Understanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdm

Diunggah oleh

Vijayabhaskarareddy VemireddyJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Understanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdm

Diunggah oleh

Vijayabhaskarareddy VemireddyHak Cipta:

Format Tersedia

Understanding Cash Flow Analysis

File C3-14

December 2009

www.extension.iastate.edu/agdm

Don Hofstrand

extension value-added agriculture specialist

co-director Ag Marketing Resource Center

641-423-0844

dhof@iastate.edu

A

cash ow statement is one of the most

important nancial statements for a project

or business. The statement can be as simple

as a one page analysis or may involve several

schedules that feed information into a central

statement.

A cash ow statement is a listing of the ows of cash

into and out of the business or project. Think of it as

your checking account at the bank. Deposits are the

cash inow and withdrawals (checks) are the cash

outows. The balance in your checking account is

your net cash ow at a specic point in time.

A cash ow statement is a listing of cash ows

that occurred during the past accounting period. A

projection of future ows of cash is called a cash

ow budget. You can think of a cash ow budget as a

projection of the future deposits and withdrawals to

your checking account.

A cash ow statement is not only concerned with

the amount of the cash ows but also the timing of

the ows. Many cash ows are constructed with

multiple time periods. For example, it may list

monthly cash inows and outows over a years

time. It not only projects the cash balance remaining

at the end of the year but also the cash balance for

each month.

Working capital is an important part of a cash ow

analysis. It is dened as the amount of money

needed to facilitate business operations and

transactions, and is calculated as current assets (cash

or near cash assets) less current liabilities (liabilities

due during the upcoming accounting period).

Computing the amount of working capital gives

you a quick analysis of the liquidity of the business

over the future accounting period. If working capital

appears to be sufcient, developing a cash ow

budget may be not critical. But if working capital

appears to be insufcient, a cash ow budget may

highlight liquidity problems that may occur during

the coming year.

Most statements are constructed so that you can

identify each individual inow or outow item with

a place for a description of the item. Statements like

Decision Tool Cash Flow Budget (short form 6

periods) and Decision Tool Cash Flow Budget (12

periods) provide exible tools for simple cash ow

projections. A more comprehensive tool for a Farm

Cash Flow (Decision Tool) is also available. A more

in-depth discussion of creating a cash ow budget is

Twelve Steps to Cash Flow Budgeting.

Some cash ow budgets are constructed so that

you can monitor the accuracy of your projections.

These budgets allow you may make monthly cash

ow projections for the coming year and also enter

actual inows and outows as you progress through

the year as provided in Decision Tool Cash Flow

Budget (short form monitor projections). This

will allow you to compare your projections to your

actual cash ows and make adjustments to the

projections for the remainder of the year.

File C3-14

Page 2

Sample 1. Cash ow budget (by quarter of the year).

Cash inow First Q Second Q Third Q Fourth Q

Beginning cash balance $5,000

Sale of crop products $50,000

Sale of livestock products 25,000

Government payments $10,000

Total inow $30,000 $50,000 $10,000

Cash expenditures

Seed $10,000

Fertilizer $20,000

Feed 10,000

Processing $10,000

Marketing $5,000

Capital purchases 10,000

Interest 5,000

Debt payments 10,000

Total expenditures $20,000 $30,000 $25,000 $5,000

Quarterly net cash ow $10,000 $20,000 -$25,000 $5,000

Cummulative net cash ow $10,000 $30,000 $5,000 $10,000

Reasons for Creating a Cash Flow Budget

Think of cash as the ingredient that makes the

business operate smoothly just as grease is the

ingredient that makes a machine function smoothly.

Without adequate cash a business cannot function

because many of the transactions require cash to

complete them.

By creating a cash ow budget you can project

your sources and applications of funds for the

upcoming time periods. You will identify any cash

decit periods in advance so you can take corrective

actions now to alleviate the decit. This may involve

shifting the timing of certain transactions. It may

also determine when money will be borrowed. If

borrowing is involved, it will also determine the

amount of cash that needs to be borrowed.

Periods of excess cash can also be identied. This

information can be used to direct excess cash into

interest bearing assets where additional revenue can

be generated or to scheduled loan payments.

Cash Flow is Not Protability

People often mistakenly believe that a cash ow

statement will show the protability of a business

or project. Although closely related, cash ow and

protability are different. A cash ow statement lists

cash inows and cash outows while the income

statement lists income and expenses. A cash ow

statement shows liquidity while an income statement

shows protability.

