Daily Report 20141125

Diunggah oleh

Joseph DavidsonHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Daily Report 20141125

Diunggah oleh

Joseph DavidsonHak Cipta:

Format Tersedia

2014-11-25

Daily Report

Report

Daily

|

NEWS & ANALYSIS

25 November 2014

2014.11.25

Performance

Index

Country

MSE - Top20

DJIA

S&P 500

Nasdaq

S&P/TSX comp

FTSE 100

S&P/ASX 200

Hang Seng

Bloomberg/asia.pac

Last

Change %

(Day)

14,849.49

17,817.90

2,069.41

4,754.89

15,015.41

6,729.79

5,321.00

23,893.14

176.73

MN

US

US

US

CN

UK

US

HK

ASIA

YTD change %

0.10

0.04

0.29

0.89

-0.63

-0.31

-0.76

1.95

1.07

-8.91

7.49

11.96

13.85

10.23

-0.29

-0.58

2.52

5.11

COMMODITY PRICES

Performance

Last

USD

Commodity

Prime Coking Coal /Tianjin

Zinc Spot /LME

Iron Ore 58%/Tianjin

Copper Spot /LME

Oil

Gold Spot /LME

Silver Spot /LME

Change %

(Day)

139.94

2,285.50

80.09

6,729.50

75.68

1,197.65

16.53

YTD change %

0.00

-0.28

-26.50

11.32

-41.02

-8.76

-23.11

-0.33

-15.12

-0.82

-0.13

0.04

0.25

MONGOLIAN ECONOMIC INDICATORS

Indicator

RGDP /bln. MNT/

NGDP /bln.MNT/

Inflation

Foreign reserve /mln. USD/

Policy rate

Date

Last

2014.07

2014.07

2014.10

2014.09

July 31 ,2014

9,857

6,635

1,542.7

12.00

Last

Yield

YoY change

%

5.3

14.6

12.1

-42.4

DEBT MARKET

Amt.

issued mln

USD

DBM bond - 5.75

580

MMC bond - 8.875

600

Mongol 2018 - 4.125

500

Mongol 2022 - 5.125

1,000

TDBM 2015 - 8.5

300

TDBM 2015 - 12.5

25

TDBM 2017 - 10 dim sum

115

DBM bond - 1.52 sam.

290

Bonds - Coupon

97.75

68.88

95.41

89.80

99.88

100.25

98.04

103.22

Maturity date

6.812

27.897

5.546

6.707

8.634

11.927

10.789

1.138

3/21/2017

3/29/2017

1/5/2018

12/5/2022

9/20/2015

11/17/2015

1/21/2017

12/25/2023

INDICES CHANGE

Nikkei 225

6.72

0.16

DAX

2.44

0.54

Hang Seng

2.52

1.95

S&P/ASX -0.76

200

-0.58

FTSE 100-0.31

-0.29

S&P/TSX comp

-0.63

10.23

0.89

Nasdaq

13.85

0.04

DJIA

7.49

MSE - Top20

0.10

-8.91

Change % (Day)

China Investment Corporation Issues the Press Release in Accordance With Canadian

Securities Administrators' National Investment 62-103

China Investment Corporation previously filed early warning reports in respect to a US$500 million

convertible debenture (the "Debenture") LB purchased from SouthGobi Resources Ltd.

("SouthGobi"), in respect to the exercise on March 29, 2010 of SouthGobi's right to call for the

conversion of up to US$250 million of the Debenture and in respect to the receiving of paid in kind

interest on November 21, 2013. China Investment Corporation is a sovereign wealth fund of the

People's Republic of China. Pursuant to the Debenture, since March 29, 2010, LB has acquired

ownership of 13,274,681 common shares of SouthGobi, which includes 6,206,833 common shares

previously issued and reported upon, and 7,067,848 common shares issued on November 21, 2014

in each case, in satisfaction of the paid in kind component of the interest accrued on the Debenture.

