Jen and Larry's Frozen Yogurt Analysis

Diunggah oleh

ZachLovingJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Jen and Larry's Frozen Yogurt Analysis

Diunggah oleh

ZachLovingHak Cipta:

Format Tersedia

CHAPTER 4 MINI CASE: JEN AND LARRYS FROZEN YOGURT COMPANY

In 2008, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larrys Frozen Yogurt Company,

which was based on the idea of applying the microbrew or microbatch strategy to the production and

sale of frozen yogurt. [You may recall that this yogurt venture was introduced in the problems

section at the end of Chapter 2.] Jen and Larry began producing small quantities of unique flavors

and blends in limited editions. Revenues were $600,000 in 2010 and were estimated at $1.2 million

in 2011.

Since Jen and Larry were selling premium frozen yogurt containing high-quality ingredients, each

small cup of yogurt sold for $3 and the cost of producing the frozen yogurt averaged $1.50 per cup.

Administrative expenses, including Jens and Larrys salaries and expenses for an accountant and

two other administrative staff, were estimated at $180,000 in year 2011. Marketing expenses,

largely in the form of behind-the-counter workers, in-store posters, and advertising in local

newspapers, were projected to be $200,000 in year 2011.

An investment in bricks and mortar was necessary to make and sell the yogurt. Initial specialty

equipment and the renovation of an old warehouse building in Lower Downtown (known as LoDo)

occurred at the beginning of 2010 and additional equipment needed to make the amount of yogurt

forecasted to be sold in year 2011 was purchased at the beginning of 2011. As a result, depreciation

expenses were expected to be $50,000 in year 2011. Interest expenses were estimated at $15,000 in

2011. The average tax rate was expected to be 25 percent of taxable income.

Note: For analysis and reference purposes, you should keep in mind the following definitions:

EBITDA (page 135) is a firms earning before interest, taxes, depreciation, and amortization.

EBDAT (page 135) is a firms earnings before depreciation, amortization, and taxes (and includes

interest).

EBDAT = Revenues - Variable Costs - Cash Fixed Costs (CFC)

EBIT is the firms earnings before interest and taxes.

EBDAT Breakeven (page 135) is the amount of revenues (i.e., survival revenues) needed to cover a

ventures cash operating expenses. Breakeven means that revenues minus variable costs minus fixed

costs equal zero.

Survival Revenue (SR) (page 136) is the amount of revenues needed to cover the venture's variable

and fixed costs to breakeven (i.e., EBDAT Breakeven).

SR = [CFC/(1-VCRR)]

Cash Fixed Costs (CFC) (include both fixed operating costs (i.e., administrative and marketing)

and fixed financing (i.e., interest) costs.

Variable Cost Revenue Ratio (VCRR) is the ratio of variable costs to revenues; i.e., cost of goods

sold as a percent of revenues/sales.

Page 1 of 4

CHAPTER 4 MINI CASE: JEN AND LARRYS FROZEN YOGURT COMPANY

You should refer to the comparative income statement for Jen and Larry's Frozen Yogurt Company in the

following worksheet (i.e., in the tab "CH4 Answers").

Additional Case Information:

Jen and Larry projected revenues of $1.2 million for 2011. In addition, they believe that under a worst-case

scenario for 2011, yogurt revenues would be at the 2010 level of $600,000 even after plans and expenditures

were put in place to ramp up revenues.

On the other hand, Jen and Larry also believe that under very optimistic conditions, yogurt revenues could

reach $1.5 million in year 2011. In this case, they anticipate finding ways to reduce production costs and plan to

increase marketing expenses.

Problems:

Note: You should also insert your answers to these questions in the yellow highlighted cells below the income

statement. You should use the highlighted Excel cell to insert a formula so that your calculations can be verified.

A. How many cups of frozen yogurt would have to be sold in order for the firm to reach its projected revenues for

2011, the worst case scenario and the optimistic scenario?

B. Calculate the dollar amount of EBDAT if Jen and Larrys Micro-Batch Frozen Yogurt Company achieves the

forecasted $1.2 million in sales for year 2011. Also calculate the dollar amount EBDAT for the worst case

scenario and the optimistic scenario.

C. What would EBDAT be as a percent of revenues (sales) in 2011, in the worst case scenario, and in the

optimistic scenario?

D. Calculate the EBDAT breakeven point in terms of survival revenues for Jen and Larrys Frozen Yogurt

Company.

