Diamond Bank PLC - q1 2011 Results

Diunggah oleh

Oladipupo Mayowa Paul0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan5 halamanREPORT

Judul Asli

Diamond Bank Plc - q1 2011 Results

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniREPORT

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan5 halamanDiamond Bank PLC - q1 2011 Results

Diunggah oleh

Oladipupo Mayowa PaulREPORT

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

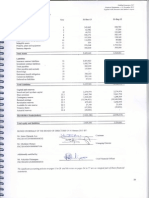

DIAMOND BANK PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE

PERIOD ENDED: 31st Mar 2011 31st Mar 2010 31st Mar 2011 31st Mar 2010

Group Group Bank Bank

N'000 N'000 N'000 N'000

Notes

Gross Earnings 20,270,781 24,464,216 19,317,410 22,733,718

Interest and Discount Income 1 14,422,973 18,172,808 14,162,200 17,694,419

Interest Expense 2 (2,075,160) (7,959,604) (2,122,451) (7,735,367)

Net Interest And Discount Income 12,347,813 10,213,204 12,039,750 9,959,052

Other Income 5,847,808 6,291,408 5,155,210 5,039,299

Operating Income 18,195,621 16,504,612 17,194,959 14,998,351

Operating Expenses 3 (11,861,362) (11,566,532) (10,799,125) (10,114,828)

Operating Profit before Tax 6,334,259 4,938,080 6,395,834 4,883,523

Provision For Losses (4,521,261) (2,939,283) (4,505,410) (2,817,645)

Profit/(Loss) Before Taxation 1,812,998 1,998,797 1,890,424 2,065,878

Taxation (737,525) (471,403) (661,649) (413,175)

Profit/(Loss) After Taxation 1,075,473 1,527,394 1,228,776 1,652,703

Non-controling Interest 10,964 9,407 - -

Profit Attributable To The Group 1,064,509 1,517,987 1,228,776 1,652,703

Key Financial Information

Total Non-Performing Loans 52,449,713 65,234,512 49,764,133 62,193,996

Total Non-Performing Loans To Total Loans 14.4% 17.5% 14.0% 17.1%

Basic Eps (Annualized, Kobo) 30 33 34 46

Diluted Eps (Annualized, Kobo) 30 33 34 46

DIAMOND BANK PLC

CONSOLIDATED BALANCE SHEET AS AT : 31st Mar 2011 31st Dec. 2010 31st Mar 2011 31st Dec. 2010

Group Group Bank Bank

Notes N'000 N'000 N'000 N'000

Assets

Cash And Balances With Central Banks 4 26,370,163 27,606,200 20,002,896 17,764,318

Due from Other Banks & Financial Institutions 5 102,630,568 66,815,068 93,830,040 61,609,150

Short Term Investment 41,234,276 51,302,987 28,921,261 43,063,637

Loans and Advances to Customers 6 321,378,189 307,135,161 317,422,427 307,828,170

Advances Under Finance Lease 7 5,640,556 5,071,279 5,633,889 5,071,279

Deferred Taxation 4,824,529 4,757,142 3,265,430 3,265,430

Other Assets 22,535,996 18,109,748 11,750,613 8,386,866

Investment Securites 8 71,602,542 73,491,632 51,412,417 49,528,513

Investment in subsidiaries 9 - - 20,173,583 17,442,980

Investment Property 3,927,253 3,755,064 - -

Property Plant & Equipment 36,675,595 36,750,856 34,309,736 34,442,217

Total Assets 636,819,667 594,795,137 586,722,292 548,402,560

Liabilities

Deposits 10 448,505,148 412,031,918 410,738,379 378,733,006

Due to Other Banks & Financial Institutions 3,696,704 15,347,216 3,696,704 4,104,098

