Islamic Banking - Prospects and Challenges in India - PA Shameel Sajjad - Zirva Institute of Islamic Finance

Diunggah oleh

Shameel SajjadHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Islamic Banking - Prospects and Challenges in India - PA Shameel Sajjad - Zirva Institute of Islamic Finance

Diunggah oleh

Shameel SajjadHak Cipta:

Format Tersedia

ISLAMIC BANKING:

PROSPECTS &

CHALLENGES

Brennen College Seminar

27 October 2014

PA Shameel Sajjad

Director Zirva Institute of Islamic Finance

Outline

The Inherent Problem with Conventional Banking

The Alternative of Islamic Banking

Challenges Posed by the Law in India

The Inherent Problem with

Conventional Banking

The Instrument of Interest

The concept of interest presumes the usage of capital as a

factor of production and claiming a reward for the usage like

the other factors of production vis a vis land, labour and

organization.

But in reality capital is not an original factor of production.

It is only a means to acquiring other factors of production.

This is evident from the fact that capital cant go directly into

production like other factors but will be used only in the

procurement of any of the other factors of production that

can be directly used in the process of production.

This argument is supported by several economists including

Ludwig Heinrich Edler von Mises (1881 1973); the world

renowned philosopher, Austrian School economist,

sociologist, and classical liberal It is true that majority of

the economists reckon money among production goods.

Nevertheless, arguments from authority are invalid; the proof

of a theory is in its reasoning, not in its sponsorship; and with

all due respect for the masters, it must be said that they have

not justified their position very thoroughly in the matter.

The concept of the right to interest on

capital creates the necessity for securing the

capital loaned and the interest thereupon.

Securing this right and ensuring repayment of

capital and payment of interest cant depend

upon the financial destiny of the enterprise.

This makes the whole mechanism of

conventional banking collateral based even

for risky enterprises.

With the existence of collateral as an essential

condition for lending, conventional banking system

can never become inclusive.

Rather it becomes exclusively reserved for the

sections of population who are relatively well off

with some asset base (which can be offered as a

collateral).

This reality can be verified in the Indian context from

the statistics issued by the Reserve Bank of India.

The number of loan accounts constituted only 14 per cent of

adult population - In rural areas, the coverage is 9.5 per cent

against 14 per cent in urban areas.

The extent of exclusion from credit markets can be observed

from a different view point. Out of 203 million households in

India; 89 million are farmer households. 51.4 per cent of farm

households have no access to formal or informal sources of

credit while 73 per cent have no access to formal sources of

credit.

However after 1991, the share of non institutional sources has

increased; specifically, the share of moneylenders in the debt

of rural households increased from 17.5 % in 1991 to 29.6% in

2002.

The financially excluded sections largely

comprise marginal farmers, landless labourers,

oral lessees, self employed and unorganised

sector enterprises, urban slum dwellers,

migrants, ethnic minorities and socially

excluded groups, senior citizens and women.

Source: Text of speech by Smt. Usha Thorat,

Deputy Governor, Reserve Bank of India at the

HMT-DFID Financial Inclusion Conference 2007,

Whitehall Place, London, UK on June 19, 2007.

For India, financial inclusion has become a key

policy concern as there are over 600 million

citizens who lack basic banking and financial

services.

In India, financial exclusion has strong linkages

with poverty and is predominantly

concentrated among the vast sections of

disadvantaged and low income groups.

One of the important factors behind rising farmer

suicides in the countryside is the lack of access to credit

from banks and institutional sources and the inability to

repay due to loss of crops.

In the early 2000s, India launched a massive drive to

bring most of its population under the formal banking

system.

However, 90% of the 100 million accounts opened under

the plan are unused and close to half of Indias 1.2

billion-strong population still dont have bank accounts.

The number of the Indian poor constitutes

33% of the global poor, which is pegged at 1.4

billion people.

According to World Bank estimate, India had

456 million people or about 42% of the

population living below poverty according to

the new international poverty line of US$ 1.25

per day.

If the international poverty line is slightly

raised from the US$ 1.25 /day to US$ 2 / day

the scenario is further disheartening.

Based on that measurement, India had 828

million people, or 75.6% of the population

living below the poverty line surpassing the

sub Saharan Africa, considered the worlds

poorest region with 72.2% people without

US$ 2 / day.