G. How many cups of frozen yogurt would have to be sold to reach EBDAT breakeven.

Analysis:

Using the last worksheet (i.e., CH4 Analysis), please comment on the significance of these calculations and

compare the 2011 operations with the worst case and optimistic case for Jen and Larry's venture.

A. 1.2 million = 3 times x(number of cups sold--->400000 cups sold

B. EBDAT= Revenue-Cash Fixed Cost-Variable Costs

Forcasted 1200000-180000-200000-15000-600000=205000

Worst Case 600000-180000-200000-15000-300000=-95000

Optimistic Case 1500000-180000-225000-15000-675000=405000

C. EBDAT/Sales

Forecasted 205000/1200000=17%

Page 2 of 4

Worst Case -95000/600000=-16%

Optimistic Case 405000/1500000=27%

D. CFC/1-.5 (180000+200000+15000)/(1-.5) =790000

G. 790000/3 = 263333 Cups

Page 2 of 4

urt Company in the

hat under a worst-case

plans and expenditures

ogurt revenues could

oduction costs and plan to

d cells below the income

alculations can be verified.

h its projected revenues for

Company achieves the

for the worst case

and in the

ys Frozen Yogurt

ese calculations and

These Calculations show just how big of a difference there is between a bad year and an optimistic year. If they reach th

Page 2 of 4

Page 2 of 4

an optimistic year. If they reach the forecasted sales they will make good sales and if the sales are the same as the previous years they wi

Page 2 of 4

Page 2 of 4

nd if the sales are the same as the previous years they will lose a substatial amount of money.

Page 2 of 4

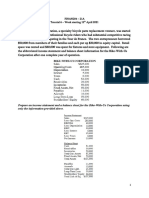

Jen and Larry's Frozen Yogurt Company

Comparative Income Statement

Sales

Cost of Goods Sold (50%)

Gross Profit

Administrative Expenses

Marketing Expenses

EBITDA

Depreciation

EBIT

Interest Expenses

Earnings Before Taxes

180,000

200,000

220,000

15.0%

16.7%

18.3% $

180,000

200,000

(80,000)

30.0%

33.3%

-13.3% $

180,000

225,000

420,000

12.0%

15.0%

28.0%

50,000

170,000

4.2%

14.2% $

50,000

(130,000)

8.3%

-21.7% $

50,000

370,000

3.3%

24.7%

15,000

155,000

1.3%

12.9% $

15,000

(145,000)

2.5%

-24.2% $

15,000

355,000

1.0%

23.7%

88,750

5.9%

266,250

17.8%

38,750

$

116,250

3.2%

(36,250)

9.7% $

Please insert your answers in the cells highlighted in yellow.

Exemplar

A Sales in units (i.e., cups)

400,000

B EBDAT

C EBDAT/Sales

F EBDAT Breakeven Sales-a)

G EBDAT Breakeven Units-b)

Optimistic

% Rev

Scenario

100.0% $ 1,500,000

50.0%

675,000

50.0% $

825,000

2011

1,200,000

600,000

600,000

Taxes (25% of EBT)

Net Income

Worst Case

% Rev

Scenario

100.0% $

600,000

50.0%

300,000

50.0% $

300,000

205,000

790,000

263,333

Page 3 of 4

-18.1% $

200,000

$

17.08%

$

(108,750)

-6.0%

(95,000)

500,000

$

-16.00%

$

790,000

263,333

405,000

27.00%

840,000

280,000

% Rev

100.0%

45.0%

55.0%

CHAPTER 4 MINI CASE: JEN AND LARRYS FROZEN YOGURT COMPANY

Analysis:

Here are some key points from the chapter where we used accounting information to address

venture survival and breakeven levels of revenue and unit sales. You may also refer to the

formulas and definitions in the working papers for Chapter 4 problems.

1. The EBDAT breakeven analysis determined the level of survival revenues (SR) that would be

necessary to cover the venture's variable and cash fixed costs (CFC).

SR = [CFC/91-VCRR)]

2. The relationship of variable costs to revenue ratio (VCRR) and the amount of cash fixed costs

related to the amount of revenues affected the venture's survival.

Narrative:

Please use the space below to comment on the significance of the calculations on the previous

worksheet and compare the 2009 operations with the worst case and optimistic case for Jen and

Larry's venture.

