Wrap Sheet - Jun 17, 2011

Diunggah oleh

jpkoningHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Wrap Sheet - Jun 17, 2011

Diunggah oleh

jpkoningHak Cipta:

Format Tersedia

Gold vs. Gold Shares: A divergence?

Why were not so sure that the values of gold equities are lagging the price of gold

There has been much hand-wringing among gold equity investors

of late. The average gold share seems to have forgotten that it is,

indeed, a gold share, and that it should be scooting on higher

hand-in-hand with its big brother, the metal. In fact, one would

expect that the operating leverage that mining companies have to

the gold price would juice their performance such that an x%

increase in gold would equate to an x+n% increase in share

prices. But the shares seem to have lost their way. While observers are right that the average price of a gold share has been lagging

gold, our view is that the overall market capitalization of the gold

industry has been increasing much faster than the price of the

average share. This is because even though share prices have been

dilly-dallying, exuberant growth in share issuance has more than

compensated. As such, the mysterious gold-share divergence is

not really a divergence, since the gold companies collective market capitalization, and not their price, has much better approximated the rising gold price.

First, we present the evidence for weak prices. The most popular way to measure the relative strength of gold shares vs. physical gold is to take the ratio of the Philadelphia Gold & Silver

Index (XAU) to the gold price. We submit figure 1.

The XAU gold index managed to maintain a fixed, even slightly

rising, ratio to the gold price through the first few years of the

gold bull market. Everything was as it should be. But starting in

2006 the XAU began to fall relative to gold, with the fall accelerating during the credit crisis of late 2008. Shares managed to

rally briefly versus the metal in 2009, but this rally stalled and

the XAUs relative weakness continues in 2011.

Next well focus in on the last three or so years. From the end of

2007 to May 31, 2011, the spot price of gold rose 84%. Over

Pollitt & Co. Inc.

11 King Street West, Suite 1950, Toronto, ON. Tel: 416.365.3313

625 Boulevard Ren Lvesque Ouest, Bureau 930, Montral, QC. Tel: 514.395.8910

that same period the XAU underperformed, rising a measly

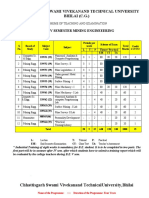

21%. We have constructed our own capitalization-weighted

grouping of 10 international gold companies, removing the

silver and base metals bias that characterizes the XAU. That

group is up 28%. Lastly, we have crunched the return for the

11 Canadian gold miners spotlighted in our 2011 Gold Survey.

These are up 73%. See figure 2 for the respective changes,

weightings, and constituents.

While the mid-caps in the Canadian-11 group have outperformed the stocks in our International-10 group, in general

stocks have underperformed gold. In the table on the opposite

page we show the market capitalizations for our Canadian-11

and International-10 groupings. Starting from a market cap of

$3.0 billion at the end of 2007, the value of the Canadian-11

has jumped to $6.7 billion. The market cap of the International11 has run up from $137 to $202 billion. The total values of

our two indexes have risen by 124% and 48% respectively.

Figure 3, opposite page, puts everything in perspective. While

the price of the average share in the Canadian-11 has underperformed gold, the increase in their combined market cap has

almost doubled that of the metal. While the average international miners market capitalization is still underperforming

gold, this market cap is still increasing twice as fast as the average international miners share price.

The rise in gold company valuations since the end of 2007 is

due in no small part to the flood of new capital entering the

market. Over the last three years about $1.7 billion in new

Table 1. The values of Pollitts two gold indexes

Changes from Dec 31, 2007 to May 31, 2011

Billion $

Canadian-11 International-10

Initial Market Cap

3.0

137

End Market Cap

6.7

202

$ Change

% Change

Equity raised

3.7

124%

65

48%

1.7

26

shares has been issued by the Canadian-11, and $26 billion by the

international players.

This underlines the main difference between the physical gold

market and the gold share market. When demand for gold rises,

the sole way that demand can be satisfied is through existing

ounces of the metal coming to the market, or new ounces mined

through sweat and tears. Only a higher gold price can coax these

ounces out. But when the demand for gold shares rises, this demand can be met by either existing shares coming to market, or

newly-printed shares coming to the market. Thus, unlike gold,

higher equity prices are not needed to coax shares onto the market to meet demand, since eager mine promoters are more than

willing to meet that demand at existing share prices by creating

shares out of thin air. That is why we see the phenomenon of a

rising gold price, lagging gold share prices, and outperforming

gold market capitalization.