Many income items are also cash inows. The sales

of crops and livestock are usually both income and

cash inows. The timing is also usually the same

as long as a check is received and deposited in

your account at the time of the sale. Many expense

items are also cash outow items. The purchase of

livestock feed (cash method of accounting) is both an

expense and a cash outow item. The timing is also

the same if a check is written at the time of purchase.

However, there are many cash items that are not

income and expense items, and vice versa. For

example, the purchase of a tractor is a cash outow

if you pay cash at the time of purchase as shown in

the example in Table 1. If money is borrowed for the

purchase using a term loan, the down payment is a

cash outow at the time of purchase and the annual

principal and interest payments are cash outows

each year as shown in Table 2.

The tractor is a capital asset and has a life of more

than one year. It is included as an expense item in

Page 3

File C3-14

an income statement by the amount it declines in

value due to wear and obsolescence. This is called

depreciation. The cost of depreciation is listed

every year. In the tables below a $70,000 tractor is

depreciated over seven years at the rate of $10,000

per year.

Depreciation calculated for income tax purposes can

be used. However, to more accurately calculate net

income, a realistic depreciation amount should be

used to approximate the actual decline in the value

of the machine during the year.

In Table 2, where the purchase is nanced, the

amount of interest paid on the loan is included as an

expense, along with depreciation, because interest

is the cost of borrowing money. However, principal

payments are not an expense but merely a cash

transfer between you and your lender.

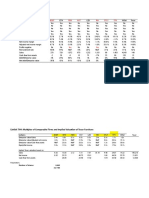

Table 1. Tractor purchase - no borrowing.

Purchase of a $70,000 tractor, no money borrowed, depreciated over seven years.

Cash Outow Expense

Current Period $70,000

Year 1 $10,000

Year 2 10,000

Year 3 10,000

Year 4 10,000

Year 5 10,000

Year 6 10,000

Year 7 10,000

Total $70,000 $70,000

Table 2. Tractor purchase - borrowing.

Purchase of a $70,000 tractor, $45,000 down payment, $25,000 paid over ve year, seven percent

interest, depreciated over seven years.

Cash Outow Expense

Current Period $45,000 $0

Year 1 $5,000 principal $10,000 depreciation

$1,750 interest $1,750 interest

Year 2 $5,000 principal $10,000 depreciation

$1,400 interest $1,400 interest

Year 3 $5,000 principal $10,000 depreciation

$1,050 interest $1,050 interest

Year 4 $5,000 principal $10,000 depreciation

$700 interest $700 interest

Year 5 $5,000 principal $10,000 depreciation

$350 interest $350 interest

Year 6 $0 $10,000 depreciation

Year 7 $0 $10,000 depreciation

Total $75,250 $75,250

Page 4

File C3-14

Other Financial Statements

A cash ow statement is only one of several nancial

statements that can be used to measure the nancial

strength of a business. Other common statements

include the balance sheet or Net Worth Statement and

the Income Statement, although there are several other

statements that may be included.

These statements t together to form a comprehensive

nancial picture of the business. The balance sheet or

net worth statement shows the solvency of the business

at a specic point in time. Statements are often prepared

at the beginning and ending of the accounting period

(i.e. J anuary 1). The statement records the assets of the

business and their value and the liabilities or nancial

claims against the business, i.e. debts. The

amount by which assets exceed liabilities is the

net worth of the business. The net worth reects

the current value of investment in the business by

the owners.

The income statement is a dynamic statement

that records income and expenses over the

accounting period. The net income (loss) for the

period increases (decreases) the net worth of the

business (as shown in the ending balance sheet

versus the beginning balance sheet).

Figure 1. Integrated nancial statements.

Balance

Sheet

Balance

Sheet

Income Statement

Cash Flow Statement

Time

A complete set of Financial Statements (Decision

Tool), including the beginning and ending net worth

statements, the income statement, the cash ow

statement, the statement of owner equity and the

nancial performance measures is available to do a

comprehensive nancial analysis of your business.

To help you assess the nancial health of your

business, Financial Performance Measures allows

you to give your business a check-up. Interpreting

Financial Performance Measures helps you to

understand what these performance measures mean

for your business.

. . . and justice for all

The U.S. Department of Agriculture (USDA) prohibits discrimination in

all its programs and activities on the basis of race, color, national origin,

gender, religion, age, disability, political beliefs, sexual orientation, and

marital or family status. (Not all prohibited bases apply to all programs.)

