example Page 11 NF 202

PCC tax rate of 4,65% should be withheld at the payment moment.

ISS tax rate should be withheld at invoice receiving, and obey the values contained at ISS table, provided by the

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

PCC tax rate of 4,65% should be withheld at payment.

INSS tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

IRRF tax rate should be withheld at invoice receiving, and obey the values contained at progressive table, provided by

ISS tax rate should be withheld at invoice receiving, and obey the values contained at ISS table, provided by the

This process is very close of the normal purchase for industrialization. The attention point is that credits are taken monthly

1/48. It happens only for some specific materials and operations.

The communication purchase has a special taxation, as described below:

CFOP: 1.551/2.551

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple, plant is Camaari, or special NCM. Monthly

credit of 1/48 for productive process FI Control.

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

NF example

CFOP: 5.553/6.553

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple. Monthly credit of 1/48 for productive process

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

The communication purchase has a special taxation, as described below:

CFOP: 1.406/2.406

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple. Monthly credit of 1/48 for productive process

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

CFOP: 5.412/6.412

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if Vendor is National Simple. Monthly credit of 1/48 for productive process

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

The communication purchase has a special taxation, as described below:

CFOP: 3.551

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1). Exempt if nationalized inside state. Monthly credit of 1/48 for productive process FI

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

The communication purchase has a special taxation, as described below:

CFOP: 5.552/6.552

IPI Suspended.

ICMS Basic table (J_1BTXIC1) (Monthly credit of 1/48 for productive process).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 1.552 / 2.552

IPI Suspended.

ICMS Basic table (J_1BTXIC1) (Monthly credit of 1/48 for productive process).

PIS / COFINS Calculated with regular rates (J_1BTXPIS and J_1BTXCOF) (Monthly credit of 1/12 for productive

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

This process is used in cases that vendors sends their fixed assets to perform something at Cooper:

CFOP: 1.555/2.555

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 5.555/6.555

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

The government allowed Cooper Standard Brazil to buy ICMS credit from other companies.

CFOP: 1.601/2.601

IPI Exempt.

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text ICMS: Crdito recebido em transferncia conforme anexo VII do RICMS MG.

NF example

Operation used to send goods to warehouse.

CFOP: 5.906/5.905

IPI Suspended.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conf. Art. 42 Inc. III do dec 4544/02 RIPI

Legal text ICMS: ICMS no incidente conf. Art. 5, Inc. XI do dec 43080/02 NF emitida conf. Art. 69 do anexo IX do dec

Operation used to receive goods sent to warehouse.

CFOP: 1.906/2.906

IPI Suspended.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conf. Art. 42 Inc. III do dec 4544/02 RIPI

Legal text ICMS: ICMS no incidente conf. Art. 5, Inc. XI do dec 43080/02 NF emitida conf. Art. 69 do anexo IX do dec

NF example

Operation used to symbolic return of goods sent to warehouse.

CFOP: 1.907/2.907

IPI Suspended.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conf. Art. 42 Inc. III do dec 4544/02 RIPI

Legal text ICMS: ICMS no incidente conf. Art. 5, Inc. XI do dec 43080/02 NF emitida conf. Art. 69 do anexo IX do dec

Used to receive leasing from another companies, for example, cell phones.

CFOP: 1.908/2.908

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

CFOP: 5.908/6.908

IPI Suspended.

ICMS Suspended.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

This operation is used to buy boxes of food to the Brazilian employers.

CFOP: 1.910/2.910

IPI Exempt.

ICMS Basic table (J_1BTXIC1) / if vendor is simples nacional, no ICMS.

ICMS ST Basic tables (J_1BTXST1, J_1BTXST2 and J_1BTXST3).

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Dont exist.

NF example Simples Nacional vendor

NF example Regular vendor

This operation is used to receive samples.

CFOP: 1.911/2.911

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: ???

Legal text ICMS: ???

