Income Tax Slabs & Rates - AY 2015-16

Diunggah oleh

shivashankari86Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Income Tax Slabs & Rates - AY 2015-16

Diunggah oleh

shivashankari86Hak Cipta:

Format Tersedia

HomeIncome TaxTax PlanningPPFOther TaxesFormsForexMisc.

Hide Menu

Top

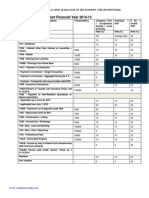

Income Tax Slabs & Rates

for Assessment Year 2015-16

Change Assessment Year

AY 2014-15 ( FY 2013-14 )

AY 2013-14 ( FY 2012-13 )

Please click on the links below to view the Income Tax (also written shortly as I. tax or Inc. tax) Slabs

and Rates for Assessment Year 2015-16 (applicable on income earned during 01.04.2014 to

31.03.2015) for various categories of Indian Income Tax payers.

Please send us your suggestions / feedback to enable us to make this page more user-friendly and

useful.

Individual resident (Age below 60 Yrs.) or any NRI / HUF / AOP /

BOI / AJP

Senior Citizen

Super Senior Citizen

Co-operative Society

I.

Firm

Local Authority

Domestic Company

Other Company

Individual resident aged below 60 years (i.e. born on or after 1st April 1955) or any

NRI / HUF / AOP / BOI / AJP*

Income Tax :

Income Slabs

i. Where the total income does not exceed Rs.

2,50,000/-.

ii. Where the total income exceeds Rs. 2,50,000/but does not exceed Rs. 5,00,000/-.

Tax Rates

NIL

10% of amount by which the total income

exceeds Rs. 2,50,000/-.

Less ( in case of Resident Individuals only )

: Tax Credit u/s 87A - 10% of taxable

income upto a maximum of Rs. 2000/-.

iii. Where the total income exceeds Rs. 5,00,000/- Rs. 25,000/- + 20% of the amount by which

but does not exceed Rs. 10,00,000/-.

the total income exceeds Rs. 5,00,000/-.

iv. Where the total income exceeds Rs. 10,00,000/-. Rs. 125,000/- + 30% of the amount by

which the total income exceeds Rs.

10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

* Abbreviations used :

NRI - Non Resident Individual; HUF - Hindu Undivided Family; AOP - Association of Persons; BOI - Body of

Individuals; AJP - Artificial Judicial Person

Tax Calculator

Income Tax

TDS Rates

Tax Rate

II.

Individual resident who is of the age of 60 years or more but below the age

of 80 years at any time during the previous year (i.e. born on or after 1st April 1934

but before 1st April 1954)

Income Tax :

Income Slabs

i. Where the total income does not exceed Rs.

3,00,000/-.

ii. Where the total income exceeds Rs. 3,00,000/but does not exceed Rs. 5,00,000/-

Tax Rates

NIL

10% of the amount by which the total

income exceeds Rs. 3,00,000/-.

Less : Tax Credit u/s 87A - 10% of taxable

income upto a maximum of Rs. 2000/-.

iii. Where the total income exceeds Rs. 5,00,000/- Rs. 20,000/- + 20% of the amount by which

but does not exceed Rs. 10,00,000/the total income exceeds Rs. 5,00,000/-.

iv. Where the total income exceeds Rs. 10,00,000/- Rs. 120,000/- + 30% of the amount by

which the total income exceeds Rs.

10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

III.

Individual resident who is of the age of 80 years or more at any time during

the previous year (i.e. born before 1st April 1934)

Income Tax :

Income Slabs

i. Where the total income does not exceed Rs.

5,00,000/-.

ii. Where the total income exceeds Rs. 5,00,000/but does not exceed Rs. 10,00,000/iii. Where the total income exceeds Rs. 10,00,000/-

Tax Rates

NIL

20% of the amount by which the total

income exceeds Rs. 5,00,000/-.

Rs. 100,000/- + 30% of the amount by

which the total income exceeds Rs.

10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

IV.

Co-operative Society

Income Tax :

Income Slabs

Tax Rates

i. Where the total income does not exceed Rs.

10% of the income.

10,000/-.

ii. Where the total income exceeds Rs. 10,000/- but Rs. 1,000/- + 20% of income in excess of

does not exceed Rs. 20,000/-.

Rs. 10,000/-.

iii. Where the total income exceeds Rs. 20,000/-

Rs. 3.000/- + 30% of the amount by which

iii. Where the total income exceeds Rs. 20,000/-

Rs. 3.000/- + 30% of the amount by which

the total income exceeds Rs. 20,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

V.

