Economic Survey

Diunggah oleh

P Venu Gopala RaoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Economic Survey

Diunggah oleh

P Venu Gopala RaoHak Cipta:

Format Tersedia

Finance minister Arun Jaitley on Wednesday showcased the pre-budget Economic Sur

vey in the Lok Sabha. As per the Economic Survey, the GDP growth for 2014-15 was

pegged at 5.4 to 5.9%.

Passage of PFRDA Act, shift of commodity futures trading into the finance minist

ry and the presentation of the FSLRC report were the three major milestones of 2

013-14.

* FSLRC, in its report, has given wide-ranging recommendations, broadly in the n

ature of governance enhancing principles for enhanced consumer protection, great

er transparency in the functioning of financial sector regulators in terms of th

eir reporting system, greater clarity on their interface with the regulated enti

ties and greater transparency in the regulation making process by means of manda

tory public consultations and incorporation of cost benefit analysis, among othe

rs

* Gross NPAs of banks registered a sharp increase. Overall NPAs of the banking s

ector increased from 2.36 percent of credit advanced in March 2011 to 4.40 perce

nt of credit advanced in December 2013.

* RBI has identified infrastructure, iron and steel, textiles, aviation and mini

ng as stressed sectors

* New Pension System (NPS), now National Pension System, represents a major refo

rm of Indian pension arrangements, and lays the foundation for a sustainable sol

ution to ageing in India by shifting to an individual account, defined-contribut

ion system.

* Till May 7, 2014 67.11 lakh members have been enrolled under the NPS with a co

rpus of Rs. 51,147 crore

* Swavalamban Scheme for workers in the unorganized sector launched in 2010, ext

ended to five years for the beneficiaries enrolled in 2010-11, 2011-12, and 2012

-13; benefits of co-contribution would be available till 2016-17.

* Long-term external debt accounts for 78.2 percent of total external debt at en

d-December 2013 against 76.1 percent at end-March 2013. Long-term debt at end-De

cember 2013 increased by $25.1 billion (8.1 percent) over the level at end-March

2013 while short-term debt declined by $4 billion (4.1 percent), reflecting a f

all in imports

* Wholesale Price Index inflation fell to three-year low of 5.98 percent during

2013-14

* Consumer Price Inflation also showed signs of moderation

* Both Wholesale and Consumer Price Inflation expected to go downward

* Fiscal consolidations remains imperative for the economy

* Fiscal consolidation recommended through higher tax-GDP ratio then merely redu

cing the expenditure-GDP ratio

* Proactive policy action helped government remain in fiscal consolidation mode

in 2013-14

* Fiscal deficit for 2013-14 contained at 4.5 percent of GDP

* Total outstanding liabilities of the central and state governments decline as

a proportion of GDP

* India s balance-of-payments position improved dramatically in 2013-14 with the c

urrent account deficit (CAD) at $32.4 billion (1.7 percent of GDP) as against $8

8.2 billion (4.7 percent of GDP) in 2012-13

* The annual average exchange rate of the rupee went up from 47.92 per dollar in

2011-12 to Rs.54.41 per dollar in 2012-13 and further to Rs.60.50 per dollar in

2013-14

* India s foreign exchange reserves increased from $292 billion at end March 2013

to $304.2 billion at end March, 2014

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Tenancy Agreement TemplateDokumen8 halamanTenancy Agreement TemplateGary LowBelum ada peringkat

- Warren E. Buffett, 2005: Case Studies in FinanceDokumen2 halamanWarren E. Buffett, 2005: Case Studies in FinanceNakonoaBelum ada peringkat

- Ayyappa Pooja Booklet With Bhajans Print-Version-vFINAL PDFDokumen220 halamanAyyappa Pooja Booklet With Bhajans Print-Version-vFINAL PDFS Nagraj RamanBelum ada peringkat

- SOQLDokumen27 halamanSOQLP Venu Gopala Rao100% (2)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- SELENIUM SyllabusDokumen1 halamanSELENIUM SyllabusP Venu Gopala RaoBelum ada peringkat