The massive dilution that gold companies have perpetrated on

existing shareholders has only compounded gold shares underperformance relative to the metal. With many miners issuing

new shares, and the gambling public more than willing to snap

these issues up, there has been an artificially large amount of new

funds entering the mining camps, driving up the price of everything from washed-up gold mines, machinery, mining wages,

drilling contractors, and mine engineering costs. The result is

that any rise in the gold price has been eroded by these higher

costs. Had gold companies not issued so many shares, and the

gold investing community been less tolerant of dilution, less

money would be chasing the limited number of miners, contractors, etc., and the operating position of gold companies would be

less precarious.

John Paul Koning

jpkoning@pollitt.com

Gold mining is a tough business that typically yields low returns

on capital. But it has always attracted its fair share of dreamers

and, as a result, gold shares tend to be issued in such tremendous amounts, and at such high valuations, that they never outperform the metal for any extended period of time. The

divergence between shares and the metal is not so much a

divergence, as a convergence to the mean.

Toronto, Ontario

June 17, 2011

The information contained in this report is believed to be reliable, but its accuracy and/or completeness is not guaranteed. All opinions, estimates and other information included in this report constitute our

judgement as of the date thereof and are subject to change without notice. Pollitt & Co. Inc. does not issue ratings or price targets on any securities mentioned within this letter, nor does Pollitt & Co. Inc.

maintain and publish current financial estimates and recommendations on securities mentioned in this publication. Pollitt & Co. Inc. discontinues coverage of the stocks highlighted in this letter. For information on our policies on research dissemination, please see our website, www.pollitt.com. Stock Recommendation System and Terminology: Pollitt does not issue price targets for companies. Pollitt intends to

maintain a Buy List of 10-15 stocks. The listing of a stock on the Buy List should be considered as advice to carry a position in that stock. The removal of a stock from the list should be considered as advice to

reduce a position in that stock. Pollitt provides continuous coverage of all stock ideas on its Buy List. The only stocks currently on the Buy List are Franco-Nevada, Reitmans, Fibrek, and Softchoice.

Anda mungkin juga menyukai

- Lord Mansfield and The Law MerchantDokumen19 halamanLord Mansfield and The Law MerchantjpkoningBelum ada peringkat

- Clower - 1967 - A Reconsideration of The Microfoundations of Monetary TheoryDokumen8 halamanClower - 1967 - A Reconsideration of The Microfoundations of Monetary TheoryjpkoningBelum ada peringkat

- Swot Analysis of Asset ClassesDokumen5 halamanSwot Analysis of Asset ClassesRakkuyil Sarath33% (3)

- Kaldor - 1939 - Speculation and Economic StabilityDokumen28 halamanKaldor - 1939 - Speculation and Economic Stabilityjpkoning100% (1)

- Comment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A SkepticalDokumen14 halamanComment - 2011 - Revisiting The Illiquidity Discount For Private Companies, A Skepticaljpkoning100% (1)

- Money in An Economy Without Banks - The Case of IrelandDokumen10 halamanMoney in An Economy Without Banks - The Case of Irelandjpkoning100% (1)

- A History of Dividend UtahDokumen20 halamanA History of Dividend UtahChristine BrimBelum ada peringkat

- Gold Price Fluctuation Research PaperDokumen4 halamanGold Price Fluctuation Research Papergz91rnat100% (1)

- A Golden MulliganDokumen14 halamanA Golden MulliganNick WeeksBelum ada peringkat

- Barrick Annual Report 2011Dokumen196 halamanBarrick Annual Report 2011Normand AlbertoBelum ada peringkat

- Debunking The Gold Bubble Myth: By: Eric Sprott & Andrew MorrisDokumen4 halamanDebunking The Gold Bubble Myth: By: Eric Sprott & Andrew Morrisscribd_tsan100% (1)

- Week in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Dokumen26 halamanWeek in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Paolo GerosaBelum ada peringkat

- 1gold Report PDFDokumen86 halaman1gold Report PDFrahul84803Belum ada peringkat

- Bonfire of The CurrenciesDokumen5 halamanBonfire of The CurrenciesNolan AndersonBelum ada peringkat

