History of The Company: Vaibhav Global Limited

Diunggah oleh

gjdflja0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

84 tayangan8 halamankygyu

Judul Asli

Accunts Assi..

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inikygyu

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

84 tayangan8 halamanHistory of The Company: Vaibhav Global Limited

Diunggah oleh

gjdfljakygyu

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 8

1 VAIBHAV GLOBAL LIMITED

HISTORY OF THE COMPANY

Vaibhav Global Limited is an electronic retailer of fashion jewellery and lifestyle accessories

around different parts of the world like U.K, U.S, Canada and Republic of Ireland. VAIBHAV GLOBAL

LIMITED is a listed company registered on 08/05/1989. Its registered office is situated at K-6b,

FatehTiba ,adarsh Nagarjaipur 302 004, , Rajasthan, India. They have access to over 100 million

households in these countries through our own TV Shopping networks - Liquidation Channel in USA and

Canada, The Jewellery Channel in UK and Republic of Ireland. Our TV shopping channels reach

customers directly 24x7 on all the major cable, satellite and DTH platforms Dish TV, DirecTV,

Comcast, Verizon Fios, Time Warner, AT&T, Sky, Virgin, Freeview, and Freesat etc. Our e-commerce

websites in the US www.liquidationchannel.com and UK www.thejewellerychannel.tv complement our

TV coverage, while diversifying customer engagement.

2004-05 VGL ventured into international retail market by setting up its wholly owned subsidiary

Jewel Gem Inc. USA. The company set up retail chain stores at major tourists destinations like

Alaskaand Caribbean under the brand name GenoA Jewelers.

VGL also commissioned diamond-processing unit at Adarsh Nagar, Jaipur for captive consumption in

manufacturing jewellery and exports.

2005-06 Acquisition of a manufacturing facility at Thailand and marketing facilities at USA, UK, Japan,

Hong Kong and Canada Retail Chain stores at Alaska, Caribbean Islands, Mexico, St. Kitts, St. Thomas,

St. Maartin was set up Warburg Pincus Group, one of the leading private equity investors in the world,

invested USD 47 million (Rs. 245 crores) in the company by way of private equity placement.

Moreover, VGL also marketed products on the UK-based Jewellery TV channel (launched in April 2006)

under the brand name of Iliana, FH (For Him) and Kara.

Completion of USD 70 Million GDR issue

2006-07 Set up seven more retail stores at high-end holiday destinations, taking the total count of stores

at holiday destinations to nineteen outlets.

Started twenty four hour online jewellery shopping channels The Jewelry Channel Inc. in USA in

April 2007. Started a 24-hour jewellery TV channel in Germany.

2007-08 Nalanda Capitals India Fund acquired 14.9% share of the company in the form of Global

Depository receipts and an additional 5% stake through warrants. The total transaction size was about

US $25 million.

2008-09 Global turmoil took a toll on the companys financial health. Company took various

restructuring initiatives to counter the ill-effects. The company exited business in German TV retail

market and Caribbean and Alaska B&M Retail Markets. VGL consolidated Gemstone manufacturing

operations in Jaipur.

2 VAIBHAV GLOBAL LIMITED

ABOUT THE COMPANY

In addition to electronic Retailing, VGL Group engages in traditional B2B wholesale distribution through

STS Jewels, serving various retail chains in USA and UK. STS Group with headquarters in Austin, TX

(STS Jewels Inc.) is amongst the better-known organizations in the colour gemstones and jewellery

industry. Tanzanite Jewellery is STS Groups specialty.

Product range of the company includes: VGL is manufacturing studded (both diamonds

and colour stones) yellow as well as white gold jewelry items viz. Rings, Earrings, Pendants and Bracelets,

etc out of divine passion with a touch of Indian tradition. Major Brands of the company are RHAPSODY,

ILIANA, J FRANCIS, ELANZA, KARIS, EON 1962, STRADA AND GENOA.

Fine & Fashion Jewelry- Product catalogue includes: bracelet, bangle, earrings, studded jewelry etc.

Fashion Accessories- Product catalogue includes watches, bags, phone protective shell etc.

Other Lifestyle Products- Product catalogue includes office and home dcor, etc

VGL Group is a professionally managed public limited company listed on BSE and NSE, India. VGL

Group employs progressive HR practices, focused on talent acquisition, engagement and retention,

including employee ownership, performance incentive and reward programs.

