CHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)

Diunggah oleh

m_huges0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

50 tayangan7 halamanAlternative Investment Rules Formulas

Judul Asli

Alternative Investment Rules

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAlternative Investment Rules Formulas

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

50 tayangan7 halamanCHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)

Diunggah oleh

m_hugesAlternative Investment Rules Formulas

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 7

CHAPTER 6 : Some Alternative Investment Rules

1. INTERNAL RATE OF RETURN IRR!

IRR is the discount rate which makes NPV=0 IRR is the discount rate which makes NPV=0

0

) 1 ( ) 1 ( ) 1 (

2

2 1

0

=

+

+ +

+

+

+

+ =

T

T

IRR

C

IRR

C

IRR

C

C NPV

". NP# PROFILE

NPV Profile NPV Profile

C C

0 0 = - = -

C C

1 1 = !2 = !2

C C

2 2 = ! = !

"rial and #rror #stimation$ "rial and #rror #stimation$

If discount rate = 0%& then NPV =' If discount rate = 0%& then NPV ='

If discount rate = 2(% then NPV = ' If discount rate = 2(% then NPV = '

If discount rate = )0%& then NPV = ' If discount rate = )0%& then NPV = '

If discount rate = 2*%& then NPV = ' If discount rate = 2*%& then NPV = '

$. IRR RULE

+cce,t the ,ro-ect +cce,t the ,ro-ect

If IRR . /,,ortunit0 Cost of Ca,ital$ If IRR . /,,ortunit0 Cost of Ca,ital$

1ookin2 at the NPV ,rofile for a con3entional ,ro-ect& we will 4e acce,tin2 ,ro-ects with ,ositi3e NPV$ 1ookin2 at the NPV ,rofile for a con3entional ,ro-ect& we will 4e acce,tin2 ,ro-ects with ,ositi3e NPV$

%. &ULTIPLE IRRs

#5am,le #5am,le

6ear 6ear 0 0 1 1 2 2

C7 C7 -8 -8 82( 82( -82( -82(

"wo chan2es in si2n of cash flows$ "wo chan2es in si2n of cash flows$

- - 9enerates two IRRs : 2(% and 00% 9enerates two IRRs : 2(% and 00%

- - If r ; 2(%& NPV ; 0 If r ; 2(%& NPV ; 0

- - If 2(% ; r ; 00%& NPV . 0 If 2(% ; r ; 00%& NPV . 0

- - If r . 00& NPV ; 0$ If r . 00& NPV ; 0$

<ow does NPV ,rofile look like ' <ow does NPV ,rofile look like '

1

'. NO IRR E(ISTS

#5am,le #5am,le

6ear 6ear 0 0 1 1 2 2

C7 C7 81 81 -8) -8) 82$( 82$(

7or an0 r . 0& the PV of C7 a4o3e is ,ositi3e$ 7or an0 r . 0& the PV of C7 a4o3e is ,ositi3e$

"herefore& should I acce,t this ,ro-ect ' "herefore& should I acce,t this ,ro-ect '

Pro3e it for 0ourself$ Pro3e it for 0ourself$

6. CONFLICT )ET*EEN NP# AN+ IRR

IRR ma0 2i3e the wron2 decision with IRR ma0 2i3e the wron2 decision with mutually exclusive mutually exclusive ,ro-ects which differ in ,ro-ects which differ in

Scale and Pattern of Cash Flows Over Time Scale and Pattern of Cash Flows Over Time

Year 0 1 2 3 4 Year 0 1 2 3 4

Project G Project G -$9 $6 $5 $4 -$9 $6 $5 $4 $0 $0

Project H -$9 $1.8 every yr. forever

- - =hich ,ro-ect has hi2her IRR' =hich ,ro-ect has hi2her IRR'

- - =hich ,ro-ect has hi2her NPV& 2i3en r=10%' =hich ,ro-ect has hi2her NPV& 2i3en r=10%'

- - =hich ,ro-ect should I acce,t& if 4oth ,ro-ects are mutuall0 e5clusi3e ' =hich ,ro-ect should I acce,t& if 4oth ,ro-ects are mutuall0 e5clusi3e '

,. NP# PROFILES FOR )OTH PRO-ECTS

NP#

.6

Pro/e0t 1

"23 $$.$3 +is0ount Rate

4

Pro/e0t H

5. &UTUALL6 E(CLUSI#E PRO-ECTS

+nal0sis of Incremental Pro-ect > Pro-ect < - Pro-ect 9 ? +nal0sis of Incremental Pro-ect > Pro-ect < - Pro-ect 9 ?

