Chapter6 - Final

Diunggah oleh

braveusmanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter6 - Final

Diunggah oleh

braveusmanHak Cipta:

Format Tersedia

CHAPTER 6

Multiple-Choice Questions

1. The objective of the ordinary audit of financial statements is the expression of an opinion on:

easy a. the fairness of the financial statements.

a b. the accuracy of the financial statements.

c. the accuracy of the annual report.

d. the balance sheet and income statement.

2.

easy

f the auditor believes that the financial statements are not fairly stated or is unable to reach an

conclusion because of insufficient evidence! the auditor:

c a. should "ithdra" from the en#a#ement.

b. should re$uest an increase in audit fees so that more resources can be used to conduct the

audit.

c. has the responsibility of notifyin# financial statement users throu#h the auditor%s report.

d. should notify re#ulators of the circumstances.

&. 'uditors accumulate evidence to:

easy a. defend themselves in the event of a la"suit.

d b. justify the conclusions they have other"ise reached.

c. satisfy the re$uirements of the (ecurities 'cts of 1)&& and 1)&*.

d. enable them to reach conclusions about the fairness of the financial statements.

*.

easy

The responsibility for adoptin# sound accountin# policies and maintainin# ade$uate internal

control rests "ith the:

b a. board of directors.

b. company mana#ement.

c. financial statement auditor.

d. company%s internal audit department.

+.

easy

The auditor%s best defense "hen material misstatements are not uncovered is to have conducted

the audit:

a a. in accordance "ith auditin# standards.

b. as effectively as reasonably possible.

c. in a timely manner.

d. only after an ade$uate investi#ation of the mana#ement team.

,.

easy

f mana#ement insists on financial statement disclosures that the auditor finds unacceptable! the

auditor can:

d a. issue an adverse audit report.

b. issue a $ualified audit report.

c. "ithdra" from the en#a#ement.

d. choose any of these three courses of action.

-.

easy

f mana#ement insists on financial statement disclosures that the auditor finds unacceptable! the

auditor can do all but "hich of the follo"in#.

b a. ssue an adverse audit report.

b. ssue a disclaimer of opinion.

c. /ithdra" from the en#a#ement.

d. ssue a $ualified audit report.

,-1

0.

easy

/hich of the follo"in# is not one of the reasons that auditors provide only reasonable

assurance on the financial statements.

d a. The auditor commonly examines a sample! rather than the entire population of

transactions.

b. 'ccountin# presentations contain complex estimates "hich involve uncertainty.

c. 1raudulently prepared financial statements are often difficult to detect.

d. 'uditors believe that reasonable assurance is sufficient in the vast majority of cases.

). 23ublic4

easy

n certifyin# their annual financial statements! the C56 and C16 of a public company certify

that the financial statements comply "ith the re$uirements of:

c a. 7''3.

b. the (arbanes-6xley 'ct.

c. the (ecurities 5xchan#e 'ct of 1)&*.

d. 7''(.

18. /hich of the follo"in# statements is most correct re#ardin# errors and fraud.

easy a. 'n error is unintentional! "hereas fraud is intentional.

a b. 1rauds occur more often than errors in financial statements.

c. 5rrors are al"ays fraud and frauds are al"ays errors.

d. 'uditors have more responsibility for findin# fraud than errors.

11. 2(694 /hich of the follo"in# statements is true of a public company%s financial statements.

easy a. (arbanes-6xley re$uires the C56 only to certify the financial statements.

c b. (arbanes-6xley re$uires the C16 only to certify the financial statements.

c. (arbanes-6xley re$uires the C56 and C16 to certify the financial statements.

d. (arbanes-6xley neither re$uires the C56 nor the C16 to certify the financial statements.

12. /hich of the follo"in# is not one of the three cate#ories of assertions.

easy a. 'ssertions about classes of transactions and events for the period under audit

b b. 'ssertions about financial statements and correspondence to 7''3

c. 'ssertions about account balances at period end

d. 'ssertions about presentation and disclosure

1&.

easy

f a short-term note payable is included in the accounts payable balance on the financial

statement! there is a violation of the:

d a. completeness assertion.

b. existence assertion.

c. cutoff assertion.

d. classification and understandability assertion.

1*. 3rofessional s:epticism re$uires auditors to possess a2n4 ;;;;;; mind.

easy a. introspective

b b. $uestionin#

c. intelli#ent

d. unbelievin#

1+.

easy

c

The auditor has no responsibility to plan and perform the audit to obtain reasonable assurance

that misstatements! "hether caused by errors or fraud! that are not ;;;;;;;; are detected.

a. important to the financial statements

b. statistically si#nificant to the financial statements

c. material to the financial statements

d. identified by the client

,-2

1,. 1raudulent financial reportin# is most li:ely to be committed by "hom.

easy a. <ine employees of the company.

c b. 6utside members of the company%s board of directors.

c. Company mana#ement.

d. The company%s auditors.

1-. /hich of the follo"in# "ould most li:ely be deemed a direct-effect ille#al act.

easy a. =iolation of federal employment la"s.

c b. =iolation of federal environmental re#ulations.

c. =iolation of federal income tax la"s.

d. =iolation of civil ri#hts la"s.

10. The concept of reasonable assurance indicates that the auditor is:

easy a. not an insurer of the correctness of the financial statements.

a b. not responsible for the fairness of the financial statements.

c. responsible only for issuin# an opinion on the financial statements.

d. responsible for findin# all misstatements.

1). Tests of details of balances are specific procedures intended to:

easy a. test for monetary errors in the financial statements.

a b. prove that the accounts "ith material balances are classified correctly.

c. prove that the trial balance is in balance.

d. identify the details of the internal control system.

28. /hich of the follo"in# is the auditor least li:ely to do "hen a"are of an ille#al act.

easy a. >iscuss the matter "ith the client%s le#al counsel.

c b. 6btain evidence about the potential effect of the ille#al act on the financial statements.

c. Contact the local la" enforcement officials re#ardin# potential criminal "ron#doin#.

d. Consider the impact of the ille#al act on the relationship "ith the company%s mana#ement.

21.

medium

c

The auditor #ives an audit opinion on the fair presentation of the financial statements and

associates his or her name "ith it "hen! on the basis of ade$uate evidence! the auditor

concludes that the financial statements are unli:ely to mislead:

a. investors.

b. mana#ement.

c. a prudent user.

d. the reader.

22.

medium

The responsibility for the preparation of the financial statements and the accompanyin#

footnotes belon#s to:

b a. the auditor.

b. mana#ement.

c. both mana#ement and the auditor e$ually.

d. mana#ement for the statements and the auditor for the notes.

2&. /hen en#a#ed to audit the financial statements! it is acceptable for the auditor to prepare:

medium a. the financial statements for the client.

d b. the footnotes for the client.

c. a draft of the financial statements for the client.

d. a draft of the financial statements and footnotes for the client.

