Saskatoon City Budget 2015

Diunggah oleh

David A. GilesHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Saskatoon City Budget 2015

Diunggah oleh

David A. GilesHak Cipta:

Format Tersedia

BUDGET 2015: AT A GLANCE

2015 PRELIMINARY CORPORATE BUSINESS PLAN AND BUDGET

BUDGET 2015 HIGHLIGHTS

Sustaining the

Saskatoon Advantage

The Citys 2015 Preliminary

Corporate Business Plan and Budget

focuses on Sustaining the Saskatoon

Advantage through strategic

investments in infrastructure and

core civic services that will make

Saskatoon an even more attractive

and desirable place to live, work

and invest.

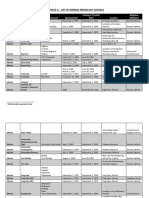

Capital Investment by Business Line

Total Investment: $225.6 Million (value in thousands)

Saskatoon Public Library: 3.33% - $7,509

Recreation and Culture: 7.07% - $15,954

Policing: 0.78% - $1,762

Fire Services: 0.69% - $1,559

Environmental Health: 1.78% - $4,007

Corporate Governance and Finance: 0.58% - $1,306

Corporate Asset Management: 6.94% - $15,647

Community Support: 0.18% - $400

Transportation: 51.1% - $115,280

Proposed Consolidated 2015 Operating

and Capital Investment is $1.1 billion:

Capital Investments

2014

2015

Civic Services

Utilities

$143.5

$65.3

$165.8

$59.8

Land Development

$172.3

$147.8

Totals

$381.1

$373.4

(millions)

Urban Planning and Development: 1.07% - $2,415

Utilities: 26.49% - $59,775

Note: Does not include Land Development

Operating Expenditures by Business Line

Total Operating Budget: $434.1 Million (value in thousands)

Corporate Asset Management: 2.33% - $10,119

Community Support: 3.60% - $15,627

Operating Expenditures

Urban Planning and Development: 3.21% - $13,926

2014

2015

Civic Services

$404.9

$434.1

Environmental Health: 4.49% - $19,474

Utilities

$271.4

$289.3

Transportation: 26.56% - $115,304

$7.0

$8.4

$683.3

$731.8

(millions)

Land Development

Totals

Corporate Governance and Finance: 14.97% - $64,964

Fire Services: 10.55% - $45,812

Taxation:1.22% - $5,309

Recreation and Culture: 12.34% - $53,554

Policing: 20.74% - $90,018

The budget review for the 2015

Preliminary Corporate Business Plan and

Budget will take place on December 2-3,

2014 from 1:00 pm - 6:00 pm in City

Council Chambers.

The City has heard loud and clear that residents

continue to want more resources directed

to improving the condition of Saskatoons

roads. According to the Citys 2013 and 2014

Civic Services Survey results, almost 90% of

respondents rate the quality of life in Saskatoon

as either good or very good. The majority of

residents also believe that the condition of

Note: Does not include Land Development or Utilities which are not tax supported programs

Saskatoons roads is by far, the single most

important issue facing the City.

Budget 2015, like Budget 2014,

is proposing an unprecedented

investment of $53.2 million to

maintain and repair Saskatoons

roadways - approximately $2.7

million over the 2014 investment.

This proposed investment, coupled

with the Citys new road design

standards, will contribute to improving

the condition, safety and longevity of

Saskatoons roads.

To help pay for the roadways investment,

the City proposes a dedicated property

tax increase of 2.92% in 2015. This is

the second year of a three-year phase-in

BUDGET 2015: AT A GLANCE

2015 PRELIMINARY CORPORATE BUSINESS PLAN AND BUDGET

to build the annual investment in Saskatoons

roads - to meet the demands of our strong

economy, and growing population. The

Citys investment in roadways has doubled

since 2011.

Breakdown of the Proposed 2015 Property Tax Increase: 7.32%

2.46% - Saskatoon Police Service

2.92% - Dedicated to Roadways

For 2015, Civic Administration is

proposing Operating Expenditures of

$434.1million, and a Capital Budget

of $225.6 million.

1.32% - Saskatoon Fire Department

0.32% - Civic Services

0.30% - Traffic Noise Attenuation

The 2015 Preliminary Operating Budget also

proposes almost $1 million more resources for

Snow and Ice Management, and an increase

of $200,000 over last year towards Street

Sweeping Investment.

