27-Oct-2014 Govt To Fuel Up 91k MW of Stuck Power Projects

Diunggah oleh

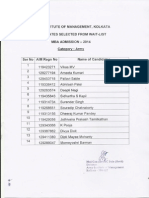

Army Institute of Management, KolkataJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

27-Oct-2014 Govt To Fuel Up 91k MW of Stuck Power Projects

Diunggah oleh

Army Institute of Management, KolkataHak Cipta:

Format Tersedia

27-Oct-2014

Govt to Fuel Up 91k mw of Stuck Power Projects: After clarity on natural gas prices and an

ordinance on coal, the government is set to decide on pooling of imported and domestic fuel prices to

help stressed power stations with a combined capacity of 91,000 mw generate electricity thats badly

needed as India tries to revive its economy. The Cabinet Committee on Economic Affairs is likely to

decide on pooling gas and coal prices at its meeting this week, sources said. The proposals include a

bailout package for pow- er plants that are idle due to the acute scarcity of domestic gas and a plan to

meet the needs of coal- based power plants till 2017. Of the 24,148 mw gas-based projects set up at an

investment of about. 1, 50,000 crore, those that can generate about 16,000 mw arent running while the

rest are operating at sub-optimal levels. The Supreme Court on September 24 cancelled 204 coal mine

allotments of which 59 were to supply power plants with nearly 67,000 mw capacity. The 59 include 20

producing blocks supplying projects of more than 11,000 mw capacities. Plants that can produce

another 7,200 mw have stalled as Coal India supplies have dried up.

25 Banks Fail ECB Stress Test: Twenty-five banks including Italys Banca Monte dei Paschi di

Siena SpA failed a stress test led by the European Central Bank, which said almost half of them must act

to raise more capital. The central bank in Frankfurt identified a 25 b-euro shortfall ($32 billion) for the

regions lenders

28-Oct-2014

Govt Reveals 3 Names in Black Money Case: The government disclosed the names of three

entities in the Supreme Court in the black money case, the first time it was doing so. The administration

said it had done this after following the due process of law and that more names will be revealed once

prosecutions have been launched once investigations are complete. No information will be with- held

but due legal process would be followed, a finance ministry official told ET. India also wants to be

careful that it doesnt violate confidentiality clauses that are part of bilateral tax treaties. Finance

Minister Arun Jaitley made clear that only the names of those against whom the authorities get

prosecutable evidence will be revealed. This was in response to criticism by the Opposition, including

Congress, demanding dis- closure of all names of black money holders. The three names given by the

government on Monday were those of Pradip Burman, a Dabur India promoter and bullion trader Pankaj

Chimanlal Lodhiya besides Goa miner Timblo Pvt Ltd and five of its directors. The names figured in a 16-

page affidavit. All those named denied any wrongdoing. In addition, ET had reported earlier this year

that members of the Burman family paid taxes after their names cropped up in the so-called HSBC list of

overseas ac- count-holders. The official cited above said names would be revealed in line with the

provisions of bilateral accords. Wherever cases have been completed and prosecution launched, names

could be given out, the official said without elaborating on such cases. The government is also in the

process of understanding how much secrecy clauses allow it to reveal without compromising treaties.

UK Net Service Provider Picks up 70% in Nimbuzz: $175-m deal values co at 8

times expected revenue. New Call Telecom, a UK-based internet service provider, has acquired a

70% stake in India-headquartered Nimbuzz for about $175 million, valuing the popular instant

messaging, voice-over-internet call and mobile advertising services provider at more than eight times its

expected revenue for this fiscal year, underlining the huge interest in the segment. We see huge

potential for new revenue streams and very large expansion of broadband in India through this, Jerome

Booth, chairman of New Call Telecom and the principal investor in the company, told ET. He added that

the company is planning more acquisitions in the Indian market.