After giving effect to the issuances noted in item 2 above, LB owns and controls 37,917,292 common

shares of SouthGobi representing approximately 19.51% of the issued and outstanding common

shares of SouthGobi as of November 21, 2014. LB also continues to own US$250 million of principal

amount under the Debenture which, if converted at the current conversion price of Cdn$8.88 (and the

currency exchange rate of 0.8851) would represent approximately 31.8 million additional common

shares. If the Debenture in the principal amount of US$250 million that remains outstanding after the

issuances noted in item 2 above is fully converted into SouthGobi common shares at the current

conversion price of Cdn$8.88 and the currency exchange rate of 0.8851 then, together with the actual

common shares owned or controlled by LB as of the date hereof, LB would own or control a total of

approximately 69.7 million common shares or approximately 30.82% of the common shares of

SouthGobi.

http://www.digitaljournal.com/pr/2356221

GLOBAL NEWS

Asian Stocks Advance Third Day as Japan Plays Catch-Up

Asian stocks rose, with the regional benchmark gauge heading for a three-day advance, as consumer

and industrial shares climbed as Japanese stocks rallied after a holiday. The MSCI Asia Pacific Index

(MXAP) added 0.1 percent to 140.62 as of 9:03 a.m. in Tokyo. Japans Topix (TPX) index climbed 0.7

percent after the yen dropped 0.4 percent versus the dollar yesterday. South Koreas Kospi index was

little changed. Australias S&P/ASX 200 Index dropped 0.8 percent, while New Zealands NZX 50

Index slid 0.6 percent. Futures on the Standard & Poors 500 Index were little changed. The

underlying equity measure advanced 0.3 percent yesterday, extending a record high after European

Central Bank President Mario Draghi pledged to raise inflation as fast as possible and China

unexpectedly cut interest rates last week. Reports today may show the U.S. economy grew at a

slower rate in the third quarter than first estimated, while consumer confidence probably climbed in

November. The Peoples Bank of China from Nov. 22 lowered the one-year lending rate by 40 basis

points to 5.6 percent and the one-year saving rate 25 basis points to 2.75 percent, and increased the

ceiling for deposit rates. The one-year lending rate will be 5.35 percent in the second quarter of 2015

and the one-year deposit rate will be 2.5 percent, according to the median forecast of economists

Volume

Thousands

YTD %

MSE TOP 5 MOST TRADED

Trade value '000

APU

MONGOLIAN RELATED NEWS

World Bank ready to implement four projects in Mongolia

Member of Parliament and Chairman of the Parliamentary Standing Committee on State Structure,

A.Bakei had a meeting with the World Bank Country Representative for Mongolia, James Anderson,

on November 19, to discuss the banks readiness to implement four projects in Mongolia. Beginning

the meeting, A.Bakei congratulated James Anderson on his reappointment and expressed his

confidence in Andersons success as an experienced individual with considerable experience working

in Mongolia during its economic transition. James Anderson thanked the MP for the reception and

introduced the four World Bank projects for Mongolia, namely the Education Quality Reform Project,

the Third Sustainable Livelihoods Project, the E-Health Project, and the SMART Government Project.

Anderson asked A.Bakei to have the projects ratified by the relevant Standing Committees in the near

future. The MP agreed to Andersons call for his support. The Third Sustainable Livelihoods Project is

the third phase of a project to benefit rural citizens throughout Mongolia with improved local

governance through the implementation of local development funds and to support the further

development of the Governments Soum Program for local economic development. The E-Health

Project will take advantage of Mongolias vast broadband infrastructure to ensure faster access to

more integrated health information systems across the country to benefit healthcare providers,

patients, and hospitals. The Education Quality Reform Project is focused on improving the quality of

education for primary school children in Mongolia, and the SMART Government Project will use

information and communication technology to improve the accessibility, transparency and efficiency

of public services and governance in Mongolia.