2*.

medium

The auditor has considerable responsibility for notifyin# users as to "hether or not the

statements are properly stated. This imposes upon the auditor a duty to:

a a. provide reasonable assurance that material misstatements "ill be detected.

b. be a #uarantor of the fairness in the statements.

c. be e$ually responsible "ith mana#ement for the preparation of the financial statements.

d. be an insurer of the fairness in the statements.

,-&

2+.

medium

?The auditor should not assume that mana#ement is dishonest! but the possibility of dishonesty

must be considered.@ This is an example of:

b a. unprofessional behavior.

b. an attitude of professional s:epticism.

c. due dili#ence.

d. a rule in the 'C3'%s Code of Professional Conduct.

2,.

medium

f the auditor "ere responsible for ma:in# certain that all of mana#ement%s assertions in the

financial statements "ere absolutely correct:

d a. ban:ruptcies could no lon#er occur.

b. ban:ruptcies "ould be reduced to a very small number.

c. audits "ould be much easier to complete.

d. audits "ould not be economically feasible.

2-.

medium

The auditor%s best defense "hen existin# material misstatements in the financial statements are

not uncovered in the audit is:

d a. the audit "as conducted in accordance "ith #enerally accepted accountin# principles.

b. the financial statements are client%s responsibility.

c. client is #uilty of contributory ne#li#ence.

d. none of the above.

20. 1raudulent financial reportin# is often called:

medium a. mana#ement fraud.

a b. theft of assets.

c. defalcation.

d. embeAAlement.

2). /hich of the follo"in# statements is true.

medium a. t is usually easier for the auditor to uncover frauds than errors.

b b. t is usually easier for the auditor to uncover errors than frauds.

c. t is usually e$ually difficult for the auditor to uncover errors or frauds.

d. Bsually! none of the above statements is true.

&8.

medium

'uditin# standards ma:e ;;;;; distinction2s4 bet"een the auditor%s responsibilities for

searchin# for errors and fraud.

c a. little

b. a si#nificant

c. no

d. various

&1.

medium

n comparin# mana#ement fraud "ith employee fraud! the auditor%s ris: of failin# to discover

the fraud is:

b a. #reater for mana#ement fraud because mana#ers are inherently more deceptive than

employees.

b. #reater for mana#ement fraud because of mana#ement%s ability to override existin#

internal controls.

c. #reater for employee fraud because of the hi#her crime rate amon# blue collar "or:ers.

d. #reater for employee fraud because of the lar#er number of employees in the or#aniAation.

,-*

&2.

medium

/hich of the follo"in# statements is correct "ith respect to the auditor%s responsibilities

relative to the detection of indirect-effect ille#al acts.

a a. The auditor has no responsibility for searchin# for indirect-effect ille#al acts.

b. The auditor has the same responsibility for searchin# for indirect-effect ille#al acts as any

other potential misstatement that may occur.

c. 'uditors have responsibility for searchin# for any ille#al act! "hether direct-effect or

indirect-effect.

d. Cone of the above is correct.

&&.

medium

/hen comparin# the auditor%s responsibility for detectin# employee fraud and for detectin#

errors! the profession has placed the responsibility:

c a. more on discoverin# errors than employee fraud.

b. more on discoverin# employee fraud than errors.

c. e$ually on discoverin# either one.

d. on the senior auditor for detectin# errors and on the mana#er for detectin# employee fraud.

&*.

medium

f several employees collude to falsify documents! the chance a normal audit "ould uncover

such acts is:

a a. very lo".

b. very hi#h.

c. Aero.

d. none of the above.

&+.

medium

/hen plannin# the audit! if the auditor has no reason to believe that ille#al acts exist! the

auditor should:

d a. include audit procedures "hich have a stron# probability of detectin# ille#al acts.

b. still include some audit procedures desi#ned specifically to uncover ille#alities.

c. i#nore the issue.

d. ma:e in$uiries of mana#ement re#ardin# their policies for detectin# and preventin# ille#al

acts and re#ardin# their :no"led#e of violations! and then rely on normal audit procedures

to detect errors! irre#ularities! and ille#alities.

&,. /hen the auditor has reason to believe an ille#al act has occurred! the auditor should:

medium a. in$uire of mana#ement at a level above those li:ely to be involved "ith the ille#ality.

d b. consult "ith the client%s le#al counsel.

c. consider accumulatin# additional evidence to determine if there is actually an ille#al act.

d. do all three of the above.

&-. /hen the auditor :no"s that an ille#al act has occurred! the auditor must:

medium a. report it to the proper #overnmental authorities.

b b. consider the effects on the financial statements! includin# the ade$uacy of disclosure.

c. "ithdra" from the en#a#ement.

d. issue an adverse opinion.

&0. 23ublic4 f an auditor uncovers an ille#al act at a public company! the auditor must notify:

medium a. local la" enforcement officials.

c b. the 3ublic Company 'ccountin# 6versi#ht Doard.

c. the (ecurities and 5xchan#e Commission.

d. all of the above.

&). /hy does the auditor divide the financial statements into smaller se#ments.

medium a. Bsin# the cycle approach ma:es the audit more mana#eable.

a b. Most accounts have fe" relationships "ith others and so it is more efficient to brea: the

financial statements into smaller pieces.

c. The cycle approach is used because auditin# standards re$uire it.

d. 'll of the above are correct.

,-+

*8.

medium

/hy does the auditor divide the financial statements into se#ments around the financial

statement cycles.

b a. Most auditors are trained to audit cycles as opposed to entire financial statements.

b. The approach aids in the assi#nment of tas:s to different members of the audit team.

c. The cycle approach is re$uired by auditin# standards.

d. Cone of the above is correct.

*1. The most important #eneral led#er account included in and affectin# several cycles is the:

medium a. cash account.

a b. inventory account.

c. income tax expense and liability accounts.

d. retained earnin#s account.

*2. Mana#ement assertions are:

medium

a

a. implied or expressed representations about accounts! transactions! and disclosures in the

financial statements.

b. stated in the footnotes to the financial statements.

c. explicitly expressed representations about the financial statements.

d. provided to the auditor in the assertions letter! but are not disclosed on the financial

statements.

*&. /hich of the follo"in# statements is not true.

medium

c

a. 'uditors have found that the most effective "ay to conduct audits is to audit the balance

sheet and use analytical procedures only for other financial statements.

b. 'uditors have found that the most efficient "ay to conduct audits is to audit the balance

sheet and use analytical procedures only for other financial statements.

c. 'uditors have found that the most efficient and effective "ay to conduct audits is to obtain

some combination of assurance for each class of transactions and for the endin# balance in

the related account.

d. 'uditors have found that the most efficient and effective "ay to conduct audits is to obtain

some combination of assurance for specified classes of transactions only.

**. /hich of the follo"in# statements is true.

medium a. 'udit objectives follo" and are closely related to mana#ement assertions.

a b. Mana#ement%s assertions follo" and are closely related to the audit objectives.

c. The auditor%s primary responsibility is to find and disclose fraudulent mana#ement

assertions.

d. 'ssertions about presentation and disclosure deal "ith "hether the accounts have been

included in the financial statements at appropriate amounts.