Year Year 0 1 2 3 4 0 1 2 3 4

H-G $0 -$4.2 -$3.2 -$2.2 $1.8 . . . H-G $0 -$4.2 -$3.2 -$2.2 $1.8 . . .

- - =hat is the IRR for Incremental Pro-ect >i$e$& <-9? ' =hat is the IRR for Incremental Pro-ect >i$e$& <-9? '

- - If cost of ca,ital . 1($@%& which ,ro-ect should I choose' If cost of ca,ital . 1($@%& which ,ro-ect should I choose'

- - If 1($@% ; c$o$c ; ))$) %& which ,ro-ect should I choose' If 1($@% ; c$o$c ; ))$) %& which ,ro-ect should I choose'

- - If c$o$c . ))$) %& which ,ro-ect should I choose' If c$o$c . ))$) %& which ,ro-ect should I choose'

2

7. CAPITAL RATIONIN1

- - Ased when limitations on the in3estment funds e5ist$ Ased when limitations on the in3estment funds e5ist$

in3estment initial

NPV

= PI$? >i$e$ index ity profitabil

Pro-ect Pro-ect In3estment In3estment NPV NPV Profit$ Inde5$ Profit$ Inde5$

+ + 10 10 21 21 2$1 2$1

B B ( ( 1@ 1@ )$2 )$2

C C ( ( 12 12 2$ 2$

Choose the ,ro-ect from hi2hest P$I until ca,ital e5hausted Choose the ,ro-ect from hi2hest P$I until ca,ital e5hausted

12. LI&ITATIONS IN USE OF P.I. ÐO+

Ca,ital Constraints in more than one ,eriod Ca,ital Constraints in more than one ,eriod

Cu,,ose firm can raise 810 million in each of 0ear 0 and 1$ Cu,,ose firm can raise 810 million in each of 0ear 0 and 1$

0 0 1 1 2 2 NPVD10% NPVD10% P$I P$I

+ + -10 -10 !)0 !)0 !( !( 21 21 2$1 2$1

B B -( -( !( !( !20 !20 1@ 1@ )$2 )$2

C C -( -( !( !( !1( !1( 12 12 )$ )$

E E 0 0 -0 -0 !@0 !@0 1) 1) 0$ 0$

If we acce,t B and C 4ased on PI& we canFt acce,t E$ If we acce,t B and C 4ased on PI& we canFt acce,t E$

=hat if we take + and E' 9i3e hi2her total NPV$ =hat if we take + and E' 9i3e hi2her total NPV$

11. PA6)AC8 PERIO+

<ow lon2 will it take to reco3er the initial in3estment' >"he shorter& the 4etter? <ow lon2 will it take to reco3er the initial in3estment' >"he shorter& the 4etter?

Pro4lems Pro4lems

1$ 1$ Eoes not consider the timin2 of C7s >i$e$& i2nore the "VG? Eoes not consider the timin2 of C7s >i$e$& i2nore the "VG?

2$ 2$ Eoes not consider the C7s after the ,a04ack ,eriod$ Eoes not consider the C7s after the ,a04ack ,eriod$

)$ )$ +r4itrar0 standard for ,a04ack ,eriod$ +r4itrar0 standard for ,a04ack ,eriod$

1". +ISCOUNTE+ PA6)AC8 PERIO+

"o correct the Pro4lem 1 mentioned a4o3e$ "o correct the Pro4lem 1 mentioned a4o3e$

Pro4lem Pro4lem

1$ 1$ Eoes not consider the C7s after the ,a04ack ,eriod$ Eoes not consider the C7s after the ,a04ack ,eriod$

Solve all t9e :uestions an; Pro<lems in Te=t <oo> P? 1'6@162!

- E=0eAt 6.$ an; 6.% on P?. 1'6

- Pro<lem 6.15.

:t9e Bourt9 line s9oul; <e C Aro/e0te; to ?roD at 5 Aer0ent Aer Eear Bor 12 Eears after first year.F

)

CHAPTER ,. NP# an; CaAital )u;?etin?