29-Oct-2014

BJP Legislature Party Elects Fadnavis Maha CM-Designate Mumbai: Maharashtra will

have its first BJP chief minister take charge on Friday evening. State BJP president and Nagpur MLA

Devendra Fadnavis was unanimously elected the chief minister- designate at the BJP legislature party

meeting held at the Vidhan Bhavan on Tues- day. The core committee of BJP under the leadership of

Fadnavis met the state governor and staked claim to form the next government as the single largest

party. The governor has given BJP 15 days to prove majority in the House. A legislature party meeting to

choose the CM-designate got over in about 15 minutes.

Envisioning Indias Century Having invested $1 b in Indian startups, SoftBank

chief says India could produce Internet heroes if it creates a digital

superhighway: Masayoshi Son is searching for the next Jack Ma, a quest which he thinks might meet

with success amidst the ranks of Indian entrepreneurs selling to consumers and businesses through the

Internet. Son, 57, the founder of Japanese Inter- net and telecom group SoftBank, says he is constantly

on the lookout for entrepreneurial heroes who create jobs in the manner of Alibabas Jack Ma, who

has created employment for 25 million. Sons investment in Alibaba, the Chinese online marketplace, is

the stuff of legend with a $20 million investment made 14 years ago now worth $80 billion after the

Chinese company went public earlier this year. SoftBank owns 37% of Alibaba, which had a market cap

of $250 billion on Tuesday. Such local heroes could emerge in India as well provided Asias third-

largest economy manages to create the digital super-highway envisaged by Prime Minister Narendra

Modi. I think India will be one of the top two economies in this century it has over a billion people,

good education and engi- neering skills. This is Indias century. It could be among the top two economies

in the world, he said in an interview on Tuesday. With that belief, if you can invest (at a) low price and

harvest high price, its a good investment, he added, sitting alongside Nikesh Arora, the Google ex-

ecutive he poached recently. Arora, who joined as vice-chairman and CEO of SoftBank Internet and

Media in July this year, is spearheading the groups US business, as well as its foray into the media and

entertainment industries. On Monday, SoftBank announced a $627 million investment in Snapdeal, be-

coming the largest investor in the fast- growing online marketplace. It also announced a $210 million

investment in Olacabs, a transport aggregator that competes with Uber. Cumulatively, Soft- Bank has

invested $1 billion in Indian startups, becoming the largest investor in that space. In the interaction with

ET, Son enthused about Snapdeals prospects, pointing to its growth of 800% per year. The SoftBank

founder is in India on a three-day visit that started on Monday with an hour-long meeting with Prime

Minister Modi. Son, whose stated goal is to head the largest company in the world, was wooed by the

Indian prime minister on his recent trip to Japan. Last month, Prime Minister Modi visited Tokyo. We

had a face-to-face meeting. He gave us more confidence that India is going to be more transparent and

deregulated with lot of focus and passion to improve India as the environment for investment, he said.

The diminutive Son, famous for some- times setting outlandish goals (and even achieving some of

them), was born in a poor South Korean family. His father was a pig farmer who brewed illegal alcohol.

In explaining SoftBanks investment philosophy, Son likens himself to the conductor of an orchestra.

We would like to be the conductor of the in- formation revolution by looking at the total landscape and

understanding which parts are growing to grow more quickly. He will be listening to the pitches of

nearly two dozen startups over Tuesday and Wednesday, in an attempt to identify future Alibabas. Soft-

Bank has grown more than 600 times since its founding in 1981 and the $66-bil- lion (revenue for the

year ended 2013) company could potentially grow a hundred-fold, according to Son.

Hedge Funds close in on Consumer Startups: Global hedge funds and top technology funds

are making a beeline for India, drawn by the countrys booming consumer Internet sector, boosting

valuations and expectations across startups. These funds include New York-based Falcon Edge Capital,

Technology Crossover Ventures, DST Global and Tybourne Capital Management. According to sources,

hedge funds such as Steadview Capital Management, Hillhouse Capital Group, Think Investments and

Tybourne Capital are actively chasing startups. Venture capital investors focused on the Internet space

such as In- sight Venture Partners and VY Capital are also looking at these companies, which are growing

at over 15-20% month on month. Emails sent to TCV, Tybourne, Steadview, Hill- house, VY Capital, In-

sight Venture by ET did not elicit a response.

