Schauer 2013 Tax Return

Diunggah oleh

Detroit Free PressHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Schauer 2013 Tax Return

Diunggah oleh

Detroit Free PressHak Cipta:

Format Tersedia

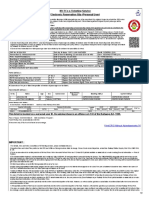

F

o

r

m

1040

Department of the TreasuryInternal Revenue Service

OMB No. 1545-0074

(99)

IRS Use OnlyDo not write or staple in this space. U.S. Individual Income Tax Return

2013

For the year Jan. 1Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions.

Your first name and initial Last name Your social security number

If a joint return, spouses first name and initial Last name Spouses social security number

Make sure the SSN(s) above

and on line 6c are correct.

Home address (number and street). If you have a P.O. box, see instructions. Apt. no.

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Foreign country name Foreign province/state/county Foreign postal code

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

a box below will not change your tax or

refund.

You Spouse

Filing Status

Check only one

box.

1 Single

2 Married filing jointly (even if only one had income)

3 Married filing separately. Enter spouses SSN above

and full name here.

4 Head of household (with qualifying person). (See instructions.) If

the qualifying person is a child but not your dependent, enter this

childs name here.

5 Qualifying widow(er) with dependent child

Exemptions

6a Yourself. If someone can claim you as a dependent, do not check box 6a . . . . .

b Spouse . . . . . . . . . . . . . . . . . . . . . . . .

}

c Dependents:

(1) First name Last name

(2) Dependents

social security number

(3) Dependents

relationship to you

(4) if child under age 17

qualifying for child tax credit

(see instructions)

If more than four

dependents, see

instructions and

check here

d Total number of exemptions claimed . . . . . . . . . . . . . . . . .

Boxes checked

on 6a and 6b

No. of children

on 6c who:

lived with you

did not live with

you due to divorce

or separation

(see instructions)

Dependents on 6c

not entered above

Add numbers on

lines above

Income

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

7 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . 7

8a Taxable interest. Attach Schedule B if required . . . . . . . . . . . . 8a

b Tax-exempt interest. Do not include on line 8a . . . 8b

9 a Ordinary dividends. Attach Schedule B if required . . . . . . . . . . . 9a

b Qualified dividends . . . . . . . . . . . 9b

10 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . 10

11 Alimony received . . . . . . . . . . . . . . . . . . . . . 11

12 Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . 12

13 Capital gain or (loss). Attach Schedule D if required. If not required, check here

13

14 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . 14

15 a IRA distributions . 15a b Taxable amount . . . 15b

16 a Pensions and annuities 16a b Taxable amount . . . 16b

17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17

18 Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . 18

19 Unemployment compensation . . . . . . . . . . . . . . . . . 19

20 a Social security benefits 20a b Taxable amount . . . 20b

21 Other income. List type and amount 21

22 Combine the amounts in the far right column for lines 7 through 21. This is your total income

22

Adjusted

Gross

Income

23 Educator expenses . . . . . . . . . . 23

24 Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ 24

25 Health savings account deduction. Attach Form 8889 . 25

26 Moving expenses. Attach Form 3903 . . . . . . 26

27 Deductible part of self-employment tax. Attach Schedule SE . 27

28 Self-employed SEP, SIMPLE, and qualified plans . . 28

29 Self-employed health insurance deduction . . . . 29

30 Penalty on early withdrawal of savings . . . . . . 30

31 a Alimony paid b Recipients SSN

31a

32 IRA deduction . . . . . . . . . . . . . 32

33 Student loan interest deduction . . . . . . . . 33

34 Tuition and fees. Attach Form 8917 . . . . . . . 34

35 Domestic production activities deduction. Attach Form 8903 35

36 Add lines 23 through 35 . . . . . . . . . . . . . . . . . . . 36

37 Subtract line 36 from line 22. This is your adjusted gross income . . . . .

37

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (2013)

-34,224.

6,360.

934.

16.

Schauer 383-62-7407

113,925.

Schauer 381-72-1395

1795 Hamilton Road

ROLLOVER

2

2

9,380. 0.