Basically, there vision and mission are to be the Value Leader in Electronic Retailing of Jewellery and

Life Style Products.

Mission:

Build a Learning Organisation with High Performing People

Offer Low Priced High Quality Products

Delight Our Customers Every Day.

3 VAIBHAV GLOBAL LIMITED

Management of the company

Basically, the management of the company is distributed in much different top executive management.

As, they have board of directors, core management team, mangers and then workers which are working

under these people. There are 10 boards of directors in the company and 9 members are the top level

executives which hold different section of the company.

Sri Burugapalli

Senior Vice President, Group Strategy

Sri is currently the Group Senior Vice President, Corporate Strategy for VGL Group.

Prior to that Sri served as Managing Director of The Jewellery Channel, UK and President

of The Jewellery Channel, USA, where he was Instrumental for the development and

successful deployment of Corporate Restructure/Turn Around and Rebranding strategies.

Hemant Sultania

Group Chief Financial Officer

Hemant joined VGL in December, 2013 as Group Chief Financial Officer. He is CA, CS

and CWA and having 17 years of rich experience in strategic financial planning, budgeting,

project evaluation, commercial and legal affairs, taxation, fund management, finalization

of accounts, revenue assurance, auditing, MIS development & Merger and acquisition. He

has worked as CFO with Dr. Lal Path labs, Vice President with Bata India Limited and

Senior Tax Manager at Ernst & Young India Private Limited.

Gerald Tempton

President, Liquidation Channel USA

Gerald Tempton joined VGL Group in 2009 as President of Liquidation Channel, USA.

Having over 25 years of Sales & Marketing, Operations, Merchandising, Financial

Services, Commercial Real Estate, and Retail/Consumer Products experience, Tempton

served in key positions with highly regarded multi-national companies such as, Group

Sales Manager for the Gordon Jewelry Corporations Traditional (High End) Division,

Director of Store Operations for Limited Brands, Director of Sales Southern Region for

Gap, Inc.

Colin Wagstaffe

Managing Director, The Jewellery Channel UK

Colin Wagstaffe joined VGL Group in April 2013 as Managing Director of The Jewellery

Channel UK. Previously he was at Signet Jewelers the largest specialty retail jeweler by

sales in the US and UK. As Director of Marketing for the UK division for six years, Colin

lead all aspects of marketing and ecommerce for Signets three retail brands in the UK and

The Republic of Ireland. Prior to that Colin has held a number of leadership marketing

roles in major UK businesses.

Charlie Curnow

Chief Information Officer, Group

Charlie joined VGL Group in October 2013 as Chief Information Officer. During his

career he has served in both the public and private sector, holding leadership positions

with many Fortune 500 companies. As an IT business partner, he has focused on driving

technology strategy to create efficient business processes across organizations with a

penchant for pragmatic innovation. He has a tremendous track record of success with

large-scale deployments allowing for productivity gains and competitive advantage. Most

4 VAIBHAV GLOBAL LIMITED

recently, Charlie was SVP and CIO of Academic Partnerships where he reengineered the

technical foundation on which state universities offered online graduate degree programs

while expanding the companys e-commerce marketing and tracking capabilities of

potential students.

Pushpendra Singh

Vice President, HR Asia

is our Vice President HR and has total 17 years of experience in HR. He was previously

employed with companies like NTPC, Kalptaru and Reliance Communications. He has

successfully implemented many Talent Acquisition, Talent Retention and Talent

Management initiatives in his career. He is now set to structure and streamline various HR

processes of VGL Group to help make it a Vibrant Organization.

Nitin Dugar

Vice President Strategy, Liquidation Channel USA

Nitin is associated with VGL group since 2003. He joined the group at the Bangkok unit

looking after Silver factory operations, moved to Gold unit and finally relocated to USA in

2006. Currently, Working as Vice President of Strategy at Liquidation Channel, he

oversees the companys Key Strategic Projects, New initiatives and Process improvements .