30-Oct-2014

Diesel, Petrol to Get Cheaper by INR 2.50: Diesel and petrol are likely to be cheaper by

about INR 2.50 a litre soon, which would dampen inflation as diesel rates would be down 11% in less

than two weeks, and cheer consumers ahead of assembly elections in Jharkhand and Jammu & Kashmir,

government and industry sources said. This will be the sixth consecutive reduction in petrol prices since

August and the first cut in diesel rates after the government deregulated the fuel. The Cabinet on

October 18 allowed state oil firms to align pump prices of diesel with market rates and announced . INR

3.37 per litre price cut. Petrol price was deregulated by the previous UPA government in June 2010. The

planned reduction in auto fuel rates in the next few days would bring down petrol prices to a 16-month

low and diesel prices to a level where it existed a year ago. The steep price cut is because of a sharp fall

in inter- national oil prices. Brent crude dropped to a four-year low of $82.60 per barrel two weeks ago

from above $115 in June. It was trading at $87 per barrel on Wednesday. According to international oil

price data, companies are having margins of about $7-8 per barrel on petrol and diesel in the current

pricing cycle compared to previous fortnight and the rupee dollar exchange rate variation minimal,

sources said. But, a definite figure would be known only by the weekend after we get figures for

remaining three days. This could change the average and pump prices would change accordingly, an

industry executive said.

B-schoolers get a Haversack of Happiness: Big recruiters at leading B-schools are hiking

stipends for summer internships by 30%-40%, sending out a strong signal that they expect the economy

to rev up and the job market to turn red hot in FY16 and FY17. Companies are offering as much as INR

4.2 lakh for a two-month internship and large and established companies are jostling with upstart

ecommerce startups for fresh talent. Online retailer Snapdeal which just raised $627 million from

SoftBank has already made offers to over 50 interns during summer placements compared with 15

last year. It is offering stipends of Rs 1 lakh for two months. Goldman Sachs will be offering stipends of

around Rs 1.55 lakh; HUL, Marico and Castrol around Rs 1.5 lakh; Barclays Shared Services around Rs 1.6

lakh and Dabur approximately Rs 1.4 lakh, campus sources said. The Boston Consulting Group (BCG) has

offered a stipend of Rs 3 lakh, said a member of the IIM-Indore placement team. Companies started

picking candidates from IIMs, MDI, IMI, XLRI, NMIMS and XIM- Bhubaneswar this month, for internships

in the summer of 2015. Summer internships are now a key component in the campus recruitment

process with most companies likely to roll out PPOsat the end of the internships. BCG, for example,

offered jobs to 80% of the 48 students who interned with it this summer. We will make at least 15-20%

more summer internship offers this year, says Suresh Subudhi, partner and director, BCG India. In all,

many companies now find almost 60- 70% of their total campus hires through the internship and PPO

route. Snapdeal, which offered only two profiles to in- terns last year, headed to campuses with nine

profiles this year, across marketing, supply chain, finance, HR and product development. We have

covered around 8-9 campuses so far and by the time we finish with the three IIMs at Ahmedabad,

Bangalore and Calcutta, we would have made close to 70 offers, says Saurabh Ni- gam, VP-HR at

Snapdeal. B-schools are cruising through the summer placements despite almost all of them having

larger batch sizes to place. At IIM-Indore, 153 companies snapped up the 557-strong batch for

internships this year.

