21 Big Ideas

Diunggah oleh

kt0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan25 halamanInvestment

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniInvestment

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan25 halaman21 Big Ideas

Diunggah oleh

ktInvestment

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 25

21 Big Profit Ideas For

Small Retail Investors

Brought to you by:

www.BigFatPurse.com

Investing, Personal Finance, Success

www.BigFatPurse.com

2

Disclaimer:

The material from BigFatPurse.com and this report have no regard to the specific

investment objectives, financial situation, or particular needs of any reader.

Information, tools and articles published are solely for informational purposes and

are not to be construed as a solicitation or an offer to buy or sell any securities or

related financial instruments.

Any references made to third parties are based on information obtained from

sources believed to be reliable, but are not guaranteed as being accurate. Visitors

should not regard it as a substitute for the exercise of their own judgment.

Any opinions expressed in this report are subjected to change without notice and

BigFatPurse.com or any affiliated sites or authors are not under any obligation to

update or keep current the information contained herein.

BigFatPurse.com accepts no liability whatsoever for any loss or damage of any kind

arising out of the use of this report.

The ideas from this report are merely a start to a means of further research and

uncovering a great business and investment. BigFatPurse.com holds no

responsibility for any investment whatsoever.

You Can Share With Your Friends!

You have full giveaway rights to this ebook. If you feel that your family

or friends will benefit from this report, please feel free and share with

them. However you must not change any part of the report

whatsoever. Thank you.

www.BigFatPurse.com

3

21 Big Ideas

#1 - Listen to the Shoe Shine Boy

#2 - Invest In Small Caps Stocks

#3 - Look For Insider Trading

#4 - Buying REITS Below Their Net

Asset Value

#5 - Sell High Buy Low

#6 - Follow A Few Stocks You

Really Know Well

#7 - Look At Charts

#8 - Ignore The Media

#9 - Keep It Simple

#10 - Do Not Invest In Anything

You Do Not Know

#11 - Know Yourself

#12 - If Something Is Too Good To

Be True, It Probably Is

#13 - Choose Passive Investing If

You Do Not Have Time

#14 - Patience Is A Virtue

#15 Qualitative or Quantitative

Analysis

#16 - Understand the Power Of

Compounding Interest

#17 - Think Of Investing As A

Sport

#18 - Differentiate Price From

Value

#19 - Do Not Follow Gurus Blindly

#20 - Keep Your Biases In Check

#21 - Track Your Performance And

Measure Your Returns

www.BigFatPurse.com

4

#1 - LISTEN TO THE SHOE SHINE BOY

In 1928 in New York City, or so the story goes, John D. Rockefeller was

having his shoes shined. The shoe shine boy, presumably not knowing

who Rockefeller was, started giving him stock tips. J.D. took his shoe

shine boys advice but not in the way youd expect.

He decided that if a shoe shine boy making a penny a shine was

giving stock tips it was time to get out of the market. He did and its

the reason his family was able to stave off the Depression, and

continued to be one of the richest in our history.

Who is your equivalent shoe shine boy? Is he the taxi driver? Is he your

colleague who has shown sudden interest in stocks like never before?

The first tip is about increasing your street smarts by surveying the

sentiments of the people around you. When many people are

optimistic about investing in stocks, it is probably time to get out.

www.BigFatPurse.com

5

#2 INVEST IN SMALL CAPS STOCKS

Big cap stocks are the favourites of funds, institutions and many

investors. Due to high demand for big caps, there is a premium to pay

to own their shares. It is more worthwhile to invest in smaller caps

where they are often overlooked by investors, and thus, undervalued.

Many funds are not able to buy small cap stocks due to a few reasons

and we will only name two.

First, it is difficult for them to buy small cap because they have too

much money. Investing a portion of their funds would make them the

majority shareholder of the company. This is not something they would

want.

Second, fund managers want to keep their job, as Peter Lynch said, "If

IBM goes bad and you bought it, the clients and the bosses will ask:

Whats wrong with the damn IBM lately? But if La Quinta Motor Inns

goes bad, theyll ask: Whats wrong with you?" In other words, it is not

worthwhile for fund managers to risk their career on unknown stocks,

because like it or not, all stocks will come down in price someday. Since

you have nobody to answer to except yourself, buy small caps for

bigger gains. Of course, most small cap stocks are lousy in terms of

fundamentals and you will need to learn how to filter and invest in the

right ones.

www.BigFatPurse.com

6

#3 - LOOK FOR INSIDER TRADING

Insiders of a company are the decision makers and senior management

personnels. They are normally the CEOs, directors, or substantial

shareholders etc. They are the ones who know best what's going on in

the company.

