SWB01EquityWeekly11 01

Diunggah oleh

naudaslietasDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

SWB01EquityWeekly11 01

Diunggah oleh

naudaslietasHak Cipta:

Format Tersedia

Equity Weekly

Equity Research - Monday, January 11, 2009

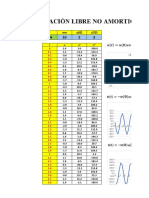

Index value Weekly Change,% Weekly Turnover

Baltic Indices

355 Estonia 422 4.32% €2,6m

First week of the year was calm. As usual the most traded shares were Tallink,

335 Olympic and Tallinna Kaubamaja. In Tallink we still see selling pressure from

institutions, Olympic has performed quite nicely and demand is decent. Few

blocks were crossed in Tallinna Kaubamaja.

315

Latvia 315.7 13.17% €97,5k

295

The New Year started with impressive double digit gains for most of shares which

275 led OMX Riga index by 13.17 % higher. There wasn’t any significant news and

8-Oct 22-Oct 5-Nov 19-Nov 3-Dec 17-Dec 31-Dec mostly retail market participants were seen in the market as traded volumes

Baltic Benchmark OMX Tallinn* remained very small.

OMX Riga* OMX Vilnius*

* Relativ e to Baltic Benchmark Source: Reuters, Swedbank

Lithuania 266.2 1.67% €2m

Last Weekly Weekly P/E P/BV

Estonia (in €) Close Change Volume Trail. 4Q 09F Last Q 09F

Arco Vara 0.19 11.8% 575096 -0.2 9.0 0.6 0.4 Most actively traded shares on Vilnius Stock Exchange were TEO, gaining 5% to

Baltika 0.68 -6.8% 65516 -1.6 -1.8 1.0 1.1 1.91 LTL level, and banks. Institutional demand was recorded in City Service,

Eesti Telekom 5.90 -0.7% 2647 10.1 16.6 4.0 4.8 Klaipedos Nafta and Lifosa.

Ekspress Grupp 1.01 -1.9% 26155 -4.4 -4.3 0.6 0.6

Harju Elekter 2.24 8.2% 37198 35.4 28.5 1.3 1.5

Järvevana 0.37 5.7% 9600

Merko Ehitus 5.44 8.4% 17185 21.0 -77.9 0.7 0.8

Nordecon International 1.70 7.6% 45033 91.4 -32.1 1.0 1.2

Norma 4.10

Olympic Entertainment Group 0.76

5.1%

-1.3%

7845

1429071

39.9

-2.3

-40.3

-3.8

0.9

1.4

0.9

1.5

Estonia

Silvano Fashion Group 0.86 10.3% 67357 -29.4 -22.7 1.1 0.9

Tallink

Tallinna Kaubamaja

0.38

3.86

2.7%

6.9%

1587536

81899

-31.3

-26.9

7.5

-16.3

0.4

1.4

0.4

1.5

AS Ekspress Grupp made an announcement of increasing share capital

Tallinna Vesi 10.40 4.0% 4091 10.6 10.1 2.6 2.4 with 8 896 800 new shares with the nominal value of EEK 10 per share. As

Viisnurk 0.81 12.5% 12760 241.6 5.1 0.8 0.7 a result the new size of the share capital is EEK 297,456,410 or approx.

Last Weekly Weekly P/E P/BV

€19m. Upon the increase of share capital, the right to subscribe about

Latvia (in LVL) Close Change Volume Trail. 4Q 09F Last Q 09F

Grindeks 3.90 2.6% 716 3.5 5.6 0.5 0.7

6,250,000 new shares to be given to existing shareholders of AS Ekspress

Latvian Gas 5.00 22.0% 839 9.8 0.7 Grupp and to any other interested party. The subscription rights with respect

Latvian Shipping Company 0.47 17.5% 43007 1.8 1.3 0.2 0.2 of existing shareholders, the shareholders shall have pre-emptive right to

Latvijas Balzams 1.83 -3.7% 37 6.2 0.4

Liepajas Metalurgs 1.40 25.0% 3775 1.3 0.3

subscribe new shares in case they are fixed in the list of shareholders as at

Olainfarm 1.04 10.6% 8421 105.7 9.7 0.9 0.9 27.01.2010 at 23.59. About 2,646,800 new shares shall be offered directly

SAF Tehnika 0.54 12.5% 24797 -1.8 0.8 0.2 0.1 to ING Luxembourg S.A. and HHL Rühm OÜ.

