Ultimas Inversiones en GNL en El Mundo PDF

Diunggah oleh

gahortahJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ultimas Inversiones en GNL en El Mundo PDF

Diunggah oleh

gahortahHak Cipta:

Format Tersedia

Tarea 2:

ULTIMAS INVERSIONES

EN GNL EN EL MUNDO Y

SU INCIDENCIA SOBRE EL

COMERCIO MUNDIAL DE

GNL.

ING. GERMAN ALBERTO HORTA

INDICE

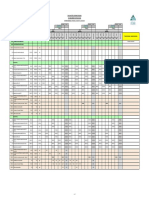

1. RESUMEN EJECUTIVO ................................................................................................................ 2

2. INTRODUCCIN ............................................................................................................................ 4

3. CONTENIDO................................................................................................................................... 4

4. CONCLUSIONES .......................................................................................................................... 31

5. REFERENCIAS ............................................................................................................................ 32

1. RESUMEN EJECUTIVO

Al comenzar el ao 2014, el suministro y la demanda de GNL en gran medida se mantuvo en

equilibrio. Solo dos plantas de licuefaccin entraron en funcionamiento el ao pasado, mientras que

entraron muchas terminales nuevas o ampliadas, especialmente en Asia, ayudaron fcilmente a

mantener la demanda al paso con el suministro.

La cuenca del Atlntico experimento descensos en la produccin el ltimo ao, principalmente en

Nigeria y Egipto, conduciendo a prdidas de produccin en la base de suministro. En la cuenca del

Pacifico sin embargo, se esperaba crecimiento de la produccin Australiana y un repunte en los

volmenes de Malasia lo que condujo a un incremento del 3.3% en GNL.

El medio Este, permaneci siendo la principal fuente de crecimiento de la produccin de GNL, en la

gran mayora de los flujos constantes de Yemen y de un aumento de la produccin de Qatar.

El estudio encontr que fuertes consumos en Asia y Amrica Latina, desvi muchos cargamentos

desde mercados Europeos el ltimo Ao. En Corea del Sur, una fuerte demanda de GNL ha

resultado de seis plantas nucleares que quedaron fuera de lnea durante el 2013. Al mismo tiempo,

las ampliaciones de terminales del 2012 en Dalian y Zhejiang en China empujaron las importaciones

durante el 2013.

La demanda de GNL en Japn permaneci firme e inclusive tuvo un leve incremento a medida que

contino luchando con los efectos de la parada de las centrales nucleares por el terremoto de marzo

de 2011 y posterior tsunami.

En Amrica Latina, la fuerte demanda de GNL de Brasil se desacelero un poco en la segunda mitad

del 2013 a medida que sus reservas hdricas mejoraron, mientras que el GNL de Mxico tuvo un

incremento en la segunda mitad del 2013.

Se espera que la demanda se mantenga ajustada este ao, ya que solo se espera que cuatro plantas de

GNL entren en funcionamiento. De hecho, una de estas la Indonesa Donggi Senoro ha sido

atrasada de nuevo, al 2015. Pero en general, es de anotar que cualquiera que entre en lnea en 2014

probablemente lo har tarde en el ao y no alcanzaran plena capacidad de produccin.

AUSTRALIA, CHINA

Por el lado de la demanda, dijo el consultor, "los compradores de GNL a nivel mundial poseen

opciones para posibles suministros de los EE.UU., Canad, frica del Este y Rusia, despus de una

fiebre de compras en los ltimos aos [que] llen sus requerimientos de cartera de GNL de

Australia."

Adems, las perspectivas inmediatas de los precios del petrleo es "menos optimista", y los

propietarios de grandes recursos de gas de Australia se han convertido en "ms prudente".

Uno de los nuevos terminales es la primera terminal de GNL flotante de China en Tianjin. Recibi su

primer cargamento en enero, 30.000 toneladas a bordo del gaslog Savannah de Atlantic LNG en

Trinidad y Tobago.

La nueva terminal de FLNG $ 539 millones se puede recibir hasta 2,2 millones de toneladas anuales.

El proyecto incluye una litera y dos tanques de 30.000 m

3

de almacenamiento. Una segunda fase,

con base en tierra podra ampliar la capacidad de recibir a tanto como de 6 millones de toneladas

anuales.

El terminal flotante se construy sobre la base de 145 mil m

3

de GDF de la unidad almacenamiento y

regasificacin (FSRU) flotante del Suez en el Cabo Ana bajo un contrato de 5 aos.

SUR AMERICA

En Colombia, Pacific Rubiales Energy y Exmar, comenzaran la operacin de una planta de

licuefaccin de 70 MMcfd para exportacin en Tolu, en la costa caribe Colombiana a comienzos del

2015, segn reportaron noticias mundiales. China esta construyendo la FSRU para entrega al

finalizar el ao. La embarcacin, Caribean FLNG, tendr 16100 m3 de alamacenaje. Exmar pagara la

embarcacin mientras que Pacific Rubiales tomara el costo de la lnea de 18 de 90 km que la

conectara con la planta de suministro en tierra, en el campo La creciente en el departamento de

Sucre.

EUROPA

Mientras que Rusia ve las exportaciones de GNL como un camino hacia nuevos mercados potenciales

de gas natural, el resto de Europa sigue construyendo terminales de regasificacin en un esfuerzo

para reducir su dependencia de los suministros rusos.

Rusia. El ao pasado alcanzaron FID en Yamal GNL, con la planta de licuefaccin de 16,5 millones

de toneladas anuales que se construir en la pennsula de Yamal, en el Mar de Kara y de el primer

tren conjunto que se pondra en marcha para el ao 2017.

El proyecto de 27 mil millones dlares consiste en desarrollar una planta gigante de gas onshore al

Sur de Tambey y una de condensado en la pennsula, tres trenes de 5,5 millones de tons/ao,

tanques de almacenamiento de GNL y la infraestructura portuaria en Sabetta. Nada menos que 16

rompehielos metaneros se encargarn de manejar el comercio internacional a travs del Ocano

rtico.

2. INTRODUCCIN

Los mercados mundiales de GNL permanecen en movimiento constante debido a los proyectos que

se desarrollan en el mundo en la bsqueda de la exportacin e importacin de gas para las

necesidades domsticas y para aumentar las exportaciones para obtener un crecimiento econmico

Muchos pases del mundo ponen en marcha inversiones tendientes a mejorar o a iniciar su

infraestructura de GNL para suplir su demanda energtica interna o para comenzar su negocio de

exportacin.

Se firman tratos de cooperacin entre pases que buscan una expansin de sus operaciones y

avances en desarrollos de tecnologas de GNL.

3. CONTENIDO

LNG UPDATE Global LNG supply, demand remain tight

04/07/2014

Storage tank construction progresses in 2013 on Poland's first LNG terminal in Swinoujscie. When Stage 1 starts

up later this year, the terminal will be able to send out 5 billion cu m/year, expandable in Stage 2 to 7.5 billion cu m/year.

Photo from Polskie LNG.

Chris Smith

Senior Technology Editor

Warren R. True

Chief Technology Editor

As 2014 began, global LNG supply and demand remained largely in balance. Only two liquefaction plants came on stream

last year, while several new or expanded terminals, especially in Asia, easily helped demand keep pace with supply.

A study of global LNG markets published by Barclays in February noted that start-up of Algeria's Skikda rebuild in March

2013 had not "translated into production growth for the country" and, citing shipping data from Waterborne Energy, that

Angola's Luanda project, commissioned in June 2013, had delivered only 16 bcf. Both projects are described later.

The Atlantic Basin experienced steep production declines last year, mainly in Nigeria and Egypt, leading to production

losses in the supply basin. In the Pacific Basin, however, expected growth of Australian production and a rebound in

Malaysian volumes led to a 3.3% increase in LNG.

The Middle East, said Barclays, remained the main source of LNG production increases, mostly from more constant LNG

flows from Yemen and an uptick in Qatari output.

Strong LNG consumption in Asia and Latin America, the study found, diverted many cargoes from European markets last

year. In South Korea, strong LNG demand has resulted from six nuclear power plants remaining offline for much of 2013.

At the same time, terminal expansions in 2012 at Dalian and Zhejiang in China pushed 2013 imports ahead.

Japan's LNG demand remained firm and even advanced slightly as it continued to wrestle with effects of nuclear power

plants shutdown by the March 2011 earthquake and tsunami (OGJ Online, Apr. 8, 2011). In Latin America, Brazil's robust

LNG demand slowed a bit in second-half 2013 as hydro reserves improved, said the Barclays study, while Mexico's LNG

takes rose in second-half 2013.

The study expects tightness to continue this year, as only four LNG plants were expected to come online. In fact, one of

thoseIndonesia's Donggi Senorohas been delayed yet again, to 2015. But in general, the study notes that whatever

comes on line in 2014 will likely be late in the year and fall short of full production capacity.

What's happening, where, when

What follows is a roundup of developments in both supply and demand during 2013 and into 2014.