203,726.

26,201.

7,294.

313,456.

306,162.

1,062. 62.

3,750. Non-employee compensation from 1099-Misc

STMT

Mark H

Christine A

Battle Creek MI 49017

BAA

REV 03/03/14 TTW

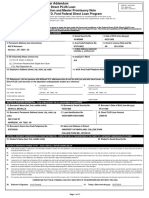

Form 1040 (2013) Page 2

Tax and

Credits

38 Amount from line 37 (adjusted gross income) . . . . . . . . . . . . . . 38

39a Check

if:

{

You were born before January 2, 1949, Blind.

Spouse was born before January 2, 1949, Blind.

}

Total boxes

checked

39a

b If your spouse itemizes on a separate return or you were a dual-status alien, check here

39b Standard

Deduction

for

People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$6,100

Married filing

jointly or

Qualifying

widow(er),

$12,200

Head of

household,

$8,950

40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) . . 40

41 Subtract line 40 from line 38 . . . . . . . . . . . . . . . . . . . 41

42 Exemptions. If line 38 is $150,000 or less, multiply $3,900 by the number on line 6d. Otherwise, see instructions 42

43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . . 43

44 Tax (see instructions). Check if any from: a Form(s) 8814 b Form 4972 c 44

45 Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . 45

46 Add lines 44 and 45 . . . . . . . . . . . . . . . . . . . . .

46

47 Foreign tax credit. Attach Form 1116 if required . . . . 47

48 Credit for child and dependent care expenses. Attach Form 2441 48

49 Education credits from Form 8863, line 19 . . . . . 49

50 Retirement savings contributions credit. Attach Form 8880 50

51 Child tax credit. Attach Schedule 8812, if required. . . 51

52 Residential energy credits. Attach Form 5695 . . . . 52

53 Other credits from Form: a 3800 b 8801 c 53

54 Add lines 47 through 53. These are your total credits . . . . . . . . . . . . 54

55 Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- . . . . . .

55

Other

Taxes

56 Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . 56

57 Unreported social security and Medicare tax from Form: a 4137 b 8919 . . 57

58 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required . . 58

59a 59a

b 59b

Household employment taxes from Schedule H . . . . . . . . . . . . . .

First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . .

60 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) 60

61 Add lines 55 through 60. This is your total tax . . . . . . . . . . . . .

61

Payments

62 Federal income tax withheld from Forms W-2 and 1099 . . 62

63 2013 estimated tax payments and amount applied from 2012 return 63

If you have a

qualifying

child, attach

Schedule EIC.

64a Earned income credit (EIC) . . . . . . . . . . 64a

b Nontaxable combat pay election 64b

65 Additional child tax credit. Attach Schedule 8812 . . . . . 65

66 American opportunity credit from Form 8863, line 8 . . . . 66

67 Reserved . . . . . . . . . . . . . . . . 67

68 Amount paid with request for extension to file . . . . . 68

69 Excess social security and tier 1 RRTA tax withheld . . . . 69

70 Credit for federal tax on fuels. Attach Form 4136 . . . . 70

71 Credits from Form: a 2439 b Reserved c 8885 d 71

72 Add lines 62, 63, 64a, and 65 through 71. These are your total payments . . . . .

72

Refund

Direct deposit?

See

instructions.

73 If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid 73

74a Amount of line 73 you want refunded to you. If Form 8888 is attached, check here .

74a

b Routing number

c Type: Checking Savings

d Account number

75 Amount of line 73 you want applied to your 2014 estimated tax

75

Amount

You Owe

76 Amount you owe. Subtract line 72 from line 61. For details on how to pay, see instructions

76

77 Estimated tax penalty (see instructions) . . . . . . . 77

Third Party

Designee

Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete below. No

Designees

name

Phone

no.

Personal identification

number (PIN)

Sign

Here

Joint return? See

instructions.

Keep a copy for

your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature Date Your occupation Daytime phone number

Spouses signature. If a joint return, both must sign.

Date Spouses occupation If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

Paid

Preparer

Use Only

Print/Type preparers name Preparers signature Date

Check if

self-employed

PTIN

Firms name

Firms address

Firm's EIN

Phone no.