*+.

medium

/hich of the follo"in# statements is true re#ardin# the distinction bet"een #eneral audit

objectives and specific audit objectives for each account balance.

b a. The specific audit objectives are applicable to every account balance on the financial

statements.

b. The #eneral audit objectives are applicable to every account balance on the financial

statements.

c. The #eneral audit objectives are stated in terms tailored to the en#a#ement.

d. 'll of the above statements are true.

*,. /hich of the follo"in# statements about the existence and completeness assertions is not true.

medium a. The existence and completeness assertions emphasiAe different audit concerns.

c b. 5xistence deals "ith overstatements and completeness deals "ith understatements.

c. 5xistence deals "ith understatements and completeness deals "ith overstatements.

d. The completeness assertion deals "ith unrecorded transactions.

,-,

*-. The occurrence assertion applies to ;;;;;;;.

medium a. presentation and disclosure matters

b b. classes of transactions and events durin# the period

c. account balances

d. none of the above

*0.

medium

/hich of the follo"in# mana#ement assertions is not associated "ith transaction-related audit

objectives.

b a. 6ccurrence

b. Classification and understandability

c. 'ccuracy

d. Completeness

*). /hich of the follo"in# statements is not true.

medium a. Dalance-related audit objectives are applied to account balances.

d b. Transaction-related audit objectives are applied to classes of transactions.

c. Dalance-related audit objectives are applied to the endin# balance in balance sheet

accounts.

d. Dalance-related audit objectives are applied to both be#innin# and endin# balances in

balance sheet accounts.

+8. n testin# for cutoff! the objective is to determine:

medium a. "hether all of the current period%s transactions are recorded.

b b. "hether transactions are recorded in the correct accountin# period.

c. a and b are correct.

d. neither a nor b is correct.

+1. The detail tie-in objective is not concerned that the details in the account balance:

medium a. a#ree "ith related subsidiary led#er amounts.

b b. are properly disclosed in accordance "ith 7''3.

c. foot to the total in the account balance.

d. a#ree "ith the total in the #eneral led#er.

+2. The detail tie-in is part of the;;;;;;; assertion for account balances.

medium a. classification

b b. valuation and allocation

c. ri#hts and obli#ations

d. completeness

+&.

medium

/hich of the follo"in# is not a proper match of a transaction-related audit objective and

mana#ement assertion.

a a. 'ccuracy and cutoff.

b. Classification and classification.

c. 3ostin# and summariAation "ith accuracy.

d. 6ccurrence and occurrence.

+*. /hich of the follo"in# statements is not correct.

medium a. There are many "ays an auditor can accumulate evidence to meet overall audit objectives.

d b. (ufficient appropriate evidence must be accumulated to meet the auditor%s professional

responsibility.

c. t is appropriate to minimiAe the cost of accumulatin# evidence.

d. 7atherin# evidence and minimiAin# costs are e$ually important considerations that affect

the approach the auditor selects.

,--

++. T"o overridin# considerations affect the many "ays an auditor can accumulate evidence:

medium

a

1. (ufficient appropriate evidence must be accumulated to meet the auditor%s

professional responsibility.

2. Cost of accumulatin# evidence should be minimiAed.

n evaluatin# these considerations:

a. the first is more important than the second.

b. the second is more important than the first.

c. they are e$ually important.

d. it is impossible to prioritiAe them.

+,.

medium

b

f the auditor has obtained a reasonable level of assurance about the fair presentation of the

financial statements throu#h understandin# internal control! assessin# control ris:! testin#

controls! and analytical procedures! then the auditor:

a. can issue an un$ualified opinion.

b. can si#nificantly reduce other substantive tests.

c. can "rite the en#a#ement letter.

d. needs to do additional tests of controls so that the assurance level can be increased.

+-.

medium

d

'fter the auditor has completed all audit procedures! it is necessary to combine the information

obtained to reach an overall conclusion as to "hether the financial statements are fairly

presented. This is a hi#hly subjective process that relies heavily on:

a. #enerally accepted auditin# standards.

b. the 'C3'%s Code of Professional Conduct.

c. #enerally accepted accountin# principles.

d. the auditor%s professional jud#ment.

+0. /hich of the follo"in# combinations is correct.

medium a. 5xistence relates to "hether amounts included occurred.

c b. 6ccurrence relates to "hether balances exist.

c. 5xistence relates to "hether amounts included exist.

d. Cone of the above is true.

+).

medium

f an auditor conducted an audit in accordance "ith auditin# standards! "hich of the follo"in#

"ould the auditor li:ely detect.

b a. Bnrecorded transactions.

b. ncorrect postin#s of recorded transactions.

c. Counterfeit si#natures on paid chec:s.

d. 1raud involvin# collusion.

,8.

medium

/hich of the follo"in# statements best describes the auditor%s responsibility "ith respect to

ille#al acts that do not have a material effect on the client%s financial statements.

a a. 7enerally! the auditor is under no obli#ation to notify parties other than personnel "ithin

the client%s or#aniAation.

b. 7enerally! the auditor is under an obli#ation to see that stoc:holders are notified.

c. 7enerally! the auditor is obli#ated to disclose the relevant facts in the auditor%s report.

d. 7enerally! the auditor is expected to compel the client to adhere to re$uirements of the

1orei#n Corrupt 3ractices 'ct.

,-0

,1.

medium

/hich of the follo"in# statements best describes the auditor%s responsibility re#ardin# the

detection of fraud.

c a. The auditor is responsible for the failure to detect fraud only "hen such failure clearly

results from nonperformance of audit procedures specifically described in the en#a#ement

letter.

b. The auditor must extend auditin# procedures to actively search for evidence of fraud in all

situations.

c. The auditor must extend auditin# procedures to actively search for evidence of fraud

"here the examination indicates that fraud may exist.

d. The auditor is responsible for the failure to detect fraud only "hen an un$ualified opinion

is issued.

,2. The essence of the attest function is to:

medium a. assure the consistent application of correct accountin# procedures.

b b. determine "hether the client%s financial statements are fairly stated.

c. examine individual transactions so that the auditor may certify as to their validity.

d. detect collusion and fraud.

,&.

medium

The primary difference bet"een an audit of the balance sheet and an audit of the income

statement is that the audit of the income statement deals "ith the verification of:

a a. transactions.

b. authoriAations.

c. costs.

d. cutoffs.

,*.

challen#in#

The auditor%s evaluation of the li:elihood of material employee fraud is normally done initially

as a part of:

c a. tests of controls.

b. tests of transactions.

c. understandin# the entity%s internal control.

d. the assessment of "hether to accept the audit en#a#ement.

,+.

challen#in#

/hen usin# the cycle approach to se#mentin# the audit! the reason for treatin# capital

ac$uisition and repayment separately from the ac$uisition of #oods and services is that:

c a. the transactions are related to financin# a company rather than to its operations.

b. most capital ac$uisition and repayment cycle accounts involve fe" transactions! but each

is often hi#hly material and therefore should be audited extensively.

c. both a and b are correct.

d. neither a nor b is correct.