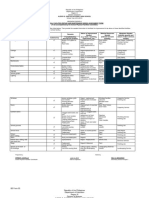

Key Facts and Figures

41% of the population in India is unbanked.

40% is unbanked in urban areas.

61% is unbanked in rural areas.

Only 14% of the population have loan

accounts.

9.5% in rural areas.

14% in urban areas.

203 million households in India

147 million households in rural areas

89 million are farmer households.

51.4% of farm households have no access to formal

or informal sources of credit.

73% of farm households have no access to formal

sources of credit.

Share of money lenders in debt finance has

increased.

The Islamic Alternative

By taking out the interest out of the process of financial

intermediation Islamic baking has strong nexus with actual

production and distribution on the ground.

Money as such doesnt have a right to earn. The right to

positive revenues is an entitlement which is granted by

partaking the risks and uncertainties of productive activities.

When this maxim is established collateral will have no

significant role as far as financing for productive activities are

concerned.

This is because there is no binding responsibility on the

entrepreneur to guarantee the repayment of the capital and

interest. The binding responsibility is to share the revenue /

profit of the venture.

As soon as this happens the focus shifts to inherent capability

of the venture to generate profits which will depend in turn

on a number of factors like demand for the commodity /

brand, capability of the entrepreneur, quality of management,

sincerity of the entrepreneur etc.

Thus a financial atmosphere is established in which the asset

backing of the clients of the bank will be of little use to the

bank and the rich and the poor will be on a level playing field;

a scenario where the richness of the rich will no longer be a

privilege and the poverty of the poor will no longer be a an

obstacle.

Thus Islamic banking is a transition from

aristocratic / feudal / undemocratic banking to

democratic banking for the masses.

For the bank its positive returns will be worked

out on the basis of the Portfolio theory. That is

even after the due diligence exercised before

investing in projects if some projects fail they will

be made up by the success of other projects.

Potential High Impact Areas for

Islamic Banking in India

Agriculture

"Slow agricultural growth is a concern for policymakers

as some two-thirds of Indias people depend on rural

employment for a living. Current agricultural practices

are neither economically nor environmentally sustainable

and India's yields for many agricultural commodities are

low. Poorly maintained irrigation systems and almost

universal lack of good extension services are among the

factors responsible. Farmers' access to markets is

hampered by poor roads, rudimentary market

infrastructure, and excessive regulation."

World Bank: "India Country Overview 2008"

"With a population of just over 1.2 billion, India is the worlds largest

democracy. In the past decade, the country has witnessed accelerated

economic growth, emerged as a global player with the worlds fourth

largest economy in purchasing power parity terms, and made progress

towards achieving most of the Millennium Development Goals. Indias

integration into the global economy has been accompanied by impressive

economic growth that has brought significant economic and social

benefits to the country. Nevertheless, disparities in income and human

development are on the rise. Preliminary estimates suggest that in 2009-

10 the combined all India poverty rate was 32 % compared to 37 % in

2004-05. Going forward, it will be essential for India to build a productive,

competitive, and diversified agricultural sector and facilitate rural, non-

farm entrepreneurship and employment. Encouraging policies that

promote competition in agricultural marketing will ensure that farmers

receive better prices."

World Bank: "India Country Overview 2011

Share in National Income: The contribution from

agriculture has been continuously falling from 55.1% in

1950-51 to 37.6% in 1981-82 & further to 18.5% in 2006-

07. But agriculture still continues to be the main sector

because it provides livelihood to majority of the people.

Largest Employment Providing Sector: in 1951, 69.5% of

the working population was engaged in agriculture. This

percentage fell to 66.9% in 1991 and to 56.7% in 2001.

However, with rapid increase in population the absolute

number of people engaged in agriculture has become

exceedingly large.

Islamic Banking Solutions to the

Farming Sector

Salam Advance Purchase of Crops

Muzaraa Share Cropping

Musaqath Crop Sharing for Maintenance

Infrastructure

The infrastructural requirement of India is US$ 1

trillion.

This cant be financed by government funding alone.

Islamic banks can issue sukuk to address this

requirement.

This will not introduce any additional debt burden on

the citizens of India.

We currently have a per capita debt of Rs. 33,000/-

The debt repayment for 2014/15 is seen at 1.397

trillion rupees.

