Petrozuata Financial Model

Diunggah oleh

samdhathriHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Petrozuata Financial Model

Diunggah oleh

samdhathriHak Cipta:

Format Tersedia

Petrolera Zuata, Petrozuata C.A.

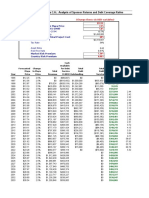

: Analysis of Sponsor Returns and Debt Coverage Ratios

Assumptions

(Change these six RED variables)

Initial Oil Price in 1996

Annual Change in Oil Price (1996-2012)

Royalty Rate (2001-2008)

Royalty Rate (2009-2034)

Total Debt Financing

Leverage: Debt/Total Project Cost

Project's Total Cost

Tax Rate

$12.25

2.5%

1.0%

16.7%

$1,450,000

60%

$2,416,667

34%

Asset Beta

Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997)

Market Risk Premium

Country Risk Premium

Year

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

Forecasted

Maya

Price

$12.25

$12.56

$12.87

$13.19

$13.52

$13.86

$14.21

$14.56

$14.93

$15.30

$15.68

$16.07

$16.47

$16.89

$17.31

$17.74

$18.19

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

Change

in Maya

Price

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

Total

Revenue

$0

$0

$78,524

$429,059

$803,290

$560,499

$580,141

$594,310

$608,833

$623,720

$638,978

$654,618

$670,649

$687,081

$703,924

$721,187

$738,882

$757,020

$758,224

$759,457

$760,722

$762,018

$763,347

$764,708

$766,104

$767,535

$769,001

$770,504

$772,045

$773,624

$775,243

$776,902

$778,603

$780,346

$782,133

$783,964

$785,842

$787,766

$789,738

Cash

Available

for Debt

Service

(CADS)

($80,007)

($610,492)

($820,154)

($139,352)

$243,952

$383,869

$374,482

$351,470

$383,135

$379,409

$415,819

$416,376

$417,733

$364,040

$353,700

$359,505

$367,531

$309,595

$341,704

$373,643

$365,851

$366,964

$312,682

$293,660

$264,839

$281,934

$276,305

$278,150

$273,514

$274,138

$263,068

$262,329

$260,484

$250,113

$234,648

$238,181

$231,118

$229,576

$215,770

Total

Debt

Outstanding

$0

$1,000,000

$1,024,299

$1,242,981

$1,450,000

$1,411,120

$1,372,240

$1,333,360

$1,268,892

$1,205,447

$1,103,295

$992,187

$864,195

$768,166

$680,692

$576,861

$456,838

$408,576

$354,212

$256,355

$136,753

$75,000

$75,000

$75,000

$75,000

$75,000

$0

0.60

6.81%

7.50%

0.00%

Total

Debt

Service

Equity

Cash

Flows

$0

$935,950

($63,079)

$113,580

$85,113

($157,629)

($154,472)

($151,315)

($171,563)

($165,270)

($195,423)

($195,059)

($201,103)

($161,187)

($145,382)

($153,095)

($159,037)

($83,154)

($84,614)

($119,749)

($131,281)

($68,159)

($6,405)

($6,405)

($6,405)

($6,405)

($75,000)

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

($79,035)

($1,986)

($550,148)

$1,576

$185,047

$227,819

$221,589

$190,031

$214,719

$199,063

$220,578

$218,294

$236,588

$210,755

$204,461

$203,439

$246,435

$225,711

$239,522

$248,128

$266,131

$329,682

$306,277

$287,255

$258,434

$241,232

$201,306

$278,150

$273,514

$274,138

$263,068

$262,329

$260,484

$250,113

$234,648

$238,181

$231,118

$229,576

$215,770

Debt

Service

Coverage

Ratio

2.44

2.42

2.32

2.23

2.30

2.13

2.13

2.08

2.26

2.43

2.35

2.31

3.72

4.04

3.12

2.79

5.38

48.82

45.85

41.35

44.02

3.68

Note: This simplified version of the Petrozuata project's economics is designed to accompany Petrolera Zuata, Petrozuata C.A. , HBS No. 299-012. Although the have been made to

model is based on the actual model used, a number of changes have been made to facilitate the analysis.