The Drug Wars: Novartis, Cipla in Patent Fight: Cipla the countrys fifth-largest drug-

maker by revenue, has asked the government to revoke Novartis five patents on its respiratory drug

Onbrez (Indacaterol) and has launched a generic version of the medicine at a fifth of the price at which

the Swiss company sells this drug, triggering another confrontation between an Indian generic company

and a foreign innovator firm. The domestic drug maker has sought cancellation of these patents on the

ground that the Swiss innovator has held these patents for the past six years but has neither

manufactured nor imported the medicine in sufficient quantity. It has alleged that Novartis imports only

about 54,000 units (a unit consists of a bottle of 30 capsules) annually, and deprives 99.9% of the 1.5

crore people in India who need this drug. Novartis products do not satisfy even 4,500 patients annually

and our feedback shows the product is urgently needed by the doctor and patient community, said a

Cipla spokesman. An email sent to a Novartis India spokesperson went unanswered. Ciplas decision to

demand revocation of patents is likely to open a new front in the conflict between domestic drug-

makers and MNCs that goes back several decades. The government will be forced to take notice of all

such cases and will have to take a stand on how it should monitor the situation, said a patent head of

another top generic firm.

Anda mungkin juga menyukai

- RBI Not On Same Page With Finance Ministry On Many IssuesDokumen7 halamanRBI Not On Same Page With Finance Ministry On Many Issuesshreya_chakrabortyBelum ada peringkat

- SPEconomics 2nd SeptDokumen7 halamanSPEconomics 2nd SeptDhiraj PatilBelum ada peringkat

- Business News: 1. Freebies Help Tata Revive Nano buzz-NEW DELHI: A Series of CustomerDokumen7 halamanBusiness News: 1. Freebies Help Tata Revive Nano buzz-NEW DELHI: A Series of CustomerAshwini KumarBelum ada peringkat

- Current Affairs Reading Material - Part ADokumen56 halamanCurrent Affairs Reading Material - Part Amuttu&moonBelum ada peringkat

- Crux 3.0 - 04Dokumen11 halamanCrux 3.0 - 04Neeraj GargBelum ada peringkat

- 26.12.2023 - The Banking FrontlineDokumen9 halaman26.12.2023 - The Banking Frontlineservice.chennaiboiBelum ada peringkat

- Air India Set To Join Star AllianceDokumen4 halamanAir India Set To Join Star AllianceSivaguru SanBelum ada peringkat

- India To Be Test Bed For Google's New Projects: HE Conomic ImesDokumen1 halamanIndia To Be Test Bed For Google's New Projects: HE Conomic ImesSumit RepswalBelum ada peringkat

- Make in IndiaDokumen10 halamanMake in IndiaRajeshsharmapurangBelum ada peringkat

- TAPMI Newsletter Analyzes Modi's Independence Day SpeechDokumen4 halamanTAPMI Newsletter Analyzes Modi's Independence Day SpeechRobert MillerBelum ada peringkat

- FinPrint (ET Mint)Dokumen4 halamanFinPrint (ET Mint)Nitin R GanapuleBelum ada peringkat

- Weekend News: Bhawana Chawla MBA-2CDokumen13 halamanWeekend News: Bhawana Chawla MBA-2CBHAWANACHAWLABelum ada peringkat

- Indian ExpressDokumen47 halamanIndian ExpressRikEn PAtelBelum ada peringkat

- 11.03.2024 - The Banking FrontlineDokumen8 halaman11.03.2024 - The Banking FrontlineAntony ABelum ada peringkat

- 20BSP0127 - Akanksha EcoDokumen46 halaman20BSP0127 - Akanksha EcoNeha SarayanBelum ada peringkat

- Niveshak July15 PDFDokumen36 halamanNiveshak July15 PDFNivetha SridharBelum ada peringkat

- Coal India LTDDokumen5 halamanCoal India LTDipslogBelum ada peringkat

- Current Affairs Assignment 3 - OTPE11Dokumen4 halamanCurrent Affairs Assignment 3 - OTPE11vishal sinhaBelum ada peringkat

- Tata Motors Should Be More Mature by 2020: Ratan Tata (CMP 980)Dokumen6 halamanTata Motors Should Be More Mature by 2020: Ratan Tata (CMP 980)venkatrao_gvBelum ada peringkat

- Vol 2 Issue 25Dokumen13 halamanVol 2 Issue 25Satya Prakash ChinnaraBelum ada peringkat