http://ubpost.mongolnews.mn/?p=12605

MSETOP Index

16,000

20,000

14,000

18,000

16,000

12,000

14,000

10,000

12,000

8,000

10,000

6,000

8,000

1,022

HRM

6,000

4,000

-2.23%

56

4,000

2,000

-2%

-1%

0%

June-14

May-14

April-14

March-14

January-14

October-13

August-13

July-13

June-13

February-14

-3%

December-13

1,500

November-13

1,000

May-13

-0.80%

500

September-13

April-13

54

0

March-13

JTB

2,000

0

January-13

0.00%

851

February-13

EER

25 November 2014

MONGOLIAN RELATED COMPANIES

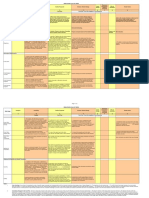

Name

Sym

Currency

Last

30 day graphic

Chg day %

YTD %

Trade value 000 Market cap mln

52w high

USD

USD/

52w low

Currency

cross

Turquoise Hill

TRQ US Equity

USD

3.480

-3.06

5.45

13,198.8

7,002.80

4.36

2.93

1.00

Centerra Gold

CG CN Equity

CAD

5.750

-1.71

33.10

2,986.4

1,204.31

6.90

2.98

1.13

MMC

975 HK Equity

HKD

0.660

0.00

-35.92

269.4

315.27

1.39

0.48

7.76

Denison Mines Corp

DML CN Equity

CAD

1.260

-5.26

-2.33

2,178.2

564.57

1.95

1.02

1.13

Winsway Coking Coal Holdings Ltd

1733 HK Equity

HKD

0.335

0.00

-31.63

265.1

162.97

0.58

0.31

7.76

276 HK Equity

HKD

0.173

0.00

#N/A N/A

302.3

#VALUE!

#N/A N/A

#N/A N/A

7.76

1878 HK Equity

HKD

3.820

0.00

-44.48

61.7

95.74

9.46

3.78

7.76

CAML LN Equity

GBp

160.500

3.55

13.83

2,186.5

280.39

190.00

141.00

0.64

402 HK Equity

HKD

0.285

0.00

-1.72

680.5

246.25

0.38

0.16

7.76

YAK CN Equity

CAD

1.140

-6.56

-49.78

76.7

35.20

3.07

1.12

1.13

MoEnCo

SouthGobi Resources

Central Asia Metals PLC

Mongolia Investment Group Ltd

Mongolia Growth Group

North Asia Resources Holdings Ltd

61 HK Equity

HKD

0.147

0.00

-19.23

43.6

114.38

0.21

0.10

7.76

Guildford Coal Ltd

GUF AU Equity

AUD

0.041

-8.89

-50.52

3.4

32.34

0.11

0.04

1.16

Origo Partners PLC

OPP LN Equity

GBp

7.188

0.00

-2.54

55.8

40.23

8.25

6.63

0.64

Entree Gold Inc

ETG CN Equity

CAD

0.240

-7.69

-22.58

1.8

31.25

0.52

0.21

1.13

Aspire Mining Ltd

AKM AU Equity

AUD

0.038

-2.56

-32.14

1.1

22.98

0.07

0.03

1.16

Prophecy Coal Corp

PCY CN Equity

CAD

0.060

0.00

-25.00

16.9

13.39

0.11

0.04

1.13

FeOre Ltd

FEO AU Equity

AUD

0.025

0.00

-39.02

0.6

11.37

0.08

0.03

1.16

MATD LN Equity

GBp

2.750

-12.00

-26.67

325.1

12.06

11.50

2.00

0.64

Xanadu Mines Ltd

XAM AU Equity

AUD

0.120

4.35

140.00

0.3

25.12

0.18

0.03

1.16

Haranga Resources Ltd

HAR AU Equity

AUD

0.017

0.00

-72.58

0.8

3.53

0.09

0.01

1.16

WOF AU Equity

AUD

0.045

0.00

-35.71

9.0

11.38

0.09

0.03

1.16

MNAP US Equity

USD

0.075

-6.13

9.64

5.3

12.54

0.17

0.04

1.00

KRI CN Equity

CAD

0.400

2.56

40.35

0.7

24.14

0.45

0.18

1.13

Voyager Resources Ltd

VOR AU Equity

AUD

0.002

0.00

-50.00

0.5

3.01

0.01

0.00

1.16

East Asia Minerals Corp

EAS CN Equity

CAD

0.015

0.00

-62.50

0.3

1.42

0.11

0.02

1.16

Erdene Resource Development Corp

ERD CN Equity

CAD

0.110

15.79

-21.43

1.5

7.46

0.26

0.08

1.13

Modun Resources Ltd

MOU AU Equity

AUD

0.003

0.00

-25.00

18.2

4.58

0.01

0.00

1.16

Kincora Copper Ltd

KCC CN Equity

CAD

0.025

0.00

0.00

0.4

6.86

0.09

0.02

1.13

General Mining Corp Ltd

GMM AU Equity

AUD

0.007

0.00

-58.82

1.3

0.81

0.02

0.01

1.16

Draig Resources Ltd

DRG AU Equity

AUD

0.018

0.00

-48.57

0.2

1.03

0.04

0.01

1.16

Newera Resouces Ltd

NRU AU Equity

AUD

0.001

0.00

-83.33

1.3

1.01

0.01

0.00

1.16

BDI AU Equity

AUD

0.002

0.00

50.00

1.3

1.92

0.00

0.00

1.16

Petro Matad Ltd

Wolf Petroleum Ltd

Manas Petroleum Corp

Khan Resources Inc.