*HAT TO +ISCOUNT

9eneral rules for discountin2 9eneral rules for discountin2

1$ /nl0 C7 is rele3ant 1$ /nl0 C7 is rele3ant

2$ +lwa0s estimate C7 on an incremental 4asis 2$ +lwa0s estimate C7 on an incremental 4asis

1$ Eo not confuse a3era2e with incremental ,a0offs 1$ Eo not confuse a3era2e with incremental ,a0offs

2$ Include all incidental effects and o,,ortunit0 2$ Include all incidental effects and o,,ortunit0

)$ Eo not for2et workin2 ca,ital reHuirements )$ Eo not for2et workin2 ca,ital reHuirements

$ 7or2et sunk costs$ $ 7or2et sunk costs$

($ Be ware of allocated o3erhead costs$ ($ Be ware of allocated o3erhead costs$

)$ Be consistent in the treatment of inflation )$ Be consistent in the treatment of inflation

Remem4er the relationshi, 4etween the nominal and real interest rate$ Remem4er the relationshi, 4etween the nominal and real interest rate$

CAPITAL )U+1ETIN1 PRO)LE&S

Ca,ital Bud2etin2 in3ol3es the anal0sis of costs and 4enefits that are s,read out o3er Ca,ital Bud2etin2 in3ol3es the anal0sis of costs and 4enefits that are s,read out o3er

se3eral time ,eriod$ se3eral time ,eriod$

- "his leads to a reHuirement that "VG 4e considered to e3aluate the alternati3e correctl0$ - "his leads to a reHuirement that "VG 4e considered to e3aluate the alternati3e correctl0$

NC7=(Re3-Cost-Ee,) (1-") ! Ee,$-Chan2e in N=C$ NC7=(Re3-Cost-Ee,) (1-") ! Ee,$-Chan2e in N=C$

NC7=(Re3-Cost) (1-") ! Ee,(") - Chan2e in N=C$ NC7=(Re3-Cost) (1-") ! Ee,(") - Chan2e in N=C$

- "his eHuation hi2hli2hts that fact that the hi2her the de,reciation e5,ense& the lar2er the NC7$ - "his eHuation hi2hli2hts that fact that the hi2her the de,reciation e5,ense& the lar2er the NC7$

"a5 Chield on Ee,$ = Ee,$ (") "a5 Chield on Ee,$ = Ee,$ (")

UNE:UAL ECON&IC LIFE

If we were choosin2 4etween two mutuall0 e5clusi3e ,ro-ects with different economic li3es& an ad-ustment would 4e necessar0$

=e discuss two ,rocedures

- Re,lacement Chain Gethod

- #Hui3alent +nnaul +nnuit0 Gethod >#++?

#++>1? : Consider Costs /nl0

#++>2? : Consider Both Costs and Re3enue

REPLACE&ENT CHAIN ÐO+

Cu,,ose A< com,an0 is ,lannin2 to moderniIe its ,roduction facilities$ 7ollowin2 are the cash flows for Cu,,ose A< com,an0 is ,lannin2 to moderniIe its ,roduction facilities$ 7ollowin2 are the cash flows for

each machine$ each machine$

6R 6R tJ0 tJ0 tJ1 tJ1 tJ2 tJ2 tJ) tJ) tJ tJ tJ( tJ( tJ@ tJ@ NPVD12% NPVD12%

Pro-ect C Pro-ect C -80 -80 8* 8* 81 81 81) 81) 812 812 811 811 810 810 ' '

Pro-ect 7 Pro-ect 7 -820 -820 8K 8K 81) 81) 812 812 ' '

=hich one 2i3es hi2her NPV' Chould we choose Pro-ect C' =hich one 2i3es hi2her NPV' Chould we choose Pro-ect C'

"o make a ,ro,er com,arison& we could a,,l0 the re,lacement chain method: that is we could find the "o make a ,ro,er com,arison& we could a,,l0 the re,lacement chain method: that is we could find the

NPV of ,ro-ect 7 o3er @-0ear ,eriod and then com,are this with NPV of Pro-ect C o3er the same @ 0ears$ NPV of ,ro-ect 7 o3er @-0ear ,eriod and then com,are this with NPV of Pro-ect C o3er the same @ 0ears$