Form 1040 (2013)

Self-Prepared

County Treasurer

Business Development (269)963-6810

306,162.

14,071.

65,638.

7,332.

12,719.

25,737.

280,425.

273,093.

61,717.

1,377.

62,435.

62,435.

76,531.

718.

6.

10,899.

X X X X X X X X X X X X X X X X X

51,567.

X X X X X X X X X

REV 03/03/14 TTW

SCHEDULE A

(Form 1040)

Department of the Treasury

Internal Revenue Service (99)

Itemized Deductions

Information about Schedule A and its separate instructions is at www.irs.gov/schedulea.

Attach to Form 1040.

OMB No. 1545-0074

2013

Attachment

Sequence No. 07

Name(s) shown on Form 1040 Your social security number

Medical

and

Dental

Expenses

Caution. Do not include expenses reimbursed or paid by others.

1 Medical and dental expenses (see instructions) . . . . . 1

2 Enter amount from Form 1040, line 38 2

3

Multiply line 2 by 10% (.10). But if either you or your spouse was

born before January 2, 1949, multiply line 2 by 7.5% (.075) instead 3

4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . . . . . . . 4

Taxes You

Paid

5 State and local (check only one box):

a Income taxes, or

b General sales taxes

}

. . . . . . . . . . . 5

6 Real estate taxes (see instructions) . . . . . . . . . 6

7 Personal property taxes . . . . . . . . . . . . . 7

8 Other taxes. List type and amount

8

9 Add lines 5 through 8 . . . . . . . . . . . . . . . . . . . . . . 9

Interest

You Paid

Note.

Your mortgage

interest

deduction may

be limited (see

instructions).

10 Home mortgage interest and points reported to you on Form 1098 10

11

Home mortgage interest not reported to you on Form 1098. If paid

to the person from whom you bought the home, see instructions

and show that persons name, identifying no., and address

11

12

Points not reported to you on Form 1098. See instructions for

special rules . . . . . . . . . . . . . . . . . 12

13 Mortgage insurance premiums (see instructions) . . . . . 13

14 Investment interest. Attach Form 4952 if required. (See instructions.) 14

15 Add lines 10 through 14 . . . . . . . . . . . . . . . . . . . . . 15

Gifts to

Charity

If you made a

gift and got a

benefit for it,

see instructions.

16

Gifts by cash or check. If you made any gift of $250 or more,

see instructions . . . . . . . . . . . . . . . . 16

17

Other than by cash or check. If any gift of $250 or more, see

instructions. You must attach Form 8283 if over $500 . . . 17

18 Carryover from prior year . . . . . . . . . . . . 18

19 Add lines 16 through 18 . . . . . . . . . . . . . . . . . . . . . 19

Casualty and

Theft Losses 20 Casualty or theft loss(es). Attach Form 4684. (See instructions.) . . . . . . . . 20

Job Expenses

and Certain

Miscellaneous

Deductions

21

Unreimbursed employee expensesjob travel, union dues,

job education, etc. Attach Form 2106 or 2106-EZ if required.

(See instructions.)

21

22 Tax preparation fees . . . . . . . . . . . . . 22

23

Other expensesinvestment, safe deposit box, etc. List type

and amount

23

24 Add lines 21 through 23 . . . . . . . . . . . . 24

25 Enter amount from Form 1040, line 38 25

26 Multiply line 25 by 2% (.02) . . . . . . . . . . . 26

27 Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . . . . . . 27

Other

Miscellaneous

Deductions

28 Otherfrom list in instructions. List type and amount

28

Total

Itemized

Deductions

29

Is Form 1040, line 38, over $150,000?

29

No. Your deduction is not limited. Add the amounts in the far right column

for lines 4 through 28. Also, enter this amount on Form 1040, line 40.

}

. .

Yes. Your deduction may be limited. See the Itemized Deductions

Worksheet in the instructions to figure the amount to enter.

30

If you elect to itemize deductions even though they are less than your standard

deduction, check here . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see Form 1040 instructions. Schedule A (Form 1040) 2013

104.