- Feasibilty Study: Gold SupplyDokumen8 halamanFeasibilty Study: Gold SupplyRuffy SGBelum ada peringkat

- Gold-Physical Vs MF DemystifiedDokumen4 halamanGold-Physical Vs MF Demystifiedmcube4uBelum ada peringkat

- Gold in The Investment Portfolio: Frankfurt School - Working PaperDokumen50 halamanGold in The Investment Portfolio: Frankfurt School - Working PaperSharvani ChadalawadaBelum ada peringkat

- Investor'S Guide: by Jeff Clark, Editor of Big GoldDokumen12 halamanInvestor'S Guide: by Jeff Clark, Editor of Big GoldaldilnojinjaloBelum ada peringkat

- Gold OutlookDokumen5 halamanGold Outlookksat85Belum ada peringkat

- Guide To Investing in Gold & SilverDokumen12 halamanGuide To Investing in Gold & Silveravoman123100% (1)

- Historical Pullbacks in Gold Prices Have Been Long and SevereDokumen5 halamanHistorical Pullbacks in Gold Prices Have Been Long and SevereAsad HashmiBelum ada peringkat

- GOLD - A Safe HavenDokumen9 halamanGOLD - A Safe HavenAzeembhaiBelum ada peringkat

- Gold Commodity ProfileDokumen38 halamanGold Commodity Profileraveendhar.k100% (3)

- How Does Gold'S Value Change With The Stock Market?Dokumen12 halamanHow Does Gold'S Value Change With The Stock Market?bharathandcompanyBelum ada peringkat

- The Golden Mean: NterviewDokumen6 halamanThe Golden Mean: NterviewvagierayBelum ada peringkat

- Gold As CollateralDokumen0 halamanGold As Collateralkoib789Belum ada peringkat

- Gold Public Monthly Commentary 2011 05Dokumen3 halamanGold Public Monthly Commentary 2011 05Sara CostaBelum ada peringkat

- Why Is Gold Different From Other Assets? An Empirical InvestigationDokumen45 halamanWhy Is Gold Different From Other Assets? An Empirical InvestigationAnonymous XR7iq7Belum ada peringkat

- Investor'S Guide: by Jeff Clark, Editor of Big GoldDokumen12 halamanInvestor'S Guide: by Jeff Clark, Editor of Big GoldVishnu VardhanBelum ada peringkat

- Gold Not Oil InflationDokumen8 halamanGold Not Oil Inflationpderby1Belum ada peringkat

- AWN ThePerfectGoldPortfolioDokumen8 halamanAWN ThePerfectGoldPortfolioCraig CannonBelum ada peringkat

- RGSF Product Note Oct 2012 PDFDokumen10 halamanRGSF Product Note Oct 2012 PDFinfosipriBelum ada peringkat

- 8-22-11 Breakout in Precious MetalsDokumen4 halaman8-22-11 Breakout in Precious MetalsThe Gold SpeculatorBelum ada peringkat

- How Gold Price Is Determined?Dokumen3 halamanHow Gold Price Is Determined?MOHAK AGARWALBelum ada peringkat

- Gold Vs Gold StocksDokumen4 halamanGold Vs Gold StocksZerohedgeBelum ada peringkat

- Is Gold Still A Good Investment OptionDokumen3 halamanIs Gold Still A Good Investment OptionSwati ShahBelum ada peringkat

- Gold's Irrational Price Movement: Understanding GoldDokumen7 halamanGold's Irrational Price Movement: Understanding GoldNamrata KanodiaBelum ada peringkat

- Gold Sector Initiation: Don't Miss This Golden OpportunityDokumen44 halamanGold Sector Initiation: Don't Miss This Golden OpportunityDavid QuahBelum ada peringkat

- Alch29 LeasesDokumen3 halamanAlch29 LeasesAmol KulkarniBelum ada peringkat

- Ruling The Roost - Precious Metals: Thought PaperDokumen6 halamanRuling The Roost - Precious Metals: Thought PaperPrashant UjjawalBelum ada peringkat

- Gold Investor Volume 3Dokumen36 halamanGold Investor Volume 3Hung NguyenBelum ada peringkat

- A Study On Role of Gold Portfolio AllocationDokumen6 halamanA Study On Role of Gold Portfolio AllocationNITINBelum ada peringkat