Australia, China

As 2014 began, FACTS Global Energy (FGE), Honolulu, painted a sobering picture of LNG in Australia, present and

immediate future.

The unprecedented activity in LNG investment there during 2009-12 was "buoyed by an optimistic view of the market along

with a healthy dose of euphoria." That has been replaced, FGE said, by "much more cautious and conservative

consideration for LNG developments, plus just a dash of pessimism."

On the supply side, the picture is clouded by the "strength of the Australian dollar; high labor and materials costs;

environmental regulation compliance and retrospective changes in requirements; private, heritage, and indigenous land

rights; poor reserve conversion and well productivity; public opposition; industrial relations and productivity issues; taxation

changes; and resource nationalism."

On the demand side, said the consultant, "global LNG buyers possess options for potential supplies from the US, Canada,

East Africa, and Russia, after a buying spree over recent years [that] filled their portfolio requirements for Australian LNG."

In addition, the immediate outlook for oil prices is "less bullish," and owners of large Australian gas resources have become

"more prudent."

Newly proposed LNG projects have been replaced by "cancellations or postponements, major development concept

changes, less enthusiasm for brownfield expansions for projects being built, and large equity disposals."

FGE cited the latest twists in Browse LNG as evidence of recent changes in sentiment and "possibly a model for the future

direction [of] Australian LNG."

Earlier this year, Woodside Energy Ltd. said it would not process gas destined for Browse LNG through the James Price

Point onshore site, as it had planned and which Western Australia's state government had supported (OGJ Online, Apr. 12,

2013).

FGE said that, after spending $2 billion on studies to advance a plant, Woodside and JV partnersRoyal Dutch Shell, BP,

a Mitsubishi-Mitsui JV, and PetroChinadecided instead to look at monetizing their Browse basin gas reserves through

floating LNG (FLNG). PetroChina is a unit of China National Petroleum Corp. (CNPC).

Woodside had concluded that the total cost for the 12 million tonnes/year (tpy), land-based LNG plant had reached $80

billion, making that option uneconomic.

Woodside will proceed with an FLNG scheme to develop the three Browse gas fields Torosa, Brecknock, and Calliance,

which lie off Western Australia about 264 miles north of Broome. The company said the concept will use Royal Dutch Shell

PLC's FLNG technology.

Browse participants include Woodside as operator, Shell Development (Australia) Pty. Ltd., BP Developments Australia

Pty. Ltd., Japan Australia LNG (MIMI Browse) Pty. Ltd., and PetroChina International Investment (Australia) Pty. (OGJ

Online, Aug. 21, 2013).

In another FLNG-based development, GDF Suez expects first gas shipments from its Bonaparte floating LNG plant off

northern Australia in 2019. GDF Suez holds 60% of the project with Santos holding the remaining share.

Front-end engineering is under way; no final investment decision is expected before mid next year. Bonaparte is designed

to produce 2.4 million tpy from Petrel, Tern, and Frigate gas fields.

And in fourth-quarter 2013, the Australian government approved another proposed FLNG project, this time for Scarborough

gas field off Western Australia, owned equally by ExxonMobil Corp. and BHP Billiton.

As proposed, that FLNG plant would produce 6-7 million tpy from five trains. The 1,624-ft vessel would be permanently

moored on Scarborough.

ExxonMobil has said offshore installation and commissioning would take place in 2019-20; production could start in 2020-

21 (OGJ Online, Nov. 12, 2013).

Finally among projects on Australia's western side, Royal Dutch Shell earlier this year agreed to sell its 8% equity interest

in the Wheatstone-Iago joint venture (JV) and 6.4% interest in the 8.9-million-tpy Wheatstone LNG project in Western

Australia for nearly $1.14 billion to Kuwait Foreign Petroleum Exploration Co. (Kufpec).

The acquisition nearly doubled Kufpec's interest in the $29 billion (Aus.) LNG project to 13.4% from 7%. It will now hold the

second-largest stake behind project operator Chevron Australia, which has 64.1%. Other interest holders are Apache

Energy 13%, Tokyo Electric Power Co. 8%, and Kyushu Electric Power Co. 1.46% (OGJ Online, Jan. 20, 2014).

Turning to projects along Australia's eastern coast and centered on Gladstone, owners of the Santos GLNG project

reported only a few weeks ago that it had reached 75% completion and was on track for first shipment from Gladstone

Harbor in Queensland in 2015. Santos GLNG is a JV among Santos, Petroliam Nasional Bhd. (Petronas), Total, and Korea

Gas Corp. (Kogas).

The project reported that, on Curtis Island, a 2.5-mile pipeline under Gladstone Harbor had reached the island following 10

months of tunneling. The segment is part of an overall 261-mile pipeline due to be completed around mid-year.

In addition, the first train was nearing completion and the second train was under construction.

Also on Curtis Island, operator BG Group announced in December first gas had moved more than 335 miles from the Surat

basin coalseam gas fields to the island where commissioning of the first of two trains of Queensland Curtis LNG (QCLNG)

was expected early this year.

Earlier last year, China National Offshore Oil Corp. (CNOOC) took a 50% interest in Train 1 of QCLNG.

Under a separate agreement and from its own global sources, BG is to supply CNOOC with another 5 million tpy of LNG

for 20 years beginning in 2015.

The agreement included CNOOC's receiving a 20% interest in reserves and resources of some of BG's permits in the

Walloon Fairway region of the Surat basin, taking its share there to 25%. In addition CNOOC gets a 25% equity in other

BG permits in the Bowen and Surat basins.

CNOOC also retains the option to participate up to 25% in one of the possible expansion LNG trains at QCLNG on Curtis

Island (OGJ Online, Nov. 12, 2013).

In other developments on the east coast, Australia Pacific LNG is building an LNG plant that it said last year was more than

50% complete. Completion is on track for mid-2015.

Along with other LNG projects, this JV of Origin Energy 37.5%, ConocoPhillips 37.5%, and China Petroleum & Chemical

Corp. (Sinopec) 25% will be supplied by coalbed methane from fields in the Surat and Bowen basins. It plans two, 4.5-

million-tpy trains (OGJ Online, Oct. 28, 2013).

In China in July last year, Sinopec began building its Tianjin LNG import terminal. Work is progressing in two phases to

install a total of 10 million tpy.

Each phase is to include three 160,000-cu-m LNG tanks. The first phase includes a carrier berth, LNG receiving

equipment, and a 435-mile pipeline able to send out 4 billion cu m/year (about 1.4 tcf).

At Qingdao, in Shandong Province, Sinopec will finish by yearend its first LNG import terminal. After completion and start-

up of its 3-million-tpy first phase, a second phase will expand capacity to 5 million tpy with possible later expansion to 10

million tpy.

Cargoes are expected from Papua New Guinea and from Australia Pacific LNG's Queensland project, described earlier, by

mid-2015.

CNOOC last year laid out plans for five LNG terminals in operation by 2015 with total import capacity of nearly 40 million

tpy.

One of the new terminals is China's first floating LNG terminal at Tianjin. It received its first cargo in January, 30,000

tonnes aboard the Gaslog Savannah from Atlantic LNG in Trinidad and Tobago.

The new, $539-million FLNG terminal can receive up to 2.2 million tpy. The project includes a berth and two 30,000-cu-m

storage tanks. A second, land-based phase could expand receiving capacity to as much as 6 million tpy.

The floating terminal was built on the base of GDF Suez's 145,000-cu-m Cape Ann floating storage and regasification unit

(FSRU) under a 5-year charter.

The Tianjin terminal is the company's second import terminal brought online last year. In late October, CNOOC

commissioned the 3.7-million-tpy Zhuhai terminal at Gaolan in the southern Guangdong Province with a cargo from

Qatargas aboard the 216,000-cu-m Al Gattara.

The Fujian terminal can handle up to 3 million tpy in its first phase and cost $1.1 billion, said area press reports. It could

accommodate 260,000-cu-m tankers and has three 160,000-cu-m storage tanks.

Planned terminals over the next 2-3 years include a 3-million-tpy project on Hainan Island, a 2-million-tpy Yuedong terminal

in Jieyang in southern Guangdong Province, and a 4-million-tpy Diefu terminal in Shenzhen in Guangdong.

.

In early November 2013, GDF Suez unit Elengy, which operates the Montoir-de-

Bretagne regasification terminal on France's Atlantic coast, undertook a

transhipment operation between the 147,000-cu-m Arctic Princess LNG carrier

(right) and the 177,000-cu-m LNG carrier Grace Dahlia. According to Elengy, the

Grace Dahlia is the world's largest LNG carrier to employ four spherical, or "Moss"

technology, tanks. Photo from Elengy.

CNOOC is also considering expanding the newly opened Zhuhai terminal by 7 million tpy.

In December last year, PetroChina's new Tangshan terminal in China's Hebei Province received its first cargo in

preparation for full commissioning early this year.