This operation is used to receive goods send as demonstration.

CFOP: 1.912/2.912

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: ???

Legal text ICMS: ???

CFOP: 1.913/2.913

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Dont exist

Legal text ICMS: Dont exist

NF example Regular vendor

This operation is used to send goods sent to de repaired.

CFOP: 5.916/6.916

IPI Exempt.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conf. Art. 43 do dec 7212/10

Legal text ICMS: ICMS suspenso conf. art. 19 do anexo III do dec estadual 43.080/02

NF example

CFOP: 1.916/2.916

IPI Exempt

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: IPI suspenso conf. Art. 43 do dec 7212/10

Legal text ICMS: ICMS suspenso conf. art. 19 inc. V item do dec estadual 43.080/02

NF example Cooper creates this NF for an operational problem.

NF example Vendor return of repaired item

This operation is used to receive containers.

CFOP: 1.920/2.920

IPI Exempt.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Isento de ICMS nos termos do art. 82 do anexo I do decreto 45490/00

NF example

CFOP: 5.920/6.920

IPI Exempt.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: ICMS isento conf. anexo I do art. 82 do decreto 45490/00

NF example

This operation is used to receive containers.

CFOP: 1.921/2.921

IPI Exempt.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: Isento de ICMS nos termos do art. 82 do anexo I do decreto 45490/00

CFOP: 5.921/6.921

IPI Exempt.

ICMS Exempt.

PIS / COFINS Exempt.

Legal text IPI: Dont exist.

Legal text ICMS: ICMS isento conf. anexo I do art. 82 do decreto 45490/00

This operation is used for other receipts.

CFOP: 1.949/2.949

IPI Regular table (J_1BTXIP1).

ICMS Basic table (J_1BTXIC1).

PIS / COFINS Exempt.

Legal text IPI: Suspenso de IPI nos termos do art. 29 da lei 10.637 de 30.12.2002.

Legal text ICMS: Dont exist

NF example Simply outbound operation

NF example Rental Outbound operation

Anda mungkin juga menyukai

- Agricomseeds SDokumen8 halamanAgricomseeds Sisaura mamaniBelum ada peringkat

- Presupuesto de GastoDokumen61 halamanPresupuesto de GastoOMAR MORALES BELEÑOBelum ada peringkat

- Cost Ledger ControlDokumen2 halamanCost Ledger Controlsritesh0Belum ada peringkat

- E DTRDokumen4 halamanE DTRCheryl Villon Gabinete UssimBelum ada peringkat

- MOW Prequalification CriteriaDokumen1 halamanMOW Prequalification CriteriaVamasBelum ada peringkat

- LH 4000W 8x500mL Windshielded Swinging Bucket Rotor Instruction Manual 50134636 EN PDFDokumen48 halamanLH 4000W 8x500mL Windshielded Swinging Bucket Rotor Instruction Manual 50134636 EN PDFRajeesh P RaviBelum ada peringkat

- Business PlanDokumen20 halamanBusiness PlanDagim AbrehamBelum ada peringkat

- R Series Manual PDFDokumen178 halamanR Series Manual PDFFrankling Robin Vila RomanBelum ada peringkat

- First Edition Sep 1980Dokumen40 halamanFirst Edition Sep 1980TeresaFerreiraBelum ada peringkat

- Amtip Feasibility Study Report Slaughterhouses August 2015Dokumen41 halamanAmtip Feasibility Study Report Slaughterhouses August 2015Renzlyn Ann MendiolaBelum ada peringkat

- COADokumen283 halamanCOAcahyo wahyudinBelum ada peringkat

- Sebu9293sebu9293 03 InglesDokumen226 halamanSebu9293sebu9293 03 InglesDiego CaBelum ada peringkat

- Intercompany Transactions PDFDokumen58 halamanIntercompany Transactions PDFapuri3Belum ada peringkat