Gaurav Vishal Soni

Chief Operating Officer, VGL

Gaurav joined VGL in 2013 as COO India Operations. He has done his BE in

Instrumentation and Control and is having over 17 plus years of Extensive Experience in

dealing with Automotive giants (like Suzuki, Hero Moto Corp, Yamaha, General Motors,

Honda etc), FMCG Sector (like Hindustan Unilever, Reckitt Benckiser & Colgate

Palmolive) and Power Sector (Like Abb Areva, Crompton Greaves & Helstron).

Praveen Tiwari

Vice President, STS Gems

He is currently heading the China & HKK operations unit of the Group. He is an MBA by

qualification and joined VGL group in 1997; started his career as sales executive with the

group. He has been Instrumental in turning around the group with many initiatives to his

credit. His interests are rowing, hiking and poetry. He is married and has a beautiful

daughter.

5 VAIBHAV GLOBAL LIMITED

COMPETITERS

There is no direct competitor of VGL in India as the company deals in retailing of jewellery through TV

channels, so we have compared VGL with HSN and QVC (Liberty Interactive Corp) of USA which deals

into the same products and function of the business is also same. If we compare VGL with HSN and

QVC, VGL is relatively much smaller in size. VGL trades at a lower PE multiple and EV/EBITDA

compared to HSN and QVC. The plus point which sets VGL apart from HSN and QVC is selling a

product by discounted model through TV channel. VGL is able to control the cost as the company is

backward integrated and sources the raw-material at a very low price and get the material manufactured

in low cost area like India, China, Thailand, etc. This helps the company to lower the average selling

price. VGL like HSN and QVC has extended its product line where it has added other fashion accessories

like scarves, handbags, etc. VGL is available at a PE of 6x FY13E and 4.4x FY14E compared to 21.5x

FY13E and 17.4x FY14E of HSN and 21.1x FY13E and 16.3x QVC. With the ability to grow strong and

focus on the discounted segment where it differentiated with its competitor, we feel that VGL valuation

can also improve.

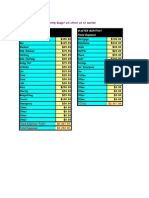

INR Net Sale EBITDA EBITDA% P

A

T

PAT

%

EV/EBIT

DA

EV/Sales ROE PE

COMP

ANIES

FY13

E

FY14

E

FY13

E

FY14

E

FY13

E

FY14

E

FY

13E

FY13

E

FY

13E

FY

14E

FY

13E

FY

14E

FY

13

E

F

Y

14

E

FY

13E

FY

14E

VIABH

AV

GLOBA

L

838.5 1021.

5

87.8 112.6 10.5

%

11.0

%

5.4 0.6% 4.6 3.5 0.5 0.4 23.

7%

26

.6

%

6.0 4.4

HSN 18083

.6

1911

1.0

1778.

0

1920.

1

9.8% 10.0

%

850.

3

4.7% 10.1 9.4 1.0 0.9 26

%

41

%

21.5 17.4

QVC 55959

.8

5889

3.2

6879.

5

7702.

3

12.3

%

13.1

%

318

4.5

5.7% 12.2 10.9 1.50 1.4 9

%

10

%

21.1 16.3

6 VAIBHAV GLOBAL LIMITED

Future Plans of the company

The financial highlights of Vaibhav Global Limited for the year 2013-14. During the year,there

consolidated total revenue grew by 45% to Rs.1298 crores, EBITDA margin (excluding exchange

gain/loss) increased from 9% to 12 % at Rs.157 crores and profit after tax was higher by 95% to Rs. 153

crores. Free cash flow of Rs.160 crores was generated which was used judiciously to grow the business

and rationalize business liabilities. During 2013-14, outstanding debt reduced by Rs.63 crores and

preference shares including dividend thereon of Rs. 46.89 crores were redeemed entirely out of internal

accruals. We expect to further pay down our outstanding debt in the current year to emerge as zero net

debt company. Strong cash generation from the business has allowed us to expand returns on the capital

employed in the business from 34% to 60% over the last year.

Underlying this strong performance is the growing customer engagement with our proprietary television

and e-commerce platforms. They delivered significant value driven by taking a vertically integrated

business model to over 1.3 million customers over the last seven years in the developed markets of the US,

UK, Canada, and Ireland. Our TV business and web business grew by 23% and 90% respectively during

the year in dollar terms. They believe that we have hit the sweet spot on product pricing, creating a

unique customer proposition that has seen retail sales volumes grow by 35% last year and by more than

four times over the last three years. Currently, they ship out over 25,000 unique products every day on an

average to our customers who have been constantly increasing their repeat buying on their sales

platforms.