Valmiera Fibre Glass 0.48 11.6% 1147 0.9 0.4

Ventspils Nafta 0.98 4.3% 1981 2.8 0.3 On Jan 5th Baltika reported its Q4 and 2009 sales. Total sales for Q4

Last Weekly Weekly P/E P/BV

amounted to €4.4m, 26% decrease yoy. Main driver was the Baltic market

Lithuania (in LT L) Close Change Volume Trail. 4Q 09F Last Q 09F

Apranga 2.94 6.9% 118098 22.7 -4.4 1.2 1.1

with CEE posting highest % declines as company left Czech Republic

City Service 6.26 -3.1% 92662 10.9 7.4 1.9 1.5 market in October. Sales in Russia and Ukraine were down 15% yoy. Sales

Grigiskes 0.95 2.2% 104486 -12.5 0.9 for the full year were €56.4m (-26% yoy). Number of stores for the end of

Invalda

Klaipedos Nafta

2.12

0.96

15.2%

2.1%

142816

200893

-0.8

12.2

0.6

0.8

the year was 133 over 26900 m². The company opened 23 stores and

Lietuvos Dujos 2.05 -2.4% 30833 24.1 15.3 0.5 0.5 closed 24. Overall this has been a very difficult year for the company but

Lietuvos Energija 2.35 -0.4% 16709 -44.9 0.6 2010 is going to be a very tough test as well as company now needs to

Lietuvos Juru Laivininkyste 0.45 4.7% 12035 -2.2 0.4 return to profitability and we see this as rather difficult task as consumer

31.70 14.1%

Lifosa

Panevezio Statybos Trestas 3.92 3.4%

24993

61570

4.2

2.2

0.8

0.6

demand in Baltics remains very weak. However it is likely that we have

Pieno Zvaigzdes 2.97 1.0% 3207 19.1 5.4 1.1 1.0 reached a bottom in terms of retail sales and further declines are not likely

Rokishkio Suris 3.10 3.3% 3498 -13.7 0.8 to be big (Q1 10 will still be difficult). We keep a Hold recommendation on

RST 1.93 5.5% 270964 -10.9 0.4

the share as we see little upside at this point.

Sanitas 9.80 2.8% 5798 -12.0 1.2

Siauliu Bankas 1.09 -2.7% 137117 4.4 0.7

Snaige 0.59 3.5% 275920 -0.5 0.3

Snoras 0.95 -5.0% 818514 1.3 0.4

TEO LT 1.91 4.4% 566558 9.0 8.9 1.5 1.4

Ukio Bankas 1.03 -2.8% 1185634 1.2 0.4

Source: Reuters, Swedbank

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 1 of 5

Equity Weekly – 11 January 2009

Latvia

No Corporate News.

Lithuania

Apranga continues to struggle for the retail turnover (sales including VAT). In December

the retail turnover comprised LTL 35.2m (EUR 10.2m), down 21.4% yoy. The retail turnover

for the whole year was LTL 392.6m (EUR 113.7m) or 22.9% less than in 2008.

In December 2009 Rokiskio suris delivered LTL 43.6m (EUR 12.6m) in sales or 17.5%

less than for the same period a year ago. Throughout 2009 the company’s sales were LTL

561.2m (EUR 162.5m), down 17.7% yoy. The 2009 sales lagged from the estimated by 3.8

%, mainly due to the temporary export ban to Russia, and the decreased sales on the

internal market due to the drop in demand.