The 2015 Preliminary Corporate Business Plan

and Budget is aligned with the Citys 20132023

Strategic Plan. It aims to balance the pressures

of the increased costs of maintaining existing

services and the requirements of a growing city

with available funding and resources.

The 2015 Corporate Business Plan and Budget

will form the path the City will take over the

next year to focus on the major issues and

challenges facing the City, while continuing to

provide quality services to our citizens.

The Citys budget planning process ensures

resources are allocated to various programs and

services within the Citys business lines, and that

resources are tied to clear and achievable plans.

The Operating and Capital Budgets are integrated

for effective resource management. This process

provides a framework which allows the City

to adapt and respond quickly to changing

municipal, provincial and federal dynamics.

The proposed 2015 Capital and Operating

investment of $659.7 million will help ensure

the City has the right balance of funding

sources to pay for both capital infrastructure

projects and its day-to-day operations.

With a proposed Property Tax increase

of 7.32%, what will residents pay for

municipal property taxes in 2015?

Municipal Tax Increase Per Average Household $325,000 Assessment

Municipal

Operating*

Traffic Noise

Attenuation

Dedicated to

Roadways

Total

4.10%

0.30%

2.92%

7.32%

Estimated

Total Increase

$64

$5

$45

$114

Approximate

$ Per Month

$5

$0.50

$4

$9.50

* Includes Policing, Fire, Civic Services

The proposed property tax increase

means that a homeowner who owns a

single-family detached home with an

average assessment of $325,000 will see

their municipal property taxes increase

by $9.50 a month, or $114 for the year as

shown in the table estimates above.

The City of Saskatoon is dedicated

to Continuous Improvement and

Cost Savings.

With a vision of being the best-managed

city in Canada, the City is committed

to high standards of performance and

providing the services that matter most

to citizens.

The Citys Continuous Improvement

Strategy supports a long-term strategy

to focus on the use of innovative

and creative means to identify and

implement workplace efficiencies

and provide the best possible services

to citizens.

The City identified cost-saving measures

in 2014 that totalled $1.37 million in

sustainable savings. Additionally, over

$25 million in increased operational

efficiencies, capital savings and service

level enhancements were identified

in 2014.

BUDGET 2015: AT A GLANCE

2015 PRELIMINARY CORPORATE BUSINESS PLAN AND BUDGET

HOW YOUR MUNICIPAL PROPERTY

TAXES ARE DISTRIBUTED

20

The City of Saskatoon provides a wide range of services to its residents.

Every $1 of municipal property tax is shared between the

civic services shown in this chart.

Other includes street lighting, urban forestry, pest management, animal services, cemeteries and facilities

(2)

Debt Servicing includes provisions for current and future debt servicing

(3)

Includes Access Transit

(4)

Corporate Support includes the offices of the City Manager, City Clerks, City Solicitor, Finance, Revenue, Assessment & Taxation, Information Technology,

Human Resources and General Administration

For additional detailed tax information

visit saskatoon.ca and use the Property

Assessment & Online Tax Tool located on

the homepage. You can also view a summary

of the 2015 Preliminary Corporate Business

Plan and Budget at saskatoon.ca. Look under

B for Budget.

Once approved by City Council, the 2015

Corporate Business Plan and Budget will serve

to guide the investment activities, projects

and service levels the City of Saskatoon

will implement to achieve the Saskatoon

Advantage in 2015 and beyond.

Property Tax Notices will be sent to

residents in May 2015.

ICE

POL

N

ORT

ATIO

NSP

TRA

UPP

ORA

TE S

COR

P

(4)

(1)

Where Can I Get More Information

On Property Taxes?

FIRE

ORT

T

NSI

TRA

(3)

N

REA

TIO

RVI

C

(2)

DEB

T SE

REC

ING

R

OTH

E

(1)

NTS

/AF

PAR

K

13

GRA

WA

ST

GA

E RE RBAG

DUC E &

TIO

N

NG

NNI

PLA

FOR

D

HOU ABLE

SIN

G

URB

AN

22

Distribution of Total Tax Dollars (2014)

The following chart shows how your property tax dollars were distributed in 2014.

The chart reveals that about half of all property taxes collected go to the City of

Saskatoon for the delivery of key services like municipal policing, fire protection,

and public transit. For 2015, the Education Property Tax rate is yet to be set. The

finalized total will be shown on your property tax notice sent out in May 2015.