They continue to make meaningful investments in our transition to the next level of competence and

performance as a global corporation. This includes expansion and improvement in customer offerings,

sales platforms, supply chain mechanisms, physical infrastructure and management resources. Last year,

they introduced 2.4 million new unique products to our collection across fashion jewellery and lifestyle

accessory offerings, closely following market trends. They initiated work on a robust SAP web platform

that will become operational this year. During the year, we expanded our integrated US operations

located in Austin, Texas, to over 65,000 sq. ft. and also moved our UK operations to a new 30,000 sq. ft.

facility in London, which is an integrated operation comprising of warehouse, studio, customer service, IT

and management resources. These facilities will support our growing volumes over the next few years.

Further, we continue to expand our supply chain establishments in India, China, Thailand and Indonesia.

They have also expanded our manufacturing capacity in Jaipur,India to 4 million pieces annually, which

increases our annual aggregate global supply capability to 12 million units.

Following up on the additions to the senior management team last year, they have appointed Pulak

Chandan Prasad, Vikram Kaushik, Mahendra Kumar Doogar and Peter Duncan Whitford to our Board

of Directors and Hemant Sultania as Group CFO. They bring significant experience in management,

finance and operations domains and we look forward to their continuing contribution to our onward

journey of evolution. They also continue to invest in a robust senior and middle management team at both

strategic and operational levels that will help create a strong bandwidth of capability.

They will continue to invest in products, operations, facilities, people development, marketing and

technology to build on our strong execution capabilities and customer experience. They are also

committed to follow the highest standards of corporate governance and organizational integrity, while

consistently creating value for all stakeholders.

7 VAIBHAV GLOBAL LIMITED

SWOT ANAYLSIS OF THE COMPANY

Strengths

The various strengths that the company can capitalise on comprise the following:

International acceptability of the entire product range.

World-class quality.

Global cost competitiveness.

Availability of a wide and well-accepted product range addressing various segments of the retail market.

Synergy leading to end-to-end vertical integration in the product value chain.

Product consistency across batches and time.

Stable supply relationships with corporate customers.

Weaknesses

Relatively small size compared to global standards.

Excessive concentration on USA could affect sustainability.

Exposure to foreign exchange and raw material price fluctuations.

Dependent on the international market for raw material.

Opportunities

The various opportunities that the company expects to capitalise on comprise the following:

Opening of retail stores through wholly-owned subsidiary Jewel Gem USA Inc., the final step towards

total vertical integration and a face-to-face interaction with the customer.

Branding opportunity to unlock vast value, created over decades. .

Starting point of building lasting value

Ever-changing but ever-growing demand.

Worldwide market of 120 bn USD

Threats

The various threats faced by the company comprise the following:

Competition from Indian and international companies.

Indias reputation as a sub-quality supplier.

Probable loss of goodwill and dependability in the event of under-performance.

Variations in customer requirements in terms of quality.

Lower than expected off take from the companys retail outlets.

8 VAIBHAV GLOBAL LIMITED

Anda mungkin juga menyukai

- Time and Motion StudyDokumen20 halamanTime and Motion StudyJayson Pobar100% (2)

- Axial DCF Business Valuation Calculator GuideDokumen4 halamanAxial DCF Business Valuation Calculator GuideUdit AgrawalBelum ada peringkat

- TradeacademyDokumen32 halamanTradeacademyapi-335292143Belum ada peringkat

- Starting and Running a Business All-in-One For DummiesDari EverandStarting and Running a Business All-in-One For DummiesPenilaian: 4 dari 5 bintang4/5 (1)

- Leading Corporate Turnaround: How Leaders Fix Troubled CompaniesDari EverandLeading Corporate Turnaround: How Leaders Fix Troubled CompaniesBelum ada peringkat

- Dan Loeb Sony LetterDokumen4 halamanDan Loeb Sony LetterZerohedge100% (1)

- The Global EconomyDokumen22 halamanThe Global EconomyАнастасия НамолованBelum ada peringkat