Current Taxation 1,861,303 1,995,250 1,649,557 1,649,557

Deferred Taxation 580,464 580,464 580,464 580,464

Other Liabilities 47,346,461 29,474,415 25,432,695 18,173,265

Borrowings 11 27,743,334 28,281,011 27,743,334 28,281,011

Total Liabilities 529,733,414 487,710,274 469,841,133 431,521,401

Equity

Share capital 7,237,622 7,237,622 7,237,622 7,237,622

Reserves 99,391,580 99,391,580 109,643,537 109,643,537

106,629,202 106,629,202 116,881,159 116,881,159

Non-controlling Interest 457,051 455,661 - -

Liabilities and Equity 636,819,667 594,795,137 586,722,292 548,402,560

Acceptances and guarantees 238,043,892 228,845,811 150,690,694 155,424,498

DIAMOND BANK PLC

CONSOLIDATED CASHFLOW STATEMENT FOR THE PERIOD

ENDED: 31st Mar 2011 31st Dec. 2010 31st Mar 2011 31st Dec. 2010

Group Group Bank Bank

N'000 N'000 N'000 N'000

Net cash generated from operating activities 30,684,028 (23,544,183) 28,922,219 (36,037,951)

Investing Activities

Purchase of Long Term Investment Securities - Bonds (1,003,900) (9,851,099) (993,527) (9,688,084)

Sale of Long Term Bonds - 1,327,323 - 328,462

Additional Investment In Subsidiaries - - (2,730,603) (1,000,000)

Addition to Investment Property (172,189) (427,452) - -

Proceeds from Sale of Investment Property - 147,000 - -

Purchase of Property and Equipment (1,383,825) (4,385,205) (1,383,825) (4,166,145)

Proceeds from Sale of Property and Equipment 417,747 232,315 417,747 266,607

Net Cash From Investing Activities (2,142,167) (12,957,118) (4,690,209) (14,259,160)

Financing Activities

Repayment of Borrowings (537,677) (6,279,985) (537,677) (6,279,986)

Dividend Paid to Shareholders (473) (91,372) (473) (91,373)

Proceed of New Borrowings - 15,510,000 - 15,510,000

Net Cash From Financing Activities (538,150) 9,138,643 (538,150) 9,138,641

Effect of Exchange Rate Changes on Cash and Cash

Equivalents (116,190) (305,883) - -

Increase In Cash and Cash Equivalents 27,887,520 (27,668,541) 23,693,860 (41,158,470)

Analysis of Changes In Cash and Cash Equivalents

Balance as st beginning of period 142,347,487 170,016,028 119,060,337 160,218,807

Balance as at end of period 170,235,007 142,347,487 142,754,197 119,060,337

Increase In Cash and Cash Equivalents 27,887,520 (27,668,541) 23,693,860 (41,158,470)

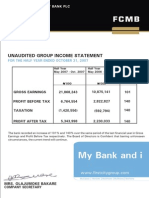

DIAMOND BANK PLC

NOTES TO THE ACCOUNT 31st Mar 2011 31st Mar 2010 31st Mar 2011 31st Mar 2010

Group Group Bank Bank

N'000 N'000 N'000 N'000

1 Interest and discount income

Placements and short-term funds 916,601 321,462 820,403 208,200

Treasury bills and investment securities 1,961,847 431,784 1,952,144 415,162

Risk assets 11,544,525 17,419,562 11,389,653 17,071,057

14,422,973 18,172,808 14,162,200 17,694,419

2 Interest expense

Inter-bank takings 4,564 - 4,564 -

Current accounts 136,432 201,356 136,424 201,335

Time deposits 1,131,673 6,823,594 1,131,409 6,819,136

Savings accounts 677,317 340,288 677,014 339,726

Borrowed funds 125,174 594,366 173,040 375,170

Others - - - -

2,075,160 7,959,604 2,122,451 7,735,367

3 Operating expenses

Staff costs 4,165,378 3,635,263 3,744,998 3,303,941

Depreciation 1,250,053 1,184,282 1,106,295 1,070,132

Other operating expenses 6,445,930 6,746,987 5,947,832 5,740,755

11,861,362 11,566,532 10,799,125 10,114,828

31st Mar 2011 31st Dec. 2010 31st Mar 2011 31st Dec. 2010

Group Group Bank Bank

N'000 N'000 N'000 N'000

4 Cash and balances with central banks

Cash & Short Term Funds 12,703,541 9,433,800 8,044,786 7,859,065

Operating with central banks 10,254,559 14,795,632 11,958,110 6,528,485

Included in cash and cash equivalents 22,958,099 24,229,432 20,002,896 14,387,550