Model Output

Minimum Debt Service Coverage Ratio (DSCR)

Year of Minimum DSCR

Average DSCR

Internal Rate of Return

Net Present Value

2.08

2008

10.46

25.1%

$267,607

IRR and Minimum DSCR Output Table

Leverage

IRR

25.1%

40%

45%

50%

55%

60%

65%

70%

75%

80%

18.4%

19.5%

21.0%

22.8%

25.1%

28.2%

32.5%

39.0%

49.0%

Min. DSCR

2.08

3.05

2.73

2.47

2.25

2.08

1.93

1.80

1.69

1.59

IRR as a Function of the Number

of Years of Cash Flow

Number of Years

With Cash Flow

IRR

5

10

15

20

25

30

34

15.9%

22.7%

24.3%

24.9%

25.0%

25.0%

25.1%

Petrolera Zuata, Petrozuata C.A.: Analysis of Sponsor Returns and Debt Coverage Ratios

Year

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

Forecasted

Maya

Price

$12.25

$12.56

$12.87

$13.19

$13.52

$13.86

$14.21

$14.56

$14.93

$15.30

$15.68

$16.07

$16.47

$16.89

$17.31

$17.74

$18.19

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

$18.64

Change

in Maya

Price

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

Total

Revenue

$0

$0

$78,524

$429,059

$803,290

$560,499

$580,141

$594,310

$608,833

$623,720

$638,978

$654,618

$670,649

$687,081

$703,924

$721,187

$738,882

$757,020

$758,224

$759,457

$760,722

$762,018

$763,347

$764,708

$766,104

$767,535

$769,001

$770,504

$772,045

$773,624

$775,243

$776,902

$778,603

$780,346

$782,133

$783,964

$785,842

$787,766

$789,738

Cash

Available

for Debt

Service

(CADS)

($80,007)

($610,492)

($820,154)

($139,352)

$243,952

$383,869

$374,482

$351,470

$383,135

$379,409

$415,819

$416,376

$417,733

$364,040

$353,700

$359,505

$367,531

$309,595

$341,704

$373,643

$365,851

$366,964

$312,682

$293,660

$264,839

$281,934

$276,305

$278,150

$273,514

$274,138

$263,068

$262,329

$260,484

$250,113

$234,648

$238,181

$231,118

$229,576

$215,770

Total

Debt

Outstanding

$0

$1,000,000

$1,024,299

$1,242,981

$1,450,000

$1,411,120

$1,372,240

$1,333,360

$1,268,892

$1,205,447

$1,103,295

$992,187

$864,195

$768,166

$680,692

$576,861

$456,838

$408,576

$354,212

$256,355

$136,753

$75,000

$75,000

$75,000

$75,000

$75,000

$0

Total

Debt

Service

Equity

Cash

Flows

$0

$935,950

($63,079)

$113,580

$85,113

($157,629)

($154,472)

($151,315)

($171,563)

($165,270)

($195,423)

($195,059)

($201,103)

($161,187)

($145,382)

($153,095)

($159,037)

($83,154)

($84,614)

($119,749)

($131,281)

($68,159)

($6,405)

($6,405)

($6,405)

($6,405)

($75,000)

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

($79,035)

($1,986)

($550,148)