- The End of Diversity As We Know It: Why Diversity Efforts Fail and How Leveraging Difference Can SucceedDari EverandThe End of Diversity As We Know It: Why Diversity Efforts Fail and How Leveraging Difference Can SucceedBelum ada peringkat

- Strategic Analysis of Epyllion GroupDokumen33 halamanStrategic Analysis of Epyllion GroupTANVIRHMP007Belum ada peringkat

- A Review On Julie's Manufactring SDN BHD - Chika OgbuehiDokumen8 halamanA Review On Julie's Manufactring SDN BHD - Chika OgbuehiChika100% (1)

- Colgate (Brand Management)Dokumen18 halamanColgate (Brand Management)Abhishek PramanikBelum ada peringkat

- Nestle SWOT AnalysisDokumen3 halamanNestle SWOT AnalysisSirsanath Banerjee100% (1)

- Roland Gareis Happy ProjectsDokumen88 halamanRoland Gareis Happy ProjectsStefana RondakBelum ada peringkat

- Colgate ReportDokumen14 halamanColgate ReportMaulee Desai ChainaniBelum ada peringkat

- Uni Lever.Dokumen20 halamanUni Lever.SyedFaisalHasanShahBelum ada peringkat

- 53242403166Dokumen156 halaman53242403166gopalkpsahuBelum ada peringkat

- The Procter & GambleDokumen2 halamanThe Procter & GambleAteng Cleofe KimBelum ada peringkat

- NYSE: CLDokumen11 halamanNYSE: CLpearsagarwalBelum ada peringkat

- Components of The Capstone Project: New York Institute of TechnologyDokumen27 halamanComponents of The Capstone Project: New York Institute of TechnologyVINIT MEHTABelum ada peringkat

- Etika AR'10Dokumen128 halamanEtika AR'10Hani BerryBelum ada peringkat

- Project on Nepal's largest conglomerate Chaudhary GroupDokumen4 halamanProject on Nepal's largest conglomerate Chaudhary GroupNiraj YtBelum ada peringkat

- Colgate MDApdfDokumen5 halamanColgate MDApdfShreyasBelum ada peringkat

- Gitanjali Gems Annual Report Highlights GrowthDokumen120 halamanGitanjali Gems Annual Report Highlights GrowthHimanshu JainBelum ada peringkat

- Annual Report Cadbury 2006Dokumen196 halamanAnnual Report Cadbury 2006Florian_JeschkeBelum ada peringkat

- Strategic Management NEWWWWWWWWWWWDokumen32 halamanStrategic Management NEWWWWWWWWWWWnadarkavita20Belum ada peringkat

- Corporate Strategy of ColgateDokumen2 halamanCorporate Strategy of ColgateHiteshGamit100% (1)

- New Microsoft Word DocumentDokumen5 halamanNew Microsoft Word DocumentAmardeepKumarBelum ada peringkat

- PMD 2014 Intake Program BrochureDokumen2 halamanPMD 2014 Intake Program BrochureVaibhav GargBelum ada peringkat

- COLGATE COMPANY PROFILEDokumen20 halamanCOLGATE COMPANY PROFILEUdaya ChoudaryBelum ada peringkat

- Colgat Palmolive Company OverviewDokumen9 halamanColgat Palmolive Company OverviewNiravMakwanaBelum ada peringkat

- Marketing Term Report On P&GDokumen26 halamanMarketing Term Report On P&GGhulam MuhammadBelum ada peringkat

- Company Profile: Global Consumer Products Pvt. LTDDokumen13 halamanCompany Profile: Global Consumer Products Pvt. LTDlitzBelum ada peringkat

- Dabur Company A Comprehensive Analysis of Success and Growth StrategiesDokumen11 halamanDabur Company A Comprehensive Analysis of Success and Growth StrategiesMr. animeweedBelum ada peringkat

- Appco Group inDokumen9 halamanAppco Group inmanojsweetyBelum ada peringkat

- F&N 2012 Annual ReportDokumen224 halamanF&N 2012 Annual Reportchow_hoong_3Belum ada peringkat

- A Project Report ON: Maharaja Agrasen University School of ManagementDokumen27 halamanA Project Report ON: Maharaja Agrasen University School of ManagementNiks VermaBelum ada peringkat