If these insiders know that their company's shares are undervalued or

there is a huge growth potential for the company, they are going to buy

their shares NOW while it's still cheap relatively. They know they will

profit handsomely when the share prices run up in the future.

So, if these insiders buy substantially, it usually indicates that they have

a lot of confidence in their stock.

www.BigFatPurse.com

7

#4 - BUYING REITS BELOW THEIR NET ASSET VALUE

It is easier to evaluate assets than to evaluate earnings. Assets are what

the companies already have while earnings will fluctuate going forward.

However, not all assets are good assets. Assets like investment-grade

property and cash are good assets. Assets like machinery and inventory

are not good assets.

Of all the companies listed on the exchange, REITs have very good

assets because they hold investment-grade properties. One way to

evaluate their worth is to take the difference between their total assets

and total liabilities. The difference is known as Net Asset Value or NAV.

Then you divide the NAV by the number of shares to know how much

each share is worth.

Lastly, you compare the NAV per share to the share price. The REIT is

considered undervalued if the share price is less than the NAV per

share. Buying undervalued REITs is one of the easiest ways to make

money in the stock market.

www.BigFatPurse.com

8

#5 - SELL HIGH BUY LOW

Most investors are very familiar with "buy low sell high", which work

very well if a stock is on an uptrend. We call it trading the long side of

the market. Trading "long", or buying, is when an investor buys a stock

with the hope of making a profit when the share price rises in value.

However, when stock prices are falling, most retail investors would just

stand aside, do nothing and wait for the next opportunity to long again.

Prices tend to fall a lot faster than they go up. You can make your profit

much faster if you are able to participate in a falling market.

This is where short-selling, or trading short, comes in and give you the

opportunity to profit in a falling market. It is the opposite of going long.

Instead you sell at higher price first and buy it back when it reaches a

lower price to earn a profit. Hence the term, "Sell high buy low"

For eg, you short-sell 1000 shares at $1.00 (value at $1,000), if the share

price drops to $0.60, you buy-back 1000 shares at this lower price

(value at $600). Your profit would be ($1,000 - $600) which is $400.

You are able to short-sell via CFDs or through Securities Borrowing and

Lending (SBL)

www.BigFatPurse.com

9

#6 - FOLLOW A FEW STOCKS YOU REALLY KNOW

WELL

"It is easier to follow a few stocks well than it is to follow a well full of

stocks" ~ S.A Nelson

Too many investors try to analyse and track far too many different

stocks beyond they can handle and it can lead to information overload.

They feel that they need to understand as many companies as possible,

or else they will miss a good opportunity to buy a good stock.

Nowadays, because of Internet, you can get access to news extremely

fast and to keep up with the ever changing daily events becomes

almost impossible. By the time the news reach you, normally it's too

late already. Most retail investors like to follow companies' news and

react according to the news. Bad move. They tend to buy at the top, got

frightened when price falls and sell out at the bottom. Only to see price

rise again!

What you should really do is to just follow a few stocks... can be

between 5 to 10 stocks, whatever you are comfortable. Follow those

stocks you know well, have keen interest or have an advantage in. For

example, you could be working in the F&B industry and you have an in-

dept knowledge on how restaurants operate. You can follow stocks that

are in the F&B industry because you know them so well that you have

advantage over other people.

Learn a great deal about them, know them inside-out fundamentally,

sieve out the potential winners and wait for the right timing to buy the

stocks.

www.BigFatPurse.com

10

#7 - LOOK AT CHARTS

After doing your research, you reckon that company ABC is

fundamentally sound and is a good stock to invest in. So when is a good

timing to buy? This is where looking at charts - commonly known as

Technical Analysis (TA) - can be useful.

The chart will show the stock's price over time and TA can help

investors anticipate what is "likely" to happen to prices in the near

future. Chart reading is about probability and does not result in

absolute prediction about the future.

However, it provides a useful tool for analysis. For example, a very

common TA chart pattern is called "double bottom". If the stock you are

interested in is showing such pattern, it may signal that price has

reached a bottom and may reverse soon.