52.5% - Municipal

42.2% - Education

5.3% - Library

Anda mungkin juga menyukai

- Saskatoon Budget at A GlanceDokumen3 halamanSaskatoon Budget at A GlanceDavid A. GilesBelum ada peringkat

- Sioux City 2013 Operating BudgetDokumen378 halamanSioux City 2013 Operating BudgetSioux City JournalBelum ada peringkat

- Web Pearland 2016 Annualreport CalendarDokumen32 halamanWeb Pearland 2016 Annualreport Calendarapi-306549584Belum ada peringkat

- San Antonio FY2015 Proposed BudgetDokumen346 halamanSan Antonio FY2015 Proposed BudgetNOWCastSABelum ada peringkat

- 2017 Glenville Tentative BudgetDokumen59 halaman2017 Glenville Tentative BudgetAnonymous B6kbhGBelum ada peringkat

- Dawson Creek 2016 Draft Financial PlanDokumen151 halamanDawson Creek 2016 Draft Financial PlanJonny WakefieldBelum ada peringkat

- City of Ottawa 2021 Draft Budget at A GlanceDokumen9 halamanCity of Ottawa 2021 Draft Budget at A GlanceCTV OttawaBelum ada peringkat

- Atlantic City Recovery Plan in Brief 10.24.2016 - FINALDokumen23 halamanAtlantic City Recovery Plan in Brief 10.24.2016 - FINALPress of Atlantic CityBelum ada peringkat

- Montreal 2014 Municipal BudgetDokumen24 halamanMontreal 2014 Municipal BudgetThe GazetteBelum ada peringkat

- 2015 Preliminary Budget PresentationDokumen41 halaman2015 Preliminary Budget PresentationTessa VanderhartBelum ada peringkat

- Tentative Schenectady County BudgetDokumen310 halamanTentative Schenectady County BudgetDan ShepardBelum ada peringkat

- Town of Galway: Financial OperationsDokumen17 halamanTown of Galway: Financial OperationsdayuskoBelum ada peringkat

- Councils Capital Plan 2014Dokumen25 halamanCouncils Capital Plan 2014windsorstarBelum ada peringkat

- Wrrbfy14 BudgetDokumen18 halamanWrrbfy14 BudgetMass LiveBelum ada peringkat

- 2020 Presentation Mary May T. Antonio BSA-2A: Budget ProposalDokumen12 halaman2020 Presentation Mary May T. Antonio BSA-2A: Budget ProposalTineTine TamayoBelum ada peringkat

- Springfield Multi-Year Financial Plan (FY12-FY15), DraftDokumen72 halamanSpringfield Multi-Year Financial Plan (FY12-FY15), DraftMassLiveBelum ada peringkat

- 2012 Proposed Budget by The NumbersDokumen8 halaman2012 Proposed Budget by The NumbersChs BlogBelum ada peringkat

- Budget 2014 Release1Dokumen5 halamanBudget 2014 Release1Steve ForsethBelum ada peringkat

- City of San Antonio FY 2013 Proposed BudgetDokumen406 halamanCity of San Antonio FY 2013 Proposed BudgetNOWCastSABelum ada peringkat

- 2918 - Quarterly Financial Update Q2-2016Dokumen6 halaman2918 - Quarterly Financial Update Q2-2016Brad TabkeBelum ada peringkat

- Shakopee Quarterly Financial Update Q1-2016Dokumen6 halamanShakopee Quarterly Financial Update Q1-2016Brad TabkeBelum ada peringkat

- 2015 Mid Year ReportDokumen36 halaman2015 Mid Year ReportPennLiveBelum ada peringkat

- Los Angeles City Controller Ron Galperin's Community Financial ReportDokumen29 halamanLos Angeles City Controller Ron Galperin's Community Financial Reportjuan4presidentBelum ada peringkat

- Press Release 04-14-14 - Sarartoga Springs 2013 Year End Finances PDFDokumen2 halamanPress Release 04-14-14 - Sarartoga Springs 2013 Year End Finances PDFDeanna BarberBelum ada peringkat

- Cip Update Fy 19 24 Final Copy - Wf.ffdfghtyuhj1234Dokumen145 halamanCip Update Fy 19 24 Final Copy - Wf.ffdfghtyuhj1234someone elseBelum ada peringkat