Platts reported that the 216,000-cu-m Al Gharrafa arrived at the Caofeidian port in Tangshan in November with a cargo

from Ras Laffan. The new terminal's first phase can accommodate up to 3.5 million tpy; its second phase will take capacity

to 10 million tpy.

Also last month, Platts reported that privately owned Guanghui Energy had started building an LNG terminal in Qidong, in

eastern Jiangsu Province.

Start-up was planned for late 2016 or early 2017. Phase 1 envisions 600,000 tpy, ramping up to 3 million tpy by 2019 if

market conditions warrant.

Other Asia

Singapore LNG officially commenced operations at its $1.7 billion, Jurong Island site, accepting the first cargo in early May

2013 from BG Group.

The terminal had an initial throughput capacity of 3.5 million tpy with two tanks but expanded by yearend to 6 million tpy

when a third tank, additional jetties, and regasification equipment were completed.

In October 2012, SLNG announced plans for a fourth tank and associated regasification, raising throughput capacity to 9

million tpy.

In India in August last year, Petronet LNG finally started up its 5-million-tpy Kochi LNG terminal on the country's western

coast after several delays (OGJ, Apr. 1, 2013, p. 90). The 125,000-cu-m Wilenergy carrying a cargo from RasGas landed

in heavy weather in August.

Kochi is the fourth LNG terminal to be commissioned in India, the second by Petronet, which also operates the 10-million-

tpy Dahej terminal in Gujarat state.

In May of last year, Shell completed expanding the Hazira terminal, also in Gujarat on India's western coast, to 5 million tpy

from 3.6 million tpy. Operator Hazira LNG is a JV between Shell 76% and Total 26%.

The Hazira terminal has been greatly underutilized, however, and was immediately shut down upon completion of the

expansion.

But Shell is moving ahead with another terminal, this one at Kakinada in India's Andhra Pradesh state in what would be the

first FLNG project on the eastern coast. Planned capacity is 5 million tpy with an option to double that if warranted by gas

demand in the region.

In Pakistan in January this year, Sui Southern Gas approved construction of Engro Corp.'s Elengy regasification terminal at

Port Qasim. Following a memorandum of understanding in February 2012, Pakistan is in negotiations with Qatar to import

3.5 million tpy, which could begin as early as fourth-quarter this year.

In Indonesia, start-up of the 2.1-million-tpy Donggi-Senoro LNG project has been delayed to March 2015 from 2014,

according to shareholder Mitsubishi Corp. Other shareholders include Kogas, Indonesia's Medco Energi Internasional, and

Indonesia's state-owned PT Pertamina.

In Japan last month, the government issued a final draft of a new medium-to-long-term energy program, the first since the

2011 earthquake and tsunami. The draft envisions nuclear power as a baseload source but looks for renewable energy

sources (hydro) and thermal power plants to dominate.

Japan is the world's largest importer of LNG, and in an analysis Barclays stated thermal generation will likely drop crude oil

and fuel oil before there are any reductions in natural gas-fired generation.

In early December of last year, Inpex Corp. began operations at its Naoetsu LNG terminal in Joetsu City, Japan. The

terminal includes two aboveground LNG tanks and a berth for unloading a 210,000-cu-m LNG tanker. It can receive and

regasify 1.5 million tpy of LNG (OGJ Online, Dec. 10, 2013).

Inpex reached final investment decision (FID) to construct the terminal in 2008 and began construction in 2009.

Commissioning work began in August for full-scale commercial operations, which had been scheduled for January 2014

(OGJ Online, Aug. 27, 2013).

In Malaysia earlier this year, state oil company Petronas reached FID on its second floating LNG project. The unit

PFLNG2will be moored at Rotan gas field in deepwater Block H, offshore Sabah, and produce 1.5 million tpy of LNG

(OGJ Online, Feb. 5, 2007). It is to be ready for start-up by early 2018, said the company's announcement (OGJ Online,

Feb. 14, 2014).

Last year in Papua New Guinea, ExxonMobil commissioned its LNG plant near Port Moresby for first production in the

second half of this year.

The plant will have capacity to produce 6.9 million tpy of LNG. The project is owned by ExxonMobil 33.2%, Oil Search

29%, the PNG government's National Petroleum Co. of PNG 16.8%, Santos 13.5%, JX Nippon Oil and Energy 4.7%, and

local landowner company MRDC 2.8%.

In Thailand, PTT LNG, a subsidiary of state-owned PTT, decided last year to move ahead with plans to double capacity at

its 5-million-tpy Map Tha Phut import terminal. Expanding the terminal includes building a new jetty, processing, and

regasification, and storage tanks. Last year, the government approved investment of $698 million for the expansion.

The existing terminal, in Thailand's eastern Map Tha Phut Industrial Estate in Rayong Province, started operating in

September 2011.

In Russia's Far East in December, Gazprom and Shell agreed to expand the two-train, 4.8-million-tpy Sakhalin 2 LNG plant

by 5 million tpy to enter service as early as 2017-18.

Sakhalin 2 draws gas from Piltun-Astokhskoye oil field and Lunskoye gas field, with combined recoverable gas reserves

estimated at 500 billion cu m. The project's shareholders are Gazprom 50% (plus one share), Shell 27.5% (minus one

share), Mitsui 12.5%, and Mitsubishi 10%.

Gazprom last year also reached FID on the Vladivostok LNG plant. It would use three 5-million-tpy trains on Lomonosov

Peninsula, the first coming on line in 2018. A JV of Itochu 32.5%, Japex 32.5%, Marubeni 20%, Inpex 10%, and Itochu Oil

Exploration 5% joined Gazprom in the investment study.

Africa

Emerging as major competition for Australian LNG projects in Asian markets are the gas fields off East Africa. In a report in

late 2012, London-based Center for Global Energy Studies noted that a steady stream of drilling had transformed

Mozambique and Tanzania into future LNG exporters.

The two nations, said CGES, were at a point of confluence for numerous important developments in the energy industry.

"These include the rise of Africa as an energy hub, the advancement of deepwater exploration and production as a result of

higher oil prices, and the rising prominence of LNG as a rival to oil," said the study.

Major upstream players in the region have included Anadarko, ENI, Ophir, BG Group, and Statoil. "All are sitting atop gas

reserves of a suitable size to be monetized by LNG development," it said.

Early last year, Anadarko Corp. awarded Bechtel a front-end engineering and design contract for an LNG plant in

Mozambique. The contract was for Phase 1 of the shore-based plant to be built in Cabo Delgado Province in the northeast

of the country.

Bechtel said in an announcement that the design would feature a "multi-train liquefaction plant" with nameplate capacity of

5 million tpy, expandable to 50 million tpy. Initial sales were planned for 2018 (OGJ Online, Apr. 26, 2013).

Later, in March 2013, Reuters reported that Statoil and BG Group were planning a two-train, $10 billion East African LNG

plant to liquefy natural gas from a discovery of 4-6 tcf in the Indian Ocean off Tanzania. FID on the project, however, was

not expected before 2016.

About the same time, PetroChina agreed to purchase part of Eni's gas field in Area 4 off Mozambique for $4.2 billion (OGJ

Online, Mar. 14, 2013).

PetroChina bought 28.57% of Eni East Africa's 70% interest in Area 4. With the purchase, CNPC indirectly acquired a 20%

stake in Area 4, while Eni remained the owner of 50%.

Remaining shares in Area 4 are held by Kogas and Galp Energa, each with 10%, while Mozambique's state ENH has 10%

carried through the exploration phase (OGJ Online, Feb. 26, 2013).

At the time, Eni said it expected to take FID on the Mozambique project in 2014.

In North Africa last year, Algerian state company Sonatrach commissioned the new 4.5-million-tpy LNG production train at

Skikda on the Mediterranean coast about 300 miles east of Algiers.

The train replaces a 3.7-million-tpy complex destroyed in an explosion in 2004 (OGJ, Apr. 1, 2013, p. 90; OGJ Online, Jan.

27, 2004).

And in West Africa in July last year, Angola LNG delivered its first cargo, to Brazil aboard SS Sonangol Sambizanga. The

160,000-cu-m shipment unloaded at Petrobras's regas terminal in Guanabara Bay, Rio de Janeiro.

At full production, the $10 billion plant at Soyo, Angola, can supply 5.2 million tpy of LNG, plus propane, butane, and

condensate, according to an Angola LNG announcement at the time.

Angola LNG is a partnership among Sonangol 22.8%, Chevron 36.4%, BP 13.6%, ENI 13.6%, and Total 13.6%. The

project, according to the company, seeks to reduce flaring and environmental pollution by gathering associated gas from

Angola's offshore oil fields.

Canada

British Columbia has proposed a two-tiered tax regime for LNG projects in the province. The first tier would tax operators at

a 1.5% rate on net income once commercial operations start, with the second tier kicking in at 7% once the operator has

fully recouped its capital investment.

Legislation putting the tax system in place will occur over the balance of this year and into 2015. British Columbia Prime

Minister Christy Clark has said the province would start collecting LNG revenues by 2017.