In short, Fundamental Analysis tells you "what" to buy and Technical

Analysis tells you "when" to buy.

www.BigFatPurse.com

11

#8 - IGNORE THE MEDIA

Whether it is newspapers, mainstream financial websites or TV, the

media's primarily goal is to capture the audience's attention and create

excitement. This is why if you follow the media long enough, you will

realize that they tend to exaggerate and take things out of context.

The markets don't drop or rise 1%, they "plunge" or "drop sharply" or

"soar", helping to create fear or greed in the process. By the time you

receive the information from the media, it is OLD news already.

Listening and reacting on the advice from the media is a recipe for

disaster. It will definitely throw you off from your initial investing

strategy. For example, because of a "bad news" from the media, you

sold away your stocks in fear when the fundamentals are still intact.

You need to have your own independent views and should not let the

media affects your emotions.

www.BigFatPurse.com

12

#9 - KEEP IT SIMPLE

Albert Einstein said, "If you can't explain it simply, you don't understand

it well enough"

This quote is an excellent way to keep yourself in check. Can you

explain your investment to someone how it works, why you decide to

invest, or why is it a good investment? Would your partner find your

explanation convincing? If you struggle to explain, most likely it's too

complicated and you aren't aware of the potential risks.

Just look at those mortgage-backed securities (MBS), collateralized debt

obligations (CDO) and credit default swaps during the 2008 Global

Financial Crisis. They were complex investments that most people had

difficulty understanding them.

You don't need complex investments to generate good returns.

Sometimes the simplest ones (stocks, properties etc) are the best!

www.BigFatPurse.com

13

#10 - DO NOT INVEST IN ANYTHING YOU DO NOT

KNOW

A friend excitedly came up to me with insisting that I buy into Australian

mining company Redfork immediately. I asked him when he knew

about investing in Australia, his insight on the mining industry Down

Under, and also his thoughts of the company's prospects.

It turns out that he was acting on a hot tip from another friend and had

no inkling whatsoever. His first purchase has already made him some

money and that is all that matters.

It was then that I realized. The difference between Investing and

Speculating is the level of knowledge. An Investor knows what he is

investing in. He knows about the industry, the product. He knows about

the company and the prospects. He knows about the asset class and

the peculiarities. He knows about the risk and reward, the upside and

the downside. He knows exactly how much his investment is worth, and

consequently when to buy more and when to sell. The Investor has

sound reasons for making every single investment.

Be an Investor. Operate in the know.

www.BigFatPurse.com

14

#11 - KNOW YOURSELF

Remember the last time you bought a shoe without trying it on?

Probably not. Even though you have been buying shoes your whole life

and know your own shoe size better than anyone else, chances are like

me, you try on every single pair of shoes before buying. Because

nothing is more painful buying a pair of expensive shoes and then

realizing that it does not fit.

Now try and recall the last time you made an investment. Have you

ever paused for a moment and considered whether the investment is a

good fit for you, like the shoe, or is it going to cause pain and more than

a few blisters?

When it comes to investing, the majority of us take an 'outside-in'

approach. We see something with great potential and fantastic returns

and waste no time jumping into it. In fact it will be more beneficial to

approach investing from an 'inside-out' perspective.

Look inside ourselves to find out what are our strengths and

weaknesses lie, know our own risk appetite and our own emotional

strength, know our interest and our dislikes. Only then will we be able

to seek out the perfect investment for ourselves. Only then will the

shoe fit.

www.BigFatPurse.com

15

#12 - IF SOMETHING IS TOO GOOD TO BE TRUE, IT

PROBABLY IS

If someone promises you super normal returns for a seemingly risk

free investment, would you do a double take? I would. Often I am

seduced, and sometimes I even considered parting with my money for

a shot at financial stardom. But over the years I have learnt to do a

double take on my double take and rationally examine every good deal

that comes along with a healthy dose of skeptism.

If that heritage building redevelopment project in faraway Europe deal

is really such a steal, if that plot of land on the other side of the earth

really has that amount of potential to be redeveloped into a township,

if there is really such great returns to be made, someone who is nearer

to the deal, more well informed than you and me and richer than all of

us combined would have jumped on it long ago.

Financial scammers are successful because they have one powerful

weapon against us that we willingly relinquish to them. They play on

our emotions; our greed and fear. Just because someone has made a

lot of money and has been made an example should only serve to put

us on our guard more. Unfortunately more often than not we choose to

be greedy when we see the spoils laid out and fearful that others will

get to it if we do not, and that often leads to the ultimate downfall.

www.BigFatPurse.com

16

#13 - CHOOSE PASSIVE INVESTING IF YOU DO NOT

HAVE TIME

For the working class and small retail investors, investing has been

touted as the way out of the rat race and towards financial freedom.