- Building Together: Guide For Municipal Asset Management PlansDokumen52 halamanBuilding Together: Guide For Municipal Asset Management PlansDiyoke HenryBelum ada peringkat

- Mayor's Budget Letter FY 2022 210707Dokumen3 halamanMayor's Budget Letter FY 2022 210707NBC MontanaBelum ada peringkat

- The Peoples BudgetDokumen14 halamanThe Peoples BudgetActionNewsJaxBelum ada peringkat

- Technology RoadmapDokumen30 halamanTechnology RoadmapClaire Murray100% (1)

- 2016 Financial Plan Presentation Feb 18 PDFDokumen60 halaman2016 Financial Plan Presentation Feb 18 PDFreporter4Belum ada peringkat

- Sioux City Proposed Capital Improvement Budget 2014-2018Dokumen551 halamanSioux City Proposed Capital Improvement Budget 2014-2018Sioux City JournalBelum ada peringkat

- Ayor S Ffice Udget ReviewDokumen6 halamanAyor S Ffice Udget Reviewapi-237071663Belum ada peringkat

- La Credit ReportDokumen31 halamanLa Credit ReportSouthern California Public RadioBelum ada peringkat

- SOE 2010 Policy Brief - Infrastructure ChallengesDokumen15 halamanSOE 2010 Policy Brief - Infrastructure ChallengesIPS Sri LankaBelum ada peringkat

- Strategic Financial PlanDokumen26 halamanStrategic Financial Plannisarg_100% (1)

- 2021 Budget Speech.Dokumen24 halaman2021 Budget Speech.Ashley KnowledgeBelum ada peringkat

- Kitchener 2013 Budget Preview Nov 5 2012Dokumen52 halamanKitchener 2013 Budget Preview Nov 5 2012WR_RecordBelum ada peringkat

- City of Bloomington, Minnesota Annual Budget - Fiscal Year 2014Dokumen285 halamanCity of Bloomington, Minnesota Annual Budget - Fiscal Year 2014MetalAnonBelum ada peringkat

- Main Street Gettysburg Fund UseDokumen4 halamanMain Street Gettysburg Fund UseAnonymous IQn9UpIBelum ada peringkat

- City of Gahanna 2013 Proposed AppropriationsDokumen303 halamanCity of Gahanna 2013 Proposed AppropriationsbjhoytBelum ada peringkat

- Edmonton Mayor Amarjeet Sohi Letter To Alberta Premier Danielle Smith, April 2, 2024Dokumen6 halamanEdmonton Mayor Amarjeet Sohi Letter To Alberta Premier Danielle Smith, April 2, 2024edmontonjournalBelum ada peringkat

- Recommended Budget 2011Dokumen375 halamanRecommended Budget 2011clilly8037Belum ada peringkat

- Charlotte FY2017 Operating Budget OverviewDokumen2 halamanCharlotte FY2017 Operating Budget OverviewElizabethRiebe-ThomasBelum ada peringkat

- Cbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011Dokumen20 halamanCbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011jeanettecriscione762Belum ada peringkat

- FY 2016 & FY 2017 Final Adopted Biennial Budget BookDokumen309 halamanFY 2016 & FY 2017 Final Adopted Biennial Budget BookCityofBerkeleyBelum ada peringkat

- FY 2015-2016 Budget Message - FranklinDokumen4 halamanFY 2015-2016 Budget Message - FranklinThunder PigBelum ada peringkat

- FY 22 Budget Executive SummaryDokumen18 halamanFY 22 Budget Executive SummaryDan LehrBelum ada peringkat

- City of Oakland FY 2013-2015 Proposed Policy BudgetDokumen378 halamanCity of Oakland FY 2013-2015 Proposed Policy BudgetZennie AbrahamBelum ada peringkat

- To: From: CC: Date: ReDokumen11 halamanTo: From: CC: Date: ReBrad TabkeBelum ada peringkat

- 2015 2018 Strategic Plan enDokumen89 halaman2015 2018 Strategic Plan enSalsa_Picante_BabyBelum ada peringkat

- BRCC Rating and Revenue Plan 2021 2025Dokumen30 halamanBRCC Rating and Revenue Plan 2021 2025gabozauBelum ada peringkat

- 2014 Seattle City Council Green Sheet Ready For Notebook: Budget Action DescriptionDokumen6 halaman2014 Seattle City Council Green Sheet Ready For Notebook: Budget Action DescriptiontfooqBelum ada peringkat