Kitimat LNG partner Chevron Canada Ltd. in January awarded an engineering, procurement, and construction (EPC)

contract to a JV of Fluor and JGC Corp. Project scope includes completing the existing front-end engineering and design

(FEED) package and detailed engineering and procurement for the initial phases of the project.

Apache Canada Ltd. is the other equal-interest partner with Chevron for the Bish Cove, BC, project. Apache, however, is

looking to sell a portion of its stake as part of ongoing cost-cutting. Chevron Canada acquired its 50% interest in Kitimat

LNG last year along with half interests in the proposed Pacific Trail Pipeline and in 644,000 acres in the Horn River and

Liard basins in BC (OGJ Online, July 10, 2013; OGJ, Jan. 7, 2013, p. 42).

The two-train Kitimat project targets a 2016 start-up (Table 1). Canada's National Energy Board (NEB) license allows

export of 10 million tpy.

In March 2013, Japan Petroleum Exploration Co. (Japex) bought 10% of Pacific Northwest LNG and associated North

Montney shale gas project from operator Petronas. Japex would receive 1.2 million tpy from the 12-million-tpy terminal on

Lelu Island, Prince Rupert, BC.

Petronas in February this year sold Indian Oil Corp. 10% of the project, with Bloomberg reporting another 15% sale likely to

a second Asian buyer, bringing Petronas's ownership down to 62%, with Japex holding 10%, and Petroleum Brunei 3%.

Press reports at the time also had Petronas talking to other buyers in an effort to bring down its total interest to 50%.

The NEB approved a 25-year export license for this project to ship as much as 19.68 million tpy. Petronas plans to reach

FID by the end of this year and start operations by yearend 2018. It submitted its environmental assessment applications in

February.

LNG Canadaa consortium of Shell, Kogas, Mitsubishi Corp., and PetroChina Internationalreceived in February 2013

NEB approval to export as much as 24 million tpy for 25 years. Its plant would be in Kitimat, with start-up expected in 2020.

An environmental review of the project is under way. The company in February secured wharf space at Kitimat from Rio

Tinto on property once used by Eurocan.

Under a 50:50 plan by oil refiner Idemitsu and gas pipeline operator AltaGas, the two may build an LNG export terminal

near Kitimat, possibly starting LNG exports mainly to Japan as early as 2017. The venture, Triton LNG, also plans to

develop an LPG export business.

Aurora LNG, a JV of Nexen (a division of CNOOC), Inpex, and JGC, in November last year acquired exclusive rights to

almost 1,900 acres of BC government land and deepwater access at Grassy Point, 18 miles north of Prince Rupert, for an

LNG export plant. Aurora must apply to NEB for an LNG export permit and is conducting a feasibility study, environmental

impact assessment, and consultations. CNOOC acquired Nexen in 2012 to improve its access to Western Canadian shale

gas.

An Imperial Oil-ExxonMobil partnership and Woodside Petroleum have also expressed interest in developing separate

LNG plants at Grassy Point. WCC LNG Ltd., the ExxonMobil-Imperial JV, in December last year received NEB permission

to export up to 30 million tpy under a 25-year license. The JV owns 340,000 acres in the Horn River basin in northeastern

BC. WCC expects initial exports of 5 million tpy in 2021, with full rates reached by 2025.

Woodside and the BC government agreed to give Woodside exclusive rights to negotiate a long-term lease with the federal

government to build an LNG plant on the southern end of Grassy Point near Prince Rupert.

Pacific Oil and Gas Group in December received NEB permission as Woodfibre LNG Export to build an LNG export plant

in Woodfibre, BC. The plant would have 2.1 million tpy capacity and received NEB authorization to export that amount for

25 years. The company expects first LNG by late 2017. Target markets include Japan, China, and South Korea. Pacific

Energy, a Pacific Oil and Gas Group affiliate, would supply the natural gas.

The NEB at the same time approved a 25-year natural gas export license to BG Group's Prince Rupert LNG Exports Ltd.

(21.6 million tpy). British Columbia's new tax proposal, however, has caused BG to delay FID to 2017 while it evaluates the

proposal's implications, according to local media.

Kitsault Energy Ltd. applied for a 20-million-tpy export permit for a plant it would build at Kitsault, BC, a privately owned

abandoned mining town on the province's northern coast. The company is still working to secure gas supply agreements.

On Canada's Atlantic Coast, Pieridae Energy (Canada) Ltd. has proposed construction of a 10-million-tpy liquefaction plant

in Goldsboro, NS. The site is adjacent to the Maritimes & Northeast Pipeline and would include 690,000 cu m of LNG

storage. Local press reported review of the project as under way and, pending regulatory approvals, that construction on

Goldsboro LNG could begin next year with operations targeted for 2019.

US

Australia's Liquefied Natural Gas Ltd. signed a binding pipeline capacity agreement in January with Kinder Morgan

Louisiana Pipeline (KMLP) for its proposed Magnolia LNG export project in Lake Charles, La., securing sufficient firm gas

transportation for the plant's full 8-million-tpy capacity. Magnolia will use four 2-million-tpy trains.

The KMLP pipeline crosses the project site. In addition to the on site Kinder Morgan pipeline, Magnolia can access supply

from 11 other gas transmission corridors, including three pipelines it describes as underutilized within 3 miles.

LNG Ltd. hopes to gain full regulatory approval by 2015 to reach FID by the middle of that year and meet a mid-2018 start

date. The company in February named SKEC Group preferred EPC contractor.

Corpus Christi Liquefaction LLC, a unit of Cheniere Energy Inc., Houston, last year awarded an EPC contract for LNG

trains and related facilities to Bechtel. Yet to be approved by the US Federal Energy Regulatory Commission (FERC), the

three-train, 13.5-million-tpy Corpus Christi project would be built in two stages. Work under the contract is to begin this

year, subject to Corpus Christi Liquefaction's reaching FID; operation of the first LNG train would begin in 2018.

The Stage 1 EPC contract includes two LNG trains, two tanks, one complete berth, and a second partial berth. Stage 2

EPC contract includes one LNG train, one additional tank, and completion of the second berth, according to the Bechtel

announcement.

Cheniere's first LNG sale and purchase agreement for the Corpus Christi project was with Pertamina for about 0.8 million

tpy.

Cheniere also applied to FERC last year for authorization to expand its Sabine Pass LNG export terminal in Louisiana. The

application requested authorization to add two 1.4-bcfd liquefaction trains to the four being built at the Sabine Pass site

under an export permit from the US Department of Energy (DOE) and a FERC construction permit (OGJ Online, Dec. 18,

2013).

The company plans to start operations at Train 5 by yearend 2018, with Train 6 coming online whenever commercially

feasible. The original Sabine Pass export project is one of only five Lower-48 projects approved by DOE to ship LNG to

non-free trade agreement (FTA) countries (Table 2). In February, FERC approved Sabine Pass LNG increasing throughput

to its original four trains to 2.76 bcfd.

DOE in November last year conditionally approved 0.4 bcfd more non-FTA exports from Freeport LNG, bringing its total

permitted volumes to 1.8 bcfd (OGJ Online, Nov. 15, 2013). Freeport signed liquefaction tolling agreements with Chubu

Electric and Osaka Gas for the first of this plant's three trains, with BP Energy Co. for the second, and in September with

Toshiba Corp and SK E&S for the third.

FERC in March issued a draft environmental impact statement citing "temporary and short-term" effects of the Freeport

export project, which could be adequately mitigated to allow its approval.

In Louisiana, Lake Charles LLC, a JV of Southern Union Co. and BG Group, was licensed to export 2 bcfd (OGJ Online,

Aug. 8, 2013). In Maryland, Cove Point's conditional approval to export up to 0.77 bcfd pushed overall non-FTA export

approvals to 6.77 bcfd as of November.

This total grew in February this year when DOE approved Sempra's Cameron LNG plant in Hackberry, La., to export 1.7

bcfd to non-FTA countries. Sempra plans to have the plant in operation by 2017 (OGJ Online, Feb. 11, 2014).

El Paso Pipeline Partners LP announced last year that Shell US Gas & Power LLC, a Royal Dutch Shell subsidiary, had

given notice to Elba Liquefaction Co. LLC to move ahead on Phase 2 of the jointly owned liquefaction project at Southern

LNG Co.'s Elba Island LNG terminal, near Savannah, Ga.

Phase 2 will add 0.5-1.0 million tpy of capacity at an estimated $500 million at the maximum volume, said the

announcement. The planned six trains of Phase 1 will provide about 2.4 million tpy of export capacity at start-up in late

2016 or early 2017 (OGJ Online, Aug. 16, 2013).

Phase 2 will add two trains and start up in 2017-18. If the maximum volume for Phase 2 is elected, said the announcement,

the Elba liquefaction project will have total capacity of about 2.5 million tpy of LNG.

The project remains under review by FERC.