REPLACE&ENT CHAIN ÐO+GContinue;H

6R 6R tJ0 tJ0 tJ1 tJ1 tJ2 tJ2 tJ) tJ) tJ tJ tJ( tJ( tJ@ tJ@ NPVD12% NPVD12%

Pro-ect C Pro-ect C -80 -80 8* 8* 81 81 81) 81) 812 812 811 811 810 810 ' '

Pro-ect 7 Pro-ect 7 -820 -820 8K 8K 81) 81) 812 812

-820 -820 8K 8K 81) 81) 812 812

Pro-ect 7J#5t$ Pro-ect 7J#5t$ -$20 -$20 $7 $7 $13 $13 $8 $8 $7 $7 $13 $13 $12 $12 ? ?

Now we can directl0 com,are Pro-ect C with Pro-ect 7J#5t$ Now we can directl0 com,are Pro-ect C with Pro-ect 7J#5t$

=hich one 2i3es 0ou hi2her NPV at 12% interest rate (or cost of ca,ital)' =hich one 2i3es 0ou hi2her NPV at 12% interest rate (or cost of ca,ital)'

+ssum,tion a,,lied here$ +ssum,tion a,,lied here$

1$ "he ,ro-ect 7Fs cost and C7 will not chan2e o3er e5tended ,eriod$ 1$ "he ,ro-ect 7Fs cost and C7 will not chan2e o3er e5tended ,eriod$

2$ "he interest rate (or cost of ca,ital) will remain at 12% 2$ "he interest rate (or cost of ca,ital) will remain at 12%

Pro4lems : +rithmetic is more com,le5 (@ 6r VC$ K 6r life) Pro4lems : +rithmetic is more com,le5 (@ 6r VC$ K 6r life)

(

EAA1! : Consi;er Costs onlE

"his method i2nores "his method i2nores the revenue side the revenue side$ $

G+C<IN# G+C<IN# CJ0 CJ0 CJ1 CJ1 CJ2 CJ2 CJ) CJ) PVD@% PVD@%

+ + 1( 1( ( ( ( ( ( ( 2*$)K 2*$)K

B B 10 10 @ @ @ @ 21$00 21$00

Chould we take machine B& the one with the lower PV$ of cost' Chould we take machine B& the one with the lower PV$ of cost'

1$ Not necessaril0& 4ecause B will ha3e to 4e re,laced a 0ear earlier than +$ 1$ Not necessaril0& 4ecause B will ha3e to 4e re,laced a 0ear earlier than +$

2$ "imin2 of a future in3$ decision is contin2ent on "oda0Fs choice& + or B$ 2$ "imin2 of a future in3$ decision is contin2ent on "oda0Fs choice& + or B$

)$ Co a machine with PV(costs) of 821&000 s,read o3er ) 0ears is not necessaril0 4etter than a )$ Co a machine with PV(costs) of 821&000 s,read o3er ) 0ears is not necessaril0 4etter than a

com,etin2 machine with PV(costs) of 82(&@L0 s,read o3er 0ears$ com,etin2 machine with PV(costs) of 82(&@L0 s,read o3er 0ears$

=e ha3e to con3ert total PV(costs) to a cost =e ha3e to con3ert total PV(costs) to a cost per year per year$ $

CJ0 CJ0 CJ1 CJ1 CJ2 CJ2 CJ) CJ) PVD@% PVD@%

Gachine + Gachine + 1( 1( ( ( ( ( ( ( 2*$)K 2*$)K

#Hui$ +nn$ Cost #Hui$ +nn$ Cost 10.1 10.1 10.1 10.1 10.1 10.1 2*$)K 2*$)K

<ow do we 2et 810$@1' <ow do we 2et 810$@1'

PV=2*$)K PV=2*$)K N=) N=) 7V=0 7V=0 I=@ I=@ PG"=' PG"='

Cimilarl0& 0ou can 2et Cimilarl0& 0ou can 2et

CJ0 CJ0 CJ1 CJ1 CJ2 CJ2 PVD@% PVD@%

Gachine + Gachine + 10 10 @ @ @ @ 21$00 21$00

#Hui$ +nn$ Cost #Hui$ +nn$ Cost 11.!" 11.!" 11.!" 11.!" 21$00 21$00

=e see that Gachine + is 4etter& 4ecause its eHui3alent annual costs is less (810$@1 3s$ 811$( for =e see that Gachine + is 4etter& 4ecause its eHui3alent annual costs is less (810$@1 3s$ 811$( for

Gachine B)$ Gachine B)$

Rule : Celect the machine that has the lowest #Hui3alent +nnual Cost >#+C? Rule : Celect the machine that has the lowest #Hui3alent +nnual Cost >#+C?