- EWS Elease: Mayor Ballard Unveils 2015 Proposed BudgetDokumen2 halamanEWS Elease: Mayor Ballard Unveils 2015 Proposed BudgetMarissaMillerBelum ada peringkat

- Lakeport City Council - Budget PresentationDokumen37 halamanLakeport City Council - Budget PresentationLakeCoNewsBelum ada peringkat

- City of Wooster: Message From The MayorDokumen8 halamanCity of Wooster: Message From The MayorCityofWoosterBelum ada peringkat

- West Hartford Proposed Budget 2024-2025Dokumen472 halamanWest Hartford Proposed Budget 2024-2025Helen BennettBelum ada peringkat

- 2016 LIFT ReportDokumen43 halaman2016 LIFT ReportCERBManagerBelum ada peringkat

- Tool Kit for Tax Administration Management Information SystemDari EverandTool Kit for Tax Administration Management Information SystemPenilaian: 1 dari 5 bintang1/5 (1)

- Modernizing Local Government Taxation in IndonesiaDari EverandModernizing Local Government Taxation in IndonesiaBelum ada peringkat

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismDari EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismBelum ada peringkat

- SPS Seized Firearms 2019Dokumen29 halamanSPS Seized Firearms 2019David A. GilesBelum ada peringkat

- Lawsuit Claims Land in Northern Alberta and Saskatchewan Owed To MetisDokumen31 halamanLawsuit Claims Land in Northern Alberta and Saskatchewan Owed To MetisDavid A. Giles100% (1)

- Saskatchewan Hospital North Battleford Audit ReportDokumen16 halamanSaskatchewan Hospital North Battleford Audit ReportDavid A. GilesBelum ada peringkat

- Pilosio Canada Inc Banff Constructors Inc Apr14 21 Skpc30Dokumen30 halamanPilosio Canada Inc Banff Constructors Inc Apr14 21 Skpc30David A. GilesBelum ada peringkat

- Schedule K Indian Day SchoolsDokumen58 halamanSchedule K Indian Day SchoolsDavid A. Giles0% (1)

- Retail Liquor Stores BackgrounderDokumen1 halamanRetail Liquor Stores BackgrounderDavid A. GilesBelum ada peringkat

- Humboldt Broncos Jaskirat Singh Sidhu SentencingDokumen35 halamanHumboldt Broncos Jaskirat Singh Sidhu SentencingDavid A. Giles100% (2)

- Statement of Facts in Humboldt Broncos CrashDokumen8 halamanStatement of Facts in Humboldt Broncos CrashCTV News100% (3)

- Checklist Safety FarmSafetyDokumen1 halamanChecklist Safety FarmSafetyDavid A. GilesBelum ada peringkat

- Saskatchewan Cancer Agency Patient LetterDokumen1 halamanSaskatchewan Cancer Agency Patient LetterDavid A. GilesBelum ada peringkat

- Colten Boushie's Family Files Lawsuits Against Gerald Stanley, RCMPDokumen17 halamanColten Boushie's Family Files Lawsuits Against Gerald Stanley, RCMPDavid A. GilesBelum ada peringkat

- Carolyn Strom Saskatchewan Registered Nurses' AssociationDokumen42 halamanCarolyn Strom Saskatchewan Registered Nurses' AssociationDavid A. GilesBelum ada peringkat

- SHC No-Smoking Policy QAsDokumen3 halamanSHC No-Smoking Policy QAsDavid A. GilesBelum ada peringkat

- Saskatchewan Sees Significant Decline in Impaired Driving DeathsDokumen2 halamanSaskatchewan Sees Significant Decline in Impaired Driving DeathsDavid A. GilesBelum ada peringkat

- Saskatchewan Municipal Fire Bans May 15Dokumen2 halamanSaskatchewan Municipal Fire Bans May 15David A. GilesBelum ada peringkat

- Backgrounder - Regulatory Process For The Star-Orion South Diamond MineDokumen1 halamanBackgrounder - Regulatory Process For The Star-Orion South Diamond MineDavid A. GilesBelum ada peringkat

- Saskatchewan Predatory AnimalsDokumen6 halamanSaskatchewan Predatory AnimalsDavid A. GilesBelum ada peringkat