Invalda plans to issue a non-public LTL 25m convertible bonds issue. Total convertible

bonds issue size is 250 000 units, the nominal value of one convertible bond is LTL 100

with an annual interest of 9.9% (considering there are 365 days per year). The bond of

nominal value LTL 100 can be converted to ordinary registered shares at ratio 5.5 (one

bond would be converted into 18.18 shares approximately, final result is to be rounded by

arithmetical rules). The investor, who acquired the whole bonds issue and chooses to

convert to shares all owned bonds, can exercise this right at any time until April 2, 2012, by

delivering written application to Invalda AB.

The company plans another non-public LTL 7.44m convertible bonds issue under the same

terms but cancelling the pre-emptive right of existing shareholders to acquire the bonds.

The right to acquire all convertible bonds of this issue is granted to DIM Investment UAB,

code 301145749, registered address Konstitucijos ave. 23, Vilnius, Lithuania. The reason

for withdrawal of the pre-emptive right is to secure funds to rearrange the liabilities of

Invalda AB.

Vilkysiu pienine managed to increase December sales by 14.2% yoy to LTL 14.03m (EUR

4.06m). Throughout the year the company’s sales amounted to LTL 159.5m (EUR 46.2m),

up by 4.9% yoy.

Pursuing the resolution of the 31st August 2009 general meeting of shareholders of

Rokiskio suris - to acquire up to 3.844.480 units of ordinary registered shares (10% of the

authorized capital). The price for purchase of own shares is set at LTL 2.50 per ordinary

share. The duration of the offer is set at 14 days. The shares will be purchased as from

13th January 2010 until 26th January 2010, via the official tender submarket of Securities

Exchange NASDAQ OMX Vilnius. In case the quantity of shares offered for purchase is

greater than it is intended to buy, the amount of offered for purchase shares will be

proportionally decreased.

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 2 of 5

Equity Weekly – 11 January 2009

Investor Calendar:

Date Description

Estonia

No Corporate News

Latvia

No Corporate News

Lithuania

No Corporate News

Source: NASDAQ OMX

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 3 of 5

Equity Weekly – 11 January 2009

Swedbank Markets Baltic Equity research & Institutional sales:

Energy, Materials & Utilities Industrials Equity Sales

Pavel Lupandin Estonia Risto Hunt Estonia Kristiina Vassilkova Baltic Institutional Sales

pavel.lupandin@swedbank.ee +372 6 131 535 risto.hunt@swedbank.ee +372 6 136 796 kristiina.vassilkova@swedbank.ee +372 6 131 663

Donatas Užkurėlis Lithuania Marko Daljajev Estonia Andres Suimets Head of Sales (Estonia)

donatas.uzkurelis@swedbank.lt +370 5 268 4395 marko.daljajev@swedbank.ee +372 6 131 246 andres.suimets@swedbank.ee +372 6 131 657

Svetlana Skutelska Head of Sales (Latvia)

Telecom Services Financials Svetlana.skutelska@swedbank.lv +371 6744 4154

Marko Daljajev Estonia Risto Hunt Estonia Simona Sileviciute Head of Sales (Lithuania)

marko.daljajev@swedbank.ee +372 6 131 246 risto.hunt@swedbank.ee +372 6 136 796 simona.sileviciute@swedbank.lt +370 5268 4513

Marko Daljajev Estonia

marko.daljajev@swedbank.ee +372 6 131 246 Equity Trading

Simmo Sommer Head of Baltic Trading

Consumers Healthcare simmo.sommer@swedbank.ee +372 6131 605

Pavel Lupandin Estonia Marko Daljajev Latvia

pavel.lupandin@swedbank.ee +372 6 131 535 marko.daljajev@swedbank.ee +372 6 131 246 Equity Capital Markets

Donatas Užkurėlis Lithuania Mihkel Torim Baltic Equity Capital Markets

donatas.uzkurelis@swedbank.lt +370 5 268 4395 mihkel.torim@swedbank.ee +372 6 131 564

Swedbank Group Homepage: www.swedbank.com. For Research products on Bloomberg please type: HBME <GO>.