The allure of multiple passive income streams drive people to plunge

headlong into the stock market.

However, many new Investors do not realize that a buy and hold

strategy for stocks is hardly "passive". Yes, an investor could pick up

stock tips and punt the market without much knowledge or

understanding of the fundamentals of the company. But to pursue a

sound and sustainable and successful stock picking strategy requires

much effort and time.

There are Annual Reports to peruse, analysts recommendations to take

into account, fundamentals of the company to consider and other

stocks to benchmark against. Market conditions and situations within

the industry change with time and one needs to remain in touch

always.

A typical day for the world's greatest value investor Warren Buffet

involves reading five different newspapers and stacks of reports and

trade journals. It is hard work, and passive would be the last word one

can use to describe this form of investing.

Fortunately for many of you who genuinely want to invest and grow

your money passively, there is a free lunch. Invest in an STI ETF. It has

returned 10% annually over the past decade, the charges are low and

most importantly, it is a totally hands off investment suitable for busy

people with no time to monitor their portfolio on a regular basis. Go for

it now!

www.BigFatPurse.com

17

#14 - PATIENCE IS A VIRTUE

So you did your research, analysed the financial report and determined

that the stock is undervalued. You bought the stock, feeling that it is

going to be a winner for you. Now you are waiting in anticipation for

the price to rise.

A few months have passed but your stock price is not moving at all. You

begin to question yourself whether you made the right decision and

your patience is waning. Then there are bad news in the market, you

are shaken and you sold the stock. Sounds familiar?

Sometimes an undervalued stock can stay undervalued for a prolonged

period of time before analysts uncover the gem. Major advances

require time to complete. Your holding period should be in terms of

years, not months. The best investors understand the importance of

patience and it is one of the most difficult skills to learn as an investor.

Be patient!

www.BigFatPurse.com

18

#15 QUALITATIVE OR QUATITATIVE ANALYSIS

Benjamin Graham mentioned that there are two ways to select stocks.

The first way is to conduct qualitative analysis on stocks. Usually, this

requires the investor to understand the business and be able to

evaluate factors that are not quantifiable. For example, the investor

need to assess the capability of the management and the trends of the

industry the company is in, and determine if the company is cheap at

current prices compared to its future value.

The second method is to use quantitative analysis, which emphasises

on the companys past and present financial performance. The investor

will usually make use of financial ratios such as Price-to-Earnings and

Price-to-Book to assess the companies, and invest in them if they are

selling below todays value. In this way, the investor does not need to

understand the business as detailed as the qualitative analyst.

Both analyses have their own merits and it is up to the investor to

decide which suits him better.

www.BigFatPurse.com

19

#16 - UNDERSTAND THE POWER OF COMPOUNDING

INTEREST

The secret to wealth is the miracle of compound interest. Even a

seemingly modest return can generate great wealth if you give it

enough time. On the surface, compounding looks insignificant and even

boring. "So what if my investments give me a 6% returns annually. It's

so little", you may tell yourself.

In the short term, it doesn't make much difference. But in the long run,

the difference is huge!

For example, if 20 year old John makes a one-time investment of

$10,000, in an Index fund which generates an average of 8% return

annually, and if he never touches the money, the $10,000 will grow to

$320,000 by the time he retires! Compounding interest is more

powerful than you think!

www.BigFatPurse.com

20

#17 - THINK OF INVESTING AS A SPORT

Can you beat Roger Federer at tennis? If not, what makes you think you

can waltz into the market place and expect to beat the professionals at

their own money game?

Many retail investors and traders see the markets as an easy and

accessible way to make money. Everyone thinks they can invest and

trade their way to financial freedom and great riches in the shortest

possible time. Seldom do people consider what they are up against.

The fact is, every retail investor is up against the very best in the

business.

Think of investing as a sport. As with all sporting endeavors, the harder

one trains, the better one would be. But if one is not prepared when

the bell is rung, one can only expect total decimation in the arena. By

training, we mean get yourself educated - read widely, attend courses

or seminars (can be free or paid), have a mentor and gain the necessary

experience.

www.BigFatPurse.com

21

#18 - DIFFERENTIATE PRICE FROM VALUE

We all know what price is. To find the price of a stock one just needs to

get online and you have all these prices coming at you instantaneously.

Despite the speed at which they change, the price of a stock is absolute.