289.

Mark H & Christine A Schauer 381-72-1395

3,416.

206.

9,850.

13,555.

310.

306,162.

6,123.

0.

7,384.

965.

4,018.

4,983.

25,737.

7,384.

Deductible expenses from Form 2106

BAA

REV 03/03/14 TTW

Anda mungkin juga menyukai

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDari EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeBelum ada peringkat

- Santos Return PDFDokumen14 halamanSantos Return PDFMark Long75% (4)

- Form 1040A Tax Credit DetailsDokumen3 halamanForm 1040A Tax Credit DetailsYosbanyBelum ada peringkat

- 1040 Tax Form SummaryDokumen2 halaman1040 Tax Form SummaryKevin RowanBelum ada peringkat

- 2015 TaxReturn GregAbbottDokumen14 halaman2015 TaxReturn GregAbbottDana ThompsonBelum ada peringkat

- FTF1301242185129Dokumen3 halamanFTF1301242185129Donna SchatzBelum ada peringkat

- 2014 Form 1040 Individual Income Tax ReturnDokumen9 halaman2014 Form 1040 Individual Income Tax ReturnKuan ChenBelum ada peringkat

- F 1040Dokumen2 halamanF 1040Sue BosleyBelum ada peringkat

- Jeff Bell 2012 Tax ReturnDokumen71 halamanJeff Bell 2012 Tax ReturnRaylene_Belum ada peringkat

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Dokumen21 halamanSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- Income Tax Return For Single and Joint Filers With No DependentsDokumen3 halamanIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンBelum ada peringkat

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyBelum ada peringkat

- SC Tax ReturnDokumen12 halamanSC Tax ReturnCeleste KatzBelum ada peringkat

- Income Tax Return - MHSO - 2022-23Dokumen5 halamanIncome Tax Return - MHSO - 2022-23Mahbub SiddiqueBelum ada peringkat

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyBelum ada peringkat

- Tax Sentry Organizer 2016 PDFDokumen9 halamanTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20YBelum ada peringkat

- Marylynn Huggins - Clifden Ut State Tax Return 2013Dokumen4 halamanMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- Income Tax and Benefit ReturnDokumen8 halamanIncome Tax and Benefit Returnapi-457375876Belum ada peringkat

- 2011 Federal 1040Dokumen2 halaman2011 Federal 1040Swati SarangBelum ada peringkat

- StatementDokumen2 halamanStatementLuis HarrisonBelum ada peringkat

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDokumen6 halamanElectronic Filing Instructions For Your 2019 Federal Tax ReturnSindy Cruz100% (1)

- NYS - EWF BENEFITS - 2021 BY Grammaster00Dokumen27 halamanNYS - EWF BENEFITS - 2021 BY Grammaster00Richard GriffinBelum ada peringkat

- 15 1 03 003887Dokumen1 halaman15 1 03 003887Aryan ChaudharyBelum ada peringkat

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Dokumen8 halamanJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- File 1040 U.S. Individual Income Tax ReturnDokumen2 halamanFile 1040 U.S. Individual Income Tax Returnmarcel100% (1)

- U.S. Individual Income Tax Return: Filing StatusDokumen2 halamanU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Elina Shinkar w2 2014Dokumen2 halamanElina Shinkar w2 2014api-318948819Belum ada peringkat

- US Internal Revenue Service: f1040nr - 2004Dokumen5 halamanUS Internal Revenue Service: f1040nr - 2004IRSBelum ada peringkat

- FTF1299519215531Dokumen3 halamanFTF1299519215531Leslie Washington100% (1)

- OutputDokumen6 halamanOutputSylvia MorenoBelum ada peringkat

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Dokumen2 halamanFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- Beginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Dokumen34 halamanBeginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Nancy GuerraBelum ada peringkat

- Tax ReturnDokumen4 halamanTax ReturncykablyatBelum ada peringkat

- LifeDokumen11 halamanLifejasBelum ada peringkat

- Unknown PDFDokumen4 halamanUnknown PDFomar hernandezBelum ada peringkat

- 2020 Tax Return Documents (DERICK BROOKS A)Dokumen2 halaman2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- Federal Electronic Filing Instructions: Tax Year 2018Dokumen13 halamanFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielBelum ada peringkat