- COLGATEDokumen16 halamanCOLGATESherali SoodBelum ada peringkat

- Nestle Audit AnalysisDokumen38 halamanNestle Audit AnalysisAmira Nur Afiqah Agus SalimBelum ada peringkat

- FSA Group Assignment, Group-01Dokumen20 halamanFSA Group Assignment, Group-01Heena MoorpanaBelum ada peringkat

- New Project Report On Coalgate MbaDokumen42 halamanNew Project Report On Coalgate MbaPrints Bindings71% (7)

- Environmental Scanning and Industry Analysis of Splash CorporationDokumen32 halamanEnvironmental Scanning and Industry Analysis of Splash CorporationJayBelum ada peringkat

- Dokumen - Tips Industry Analysis Splash CorpDokumen32 halamanDokumen - Tips Industry Analysis Splash CorpJayBelum ada peringkat

- Project on Dabur AIM2023Dokumen18 halamanProject on Dabur AIM2023Jitu BeheraBelum ada peringkat

- ColgateDokumen40 halamanColgateVinayak Shinde100% (2)

- Colgate Marketing Strategy AnalysisDokumen22 halamanColgate Marketing Strategy AnalysisSohaib ArifBelum ada peringkat

- Strategic ManagementDokumen34 halamanStrategic ManagementAnimalaRamachandran100% (1)

- Marketing Management ProjectDokumen23 halamanMarketing Management ProjectPalash DholekarBelum ada peringkat

- Splash Corporation Background: Early BeginningsDokumen9 halamanSplash Corporation Background: Early BeginningsTelle MarieBelum ada peringkat

- Sip Report On Customer Preferance For Vimal Ice CreamDokumen53 halamanSip Report On Customer Preferance For Vimal Ice CreamSohel Shaikh100% (1)

- Birla Sun MFDokumen3 halamanBirla Sun MFManoranjan ManuBelum ada peringkat

- Brighter Horizons: Godrej Consumer Products LimitedDokumen156 halamanBrighter Horizons: Godrej Consumer Products LimitedKrithika VenkateshBelum ada peringkat

- Anees PK BRMDokumen21 halamanAnees PK BRMShifz 96Belum ada peringkat

- GIL Annual Report 2013 14Dokumen204 halamanGIL Annual Report 2013 14Khyati DhabaliaBelum ada peringkat

- Vadilal's Sales and Marketing Strategies for Ice CreamDokumen56 halamanVadilal's Sales and Marketing Strategies for Ice Creamshobhit0% (2)

- Company Profile LandmarkDokumen9 halamanCompany Profile LandmarkIshaq IsmailBelum ada peringkat

- Gap Inc.'s Strategic Audit and SWOT Analysis (40/40Dokumen11 halamanGap Inc.'s Strategic Audit and SWOT Analysis (40/40Zeeshan MunirBelum ada peringkat

- Explore Opportunities with Providence Trading CorporationDokumen27 halamanExplore Opportunities with Providence Trading Corporationபெண்மை பெண்Belum ada peringkat

- 4.course Challenge TasksDokumen2 halaman4.course Challenge TasksVijačni kompresori- Prodaja i servisBelum ada peringkat

- United Kingdom North America, Europe, Central Europe, Asia and AfricaDokumen5 halamanUnited Kingdom North America, Europe, Central Europe, Asia and Africaashish_aBelum ada peringkat

- Birla Sun MFDokumen3 halamanBirla Sun MFpankaj5130Belum ada peringkat

- KHJ Annual Report Highlights Growth in Retail and Distribution BusinessDokumen156 halamanKHJ Annual Report Highlights Growth in Retail and Distribution BusinessLee KangBelum ada peringkat

- Colgate Palmolive Case StudyDokumen8 halamanColgate Palmolive Case StudyArpita SenBelum ada peringkat

- Advertising and Promotional Research AnalysisDokumen70 halamanAdvertising and Promotional Research Analysiskaran paradkarBelum ada peringkat

- Marketing of ColgateDokumen18 halamanMarketing of ColgateA. L. JainBelum ada peringkat

- Shareholding Pattern of The CompanyDokumen5 halamanShareholding Pattern of The CompanyVaishali GuptaBelum ada peringkat