Trunkline LNG Export LLC awarded Technip the FEED contract for potential expansion of its three-train, 15-million-tpy

plant planned for the site of Trunline's existing LNG import terminal in Lake Charles, La. The project includes a three-train,

15-million-tpy LNG liquefaction plant.

Trunkline LNG, a JV of Energy Transfer and BG Group, expected the study to be completed by Apr. 1.

Elsewhere, ExxonMobil, BP , ConocoPhillips, and TransCanada last year selected the Nikiski area on the Kenai Peninsula

as the lead site for the proposed Alaska LNG project's liquefaction plant and terminal.

More than 20 locations were evaluated based on conditions related to the environment, socioeconomics, cost, and other

project and technical issues (OGJ Online, Oct. 7, 2013; Jan. 27, 2014).

The companies are continuing to refine the agreed project, which includes a gas-treatment plant on the North Slope, an

800-mile, 42-in. OD pipeline with up to eight compression stations and at least five off-take points for in-state gas delivery,

and a liquefaction plant.

More detailed engineering and design work is under way, consistent with previously released plan phases.

Alaska LNG plans to reach FID in 2018-19 and will file for an export license later this year to meet that timeframe. In

February, Alaska's Senate Resources Committee passed Bill 138 authorizing the project with the bill subsequently moving

to the Senate Finance Committee.

ConocoPhillips also filed applications for 2-year authorizations with DOE to resume seasonal LNG exports from its

mothballed Kenai Peninsula LNG plant during non-winter periods. Exports would total about 20 bcf/year.

Panama Canal

Delays to the Panama Canal expansion are likely to create only limited disruptions to global LNG trade, according to a

report in February by Wood Mackenzie. Delays of 6-12 months would fall into this limited-disruption category, but further

delays could pose problems as new non-FTA US export projects begin to come online.

Wood Mackenzie noted in particular that a delay until early 2016 would affect the first LNG exports from Sabine Pass,

imposing higher shipping costs as vessels would have to round the Cape of Good Hope to reach Asia. The longer routing

would also tighten the LNG shipping market.

Expected differentials between US and Asian gas prices, however, and expansion of the shipping fleet between now and

2016 would help mitigate these effects, Wood Mackenzie said. Work stopped for 2 weeks due to disputes with the

contractor regarding who was responsible for $1.6 billion in cost overruns. Work on the third set of locks resumed in

February.

LNG does not currently pass through the Panama Canal because the carriers are too wide. The expansion will allow

passage to all but the very largest LNG carriers. The Panama Canal Authority said in February that the expansion would

enter commercial service January 2016, assuming no more work stoppages.

South America

Brazil and Uruguay plan to expand their LNG import infrastructure, while Colombia and Peru look to boost exports.

Brazil. Brazil's state-owned Petroleo Brasileiro SA (Petrobras) in January started its third LNG import terminal. The

Petrobras LNG regasification terminal in Bahia has a 14-million-cu-m/day (cmd) capacity, bringing Brazil's total

regasification capacity to 41 million cmd. The country's other two import terminals are in Pecem, Ceara state (7 million

cmd), and Guanabara Bay, Rio de Janeiro state (20 million cmd).

Colombia. Pacific Rubiales Energy and Exmar will begin operating a 70-MMcfd export gas liquefaction plant in Tolu on

Colombia's Caribbean Coast by early 2015, LNG World News reported. China is building the FSRU for delivery late this

year. The vessel, Caribbean FLNG, will have 16,100 cu m of LNG storage. Exmar is paying for the vessel while Pacific

Rubiales picks up the cost of an 18-in. OD, 90-km pipeline connecting it to onshore gas supply from La Cresciente field in

Sucre province.

Pacific Rubiales has a 15-year agreement in place to supply Exmar with gas FOB Colombia for delivery to Caribbean

customers.

Peru. Royal Dutch Shell in January acquired Repsol SA's non-North American LNG portfolio, including Peru LNG Co.'s

4.45 million tpy of liquefaction capacity (OGJ Online, Feb. 26, 2013).

Uruguay. GDF Suez and Marubeni in February chartered the world's largest FSRU to supply LNG to Uruguay from 4 km

off Montevideo, Platts reported. The 1,132-ft ship will have 263,000 cu m of LNG storage (160.17 million cu m natural gas)

and as much as 10 million cmd of natural gas sendout capacity, expandable to 15 million cmd.

The terminal, to be delivered in late 2016, would be able to receive LNG tankers up to 218,000-cu-m capacity. GDF Suez's

regasification vessel Neptune will provide LNG offtake starting next year until the terminal begins operations.

Europe

While Russia sees LNG exports as a path to potential new natural gas markets, the rest of Europe continues to build

regasification terminals in an effort to reduce its dependence on Russian supplies.

Russia. Owners last year reached FID on Yamal LNG, with the 16.5-million-tpy liquefaction plant to be built on the Yamal

Peninsula on the Kara Sea and first-train start-up set for 2017.

The $27 billion project consists of developing giant onshore South Tambey gas and condensate field on the peninsula,

three 5.5-million-tpy trains, LNG storage tanks, and port infrastructure at Sabetta. As many as 16 icebreaking LNG carriers

will be commissioned to handle international trade via the Arctic Ocean.

Operator Yamal LNG JSC is owned by Total 20% and Novatek 80%. In September, Novatek and CNPC agreed to CNPC's

acquiring 20% of the project. A consortium of France's Technip and Japan's JGC will perform engineering, procurement,

supply, construction, and commissioning of the plant (OGJ Online, Apr. 5, 2013). The consortium selected Air Products to

supply three cryogenic heat exchangers. Vinci will build four 160,000-cu-m storage tanks.

Poland. Polskie LNG's 5 billion cu m/year terminal at Swinoujscie continues to fall behind in its development due to

financial problems at contractor PBG. Polskie originally planned to have the terminal operating in time to receive contract

shipments of 1.5 billion cu m/year from Qatargas as early as July, but this now looks likely to occur later in the year. The

terminal was 75% complete as of February, Platts reported. Polskie is also considering adding a third train to increase

capacity to 7.5 billion cu m/year.

Finland. Wartsila signed a contract with Manga LNG to build Finland's first LNG receiving terminal in Tornio. The terminal

would supply the local steel mill as well as other regional industry and, eventually, bunkering for LNG-fuelled ships. Manga

expects the terminal, including 30.4-billion-cu-m storage, to begin operations in 2017.

Estonia, Latvia, Lithuania. Klaipedos Nafta in January received permits to begin building the embankment for the shore

portion of a regasification terminal in Lithuania. The company expects to take delivery of the FSRU Independence by

yearend for stationing off Klaipeda.

Latvia, however, has said that a Baltic LNG terminal should be its project. Finland and Estonia, meanwhile, asked the

European Commission to decide the location of a Baltic terminal, with the EC advising that the countries instead decide

among themselves. The European Union could fund as much as 40% of a regional terminal's costs as long as it serves

more than one country.

Estonia and Finland signed an agreement in February to build two LNG terminals on either side of the Gulf of Finland,

linked by a pipeline. The respective terminal developers must turn in technical and commercial details to domestic

regulators and the EC by the end of May.

Italy. The long-delayed FRSU for the Italian port of Livorno started operations last year 12 miles offshore (OGJ Online,

Aug. 29, 2013). The Toscana FSRU can vaporize 3.75 billion cu m/year of LNG and store up to 137,500 cu m.

Shareholders are E.On Group 46.79%, Iren Group 46.79%, OLT Energy Toscana 3.73%, and Golar Offshore Toscana

2.69%.

Italy has two other operating LNG terminals. The 2.5-million-tpy onshore terminal at Panigaglia is owned and operated by

GNL Italia and began operations in 1969. The world's only fixed offshore LNG terminal at Porto Levante can accommodate

5.8 million tpy. It is owned and operated by Adriatic LNG, a JV of ExxonMobil, Qatar Petroleum, and Edison.

The 5.8-million-tpy Porto Empedocle terminal in Sicily is under construction. Owned by Nuove Energie, a JV of Enel and

the Siderurgica Investimenti Group, the terminal targets commissioning and start-up in 2016.

Smart Gas Monfalcone, a 12-company consortium, plans to build a regasification terminal in northeastern Italy capable of

importing 800 million cu m/year of LNG. The consortium expects the terminal to begin operations in 2018

Cyprus. The Republic of Cyprus and Total E&P Cyprus BV in November 2013 signed a memorandum of understanding

(MOU) furthering prospects for LNG exports from the island (OGJ Online, Nov. 8, 2013).

This follows the award in February to Total of production-sharing contracts for Blocks 10 and 11 in Cyprus's Exclusive

Economic Zone (OGJ Online, Feb. 6, 2013).

The MOU, said the joint announcement, "records the support" of Total for monetization of potential natural gas reserves in

the area through a "variety of options giving priority" to liquefaction and LNG export to European and Asian markets. The

two parties will cooperate on the feasibility of an onshore LNG plant to be built at Vasilikos, Cyprus.