Firm

Income Tax : 30% of total income.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

VI.

Local Authority

Income Tax : 30% of total income.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

VII.

Domestic Company

Income Tax : 30% of total income.

Surcharge : The amount of income tax as computed in accordance with above rates, and after

being reduced by the amount of tax rebate shall be increased by a surcharge

At the rate of 5% of such income tax, provided that the total income exceeds Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

At the rate of 10% of such income tax, provided that the total income exceeds Rs. 10 crores.

Education Cess : 3% of the total of Income Tax and Surcharge.

VIII.

Company other than a Domestic Company

Income Tax :

@ 50% of on so much of the total income as consist of (a) royalties received from Government

or an Indian concern in pursuance of an agreement made by it with the Government or the

Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976; or (b)

fees for rendering technical services received from Government or an Indian concern in

pursuance of an agreement made by it with the Government or the Indian concern after the

29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement

has, in either case, been approved by the Central Government.

@ 40% of the balance

Surcharge :

The amount of income tax as computed in accordance with above rates, and after being reduced

by the amount of tax rebate shall be increased by a surcharge as under

At the rate of 2% of such income tax, provided that the total income exceeds Rs. 1 crore.

(Marginal Relief in Surcharge, if applicable)

At the rate of 5% of such income tax, provided that the total income exceeds Rs. 10 crores.

Education Cess : 3% of the total of Income Tax and Surcharge.

Marginal Relief : When an assessee's taxable income exceeds Rs. 1 crore, he is liable to pay

Surcharge at prescribed rates mentioned above on Income Tax payable by him. However, the amount of

Income Tax and Surcharge shall not increase the amount of income tax payable on a taxable income of

Rs. 1 crore by more than the amount of increase in taxable income.

Example :

In case of an individual assesseee (< 60 years) having taxable income of Rs. 1,00,01,000/1.

2.

3.

4.

5.

6.

Income Tax

Surcharge @10% of Income Tax

Income Tax on income of Rs. 1 crore

Maximum Surcharge payable

(Income over Rs. 1 crore less income tax on income

over Rs. 1 crore)

Income Tax + Surcharge payable

Marginal Relief in Surcharge

Rs. 28,30,300

Rs. 2,83,030

Rs. 28,30,000

Rs. 700/- (1000 - 300)

Rs. 28,31,000

Rs. 2,82,330/- (2,83,030 - 700)

No change in existing Tax Rates (as shown above) has been proposed in the Interim Budget

for the Fiscal Year 2014-15.

Disclaimer :

All efforts are made to keep the content of this site correct and up-to-date. But, this site does not make

any claim regarding the information provided on its pages as correct and up-to-date. The contents of this

site cannot be treated or interpreted as a statement of law. In case, any loss or damage is caused to

any person due to his/her treating or interpreting the contents of this site or any part thereof as correct,

complete and up-to-date statement of law out of ignorance or otherwise, this site will not be liable in any

manner whatsoever for such loss or damage.

Anda mungkin juga menyukai

- Section 58 in The Indian Partnership Act, 1932Dokumen2 halamanSection 58 in The Indian Partnership Act, 1932shivashankari86Belum ada peringkat

- PF DeclarationDokumen2 halamanPF Declarationshivashankari86Belum ada peringkat

- Pushpaka Loan Scheme PDFDokumen2 halamanPushpaka Loan Scheme PDFVeeru MudirajBelum ada peringkat

- Std02 III MSSS TM 3Dokumen9 halamanStd02 III MSSS TM 3shivashankari86Belum ada peringkat

- Pranav Kumar ScienceDokumen6 halamanPranav Kumar Scienceshivashankari86Belum ada peringkat

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDokumen11 halamanTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86Belum ada peringkat

- Assessment of Charitable Trust and InstitutionDokumen51 halamanAssessment of Charitable Trust and InstitutionukalBelum ada peringkat

- Tnpsc+Group+IV 2008Dokumen15 halamanTnpsc+Group+IV 2008vinoknkBelum ada peringkat

- TNPSC Question OMR-ModelDokumen1 halamanTNPSC Question OMR-Modelshivashankari86Belum ada peringkat

- Budget 2014-15 Key Highlights-Income-Tax, Service Tax DownloadDokumen3 halamanBudget 2014-15 Key Highlights-Income-Tax, Service Tax Downloadshivashankari86Belum ada peringkat