- Notes PDFDokumen1 halamanNotes PDFP Venu Gopala RaoBelum ada peringkat

- How To Write Effective Xpath Selenium: Xpath //tag - Name (@attribute - Name 'Value')Dokumen6 halamanHow To Write Effective Xpath Selenium: Xpath //tag - Name (@attribute - Name 'Value')P Venu Gopala RaoBelum ada peringkat

- SQLDokumen92 halamanSQLEASY TO TECHBelum ada peringkat

- Score Report - Selenium Webdriver - Master Synchronization Techniques - Final ExamDokumen2 halamanScore Report - Selenium Webdriver - Master Synchronization Techniques - Final ExamP Venu Gopala RaoBelum ada peringkat

- Oracle 11 G (SQL) : Quality Thought TechnologiesDokumen127 halamanOracle 11 G (SQL) : Quality Thought Technologiessirivella venkateshBelum ada peringkat

- DocumentDokumen2 halamanDocumentP Venu Gopala RaoBelum ada peringkat

- BMC Remedy Action Request System 7.5.00 Concepts GuideDokumen92 halamanBMC Remedy Action Request System 7.5.00 Concepts GuidebeyondgoodBelum ada peringkat

- QT Lakshmi (To All - Entire Audience) : QT Lakshmi (To All - Entire Audience)Dokumen1 halamanQT Lakshmi (To All - Entire Audience) : QT Lakshmi (To All - Entire Audience)P Venu Gopala RaoBelum ada peringkat

- Application Life Cycle ManagementDokumen50 halamanApplication Life Cycle ManagementP Venu Gopala RaoBelum ada peringkat

- ICICI Direct - Customer ServiceDokumen2 halamanICICI Direct - Customer ServiceP Venu Gopala RaoBelum ada peringkat

- UAT TestingDokumen13 halamanUAT TestingP Venu Gopala RaoBelum ada peringkat

- ChatLog Manual TestingDokumen1 halamanChatLog Manual TestingP Venu Gopala RaoBelum ada peringkat

- BMC Remedy Action Request System 7.5.00 Concepts GuideDokumen92 halamanBMC Remedy Action Request System 7.5.00 Concepts GuidebeyondgoodBelum ada peringkat

- BMC Remedy IT Service Management: Concepts GuideDokumen204 halamanBMC Remedy IT Service Management: Concepts GuideP Venu Gopala RaoBelum ada peringkat

- Visual ForceDokumen4 halamanVisual ForceP Venu Gopala RaoBelum ada peringkat

- Org Structure Presentation Oct 8Dokumen45 halamanOrg Structure Presentation Oct 8Jit GhoshBelum ada peringkat

- Process BuilderDokumen9 halamanProcess BuilderP Venu Gopala RaoBelum ada peringkat

- Application For Closure of Demat Account (NSDL/CDSL) : DdmmyyyyDokumen1 halamanApplication For Closure of Demat Account (NSDL/CDSL) : DdmmyyyyP Venu Gopala RaoBelum ada peringkat

- Sap MM JobsDokumen1 halamanSap MM JobsP Venu Gopala RaoBelum ada peringkat

- SEMrush PDF ReportDokumen6 halamanSEMrush PDF ReportP Venu Gopala RaoBelum ada peringkat

- HTML N CssDokumen3 halamanHTML N CssP Venu Gopala RaoBelum ada peringkat

- Email 2 CaseDokumen18 halamanEmail 2 CaseP Venu Gopala RaoBelum ada peringkat

- Types of ProgramingDokumen11 halamanTypes of ProgramingP Venu Gopala RaoBelum ada peringkat

- Compound InterestDokumen22 halamanCompound InterestAnonymous rDNAiszDjX100% (1)

- Clerk 2016-17Dokumen49 halamanClerk 2016-17BAJIBelum ada peringkat

- Keerthi RavellaDokumen5 halamanKeerthi RavellaP Venu Gopala RaoBelum ada peringkat

- How To Approach Gs GeographyDokumen6 halamanHow To Approach Gs GeographyrahulBelum ada peringkat

- Money - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ADokumen12 halamanMoney - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ASasuke UchichaBelum ada peringkat