- GK Compendium For Non-CAT Exams 2015Dokumen58 halamanGK Compendium For Non-CAT Exams 2015vivgupta04Belum ada peringkat

- FII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesDokumen1 halamanFII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesnikhiljeswaninjBelum ada peringkat

- 23 March: Coal Scam: CBI Receives Authority's Nod On Final Probe ReportDokumen6 halaman23 March: Coal Scam: CBI Receives Authority's Nod On Final Probe ReportArmy Institute of Management, KolkataBelum ada peringkat

- BHARTI AIRTEL COMPLETES ACQUISITION OF ZAIN TELECOMDokumen6 halamanBHARTI AIRTEL COMPLETES ACQUISITION OF ZAIN TELECOMShivam BajajBelum ada peringkat

- SBI Bond Oversubscribed, Coal India IPO Fully SubscribedDokumen3 halamanSBI Bond Oversubscribed, Coal India IPO Fully SubscribedPrateek JaiswalBelum ada peringkat

- Daily Current Affairs - 14th November 2022 - 1668426071 PDFDokumen10 halamanDaily Current Affairs - 14th November 2022 - 1668426071 PDFAbhimanyu GuptaBelum ada peringkat

- 22.06.2023 - Morning Financial News UpdatesDokumen6 halaman22.06.2023 - Morning Financial News UpdatesAnkur ChattopadhayayBelum ada peringkat

- India Property Ford Classic DieselDokumen6 halamanIndia Property Ford Classic Dieselniteshm4uBelum ada peringkat

- (Gkmojo) April Month Affairs: Important Days of AprilDokumen21 halaman(Gkmojo) April Month Affairs: Important Days of AprilAdarsh AgarwalBelum ada peringkat

- Air India 1Dokumen6 halamanAir India 1jyotsna07Belum ada peringkat

- Economic Issues: India'S Inflation Highest Among Developing NationsDokumen7 halamanEconomic Issues: India'S Inflation Highest Among Developing NationsReishabh SharmaBelum ada peringkat

- The Economics Hub 280 2Dokumen11 halamanThe Economics Hub 280 2minakshi.pandey8Belum ada peringkat

- Aurobinda BD 100 ArticlesDokumen44 halamanAurobinda BD 100 ArticlesAUROBINDA SAHOOBelum ada peringkat

- Real Estate Last Updated February 2010Dokumen3 halamanReal Estate Last Updated February 2010Yogesh KendeBelum ada peringkat

- 11.01.2024 - The Banking FrontlineDokumen9 halaman11.01.2024 - The Banking Frontlineservice.chennaiboiBelum ada peringkat

- The Derrick 20theditionDokumen21 halamanThe Derrick 20theditionGagandeep SinghBelum ada peringkat

- Economic Times News - FinalDokumen20 halamanEconomic Times News - FinalNeeraj DharBelum ada peringkat

- Finsight 1april2012Dokumen10 halamanFinsight 1april2012Archish GuptaBelum ada peringkat

- L&T Bags Hyderabad Metro Train Project: Add CommentDokumen8 halamanL&T Bags Hyderabad Metro Train Project: Add CommentsuryaramdegalaBelum ada peringkat

- Dna CDS 2Dokumen1 halamanDna CDS 2xt100Belum ada peringkat

- Weekly GK Capsule 22-28 AprilDokumen21 halamanWeekly GK Capsule 22-28 AprilSANDEEP GAWANDEBelum ada peringkat

- Awards & Honours: Was Ranked Second On The BusinessDokumen17 halamanAwards & Honours: Was Ranked Second On The BusinessKUMAR ABHISHEKBelum ada peringkat

- 1438640868CareerAnna GK2015 FebruaryFactSheetDokumen11 halaman1438640868CareerAnna GK2015 FebruaryFactSheetRitesh RamanBelum ada peringkat

- Feb 2016Dokumen61 halamanFeb 2016arunjangra566Belum ada peringkat

- India's Crypto Community Fights Proposed Ban as Economic Crisis LoomsDokumen21 halamanIndia's Crypto Community Fights Proposed Ban as Economic Crisis LoomsJeevan ManojBelum ada peringkat