- History 9 TNPSC Exam Question Answer Download ModelDokumen18 halamanHistory 9 TNPSC Exam Question Answer Download ModelMathan NaganBelum ada peringkat

- Tds Rate Chart Fy 2014-15 Ay 2015-16Dokumen26 halamanTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86Belum ada peringkat

- Regn. No.: The Employees' Deposit Linked Insurance Scheme 1976Dokumen2 halamanRegn. No.: The Employees' Deposit Linked Insurance Scheme 1976Tilak RajBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- TAX ProjectDokumen3 halamanTAX ProjectJames Ibrahim AlihBelum ada peringkat

- 0055450928Dokumen1 halaman0055450928chandramouliyadavBelum ada peringkat

- 5 Quezon City VS Abs CBNDokumen4 halaman5 Quezon City VS Abs CBNSuzyBelum ada peringkat

- Taguig City Ordinance No. 004-07Dokumen4 halamanTaguig City Ordinance No. 004-07henson montalvoBelum ada peringkat

- Special Journals - Quiz 36Dokumen8 halamanSpecial Journals - Quiz 36Joana TrinidadBelum ada peringkat

- AIRTEL Tariff Guide Poster A1Dokumen1 halamanAIRTEL Tariff Guide Poster A1KENNEDY MKBelum ada peringkat

- Payroll Dec With 13th MonthDokumen8 halamanPayroll Dec With 13th MonthchippaiUSABelum ada peringkat

- CTS, Neft, RTGSDokumen24 halamanCTS, Neft, RTGSSakthiBelum ada peringkat

- COP 6th RA PDFDokumen1 halamanCOP 6th RA PDFshahid alamBelum ada peringkat

- F6 PIT AnswersDokumen18 halamanF6 PIT AnswersHuỳnh TrungBelum ada peringkat

- PEZA NotesDokumen25 halamanPEZA NotesJane BiancaBelum ada peringkat

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Dokumen16 halamanGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanBelum ada peringkat

- CIR v. PLDTDokumen3 halamanCIR v. PLDTHoney BiBelum ada peringkat

- Benefits and Impact of The Proposed Tax Reform To The People and The GovernmentDokumen12 halamanBenefits and Impact of The Proposed Tax Reform To The People and The GovernmentGretchen CanedoBelum ada peringkat

- Od 329347391899682100Dokumen2 halamanOd 32934739189968210099rakeshghotiyaBelum ada peringkat

- Wirex Investment Opportunity 05042019Dokumen7 halamanWirex Investment Opportunity 05042019vsBelum ada peringkat

- Statement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Dokumen4 halamanStatement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Chandrani ChatterjeeBelum ada peringkat

- Hampton Machine Tool CaseDokumen7 halamanHampton Machine Tool CaseChaitanya80% (10)

- New Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeDokumen4 halamanNew Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeKiran KumarBelum ada peringkat

- Monthly Payroll Barangay OfficialsDokumen2 halamanMonthly Payroll Barangay OfficialsRosalie Sareno Alvior100% (5)

- Acct11 1hwDokumen3 halamanAcct11 1hwRonald James Siruno MonisBelum ada peringkat

- Contractor BillDokumen4 halamanContractor BillMuhammad RiazBelum ada peringkat

- Charitable Contributions: Publication 526Dokumen26 halamanCharitable Contributions: Publication 526jBelum ada peringkat

- Chaseo: Beginning BalanceDokumen1 halamanChaseo: Beginning BalanceAvalina LindaBelum ada peringkat

- Acct Statement - XX6782 - 23012024Dokumen5 halamanAcct Statement - XX6782 - 23012024Thejesh tejuBelum ada peringkat

- Syllabus - Law 129B Taxation 2 (Lucenario)Dokumen24 halamanSyllabus - Law 129B Taxation 2 (Lucenario)Renz RuizBelum ada peringkat

- NAME - PER - Unit 2: 8.4 Checkbook NotesDokumen3 halamanNAME - PER - Unit 2: 8.4 Checkbook Notesapi-556843268Belum ada peringkat

- CRN5594681450Dokumen3 halamanCRN5594681450amitdesai92Belum ada peringkat

- 2022 AllSlipsDokumen3 halaman2022 AllSlipsAshley LehmanBelum ada peringkat

- Payroll ExercisesDokumen1 halamanPayroll ExercisesMerry Grace EsquivelBelum ada peringkat