Micro Medium and Small Enterprises

MSMEs are the real growth drivers in any

economy.

Overall finance gap in MSME sector is 32.5 trillion

rupees (MSME Census, RBI, SIDBI).

MSMEs largely require equity financing.

But the demands of listing and the competitive

conventional equity markets are not easily

accessible for them.

This vast need can be financed by Islamic banks

which rely on risk financing which is the essence

of the MSME sector.

Obstacles for the Introduction of

Islamic Banking in India

Section 5 (b) and 5 (c) of the Banking Regulation Act,

1949 prohibit the banks to invest on Profit Loss Sharing

basis -the very basis of Islamic banking.

Section 8 of the Banking Regulations Act (BR Act, 1949)

reads, No banking company shall directly or indirectly

deal in buying or selling or bartering of goods

Section 9 of the Banking Regulations Act prohibits bank

to use any sort of immovable property apart from

private use this is against Ijarah for home finance.

Section 21 of the Banking Regulations Act requires

payment of Interest which is against Sharia.

Operational Issues

SLR Requirements Banks have to invest at

least 25% of their NTDL (Net Demand and

Time Liability) in government securities.

CRR Requirements 6.5% of NTDL should be

deposited with RBI on which interest accrues.

Call Money Call Money Rate on Borrowing

from other banks which carries interest.

Repo Transactions Banks borrow from the

Central Bank which carries interest.

Raghuramrajan Committee Report

Chapter 3: Broadening Access to finance Page 35

While interest-free banking is provided in a limited manner through

NBFCs and cooperatives, the Committee recommends that measures be

taken to permit the delivery of interest-free finance on a larger scale,

including through the banking system. This is in consonance with the

objectives of inclusion and growth through innovation. The Committee

believes that it would be possible, through appropriate measures, to

create a framework for such products without any adverse systemic risk

impact.

THANK YOU!!

Contact details

shameelsajjad.pa@zirvabs.com

+91 9745 812 277

Learn Islamic Finance with Zirva

Institute of Islamic Finance and Be a

Part of the Transition

Zirva Institute of Islamic Finance is the go to

place for Islamic finance courses.

We offer students a wide array of courses to

choose from according to their availability of

time, requirements and orientation to the

subject.

We Offer

MBA in Islamic Economics and Finance

(Certificates Issued jointly by Pebble Hills

University, USA and Zirva Institute of Islamic

Finance) (10 months) - Fees US$ 2000

Accounting and Auditing Organization for

Islamic Financial Institutions, Bahrain

(AAOIFI) - Certified Shariah Adviser and

Auditor - (30 sessions) - Fees 1.5 lakhs

Chartered Institute of Management

Accountants, London (CIMA) Modules

1. CIMA Certification in Islamic Commercial

Law (15 sessions) - Fees Rs. 50,000/-

2. CIMA Certification in Islamic Banking and

Takaful (15 sessions) - Fees Rs. 50,000/-

3. CIMA Certification in Islamic Commercial

Law (15 sessions) - Fees Rs. 50,000/-

Twinning Programs with National Certifications in

Financial Markets (NCFM) Certifications

1. Certification in Islamic Banking + NCFM Certification

in Commercial Banking (20 sessions) - Fees Rs. 25,000/-

2. Certification in Islamic Insurance + NCFM

Certification in Insurance (20 sessions) - Fees Rs.

25,000/-

3. Certifcation in Islamic Capital Markets + NCFM

Certification in Capital Markets (20 sessions) - Fees Rs.

25,000/-

One Day & Short Term Certifications in Islamic Finance from Zirva

Institute of Islamic Finance

One day intensive awreness workshop in Islamic finance (6 hours)

Fees - Rs. 1000/-

Short Term Certification in Islamic Banking (4 sessions) - Fees - Rs.

5000/-

Short Term Certification in Islamic Islamic Insurance (4 sessions) -

Fees - Rs. 5000/-

Short Term Certification in Islamic Capital Markets (4 sessions) -

Fees - Rs. 5000/-

Short Term Certification in Islamic Commercial Law (4 sessions) -

Fees - Rs. 5000/-

Diploma in Islamic Banking and Finance (Islamic Commercial Law +

Islamic Banking + Islamic Insurance + Islamic Capital Markets) (10

sessions) - Fees Rs. 15,000/-

Our External Services

We undertake onsite training assignments for

organizations in Islamic Finance.