In June 2012, the Republic of Cyprus decided to begin work toward the LNG plant at Vasilikos, which will have initial export

capacity of 5 million tpy, expandable to 15 million tpy.

Cyprus is also preparing an MOU with Eni to include it in the Vasilikos plant plans, according to Platts. Eni and Kogas won

Blocks 2, 3, and 9. The country is also negotiating with Noble Energy regarding the LNG plant, which is not expected to

begin operations until at least 2022. China has expressed interest in participating in the project.

Correction

Table 2 in the article entitled "Product pipeline completions lead planned

construction lower" by Christopher E. Smith (OGJ, Feb. 3, 2014, p. 90) was

mistitled. Its title should have read Pipeline construction beyond 2014.'

Rosneft, CNPC strengthen cooperation

Posted on Oct 14th, 2014 with tags CNPC, Cooperation, News, Rosneft, Strengthen .

Rosneft and Chinese National Petroleum Corporation (CNPC) signed an agreement for the

extensions of strategic cooperation.

The agreement envisages elaboration of current and potential strategic cooperation areas.

The document also foresees the fueling of a deeper collaboration in these areas. In particular, the

parties intend to proceed with Upstream projects in the Russia, refinining in China (Tianjin

Refinery) and other venues of cooperation, Rosneft said in a statement.

The parties intend to apply joint efforts with the scope of further expansion of strategic

cooperation, including in the areas of the development of liquefied natural gas projects which

embraces potential Russian LNG supplies to China, the company added.

Press Release, October 14, 2014; Image: government.ru

EDF Trading Appoints Christopher McKey as Head of Business Development, North America

Published on Tuesday, 14 October 2014 06:03

EDF Trading has announced the appointment of Christopher McKey as Head of Business Development, North

America. McKey started on Monday October 13th, 2014 and reports to Philipp Bssenschtt, Chief

Commercial Officer, Origination and Business Development.

McKey joins from Goldman Sachs where he has spent the past 10 years operating at a senior level in the

firms Commodity division in Europe and Asia. Most recently he was Managing Director and Co-Head of Asia

Corporate Sales based in Singapore.

McKey will focus on identifying and structuring larger and longer term transactions in the energy trading space

including but not limited to LPG, LNG, natural gas and electricity.

Christopher has worked in the energy sector in the US, Europe and Asia and is ideally placed to develop EDF

Tradings footprint across North America as well as to originate commodity positions that link the North

American energy market to the rest of the world. To this end, while Christopher will work mainly with our

Houston office, he will have close contact with EDFTs offices in Singapore, and London, said Philipp

Bssenschtt.

Santos GLNG project has fed natural gas into its 420-kilometre gas transmission pipeline

Published on Monday, 13 October 2014 17:27

Santos has announced the Santos GLNG project has fed natural gas into its 420-kilometre gas transmission

pipeline for the first time via its primary compressor station in the Fairview field in south-west Queensland,

Australia.

Santos Vice President Downstream GLNG Rod Duke said he was pleased to take another important step

towards Santos GLNGs first shipment of LNG from Gladstone Harbor next year. Commissioning of our

pipeline is an important milestone, not only for our business, but the Queensland LNG industry as a whole, Mr

Duke said. Once fully commissioned and in operation, the pipeline will transport up to 40 million cubic meters

of natural gas each day from Santos GLNGs gas fields to its gas liquefaction plant on Curtis Island, off

Gladstone, Australia.

Mr Duke said work in Santos GLNGs gas fields across the Bowen and Surat Basins and construction of the

LNG plant at Curtis Island were also progressing strongly towards first LNG in 2015.

The pipeline will now be progressively filled with gas, section by section, with first gas into the Santos GLNG

plant scheduled for later this year. Saipem Australia constructed the pipeline for Santos GLNG.

NextDecade Formation of Strategic Partnership to Jointly Develop LNG Export Projects

Published on Monday, 13 October 2014 08:03

NextDecade LLC announced today an investment byYork Capital Management Global Advisors, LLC in

NextDecade and the formation of a strategic partnership for the joint development of a portfolio of LNG export

projects. Through this agreement, NextDecade will initially focus on developing low-cost, mid-scale LNG

export projects in Brownsville and Galveston, Texas according to a NextDecade statement.

NextDecade and York plan to work together to conduct additional Front-End Engineering and Design analysis

in order to pre-file applications with the U.S. Federal Energy Regulatory Committee to permit, site, construct

and operate LNG export terminals in Brownsville and Galveston within the first quarter of 2015.

Kathleen Eisbrenner, CEO of NextDecade said, "We are excited to announce York's investment in, and

partnership with NextDecade. York has extensive experience investing across the LNG value chain and

provides strong backing to support financing for the advancement of NextDecade's LNG export projects. We

look forward to working closely with the cities of Brownsville and Galveston to maximize the economic impact

of these projects for the local communities. Based on extensive development work already completed, and the

use of safe, reliable and proven LNG liquefaction technology, while working with strong industrial partners, we

are confident we can achieve a Final Investment Decision in a timely and cost effective manner."

AusGroup awarded contract on the Ichthys LNG Project

Published on Monday, 13 October 2014 07:29

AusGroup subsidiary AGC Industries Pty Ltd. has entered into a joint venture with Meisei Industrial Co. Ltd of

Japan to form AGC Meisei Joint Venture. It has been awarded a AU$197 million contract by JKC Australia

LNG Pty Ltd. on the onshore facilities of the INPEX-operated Ichthys LNG Project, near Darwin, Northern

Territory, Australia.

The subcontract scope of work includes; painting, surface protection, fireproofing and insulation works for lead

contractor JKC. Work is expected to start in March 2015 and will continue for 22 months until December 2016.

This is the second major contract to be awarded to a subsidiary of AusGroup on the Ichthys Project Onshore

LNG Facilities.

AusGroup CEO and Managing Director Stuart Kenny said We are pleased to be able to continue our

relationship with JKC through this AMJV contract. We look forward to bringing a level of knowledge and

expertise to the project backed by 70 years of international insulation experience within Meisei and decades of

LNG experience providing insulation and painting services within AGC. This is the second time AGC and

Meisei have worked together, previously on a AU$100 million contract for an LNG train in Western Australia

between 2002 - 2004.

Xodus Group, Saipem and Chiyoda to set up New Subsea Company

Published on Friday, 10 October 2014 05:43

Xodus Group announced yesterday the launch of a global subsea engineering company in partnership with oil

and gas contractor Saipem and mid and downstream oil and gas company Chiyoda Corporation.

The new organization will be headquartered in London and have a presence in several cities across Europe,

Africa, the Americas, Middle East and Asia Pacific including eight dedicated engineering centers in priority

energy locations.

According to a company statement Xodus Subsea engineering services will take a unique approach to

technical subsea challenges by bringing together Xodus Group's front end engineering capability, Saipem's

turnkey Engineering, Procurement, Construction and Installation expertise and Chiyoda's experience in

managing large scale international projects. The company will offer technical subsea expertise and also have

access to more than 1,000 multidiscipline engineers through the partner companies.

Colin Manson CEO of Xodus Group said: "The launch of Xodus Subsea marks a new era of subsea

engineering support to the global oil and gas industry. For the first time operators can choose a subsea

engineering company that's backed by world leading contractors without being exclusively tied to them. We

have the global reach, capability and technical prowess to support the world's largest and most complex

subsea projects. We offer integrated subsea services to minimize project risk and deliver the best technical

results.

The company plans to pass on the benefits of being able to evaluate and select suitable technology early in

the decision-making process without being constrained by convention or ownership.

Xodus Subsea engineering services cover field development, projects including FEED and detailed design,

and lifecycle consultancy with a focus on working with partners to support the development of new

technologies. Matt Kirk, Americas' regional director for Xodus Group will take up the new position of Xodus

Subsea managing director with other key positions in the leadership team being filled by managers from all

three companies.

Japan paid $13.20 MMBtu for spot LNG in September 2014

Published on Thursday, 09 October 2014 04:59

Today the Japan Ministry of Economy, Trade and Industry released preliminary figures for the trend price of

Spot LNG for September 2014

The average price of spot-LNG imported into Japan that was contracted in September 2014 was 13.20

USD/MMBtu.

The average price of Spot-LNG imported into Japan that arrived in September 2014 was 11.30 USD/MMBtu.

August Stats:

The average price of spot-LNG imported into Japan that was contracted in August 2014 was 11.40

USD/MMBtu.

The average price of Spot-LNG imported into Japan that arrived in August 2014 was 12.50 USD/MMBtu.

Wood Mackenzie Infographic - 50 years of the LNG industry

Published on Thursday, 09 October 2014 03:53

October 12th, 2014 marks 50 years since the Methane Princess delivered the world's first commercial LNG

cargo to the UK's Canvey Island regasification terminal on October 12th, 1964.