@

EAA"! : Consi;er Costs an; Revenue

Consider the Pro-ect C and 7 Consider the Pro-ect C and 7

6R 6R tJ0 tJ0 tJ1 tJ1 tJ2 tJ2 tJ) tJ) tJ tJ tJ( tJ( tJ@ tJ@ NPVD12% NPVD12%

Pro-ect C Pro-ect C -80 -80 8* 8* 81 81 81) 81) 812 812 811 811 810 810 8@$L1 8@$L1

Pro-ect 7 Pro-ect 7 -820 -820 8K 8K 81) 81) 812 812 8($1(( 8($1((

Chould we choose Pro-ect C& which 2i3es the hi2her NPV' Chould we choose Pro-ect C& which 2i3es the hi2her NPV'

If not& how can we e3aluate these two ,ro-ects' If not& how can we e3aluate these two ,ro-ects'

1$ Anlike the #+C case& here we consider cost and re3enue$ 1$ Anlike the #+C case& here we consider cost and re3enue$

2$ =hen com,arin2 ,ro-ects of uneHual li3es& the one with the hi2her eHui3alent annual annuit0 2$ =hen com,arin2 ,ro-ects of uneHual li3es& the one with the hi2her eHui3alent annual annuit0

should 4e chosen$ should 4e chosen$

Procedures Procedures

1$ 7ind each ,ro-ectFs NPV o3er its 1$ 7ind each ,ro-ectFs NPV o3er its initial initial life$ life$

2$ "here is some constant annuit0 cash flow >I$e$& #++? 2$ "here is some constant annuit0 cash flow >I$e$& #++?

- - "o find #++ for ,ro-ect 7& enter N=)& I=12& PV=-(1((& and 7V=0 and sol3e for PG"$ "o find #++ for ,ro-ect 7& enter N=)& I=12& PV=-(1((& and 7V=0 and sol3e for PG"$

- - Cimilarl0 0ou can find #++ for ,ro-ect C$ Cimilarl0 0ou can find #++ for ,ro-ect C$

)$ "he ,ro-ect with the hi2her #++ will alwa0s ha3e the hi2her NPV when e5tended out )$ "he ,ro-ect with the hi2her #++ will alwa0s ha3e the hi2her NPV when e5tended out

to an0 common life$ to an0 common life$

"herefore choose the ,ro-ect with hi2her #++$ >#++ for C=81$(KL& #++ for 7=82$1@? "herefore choose the ,ro-ect with hi2her #++$ >#++ for C=81$(KL& #++ for 7=82$1@?

#++ method is easier to a,,l0& 4ut chain method is easier to understand$ #++ method is easier to a,,l0& 4ut chain method is easier to understand$

Solve t9e BolloDin? :uestions an; Pro<lems in Te=t <oo>

- Pro<lem ,.1 I ,.11 an; ,."2 I ,.""

K

Anda mungkin juga menyukai

- Solution - Problems and Solutions Chap 10Dokumen6 halamanSolution - Problems and Solutions Chap 10سارة الهاشميBelum ada peringkat

- Net Present Value and Other Investment CriteriaDokumen6 halamanNet Present Value and Other Investment CriteriavanovnBelum ada peringkat

- FIN515 Week 2 Homework AssignmentDokumen6 halamanFIN515 Week 2 Homework AssignmentNatasha DeclanBelum ada peringkat

- 40 Costing SummaryDokumen21 halaman40 Costing SummaryQueasy PrintBelum ada peringkat

- Important Formulas For Engineering EconomicsDokumen13 halamanImportant Formulas For Engineering Economicskabirdeb5Belum ada peringkat

- Customers Setup2Dokumen32 halamanCustomers Setup2Senthil KumarBelum ada peringkat

- Microeconomics Cue CardDokumen4 halamanMicroeconomics Cue CardPaul FareseBelum ada peringkat