Many materials can be made available in alternative formats for ADA

clients. To le a complaint of discrimination, write USDA, Ofce of

Civil Rights, Room326-W, Whitten Building, 14th and Independence

Avenue, SW, Washington, DC 20250-9410 or call 202-720-5964.

Issued in furtherance of Cooperative Extension work, Acts of May 8 and

J une 30, 1914, in cooperation with the U.S. Department of Agriculture.

J ack M. Payne, director, Cooperative Extension Service, Iowa State

University of Science and Technology, Ames, Iowa.

Anda mungkin juga menyukai

- Cash Flow Management - DR ReddyDokumen103 halamanCash Flow Management - DR Reddyarjunmba119624Belum ada peringkat

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthDari EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthBelum ada peringkat

- Writing The Business PlanDokumen8 halamanWriting The Business PlanIngrid Yaneth SalamancaBelum ada peringkat

- Financial Terms and RatiosDokumen76 halamanFinancial Terms and Ratiosbanshidharbehera100% (1)

- Cash Flow StatementDokumen20 halamanCash Flow StatementKarthik Balaji100% (1)

- Fund Flow and Cash Flow AnalysisDokumen20 halamanFund Flow and Cash Flow AnalysisThirumanas Kottarathil K RBelum ada peringkat

- Smart ViewDokumen34 halamanSmart ViewVijayabhaskarareddy VemireddyBelum ada peringkat

- Teuer B DataDokumen41 halamanTeuer B DataAishwary Gupta100% (1)

- Summary of Richard A. Lambert's Financial Literacy for ManagersDari EverandSummary of Richard A. Lambert's Financial Literacy for ManagersBelum ada peringkat

- Car Loan FormDokumen5 halamanCar Loan FormDrumaraBelum ada peringkat

- Oracle HFM Beginner's Guide Part IDokumen28 halamanOracle HFM Beginner's Guide Part IAmit Sharma100% (1)

- Personal Trading BehaviourDokumen5 halamanPersonal Trading Behaviourapi-3739065Belum ada peringkat

- Huerta Alba Resort V CADokumen2 halamanHuerta Alba Resort V CAsinisteredgirl100% (1)

- Cima F1 Chapter 4Dokumen20 halamanCima F1 Chapter 4MichelaRosignoli100% (1)

- Statement of Cash Flows: Preparation, Presentation, and UseDari EverandStatement of Cash Flows: Preparation, Presentation, and UseBelum ada peringkat

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyDari EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyBelum ada peringkat

- Understanding Cash Flow Analysis: Ag Decision MakerDokumen4 halamanUnderstanding Cash Flow Analysis: Ag Decision MakerSURAJIT DAS BAURIBelum ada peringkat

- Statement of Cash Flows: Financial Accounting Presentation byDokumen11 halamanStatement of Cash Flows: Financial Accounting Presentation bykhadijaBelum ada peringkat

- Assignment 04 Cash Flow StatementDokumen6 halamanAssignment 04 Cash Flow Statementumair iqbalBelum ada peringkat

- ForecastingDokumen19 halamanForecastingKathryn TeoBelum ada peringkat

- Understanding Profitability: Dhof@iastate - EduDokumen56 halamanUnderstanding Profitability: Dhof@iastate - EduLeilanie Felicita GrandeBelum ada peringkat

- T10 Managing Finance NotesDokumen46 halamanT10 Managing Finance NotesNargis Habib MukatyBelum ada peringkat

- Understanding Profi Tability: File C3-24 December 2009 WWW - Extension.iastate - Edu/agdmDokumen5 halamanUnderstanding Profi Tability: File C3-24 December 2009 WWW - Extension.iastate - Edu/agdmmjc24Belum ada peringkat

- SCDL PGDBA Finance Sem 1 Management AccountingDokumen19 halamanSCDL PGDBA Finance Sem 1 Management Accountingamitm17Belum ada peringkat

- Introduction of Cash BudgetDokumen4 halamanIntroduction of Cash BudgetLaxman Zagge100% (2)

- ..CASH Flow@Union Bank of IndiaDokumen83 halaman..CASH Flow@Union Bank of Indiamoula nawazBelum ada peringkat

- Cash FlowsDokumen17 halamanCash Flowsmanishkaushik86Belum ada peringkat

- Financial StatementsDokumen8 halamanFinancial StatementsbouhaddihayetBelum ada peringkat

- Financial Management - Chapter 8Dokumen23 halamanFinancial Management - Chapter 8rksp99999Belum ada peringkat