We undertake corporate training assignments in

Islamic Finance.

We set up Islamic Banking and Finance courses

and facilities in educational institutions.

We take up teaching assignments in educational

institutions for Islamic Finance.

For all queries related to admissions and

conducting training programmes and teaching

assignments:

Call 9745812277

Email: consult@zirvabs.com

THANK YOU!!

Contact details

shameelsajjad.pa@zirvabs.com

+91 9745 812 277

Anda mungkin juga menyukai

- Microfinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsDokumen8 halamanMicrofinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsRohan_Kapoor_4806Belum ada peringkat

- © Ncert Not To Be Republished: Ural EvelopmentDokumen17 halaman© Ncert Not To Be Republished: Ural EvelopmentArnik JainBelum ada peringkat

- Financial InclusionDokumen30 halamanFinancial InclusionShalini MishraBelum ada peringkat

- Financial Inclusion The Indian ExperienceDokumen8 halamanFinancial Inclusion The Indian ExperienceSaad NiaziBelum ada peringkat

- Microfinance and Poverty AlleviationDokumen27 halamanMicrofinance and Poverty AlleviationIzma HussainBelum ada peringkat

- Table of Contents & Chapters on Rural Credit in IndiaDokumen201 halamanTable of Contents & Chapters on Rural Credit in IndiaShashi Bhushan Sonbhadra100% (1)

- Rural Development Notes 2020-21 CRDokumen20 halamanRural Development Notes 2020-21 CRsherly joiceBelum ada peringkat

- Micro Finance PPT FinalDokumen37 halamanMicro Finance PPT FinalVaibhav Alawa100% (1)

- Franklin D. RooseveltDokumen17 halamanFranklin D. RooseveltRupali RamtekeBelum ada peringkat

- R T H I1 L J R N Urn R: Since Lndia GrantDokumen5 halamanR T H I1 L J R N Urn R: Since Lndia GrantchurathomasBelum ada peringkat

- A Presentation On: Micro Finance InstitutionsDokumen23 halamanA Presentation On: Micro Finance InstitutionsrhythmivBelum ada peringkat

- EconomicsDokumen19 halamanEconomicsujj04Belum ada peringkat

- SH As TriDokumen5 halamanSH As TriRaqueem KhanBelum ada peringkat

- Credit Score EssayDokumen24 halamanCredit Score EssaypavistatsBelum ada peringkat

- Financial Inclusion, Microfinance and Micro InsuranceDokumen14 halamanFinancial Inclusion, Microfinance and Micro InsuranceBalendu BhagatBelum ada peringkat

- Introduction and Research Methodology: Chapter - 1Dokumen33 halamanIntroduction and Research Methodology: Chapter - 1Piyush SethiBelum ada peringkat

- Need For MF Gap DD and SSDokumen2 halamanNeed For MF Gap DD and SSalviarpitaBelum ada peringkat

- Financial Inclusion in BangaloreDokumen24 halamanFinancial Inclusion in BangaloreShankar TarwareBelum ada peringkat

- Rural Credit in India: Issues and ConcernsDokumen10 halamanRural Credit in India: Issues and ConcernsUabajBelum ada peringkat

- Interest Free Micro Finance As An Alternative Way For Financial InclusionDokumen15 halamanInterest Free Micro Finance As An Alternative Way For Financial InclusionMuhammed K PalathBelum ada peringkat

- Micro FinanceDokumen53 halamanMicro Financeamitharia100% (6)

- Eco 2Dokumen10 halamanEco 2priyaBelum ada peringkat

- Product & Services Ofmicrofinancefinancial Services Other Financial Service Snon Financial ServicesDokumen9 halamanProduct & Services Ofmicrofinancefinancial Services Other Financial Service Snon Financial ServicesGaurav KumarBelum ada peringkat

- ABV Indian Institute of Information Technology and Management, Gwalior - 474 010, IndiaDokumen32 halamanABV Indian Institute of Information Technology and Management, Gwalior - 474 010, Indiakushagrabhatnagar10Belum ada peringkat