- Oracle Inventory LabsDokumen170 halamanOracle Inventory LabsMushtaq AhmedBelum ada peringkat

- Note On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Dokumen24 halamanNote On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Vivek KankipatiBelum ada peringkat

- Capital Budgeting: Exclusive Projects or Independent ProjectsDokumen6 halamanCapital Budgeting: Exclusive Projects or Independent ProjectsMaria TariqBelum ada peringkat

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDokumen59 halamanIntermediate Accounting: Prepared by University of California, Santa BarbaramanduramBelum ada peringkat

- Rosew Oo: A Sense of PlaceDokumen14 halamanRosew Oo: A Sense of Placejc1711Belum ada peringkat

- Lot Transactions: This Chapter Covers The Following TopicsDokumen55 halamanLot Transactions: This Chapter Covers The Following Topicsrajaguru_sBelum ada peringkat

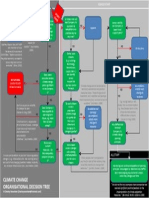

- Climate Change Decision TreeDokumen1 halamanClimate Change Decision TreeBoris Eduardo Donoso NuñezBelum ada peringkat

- D06A Prog Logice Devices (GALs)Dokumen13 halamanD06A Prog Logice Devices (GALs)P_leeBelum ada peringkat

- Practice - Enter An Expenditure Batch: WorkbookDokumen9 halamanPractice - Enter An Expenditure Batch: WorkbookSAlah MOhammedBelum ada peringkat

- Report Lab 1 Introducting To The Lab Environment: Group 10 - 10ECE Đặng Trần Chí ToànDokumen10 halamanReport Lab 1 Introducting To The Lab Environment: Group 10 - 10ECE Đặng Trần Chí ToànChi Toan Dang TranBelum ada peringkat

- Compiler DesignDokumen234 halamanCompiler DesignShaaahidBelum ada peringkat

- Contact DetailsDokumen4 halamanContact DetailsAin AdnanBelum ada peringkat

- POF Week 6 SBDokumen38 halamanPOF Week 6 SBpartyycrasherBelum ada peringkat

- CH 3 Prac ExamsDokumen4 halamanCH 3 Prac ExamsRafael GarciaBelum ada peringkat

- Introduction To Econometrics - Stock & Watson - CH 9 SlidesDokumen69 halamanIntroduction To Econometrics - Stock & Watson - CH 9 SlidesAntonio Alvino100% (1)

- Troubleshooting Addressing Services: CCNP TSHOOT: Maintaining and Troubleshooting IP NetworksDokumen104 halamanTroubleshooting Addressing Services: CCNP TSHOOT: Maintaining and Troubleshooting IP NetworksTomas Saavedra FerreiraBelum ada peringkat

- J B Chemicals LTD - Group 14Dokumen22 halamanJ B Chemicals LTD - Group 14xyz226422Belum ada peringkat

- David Sm13e CN 07Dokumen19 halamanDavid Sm13e CN 07Koki MostafaBelum ada peringkat

- PLD Vars April2010Dokumen27 halamanPLD Vars April2010scribd_pineda71Belum ada peringkat

- Lab 2 REsultDokumen7 halamanLab 2 REsultlallala4415Belum ada peringkat

- World No 1 Cert Guides: XML 1.1 and Related Technologies 000-142Dokumen57 halamanWorld No 1 Cert Guides: XML 1.1 and Related Technologies 000-142Srinivasa HelavarBelum ada peringkat

- Minggu 7 Difficulties in Solving For IRR - 12eDokumen23 halamanMinggu 7 Difficulties in Solving For IRR - 12eAchmad Nabhan YamanBelum ada peringkat

- Net Present Value and Other Investment Rules: Mcgraw-Hill/IrwinDokumen34 halamanNet Present Value and Other Investment Rules: Mcgraw-Hill/Irwinveronica1085Belum ada peringkat

- 4.6 Određivanje Nivoa Zaštite Gromobranske Instalacije: N N Xa x10 (Broj Udara/god.)Dokumen2 halaman4.6 Određivanje Nivoa Zaštite Gromobranske Instalacije: N N Xa x10 (Broj Udara/god.)strejtbreBelum ada peringkat