,,. lle#al acts are defined in ('( +* 2'B21-4 as:

challen#in# a. violations of la"s or #overnment re#ulations.

c b. violations of la"s or #overnment re#ulations other than errors.

c. violations of la"s or #overnment re#ulations other than fraud.

d. violations of la" "hich "ould result in the arrest of the perpetrator.

,-. Most ille#al acts affect the financial statements:

challen#in# a. directly.

b b. only indirectly.

c. both directly and indirectly.

d. materially if directE immaterially if indirect.

,-)

,0. /ith respect to the detection of ille#al acts! auditin# standards state that the auditor provides:

challen#in# a. no assurance that they "ill be detected.

a b. the same reasonable assurance provided for other items.

c. assurance that they "ill be detected! if material.

d. assurance that they "ill be detected! if hi#hly material.

,).

challen#in#

n describin# the cycle approach to se#mentin# an audit! "hich of the follo"in# statements is

not true.

d a. 'll #eneral led#er accounts and journals are included at least once.

b. (ome journals and #eneral led#er accounts are included in more than one cycle.

c. The ?capital ac$uisition and repayment@ cycle is closely related to the ?ac$uisition of

#oods and services and payment@ cycle.

d. The ?inventory and "arehousin#@ cycle may be audited at any time durin# the en#a#ement

since it is unrelated to the other cycles.

-8. /hich of the follo"in# journals "ould be included most often in the various audit cycles.

challen#in# a. Cash receipts journal.

c b. Cash disbursements journal.

c. 7eneral journal.

d. (ales journal.

-1. Transaction cycles be#in and end:

challen#in# a. at the be#innin# and end of the fiscal period.

d b. at the balance sheet date.

c. at Fanuary 1 and >ecember &1.

d. at the ori#in and final disposition of the company.

-2.

challen#in#

'fter #eneral audit objectives are understood! specific audit objectives for each account balance

on the financial statements can be developed. /hich of the follo"in# statements is true.

a a. There should be at least one specific objective for each relevant #eneral objective.

b. There "ill be only one specific objective for each relevant #eneral objective.

c. There "ill be many specific objectives developed for each relevant #eneral objective.

d. There must be one specific objective for each #eneral objective.

-*.

challen#in#

'n auditor should reco#niAe that the application of auditin# procedures may produce evidence

indicatin# the possibility of errors or fraud and therefore should:

a a. plan and perform the en#a#ement "ith an attitude of professional s:epticism.

b. not rely on internal controls that are desi#ned to prevent or detect errors or fraud.

c. desi#n audit tests to detect unrecorded transactions.

d. extend the "or: to audit most recorded transactions and records of an entity.

5ssay Questions

-+.

easy

>iscuss the differences bet"een errors! frauds! and ille#al acts. 7ive an example of each.

'ns"er:

The primary difference bet"een errors and frauds is that errors are unintentional

misstatements of the financial statements! "hereas frauds are intentional misstatements.

lle#al acts are violations of la"s or #overnment re#ulations! other than frauds. 'n

example of an error is a mathematical mista:e "hen footin# the columns in the sales

journal. 'n example of a fraud is the creation of fictitious accounts receivable. 'n example

of an ille#al act is the dumpin# of toxic "aste in violation of the federal environmental

protection la"s.

,-18

-,.

medium

>iscuss the actions an auditor should ta:e "hen the auditor discovers an ille#al act.

'ns"er:

The auditor should first consider the effects of the ille#al act on the financial statements!

includin# the ade$uacy of disclosures. f the auditor concludes that disclosures are

inade$uate! the audit report should be modified accordin#ly. The auditor should also

consider the effect of the ille#al act on its relationship "ith mana#ement! and

mana#ement%s trust"orthiness. Cext! the client%s audit committee or others of e$uivalent

authority should be informed of the ille#al act. f the client does not deal "ith the ille#al

act in a satisfactory manner! the auditor should consider "ithdra"in# from the

en#a#ement. 1inally! if the client is publicly held! the auditor may need to report the matter

to the (5C.

--.

medium

There are three broad cate#ories of mana#ement assertions. dentify each of these cate#ories.

'ns"er:

'ssertions about classes of transactions and events for the period under audit.

'ssertions about account balances at period end.

'ssertions about presentation and disclosure.

-0.

medium

Driefly explain each mana#ement assertion related to classes of transactions and events for the

period under audit.

'ns"er:

Occurrence. Transactions and events that have been recorded have occurred and

pertain to the entity.

Completeness. 'll transactions and events that should have been recorded have been

recorded.

Accuracy. 'mounts and other data relatin# to recorded transactions and events have

been recorded appropriately.

Classification. Transactions and events have been recorded in the proper accounts.

Cutoff. Transactions and events have been recorded in the correct accountin# period.

-).

medium

Driefly explain each mana#ement assertion related to account balances at period end.

'ns"er:

Existence. 'ssets! liabilities! and e$uity interests exist.

Completeness. 'll assets! liabilities! and e$uity interests that should have been

recorded have been recorded.

Valuation and allocation. 'ssets! liabilities! and e$uity interests are included in the

financial statements at appropriate amounts and any resultin# valuation adjustments

are appropriately recorded.

Rights and obligations. The entity holds or controls the ri#hts to assets! and liabilities

are the obli#ation of the entity.

,-11

08.

medium

Driefly explain each mana#ement assertion related to presentation and disclosure.

'ns"er:

Occurrence and rights and obligations. >isclosed events and transactions have

occurred and pertain to the entity.

Completeness. 'll disclosures that should have been included in the financial

statements have been included.

Accuracy and valuation. 1inancial and other information are disclosed appropriately

and at appropriate amounts.

Classification and understandability. 1inancial and other information is appropriately

presented and described and disclosures are clearly expressed.

01.

medium

>iscuss three reasons "hy auditors are responsible for ?reasonable@ but not ?absolute@

assurance.

'ns"er:

Most audit evidence results from testin# a sample of a population. (amplin# involves

some ris: of not uncoverin# material misstatements.

'ccountin# presentations contain complex estimates! "hich inherently involve

uncertainty and can be affected by future events. 's a result! the auditor has to rely on

evidence that is persuasive but not convincin#.

1raudulently prepared financial statements are often very difficult for the auditor to

detect! especially "hen there is collusion amon# mana#ement.

02.

medium

>istin#uish bet"een mana#ement%s responsibility and the auditor%s responsibility for the

financial statements under audit.

'ns"er:

Mana#ement is responsible for adoptin# appropriate accountin# policies! maintainin#

ade$uate internal control! and ma:in# fair representations in the financial statements. The

auditor%s responsibility is to perform an audit desi#ned to provide reasonable assurance of

detectin# any material misstatements in the financial statements and to express an opinion

on those financial statements at the conclusion of the audit.

0&.

medium

n the context of the audit of sales! distin#uish bet"een the existence and completeness

transaction-related audit objectives. (tate the effect on the sales account 2overstatement or

understatement4 of a violation of each objective.