Blina Minerals NL

Source: Bloomberg

MONGOLIAN STOCK MARKET

22 November 2014

18

JSC's

TOP20 index

was

14,849.49

Company name

Trade volume

Trade value

'000

13,178

shares

worth

Change day

Last

Chg day

Chg day %

946.72

mln

MNT

0.10%

YTD

-8.91%

Buy

volume

Buy price

Sell price

have

Sell volume

HBO

10,000

5,100

510

-85

-14.26%

250

370

599

RMC

1,000

100

100

2.33%

2312

95

100

20040

JTB

645

54

84.35

-1

-0.80%

4333

84

86

1780

EER

362

851

2350

0.00%

2389

10

HRM

322

56

175

-4

-2.23%

56

170

184

150

APU

280

1,022

3650

0.00%

3610

3650

452

BAN

172

619

3600

0.00%

50

3250

3600

165

ETR

100

10

100

10

11.11%

500

89

100

6161

TCK

92

1,702

18500

0.00%

18500

19000

MRX

51

99

0.00%

99

4740

MIE

50

850

17000

0.00%

24

17000

17500

41

NXE

30

48

1590

-10

-0.63%

1590

SHV

20

114

5700

300

5.56%

46

5400

5700

10

ECV

20

80

4000

0.00%

14

4000

ATR

15

1,020

68000

0.00%

68000

12

NEH

12

203

16900

200

1.20%

50

16500

16900

30

TAV

150

30000

-500

-1.64%

21000

30500

12

TSA

16

7800

-200

-2.50%

7800

18

been

traded.

25 November 2014

Investment Banking Division of Golomt Bank

The principal activities of Investment Banking Division constitute structuring, sourcing, negotiating and closing debt and equity

financings as well as the provision of incisive advisory services for private and public companies as well as institutions, public sector

agencies and authorities.

0

Our vision is to fuel the profitable

growth of our valued clients by providing the highest-quality investment banking services, and in so

doing create an environment which will lead to long term, mutually beneficial relationships. We strive to achieve these lasting

relationships by matching each client assignment with the collaborative expertise of the Banks team of seasoned banking and

investment professionals.

Contact

Sukhbaatar Square, Ulaanbaatar 210620A, Mongolia

Fax: +976-70117676 /1402/

E-mail: ibd@golomtbank.com

Website: www.golomtbank.com

Disclaimer

2013.06

2702.1

This

document has

been prepared by the investment banking division of Golomt Bank for information purpose only. The views

2013.06are the7591

expressed

views of the analyst and are subject to change based on market and other conditions and factors. The

information provided does not constitute investment advice or other recommendations and should not be relied on as such. It

should

not be considered a solicitation to buy or an offer to sell a security or to pursue any trading or investment strategy. All

13606.65

material, including information sourced from or attributed to Golomt Bank, has been obtained from sources believed to be

reliable, but its accuracy is not guaranteed. Past performance is no guarantee for future results. Accordingly you must

3650 for you of the securities/transactions before investing

independently determine, with your own advisors, the appropriateness

or transacting.

Anda mungkin juga menyukai

- Daily Report 20141216Dokumen3 halamanDaily Report 20141216Joseph DavidsonBelum ada peringkat

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read MoreDokumen12 halamanKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read Morerryan123123Belum ada peringkat

- Viet Nam-Update: Yield MovementsDokumen3 halamanViet Nam-Update: Yield Movementscrazyfrog1991Belum ada peringkat

- Market Outlook Market Outlook: Dealer's DiaryDokumen19 halamanMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- FI Daily Market SnapshotsxDokumen4 halamanFI Daily Market Snapshotsxr3iherBelum ada peringkat

- Daily Report 20141124Dokumen3 halamanDaily Report 20141124Joseph DavidsonBelum ada peringkat

- Daily Report 20150115Dokumen3 halamanDaily Report 20150115Joseph DavidsonBelum ada peringkat

- UT Daily Market Update 280911Dokumen5 halamanUT Daily Market Update 280911jemliang_85Belum ada peringkat

- Markets For You - 27.03.12Dokumen2 halamanMarkets For You - 27.03.12Bharat JadhavBelum ada peringkat