- News Analysis 8Dokumen6 halamanNews Analysis 8Ben HiranBelum ada peringkat

- 44 labour laws consolidated into 4 codes to simplify regulationsDokumen21 halaman44 labour laws consolidated into 4 codes to simplify regulationsMehar ChandBelum ada peringkat

- 18.03.2024 - The Banking FrontlineDokumen8 halaman18.03.2024 - The Banking Frontlineservice.chennaiboiBelum ada peringkat

- Mental Accounting: From The Desk of Editor in ChiefDokumen4 halamanMental Accounting: From The Desk of Editor in ChiefSoobian AhmedBelum ada peringkat

- Pocket News For The Week 50Dokumen2 halamanPocket News For The Week 50Vikash Chander KhatkarBelum ada peringkat

- 1 - 1st September 2007 (010907)Dokumen4 halaman1 - 1st September 2007 (010907)Chaanakya_cuimBelum ada peringkat

- 14-15-Sept: 1. Android One ExplanationDokumen2 halaman14-15-Sept: 1. Android One ExplanationdaretorainbowBelum ada peringkat

- Delhi High Court Stops Britannia From Selling Its Digestive BiscuitsDokumen13 halamanDelhi High Court Stops Britannia From Selling Its Digestive BiscuitsRashmiBelum ada peringkat

- Stimulus 12 IssueDokumen8 halamanStimulus 12 Issuecapdash2002Belum ada peringkat

- Study: Crackdown On Black Money Leading To Surge in Cash HoldingsDokumen1 halamanStudy: Crackdown On Black Money Leading To Surge in Cash HoldingsPawan SharmaBelum ada peringkat

- Current Affairs 2013Dokumen87 halamanCurrent Affairs 2013Vidushi KhajuriaBelum ada peringkat

- News Business 1Dokumen184 halamanNews Business 1Rony JamesBelum ada peringkat

- Story of The Week Life Time High For Sensex, NiftyDokumen3 halamanStory of The Week Life Time High For Sensex, NiftyTRETMSNIJSDADMajfkgnBelum ada peringkat

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsDari EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsBelum ada peringkat

- Vol XVIDokumen141 halamanVol XVIArmy Institute of Management, KolkataBelum ada peringkat

- Kindler Volume XV July-December 2015 Conference SpecialDokumen453 halamanKindler Volume XV July-December 2015 Conference SpecialArmy Institute of Management, KolkataBelum ada peringkat

- Kindler Volume XV January - June 2015Dokumen152 halamanKindler Volume XV January - June 2015Army Institute of Management, KolkataBelum ada peringkat

- SIP Guidlines MBA-18Dokumen8 halamanSIP Guidlines MBA-18Army Institute of Management, KolkataBelum ada peringkat

- ET 23-27 November 2014Dokumen8 halamanET 23-27 November 2014Army Institute of Management, KolkataBelum ada peringkat

- Kindler Volume XIV January - December 2014Dokumen93 halamanKindler Volume XIV January - December 2014Army Institute of Management, KolkataBelum ada peringkat

- Notice Dated 21 Nov 2015Dokumen1 halamanNotice Dated 21 Nov 2015Army Institute of Management, KolkataBelum ada peringkat

- FDP PosterDokumen1 halamanFDP PosterArmy Institute of Management, KolkataBelum ada peringkat

- List of Publication-2014-2015-19 Aug 15Dokumen2 halamanList of Publication-2014-2015-19 Aug 15Army Institute of Management, KolkataBelum ada peringkat

- Merged DocumentDokumen2 halamanMerged DocumentArmy Institute of Management, KolkataBelum ada peringkat

- 23 March: Coal Scam: CBI Receives Authority's Nod On Final Probe ReportDokumen6 halaman23 March: Coal Scam: CBI Receives Authority's Nod On Final Probe ReportArmy Institute of Management, KolkataBelum ada peringkat