'ns"er:

/hen testin# the existence objective for sales! the auditor%s focus is on "hether the sales

that have been recorded in the sales journal actually occurred. n contrast! tests of the

completeness objective are concerned "ith determinin# "hether all sales that actually

occurred have been recorded in the sales journal. =iolations of the existence objective

result in overstatements of salesE violations of the completeness objective result in

understatements of sales..

,-12

0*.

challen#in#

>iscuss the differences in the auditor%s responsibilities for discoverin# 214 material errors! 224

material fraud 2&4 direct-effect ille#al acts! and 2*4 indirect-effect ille#al acts.

'ns"er:

'uditin# standards ma:e no distinction bet"een the auditorGs responsibilities for searchin#

for errors and fraud. n either case! the auditor must obtain reasonable assurance about

"hether the statements are free of material misstatements. The standards also reco#niAe

that fraud is often more difficult to detect because mana#ement or the employees

perpetratin# the fraud attempt to conceal the fraud. (till! the difficulty of detection does

not chan#e the auditorGs responsibility to properly plan and perform the audit to detect

material misstatements! "hether caused by error or fraud. The auditor%s responsibility for

uncoverin# direct-effect ille#al acts is the same as for errors and fraud. Ho"ever! the

auditor is not re$uired to search for indirect-effect ille#al acts unless there is reason to

believe they exist.

0+.

challen#in#

' financial statement audit typically consists of four phases. dentify each of these four phases

of an audit and discuss the major activities performed by the auditor in each phase.

'ns"er:

Phase I Plan and design an audit approach. n this phase! the auditor obtains an

understandin# of the client%s entity and its environment. n addition! the auditor obtains an

understandin# of the client%s internal control and assesses the ris: of material

misstatement.

Phase II Perform tests of controls and substantive tests of transactions. n this phase! the

auditor tests those internal controls heIshe believes may be effective at preventin# or

detectin# misstatements. n addition! the auditor performs substantive tests of transactions

to verify the monetary amounts of transactions.

Phase III Perform analytical procedures and tests of details of balances. n this phase! the

auditor performs analytical procedures to assess the overall reasonableness of transactions

and balances. n addition! tests of details of balances are performed to test for monetary

misstatements in the financial statements.

Phase IV Complete the audit and issue an audit report. n the last phase of the audit! the

information obtained in the previous phases is combined to reach an overall conclusion as

to "hether the financial statements are fairly presented. 'n audit report is then issued

based on this conclusion.

0,.

challen#in#

>iscuss some precautionary actions an auditor should ta:e "hen there is a moderate or hi#h ris:

of mana#ement fraud.

'ns"er:

(ome precautionary actions an auditor should ta:e "hen there is a moderate or hi#h ris: of

mana#ement fraud include:

Critically challen#in# the client%s choice of accountin# principles.

'ssi#nin# more experienced personnel to the en#a#ement.

>oin# more audit "or: at year-end instead of at interim dates.

Closely supervisin# assistants and other inexperienced staff.

3erformin# additional or more effective audit procedures.

n extreme situations! the auditor should consider "ithdra"in# from the en#a#ement.

,-1&

6ther 6bjective 'ns"er 1ormat Questions

0-.

medium

Match seven of the terms 2a-:4 "ith the definitions provided belo" 21--4:

a. Tests of details of balances

b. Tests of controls

c. (ubstantive tests of transactions

d. 'nalytical procedures

e. Transaction-related audit objectives

f. Mana#ement assertions

#. Dalance-related audit objectives

h. 1raud

i. lle#al act

j. 5rror

:. Mana#ement fraud

h 1. 'n intentional misstatement of the financial statements.

e 2. ' set of six audit objectives the auditor must meet! includin# timin#! postin# and

summariAation! and accuracy.

f &. mplied or expressed representations made by the client about classes of

transactions! account balances and disclosures in the financial statements.

a *. 'udit procedures testin# for monetary misstatements to determine "hether the

balance-related audit objectives have been satisfied for each si#nificant account

balance.

# +. ' set of nine audit objectives the auditor must meet! includin# completeness!

detail tie-in! and ri#hts and obli#ations.

b ,. 'udit procedures desi#ned to test the effectiveness of control policies and

procedures.

d -. Bse of comparisons and relationships to assess "hether account balances or

other data appears reasonable.

00.

challen#in#

Delo" are five audit procedures! all of "hich are tests of transactions associated "ith the audit of

the sales and collection cycle. 'lso belo" are the six #eneral transaction-related audit objectives

and the five mana#ement assertions. 1or each audit procedure! indicate 214 its audit objective! and

224 the mana#ement assertion bein# tested.

'udit 6bjectives 'ssertions

'. 6ccurrence =. 6ccurrence

D. Completeness /. Completeness

C. 'ccuracy 9. 'ccuracy

>. 3ostin# and summariAation J. Classification

5. Classification K. Cutoff

1. Timin#

,-1*

1. =ouch recorded sales from the sales journal to the file of bills of ladin#.

' 214 .

= 224 .

2. Compare dates on the bill of ladin#! sales invoices! and sales journal to test for delays in

recordin# sales transactions.

1 214 .

K 224 .

&. 'ccount for the se$uence of prenumbered bills of ladin# and sales invoices.

D 214 .

/ 224 .

*. Trace from a sample of prelistin#s of cash receipts to the cash receipts journal! testin# for

names! amounts! and dates.

D! C 214 .

/! 9 224 .

+. 5xamine customer order forms for credit approval by the credit mana#er.

' 214 .

= 224 .

0).

challen#in#

Delo" are five audit procedures! all of "hich are tests of transactions associated "ith the audit of

the ac$uisition and payment cycle. 'lso belo" are the six #eneral transaction-related audit

objectives and the five mana#ement assertions. 1or each audit procedure! indicate 214 its audit

objective! and 224 the mana#ement assertion bein# tested.

6bjectives 'ssertions

'. 6ccurrence=. 6ccurrence

D. Completeness /. Completeness

C. 'ccuracy 9. 'ccuracy

>. 3ostin# and summariAation J. Classification

5. Classification K. Cutoff

1. Timin#

1. 1oot the purchases journal and trace the totals to the related #eneral led#er accounts.

> 214 .

9 224 .

2. Lecompute the cash discounts ta:en by the client.

C 214 .

9 224 .

&. Compare dates on cancelled chec:s "ith the ban: cancellation date.

1 214 .

K 224 .

*. Trace from a sample of cancelled chec:s to the cash disbursements journal.

D 214 .

/ 224 .

,-1+

+. 5xamine supportin# documentation for a sample of transactions for authoriAed payee and

amount and to determine services or #oods "ere received.

' 214 .

= 224 .

)8.

challen#in#

Delo" are five audit procedures! all of "hich are tests of balances associated "ith the audit of

accounts receivable. 'lso belo" are the ei#ht #eneral balance-related audit objectives and the four

mana#ement assertions. 1or each audit procedure! indicate 214 its audit objective! and 224 the

mana#ement assertion bein# tested.