- File 2011 NM Income Tax ReturnDokumen3 halamanFile 2011 NM Income Tax ReturnPedro ChapaBelum ada peringkat

- Selection-26 - 55 PDFDokumen1 halamanSelection-26 - 55 PDFAnonymous fu1jUQBelum ada peringkat

- 26 Jan 2020 ReturnDokumen2 halaman26 Jan 2020 Returnsandeep0% (1)

- TaxDokumen3 halamanTaxJames Bleeker100% (1)

- 2016 Tax ReturnDokumen19 halaman2016 Tax ReturnPatrick Svitek100% (1)

- SFR Investments: Rental ApplicationDokumen6 halamanSFR Investments: Rental ApplicationgigiBelum ada peringkat

- 2008 Form 1040 Tax ReturnDokumen5 halaman2008 Form 1040 Tax ReturnJackie Page100% (2)

- TAF DocumentsDokumen80 halamanTAF DocumentsreutersdotcomBelum ada peringkat

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDokumen20 halaman2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlBelum ada peringkat

- PDF W2Dokumen1 halamanPDF W2John LittlefairBelum ada peringkat

- Cicortflorina 8879Dokumen2 halamanCicortflorina 8879Florin Cicort100% (3)

- Langford Market Corp Form W-2Dokumen4 halamanLangford Market Corp Form W-2sohcuteBelum ada peringkat

- Georgia Individual Income Tax Guide 2019Dokumen52 halamanGeorgia Individual Income Tax Guide 2019vinayak ShedgeBelum ada peringkat

- 2019 TaxreturnDokumen6 halaman2019 TaxreturnMARC ANDREWS WOLFFBelum ada peringkat

- fw4 2020Dokumen4 halamanfw4 2020Hunter TateBelum ada peringkat

- (X) U.S. Citizen or National (2) Permanent Resident/Other Eligible Non-Citizen If (2), Alien Registration NoDokumen11 halaman(X) U.S. Citizen or National (2) Permanent Resident/Other Eligible Non-Citizen If (2), Alien Registration Nomdewald01Belum ada peringkat

- Credit OneDokumen2 halamanCredit OneS100% (1)

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Dokumen1 halamanOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonBelum ada peringkat

- 6) CaliforniaALL 2008 Tax ReturnDokumen21 halaman6) CaliforniaALL 2008 Tax ReturnCaliforniaALLExposedBelum ada peringkat

- Monica L Lindo Tax FormDokumen2 halamanMonica L Lindo Tax Formapi-299234513Belum ada peringkat

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsDari EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsBelum ada peringkat

- Evaluation of Some SMS Verification Services and Virtual Credit Cards Services for Online Accounts VerificationsDari EverandEvaluation of Some SMS Verification Services and Virtual Credit Cards Services for Online Accounts VerificationsPenilaian: 5 dari 5 bintang5/5 (1)

- Oxford LawsuitDokumen46 halamanOxford LawsuitDetroit Free Press100% (2)

- Trump GHG CAFE Letter June 6 2019 PDFDokumen2 halamanTrump GHG CAFE Letter June 6 2019 PDFDetroit Free PressBelum ada peringkat

- DLA Piper Executive Contract 2-13-18Dokumen9 halamanDLA Piper Executive Contract 2-13-18Detroit Free PressBelum ada peringkat

- Village of Grosse Pointe Shores Zoning MapDokumen1 halamanVillage of Grosse Pointe Shores Zoning MapDetroit Free PressBelum ada peringkat

- Auto Related ProductsDokumen8 halamanAuto Related ProductsDetroit Free PressBelum ada peringkat

- AFT-Michigan-Project Veritas Lawsuit RulingDokumen27 halamanAFT-Michigan-Project Veritas Lawsuit RulingDetroit Free PressBelum ada peringkat