- Lec.1 Design 5Dokumen13 halamanLec.1 Design 5karim amgedBelum ada peringkat

- David Sm13e CN 03Dokumen15 halamanDavid Sm13e CN 03Koki MostafaBelum ada peringkat

- CCNPv7 ROUTE Lab2-2 EIGRP-Stub-Routing InstructorDokumen6 halamanCCNPv7 ROUTE Lab2-2 EIGRP-Stub-Routing Instructortaco19933Belum ada peringkat

- O2C P2P Accounting Entries With India LocalizationDokumen2 halamanO2C P2P Accounting Entries With India LocalizationK.c. NayakBelum ada peringkat

- Federal Income Taxation OutlineDokumen87 halamanFederal Income Taxation OutlineSaul100% (1)

- DACE Labour Productivity Norms The New Gulf CoastDokumen25 halamanDACE Labour Productivity Norms The New Gulf Coastiplaruff0% (2)

- Value-In-Use Model From Iron Ore Through Direct-Reduced Iron and Electric Arc FurnaceDokumen11 halamanValue-In-Use Model From Iron Ore Through Direct-Reduced Iron and Electric Arc FurnaceGladman MundingiBelum ada peringkat

- RP c208 - 2013 06Dokumen66 halamanRP c208 - 2013 06Vivi GouriotiBelum ada peringkat

- Chapter 3Dokumen54 halamanChapter 3Enges Formula100% (1)

- FI S ALR 87012172 THL Customer Balances in Local CurrencyDokumen18 halamanFI S ALR 87012172 THL Customer Balances in Local CurrencynguyencaohuyBelum ada peringkat

- Net Working Capital and Cash FlowsDokumen3 halamanNet Working Capital and Cash FlowsRefger RgwseBelum ada peringkat

- Basic Information For Over Head Transmission LinesDokumen17 halamanBasic Information For Over Head Transmission LinesmohammadBelum ada peringkat

- Swiss Francs International Applications Governed Exclusively by The AgreementDokumen5 halamanSwiss Francs International Applications Governed Exclusively by The AgreementRichieDaisyBelum ada peringkat

- Exercise Demand Estimation Production Theory SolutionsDokumen12 halamanExercise Demand Estimation Production Theory SolutionsJai ToneExcelBelum ada peringkat

- Answers: No Monetary or Fiscal Policy Takes Place Unless I Tell You OtherwiseDokumen6 halamanAnswers: No Monetary or Fiscal Policy Takes Place Unless I Tell You OtherwiseLeslie LimBelum ada peringkat

- Orbiter Space Shuttle Atlantis Operations ManualDokumen15 halamanOrbiter Space Shuttle Atlantis Operations ManualYerith Villarreal CuentasBelum ada peringkat

- Process Control in SpinningDokumen31 halamanProcess Control in SpinningSandeep MeenaBelum ada peringkat

- IT Lab Assignment: (LP Models and Formulations)Dokumen13 halamanIT Lab Assignment: (LP Models and Formulations)Lamont ClintonBelum ada peringkat

- Tafi40 en 46b FV Part1Dokumen472 halamanTafi40 en 46b FV Part1manoj14febBelum ada peringkat

- Explosive Relief ValvesDokumen6 halamanExplosive Relief ValvesMichael TanBelum ada peringkat

- Pollution oceanONU PDFDokumen68 halamanPollution oceanONU PDFangel3330Belum ada peringkat

- BR100 OPM Inventory Application SetupDokumen43 halamanBR100 OPM Inventory Application Setupghazouani100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- Computer Integrated ConstructionDari EverandComputer Integrated ConstructionH. WagterBelum ada peringkat

- More Minute Math Drills, Grades 1 - 3: Addition and SubtractionDari EverandMore Minute Math Drills, Grades 1 - 3: Addition and SubtractionPenilaian: 1 dari 5 bintang1/5 (1)

- The Principles and Techniques of Engineering EstimatingDari EverandThe Principles and Techniques of Engineering EstimatingBelum ada peringkat

- Cryptocurrency - A New Investment Opportunity - Google FormsDokumen7 halamanCryptocurrency - A New Investment Opportunity - Google Formsadityasharma8970Belum ada peringkat

- Bahasa Indonesia RidhoDokumen3 halamanBahasa Indonesia RidhoRidho FirdausmanBelum ada peringkat