Mandatory reserve deposits with central banks 3,412,063 3,376,768 - 3,376,768

Escrow balances with central banks

26,370,163 27,606,200 20,002,896 17,764,318

5 Due from other banks

Banks within Nigeria 8,068,644 18,647 - -

Banks Outside Nigeria 35,806,575 24,441,867 35,806,575 19,377,042

Placements with banks and discount houses 58,975,846 42,354,554 58,023,465 42,232,108

Provisioin for doubtful balances (220,497) - - -

102,630,568 66,815,068 93,830,040 61,609,150

6 Loans and advances to customers

Overdrafts 118,317,108 76,728,580 117,758,838 99,870,391

Term loans 240,832,114 262,793,426 232,516,133 235,988,074

Commercial papers - 393,511 - -

359,149,222 339,915,517 350,274,971 335,858,465

General Provision (2,867,264) - (2,867,264) -

Specific Provision (23,808,248) (23,708,591) (19,706,831) (19,749,088)

Interest in suspense (11,095,521) (9,071,765) (10,278,449) (8,281,207)

321,378,189 307,135,161 317,422,427 307,828,170

Analysis by performance

Performing 306,699,509 288,793,843 300,510,839 289,252,958

Non-performing 52,449,713 51,121,674 49,764,133 46,605,507

359,149,222 339,915,517 350,274,971 335,858,465

DIAMOND BANK PLC

NOTES TO THE ACCOUNT (contd.)

31st Mar 2011 31st Dec. 2010 31st Mar 2011 31st Dec. 2010

Group Group Bank Bank

N'000 N'000 N'000 N'000

7 Advances under finance lease

Investment 5,696,984 5,737,504 5,690,317 5,737,504

Less: Unearned Income - (666,225) - (666,225)

Net Investment 5,696,984 5,071,279 5,690,317 5,071,279

General Provision (56,428) - (56,428)

5,640,556 5,071,279 5,633,889 5,071,279

Analysis by performance

Performing 5,696,984 5,071,279 5,690,317 5,071,279

Non-performing -

5,696,984 5,071,279 5,690,317 5,071,279

8 Investment securities

Debt securities- at cost

listed 47,881,171 45,270,953 42,502,432 40,511,663

Unlisted 5,500,102 7,552,309 4,424,283 4,424,283

Equity securities- at cost

Listed 4,428,415 11,269,381 - 1,280,073

Unlisted 17,647,857 14,583,279 4,485,702 4,480,432

Provision for diminution in value (3,855,004) (5,184,290) - (1,167,938)

71,602,542 73,491,632 51,412,417 49,528,513

9 Investment in subsidiaries

Diamond Bank du Benin S.A - - 5,865,623 3,135,020

Diamond Pension Fund Custodian Limited - - 2,000,000 2,000,000

Diamond Mortgages Limited - - 1,000,000 1,000,000

ADIC Insurance Limited - - 6,307,960 6,307,960

Diamond Capital & Financial Mkts Ltd - - 5,000,000 5,000,000

- - 20,173,583 17,442,980

10 Customer deposits

Demand 230,535,735 203,871,527 213,224,724 189,025,468

Time 110,601,068 110,468,884 98,387,797 98,270,906

Savings 107,368,345 97,691,507 99,125,857 91,436,632

448,505,148 412,031,918 410,738,379 378,733,006

11 Borrowings

Local Banks 15,171,237 15,373,750 15,171,237 15,373,750

Foreign financial institutions 12,572,097 12,907,261 12,572,097 12,907,261

Multilateral credit Institutions - - - -

27,743,334 28,281,011 27,743,334 28,281,011

Anda mungkin juga menyukai

- Filling Station GuidelinesDokumen8 halamanFilling Station GuidelinesOladipupo Mayowa PaulBelum ada peringkat