- FEE STRUC MBA-18 Second Year For UploadDokumen2 halamanFEE STRUC MBA-18 Second Year For UploadArmy Institute of Management, KolkataBelum ada peringkat

- Notice For Fresh Admission-4Dokumen1 halamanNotice For Fresh Admission-4Army Institute of Management, KolkataBelum ada peringkat

- Medal Award Ceremony, 2014Dokumen1 halamanMedal Award Ceremony, 2014Army Institute of Management, KolkataBelum ada peringkat

- Ad HR OB Counsellor ES - 16 Nov 14Dokumen1 halamanAd HR OB Counsellor ES - 16 Nov 14Army Institute of Management, KolkataBelum ada peringkat

- Present Position of The Waitlisted Army CandidateDokumen1 halamanPresent Position of The Waitlisted Army CandidateArmy Institute of Management, KolkataBelum ada peringkat

- Kindler Volume 13, Jan - Dec 13Dokumen24 halamanKindler Volume 13, Jan - Dec 13Army Institute of Management, KolkataBelum ada peringkat

- Notification For Uploading in AIMK WebsiteDokumen2 halamanNotification For Uploading in AIMK WebsiteArmy Institute of Management, KolkataBelum ada peringkat

- Menot Proj GuideDokumen4 halamanMenot Proj GuideArmy Institute of Management, KolkataBelum ada peringkat

- Final Placement Report For Website - NS 24.07.14Dokumen6 halamanFinal Placement Report For Website - NS 24.07.14Army Institute of Management, KolkataBelum ada peringkat

- Counter Strike by Abacus ClubDokumen7 halamanCounter Strike by Abacus ClubArmy Institute of Management, KolkataBelum ada peringkat

- Placement 2Dokumen26 halamanPlacement 2Army Institute of Management, KolkataBelum ada peringkat

- Gpnta SDK 310514 PDFDokumen1 halamanGpnta SDK 310514 PDFArmy Institute of Management, KolkataBelum ada peringkat

- Golden Peacock National Training AwardDokumen1 halamanGolden Peacock National Training AwardArmy Institute of Management, KolkataBelum ada peringkat

- Summer Project Guidelines-2014-Mba-17 NewDokumen8 halamanSummer Project Guidelines-2014-Mba-17 NewArmy Institute of Management, KolkataBelum ada peringkat

- Selected From Wait List-GeneralDokumen1 halamanSelected From Wait List-GeneralArmy Institute of Management, KolkataBelum ada peringkat

- Summer Project Guidelines 2014 Mba 17Dokumen4 halamanSummer Project Guidelines 2014 Mba 17Army Institute of Management, KolkataBelum ada peringkat

- Selected From Wait List-ArmyDokumen1 halamanSelected From Wait List-ArmyArmy Institute of Management, KolkataBelum ada peringkat

- Present Position of The Waitlisted General CandidatesDokumen1 halamanPresent Position of The Waitlisted General CandidatesArmy Institute of Management, KolkataBelum ada peringkat

- Uv0010 PDF EngDokumen8 halamanUv0010 PDF EngshadyBelum ada peringkat

- Partnership ChangesDokumen2 halamanPartnership ChangesRochelle BuensucesoBelum ada peringkat

- FINS 3616 Tutorial Questions-Week 7 - AnswersDokumen2 halamanFINS 3616 Tutorial Questions-Week 7 - AnswersbenBelum ada peringkat

- Zameer Và C NG S, 2013. Determinants of Dividend Policy A Case of Banking Sector in Pakistan, Middle-East Journal of Scientific Research, ISSN 1990-9233 PDFDokumen15 halamanZameer Và C NG S, 2013. Determinants of Dividend Policy A Case of Banking Sector in Pakistan, Middle-East Journal of Scientific Research, ISSN 1990-9233 PDFThi NguyenBelum ada peringkat

- Chapter 3 ExaminationDokumen4 halamanChapter 3 ExaminationSurameto HariyadiBelum ada peringkat