- Michigan Supreme Court Guns SchoolsDokumen60 halamanMichigan Supreme Court Guns SchoolsDetroit Free PressBelum ada peringkat

- Michigan Central Station Screening WaiverDokumen1 halamanMichigan Central Station Screening WaiverDetroit Free PressBelum ada peringkat

- Auto Related ProductsDokumen8 halamanAuto Related ProductsDetroit Free PressBelum ada peringkat

- Opinion - Gary B Vs Richard Snyder 16-13292Dokumen40 halamanOpinion - Gary B Vs Richard Snyder 16-13292Detroit Free Press100% (1)

- Detroit Public Schools Community DistrictDokumen8 halamanDetroit Public Schools Community DistrictDetroit Free PressBelum ada peringkat

- DLA Piper Congressional Contract 2-13-18Dokumen9 halamanDLA Piper Congressional Contract 2-13-18Detroit Free PressBelum ada peringkat

- DPSCD Lawsuit BrownDokumen28 halamanDPSCD Lawsuit BrownDetroit Free PressBelum ada peringkat

- Kithier V MHSAADokumen13 halamanKithier V MHSAADetroit Free PressBelum ada peringkat

- Ford Truck TimelineDokumen1 halamanFord Truck TimelineDetroit Free PressBelum ada peringkat

- Letter To Gillam Regarding Noise OrdinanceDokumen1 halamanLetter To Gillam Regarding Noise OrdinanceDetroit Free PressBelum ada peringkat

- Taylor International Academy Statement Friday June 2Dokumen2 halamanTaylor International Academy Statement Friday June 2Detroit Free PressBelum ada peringkat

- August Royal Oak Noise Ordinance AwardDokumen1 halamanAugust Royal Oak Noise Ordinance AwardDetroit Free PressBelum ada peringkat

- Renaissance School Services StatementDokumen1 halamanRenaissance School Services StatementDetroit Free PressBelum ada peringkat

- Road Resurfacing Project: District 1Dokumen1 halamanRoad Resurfacing Project: District 1Detroit Free PressBelum ada peringkat

- Letter Regarding Redistricting in MichiganDokumen3 halamanLetter Regarding Redistricting in MichiganDetroit Free PressBelum ada peringkat

- Statement From Mike MorseDokumen1 halamanStatement From Mike MorseDetroit Free PressBelum ada peringkat

- Gov. Snyder's Letter To Sen. Debbie StabenowDokumen2 halamanGov. Snyder's Letter To Sen. Debbie StabenowDetroit Free PressBelum ada peringkat

- All About The QLINEDokumen1 halamanAll About The QLINEDetroit Free PressBelum ada peringkat

- 2017-03-31 MDE and MDCR Joint LetterDokumen2 halaman2017-03-31 MDE and MDCR Joint LetterDetroit Free PressBelum ada peringkat

- Gov. Snyder Letter To Sen. Stabenow Re: AHCADokumen2 halamanGov. Snyder Letter To Sen. Stabenow Re: AHCADetroit Free PressBelum ada peringkat

- Court Documents: FBI Translator Married ISIS LeaderDokumen9 halamanCourt Documents: FBI Translator Married ISIS LeaderDetroit Free PressBelum ada peringkat

- Monica Conyers MemoDokumen1 halamanMonica Conyers MemoDetroit Free PressBelum ada peringkat

- Private School Funding LawsuitDokumen32 halamanPrivate School Funding LawsuitDetroit Free PressBelum ada peringkat

- Gov. Snyder Letter To Rep. Walberg Re: AHCADokumen2 halamanGov. Snyder Letter To Rep. Walberg Re: AHCADetroit Free PressBelum ada peringkat

- Full Text Tax First Set Lifeblood TheoryDokumen18 halamanFull Text Tax First Set Lifeblood TheorySu Kings AbetoBelum ada peringkat

- Application FormDokumen3 halamanApplication Formfrancismagno14Belum ada peringkat

- Basic Principles of TaxationDokumen11 halamanBasic Principles of Taxation在于在Belum ada peringkat

- PathToFreedom PDFDokumen384 halamanPathToFreedom PDFcusip1100% (3)