- Pillars of Financial Inclusion: Remittances, Micro Insurance and Micro SavingsDokumen27 halamanPillars of Financial Inclusion: Remittances, Micro Insurance and Micro SavingsDhara PatelBelum ada peringkat

- Our money, our rights: The evolution of financial services in AsiaDokumen20 halamanOur money, our rights: The evolution of financial services in AsiaKhushbu BhimaniBelum ada peringkat

- Financial Inclusion. 1Dokumen8 halamanFinancial Inclusion. 1sbbhujbalBelum ada peringkat

- Rural Banking in IndiaDokumen63 halamanRural Banking in IndiaAniket AutkarBelum ada peringkat

- Chapter 1: Financial Inclusion - Global PerspectiveDokumen74 halamanChapter 1: Financial Inclusion - Global PerspectivenitmemberBelum ada peringkat

- Microfinance and Development Banking OverviewDokumen46 halamanMicrofinance and Development Banking OverviewAMIT SINDHUBelum ada peringkat

- Report On Micro FinanceDokumen55 halamanReport On Micro FinanceSudeepti TanejaBelum ada peringkat

- Rural Banking ReportDokumen70 halamanRural Banking ReportPrashant Shinde67% (3)

- MF Final PPT 1Dokumen19 halamanMF Final PPT 1Ashutosh TulsyanBelum ada peringkat

- Complete ProjectDokumen72 halamanComplete ProjectKevin JacobBelum ada peringkat

- Financial InclusiionDokumen37 halamanFinancial InclusiionPehoo ThakurBelum ada peringkat

- Micro Finance: Microfinance Is The Provision ofDokumen7 halamanMicro Finance: Microfinance Is The Provision ofSushant ShettyBelum ada peringkat

- Reforms Required in MFIs to Eradicate PovertyDokumen17 halamanReforms Required in MFIs to Eradicate PovertyKausik KskBelum ada peringkat

- Rural DevelopmentDokumen27 halamanRural Developmentakp200522Belum ada peringkat

- On Financial Inclusion: AcknowledgementDokumen31 halamanOn Financial Inclusion: Acknowledgementilarewna86% (7)

- Inancial Inclusion: - A Path Towards India's Future Economic GrowthDokumen30 halamanInancial Inclusion: - A Path Towards India's Future Economic GrowthAnkur JainBelum ada peringkat

- Bio Metrics and Financial InclusionDokumen18 halamanBio Metrics and Financial InclusionAnuradha ChakrabortyBelum ada peringkat

- Term Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesDokumen18 halamanTerm Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesSumit SinghBelum ada peringkat

- Financial Inclusion Through Microfinance Vineeta Agrawal: Applied Sciences Department, KIIT College of EngineeringDokumen8 halamanFinancial Inclusion Through Microfinance Vineeta Agrawal: Applied Sciences Department, KIIT College of EngineeringVineeta AgrawalBelum ada peringkat

- Financial Inclusion in IndiaDokumen27 halamanFinancial Inclusion in IndiaANONYMOUS PeopleBelum ada peringkat

- ECONOMICS IMPORTANT QUESTION CLASS 10Dokumen10 halamanECONOMICS IMPORTANT QUESTION CLASS 10ashlyyyyyy33Belum ada peringkat

- Project Report On "A Critical Analysis of Micro Finance in India"Dokumen55 halamanProject Report On "A Critical Analysis of Micro Finance in India"Om Prakash MishraBelum ada peringkat

- Rural Credit Institutions Guide Rural DevelopmentDokumen13 halamanRural Credit Institutions Guide Rural DevelopmentPolitical VirusBelum ada peringkat

- RuralFinance 2Dokumen16 halamanRuralFinance 2Ratish KumarBelum ada peringkat

- RURAL DEVELOPMENT AND AGRICULTURAL MARKETINGDokumen6 halamanRURAL DEVELOPMENT AND AGRICULTURAL MARKETINGKumar SaurabhBelum ada peringkat

- Financial Inclusion in India: An Evaluation of The Coverage, Progress and TrendsDokumen22 halamanFinancial Inclusion in India: An Evaluation of The Coverage, Progress and Trendsvineet_dubeyBelum ada peringkat

- Financial Inclusion: A Road India Needs To TravelDokumen40 halamanFinancial Inclusion: A Road India Needs To TravelGourav PattnaikBelum ada peringkat