6bjectives 'ssertions

'. 5xistence =. 5xistence

D. Completeness /. Completeness

C. 'ccuracy 9. =aluation and allocation

>. Classification J. Li#hts and obli#ations

5. Cutoff

1. >etail tie-in

7. LealiAable value

H. Li#hts and obli#ations

1. 6btain an a#ed listin# of accounts receivable. 1or a sample of individual customers on the

listin#! a#ree the customer%s name! amount! and other information "ith the correspondin#

information in the accounts receivable master file.

1 214 .

9 224 .

2. 5xamine details of sales for five days before and five days after year-end to determine

"hether sales have been recorded in the proper period.

5 214 .

9 224 .

&. 'ssess the reasonableness of the balance in the allo"ance for doubtful accounts.

7 214 .

9 224 .

*. n$uire as to "hether any accounts receivable have been factored or sold durin# the period.

H 214 .

J 224 .

+. n$uire as to "hether there are any receivables from related parties.

> 214 .

9 224 .

)1.

easy

b

Lesponsibility for the fair presentation of financial statements rests e$ually "ith mana#ement and

the auditor.

a. True

b. 1alse

)2.

easy

b

5rrors are usually more difficult for an auditor to detect than frauds.

a. True

b. 1alse

,-1,

)&.

easy

b

'uditors have found that the most efficient "ay to conduct audits is to focus primarily on testin#

classes of transactions and performin# minimal or no tests of endin# account balances.

a. True

b. 1alse

)*.

easy

a

/hen an auditor has reduced assessed control ris: based on tests of controls! he or she may then

reduce the extent to "hich the accuracy of the financial statement information directly related to

those controls must be supported throu#h the accumulation of evidence usin# substantive tests.

a. True

b. 1alse

)+.

easy

b

Tests of details of balances typically involve the use of comparisons and relationships to assess the

overall reasonableness of account balances.

a. True

b. 1alse

),.

easy

a

6ther than in$uirin# of mana#ement about policies they have established to prevent ille#al acts and

"hether mana#ement :no"s of any la"s or re#ulations that the company has violated! the auditor

should not search for indirect-effect ille#al acts unless there is reason to believe they may exist.

a. True

b. 1alse

)-.

easy

a

/hen an auditor believes that an ille#al act may have occurred! the first step he or she should ta:e

is to in$uire of mana#ement at a level above those li:ely to be involved in the potential ille#al act.

a. True

b. 1alse

)0.

medium

b

'udits are expected to provide a hi#her de#ree of assurance for the detection of material frauds than

is provided for an e$ually material error.

a. True

b. 1alse

)).

medium

a

'uditors have a hi#her de#ree of responsibility for detectin# direct-effect ille#al acts than indirect-

effect ille#al acts.

a. True

b. 1alse

188.

medium

b

The auditor%s first course of action "hen an ille#al act is uncovered should be to immediately notify

the appropriate authorities! includin# but not limited to the police! and for publicly held companies!

the (ecurities and 5xchan#e Commission.

a. True

b. 1alse

181.

medium

b

Bnder the cycle approach to se#mentin# an audit! transactions recorded in different journals should

never be combined "ith the #eneral led#er balances that result from those transactions.

a. True

b. 1alse

182.

medium

b

7eneral transaction-related audit objectives vary from audit to audit! dependin# on the nature and

characteristics of the client%s business and industry.

a. True

b. 1alse

,-1-

18&.

medium

a

The audit objective of postin# and summariAation is associated "ith the mana#ement assertion of

accuracy.

a. True

b. 1alse

18*.

medium

b

Dalance-related audit objectives are usually applied to the endin# balance in income statement

accountsE transaction-related audit objectives are usually applied to transactions reflected in balance

sheet accounts.

a. True

b. 1alse

18+.

medium

a

The transaction-related audit objective of timin# is related to the assertion of cutoff.

a. True

b. 1alse

18,.

medium

a

The effect of a violation of the existence transaction-related audit objective for the sales account

"ould be an overstatement of that account.

a. True

b. 1alse

18-.

medium

b

The effect of a violation of the completeness transaction-related audit objective for cash

disbursements transactions "ould be an overstatement of cash disbursements.

a. True

b. 1alse

180.

medium

b

The transaction-related audit objective that deals "ith "hether recorded transactions have actually

occurred is the completeness objective.

a. True

b. 1alse

18).

medium

a

The #eneral balance-related audit objective that deals "ith determinin# that details in the account

balance a#ree "ith related master file amounts! foot to the total in the account balance! and a#ree

"ith the total in the #eneral led#er is the detail tie-in objective.

a. True

b. 1alse

118.

medium

a

The cutoff objective! ?transactions near the balance sheet date are recorded in the proper period!@ is

a balance-related audit objective.

a. True

b. 1alse

111.

medium

b

1or a private company audit! tests of controls are normally performed only on those internal

controls the auditor believes have not been operatin# effectively durin# the period under audit.

a. True

b. 1alse

112.

medium

a

'n audit #enerally provides no assurance that indirect-effect ille#al acts "ill be detected.

a. True

b. 1alse

11&.

medium

a

/hen an auditor believes there is a moderate or hi#h ris: of mana#ement fraud! the auditor "ill

normally do less audit "or: at interim dates instead of at year-end.

a. True

b. 1alse

,-10

11*.

challen#in#

b

'n auditor must inform a client%s audit committee of an ille#al act discovered durin# an audit in

"ritin#.

a. True

b. 1alse

11+.

challen#in#

b

The objective of the audit of financial statements by an independent auditor is to verify that the

financial statements are free of misstatements and accurately represent the company%s financial

position and results of operations.

a. True

b. 1alse

11,.

challen#in#

a

The auditor%s responsibility for uncoverin# direct-effect ille#al acts is the same as for fraud.

a. True

b. 1alse

,-1)

Anda mungkin juga menyukai

- Audit Objectives, Evidences and Techniques - 50 PagesDokumen53 halamanAudit Objectives, Evidences and Techniques - 50 PagesPam G.100% (2)

- Chapter 6 Audit Planning Understanding The Client and AsseDokumen44 halamanChapter 6 Audit Planning Understanding The Client and Asseindra83100% (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsDari EverandThe Entrepreneur’S Dictionary of Business and Financial TermsBelum ada peringkat

- CPA Review Notes 2019 - Audit (AUD)Dari EverandCPA Review Notes 2019 - Audit (AUD)Penilaian: 3.5 dari 5 bintang3.5/5 (10)

- Test Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFDokumen78 halamanTest Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFChristine Joy OriginalBelum ada peringkat

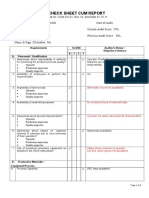

- Process Audit Check Sheet Cum ReportDokumen4 halamanProcess Audit Check Sheet Cum ReportLakshmanan Venkatesan100% (3)

- AUDIT HERORY QUIZ-2-Answer-Key PDFDokumen3 halamanAUDIT HERORY QUIZ-2-Answer-Key PDF시나50% (2)

- CQA Certification Guide and How To Crack Exam On Asq Certified Quality AuditorDokumen15 halamanCQA Certification Guide and How To Crack Exam On Asq Certified Quality AuditorAbdurRahmanF100% (1)