- Chapter 6 - Financial Statements and Analysis: The Balance SheetDokumen11 halamanChapter 6 - Financial Statements and Analysis: The Balance SheetTaimoor KhanBelum ada peringkat

- Chap2+3 1Dokumen36 halamanChap2+3 1Tarif IslamBelum ada peringkat

- Acc201 Su6Dokumen15 halamanAcc201 Su6Gwyneth LimBelum ada peringkat

- Budgeting and Budgetary ControlDokumen12 halamanBudgeting and Budgetary ControlSteve JonzieBelum ada peringkat

- How Is It Important For Banks?: Investopedia SaysDokumen5 halamanHow Is It Important For Banks?: Investopedia SaysSushant Dilip SalviBelum ada peringkat

- Chapter 2 Statements and Cash FlowDokumen7 halamanChapter 2 Statements and Cash FlowBqsauceBelum ada peringkat

- Cashflow-Project-Sandhya Hema FullDokumen71 halamanCashflow-Project-Sandhya Hema Fullkannan VenkatBelum ada peringkat

- Cashflow-Project-Sandhya Hema FullDokumen71 halamanCashflow-Project-Sandhya Hema Fullkannan Venkat100% (1)

- Cashflow-Project-Sandhya Hema FullDokumen71 halamanCashflow-Project-Sandhya Hema Fullkannan VenkatBelum ada peringkat

- Technical Accounting Interview QuestionsDokumen14 halamanTechnical Accounting Interview QuestionsRudra PatidarBelum ada peringkat

- Financial ForecastingDokumen8 halamanFinancial Forecastingtranlamtuyen1911Belum ada peringkat

- Free Cash FlowDokumen6 halamanFree Cash FlowAnh KietBelum ada peringkat

- Cash Flow AnalysisDokumen6 halamanCash Flow AnalysisRaghav IssarBelum ada peringkat

- Financial Terms and RatiosDokumen13 halamanFinancial Terms and RatiosAnonymous nTxB1EPvBelum ada peringkat

- Cash Flow StatementDokumen11 halamanCash Flow StatementTagele gashawBelum ada peringkat

- Chapter No. 8: Financial Statements AnalysisDokumen23 halamanChapter No. 8: Financial Statements AnalysisBalakrishna ChakaliBelum ada peringkat

- Cashflow Project SandhyaDokumen71 halamanCashflow Project Sandhyatarun nemalipuriBelum ada peringkat

- Financial Terms and RatiosDokumen20 halamanFinancial Terms and RatiosRethiesh ArBelum ada peringkat

- The Cash Flow StatementsDokumen13 halamanThe Cash Flow Statementsdeo omachBelum ada peringkat

- Financial Appraisals 12-1-2012Dokumen5 halamanFinancial Appraisals 12-1-2012Muhammad ShakirBelum ada peringkat

- Preface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and OutflowsDokumen45 halamanPreface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and Outflowskannan VenkatBelum ada peringkat

- Presentation On Fund Flow Statement: Presented byDokumen20 halamanPresentation On Fund Flow Statement: Presented byAnurag BhargavaBelum ada peringkat

- Cash Flow Statement AnalysisDokumen36 halamanCash Flow Statement Analysisthilaganadar100% (5)

- Cash Flow Statement PDFDokumen18 halamanCash Flow Statement PDFPrithikaBelum ada peringkat

- Tiffanyfailner Example of Word DocumentDokumen4 halamanTiffanyfailner Example of Word Documentapi-240618572Belum ada peringkat

- Funds Analysis, Cash-Flow Analysis, and Financial PlanningDokumen31 halamanFunds Analysis, Cash-Flow Analysis, and Financial Planningmyasir1992100% (1)

- Cash Flow Statement 1Dokumen5 halamanCash Flow Statement 1furqanBelum ada peringkat

- Accounting Lec - 1Dokumen3 halamanAccounting Lec - 1Fahomeda Rahman SumoniBelum ada peringkat

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDokumen24 halamanTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- What Is A Cash Flow StatementDokumen4 halamanWhat Is A Cash Flow StatementDaniel GarciaBelum ada peringkat

- Intermediate Accounting/Preparation of Financial StatementsDokumen7 halamanIntermediate Accounting/Preparation of Financial StatementsHimashu TiwariBelum ada peringkat

- Principles of Managerial FinanceDokumen37 halamanPrinciples of Managerial FinanceAngela VeronikaBelum ada peringkat