Background Information:

Recommendation structure

Swedbank Markets’ recommendation structure consists of six recommendations: Buy, Accumulate, Hold, Reduce, Sell and Avoid. The

recommendations are based on an absolute return for the security 12 months forward. The absolute return includes share price appreciation

and dividend yield combined.

The recommendations for the securities mentioned in this report are based on risk and return considerations. The higher the risk category of

the investment, the higher the required return. For equity investments, returns are defined as capital appreciation and dividends received over

the investment horizon of 12 months forward. The expected capital appreciation is the ratio of a stock’s target price over the current price. A

company risk rating depends on its stock price volatility, liquidity and business outlook. The target price depends on a company’s

fundamentals as well as the market valuation of peer stocks, and can be changed at any time if the relevant changes occur within a

company/market perception of the peer group. “Buy”, “accumulate”, “hold”, “reduce”, “sell” and “avoid” recommendations may be used in this

report. The table below presents the relationship between recommendations and target prices compared to risk level of the stock. These are

indicative ranges and actual recommendations may deviate from the indications if other relevant issues are considered. For more detailed

information about the recommendation system please visit http://www.swedbank.ee/disclaimers/recommendation2007.pdf

Recommendation structure

Buy > +20% to target price

Accumulate +10% < target price < +20%

Hold 0% < target price < +10%

Reduce -10% < target price < 0%

Sell < -10% to target price

Avoid used when security does not match the standards presented in SWB’s investment guidelines

The recommendation by Swedbank Markets Equity Research department is based on a variety of standard valuation models. However, the

base for the calculation of the target price is our DCF model (DCF = discounted cash flow) with the exception of financial and investment

companies. The DCF model discounts future cash flow at present value.

In preparation of this report different valuation methods have been used, including, but not limited to, discounted free cash-flow and

comparative analysis. The selection of methods depends on the industry, the company, the nature of the stock and other circumstances.

The target price (previous fair value) takes into account the DCF value, the relative valuation of the share versus others peers (national or

international) and news that can have a positive or negative effect on the share price. Relative and absolute multiples that we consider are:

EV/EBITDA, EV/EBIT, PE, PEG and Net Asset models for companies with liquid markets for their assets and other industry specific ratios

when available. Break-up valuation models are also sometimes considered.

Recommendations by the 11 jaan 2010

No of shares Part of total

Buy 9 ██████████ 41%

Accumulate 2 ██ 9%

Hold 3 ███ 14%

Reduce 1 █ 5%

Sell 1 █ 5%

Under Review 6 ██████ 27%

Equity Research – Swedbank Markets Page 4 of 5

Equity Weekly – 11 January 2009

Information to the customer: assessments are compounded with uncertainty. The recipients

and clients of Swedbank are responsible for such risks and they

are recommended to supplement their decision-making

General information with that material which is assessed to be necessary,

including but not limited to knowledge on the financial instruments

Equity weekly is a compilation of news, corporate events, in question and on the prevailing requirements as regards trading

companies’ results and other similar information published in stock in financial instruments. Opinions contained in the weekly

exchange notifications last week, an overview of Baltic stock represent the analyst's present opinion only and may be subject to

exchanges of the same period and a weekly timeline of upcoming change.

corporate events of listed companies. No research is made here, To the extent permitted by applicable law, no liability whatsoever is

any resemblances to research are purely coincidental and should accepted by Swedbank for any direct, indirect or consequential

be considered unintentional. Weekly may contain references to loss arising from the use of this weekly.

effective price targets and investment recommendations of

companies mentioned in previously published research reports Conflicts of interest

and may update such price targets and recommendations on the All equity weeklies are produced by Swedbank Markets’ Research

basis of important new information. Previous research reports are department, which is separated from the rest of its activities by a

available at Chinese wall; as such, equity weeklies are independent and based

https://www.swedbank.ee/private/investor/portfolio/analysis/equity solely on publicly available information. The analysts at Swedbank

Information on how the price targets and investment Markets may not own securities covered by the weekly, that

recommendations are constructed in research reports is available represent more than 5% of the total share capital or voting rights of

at http://www.swedbank.ee/disclaimers/recommendation2007.pdf. any company mentioned in this weekly.