Answer: The EBDAT breakeven is a very important bit of knowledge its almost like a

minimum goal that the company must reach. If the company doesn't at least make that much

in revenue then the company will be loosing money. The relationship between the variable

costs and revenue is also and interesting one as the revenue rises the variable costs becomes

a larger percentage of the costs because the fixed costs don't change they will account for a

smaller percentage. Based on my observations of the worst case for Jen and Larry's venture

they firm lost money in the previous year but with the projected sales that deficit will be

made up for. If the optimistic mark is reached then the firm will be doing very well. If the

worst case situation happens then there would need to be some major changes internally or

else the company will not last much longer.

Page 4 of 4

Anda mungkin juga menyukai

- Completed Chapter 5 Mini Case Working Papers FA14Dokumen12 halamanCompleted Chapter 5 Mini Case Working Papers FA14ZachLoving75% (4)

- Ford Moto Company Ratio AnalysisDokumen7 halamanFord Moto Company Ratio AnalysisEmon hassanBelum ada peringkat

- Frame It Company Master Budget for 20x1Dokumen8 halamanFrame It Company Master Budget for 20x1Kevin Mclean0% (2)

- Chap 008Dokumen26 halamanChap 008Citra Dewi WulansariBelum ada peringkat

- Pinkerton CaseDokumen6 halamanPinkerton CaseNathan GaoBelum ada peringkat

- Organizing and Financing A New Venture: 1. Describe The Major Differences Between A Proprietorship and A PartnershipDokumen21 halamanOrganizing and Financing A New Venture: 1. Describe The Major Differences Between A Proprietorship and A Partnershipmahnoor javaid100% (1)

- Eslsca - Economics For Managers - Case StudiesDokumen10 halamanEslsca - Economics For Managers - Case StudiesMahmoud Nassef100% (2)

- AdDokumen6 halamanAdShahid AbbasBelum ada peringkat

- Sample Final Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDokumen2 halamanSample Final Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick Cortez0% (1)

- 3 and 4 Final CrowdfundingDokumen3 halaman3 and 4 Final CrowdfundingPrasant Goel0% (1)

- Hershey Note PDFDokumen10 halamanHershey Note PDFdakine_10100% (1)

- Financial CasesDokumen64 halamanFinancial CasesMarwan MikdadyBelum ada peringkat

- An Iso 9001: 2000 Certified International B-SchoolDokumen4 halamanAn Iso 9001: 2000 Certified International B-SchoolKunal BadhwarBelum ada peringkat

- Measuring Exposure to Exchange Rate FluctuationsDokumen6 halamanMeasuring Exposure to Exchange Rate Fluctuationsgeorgeterekhov100% (1)

- Ratio Analysis of Glaxo SmithKline PharmaceuticalsDokumen20 halamanRatio Analysis of Glaxo SmithKline Pharmaceuticalswithlove87100% (2)

- Leach TB Chap09 Ed3Dokumen8 halamanLeach TB Chap09 Ed3bia070386Belum ada peringkat

- Caso Ford Motor Company Basic Financial RatiosDokumen7 halamanCaso Ford Motor Company Basic Financial RatiosJesus Gonzalez0% (1)

- Solution Manual CH 12 Multinational Financial ManagementDokumen1 halamanSolution Manual CH 12 Multinational Financial Managementariftanur0% (1)

- Chapter 12 Integrative ProblemDokumen3 halamanChapter 12 Integrative ProblemFRANKOBL30% (1)

- Chap 004Dokumen95 halamanChap 004kwathom1100% (2)

- The World Is CurvedDokumen7 halamanThe World Is CurvedSuperExcellent11Belum ada peringkat

- Mckenzie SolutionDokumen5 halamanMckenzie Solutionnira_110Belum ada peringkat

- Brief Financial Report On Ford Versus ToyotaDokumen8 halamanBrief Financial Report On Ford Versus ToyotaSayantani Nandy50% (2)

- Ford Motor Company Strategic Fit With THDokumen10 halamanFord Motor Company Strategic Fit With THFaisal Rehman100% (1)

- BCG Matrix Analysis of Apple's ProductsDokumen3 halamanBCG Matrix Analysis of Apple's ProductsHenny ZahranyBelum ada peringkat

- EFim 05 Ed 3Dokumen23 halamanEFim 05 Ed 3mahnoor javaidBelum ada peringkat

- Microeconimics Final ProjectDokumen7 halamanMicroeconimics Final ProjectAdil Javed KhanBelum ada peringkat