- Original 1436552353 VICTORIA ProjectDokumen12 halamanOriginal 1436552353 VICTORIA ProjectShashank SharanBelum ada peringkat

- Cash Flow AnalysisDokumen3 halamanCash Flow AnalysisMubashirAnzaBelum ada peringkat

- Summary Feature Comparison: A Comparison Between SQL Vs Oracle DB'SDokumen4 halamanSummary Feature Comparison: A Comparison Between SQL Vs Oracle DB'SVijayabhaskarareddy VemireddyBelum ada peringkat

- Oracle & MysqlcomparisonDokumen14 halamanOracle & MysqlcomparisonVijayabhaskarareddy VemireddyBelum ada peringkat

- Summary Feature Comparison: A Comparison Between SQL Vs Oracle DB'SDokumen4 halamanSummary Feature Comparison: A Comparison Between SQL Vs Oracle DB'SVijayabhaskarareddy VemireddyBelum ada peringkat

- Hackett HUGMN FDM EE PresentationDokumen40 halamanHackett HUGMN FDM EE PresentationVijayabhaskarareddy VemireddyBelum ada peringkat

- Criminal Verification FormDokumen1 halamanCriminal Verification FormVijayabhaskarareddy VemireddyBelum ada peringkat

- Dbms Comparison Report: Oracle 11i MS SQL 2000Dokumen4 halamanDbms Comparison Report: Oracle 11i MS SQL 2000Vijayabhaskarareddy VemireddyBelum ada peringkat

- Essbase Installation 11.1.1.3 ChapterDokumen24 halamanEssbase Installation 11.1.1.3 ChapterAmit SharmaBelum ada peringkat

- Whitepaper July A 2102 v01.PDF To TD Whitepaper DRMBestPraciticesDokumen13 halamanWhitepaper July A 2102 v01.PDF To TD Whitepaper DRMBestPraciticessayantan28Belum ada peringkat

- Integrat XBRL Financial Repors WP 518965Dokumen35 halamanIntegrat XBRL Financial Repors WP 518965Vijayabhaskarareddy VemireddyBelum ada peringkat

- Airport Liner TimingsDokumen10 halamanAirport Liner TimingsNagasai ViswanathBelum ada peringkat

- Translation of Foreign Currency TransactionsDokumen82 halamanTranslation of Foreign Currency TransactionsVijayabhaskarareddy VemireddyBelum ada peringkat

- Smart View 11 1 2 1 102 New Features - HUG Tech DayDokumen57 halamanSmart View 11 1 2 1 102 New Features - HUG Tech DayVijayabhaskarareddy VemireddyBelum ada peringkat

- Translation of Foreign Currency TransactionsDokumen82 halamanTranslation of Foreign Currency TransactionsVijayabhaskarareddy VemireddyBelum ada peringkat

- HFM AccountDokumen1 halamanHFM AccountVijayabhaskarareddy VemireddyBelum ada peringkat

- Essbase New FeaturesDokumen6 halamanEssbase New FeaturesLeoBelum ada peringkat

- VBA Book PDFDokumen121 halamanVBA Book PDFAriadiKetutBelum ada peringkat

- QassimHandout PDFDokumen180 halamanQassimHandout PDFApple HijauBelum ada peringkat

- Andhrapradesh Telugu Calendar 2015 MarchDokumen1 halamanAndhrapradesh Telugu Calendar 2015 MarchVijayabhaskarareddy VemireddyBelum ada peringkat

- Interrel at Kscope 13 Customer Guide 05-28-13Dokumen5 halamanInterrel at Kscope 13 Customer Guide 05-28-13Vijayabhaskarareddy VemireddyBelum ada peringkat

- Airport Liner TimingsDokumen10 halamanAirport Liner TimingsNagasai ViswanathBelum ada peringkat

- HFM AccountDokumen1 halamanHFM AccountVijayabhaskarareddy VemireddyBelum ada peringkat

- Webuser AnalysisDokumen158 halamanWebuser AnalysisVijayabhaskarareddy VemireddyBelum ada peringkat

- TtingyourdataoutofhfmDokumen64 halamanTtingyourdataoutofhfmVijayabhaskarareddy VemireddyBelum ada peringkat

- Cu-Compliance Unit - (Child & Parent Combination) Aff - Accounting Flexfileld Na - Natural Acc'S LL - Local Legal Mu-Management Unit Itp - Internal Trading Partner/ (Ict)Dokumen1 halamanCu-Compliance Unit - (Child & Parent Combination) Aff - Accounting Flexfileld Na - Natural Acc'S LL - Local Legal Mu-Management Unit Itp - Internal Trading Partner/ (Ict)Vijayabhaskarareddy VemireddyBelum ada peringkat