- IabpDokumen152 halamanIabpRaghavendra PrasadBelum ada peringkat

- Directive 2015 Final..11Dokumen54 halamanDirective 2015 Final..11Cherinet GobenaBelum ada peringkat

- Tabs (A-Z)Dokumen72 halamanTabs (A-Z)JoseCalimlimBelum ada peringkat

- 231201 KEXIM Comments+on+Draft+of+Bidding+Documents 암호화해제Dokumen108 halaman231201 KEXIM Comments+on+Draft+of+Bidding+Documents 암호화해제Huyen NguyenBelum ada peringkat

- Tarea PMCA - 1Dokumen8 halamanTarea PMCA - 1Carlos Gonzalez VergaraBelum ada peringkat

- MappingDokumen697 halamanMappingadityaBelum ada peringkat

- Radioactive Substances Regulation Permit Management ProspectusDokumen58 halamanRadioactive Substances Regulation Permit Management ProspectustzrposharingBelum ada peringkat

- Asc Aar 02 12 001Dokumen113 halamanAsc Aar 02 12 001Tom ChaiBelum ada peringkat

- Charlie The TunaDokumen5 halamanCharlie The TunaLucia Smith HasbunBelum ada peringkat

- 10000000016Dokumen246 halaman10000000016Chapter 11 DocketsBelum ada peringkat

- BP Op Entpr S4hana1611 Function List en UsDokumen72 halamanBP Op Entpr S4hana1611 Function List en UsSergio PérezBelum ada peringkat

- Scribd 123Dokumen1 halamanScribd 123GMSagorBelum ada peringkat

- Chart #:1 DB-051 Count:1379 Chart #:2 DB-167 Count:789 Chart #:3 DB-1338 Count:528 Chart #:4 DB-1133 Count:3 Chart #:5 DB-722 Count:57Dokumen1 halamanChart #:1 DB-051 Count:1379 Chart #:2 DB-167 Count:789 Chart #:3 DB-1338 Count:528 Chart #:4 DB-1133 Count:3 Chart #:5 DB-722 Count:57miggy129205Belum ada peringkat

- Cash Flow DEMODokumen1.775 halamanCash Flow DEMOMaksi UnairBelum ada peringkat

- LQ570Dokumen307 halamanLQ570BrankoBelum ada peringkat

- Air-Shields TI500 User ManualDokumen204 halamanAir-Shields TI500 User ManualAhmed GunaidBelum ada peringkat

- Codigo: 213215632 - Saboyá Municipios 01-10-2019 Al 31-12-2019 Fut - Gastos - de - Inversion Gastos - de - InversionDokumen30 halamanCodigo: 213215632 - Saboyá Municipios 01-10-2019 Al 31-12-2019 Fut - Gastos - de - Inversion Gastos - de - InversionInes ParraBelum ada peringkat

- Oraganization of Mastoi TribeDokumen7 halamanOraganization of Mastoi Tribemastoi786Belum ada peringkat

- Preliminary Inspection Reports RevDokumen99 halamanPreliminary Inspection Reports RevPaul OhiorBelum ada peringkat

- CIN Accounting Entries-SAPDokumen7 halamanCIN Accounting Entries-SAPGopal's DestinyBelum ada peringkat

- Alvima Environmental and Social Impact Assessment Revised FinalDokumen99 halamanAlvima Environmental and Social Impact Assessment Revised FinalBright MelbaBelum ada peringkat

- Manual PDFDokumen445 halamanManual PDFJULY ALEXANDRA GUZMAN QUINTEROBelum ada peringkat

- 2017 04 20 Masterlist Prosedur & IkDokumen284 halaman2017 04 20 Masterlist Prosedur & IkHery KurniawanBelum ada peringkat

- Court Manual Fraudulant MisrepDokumen21 halamanCourt Manual Fraudulant Misrepzblackx2023Belum ada peringkat