$1,576

$185,047

$227,819

$221,589

$190,031

$214,719

$199,063

$220,578

$218,294

$236,588

$210,755

$204,461

$203,439

$246,435

$225,711

$239,522

$248,128

$266,131

$329,682

$306,277

$287,255

$258,434

$241,232

$201,306

$278,150

$273,514

$274,138

$263,068

$262,329

$260,484

$250,113

$234,648

$238,181

$231,118

$229,576

$215,770

Cash

Return on

Investment

68.5%

64.6%

59.1%

62.9%

60.8%

65.1%

63.6%

62.3%

53.0%

50.2%

49.8%

49.7%

40.9%

45.1%

49.2%

48.1%

48.2%

41.0%

38.4%

34.6%

36.7%

35.9%

36.1%

35.4%

35.4%

33.9%

33.8%

33.5%

32.1%

30.0%

30.4%

29.4%

29.1%

27.3%

Debt

Service

Coverage

Ratio

2.44

2.42

2.32

2.23

2.30

2.13

2.13

2.08

2.26

2.43

2.35

2.31

3.72

4.04

3.12

2.79

5.38

48.82

45.85

41.35

44.02

3.68

Equity/Total

Capital at

BOOK VALUES

Equity

Beta

Cost of

Equity

Discount

Factor

PV

ECF

100%

10%

40%

41%

42%

42%

43%

44%

45%

46%

49%

51%

55%

58%

60%

64%

70%

72%

75%

80%

88%

93%

93%

93%

93%

93%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

0.60

6.00

1.52

1.46

1.44

1.41

1.39

1.37

1.33

1.29

1.24

1.17

1.10

1.04

0.99

0.93

0.86

0.84

0.80

0.75

0.68

0.64

0.64

0.64

0.64

0.64

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

0.60

11.31%

51.81%

18.18%

17.74%

17.57%

17.41%

17.24%

17.07%

16.79%

16.52%

16.08%

15.60%

15.04%

14.63%

14.25%

13.80%

13.28%

13.08%

12.84%

12.42%

11.90%

11.63%

11.63%

11.63%

11.63%

11.63%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

11.31%

1.000

0.659

0.557

0.473

0.403

0.343

0.293

0.250

0.214

0.184

0.158

0.137

0.119

0.104

0.091

0.080

0.070

0.062

0.055

0.049

0.044

0.039

0.035

0.032

0.028

0.025

0.023

0.020

0.018

0.016

0.015

0.013

0.012

0.011

0.010

0.009

0.008

0.007

0.006

($79,035)

($1,308)

($306,647)

$746

$74,511

$78,133

$64,822

$47,484

$45,939

$36,551

$34,892

$29,872

$28,142

$21,870

$18,570

$16,236

$17,362

$14,063

$13,225

$12,187

$11,681

$12,962

$10,787

$9,063

$7,304

$6,107

$4,579

$5,683

$5,021

$4,521

$3,898

$3,492

$3,115

$2,687

$2,265

$2,065

$1,800

$1,607

$1,357

Assumptions

Initial Oil Price in 1996

Annual Change in Oil Price (1996-2012)

Royalty Rate (2001-2008)

Royalty Rate (2009-2034)

Total Debt Financing

Leverage: Debt/Total Project Cost

Project's Total Cost

Tax Rate

Asset Beta

Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997)

Market Risk Premium

Country Risk Premium

$12.25

2.5%

1.0%

16.7%

$1,450,000

60%

$2,416,667

34%

0%

0.60

6.81%

7.50%

0.00%

Model Output

Minimum Debt Service Coverage Ratio (DSCR)

Year of Minimum DSCR

Average DSCR

Internal Rate of Return

Net Present Value

2.08

2008

10.46

25.1%

$267,607

IRR and Minimum DSCR Output Table

Leverage

40%

45%

50%

55%

60%

65%

70%

75%

80%

IRR

25.1%

25.1%

25.1%

25.1%

25.1%

25.1%

25.1%

25.1%

25.1%

25.1%

Min. DSCR

2.08

2.08

2.08

2.08

2.08

2.08

2.08

2.08

2.08

2.08

IRR as a Function of the Number

of Years of Cash Flow

Number of Years

With Cash Flow

IRR

5

10

15

20

25

30

34

15.9%

22.7%

24.3%

24.9%

25.0%

25.0%

25.1%

Anda mungkin juga menyukai

- Bankruptcy and Restructuring at Marvel Entertainment GroupDokumen12 halamanBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- BBB Case Write-UpDokumen2 halamanBBB Case Write-UpNeal Karski100% (1)

- Sequel Net Inflow Binomial TreeDokumen12 halamanSequel Net Inflow Binomial TreeJason WangBelum ada peringkat