- Forensic Audit in NPA PDFDokumen16 halamanForensic Audit in NPA PDFPooja FuliaBelum ada peringkat

- Quiz 1 Auditor's ResponsibilityDokumen10 halamanQuiz 1 Auditor's ResponsibilityLiane Angelo Acero100% (1)

- TEST BANK-Auditing-ECDokumen16 halamanTEST BANK-Auditing-ECAnonymous qi4PZkBelum ada peringkat

- Chapter 3 Test BankDokumen13 halamanChapter 3 Test Bankmyngoc1812100% (2)

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Dari EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Belum ada peringkat

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentDari EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentPenilaian: 2.5 dari 5 bintang2.5/5 (4)

- TEST BANK Auditing Tak KerjainDokumen15 halamanTEST BANK Auditing Tak Kerjaindian agitaBelum ada peringkat

- Business As UsualDokumen16 halamanBusiness As UsualShin TanBelum ada peringkat

- Summary of Richard A. Lambert's Financial Literacy for ManagersDari EverandSummary of Richard A. Lambert's Financial Literacy for ManagersBelum ada peringkat

- AT Q1 Pre-Week - MAY 2019Dokumen17 halamanAT Q1 Pre-Week - MAY 2019Aj Pacaldo100% (3)

- Internal Control/Anti-Fraud Program Design for the Small Business: A Guide for Companies NOT Subject to the Sarbanes-Oxley ActDari EverandInternal Control/Anti-Fraud Program Design for the Small Business: A Guide for Companies NOT Subject to the Sarbanes-Oxley ActPenilaian: 4 dari 5 bintang4/5 (1)

- AUD-1stPB 10.22Dokumen14 halamanAUD-1stPB 10.22Harold Dan AcebedoBelum ada peringkat

- Ch11 - Substantive Testing and Revenue CyclesDokumen20 halamanCh11 - Substantive Testing and Revenue CyclesJamie ArquiroBelum ada peringkat

- Chapter 9 FinalDokumen17 halamanChapter 9 FinalMichael Hu33% (3)

- Flowcharts of ISAsDokumen22 halamanFlowcharts of ISAskillerj911Belum ada peringkat

- Internal Control of Fixed Assets: A Controller and Auditor's GuideDari EverandInternal Control of Fixed Assets: A Controller and Auditor's GuidePenilaian: 4 dari 5 bintang4/5 (1)

- Ch01 - Auditing, Attestation, and AssuranceDokumen9 halamanCh01 - Auditing, Attestation, and AssuranceRamon Jonathan Sapalaran100% (2)

- AT PrelimDokumen32 halamanAT Prelimfer maBelum ada peringkat

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionDari EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionBelum ada peringkat

- 2013 SGV Cup Level Up FinalDokumen17 halaman2013 SGV Cup Level Up FinalAndrei GoBelum ada peringkat

- Chapter 11 FinalDokumen13 halamanChapter 11 FinalMichael Hu100% (4)

- Case 12.4Dokumen3 halamanCase 12.4DonaBelum ada peringkat

- CH 02121546Dokumen21 halamanCH 02121546Louie De La TorreBelum ada peringkat

- Ch. 1 TB Audit ACCT 3222Dokumen9 halamanCh. 1 TB Audit ACCT 3222Courtney LeeBelum ada peringkat

- Multiple-Choice QuestionsDokumen21 halamanMultiple-Choice Questionssparts23Belum ada peringkat

- Multiple-Choice QuestionsDokumen20 halamanMultiple-Choice QuestionsRafael GarciaBelum ada peringkat

- Chapter9 - FinalDokumen17 halamanChapter9 - FinalbraveusmanBelum ada peringkat

- Chapter 6 Quiz KeyDokumen3 halamanChapter 6 Quiz Keymar8357Belum ada peringkat

- Mod 3 Prof and Legal ResponsibilityDokumen54 halamanMod 3 Prof and Legal ResponsibilityDavid DavidBelum ada peringkat

- TB 67890Dokumen79 halamanTB 67890Rowbby GwynBelum ada peringkat

- Multiple-Choice QuestionsDokumen15 halamanMultiple-Choice QuestionsbraveusmanBelum ada peringkat

- T.B - CH09Dokumen17 halamanT.B - CH09MohammadYaqoobBelum ada peringkat

- Chapter 10 Solman Aud TheoDokumen8 halamanChapter 10 Solman Aud TheoRomulus AronBelum ada peringkat

- Multiple-Choice QuestionsDokumen17 halamanMultiple-Choice QuestionsathenaBelum ada peringkat

- At AsDokumen39 halamanAt AsMaribethCornel100% (1)

- Multiple-Choice QuestionsDokumen9 halamanMultiple-Choice QuestionsjhouvanBelum ada peringkat

- Aasi Fraud 2Dokumen71 halamanAasi Fraud 2Lisa ManobanBelum ada peringkat

- Multiple-Choice QuestionsDokumen75 halamanMultiple-Choice QuestionsJasmine LimBelum ada peringkat

- Arens Auditing and Assurance Services 13eDokumen9 halamanArens Auditing and Assurance Services 13eintanfidztiraBelum ada peringkat

- Jawaban Audit 1Dokumen14 halamanJawaban Audit 1JESSICA ARELLA SANTOSOBelum ada peringkat

- Auditing Theory Multiple ChoiceDokumen8 halamanAuditing Theory Multiple ChoiceEliza BethBelum ada peringkat

- Auditing and Assurance Services - Ch02Dokumen43 halamanAuditing and Assurance Services - Ch02gilli1tr33% (3)

- Chapter 12 Richuitte Financial ManagementDokumen6 halamanChapter 12 Richuitte Financial ManagementKelvin Kenneth ValmonteBelum ada peringkat

- Ch01-Auditing, Attestation, and AssuranceDokumen4 halamanCh01-Auditing, Attestation, and AssuranceShinny Lee G. UlaBelum ada peringkat

- Quiz 11.26.22Dokumen5 halamanQuiz 11.26.22karen perrerasBelum ada peringkat

- Advanced Audit First AssignmentDokumen2 halamanAdvanced Audit First AssignmentMegapoplocker MegapoplockerBelum ada peringkat

- Chap 001Dokumen36 halamanChap 001sarah.gleasonBelum ada peringkat

- Ch03-Maintaining Professional Responsibility - Regulation and Legal LiabilityDokumen18 halamanCh03-Maintaining Professional Responsibility - Regulation and Legal LiabilityShinny Lee G. UlaBelum ada peringkat

- Auditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersDokumen3 halamanAuditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersJoana Lyn BuqueronBelum ada peringkat

- Chapter 09 MaterialityDokumen26 halamanChapter 09 MaterialityNej ElocinBelum ada peringkat

- At WileyDokumen9 halamanAt WileyAldonBelum ada peringkat

- Preboard Exam - AuditDokumen10 halamanPreboard Exam - AuditLeopoldo Reuteras Morte IIBelum ada peringkat