- Markets Overview: Highlights AheadDokumen3 halamanMarkets Overview: Highlights Aheadpj doveBelum ada peringkat

- Country ReportDokumen4 halamanCountry ReportNeha FomraBelum ada peringkat

- VOF VNL VNI: Capital MarketsDokumen6 halamanVOF VNL VNI: Capital Marketsflocke2Belum ada peringkat

- Daily Report 20141106Dokumen3 halamanDaily Report 20141106Joseph DavidsonBelum ada peringkat

- Debt Mutual Fund Picks: Macro Data Round UpDokumen6 halamanDebt Mutual Fund Picks: Macro Data Round Upnaresh_dayani8459Belum ada peringkat

- Market Review & Outlook by Meridian Asset Management SDN BHDDokumen35 halamanMarket Review & Outlook by Meridian Asset Management SDN BHDMohd RasidBelum ada peringkat

- Daily Report 20141126Dokumen3 halamanDaily Report 20141126Joseph DavidsonBelum ada peringkat

- Daily Report 20150122Dokumen3 halamanDaily Report 20150122Joseph DavidsonBelum ada peringkat

- Morning Report 09sep2014Dokumen2 halamanMorning Report 09sep2014Joseph DavidsonBelum ada peringkat

- Morning Report 24sep2014Dokumen2 halamanMorning Report 24sep2014Joseph DavidsonBelum ada peringkat

- Niveshak Sept 2012Dokumen24 halamanNiveshak Sept 2012Niveshak - The InvestorBelum ada peringkat

- Daily Report 20150106Dokumen3 halamanDaily Report 20150106Joseph DavidsonBelum ada peringkat

- February 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorDokumen6 halamanFebruary 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorChrispy DuckBelum ada peringkat

- DNH Sri Lanka Weekly 10-14 Dec 2012Dokumen9 halamanDNH Sri Lanka Weekly 10-14 Dec 2012Randora LkBelum ada peringkat

- Market Wrap 07 15 11 (MG)Dokumen4 halamanMarket Wrap 07 15 11 (MG)Khairul AzmanBelum ada peringkat

- Daily Report 20141105Dokumen3 halamanDaily Report 20141105Joseph DavidsonBelum ada peringkat

- Get The Latest News of Indian MarketDokumen2 halamanGet The Latest News of Indian MarketRahulSaxenaBelum ada peringkat

- Key Indices 30-Sep-11 31-Aug-11 % Change: FII MFDokumen30 halamanKey Indices 30-Sep-11 31-Aug-11 % Change: FII MFshah_aditkBelum ada peringkat

- Press Release: क�द्र�य कायार्लय, एस.बी.एस.मागर्, मुंबई /Phone: /Fax: emailDokumen12 halamanPress Release: क�द्र�य कायार्लय, एस.बी.एस.मागर्, मुंबई /Phone: /Fax: emailAbdulBelum ada peringkat

- Morning Report 19sep2014Dokumen2 halamanMorning Report 19sep2014Joseph DavidsonBelum ada peringkat

- Asian Weekly Debt HighlightsDokumen12 halamanAsian Weekly Debt Highlightsrryan123123Belum ada peringkat

- Daily Report 20150109Dokumen3 halamanDaily Report 20150109Joseph DavidsonBelum ada peringkat

- Markets Overview: Highlights AheadDokumen3 halamanMarkets Overview: Highlights Aheadpj doveBelum ada peringkat

- Weekly Market UpdateDokumen1 halamanWeekly Market UpdateNeeta ShindeyBelum ada peringkat

- Daily Report 20141219Dokumen3 halamanDaily Report 20141219Joseph DavidsonBelum ada peringkat

- Asia Bond Monitor - November 2006Dokumen58 halamanAsia Bond Monitor - November 2006Asian Development BankBelum ada peringkat

- Markets For You - January 15 2015Dokumen2 halamanMarkets For You - January 15 2015rps92Belum ada peringkat

- Morning Report 10sep2014Dokumen2 halamanMorning Report 10sep2014Joseph DavidsonBelum ada peringkat

- ASEAN+3 Information on Transaction Flows and Settlement InfrastructuresDari EverandASEAN+3 Information on Transaction Flows and Settlement InfrastructuresBelum ada peringkat

- Asian Development Bank - Weekly HighlightsDokumen13 halamanAsian Development Bank - Weekly Highlightsrryan123123Belum ada peringkat