- ProblemDokumen3 halamanProblemNicole LabbaoBelum ada peringkat

- Econ 1000 - Test 2Dokumen165 halamanEcon 1000 - Test 2Akram SaiyedBelum ada peringkat

- Chapter 14Dokumen36 halamanChapter 14Kad Saad100% (1)

- TBUS 5116 UNIT 1 WA FINAL The Case of BMWDokumen6 halamanTBUS 5116 UNIT 1 WA FINAL The Case of BMWPyaihsone AungBelum ada peringkat

- Chapter 26 - Business Cycles, Unemployment and Inflation ExplainedDokumen20 halamanChapter 26 - Business Cycles, Unemployment and Inflation ExplainedPavan PatelBelum ada peringkat

- FINAN204-21A - Tutorial 6 Week 7Dokumen10 halamanFINAN204-21A - Tutorial 6 Week 7Danae YangBelum ada peringkat

- Starbucks CaseDokumen18 halamanStarbucks CaseDhaarani RavichandranBelum ada peringkat

- TBChap 010Dokumen42 halamanTBChap 010varun cyw100% (3)

- FQM Safe Food Vs Healthy FoodDokumen11 halamanFQM Safe Food Vs Healthy FoodVladimir SurcinskiBelum ada peringkat

- FINAN204-21A - Tutorial 1 Week 1Dokumen12 halamanFINAN204-21A - Tutorial 1 Week 1Danae YangBelum ada peringkat

- Bond After-Tax Yield CalculatorDokumen7 halamanBond After-Tax Yield CalculatorJohnBelum ada peringkat

- Pepsi CaseDokumen2 halamanPepsi CaseAshish IndoliaBelum ada peringkat

- Weighted Average Cost of CapitalDokumen26 halamanWeighted Average Cost of CapitalAysi WongBelum ada peringkat

- Chapter 1 Problems Working PapersDokumen5 halamanChapter 1 Problems Working PapersZachLovingBelum ada peringkat

- Segment AnalysisDokumen53 halamanSegment AnalysisamanBelum ada peringkat

- Ford Motor Companys Financial AnalysisDokumen22 halamanFord Motor Companys Financial AnalysisD ABelum ada peringkat

- Chapter 5 ExerciseDokumen7 halamanChapter 5 ExerciseJoe DicksonBelum ada peringkat

- Case HersheyDokumen16 halamanCase Hersheynoor74900Belum ada peringkat

- Advice To Tim CookDokumen5 halamanAdvice To Tim CookJaydeep SarnaikBelum ada peringkat

- Corporate Finance Final ExamDokumen30 halamanCorporate Finance Final ExamJobarteh FofanaBelum ada peringkat

- Chapter 10Dokumen31 halamanChapter 10Kad SaadBelum ada peringkat

- Lexus Case Study PDFDokumen16 halamanLexus Case Study PDFMonoj ChakrabortyBelum ada peringkat

- Woody's Reproduction Budgeting Case StudyDokumen2 halamanWoody's Reproduction Budgeting Case StudyMai TrầnBelum ada peringkat

- IRM Sessional Test Notes - Introduction To Risk and InsuranceDokumen5 halamanIRM Sessional Test Notes - Introduction To Risk and InsuranceRupesh SharmaBelum ada peringkat

- Banking Industry OverviewDokumen27 halamanBanking Industry OverviewNicole JoanBelum ada peringkat

- Question and Answer - 35Dokumen30 halamanQuestion and Answer - 35acc-expertBelum ada peringkat

- Actividad 8 en ClaseDokumen2 halamanActividad 8 en Claseluz_ma_6Belum ada peringkat

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDokumen44 halamanConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- Econ205 - S09Dokumen15 halamanEcon205 - S09shahimermaid92% (13)

- Financial Summary of Google's Acquisition of YouTubeDokumen4 halamanFinancial Summary of Google's Acquisition of YouTubecmcandrew21Belum ada peringkat

- Day 11 Chap 6 Rev. FI5 Ex PRDokumen8 halamanDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- Mini Case CH 3 SolutionsDokumen14 halamanMini Case CH 3 SolutionsTimeka CarterBelum ada peringkat

- Translated Copy of Copy of Como São Os BotosDokumen2 halamanTranslated Copy of Copy of Como São Os BotosZachLovingBelum ada peringkat

- Daft Punk-Adagio For Tron-SheetMusicDownload PDFDokumen4 halamanDaft Punk-Adagio For Tron-SheetMusicDownload PDFZachLovingBelum ada peringkat