Issuer and recipients Internal guidelines are implemented in order to ensure the integrity

and independence of research analysts. The guidelines include

This report by Swedbank Markets Equity Research is issued by

rules regarding, but not limited to, the identification, management

Swedbank Markets business area within Swedbank AB (publ)

and avoidance of conflicts of interest.

(“Swedbank”). Swedbank Markets is a registered secondary name

The remuneration of staff within the Research department may

to Swedbank and is under the supervision of the Swedish

include discretionary awards based on Swedbank’s total earnings,

Financial Inspection Authority (Finansinspektionen) and other

including investment banking income; staff, however, shall not

financial supervisory bodies where Swedbank or Swedbank

receive remuneration based upon specific investment banking

Markets have offices. Swedbank is a public limited liability

transactions.

company and a member of the stock exchanges in Stockholm,

Swedbank shall not receive compensation from any company

Helsinki, Oslo and Reykjavik as well as being a member of

mentioned in the weekly for making an investment

EUREX. Swedbank AS disseminates this report in Estonia.

recommendation or enter into an agreement with the said

Swedbank AS is under the supervision of the Estonian Financial

company to make an investment recommendation.

Supervisory Authority (Finantsinspektsioon). “Swedbank” AB

disseminates the report in Lithuania. “Swedbank” AB is under the

Company specific disclosures and potential conflicts of

supervision of the Lithuanian Financial Supervisory Authority

interest

(Lietuvos Respublikos vertybinių popierių komisija) in Lithuania.

In view of Swedbank’s position in its markets, recipients of this

Swedbank AS disseminates this report in Latvia. Swedbank AS is

weekly should assume that it may currently (or may in the coming

under the supervision of the Latvian Financial Supervisory

three months and beyond) be providing or seeking to provide

Authority (Finanšu un kapitāla tirgus komisija). In no instances is

confidential investment banking services to the companies referred

the report altered before dissemination.

to in this weekly and that an agreement regarding such services

may have been in effect over the previous 12 months, under which

This research report is produced for the private information of

Swedbank may have received payments.

recipients and Swedbank is not advisory nor soliciting any action

Recipients of this weekly should also note that it may happen that

based upon it. If you are not a client of ours, you are not entitled to

Swedbank, its directors, its employees or its subsidiary companies

this research report. The Equity Research report is not, and should

at various times have had, or have sought, positions, advisory

not be construed as, an offer to sell or solicitation of an offer to buy

assignments in connection with corporate finance transactions,

any securities.

investment or merchant banking assignments and/or lending as

Analyst’s certification

regards companies and/or financial instruments covered by this

The analyst(s) responsible for the content of this weekly hereby

weekly. It may also occur that Swedbank may act as a liquidity

confirm that notwithstanding the existence of any potential conflicts

provider in trading with financial instruments covered by this

of interest referred to herein, the views expressed in this weekly

weekly.

accurately reflect our personal views about the companies and

Swedbank has not been lead manager or co-lead manager over

securities covered. The analyst(s) further confirm not to have

the previous 12 months of any publicly disclosed offer of financial

been, nor are or will be, receiving direct or indirect compensation

instruments of any company mentioned in this weekly.

in exchange for expressing any of the views or the specific

recommendation contained in the weekly.