- W-8 Attachment: Citizenship, Form #04.219Dokumen50 halamanW-8 Attachment: Citizenship, Form #04.219Sovereignty Education and Defense Ministry (SEDM)Belum ada peringkat

- SC rules Arnoldus Carpentry is a manufacturerDokumen2 halamanSC rules Arnoldus Carpentry is a manufacturerPalangkikay WebBelum ada peringkat

- Audit of Allocations to LGUsDokumen7 halamanAudit of Allocations to LGUsRhuejane Gay MaquilingBelum ada peringkat

- Notes in Organization and Functions of The BirDokumen5 halamanNotes in Organization and Functions of The BirNinaBelum ada peringkat

- Aban Taxation Chapters 1-4Dokumen90 halamanAban Taxation Chapters 1-4Jana marie100% (1)

- CIR vs. Pilipinas ShellDokumen20 halamanCIR vs. Pilipinas ShellKP Gonzales CabauatanBelum ada peringkat

- Best EIN Verification Letter 05 - BackupDokumen2 halamanBest EIN Verification Letter 05 - BackupYooo100% (1)

- 2014 2015 Annual Registration Renewal Form RRF 1Dokumen2 halaman2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetBelum ada peringkat

- RR 1-99Dokumen7 halamanRR 1-99matinikkiBelum ada peringkat

- October 2014Dokumen108 halamanOctober 2014ICCFA StaffBelum ada peringkat

- 142 150Dokumen7 halaman142 150NikkandraBelum ada peringkat

- Starting a New Dental Practice ChecklistDokumen4 halamanStarting a New Dental Practice ChecklistAbdelrahman GalalBelum ada peringkat

- Waterfront v. CIRDokumen18 halamanWaterfront v. CIRaudreydql5Belum ada peringkat

- Ty Warner Filing Ahead of Sentencing On Tax Evasion ConvictionDokumen41 halamanTy Warner Filing Ahead of Sentencing On Tax Evasion ConvictionChicago Tribune100% (1)

- Freedom Path V IRSDokumen58 halamanFreedom Path V IRSRobert Wilonsky100% (1)

- Umali Vs Estanislao G.R. No. 104037 Facts:: IssuesDokumen2 halamanUmali Vs Estanislao G.R. No. 104037 Facts:: IssuesVal Sanchez100% (1)

- PANSACOLA VS COMMISSIONER ON 1997 TAX EXEMPTIONSDokumen1 halamanPANSACOLA VS COMMISSIONER ON 1997 TAX EXEMPTIONSLoury Luzadio100% (1)

- Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 G.R. No. 195909 September 26 2012Dokumen14 halamanCommissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 G.R. No. 195909 September 26 2012Roland ApareceBelum ada peringkat

- Deutsche Bank AG Manila V CIRDokumen7 halamanDeutsche Bank AG Manila V CIRNicoleMagadiaBelum ada peringkat

- Anie - Tax ReviewDokumen28 halamanAnie - Tax ReviewAnie Guiling-Hadji GaffarBelum ada peringkat

- Tax II CasesDokumen226 halamanTax II CasesMarkAnthonyAlonzoTorresBelum ada peringkat

- BOTTI James Redacted IndictmentDokumen14 halamanBOTTI James Redacted IndictmentThe Valley IndyBelum ada peringkat

- US Internal Revenue Service: p1582Dokumen27 halamanUS Internal Revenue Service: p1582IRS100% (9)

- Philacor Credit Corporation V. Commissioner of Internal RevenueDokumen10 halamanPhilacor Credit Corporation V. Commissioner of Internal RevenueCharity Gene AbuganBelum ada peringkat

- Herrera V Quezon City Board of Assessment (1961) : Bishop of Nueva Segovia vs. Provincial Board of Ilocos NorteDokumen21 halamanHerrera V Quezon City Board of Assessment (1961) : Bishop of Nueva Segovia vs. Provincial Board of Ilocos NorteMique VillanuevaBelum ada peringkat

- IRS Stimulus ChecksDokumen1 halamanIRS Stimulus Checkszaitrimairuv399Belum ada peringkat