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADokumen16 halamanBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulBelum ada peringkat

- Amcon Bonds FaqDokumen4 halamanAmcon Bonds FaqOladipupo Mayowa PaulBelum ada peringkat

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDokumen1 halamanIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulBelum ada peringkat

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDokumen1 halamanIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulBelum ada peringkat

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Dokumen3 halaman9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulBelum ada peringkat

- Abridged Financial Statement September 2012Dokumen2 halamanAbridged Financial Statement September 2012Oladipupo Mayowa PaulBelum ada peringkat

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDokumen31 halamanFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulBelum ada peringkat

- 2006 Q1resultsDokumen1 halaman2006 Q1resultsOladipupo Mayowa PaulBelum ada peringkat

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDokumen4 halamanFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulBelum ada peringkat

- 9M 2013 Unaudited ResultsDokumen2 halaman9M 2013 Unaudited ResultsOladipupo Mayowa PaulBelum ada peringkat

- FirstCity Group profit up 88% in 3 monthsDokumen1 halamanFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulBelum ada peringkat

- q1 2008 09 ResultsDokumen1 halamanq1 2008 09 ResultsOladipupo Mayowa PaulBelum ada peringkat

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDokumen32 halamanFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulBelum ada peringkat

- q1 2008 09 ResultsDokumen1 halamanq1 2008 09 ResultsOladipupo Mayowa PaulBelum ada peringkat

- June 2009 Half Year Financial Statement GaapDokumen78 halamanJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulBelum ada peringkat

- 2007 Q2resultsDokumen1 halaman2007 Q2resultsOladipupo Mayowa PaulBelum ada peringkat

- Diamond Bank Half Year Results 2011 SummaryDokumen5 halamanDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulBelum ada peringkat

- 2011 Half Year Result StatementDokumen3 halaman2011 Half Year Result StatementOladipupo Mayowa PaulBelum ada peringkat

- 5 Year Financial Report 2010Dokumen3 halaman5 Year Financial Report 2010Oladipupo Mayowa PaulBelum ada peringkat

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Dokumen5 halaman9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulBelum ada peringkat

- Fs 2011 GtbankDokumen17 halamanFs 2011 GtbankOladipupo Mayowa PaulBelum ada peringkat

- GTBank FY 2011 Results PresentationDokumen16 halamanGTBank FY 2011 Results PresentationOladipupo Mayowa PaulBelum ada peringkat

- 5 Year Financial Report 2010Dokumen3 halaman5 Year Financial Report 2010Oladipupo Mayowa PaulBelum ada peringkat

- Dec09 Inv Presentation GAAPDokumen23 halamanDec09 Inv Presentation GAAPOladipupo Mayowa PaulBelum ada peringkat

- GTBank H1 2011 Results PresentationDokumen17 halamanGTBank H1 2011 Results PresentationOladipupo Mayowa PaulBelum ada peringkat

- 2011 Year End Results Press Release - FinalDokumen2 halaman2011 Year End Results Press Release - FinalOladipupo Mayowa PaulBelum ada peringkat

- Final Fs 2012 Gtbank BV 2012Dokumen16 halamanFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulBelum ada peringkat

- GTBank H1 2012 Results AnalysisDokumen17 halamanGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- DedicationDokumen3 halamanDedicationMuhammad Nadeem AtifBelum ada peringkat

- Mobile Money Opportunities For Mobile Operators PDFDokumen21 halamanMobile Money Opportunities For Mobile Operators PDFAnupriya NagpalBelum ada peringkat