- Petrozuata Case AnalysisDokumen7 halamanPetrozuata Case AnalysisAmyo Roy100% (9)

- FT Goblin Full SizeDokumen7 halamanFT Goblin Full SizeDeakon Frost100% (1)

- The Case of Petrozuata Joint VentureDokumen20 halamanThe Case of Petrozuata Joint VentureBasit Ali Chaudhry100% (1)

- Assignment - Sampa VideoDokumen5 halamanAssignment - Sampa Videobhatiasanjay11Belum ada peringkat

- Teuer Sheet (B) - Navam Gupta - 033 (828302)Dokumen48 halamanTeuer Sheet (B) - Navam Gupta - 033 (828302)devilcaeser20100% (1)

- Arundel Case SolDokumen14 halamanArundel Case SolRohan RustagiBelum ada peringkat

- Petrolera Zuata, Petrozuata CaseDokumen8 halamanPetrolera Zuata, Petrozuata CaseAndy Vibgyor50% (2)

- Debt Policy at UST IncDokumen5 halamanDebt Policy at UST Incggrillo73Belum ada peringkat

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDokumen3 halamanProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopBelum ada peringkat

- PetrozuataDokumen13 halamanPetrozuataMikhail TitkovBelum ada peringkat

- Human Resource Solution IndustryDokumen40 halamanHuman Resource Solution IndustryPriyanka SinghBelum ada peringkat

- Analysis of Petrolera Zuata Petrozuata Debt CoverageDokumen2 halamanAnalysis of Petrolera Zuata Petrozuata Debt CoveragedewanibipinBelum ada peringkat

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Dokumen1 halamanPetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrBelum ada peringkat

- Sampa Video Group 5Dokumen6 halamanSampa Video Group 5Ankit MittalBelum ada peringkat

- Sampa Video IncDokumen4 halamanSampa Video IncarnabpramanikBelum ada peringkat

- Case 7 PetrozuataDokumen13 halamanCase 7 PetrozuatalatecircleBelum ada peringkat

- Petrozuata Project Finance Valuation and Risk AnalysisDokumen12 halamanPetrozuata Project Finance Valuation and Risk AnalysisDarshan Gosalia0% (1)

- Petrozuata CaseDokumen10 halamanPetrozuata CaseBiranchi Prasad SahooBelum ada peringkat

- Employee Central Payroll PDFDokumen4 halamanEmployee Central Payroll PDFMohamed ShanabBelum ada peringkat

- Urinary Tract Infections PowerpointDokumen22 halamanUrinary Tract Infections Powerpointsamdhathri100% (1)

- Midland WACC CalculationsDokumen19 halamanMidland WACC CalculationsRyan Domke50% (2)

- 7458-PM Putting The Pieces TogetherDokumen11 halaman7458-PM Putting The Pieces Togethermello06Belum ada peringkat

- Contract Staffing in IndiaDokumen8 halamanContract Staffing in IndiasamdhathriBelum ada peringkat

- Facebook, Inc: The Initial Public OfferingDokumen5 halamanFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoBelum ada peringkat

- SampaSoln EXCELDokumen4 halamanSampaSoln EXCELRasika Pawar-HaldankarBelum ada peringkat

- Hbs Case - Ust Inc.Dokumen4 halamanHbs Case - Ust Inc.Lau See YangBelum ada peringkat

- Petrozuata Analysis WriteupDokumen5 halamanPetrozuata Analysis Writeupgkfernandes0% (1)

- Petrozuata Case AnalysisDokumen8 halamanPetrozuata Case AnalysisVishal VishyBelum ada peringkat

- Debt Policy at Ust IncDokumen18 halamanDebt Policy at Ust InctutenkhamenBelum ada peringkat

- Proposed Delivery For PAU/AHU Method Statement SEC/MS/3-25Dokumen4 halamanProposed Delivery For PAU/AHU Method Statement SEC/MS/3-25Zin Ko NaingBelum ada peringkat

- Petrolera Zuata, Petrozuata C. A. Case AnalysisDokumen10 halamanPetrolera Zuata, Petrozuata C. A. Case Analysisshivam saraffBelum ada peringkat