Wood Mackenzie Key facts on LNG @ 50

On 12 October 1964, the Methane Princess delivered the first commercial LNG cargo to the UKs Canvey

Island regasification terminal.

The money Japan spent on importing LNG last year could have bought 197 jumbo jets, or 300,000 Ferraris, or

145 million iPads.

Despite only being the fifth largest exporter so far in 2014, Indonesia has produced the most LNG in history at

721 million tonnes.

A typical LNG ship can carry 155,000m which could fill 221 million bottles of whisky. Once regasified it could

fill 137 billion bottles.

In the past 50 years, 424 LNG ships have been built. Over the next five years 127 new ships are due for

delivery.

Japan has been the biggest importer of LNG since 1970, in that time 5 different countries have taken the

honour of largest exporter.

Growth in global LNG production will mean it will take less than 11 years to produce as much LNG as was

produced in the last 50 years.

The Wood Mackenzie LNG research team created a special infographic below using their proprietary data

which maps out the first 50 years of the LNG industry.

Above image: Wood Mackenzie

GTT receives order for two Liquefied Natural Gas Carriers

Published on Thursday, 09 October 2014 03:23

GTT announced today it has received an order for two LNGCs (Liquefied Natural Gas Carriers) which will be

built by the Korean shipbuilder DSME (Daewoo Shipbuilding & Marine Engineering).

These vessels are expected to be delivered between 2017 and 2018. They will be built with the GTT NO 96

GW membrane technology, which allows an optimized daily boil-off rate of cargo LNG, and helps to save fuel

cost during journeys according to GTT.

The vessels will be operated by BW Group, a Norwegian owner with a long history of operating GTT-designed

LNG carriers.

Philippe Berterottire, Chairman and CEO of GTT said, We are very happy to receive this new order. It shows

our long partnership with DSME, which is particularly involved in the promotion of NO 96 membrane systems;

as well as BW, who already operates many ships equipped with GTT technologies.

Bechtel to provide FEED for planned LNG export facility in Louisiana

Published on Thursday, 09 October 2014 02:32

Bechtel announced yesterday it has been selected by Louisiana LNG Energy, LLC to provide front-end

engineering and design work for a planned liquefaction facility and export terminal in Louisiana, south of New

Orleans on the Mississippi River. Bechtel noted the design will center on a modular approach, which shortens

the construction schedule and accommodates future expansion.

"Bechtel brings world-class expertise in the engineering, design, and construction of LNG liquefaction projects

coupled with leadership in modularization and Gulf Coast self-perform work," said Jim Lindsay, chief executive

officer of Louisiana LNG Energy.

The new facility will have an initial export capacity of 2 million metric tons per annum of LNG and will use Chart

Energy and Chemicals proprietary liquefaction technology.

Corpus Christi LNG Clears U.S. Government Environmental Impact Step

Published on Wednesday, 08 October 2014 16:57

Today the U.S. Federal Energy Regulatory Commission released the final environmental impact statement

(EIS) for the Corpus Christi LNG Project. The FERC staff concluded that approval of the proposed Corpus

Christi LNG Project, with some mitigation measures recommended in the EIS, would ensure that impacts in

the project area can be avoided or minimized and the project would not cause significant environmental

issues. Construction and operation of the project would result in mostly temporary and short-term

environmental impacts.

Corpus Christi Liquefaction, LLC, a subsidiary of Cheniere Energy, is developing a LNG export terminal at one

of Cheniere's existing sites that was previously permitted for a regasification terminal. The proposed

liquefaction project is being designed for three trains capable of producing in aggregate up to 13.5 million

tonnes per annum (mtpa). The Project would also include 23 miles of new 48-inch-diameter natural gas

pipeline and two compressor stations which total 53,260 horsepower. Cheniere would install additional

ancillary facilities along the pipeline including six meter stations, five mainline valves, and a pig launcher and

receiver.

The next step in the process in order for the project to move forward will be for FERC to issue an order

approving the project. The Corpus Christi LNG Project does not yet have approval from the U.S Department of

Energy to export LNG to non-free trade nations.

Corpus Christi LNG Project Rendering (Source: Cheniere Energy, Inc.)

Atlantic Gulf & Pacific Company awarded contract to supply process modules to Yamal LNG

Published on Wednesday, 08 October 2014 04:30

The Atlantic Gulf & Pacific Company announced today it has been awarded a contract to supply process

modules to the Yamal LNG project.

It is a privilege for AG&P to support the grand vision of Yamal LNG, said Augusto G. Gan, Managing

Director, AG&P. AG&Ps selection is a result of the hard work of our outstanding people and is an example of

the confidence the world is showing toward the Philippines. A significant milestone in the history of our

company, AG&P looks forward to building these complex and exciting modules to the highest levels of safety

and quality in our state of-the-art yards outside of Manila.

Atlantic Gulf & Pacific Company expects to create thousands of jobs to service the Yamal LNG Project,

providing significant value to the local economy.

Atlantic Gulf & Pacific Company Operating in the Philippines from two major yards. The company is an

industrial process outsourcing company providing modular construction and project support services to the oil

and gas, mining, power and industrial infrastructure sectors.

U.S. EIA Short Term Energy and Winter Fuels Outlook - Natural Gas

Published on Wednesday, 08 October 2014 03:36

On October 7th, 2014 the U.S. EIA released the short term energy and winter fuels outlook including natural

gas price data.

The Henry Hub natural gas spot price averaged $3.92/MMBtu in September, a slight increase from August.

EIA expects spot prices to remain below $4.00/MMBtu through November, before rising with winter heating

demand. Projected Henry Hub natural gas prices average $4.45/MMBtu in 2014 and $3.84/MMBtu in 2015.

Natural gas futures prices for January 2015 delivery (for the fiveday period ending October 2) averaged

$4.19/MMBtu. Current options and futures prices imply that market participants place the lower and upper

bounds for the 95% confidence interval for December 2014 contracts at $2.96/MMBtu and $5.94/MMBtu,

respectively. At this time last year, the natural gas futures contract for January 2014 averaged $3.83/MMBtu

and the corresponding lower and upper limits of the 95% confidence interval were $2.91/MMBtu and

$5.04/MMBtu.

FERC notice of intent to prepare environmental impact statements for two more U.S. projects

Published on Monday, 06 October 2014 07:42

The staff of the Federal Energy Regulatory Commission announced it will prepare an environmental impact

statement (EIS) that will discuss the environmental impacts for two proposed U.S. LNG projects. The projects

are the Mississippi River LNG project involving construction and operation of a LNG facility by Louisiana LNG

Energy in Plaquemines Parish, Louisiana and the Downeast LNG Import-Export Project in in Washington

County, Maine. The Commission will use this EIS in its decision-making process to determine whether the

project is in the public convenience and necessity.

Louisiana LNG Energy would construct, own, and operate a liquefaction terminal for the export of LNG. The

terminal would include four liquefaction trains, each with a capacity of 74,380 cubic feet per day; two 100,000

cubic meter (m3) full containment LNG storage tanks; 1.9 miles of 24-inch-diameter pipeline; and 1.6 miles of

12-inch-diameter pipeline.

Downeast Liquefaction plans to develop, construct, and operate liquefied natural gas terminal facilities that

would convert the proposed Downeast LNG Import Project into a bidirectional import-export LNG terminal and

pipeline capable of producing 3 million metric tonnes per annum (mtpa) of LNG and 100 million standard cubic

feet per day (mmscfd) of regasified LNG.

Egyptian government pays $350 million to BG Group

Published on Monday, 06 October 2014 04:05

BG Group announce today it has received a $350 million payment from the Egyptian government. BG Group

noted this reduces the company's domestic receivables balance in Egypt to around $1.2 billion.

According to a BG Group statement the payment is the result of the government of Egypt raising funds

specifically to help repay debts to the oil and gas sector. The company will continue to investigate options for

increasing the supply of gas and is working with the government of Egypt on resolving the outstanding

receivable balance.

BG Group operates in Egypt through its wholly-owned subsidiary BG Egypt. The company is one of the largest

producers of natural gas in Egypt spanning the gas chain from exploration through development and

production to LNG.

Cosmodyne Selected by Northstar Industries to Supply Liquefier for New Jersey Facility

Published on Thursday, 02 October 2014 08:55

Cosmodyne announced yesterday Northstar Industries has signed an agreement with Cosmodyne to supply a

nitrogen recycle liquefier for an addition to the New Jersey Natural Gas Howell LNG Facility.

Cosmodyne noted Northstar Industries executed an EPC agreement with New Jersey Natural Gas to place in

service a 120,000 gallon per day liquefaction addition at the Howell LNG Facility.

Cosmodyne is proud to have been selected by Northstar Industries and we look forward to a successful

project together with New Jersey Natural Gas. We continue to build on our extensive experience in the natural

gas industry by providing our customers with safe, reliable and efficient liquefaction solutions, said George

Pappagelis, General Manager of Cosmodyne, LLC.