- IMT 20 Managerial Economics M3Dokumen3 halamanIMT 20 Managerial Economics M3solvedcareBelum ada peringkat

- Gold Forecast 2010Dokumen12 halamanGold Forecast 2010Mohamed Said Al-QabbaniBelum ada peringkat

- Silver Likely To Touch 50K Within 2yrsDokumen4 halamanSilver Likely To Touch 50K Within 2yrskevulya_janiBelum ada peringkat

- The Silver Investment Market - An UpdateDokumen29 halamanThe Silver Investment Market - An UpdateSGSBelum ada peringkat

- Standard March2011Dokumen3 halamanStandard March2011tinypelicansBelum ada peringkat

- Silver Producers A Call To ActionDokumen5 halamanSilver Producers A Call To Actionrichardck61Belum ada peringkat

- Gold Industry Report Featuring Goliath May 4 2021Dokumen10 halamanGold Industry Report Featuring Goliath May 4 2021Chester Yukon GoldBelum ada peringkat

- Thunder Road Report 26Dokumen57 halamanThunder Road Report 26TFMetalsBelum ada peringkat

- Gold Stocks ReportDokumen5 halamanGold Stocks Reportrichardck61Belum ada peringkat

- MBS - I NewsletterDokumen2 halamanMBS - I Newsletterprateek0284Belum ada peringkat

- Ian'S Investmentment Insights Special Edition The Gold Rush of The1930s Will Rise AgainDokumen12 halamanIan'S Investmentment Insights Special Edition The Gold Rush of The1930s Will Rise Againfreemind3682Belum ada peringkat

- Delta Global Partners Research:: Chart I: Is GOLD The New "United Future World Currency"?Dokumen4 halamanDelta Global Partners Research:: Chart I: Is GOLD The New "United Future World Currency"?devnevBelum ada peringkat

- Will Gold Continue To Shine?: MarketDokumen6 halamanWill Gold Continue To Shine?: MarketdpbasicBelum ada peringkat

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldDari EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldPenilaian: 3 dari 5 bintang3/5 (1)

- MS 2012 Outlook: Precious MetalsDokumen6 halamanMS 2012 Outlook: Precious Metalsz2009z2009Belum ada peringkat

- Part II: Gold Keeps Rising As Other Commodities FallDokumen10 halamanPart II: Gold Keeps Rising As Other Commodities FallbengersonBelum ada peringkat

- GOLD - The Simple Facts: ViewpointDokumen5 halamanGOLD - The Simple Facts: ViewpointjohnreidenbaughBelum ada peringkat

- Latest Issue: Gold Demand Trends Q3 2012Dokumen9 halamanLatest Issue: Gold Demand Trends Q3 2012Manish Jains JainsBelum ada peringkat

- Not Free, Not Fair - The Long Term Manipulation of The Gold Price - Sprott Asset Management Special ReportDokumen67 halamanNot Free, Not Fair - The Long Term Manipulation of The Gold Price - Sprott Asset Management Special Reportfree404100% (1)

- A Year Performance of Present Gold Trading ContractDokumen27 halamanA Year Performance of Present Gold Trading Contractbalki123Belum ada peringkat

- What Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FranceDokumen15 halamanWhat Are The Real Drivers of Gold Prices?: HEC, Paris Jouy-en-Josas FrancePilot On BoardBelum ada peringkat

- Gold Value and Gold Prices from 1971 - 2021: An Empirical ModelDari EverandGold Value and Gold Prices from 1971 - 2021: An Empirical ModelBelum ada peringkat

- Hertzel and Smith - Market Discounts and Shareholder Gains For Placing Equity PrivatelyDokumen28 halamanHertzel and Smith - Market Discounts and Shareholder Gains For Placing Equity PrivatelyjpkoningBelum ada peringkat

- Alchian and Klein - 1973 - On A Correct Measure of InflationDokumen20 halamanAlchian and Klein - 1973 - On A Correct Measure of Inflationjpkoning100% (1)

- Reserve Bank of Zimbabwe Monetary Policy Statement 2015Dokumen73 halamanReserve Bank of Zimbabwe Monetary Policy Statement 2015Business Daily ZimbabweBelum ada peringkat