- Pdaan297 PDFDokumen96 halamanPdaan297 PDFMJoyce Dela CruzBelum ada peringkat

- Unlocked - Upitnik - ObZ 2016Dokumen75 halamanUnlocked - Upitnik - ObZ 201611111Belum ada peringkat

- R Series R Series Operator's Guide: Plus BLSDokumen198 halamanR Series R Series Operator's Guide: Plus BLSPetrus LutfyBelum ada peringkat

- TM 11240-15 - 3FDokumen111 halamanTM 11240-15 - 3Flonelylost2003100% (1)

- Ag CLDokumen4 halamanAg CLAfli Sindri Dacosta AlnabeBelum ada peringkat

- CountDokumen75 halamanCountAlfian N. ArsyadiBelum ada peringkat

- 648 Comparison of Text in Major 1999 Books: TFFC27 06/04/2005 15:44 Page 648Dokumen1 halaman648 Comparison of Text in Major 1999 Books: TFFC27 06/04/2005 15:44 Page 648kamlesh0106Belum ada peringkat

- 13 Kgopakumar ONGC - IndiaDokumen28 halaman13 Kgopakumar ONGC - Indiapasha khanBelum ada peringkat

- Rift Valley Water Supply and Sanitation ProjectDokumen59 halamanRift Valley Water Supply and Sanitation ProjectcherogonyaBelum ada peringkat

- HF A ExposureDokumen0 halamanHF A Exposurenwn_xyzBelum ada peringkat

- IRS Audit Guide For Businesses Involving LivestockDokumen104 halamanIRS Audit Guide For Businesses Involving LivestockSpringer Jones, Enrolled AgentBelum ada peringkat

- 2209 Owners ManualDokumen51 halaman2209 Owners ManualCarlos Mario UranBelum ada peringkat

- Computer Networks NotesDokumen420 halamanComputer Networks Notesbobsgally100% (1)

- Research BookDokumen28 halamanResearch Booknajib yareBelum ada peringkat

- At The Peace Palace The Hague, The Netherlands: ApplicantDokumen35 halamanAt The Peace Palace The Hague, The Netherlands: ApplicantMichaela PortarcosBelum ada peringkat

- Reservoir Stimulation 3 e 00Dokumen824 halamanReservoir Stimulation 3 e 00Victor Miguel ArevaloBelum ada peringkat

- روابط السبب والنتيجة والتناقضDokumen3 halamanروابط السبب والنتيجة والتناقضfaiza marzoukBelum ada peringkat

- The Pursuit of New Product Development: The Business Development ProcessDari EverandThe Pursuit of New Product Development: The Business Development ProcessBelum ada peringkat

- Energy and Climate: How to achieve a successful energy transitionDari EverandEnergy and Climate: How to achieve a successful energy transitionBelum ada peringkat

- Global Biogeochemical Cycles in the Climate SystemDari EverandGlobal Biogeochemical Cycles in the Climate SystemBelum ada peringkat

- Development Impacts of Solar-Powered Electricity Services in MongoliaDari EverandDevelopment Impacts of Solar-Powered Electricity Services in MongoliaBelum ada peringkat

- Cte Configuration GuideDokumen13 halamanCte Configuration GuideguroyalBelum ada peringkat

- Cte Configuration GuideDokumen13 halamanCte Configuration GuideguroyalBelum ada peringkat

- Pasta 1Dokumen7 halamanPasta 1guroyalBelum ada peringkat

- Pasta 1Dokumen7 halamanPasta 1guroyalBelum ada peringkat

- SSS Vs MoonwalkDokumen2 halamanSSS Vs MoonwalkJessa LoBelum ada peringkat

- De Barretto DigestDokumen2 halamanDe Barretto DigestrapgracelimBelum ada peringkat

- Audit Program Bank and CashDokumen4 halamanAudit Program Bank and CashFakhruddin Young Executives0% (1)