- Interest Rates and Security ValuationDokumen50 halamanInterest Rates and Security ValuationBrithney ButalidBelum ada peringkat

- Pcs Montlhy Current Affairs November 2019 English 29Dokumen30 halamanPcs Montlhy Current Affairs November 2019 English 29veer singhBelum ada peringkat

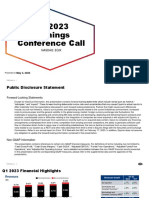

- Equinix Q1 2023 Earnings Presentation FinalDokumen50 halamanEquinix Q1 2023 Earnings Presentation FinalDaniel ChuaBelum ada peringkat

- T - TD Tetulmari-CHP Final 2266Dokumen547 halamanT - TD Tetulmari-CHP Final 2266kselvan_1Belum ada peringkat

- Allowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.Dokumen2 halamanAllowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.kavita.m.yadavBelum ada peringkat

- 200+ Sentence Fillers Questions With Solution: Daily VisitDokumen59 halaman200+ Sentence Fillers Questions With Solution: Daily VisitAkarshika pandeyBelum ada peringkat

- Current Affairs Quiz DecemberDokumen460 halamanCurrent Affairs Quiz DecemberhdswiftlyBelum ada peringkat

- EprgDokumen13 halamanEprgRajveer RathoreBelum ada peringkat

- H59H60Dokumen1 halamanH59H60MinamPeruBelum ada peringkat

- Carib Studies Module 2 NotesDokumen96 halamanCarib Studies Module 2 NotesMika Vaughn100% (1)

- Corporate Finance - Project Report - Capital Structure TrendsDokumen18 halamanCorporate Finance - Project Report - Capital Structure TrendsNikhil PathakBelum ada peringkat

- Basic Accounting: Adjusting Entries: Adjustment of Accounts Correct Amount Adjusted Ending BalancesDokumen4 halamanBasic Accounting: Adjusting Entries: Adjustment of Accounts Correct Amount Adjusted Ending BalancesMacoy LiceraldeBelum ada peringkat

- Public Private Partnership (PPP) - Group DDokumen31 halamanPublic Private Partnership (PPP) - Group Ddevdattam100% (1)

- Founder of UB Group Vittal MallyaDokumen9 halamanFounder of UB Group Vittal MallyaAnuj SharmaBelum ada peringkat

- 91 3 STOIKOV Microstructure TalkDokumen60 halaman91 3 STOIKOV Microstructure Talkantonello_camilettiBelum ada peringkat

- Applying InnovationDokumen34 halamanApplying InnovationAshish Kothari100% (1)

- IPP 2014 Appendix 1 Sectoral AnalysesDokumen63 halamanIPP 2014 Appendix 1 Sectoral AnalysesRose Ann AguilarBelum ada peringkat

- Procurement Planning PresentatinDokumen2 halamanProcurement Planning PresentatinSylvia NabwireBelum ada peringkat

- A Study On Savings and Investment Pattern of Salaried Women in Coimbatore DistrictDokumen6 halamanA Study On Savings and Investment Pattern of Salaried Women in Coimbatore DistrictJananiBelum ada peringkat

- PIM VivaanDokumen19 halamanPIM VivaanRama KrishnaBelum ada peringkat

- Challenges of Audit ProfessionDokumen8 halamanChallenges of Audit ProfessionEershad Muhammad GunessBelum ada peringkat

- Forex Trading Sessions - Everything You Need To Know From Strategy To ExecutionDokumen1 halamanForex Trading Sessions - Everything You Need To Know From Strategy To ExecutionForex Master WorkBelum ada peringkat

- Barlekha Furniture Layout-ModelDokumen1 halamanBarlekha Furniture Layout-ModelAnower ShahadatBelum ada peringkat

- The Firefly FanbookDokumen8 halamanThe Firefly FanbookTeppo Testaaja100% (2)

- Atif Noor - Resume - 22092015Dokumen4 halamanAtif Noor - Resume - 22092015Muhammad Atif NoorBelum ada peringkat