- White - 1984 - Competitive Payment Systems and The Unit of AccountDokumen15 halamanWhite - 1984 - Competitive Payment Systems and The Unit of AccountjpkoningBelum ada peringkat

- Silber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsDokumen18 halamanSilber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsjpkoningBelum ada peringkat

- Lavoie - 1999 - The Credit Led Supply of Deposits and The Demand For Money, Kaldor's Reflux Mechanism As Previously Endorsed by Joan RobinsonDokumen12 halamanLavoie - 1999 - The Credit Led Supply of Deposits and The Demand For Money, Kaldor's Reflux Mechanism As Previously Endorsed by Joan RobinsonjpkoningBelum ada peringkat

- Selgin - 1994 - On Ensuring The Acceptability of A New Fiat MoneyDokumen20 halamanSelgin - 1994 - On Ensuring The Acceptability of A New Fiat MoneyjpkoningBelum ada peringkat

- Simand and Caskey - 1994 - The Susan B. Anthony Dollar and The Theory of Coin-Note SubstitutionsDokumen16 halamanSimand and Caskey - 1994 - The Susan B. Anthony Dollar and The Theory of Coin-Note SubstitutionsjpkoningBelum ada peringkat

- Wrap Sheet - Oct 26, 2011Dokumen2 halamanWrap Sheet - Oct 26, 2011jpkoningBelum ada peringkat

- Liu - 2005 - A Liquidity Augmented Capital Asset Pricing ModelDokumen41 halamanLiu - 2005 - A Liquidity Augmented Capital Asset Pricing ModeljpkoningBelum ada peringkat

- Cowen - The New Monetary EconomcsDokumen25 halamanCowen - The New Monetary EconomcsjpkoningBelum ada peringkat

- Monetary Explanations of The Weimar Republic's HyperinflationDokumen17 halamanMonetary Explanations of The Weimar Republic's HyperinflationjpkoningBelum ada peringkat

- Shiller - Fear of The Crash Caused The CrashDokumen1 halamanShiller - Fear of The Crash Caused The CrashjpkoningBelum ada peringkat

- Wrap Sheet - July 12, 2012Dokumen2 halamanWrap Sheet - July 12, 2012jpkoningBelum ada peringkat

- The Precipitation and Fall of Mess. Douglas, Heron and Co, Late Bankers in Air With The Causes of Their Distress and Ruin Investigated and ConsideredDokumen180 halamanThe Precipitation and Fall of Mess. Douglas, Heron and Co, Late Bankers in Air With The Causes of Their Distress and Ruin Investigated and ConsideredjpkoningBelum ada peringkat

- What Does Hyperinflation Feel Like?Dokumen1 halamanWhat Does Hyperinflation Feel Like?jpkoningBelum ada peringkat

- Wrap Sheet - Feb 14, 2012Dokumen2 halamanWrap Sheet - Feb 14, 2012jpkoningBelum ada peringkat

- Pumphrey - The Exchange Equalization Account of Great Britain 1932-39Dokumen15 halamanPumphrey - The Exchange Equalization Account of Great Britain 1932-39jpkoningBelum ada peringkat

- Cowen and Kroszner - 1994 - Money's Marketability Premium and The Microfoundations of Keynes Theory of Money and CreditDokumen12 halamanCowen and Kroszner - 1994 - Money's Marketability Premium and The Microfoundations of Keynes Theory of Money and CreditjpkoningBelum ada peringkat

- Winding Down - A Visual Review of The Lending Facilities Created by The Federal Reserve During The Credit CrisisDokumen1 halamanWinding Down - A Visual Review of The Lending Facilities Created by The Federal Reserve During The Credit CrisisjpkoningBelum ada peringkat

- Wrap Sheet - Nov 23, 2009Dokumen2 halamanWrap Sheet - Nov 23, 2009jpkoningBelum ada peringkat

- Managed Currency - The People's Bank of China Balance Sheet Since 2002Dokumen1 halamanManaged Currency - The People's Bank of China Balance Sheet Since 2002jpkoningBelum ada peringkat

- Deriving The Gold Lease RateDokumen1 halamanDeriving The Gold Lease Ratejpkoning100% (1)

- Bear Markets ComparisonsDokumen1 halamanBear Markets ComparisonsjpkoningBelum ada peringkat

- Gold Mining Feasibility StudyDokumen4 halamanGold Mining Feasibility StudyChad100% (1)