At any one time there can only be one price. It is absolute, it leaves no

room for interpretation and it requires no further processing.

On the other hand, the value of a stock is subjective. One can

determine the value of a company based on its net assets or a

projection of its earnings but even within these two pathways there are

many intricacies to grapple with. At any one time there can be many

interpretations of value, and hence any determination of value requires

additional processing and thought.

And precisely because it is so tough to determine value, that many

investors overlook or disregard the value part of the equation. Warren

buffet famously quotes - price is what you pay, value is what you get.

Learn to recognize value and you will never go wrong in the long run!

www.BigFatPurse.com

22

#19 - DO NOT FOLLOW GURUS BLINDLY

At an Investment fair an elderly investor took Jim Rogers to task about

his stand on the China stock market. Rogers, he claims, was bullish on

Chinese stocks since many years ago, but instead of making meteoric

highs, the Shanghai Composite Index is now languishing at half of its

peak. The investor has taken Rogers' advice to buy into China but has

since cut his losses.

Rogers was visibly perplexed as he addressed the issue. He has bought

Chinese stocks four times over the years, but till date has never sold a

single Chinese stock, he explained. He bought them for his little

daughters and the time frame on this investment stretches for

decades. To him, sluggish performance of that market now is but a blip.

By adopting his stand on the market with no regards to the time frame,

the elderly investor painted himself into a hole and suffered losses as a

result.

In the same breathe, Jim Rogers urged all investors present not to

follow gurus blindly. Gurus can tell you what to buy and when, but

chances are they will not be around to tell you when to sell (or not sell).

Now that is a piece of advice worth following!

www.BigFatPurse.com

23

#20 - KEEP YOUR BIASES IN CHECK

Our brains are constantly processing information and drawing

conclusions and based on the stimuli we are exposed to. The amount

of neuro activity is mind boggling. Over the years, we have learnt to

apply cognitive shortcuts and heuristics to information processing and

decision making. These shortcuts reduce the load on our brains and

make our lives less effortful.

Unfortunately these shortcuts lead to biases that cause "incorrect

thinking" at times. Experiments exposing participants to an initial

random number and then asking them to provide an estimate for

something else found that exposures to higher random numbers lead

to higher estimates. For no reason other than a random exposure,

participants become anchored. Psychology experiments have also

discovered that human beings are more prone to avoiding losses than

acquiring gains.

Understanding the anchoring effect brings us closer to the true value of

our investment. Understanding the loss aversion bias frames the way

we see profit and losses and allows us to make sounder investing

decisions.

We are guilty of being affected by these biases every single day.

Understand them and keeping them in check will make us better

investors!

www.BigFatPurse.com

24

#21 - TRACK YOUR PERFORMANCE AND MEASURE

YOUR RETURNS

As an investor, you are essentially the manager of your investments.

You want to know what is working and what isn't. You want to know

how well your portfolio is performing. You want to benchmark it against

other possible options.

Unfortunately precious few retail investors actually know how well

exactly their investments are doing. Many choose to glorify their wins

and forget their painful losses. Others see it as too much of a bother

and disregard this important aspect.

As the old management adage goes, "You cannot manage what you

cannot measure". Start tracking your performance and make yourself a

better manager of your investments now!

www.BigFatPurse.com

25

BONUS STOCK INTRINSIC VALUE CALCULATOR

Warren Buffett's secrets to investing are buying a great company at a

fair price. Now you can use this simple yet powerful spreadsheet to

determine the intrinsic value of a stock.

>>> You can download it here for FREE (Visit our site now)

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Wealth Management Business PlanDokumen18 halamanWealth Management Business PlanVageesh Kumar100% (2)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Thematic Indexing, Meet Smart Beta! Merging ESG Into Factor PortfoliosDokumen14 halamanThematic Indexing, Meet Smart Beta! Merging ESG Into Factor PortfoliosHENI YUSNITABelum ada peringkat

- The Five Rules For Successful Stock InvestingDokumen4 halamanThe Five Rules For Successful Stock Investingkt0% (1)

- Critical Thinking Handbook K-3Dokumen440 halamanCritical Thinking Handbook K-3kt100% (3)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Cost of Capital at AmeritradeDokumen6 halamanCost of Capital at AmeritradeAravindBelum ada peringkat

- BetterSystemTrader UltimateGuideToTradingBooksDokumen180 halamanBetterSystemTrader UltimateGuideToTradingBooksSebastianCalle90% (10)