- Sampa Video: Project ValuationDokumen18 halamanSampa Video: Project Valuationkrissh_87Belum ada peringkat

- 01-Azeotropic Distillation (IL Chien)Dokumen35 halaman01-Azeotropic Distillation (IL Chien)Shivam Vinoth100% (1)

- GR-II-Team 11-2018Dokumen4 halamanGR-II-Team 11-2018Gautam PatilBelum ada peringkat

- Hospital Management SystemDokumen44 halamanHospital Management SystemsamdhathriBelum ada peringkat

- Petrolera Zuata Petrozuata CA. AnswerDokumen8 halamanPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- Ez Case StudyDokumen9 halamanEz Case StudysamdhathriBelum ada peringkat

- Quezon City Department of The Building OfficialDokumen2 halamanQuezon City Department of The Building OfficialBrightNotes86% (7)

- Case Analysis - Petrolera ZuataDokumen8 halamanCase Analysis - Petrolera ZuataAnupam Sharma0% (1)

- Assignment Schumpeter Finanzberatung DEC-5-21Dokumen2 halamanAssignment Schumpeter Finanzberatung DEC-5-21RaphaelBelum ada peringkat

- Aggregate MW Production and cash Flow ProjectionsDokumen15 halamanAggregate MW Production and cash Flow ProjectionsDebasmita Nandy100% (3)

- Petroleraa ZuataDokumen9 halamanPetroleraa ZuataArka MitraBelum ada peringkat

- Analysis of InterGen and the 440MW Quezon Power Project in the PhilippinesDokumen4 halamanAnalysis of InterGen and the 440MW Quezon Power Project in the PhilippinesgregsteinbrennerBelum ada peringkat

- Excel Spreadsheet Sampa VideoDokumen5 halamanExcel Spreadsheet Sampa VideoFaith AllenBelum ada peringkat

- Linear Technology Case - Ashmita SrivastavaDokumen4 halamanLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Petrozuata Questions - SPR - 2015Dokumen1 halamanPetrozuata Questions - SPR - 2015daweizhang100% (1)

- Risks Petrolera Zuata Petrozuata CaDokumen9 halamanRisks Petrolera Zuata Petrozuata CahdvdfhiaBelum ada peringkat

- Case 5Dokumen15 halamanCase 5Qiao LengBelum ada peringkat

- Asian Construction Dispute Denied ReviewDokumen2 halamanAsian Construction Dispute Denied ReviewJay jogs100% (2)

- Group PetrozuataDokumen5 halamanGroup PetrozuataBiranchi Prasad SahooBelum ada peringkat

- Petrolera Zueta, Petrozuata CDokumen6 halamanPetrolera Zueta, Petrozuata CAnkur SinhaBelum ada peringkat

- Sampa VideoDokumen2 halamanSampa VideoAadith RamanBelum ada peringkat

- MegaPower Project Memo VfinalDokumen5 halamanMegaPower Project Memo VfinalSandra Sayarath AndersonBelum ada peringkat

- 25th June - Sampa VideoDokumen6 halaman25th June - Sampa VideoAmol MahajanBelum ada peringkat

- Wm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of CapitalDokumen14 halamanWm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of Capitalsotki4100% (1)

- TN20 Diamond Chemicals PLC A and BDokumen39 halamanTN20 Diamond Chemicals PLC A and Bsimoon1100% (5)

- Group 3-Case 1Dokumen3 halamanGroup 3-Case 1Yuki Chen100% (1)

- Updated Stone Container PaperDokumen6 halamanUpdated Stone Container Paperonetime699100% (1)

- Case 45 Jetblue ValuationDokumen12 halamanCase 45 Jetblue Valuationshawnybiha100% (1)

- Restructuring Bulong Debt - 3Dokumen7 halamanRestructuring Bulong Debt - 3Kumar Abhishek100% (1)

- Diamond Chemicals Case Study11 - FinalDokumen20 halamanDiamond Chemicals Case Study11 - FinalJoao0% (1)