- Carding Dell Orders in March 2013Dokumen2 halamanCarding Dell Orders in March 2013BADBOY BRETBelum ada peringkat

- Assignment On International TradeDokumen3 halamanAssignment On International TradeMark James GarzonBelum ada peringkat

- Central Bank Search Warrant UpheldDokumen6 halamanCentral Bank Search Warrant UpheldHarris CamposanoBelum ada peringkat

- Quy Trình Hàng SEADokumen4 halamanQuy Trình Hàng SEAVũMinhBelum ada peringkat

- Topic 1 - Financial SystemDokumen29 halamanTopic 1 - Financial SystemMiera FrnhBelum ada peringkat

- 0452 w13 QP 11Dokumen20 halaman0452 w13 QP 11Naðooshii AbdallahBelum ada peringkat

- Retail Banking (With Special Reference To Icici Bank)Dokumen32 halamanRetail Banking (With Special Reference To Icici Bank)Varun PuriBelum ada peringkat

- Treasury ManagementDokumen10 halamanTreasury Managementrakeshrakesh1Belum ada peringkat

- Positive Money - Modernising Money by Andrew Jackson, Ben DysonDokumen251 halamanPositive Money - Modernising Money by Andrew Jackson, Ben DysonHelyi Pénz100% (4)

- Kaneshiro V Michael Kim, Bank of America Home LoansDokumen9 halamanKaneshiro V Michael Kim, Bank of America Home LoansForeclosure FraudBelum ada peringkat

- 07 Jul 31 Embassy DirectoryDokumen12 halaman07 Jul 31 Embassy Directorysteve-gilford-8847Belum ada peringkat

- Middleton Pathogenic FinanceDokumen26 halamanMiddleton Pathogenic Financerichardck61Belum ada peringkat

- # Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8Dokumen7 halaman# Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8PHilipBelum ada peringkat

- CPBM Gen AnsDokumen118 halamanCPBM Gen Ansmadhu pBelum ada peringkat

- Citibank CFO PresentationDokumen29 halamanCitibank CFO PresentationDiego de AragãoBelum ada peringkat

- Capital Gain Form D PDFDokumen2 halamanCapital Gain Form D PDFDigbalaya SamantarayBelum ada peringkat

- Credit Card Fraud GuideDokumen8 halamanCredit Card Fraud GuideMohamad HajarBelum ada peringkat

- KSFC ProfileDokumen143 halamanKSFC ProfilenishaarjunBelum ada peringkat

- Air-India Express SivaramanDokumen1 halamanAir-India Express SivaramanarshadhishamBelum ada peringkat

- The Study of The Effectiveness of Cashless Payment Method in The Philippine Supermarket Through Consumer SatisfactionDokumen16 halamanThe Study of The Effectiveness of Cashless Payment Method in The Philippine Supermarket Through Consumer SatisfactionBarao JonathanBelum ada peringkat

- Indian Financial SystemDokumen20 halamanIndian Financial SystemDivya JainBelum ada peringkat

- Notes ReceiDokumen2 halamanNotes ReceiDIANE EDRABelum ada peringkat

- Chapter - IDokumen36 halamanChapter - Iharman singhBelum ada peringkat

- 8 Day Study Tour v1 - Kasigit AGUNGDokumen3 halaman8 Day Study Tour v1 - Kasigit AGUNGnorzamBelum ada peringkat

- FDIC Answer To ComplaintDokumen31 halamanFDIC Answer To ComplaintLucy KirschingerBelum ada peringkat

- DS Nov Tribal Part2 LRDokumen31 halamanDS Nov Tribal Part2 LRmiller999Belum ada peringkat

- MSc Dissertation TopicsDokumen8 halamanMSc Dissertation TopicsSweetMikanBelum ada peringkat

- Option One 2006-1 Jul07Dokumen72 halamanOption One 2006-1 Jul07janisnagobadsBelum ada peringkat