- IMSLP542770 PMLP2475 Resized CombinepdfDokumen36 halamanIMSLP542770 PMLP2475 Resized CombinepdfZachLovingBelum ada peringkat

- 3 Weeks-Methods Practicum: Full-Time Teacher's Contract DayDokumen1 halaman3 Weeks-Methods Practicum: Full-Time Teacher's Contract DayZachLovingBelum ada peringkat

- Joplin High School PDFDokumen1 halamanJoplin High School PDFZachLovingBelum ada peringkat

- Sammy's Party MenuDokumen1 halamanSammy's Party MenuZachLovingBelum ada peringkat

- School class schedule by dayDokumen1 halamanSchool class schedule by dayZachLovingBelum ada peringkat

- Music Note Quiz ReviewDokumen17 halamanMusic Note Quiz ReviewZachLovingBelum ada peringkat

- Missouri Choral Directors Association: District Choir & All-State Choir Coordinator HandbookDokumen36 halamanMissouri Choral Directors Association: District Choir & All-State Choir Coordinator HandbookZachLovingBelum ada peringkat

- Yamaha 99-05 R6Dokumen1 halamanYamaha 99-05 R6ZachLovingBelum ada peringkat

- Troubadours and The Art of Courtly LoveDokumen13 halamanTroubadours and The Art of Courtly LoveZachLovingBelum ada peringkat

- IMSLP262050-PMLP54706-Fauré, Gabriel, 2 Songs, Op.43, No.1, OrganHarmPartDokumen2 halamanIMSLP262050-PMLP54706-Fauré, Gabriel, 2 Songs, Op.43, No.1, OrganHarmPartZachLovingBelum ada peringkat

- Science and Religion-Fall2013Dokumen20 halamanScience and Religion-Fall2013ZachLovingBelum ada peringkat

- Exercise #1 - "My Life in A Bag": The2220 - Acting IDokumen1 halamanExercise #1 - "My Life in A Bag": The2220 - Acting IZachLovingBelum ada peringkat

- Horace Mann On Education and National WelfareDokumen2 halamanHorace Mann On Education and National WelfareZachLovingBelum ada peringkat

- Zen4partcharacterization Pptfall2013Dokumen23 halamanZen4partcharacterization Pptfall2013ZachLovingBelum ada peringkat

- Movie Response To Inside IslamDokumen1 halamanMovie Response To Inside IslamZachLovingBelum ada peringkat

- Fowler - Strong Arts, Strong SchoolsDokumen5 halamanFowler - Strong Arts, Strong SchoolsZachLovingBelum ada peringkat

- The Tallis Scholars Peter Phillips, Director: Poetry in Music For The Virgin MaryDokumen4 halamanThe Tallis Scholars Peter Phillips, Director: Poetry in Music For The Virgin MaryZachLovingBelum ada peringkat

- Visit To RymonjiresponseDokumen1 halamanVisit To RymonjiresponseZachLovingBelum ada peringkat

- "Gloria Dei" Mary Lynn Curriculum MapDokumen4 halaman"Gloria Dei" Mary Lynn Curriculum MapZachLovingBelum ada peringkat

- Common Musical FormsDokumen3 halamanCommon Musical FormsZachLovingBelum ada peringkat

- Drums Used in Gamelan Music With AnswersDokumen19 halamanDrums Used in Gamelan Music With AnswersZachLovingBelum ada peringkat

- Mahayana and TheravadaDokumen22 halamanMahayana and TheravadaZachLovingBelum ada peringkat

- "Gloria Dei" Mary Lynn Curriculum MapDokumen4 halaman"Gloria Dei" Mary Lynn Curriculum MapZachLovingBelum ada peringkat

- Work OutDokumen4 halamanWork OutZachLovingBelum ada peringkat

- Buddhism's Four Noble Truths and Path to EnlightenmentDokumen23 halamanBuddhism's Four Noble Truths and Path to EnlightenmentZachLovingBelum ada peringkat

- 17th-Century Opera in England and FranceDokumen17 halaman17th-Century Opera in England and FranceZachLovingBelum ada peringkat

- The Influencers of Dvorak: Brahms and WagnerDokumen7 halamanThe Influencers of Dvorak: Brahms and WagnerZachLovingBelum ada peringkat

- CU Offseason 4day Per Week LiftDokumen8 halamanCU Offseason 4day Per Week LiftZachLovingBelum ada peringkat