- 2017SKCA062Dokumen52 halaman2017SKCA062David A. GilesBelum ada peringkat

- Emerald Ash Borer Fact SheetDokumen4 halamanEmerald Ash Borer Fact SheetDavid A. GilesBelum ada peringkat

- SGI Campaign ProfilesDokumen6 halamanSGI Campaign ProfilesDavid A. GilesBelum ada peringkat

- HDFC Apr To As On DateDokumen10 halamanHDFC Apr To As On DatePDRK BABIUBelum ada peringkat

- GR 194201Dokumen7 halamanGR 194201RajkumariBelum ada peringkat

- Jaya Property Annual Report 2015Dokumen169 halamanJaya Property Annual Report 2015KeziaBelum ada peringkat

- Finance Car Leasing Final ProjectDokumen21 halamanFinance Car Leasing Final ProjectShehrozAyazBelum ada peringkat

- EFIN542 U09 T01 PowerPointDokumen26 halamanEFIN542 U09 T01 PowerPointcustomsgyanBelum ada peringkat

- Mastering Financial Modelling File ListDokumen1 halamanMastering Financial Modelling File ListNamo Nishant M PatilBelum ada peringkat

- SYBFM Equity Market II Session I Ver 1.1Dokumen80 halamanSYBFM Equity Market II Session I Ver 1.111SujeetBelum ada peringkat

- Market Leader 3rd Edition - Pre-Intermediate - TB - 17 - Unit 2 - Business BriefDokumen1 halamanMarket Leader 3rd Edition - Pre-Intermediate - TB - 17 - Unit 2 - Business BriefMinh ĐứcBelum ada peringkat

- Audit of Inventories (Done)Dokumen19 halamanAudit of Inventories (Done)Hasmin Saripada AmpatuaBelum ada peringkat

- Time Value of MoneyDokumen58 halamanTime Value of MoneyJennifer Rasonabe100% (1)

- Monetarism and CryptocurrencyDokumen1 halamanMonetarism and CryptocurrencyTay NewBelum ada peringkat

- Income Tax Case List Exam Related PurposeDokumen9 halamanIncome Tax Case List Exam Related PurposeShubham PhophaliaBelum ada peringkat

- Trading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & LedgerDokumen2 halamanTrading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & Ledgersameer maddubaigariBelum ada peringkat

- Far Compre DraftDokumen27 halamanFar Compre DraftMika MolinaBelum ada peringkat

- Deliverables: Professional ExperienceDokumen1 halamanDeliverables: Professional ExperienceArjav jainBelum ada peringkat

- Account CurrentDokumen13 halamanAccount Currentfathima.comafug23Belum ada peringkat

- Lecture Note 03 - Bond Price VolatilityDokumen53 halamanLecture Note 03 - Bond Price Volatilityben tenBelum ada peringkat

- Forex Management AgreementDokumen5 halamanForex Management Agreementapi-34208217883% (6)

- Afm Examiner's Report March June 2022Dokumen15 halamanAfm Examiner's Report March June 2022Abha AbhaBelum ada peringkat

- Talk About ImbalancesDokumen1 halamanTalk About ImbalancesforbesadminBelum ada peringkat

- Study Guide 10-17Dokumen22 halamanStudy Guide 10-17minisizekevBelum ada peringkat

- Apply For A U.SDokumen1 halamanApply For A U.Scm punkBelum ada peringkat

- Cost & Management Accounting: Cia-IiiDokumen9 halamanCost & Management Accounting: Cia-IiiARYAN GARG 19212016Belum ada peringkat

- 09SKCMA002Dokumen91 halaman09SKCMA002Ammu PKBelum ada peringkat

- SUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andDokumen4 halamanSUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andkunal jainBelum ada peringkat

- Chapter 1 ParcorDokumen11 halamanChapter 1 Parcornikki sy50% (2)

- Transaction AnalysisDokumen33 halamanTransaction AnalysisIzzeah RamosBelum ada peringkat

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkDokumen3 halamanDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanBelum ada peringkat

- Defendant Federal Reserve Document Production On AIG From Sept 2008 Heavy Redactions (Lawsuit #3)Dokumen1.134 halamanDefendant Federal Reserve Document Production On AIG From Sept 2008 Heavy Redactions (Lawsuit #3)Vern McKinleyBelum ada peringkat

- Kaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseDokumen41 halamanKaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseThắng VũBelum ada peringkat