- Micro Finance Research Paper....Dokumen14 halamanMicro Finance Research Paper....Anand ChaudharyBelum ada peringkat

- Need For Financial Inclusion and Challenges Ahead - An Indian PerspectiveDokumen4 halamanNeed For Financial Inclusion and Challenges Ahead - An Indian PerspectiveInternational Organization of Scientific Research (IOSR)Belum ada peringkat

- Seminar Presentation: Presented by - SatishDokumen14 halamanSeminar Presentation: Presented by - SatishsatishmnjprBelum ada peringkat

- The Evolution of The Microfinance in India - An OverviewDokumen2 halamanThe Evolution of The Microfinance in India - An OverviewAdri MitraBelum ada peringkat

- Asignemt Final Agric.. 2003Dokumen9 halamanAsignemt Final Agric.. 2003samkappiBelum ada peringkat

- Microfinance Chapter 1Dokumen27 halamanMicrofinance Chapter 1Prakash KumarBelum ada peringkat

- RURAL DEVELOPMENT CHAPTERDokumen9 halamanRURAL DEVELOPMENT CHAPTERA.Mohammed AahilBelum ada peringkat

- Banking India: Accepting Deposits for the Purpose of LendingDari EverandBanking India: Accepting Deposits for the Purpose of LendingBelum ada peringkat

- MudarabahDokumen29 halamanMudarabahShameel SajjadBelum ada peringkat

- Zirva - Corporate ProfileDokumen39 halamanZirva - Corporate ProfileShameel SajjadBelum ada peringkat

- Zirva Brochure in Malayalam PDFDokumen4 halamanZirva Brochure in Malayalam PDFShameel SajjadBelum ada peringkat

- Zirva Brochure in English PDFDokumen7 halamanZirva Brochure in English PDFShameel SajjadBelum ada peringkat

- Mutual Funds & Zakath - Professionals' Meet On Islamic Finance - 16-07-2011Dokumen62 halamanMutual Funds & Zakath - Professionals' Meet On Islamic Finance - 16-07-2011Shameel SajjadBelum ada peringkat

- RockView Project Brochure - MalayalamDokumen4 halamanRockView Project Brochure - MalayalamZirva Business SolutionsBelum ada peringkat

- Islamic Finance Education in India - Strategizing For A Paradigm ShiftDokumen31 halamanIslamic Finance Education in India - Strategizing For A Paradigm ShiftShameel SajjadBelum ada peringkat

- RockView Project Introduction Brochure - EnglishDokumen4 halamanRockView Project Introduction Brochure - EnglishZirva Business SolutionsBelum ada peringkat

- Taurus Factsheet June 2011Dokumen16 halamanTaurus Factsheet June 2011Shameel SajjadBelum ada peringkat

- Mahallukal Sambathika Swashrayathwathinte Islamika KanikakalDokumen6 halamanMahallukal Sambathika Swashrayathwathinte Islamika KanikakalShameel SajjadBelum ada peringkat

- RockView Project Introduction Brochure - EnglishDokumen4 halamanRockView Project Introduction Brochure - EnglishZirva Business SolutionsBelum ada peringkat

- Developing Halal Business The 360 Degree Approach Mauritius Conference PresentationDokumen36 halamanDeveloping Halal Business The 360 Degree Approach Mauritius Conference PresentationShameel SajjadBelum ada peringkat

- Mahallukal Sambathika Swashrayathwathinte Islamika KanikakalDokumen6 halamanMahallukal Sambathika Swashrayathwathinte Islamika KanikakalShameel SajjadBelum ada peringkat

- Stage Fright: Its Experience As A Problem and Coping With ItDokumen11 halamanStage Fright: Its Experience As A Problem and Coping With ItcabatinganacieBelum ada peringkat

- Unprotected ResumeDokumen2 halamanUnprotected Resumeapi-337529555Belum ada peringkat

- How To Build Pyramids and Other Orgone GeneratorsDokumen6 halamanHow To Build Pyramids and Other Orgone GeneratorsGuy Jones100% (2)

- Aquacal Heat Pump Manual MultilanguageDokumen214 halamanAquacal Heat Pump Manual MultilanguageavillafanaBelum ada peringkat