- Running Head: Ethical and Legal Principles On British AirwaysDokumen8 halamanRunning Head: Ethical and Legal Principles On British AirwaysDyya EllenaBelum ada peringkat

- Auto Finance Industry AnalysisDokumen15 halamanAuto Finance Industry AnalysisMitul SuranaBelum ada peringkat

- PM RN A4.Throughput CostingDokumen5 halamanPM RN A4.Throughput Costinghow cleverBelum ada peringkat

- My India in 2047Dokumen3 halamanMy India in 2047Karttikeya Mangalam NemaniBelum ada peringkat

- ISM - PrimarkDokumen17 halamanISM - PrimarkRatri Ika PratiwiBelum ada peringkat

- Comparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsDokumen9 halamanComparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsarcherselevatorsBelum ada peringkat

- Case Study - IDokumen3 halamanCase Study - IMamta Singh RajpalBelum ada peringkat

- Review of Related LiteratureDokumen3 halamanReview of Related LiteratureEaster Joy PatuladaBelum ada peringkat

- By: Arfa Nawaz: Trade and Aid Is The Trade Being Globally Affected by Technology?Dokumen7 halamanBy: Arfa Nawaz: Trade and Aid Is The Trade Being Globally Affected by Technology?arfa.8637Belum ada peringkat

- Proposal Change Management AmendmentDokumen21 halamanProposal Change Management Amendmentyesuf abdulhakimBelum ada peringkat

- Workday Glossary of TermsDokumen27 halamanWorkday Glossary of Termsnaimenim100% (1)

- ECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and SupplyDokumen30 halamanECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and Supplyizah893640Belum ada peringkat

- MKTG2010 Written ReportDokumen17 halamanMKTG2010 Written Reportivadama100% (1)

- IKEA PresentationDokumen20 halamanIKEA PresentationAvinash2458Belum ada peringkat

- Inventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. BergeracDokumen105 halamanInventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. Bergeracsurury100% (1)

- The Case For New Leadership: Prepared by Icahn Capital LPDokumen24 halamanThe Case For New Leadership: Prepared by Icahn Capital LPMiguel RamosBelum ada peringkat

- Barriers To Entry: Resilience in The Supply ChainDokumen3 halamanBarriers To Entry: Resilience in The Supply ChainAbril GullesBelum ada peringkat

- The Nature of Staffing: Chapter One Staffing Models and StrategyDokumen32 halamanThe Nature of Staffing: Chapter One Staffing Models and StrategyHasib AhsanBelum ada peringkat

- Hamilton County Equal Pay CommitmentDokumen5 halamanHamilton County Equal Pay CommitmentWVXU NewsBelum ada peringkat

- Brand Management Assignment (Project)Dokumen9 halamanBrand Management Assignment (Project)Haider AliBelum ada peringkat

- MELC - EPP 5 Entrep ICT MELCDokumen2 halamanMELC - EPP 5 Entrep ICT MELCChristian GranadaBelum ada peringkat

- Incepta Pharmaceuticals - 2Dokumen2 halamanIncepta Pharmaceuticals - 2itsshuvroBelum ada peringkat

- NETELLER UserGuide EnglishDokumen94 halamanNETELLER UserGuide EnglishAnindita AndriatiBelum ada peringkat

- King Abdul Aziz University: IE 255 Engineering EconomyDokumen11 halamanKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaBelum ada peringkat

- Answer Sheet - Docx ABC PARTNERSHIPDokumen14 halamanAnswer Sheet - Docx ABC PARTNERSHIPCathy AluadenBelum ada peringkat

- Digital Marketing AIDA Model ExplainedDokumen85 halamanDigital Marketing AIDA Model ExplainedShibaniBelum ada peringkat

- Financial Management (Chapter 1: Getting Started-Principles of Finance)Dokumen25 halamanFinancial Management (Chapter 1: Getting Started-Principles of Finance)Bintang LazuardiBelum ada peringkat

- Managing Human Resources, 4th Edition Chapters 1 - 17Dokumen49 halamanManaging Human Resources, 4th Edition Chapters 1 - 17Aamir Akber Ali67% (3)

- Lembar Jawaban 1-JURNALDokumen9 halamanLembar Jawaban 1-JURNALClara Shinta OceeBelum ada peringkat

- Case Study On Citizens' Band RadioDokumen7 halamanCase Study On Citizens' Band RadioরাসেলআহমেদBelum ada peringkat