- Caso TeuerDokumen46 halamanCaso Teuerjoaquin bullBelum ada peringkat

- M - R T R: Ining Elated AX EvenuesDokumen14 halamanM - R T R: Ining Elated AX EvenuesGregorius Aryoko GautamaBelum ada peringkat

- Property and Title 2022 Mid-Year Industry ReportDokumen11 halamanProperty and Title 2022 Mid-Year Industry ReportDaniela TunaruBelum ada peringkat

- Group4 - CF - Dividend PolicyDokumen10 halamanGroup4 - CF - Dividend PolicyAKSHAYKUMAR SHARMABelum ada peringkat

- Periodo Años Volumen de GAS (MMPCD) Ingreso Total (MM$US) Precio Transporte de Gas ($US/MPC) Volumen de GAS (Mmmpca)Dokumen9 halamanPeriodo Años Volumen de GAS (MMPCD) Ingreso Total (MM$US) Precio Transporte de Gas ($US/MPC) Volumen de GAS (Mmmpca)Omar Amelex Cari RosalesBelum ada peringkat

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Dokumen85 halamanCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21SuZan TimilsinaBelum ada peringkat

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Dokumen85 halamanCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireBelum ada peringkat

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Dokumen85 halamanCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireBelum ada peringkat

- Hospital Management System: Presented by GroupDokumen29 halamanHospital Management System: Presented by GroupsamdhathriBelum ada peringkat

- Hospital Management System DatabaseDokumen18 halamanHospital Management System DatabasesamdhathriBelum ada peringkat

- Talentacquisition2013 TR AberdeenDokumen24 halamanTalentacquisition2013 TR AberdeensamdhathriBelum ada peringkat

- Business StrategyDokumen3 halamanBusiness StrategysamdhathriBelum ada peringkat

- Evaluation of Abnormal Placenta Invasion Using Ultrasound, Doppler and MRIDokumen19 halamanEvaluation of Abnormal Placenta Invasion Using Ultrasound, Doppler and MRIsamdhathriBelum ada peringkat

- MCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012Dokumen6 halamanMCS Assignment 2: D. Srirama Samdhathri 2013PGPUAE012samdhathriBelum ada peringkat

- The Structure of The Equity Research ReportDokumen5 halamanThe Structure of The Equity Research ReportPrateek SharmaBelum ada peringkat

- 4 Shephali Mathur 2757 Research Article VSRDIJBMR November 2013Dokumen6 halaman4 Shephali Mathur 2757 Research Article VSRDIJBMR November 2013samdhathriBelum ada peringkat

- DOI Plenary A123 NorrisDokumen9 halamanDOI Plenary A123 NorrissamdhathriBelum ada peringkat

- Cash Flow ModelDokumen6 halamanCash Flow ModelniroBelum ada peringkat

- Recruitmentstaffingindustry 130730074431 Phpapp01Dokumen14 halamanRecruitmentstaffingindustry 130730074431 Phpapp01samdhathriBelum ada peringkat

- Globalrecruitmentmarket 2013edition 131224043010 Phpapp02Dokumen10 halamanGlobalrecruitmentmarket 2013edition 131224043010 Phpapp02samdhathriBelum ada peringkat

- List of Bank Chairmen and MDsDokumen4 halamanList of Bank Chairmen and MDsManoj MoharanaBelum ada peringkat

- 4503 - Atharv 2014 Sponsorship Brochure, IPM, IIM IndoreDokumen27 halaman4503 - Atharv 2014 Sponsorship Brochure, IPM, IIM IndoresamdhathriBelum ada peringkat

- Performance Appraisal in Axis Bank PDFDokumen3 halamanPerformance Appraisal in Axis Bank PDFsiamshrijiBelum ada peringkat

- Collections PaperDokumen28 halamanCollections PapersamdhathriBelum ada peringkat

- School FundraisingDokumen70 halamanSchool FundraisingsamdhathriBelum ada peringkat

- Success Story Corporation BankDokumen4 halamanSuccess Story Corporation BanksamdhathriBelum ada peringkat