- Our Rich Journey - Ultimate Financial Independence Budget PDFDokumen3 halamanOur Rich Journey - Ultimate Financial Independence Budget PDFNabilAbbasiBelum ada peringkat

- What Is New in Detail Full Deck 13.4Dokumen340 halamanWhat Is New in Detail Full Deck 13.4Vikram SharmaBelum ada peringkat

- Multinational Companies in India (MNC)Dokumen17 halamanMultinational Companies in India (MNC)Sushil MundelBelum ada peringkat

- Filming Incentives in IndiaDokumen20 halamanFilming Incentives in Indiasowmya100% (1)

- Tanenggee v. PeopleDokumen2 halamanTanenggee v. Peopleqwerty100% (2)

- Mock Exam QuestionsDokumen11 halamanMock Exam QuestionsAlina TariqBelum ada peringkat

- Greytip OnlineDokumen15 halamanGreytip OnlinepsnspkBelum ada peringkat

- T24 Induction Arrangement Architecture - R18Dokumen50 halamanT24 Induction Arrangement Architecture - R18Shaqif Hasan Sajib82% (11)

- L1a - Financial AccountingDokumen42 halamanL1a - Financial AccountingandyBelum ada peringkat

- Tutorial 2.solutionsDokumen3 halamanTutorial 2.solutionsabcsingBelum ada peringkat

- Ascertain The Position of Cannons of Taxation in Tax System of Bangladesh'.Dokumen22 halamanAscertain The Position of Cannons of Taxation in Tax System of Bangladesh'.Dipock Mondal100% (3)

- Motion To Sell Adak PlantDokumen12 halamanMotion To Sell Adak PlantDeckbossBelum ada peringkat

- Fractional Reserve Banking PDFDokumen4 halamanFractional Reserve Banking PDFKeith KnightBelum ada peringkat

- Pyang - General Banking LawDokumen7 halamanPyang - General Banking Lawroquesa burayBelum ada peringkat

- Nism Certification V-A (Mutual Fund) MOck TestDokumen36 halamanNism Certification V-A (Mutual Fund) MOck TestAishwarya Adlakha100% (1)

- Presentation by Cs R V Seckar Mobile No - 79047 19295 Email IdDokumen21 halamanPresentation by Cs R V Seckar Mobile No - 79047 19295 Email IdShweta Prathamesh BadgujarBelum ada peringkat

- Dublin's BORD GAIS THEATRE - FOR SALE GUIDING 20 MillionDokumen2 halamanDublin's BORD GAIS THEATRE - FOR SALE GUIDING 20 MillionKurt KennedyBelum ada peringkat

- Bai Bitamal Ajil Introduction at UniklDokumen14 halamanBai Bitamal Ajil Introduction at UniklLee WongBelum ada peringkat

- Internship Report On State Bank of PakistanDokumen59 halamanInternship Report On State Bank of PakistanNadeem_Bangulzai88% (8)

- Customer Service BanksDokumen11 halamanCustomer Service BanksdodianitiBelum ada peringkat

- Enr 2008 The Top 500 Design FirmsDokumen61 halamanEnr 2008 The Top 500 Design FirmsgervaisjBelum ada peringkat

- RBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFDokumen9 halamanRBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFMayank ParekhBelum ada peringkat

- 2018.04.04 Pledged Mortgage Solution Sheet (JPMS-Final)Dokumen2 halaman2018.04.04 Pledged Mortgage Solution Sheet (JPMS-Final)kingofkweensBelum ada peringkat

- Case Full Text 2016 July To DecDokumen1.866 halamanCase Full Text 2016 July To DecDee WhyBelum ada peringkat

- Columbia Roosevelt Review 2012Dokumen71 halamanColumbia Roosevelt Review 2012Sarah ScheinmanBelum ada peringkat

- Baluyot V HolganzaDokumen2 halamanBaluyot V HolganzaMarioneMaeThiam100% (1)