- Multiple-Choice QuestionsDokumen14 halamanMultiple-Choice Questionsredearth2929Belum ada peringkat

- Fraud Risk in Governmental and Not-for-Profit OrganizationsDari EverandFraud Risk in Governmental and Not-for-Profit OrganizationsBelum ada peringkat

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19Dari EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Belum ada peringkat

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18Dari EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Belum ada peringkat

- Beyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementDari EverandBeyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementBelum ada peringkat

- Comprehensive SCFs Example - Direct Vs Indirect Operating SectionDokumen25 halamanComprehensive SCFs Example - Direct Vs Indirect Operating SectionbraveusmanBelum ada peringkat

- Intro Case Discussion QuestionsDokumen3 halamanIntro Case Discussion QuestionsbraveusmanBelum ada peringkat

- Bittman NYT ArticleDokumen3 halamanBittman NYT ArticlebraveusmanBelum ada peringkat

- Principles of Macroeconomics, 9e - TB1 (Case/Fair/Oster) : Diff: 1 TopicDokumen75 halamanPrinciples of Macroeconomics, 9e - TB1 (Case/Fair/Oster) : Diff: 1 TopicbraveusmanBelum ada peringkat

- Wal-Mart de Mexico 1Dokumen4 halamanWal-Mart de Mexico 1braveusmanBelum ada peringkat

- Wal-Mart de Mexico 1Dokumen4 halamanWal-Mart de Mexico 1braveusmanBelum ada peringkat

- Protecting Their MoneyDokumen3 halamanProtecting Their MoneybraveusmanBelum ada peringkat

- Case 1.1Dokumen1 halamanCase 1.1braveusmanBelum ada peringkat

- Sample Exam IIDokumen4 halamanSample Exam IIbraveusmanBelum ada peringkat

- Syllabus 1102 Fall12Dokumen3 halamanSyllabus 1102 Fall12braveusmanBelum ada peringkat

- Man Killed by Police in Metro Transit Tunnel Rushed at OfficerDokumen2 halamanMan Killed by Police in Metro Transit Tunnel Rushed at OfficerbraveusmanBelum ada peringkat

- MACRS ExercisesDokumen1 halamanMACRS ExercisesbraveusmanBelum ada peringkat

- 213 F Sample 4-11 VclassDokumen12 halaman213 F Sample 4-11 VclassbraveusmanBelum ada peringkat

- Multiple-Choice QuestionsDokumen15 halamanMultiple-Choice QuestionsbraveusmanBelum ada peringkat

- Chapter10 - FinalDokumen21 halamanChapter10 - FinalbraveusmanBelum ada peringkat

- If You Need LoveDokumen6 halamanIf You Need LovebraveusmanBelum ada peringkat

- Chapter24 - FinalDokumen20 halamanChapter24 - FinalbraveusmanBelum ada peringkat

- Multiple-Choice QuestionsDokumen15 halamanMultiple-Choice QuestionsbraveusmanBelum ada peringkat

- Multiple-Choice QuestionsDokumen22 halamanMultiple-Choice QuestionsbraveusmanBelum ada peringkat

- Chapter7 - FinalDokumen19 halamanChapter7 - FinalbraveusmanBelum ada peringkat

- Chapter5 - FinalDokumen20 halamanChapter5 - FinalbraveusmanBelum ada peringkat

- Auditing Chapter 2Dokumen10 halamanAuditing Chapter 2byedmundBelum ada peringkat

- Michael Little Syllabus 10AMDokumen6 halamanMichael Little Syllabus 10AMbraveusmanBelum ada peringkat

- Chapter3 - FinalDokumen28 halamanChapter3 - FinalbraveusmanBelum ada peringkat

- Chapter1 - FinalDokumen9 halamanChapter1 - FinalbraveusmanBelum ada peringkat

- 4101 Spring 2014 OutlineDokumen19 halaman4101 Spring 2014 OutlinebraveusmanBelum ada peringkat

- TeamProject..CaseCompetition - Fall 2013.Dokumen4 halamanTeamProject..CaseCompetition - Fall 2013.braveusmanBelum ada peringkat

- f050-27 Audit Results - Certification DecisionDokumen1 halamanf050-27 Audit Results - Certification DecisionygpBelum ada peringkat

- Chapter 13 - Overview of A Group AuditDokumen48 halamanChapter 13 - Overview of A Group AuditGarini Putri ParamesthiBelum ada peringkat

- BibliographyDokumen9 halamanBibliographyBruma AlexandruBelum ada peringkat

- Boa Tos Auditing.Dokumen4 halamanBoa Tos Auditing.shalomBelum ada peringkat

- Trade Payables and AccrualsDokumen5 halamanTrade Payables and Accrualsabdirahman farah AbdiBelum ada peringkat

- CFAP SyllabusDokumen16 halamanCFAP SyllabusTuseef Ahmad QadriBelum ada peringkat

- SGLG Field Test Tool - 2015Dokumen32 halamanSGLG Field Test Tool - 2015Tristan Lindsey Kaamiño AresBelum ada peringkat

- Chapter - 04, Process of Assurance - Evidence and ReportingDokumen5 halamanChapter - 04, Process of Assurance - Evidence and ReportingSakib Ex-rccBelum ada peringkat

- Audited Financials With Auditors Report EKC International FZE FY 2018 19Dokumen34 halamanAudited Financials With Auditors Report EKC International FZE FY 2018 19nader elsayedBelum ada peringkat

- CH 15 Assurance EngagementDokumen46 halamanCH 15 Assurance Engagementagus suhendra50% (2)

- SA List For CA InterDokumen3 halamanSA List For CA InterJeetendraBelum ada peringkat

- bms.0920 r0 Internal Audits PDFDokumen2 halamanbms.0920 r0 Internal Audits PDFYahia Mustafa AlfazaziBelum ada peringkat

- Module - Auditing - Chapter 1Dokumen14 halamanModule - Auditing - Chapter 1Kathleen Ebuen EncinaBelum ada peringkat

- HDJJDDokumen15 halamanHDJJDjustin maharlikaBelum ada peringkat

- Bea 326 Auditing LectureDokumen26 halamanBea 326 Auditing LectureSam RockerBelum ada peringkat

- Auditing NotesDokumen121 halamanAuditing Noteslipsa PriyadarshiniBelum ada peringkat

- At 05 - Auditor PlanningDokumen8 halamanAt 05 - Auditor PlanningRei-Anne ReaBelum ada peringkat

- CARO 2020 Book NotesDokumen11 halamanCARO 2020 Book NotesCreanativeBelum ada peringkat

- Isa-701 2 PDFDokumen20 halamanIsa-701 2 PDFAldrin ZolinaBelum ada peringkat

- Going Concern Audit Opinion and Corporate Governance in Manufacturing Company Listed BEIDokumen10 halamanGoing Concern Audit Opinion and Corporate Governance in Manufacturing Company Listed BEIGandhiBelum ada peringkat

- Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210Dokumen10 halamanSolutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210TimothyHilldpgoa100% (76)