- CH 01 IMDokumen23 halamanCH 01 IMsamdhathriBelum ada peringkat

- Accenture Has A Relatively Flat Organizational StructureDokumen1 halamanAccenture Has A Relatively Flat Organizational StructuresamdhathriBelum ada peringkat

- Sectors AccentureDokumen1 halamanSectors AccenturesamdhathriBelum ada peringkat

- Event PPT Round1Dokumen4 halamanEvent PPT Round1samdhathriBelum ada peringkat

- Glutenfree Market PositioningDokumen3 halamanGlutenfree Market PositioningsamdhathriBelum ada peringkat

- 9780702072987-Book ChapterDokumen2 halaman9780702072987-Book ChaptervisiniBelum ada peringkat

- Shoib CV Scaffold EngineerDokumen3 halamanShoib CV Scaffold EngineerMohd Shoib100% (1)

- Unit 1 2marksDokumen5 halamanUnit 1 2marksLokesh SrmBelum ada peringkat

- MsgSpec v344 PDFDokumen119 halamanMsgSpec v344 PDFqweceBelum ada peringkat

- Debentures Issued Are SecuritiesDokumen8 halamanDebentures Issued Are Securitiesarthimalla priyankaBelum ada peringkat

- NAC Case Study AnalysisDokumen25 halamanNAC Case Study AnalysisSushma chhetriBelum ada peringkat

- Supplier Quality Requirement Form (SSQRF) : Inspection NotificationDokumen1 halamanSupplier Quality Requirement Form (SSQRF) : Inspection Notificationsonnu151Belum ada peringkat

- Usa Easa 145Dokumen31 halamanUsa Easa 145Surya VenkatBelum ada peringkat

- Novirost Sample TeaserDokumen2 halamanNovirost Sample TeaserVlatko KotevskiBelum ada peringkat

- CompactLogix 5480 Controller Sales GuideDokumen2 halamanCompactLogix 5480 Controller Sales GuideMora ArthaBelum ada peringkat

- Learning HotMetal Pro 6 - 132Dokumen332 halamanLearning HotMetal Pro 6 - 132Viên Tâm LangBelum ada peringkat

- Photoshop Tools and Toolbar OverviewDokumen11 halamanPhotoshop Tools and Toolbar OverviewMcheaven NojramBelum ada peringkat

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFDokumen23 halamanPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangBelum ada peringkat

- Database Chapter 11 MCQs and True/FalseDokumen2 halamanDatabase Chapter 11 MCQs and True/FalseGauravBelum ada peringkat

- Project The Ant Ranch Ponzi Scheme JDDokumen7 halamanProject The Ant Ranch Ponzi Scheme JDmorraz360Belum ada peringkat

- Model S-20 High Performance Pressure Transmitter For General Industrial ApplicationsDokumen15 halamanModel S-20 High Performance Pressure Transmitter For General Industrial ApplicationsIndra PutraBelum ada peringkat

- Milton Hershey's Sweet StoryDokumen10 halamanMilton Hershey's Sweet Storysharlene sandovalBelum ada peringkat

- Analyze Oil Wear DebrisDokumen2 halamanAnalyze Oil Wear Debristhoma111sBelum ada peringkat

- Mini Ice Plant Design GuideDokumen4 halamanMini Ice Plant Design GuideDidy RobotIncorporatedBelum ada peringkat

- "60 Tips On Object Oriented Programming" BrochureDokumen1 halaman"60 Tips On Object Oriented Programming" BrochuresgganeshBelum ada peringkat

- Royalty-Free License AgreementDokumen4 halamanRoyalty-Free License AgreementListia TriasBelum ada peringkat

- As 1769-1975 Welded Stainless Steel Tubes For Plumbing ApplicationsDokumen6 halamanAs 1769-1975 Welded Stainless Steel Tubes For Plumbing ApplicationsSAI Global - APACBelum ada peringkat

- High Altitude Compensator Manual 10-2011Dokumen4 halamanHigh Altitude Compensator Manual 10-2011Adem NuriyeBelum ada peringkat