- 17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02Dokumen8 halaman17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02tallanzhouwenqiBelum ada peringkat

- Morning BulletinDokumen13 halamanMorning Bulletinharshilshah7676Belum ada peringkat

- Daily Report 20141205Dokumen3 halamanDaily Report 20141205Joseph DavidsonBelum ada peringkat

- Markets For You: Global Indices Indices PerformanceDokumen2 halamanMarkets For You: Global Indices Indices PerformanceRahulSaxenaBelum ada peringkat

- FOMC Minutes 10.8.2015Dokumen25 halamanFOMC Minutes 10.8.2015ZerohedgeBelum ada peringkat

- Fomc MinutesDokumen25 halamanFomc MinutesIshu GarodiaBelum ada peringkat

- Morning Report 14oct2014Dokumen2 halamanMorning Report 14oct2014Joseph DavidsonBelum ada peringkat

- Daily Trade Journal - 03.07.2013Dokumen6 halamanDaily Trade Journal - 03.07.2013Randora LkBelum ada peringkat

- Morning Report 04sep2014Dokumen2 halamanMorning Report 04sep2014Мөнхбат ДоржпүрэвBelum ada peringkat

- Morning Report 22jan2015Dokumen2 halamanMorning Report 22jan2015Joseph DavidsonBelum ada peringkat

- Morning Report 26jan2015Dokumen2 halamanMorning Report 26jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150121Dokumen3 halamanDaily Report 20150121Joseph DavidsonBelum ada peringkat

- Daily Report 20150122Dokumen3 halamanDaily Report 20150122Joseph DavidsonBelum ada peringkat

- Morning Report 23jan2015Dokumen2 halamanMorning Report 23jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150123Dokumen3 halamanDaily Report 20150123Joseph DavidsonBelum ada peringkat

- Daily Report 20150116Dokumen3 halamanDaily Report 20150116Joseph DavidsonBelum ada peringkat

- Morning Report 20jan2015Dokumen2 halamanMorning Report 20jan2015Joseph DavidsonBelum ada peringkat

- Morning Report 21jan2015Dokumen2 halamanMorning Report 21jan2015Joseph DavidsonBelum ada peringkat

- Morning Report 19jan2015Dokumen2 halamanMorning Report 19jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150119Dokumen3 halamanDaily Report 20150119Joseph DavidsonBelum ada peringkat

- Morning Report 09jan2015Dokumen2 halamanMorning Report 09jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150120Dokumen3 halamanDaily Report 20150120Joseph DavidsonBelum ada peringkat

- Morning Report 15jan2015Dokumen2 halamanMorning Report 15jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150112Dokumen3 halamanDaily Report 20150112Joseph DavidsonBelum ada peringkat

- Morning Report 16jan2015Dokumen2 halamanMorning Report 16jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150115Dokumen3 halamanDaily Report 20150115Joseph DavidsonBelum ada peringkat

- Morning Report 13jan2015Dokumen2 halamanMorning Report 13jan2015Joseph DavidsonBelum ada peringkat

- Morning Report 14jan2015Dokumen2 halamanMorning Report 14jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150113Dokumen3 halamanDaily Report 20150113Joseph DavidsonBelum ada peringkat

- Morning Report 10jan2015Dokumen2 halamanMorning Report 10jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150110Dokumen3 halamanDaily Report 20150110Joseph DavidsonBelum ada peringkat

- Daily Report 20150109Dokumen3 halamanDaily Report 20150109Joseph DavidsonBelum ada peringkat

- Daily Report 20150114Dokumen3 halamanDaily Report 20150114Joseph DavidsonBelum ada peringkat

- Morning Report 12jan2015Dokumen2 halamanMorning Report 12jan2015Joseph DavidsonBelum ada peringkat

- Morning Report 08jan2015Dokumen2 halamanMorning Report 08jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150108Dokumen3 halamanDaily Report 20150108Joseph DavidsonBelum ada peringkat

- Morning Report 07jan2015Dokumen2 halamanMorning Report 07jan2015Joseph DavidsonBelum ada peringkat

- Daily Report 20150107Dokumen3 halamanDaily Report 20150107Joseph DavidsonBelum ada peringkat

- Morning Report 07jan2015Dokumen2 halamanMorning Report 07jan2015Joseph DavidsonBelum ada peringkat

- Engineering Management Case StudiesDokumen20 halamanEngineering Management Case StudiesJohn Ryan Toledo67% (3)