- 09-PCSO2019 Part2-Observations and RecommDokumen40 halaman09-PCSO2019 Part2-Observations and RecommdemosreaBelum ada peringkat

- Project Report: Submitted in Partial Fulfillment For The Award of TheDokumen57 halamanProject Report: Submitted in Partial Fulfillment For The Award of TheShaktiSoumenSatpathy100% (1)

- Hw5 Mfe Au14 SolutionDokumen8 halamanHw5 Mfe Au14 SolutionWenn Zhang100% (2)

- Nestle India Valuation ReportDokumen10 halamanNestle India Valuation ReportSIDDHANT MOHAPATRABelum ada peringkat

- Project of Company LawDokumen22 halamanProject of Company LawHimanshu ChaudharyBelum ada peringkat

- Insurance and Risk Management AssignmentDokumen14 halamanInsurance and Risk Management AssignmentKazi JunayadBelum ada peringkat

- Combinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IDokumen13 halamanCombinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IBurnwal RBelum ada peringkat

- Depreciation, Impairments, and DepletionDokumen83 halamanDepreciation, Impairments, and DepletionfebrythiodorBelum ada peringkat

- TBChap 005Dokumen61 halamanTBChap 005trevorBelum ada peringkat

- Lupin Annual 2014Dokumen196 halamanLupin Annual 2014SUKHSAGAR1969Belum ada peringkat

- Project On HDFC BANKDokumen70 halamanProject On HDFC BANKAshutosh MishraBelum ada peringkat

- 4th Sem All Model Answers (Agrounder)Dokumen111 halaman4th Sem All Model Answers (Agrounder)Words You Can FeelBelum ada peringkat

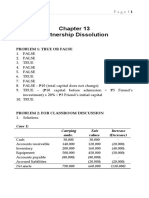

- Sol. Man. - Chapter 13 - Partnership DissolutionDokumen16 halamanSol. Man. - Chapter 13 - Partnership DissolutionJaymark RueloBelum ada peringkat

- Crif Microlend Vol XXV Sept 2023Dokumen20 halamanCrif Microlend Vol XXV Sept 2023saurav guptaBelum ada peringkat

- S4HANA 1909 Preliminary Highlights OverviewDokumen60 halamanS4HANA 1909 Preliminary Highlights OverviewAjersh Paturu100% (6)

- Lobal Investments: Discover Your Real Cost of Capital-And Your Real RiskDokumen6 halamanLobal Investments: Discover Your Real Cost of Capital-And Your Real RiskAdamSmith1990Belum ada peringkat

- Assignment II - Quiz 2Dokumen5 halamanAssignment II - Quiz 2tawfikBelum ada peringkat

- VCF Stock AnalysisDokumen36 halamanVCF Stock Analysisruh cinBelum ada peringkat

- Create Scan Old Candlestick P&F Realtime & Alerts WatchlistsDokumen5 halamanCreate Scan Old Candlestick P&F Realtime & Alerts WatchlistsSushobhan DasBelum ada peringkat

- FM Project ReportDokumen16 halamanFM Project Reportharitha hnBelum ada peringkat

- Case 43Dokumen6 halamanCase 43Maria Danice AngelaBelum ada peringkat

- 2017 It Tesidi Laurea MagureanDokumen124 halaman2017 It Tesidi Laurea Magureanضحى مسكورBelum ada peringkat

- Cost of CapitalDokumen37 halamanCost of Capitalwasiq999Belum ada peringkat

- Tata Power Compensation 2013Dokumen5 halamanTata Power Compensation 2013Vivek SinghBelum ada peringkat

- Dow Theory: Rail IndustrialDokumen13 halamanDow Theory: Rail Industrialapi-281256227Belum ada peringkat

- Namma Kalvi 12th Commerce Chapter 1-15 One Mark 215111Dokumen105 halamanNamma Kalvi 12th Commerce Chapter 1-15 One Mark 215111Aakaash C.K.Belum ada peringkat

- Tambunting v. CADokumen9 halamanTambunting v. CAAlex FelicesBelum ada peringkat