- SV AgreementDokumen3 halamanSV AgreementJanice CuevasBelum ada peringkat

- 02 - Motor PDFDokumen80 halaman02 - Motor PDFRenato Assis da SilvaBelum ada peringkat

- Kel 2 - Hospital DischargeDokumen18 halamanKel 2 - Hospital DischargeFeby KartikasariBelum ada peringkat

- Training Trances - John Overdurf and Julie Silver ThornDokumen48 halamanTraining Trances - John Overdurf and Julie Silver Thornsrinimaster18% (11)

- Abdulrahman 4 Bashir Abdirahman Hussein STR .BPNDokumen1 halamanAbdulrahman 4 Bashir Abdirahman Hussein STR .BPNFrancis OdongoBelum ada peringkat

- Reduce Electrical Costs for Extrusion With AC MotorsDokumen6 halamanReduce Electrical Costs for Extrusion With AC MotorsHicham HafianiBelum ada peringkat

- Preprint Not Peer Reviewed: A Review of Domestic Violence Against Women in India During LockdownDokumen13 halamanPreprint Not Peer Reviewed: A Review of Domestic Violence Against Women in India During LockdownAishwarya MoitraBelum ada peringkat

- RD1 Fundic Height MeasurementDokumen3 halamanRD1 Fundic Height MeasurementVillanueva JanelleBelum ada peringkat

- Micam cgpp2 10 SummaryDokumen2 halamanMicam cgpp2 10 Summaryapi-286562658Belum ada peringkat

- Course Notes On Heat ExchangerDokumen142 halamanCourse Notes On Heat Exchangerkuldeep mohiteBelum ada peringkat

- Flake Graphite Lab ManualDokumen35 halamanFlake Graphite Lab ManualJohn TesfamariamBelum ada peringkat

- Stress Ulcer ProphylaxisDokumen20 halamanStress Ulcer ProphylaxisTaufik Akbar Faried LubisBelum ada peringkat

- Amniotic Fluid: Group 5Dokumen29 halamanAmniotic Fluid: Group 5Francis ValdezBelum ada peringkat

- Causes and Effects of Public Speaking Anxiety among E-MQI FreshmenDokumen47 halamanCauses and Effects of Public Speaking Anxiety among E-MQI FreshmenVi Diễm QuỳnhBelum ada peringkat

- Fifth Dimension ExerciseDokumen1 halamanFifth Dimension ExerciseArctic IllusionBelum ada peringkat

- Zanussi ZWG 5145 Washing MachineDokumen24 halamanZanussi ZWG 5145 Washing MachineprasetyoBelum ada peringkat

- G8D Process: A Methodical 8-Step Problem Solving ToolDokumen34 halamanG8D Process: A Methodical 8-Step Problem Solving Toolpkrganesh100% (1)

- Ocp-24-Dust and Fume ControlDokumen1 halamanOcp-24-Dust and Fume ControlZubair KhanBelum ada peringkat

- Chrmistry Form 4 Chapter 3 Chemical Formulae and EquationsDokumen8 halamanChrmistry Form 4 Chapter 3 Chemical Formulae and EquationsEric Wong0% (1)

- The Symbolism of Black and White Babies in Parental Impression MythsDokumen45 halamanThe Symbolism of Black and White Babies in Parental Impression MythsNandini1008Belum ada peringkat

- 40-SERIES RED POWER COLLECTION BUILT WITH HIGH QUALITY COMPONENTSDokumen1 halaman40-SERIES RED POWER COLLECTION BUILT WITH HIGH QUALITY COMPONENTSB GoodeBelum ada peringkat

- Evidence-Based Medical Practice: An IntroductionDokumen49 halamanEvidence-Based Medical Practice: An Introductiondea adillaBelum ada peringkat

- Organic PoultryDokumen48 halamanOrganic PoultryThe Variety SpotBelum ada peringkat

- Brigada Eskwela Forms 1 and 3Dokumen4 halamanBrigada Eskwela Forms 1 and 3Mar Sebastian100% (1)

- Alcohol Use DisordersDokumen52 halamanAlcohol Use DisordersZaid Wani100% (1)

- 4 Pain Management, Theories of Labor Onset, Signs of LaborDokumen31 halaman4 Pain Management, Theories of Labor Onset, Signs of Labormamsh KlangBelum ada peringkat