- Growth Champions: The Battle for Sustained Innovation LeadershipDari EverandGrowth Champions: The Battle for Sustained Innovation LeadershipBelum ada peringkat

- Price Range: Mon - ThuDokumen1 halamanPrice Range: Mon - ThugjdfljaBelum ada peringkat

- Analysis For Intra Company Vaibhav Global Limited: Balance SheetDokumen5 halamanAnalysis For Intra Company Vaibhav Global Limited: Balance SheetgjdfljaBelum ada peringkat

- America Facts: Economy, Geography and History of the United StatesDokumen5 halamanAmerica Facts: Economy, Geography and History of the United StatesgjdfljaBelum ada peringkat

- About My SelfDokumen3 halamanAbout My SelfgjdfljaBelum ada peringkat

- Pradhan Mantri Jan Dhan YojanaDokumen30 halamanPradhan Mantri Jan Dhan YojanaKirti Chotwani100% (1)

- Assignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Dokumen3 halamanAssignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Giselle MartinezBelum ada peringkat

- Vascon Engineers - Kotak PCG PDFDokumen7 halamanVascon Engineers - Kotak PCG PDFdarshanmadeBelum ada peringkat

- Beyond Vertical Integration The Rise of The Value-Adding PartnershipDokumen17 halamanBeyond Vertical Integration The Rise of The Value-Adding Partnershipsumeet_goelBelum ada peringkat

- MGEB05-Assignment-2 (Fall-2019)Dokumen20 halamanMGEB05-Assignment-2 (Fall-2019)Macharia Ngunjiri0% (1)

- Modify Monthly Budget TemplateDokumen32 halamanModify Monthly Budget TemplateMohammed TetteyBelum ada peringkat

- Saquib Assignment 2 Attemp 1.questionsDokumen14 halamanSaquib Assignment 2 Attemp 1.questionsShar MohdBelum ada peringkat

- Faq C855 PDFDokumen6 halamanFaq C855 PDFKaren TacadenaBelum ada peringkat

- Why Renting Is Better Than BuyingDokumen4 halamanWhy Renting Is Better Than BuyingMonali MathurBelum ada peringkat

- Eric Stevanus - LA28 - Cost AnalysisDokumen8 halamanEric Stevanus - LA28 - Cost Analysiseric stevanusBelum ada peringkat

- TLE 5 EntrepDokumen10 halamanTLE 5 EntrepFrance PilapilBelum ada peringkat

- Oswal Woolen MillsDokumen76 halamanOswal Woolen MillsMohit kolliBelum ada peringkat

- Backflu SH Costing: Yusi, Mark Lawrence - Group 4Dokumen19 halamanBackflu SH Costing: Yusi, Mark Lawrence - Group 4Mark Lawrence YusiBelum ada peringkat

- Konkola Copper MinesDokumen6 halamanKonkola Copper MinesMohsin Nabeel100% (1)

- Accounting for Legal FirmsDokumen23 halamanAccounting for Legal FirmsARVIN RAJBelum ada peringkat

- 07 Cafmst14 - CH - 05Dokumen52 halaman07 Cafmst14 - CH - 05Mahabub AlamBelum ada peringkat

- Annual Report 2016 2017 PDFDokumen176 halamanAnnual Report 2016 2017 PDFTasnim Tasfia SrishtyBelum ada peringkat

- Market SegmentationDokumen21 halamanMarket SegmentationMian Mujeeb RehmanBelum ada peringkat

- Portfolio Management Karvy 2013Dokumen84 halamanPortfolio Management Karvy 2013Sai Kiran GBelum ada peringkat

- SchmidtCo ERP Case AnalysisDokumen8 halamanSchmidtCo ERP Case Analysisnitesh sharmaBelum ada peringkat

- Made By:-Sarthak Gupta Group No: - 1080zDokumen22 halamanMade By:-Sarthak Gupta Group No: - 1080zSimranAhluwaliaBelum ada peringkat

- Capital flight affects exchange ratesDokumen4 halamanCapital flight affects exchange ratesTunggal PrayogaBelum ada peringkat

- International Marketing Strategic AlliancesDokumen37 halamanInternational Marketing Strategic AlliancesMohammed Kh DerballaBelum ada peringkat

- Business CrosswordDokumen1 halamanBusiness CrosswordJHON PAEZBelum ada peringkat