- India Economy GDP 1QFY23 01-09-2022 SystematixDokumen10 halamanIndia Economy GDP 1QFY23 01-09-2022 SystematixShriramkumar SinghBelum ada peringkat

- Economy of EgyptDokumen42 halamanEconomy of EgyptAman DecoraterBelum ada peringkat

- Design StagesDokumen2 halamanDesign StagesHaneefa ChBelum ada peringkat

- They're Off To See The Wizard !: EurekaDokumen36 halamanThey're Off To See The Wizard !: EurekamooraboolBelum ada peringkat

- BRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainDokumen48 halamanBRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainAbid M. SholihulBelum ada peringkat

- Nepal Current Budgetary Policy and Its Implication in EconomyDokumen21 halamanNepal Current Budgetary Policy and Its Implication in EconomyabinBelum ada peringkat

- Sample ReportDokumen33 halamanSample ReportPubg KillerBelum ada peringkat

- Ize y Yeyati (2003) - Financial DollarizationDokumen25 halamanIze y Yeyati (2003) - Financial DollarizationEduardo MartinezBelum ada peringkat

- Question Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsDokumen64 halamanQuestion Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsRISHIKA KHURANA100% (2)

- Unilever Annual Report and Accounts 2022Dokumen241 halamanUnilever Annual Report and Accounts 2022Genji MaBelum ada peringkat

- Money and Banking: Module - 11Dokumen14 halamanMoney and Banking: Module - 11Sarthak PithoriyaBelum ada peringkat

- Grow Your Small Savings To One Crore PDFDokumen12 halamanGrow Your Small Savings To One Crore PDFqwqBelum ada peringkat

- Module 3 - Food Product DevelopmentDokumen16 halamanModule 3 - Food Product Developmentrbtlch1n88% (8)

- Montes 1987 The Impact of Macroeconomic Adjustments On Living Standard in The PhilippinesDokumen11 halamanMontes 1987 The Impact of Macroeconomic Adjustments On Living Standard in The PhilippinesCharlene EbordaBelum ada peringkat

- Introduction To Economics and FinanceDokumen4 halamanIntroduction To Economics and FinanceShaheer MalikBelum ada peringkat

- DNB Nord Bank Report. Lithuania and Baltic CountriesDokumen182 halamanDNB Nord Bank Report. Lithuania and Baltic CountriesMiquel PuertasBelum ada peringkat

- Ethiopiadtisfinal Volume1Dokumen100 halamanEthiopiadtisfinal Volume1Ezana EzanaBelum ada peringkat

- WF MLP Primer IVDokumen156 halamanWF MLP Primer IVAndrew MedvedevBelum ada peringkat

- Question 1-10 Macro Chap 24Dokumen4 halamanQuestion 1-10 Macro Chap 24Ngọc AnhBelum ada peringkat

- Sample Test Paper Sample Test Paper Sample Test Paper: Part-ADokumen8 halamanSample Test Paper Sample Test Paper Sample Test Paper: Part-AMUHAMMED SHAMMASBelum ada peringkat

- Chapter 17: Macroeconomic & Industry AnalysisDokumen7 halamanChapter 17: Macroeconomic & Industry AnalysisSilviu TrebuianBelum ada peringkat

- MGM 3101.2Dokumen8 halamanMGM 3101.2Nurul Ashikin ZulkefliBelum ada peringkat

- UBS CIO Monthly Base en Oct 2019Dokumen17 halamanUBS CIO Monthly Base en Oct 2019Blue RunnerBelum ada peringkat

- Analyzing Paper 1 - SLDokumen8 halamanAnalyzing Paper 1 - SLSushanta BaruaBelum ada peringkat

- Managerial Economics SCDLDokumen237 halamanManagerial Economics SCDLViswanath AyyalaBelum ada peringkat

- Chap 005Dokumen65 halamanChap 005Zein AhmadBelum ada peringkat

- EAE 308 International Economics II 2011 31.5.2012 PDFDokumen185 halamanEAE 308 International Economics II 2011 31.5.2012 PDFShunquartzBelum ada peringkat

- The Baby BoomDokumen3 halamanThe Baby BoomJessicaBelum ada peringkat

- Case Study 2: The Harvard Management Company and Inflation Linked Bonds (2001)Dokumen29 halamanCase Study 2: The Harvard Management Company and Inflation Linked Bonds (2001)Fast TalkerBelum ada peringkat