Cosmodyne will design and manufacture the liquefier at its facilities, and transport the liquefier to New Jersey

where Northstar will place the liquefier and other facility components in service in the spring 2016.

More Articles...

JGC Awarded Contract for LNG Receiving Terminal in Fukushima Prefecture, Japan

U.S. Government Approves Dominion Cove Point LNG Export Project in Maryland

Japan 2014 LNG Imports January-August

Video - Module Program Complete for Santos GLNG project

PETRONAS lifts first topside module for FLNG facility

Excelerate Energy FSRU Charter in Dubai

Sabine Pass Liquefaction Project Progress Report for August 2014

Liquefied Natural Gas Limited FERC Update for Magnolia LNG Project

Asian Spot LNG Prices Rally as Winter Season Approaches

Air Products' LNG Technology Selected for Freeport Terminal Facility

BP and Tokyo Electric Power Company sales and purchase agreement based on Henry Hub pricing

Linde awarded engineering contract for LNG plant in Canada

U.S. Energy Department Issues Final Authorization to Cameron LNG for Exports to Non Free Trade

Nations

Carib Energy Receives U.S. DOE Final Authorization to Export LNG in ISO Containers

Freeport LNG Selects GE for Export Project

1. Clough AMEC JV awarded FEED contract for proposed Bowen Gas Project

2. Japan preliminary spot LNG prices for August 2014

3. WorleyParsons agreement to acquire MTG, Ltd.

4. Alaska LNG Project summer field work continues for a second season as part of pre-FEED

5. Arrow moves forward with Bowen Basin front-end engineering design

6. Sabine Pass Liquefaction Project Progress Report for July 2014

7. Turret for Shells Prelude FLNG Sent to South Korea

8. GDF SUEZ Agreement with Gaz Metro LNG of Montreal for New England Supply

9. The U.S. Federal Energy Regulatory Commission has approved a Pre-Filing Request for the

Downeast LNG Import-Export Project

10. Excelerate Energys Aguirre Offshore GasPort Project Receives Draft EIS from FERC

11. Clough Acquires CH-IV International

12. Final Investment Decision Reached For Cameron LNG Export Project

13. INPEX Completes Ichthys LNG Projects dredging program

14. Leadership Changes at Bechtel

15. U.S. Energy Department conditionally authorizes Oregon LNG to export to non-free trade nations

16. Chart E&C FLNG Liquefaction Equipment Order From Black & Veatch

17. CB&I front end engineering design services contract for a proposed LNG export project

18. Freeport LNG export project receives U.S. government approval for construction

19. New British Columbia Liquefied Natural Gas Facility Regulation Document

20. ConocoPhillips Completes Sale of Nigeria Business

21. Hoegh LNG IPO to own, operate and acquire floating storage and regasification units

22. BAM Clough JV completes first Ichthys LNG facility in Australia

23. PGN FSRU Lampung starts commercial operation

24. British Columbia and National Energy Administration of China sign MOU

25. Nine New LNG Carriers built by DSME To Use GTT Membrane Technology

4. CONCLUSIONES

El mercado de GNL presenta unas inversiones considerables para aumentar el uso y suplir las

necesidades que tienen los pases, por su bajo precio y por la imposibilidad de obtener energa

suficiente mediante plantas de energa alternativas, el gas natural es la mejor opcin que se

presenta y con la creciente oferta de GNL y la demanda, sumado al patrocinio del Banco Mundial

respecto al desarrollo y construccin de nuevas plantas de licuefaccin y de regasificacin para que

el mercado crezca y as lograr que algunos pases puedan diversificar su ya monopolizado

suministro energtico.

5. REFERENCIAS

http://www.lngglobal.com/latest/

http://uk.reuters.com/article/2014/05/19/research-and-markets-

idUKnBw196561a+100+BSW20140519

http://www.iea.org/publications/freepublications/publication/weio2014.pdf

http://www.lngworldnews.com/

http://www.sigtto.org/publications/newsletters

http://www.ogj.com/articles/print/volume-112/issue-4/special-report-lng-update/lng-update-

global-lng-supply-demand-remain-tight.html

Anda mungkin juga menyukai

- Tarea 5 Conversion de Gas Natural A LiquidosDokumen9 halamanTarea 5 Conversion de Gas Natural A LiquidosgahortahBelum ada peringkat

- Analisis de Hidrocarburos en El PozoDokumen12 halamanAnalisis de Hidrocarburos en El PozogahortahBelum ada peringkat

- Manual Pozos SepticosDokumen20 halamanManual Pozos Septicosluigi1685100% (1)

- 5 Revision Proyecto ElectricoDokumen7 halaman5 Revision Proyecto ElectricogahortahBelum ada peringkat

- SoldaduraDokumen36 halamanSoldaduraandrearanguren1982Belum ada peringkat

- Cálculo de Atiesadores de Vigas MetálicasDokumen5 halamanCálculo de Atiesadores de Vigas Metálicasgahortah100% (2)

- Aci 224R-01 Agrietamiento y Fisuras PDFDokumen53 halamanAci 224R-01 Agrietamiento y Fisuras PDFErick Alex Japay Robles100% (1)

- Reanimación Cardiopulmonar: Reseña HistóricaDokumen17 halamanReanimación Cardiopulmonar: Reseña HistóricagahortahBelum ada peringkat

- 3W Look Ahead IFS-0046 PDFDokumen3 halaman3W Look Ahead IFS-0046 PDFDennys Rojas ToledoBelum ada peringkat

- Extensión de registros hidrológicos cortos usando modelos bivariadosDokumen25 halamanExtensión de registros hidrológicos cortos usando modelos bivariadosANDRES AUGUSTO JUNIOR CAJA YNGABelum ada peringkat

- Examen Sustitutorio Turbomáquinas I - MN232 - 2022-1Dokumen2 halamanExamen Sustitutorio Turbomáquinas I - MN232 - 2022-1SAMUEL TOVAR MENDEZBelum ada peringkat

- Cronograma PDFDokumen2 halamanCronograma PDFel sitio comBelum ada peringkat

- 01 Sistema IndirectoDokumen15 halaman01 Sistema IndirectoPiero ManrriqueBelum ada peringkat

- Calificación Del ProcedimientoDokumen6 halamanCalificación Del ProcedimientoWilmer Zavaleta Huamanyauri100% (1)

- Pasos construcción vivienda desde cimientos techosDokumen10 halamanPasos construcción vivienda desde cimientos techosThaisOchoaEcosBelum ada peringkat

- MecII Guia01Dokumen5 halamanMecII Guia01Cristobal Eduardo Robledo MedallaBelum ada peringkat

- 76 - Ing. Padron - Geotecnia Presupuesto CeibosDokumen1 halaman76 - Ing. Padron - Geotecnia Presupuesto CeibosfranBelum ada peringkat

- Anexo 21 Metodo de ValoraciónDokumen3 halamanAnexo 21 Metodo de ValoraciónMarco Antonio T.Belum ada peringkat

- Burger King VMT DossierDokumen40 halamanBurger King VMT DossierJhon merino rodriguezBelum ada peringkat

- Modos Ventilatorios No Convencionales FinalDokumen29 halamanModos Ventilatorios No Convencionales FinalYOshie Parras0% (1)

- Lectura 4.4 - Planes CSPDokumen3 halamanLectura 4.4 - Planes CSPShirly Johana Julio JimenezBelum ada peringkat

- Elementos de Maquinas y Fundamentos de Diseno IIDokumen3 halamanElementos de Maquinas y Fundamentos de Diseno IIrobertBelum ada peringkat

- Nomenclatura SensoresDokumen3 halamanNomenclatura SensoresBernabeBelum ada peringkat

- Diagrama Transversal Diagrama Longitudinal: Datos Técnicos Xlpe Cu 4/0 Awg 15Kv 133% PC PVC SR EcuDokumen1 halamanDiagrama Transversal Diagrama Longitudinal: Datos Técnicos Xlpe Cu 4/0 Awg 15Kv 133% PC PVC SR EcudoryBelum ada peringkat

- Inductancia y Capacitancia en Circuitos Trifásicos ParalelosDokumen7 halamanInductancia y Capacitancia en Circuitos Trifásicos Paraleloscristian Castillo0% (1)

- DROPS-Programa de objetos caídosDokumen19 halamanDROPS-Programa de objetos caídosisabel mejiaBelum ada peringkat

- SuspensiónDokumen6 halamanSuspensiónQuantyk Knight Punk SkBelum ada peringkat

- Cálculo de Entalpías MolaresDokumen51 halamanCálculo de Entalpías MolaresNelson Estela ValenzuelaBelum ada peringkat

- Formatos Del Manual Perpec para DistribuirDokumen32 halamanFormatos Del Manual Perpec para DistribuirEdgard Fernando Nontol PastorBelum ada peringkat

- Laboratorio de Fuerza Sobre Un Cilindro Sumergido.Dokumen5 halamanLaboratorio de Fuerza Sobre Un Cilindro Sumergido.Manway Mora MirandaBelum ada peringkat