- Unit Trusts Vs ETFsDokumen4 halamanUnit Trusts Vs ETFsktBelum ada peringkat

- Fittoatee: Discover The Missing Link To Playing Your Best GolfDokumen17 halamanFittoatee: Discover The Missing Link To Playing Your Best GolfktBelum ada peringkat

- 7 Ways To Compare Your InsuranceDokumen13 halaman7 Ways To Compare Your InsurancektBelum ada peringkat

- SRC (Ceniza) PDFDokumen23 halamanSRC (Ceniza) PDFWally Ann YumulBelum ada peringkat

- Project AppraisalDokumen29 halamanProject AppraisalsaravmbaBelum ada peringkat

- Components of Financial SystemDokumen1 halamanComponents of Financial SystemZaid Alavi71% (7)

- Traction VenturesDokumen14 halamanTraction Venturesmaya_12_jn0% (1)

- Introduction To Accounting Principles: Financial Accounting Standards Board (FASB)Dokumen11 halamanIntroduction To Accounting Principles: Financial Accounting Standards Board (FASB)Aamir KhanBelum ada peringkat

- Mayer Fund: Class of 2009 Recruiting PresentationDokumen15 halamanMayer Fund: Class of 2009 Recruiting PresentationgudunBelum ada peringkat

- Economic Value Added (Eva)Dokumen6 halamanEconomic Value Added (Eva)Ashwin KumarBelum ada peringkat

- Investment: A Study On The Alternatives in IndiaDokumen45 halamanInvestment: A Study On The Alternatives in Indiasayantan96Belum ada peringkat

- CAIA WorkbookDokumen113 halamanCAIA WorkbookGAYATRIBHATIA305100% (1)

- Microequities Deep Value Microcap Fund IMDokumen28 halamanMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdBelum ada peringkat

- Lse PDFDokumen28 halamanLse PDFEmil AzhibayevBelum ada peringkat

- Equity Research: Cement Sector/Industry in India: Zankhan Chandarana 18021141028 MBA 2018-2020Dokumen27 halamanEquity Research: Cement Sector/Industry in India: Zankhan Chandarana 18021141028 MBA 2018-2020PriyalBelum ada peringkat

- How To Start A Hedge FundDokumen28 halamanHow To Start A Hedge Fundaaronwontbudge50% (2)

- Fa IiiDokumen76 halamanFa Iiirishav agarwalBelum ada peringkat

- Chapter 15 Self Study SolutionsDokumen22 halamanChapter 15 Self Study SolutionsTifani Titah100% (1)

- Chapter One: Book Building Method Problems and Its Implementation - 1Dokumen18 halamanChapter One: Book Building Method Problems and Its Implementation - 1Zubayer HussainBelum ada peringkat

- Steven B. Achelis - Technical Analysis From A To ZDokumen335 halamanSteven B. Achelis - Technical Analysis From A To Zgrantukas1Belum ada peringkat

- Russell Indexes Performance: Best PerformingDokumen2 halamanRussell Indexes Performance: Best PerformingWilliam HuachisacaBelum ada peringkat

- Order in The Matter of Accel Frontline LimitedDokumen5 halamanOrder in The Matter of Accel Frontline LimitedShyam SunderBelum ada peringkat

- Kiran Sharma - CV PDFDokumen3 halamanKiran Sharma - CV PDFKiran SharmaBelum ada peringkat

- On January 1 2017 Mcilroy Inc Acquired A 60 PercentDokumen1 halamanOn January 1 2017 Mcilroy Inc Acquired A 60 PercentAmit PandeyBelum ada peringkat

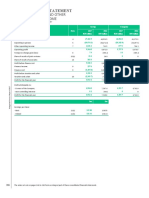

- Of Profit or Loss and Other Comprehensive Income: Consolidated StatementDokumen11 halamanOf Profit or Loss and Other Comprehensive Income: Consolidated Statementaslanalan0101Belum ada peringkat

- Moodys Ratings Report ADBDokumen18 halamanMoodys Ratings Report ADBSuranga FernandoBelum ada peringkat

- Specialists Trading Practices by Richard NeyDokumen2 halamanSpecialists Trading Practices by Richard Neyaddqdaddqd100% (2)

- TSE - What Is ArrowheadDokumen2 halamanTSE - What Is ArrowheadVel KumarBelum ada peringkat

- Manager Profile BalestraDokumen5 halamanManager Profile BalestrakunalwarwickBelum ada peringkat