- Company Profile TemplateDokumen4 halamanCompany Profile TemplateEmily MoshodiBelum ada peringkat

- Swellex SpartanDokumen2 halamanSwellex SpartanJosue Mario RamirezBelum ada peringkat

- Mammoth Eureka Utah Mine Closures MapsDokumen22 halamanMammoth Eureka Utah Mine Closures MapsRussell HartillBelum ada peringkat

- Discovering Gold in Latin AmericaDokumen14 halamanDiscovering Gold in Latin AmericaMauro CaleroBelum ada peringkat

- Limeworks OneDokumen8 halamanLimeworks Oneapi-337232977Belum ada peringkat

- The EnvironmentDokumen37 halamanThe EnvironmentAgbugui MarianBelum ada peringkat

- The Cherry Hills Mining Disaster of 1909Dokumen10 halamanThe Cherry Hills Mining Disaster of 1909sparky6818867Belum ada peringkat

- Lectures - PMC Rules 2002.pptx Version 1kDokumen66 halamanLectures - PMC Rules 2002.pptx Version 1kumerBelum ada peringkat

- Kinross Tailings ManagementDokumen1 halamanKinross Tailings ManagementAngel VegaBelum ada peringkat

- American Barrick - MP19006, 19015, 19016, 19026Dokumen9 halamanAmerican Barrick - MP19006, 19015, 19016, 19026KshitishBelum ada peringkat

- 64 Meeting January 7-8, 2013Dokumen42 halaman64 Meeting January 7-8, 2013ymadhukumarBelum ada peringkat

- Critical Review Tailing Dam Best PracticeDokumen31 halamanCritical Review Tailing Dam Best PracticeFelipe Ignacio Campos RodriguezBelum ada peringkat

- Rockwell - Bulk-Materials-Handling-CapabilitiesDokumen41 halamanRockwell - Bulk-Materials-Handling-CapabilitiessrichmechBelum ada peringkat

- DGMS 2022Dokumen13 halamanDGMS 2022Simanta SinhaBelum ada peringkat

- Hoist by TechnologyDokumen6 halamanHoist by TechnologyAnonymous ntE0hG2TPBelum ada peringkat

- Teck Resources' 10-Year Management Plan For Cheviot Mine RegionDokumen229 halamanTeck Resources' 10-Year Management Plan For Cheviot Mine RegionThe NarwhalBelum ada peringkat

- Bolting Material Chemical &..Dokumen6 halamanBolting Material Chemical &..arief setiawanBelum ada peringkat

- Cone Crusher DatasheetsDokumen3 halamanCone Crusher DatasheetsJhunior Contreras NeyraBelum ada peringkat

- LEITI Post Award Process Audit Process ReportDokumen148 halamanLEITI Post Award Process Audit Process ReportLiberiaEITIBelum ada peringkat

- MM London 2017 Main BrochureDokumen31 halamanMM London 2017 Main BrochureWojciech StrycharskiBelum ada peringkat

- Mine Machinery-1 SyllabusDokumen3 halamanMine Machinery-1 SyllabusrrathoreBelum ada peringkat

- Process Simulations in Mineralogy-Based GeometalluDokumen7 halamanProcess Simulations in Mineralogy-Based GeometalluephremBelum ada peringkat

- Kiruna Iron Drilling SuccessDokumen12 halamanKiruna Iron Drilling SuccessHannans Reward LtdBelum ada peringkat

- Mcs 2022Dokumen206 halamanMcs 2022Maria Monica Campos RamirezBelum ada peringkat

- Technical Services: Innovation and Technology in Underground Mining - The Rio Tinto PerspectiveDokumen14 halamanTechnical Services: Innovation and Technology in Underground Mining - The Rio Tinto PerspectiveKurt Kandora MontroneBelum ada peringkat

- First Class Metal (Restricted) Mml&Gs 2004Dokumen7 halamanFirst Class Metal (Restricted) Mml&Gs 2004daneshwerBelum ada peringkat

- Morgenstern Demelo 2018 PDFDokumen47 halamanMorgenstern Demelo 2018 PDFAshanti UtahelBelum ada peringkat

- Underground Mining: SolutionsDokumen8 halamanUnderground Mining: SolutionsBBBBBBBelum ada peringkat