- 1 - Understanding BrandsDokumen29 halaman1 - Understanding BrandsMehal Ur RahmanBelum ada peringkat

- Labor Law MCQDokumen12 halamanLabor Law MCQalexes negroBelum ada peringkat

- AMFI Questionnaire For Due DiligenceDokumen7 halamanAMFI Questionnaire For Due DiligenceHarish Ruparel100% (2)

- Bond, Undertaking & Indemnity (CCE)Dokumen4 halamanBond, Undertaking & Indemnity (CCE)Rahul Kumar100% (1)

- MithunDokumen4 halamanMithunvipin HBelum ada peringkat

- Dreamforce 2019 - Justifying Your Salesforce InvestmentDokumen21 halamanDreamforce 2019 - Justifying Your Salesforce InvestmentPattyBelum ada peringkat

- AE12 Module 1 Economic Development A Global PerspectiveDokumen3 halamanAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangBelum ada peringkat

- Impact of Oil Prices On The Stock MarketDokumen18 halamanImpact of Oil Prices On The Stock MarketDhruv AghiBelum ada peringkat

- VRF ComplemntryTools-100621bDokumen11 halamanVRF ComplemntryTools-100621bPorshe56Belum ada peringkat

- FPA Candidate HandbookDokumen32 halamanFPA Candidate HandbookFreddy - Marc NadjéBelum ada peringkat

- Peo Scsp0508Dokumen318 halamanPeo Scsp0508rajrudrapaa100% (1)

- Sample B Business Management EeDokumen50 halamanSample B Business Management Eeapi-529669983Belum ada peringkat

- 06 Task Performance 1Dokumen1 halaman06 Task Performance 1Richmon RabeBelum ada peringkat

- Rig Inspections: Lloyd's Register Energy - DrillingDokumen2 halamanRig Inspections: Lloyd's Register Energy - DrillingShraddhanand MoreBelum ada peringkat

- UntitledDokumen11 halamanUntitledHannah Bea AlcantaraBelum ada peringkat

- Urban-Transport PDFDokumen116 halamanUrban-Transport PDFM .U.KBelum ada peringkat

- Egyptian Processed Food Sector Development Strategy - ENDokumen442 halamanEgyptian Processed Food Sector Development Strategy - ENReyes Maria Kristina Victoria100% (1)

- The Banking and Financial Institutions (Disclosure) Regulation 2014Dokumen12 halamanThe Banking and Financial Institutions (Disclosure) Regulation 2014Michael MwambangaBelum ada peringkat

- Human Resource Management (Case Study)Dokumen1 halamanHuman Resource Management (Case Study)Amrit Baniya0% (2)

- TCS-Recruitment and SelectionDokumen17 halamanTCS-Recruitment and SelectionChirag PatelBelum ada peringkat

- Poc AdamjeeDokumen67 halamanPoc AdamjeePREMIER INSTITUTEBelum ada peringkat

- Mah Sing Group Berhad Annual Report 2018 Part 2 PDFDokumen211 halamanMah Sing Group Berhad Annual Report 2018 Part 2 PDFCheong Wei HaoBelum ada peringkat

- Tugas Ke 5 Ade Hidayat Kelas 1a MMDokumen4 halamanTugas Ke 5 Ade Hidayat Kelas 1a MMadeBelum ada peringkat

- Lecture 5 - Project Finance and Risk ManagementDokumen55 halamanLecture 5 - Project Finance and Risk ManagementLewisBelum ada peringkat

- Banking Project (Section-2) Jhanvi Kankaliya AU1712050 Topic-2 Types of Deposits With FeaturesDokumen4 halamanBanking Project (Section-2) Jhanvi Kankaliya AU1712050 Topic-2 Types of Deposits With FeaturesJhanvi KankaliyaBelum ada peringkat

- Prelim Quiz 1-Problem SolvingDokumen3 halamanPrelim Quiz 1-Problem SolvingPaupauBelum ada peringkat

- Australian Optometry TAM Stands at $4.2bnDokumen5 halamanAustralian Optometry TAM Stands at $4.2bnabeBelum ada peringkat

- BPP F3 KitDokumen7 halamanBPP F3 KitMuhammad Ubaid UllahBelum ada peringkat