- HFM Config Special StepsDokumen4 halamanHFM Config Special StepsKrishna TilakBelum ada peringkat

- Eas DevDokumen72 halamanEas DevDeepak PSBelum ada peringkat

- Hyperion Integration - ODI FDM HALDokumen30 halamanHyperion Integration - ODI FDM HALNaeem ShaikhBelum ada peringkat

- DP HCM (MATHS) Printable PDFDokumen81 halamanDP HCM (MATHS) Printable PDFAarzoo RatheeBelum ada peringkat

- Introduction of Aditya Birla GroupDokumen4 halamanIntroduction of Aditya Birla GroupdeshmonsterBelum ada peringkat

- Quiz 2Dokumen9 halamanQuiz 2yuvita prasadBelum ada peringkat

- Special Report: The Best of Hotman Paris: 1 September 2014Dokumen2 halamanSpecial Report: The Best of Hotman Paris: 1 September 2014Larasati Alexandra Sekar AyuBelum ada peringkat

- Waterways Magazine Winter 2013Dokumen84 halamanWaterways Magazine Winter 2013Waterways MagazineBelum ada peringkat

- Sworn Statement of Assets, Liabilities and Net WorthDokumen2 halamanSworn Statement of Assets, Liabilities and Net WorthKal El DadiBelum ada peringkat

- Marginal Costing and Cost Volume Profit AnalysisDokumen5 halamanMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanBelum ada peringkat

- Methodology MDG Scan 3 V 4Dokumen14 halamanMethodology MDG Scan 3 V 4Andrew GroganBelum ada peringkat

- Certification of Non-Coverage From The Areas For Priority Development (APD) PDFDokumen3 halamanCertification of Non-Coverage From The Areas For Priority Development (APD) PDFAnonymous isdp4VBelum ada peringkat

- Chapter 2Dokumen8 halamanChapter 2Pradeep RajBelum ada peringkat

- Global Economics Paper No.187Dokumen2 halamanGlobal Economics Paper No.187Velayudham ThiyagarajanBelum ada peringkat

- Property Law II - ContentsDokumen12 halamanProperty Law II - Contentsdanyal860Belum ada peringkat

- BCG - Thinking Outside The BlocksDokumen48 halamanBCG - Thinking Outside The BlocksamrrashedBelum ada peringkat

- Chapter 11 - Allocation of Joint Costs and Accounting For By-ProductsDokumen27 halamanChapter 11 - Allocation of Joint Costs and Accounting For By-ProductsJoann CaneteBelum ada peringkat

- Faculty of Commerce Department of Finance Group2 Student Name Student NumberDokumen9 halamanFaculty of Commerce Department of Finance Group2 Student Name Student NumberRumbidzai KambaBelum ada peringkat

- Checks Issued by City of Boise Idaho - 14Dokumen31 halamanChecks Issued by City of Boise Idaho - 14Mark ReinhardtBelum ada peringkat

- I Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdDokumen2 halamanI Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdMuhammad Dennis AnzarryBelum ada peringkat

- Services, Training, Delivery Equipment Right To Trade NameDokumen6 halamanServices, Training, Delivery Equipment Right To Trade Namecram colasitoBelum ada peringkat

- Attn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDDokumen1 halamanAttn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDNg Kit YinBelum ada peringkat

- Lecture 5.2-General Cost Classifications (Problem 2)Dokumen2 halamanLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- Company Secretarial Practice - Part B - (E-Forms) PDFDokumen721 halamanCompany Secretarial Practice - Part B - (E-Forms) PDFAnonymous 5Hgrr4Q8JBelum ada peringkat

- Module 1-The Concept and Development of MoneyDokumen20 halamanModule 1-The Concept and Development of MoneyRoliane LJ RugaBelum ada peringkat

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokumen1 halamanTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vijay SBelum ada peringkat

- fm4chapter03 기업가치평가Dokumen45 halamanfm4chapter03 기업가치평가quynhnhudang5Belum ada peringkat

- Future-Wealth-Gain Bajaj BrochureDokumen24 halamanFuture-Wealth-Gain Bajaj BrochureVivek SinghalBelum ada peringkat

- 2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADDokumen4 halaman2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADkinBelum ada peringkat