Reproduction and dissemination

This material may not be reproduced without permission from

Limitation of liability

Swedbank Markets. The weekly may not be disseminated to

All information, including statements of fact, contained in this

physical or legal person who are citizens of, or have domicile in a

equity weekly have been obtained and compiled in good faith from

country in which dissemination is not permitted according to

sources believed to be reliable. However, no representation or

applicable legislation or other decisions.

warranty, express or implied, is made by Swedbank with respect to

Information contained in this weekly is confidential and is intended

the completeness or accuracy of its contents, and it is not to be

to be used solely by the clients of Swedbank to whom this weekly

relied upon as authoritative and should not be taken in substitution

was addressed. By accepting this weekly you have accepted the

for the exercise of reasoned, independent judgment by you.

declared restrictions.

Swedbank would like to point out that recipients of the weekly

should note that investments in capital markets e.g. such as in this

document carry economic risks and statements regarding future

Swedbank Group, 2009, All rights reserved.

The Swedbank does not have shareholdings exceeding 5 % in companies referred to in this report, but it may hold securities mentioned in this

report on behalf of its clients, acting in custodial capacity. Companies mentioned in this report do not have shareholdings exceeding 5% in

Swedbank. For information regarding the Bank and its internal organizational and administrative arrangements for the prevention and avoidance

of conflicts of interest, refer to the following websites:

Swedbank AS in Estonia: http://www.swedbank.ee

Swedbank AS in Latvia: http://www.swedbank.lv

“Swedbank” AB in Lithuania: http://www.swedbank.lt

Anda mungkin juga menyukai

- Final ADM 3350Dokumen13 halamanFinal ADM 3350Dan Grimsey100% (1)

- Collection of Pitch Decks From Venture Capital Funded StartupsDokumen22 halamanCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)

- Equity Weekly: Equity Research - Monday, January 18, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, January 18, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, August 17, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, August 17, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 16, 2009Dokumen4 halamanEquity Weekly: Equity Research - Monday, November 16, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, September 14, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, September 14, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, August 24, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, August 24, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 09, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 09, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, September 21, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, September 21, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 2, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 2, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, December 14, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, December 14, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, July 27, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, July 27, 2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 23, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 23, 2009naudaslietasBelum ada peringkat

- SWB29 Equity Weekly 20072009Dokumen5 halamanSWB29 Equity Weekly 20072009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, May 11, 2009Dokumen6 halamanEquity Weekly: Equity Research - Monday, May 11, 2009naudaslietasBelum ada peringkat

- Swedbank EquityWeekly - 03.08.2009Dokumen5 halamanSwedbank EquityWeekly - 03.08.2009naudaslietas100% (2)

- Equity Weekly: Equity Research - Monday, August 31, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, August 31, 2009naudaslietasBelum ada peringkat

- ARR SekotongDokumen10 halamanARR Sekotonghary wirantoBelum ada peringkat

- Telechoice International Limited Annual Report 2009Dokumen118 halamanTelechoice International Limited Annual Report 2009Edwin LeeBelum ada peringkat

- Best Countries For BusinessDokumen5 halamanBest Countries For BusinessOrestes LimaBelum ada peringkat

- ICA 4 KeyDokumen6 halamanICA 4 KeyDior DimeBelum ada peringkat

- Utilities Stock Guide: WeeklyDokumen16 halamanUtilities Stock Guide: WeeklyManuel Jeremias CaldasBelum ada peringkat

- Horizon Handout 2021-09Dokumen32 halamanHorizon Handout 2021-09Orkhan GuliyevBelum ada peringkat

- Computer NetworksDokumen222 halamanComputer NetworksPatil TanishkBelum ada peringkat

- Libre Sin AmortiguacionDokumen13 halamanLibre Sin AmortiguacionF AGBelum ada peringkat

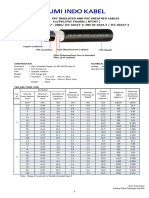

- #7 Sumiindo - CableDokumen1 halaman#7 Sumiindo - CableAzzam 3CBelum ada peringkat

- RINA S FLEET GROWS Y O Y by 15 7 IN MARCH 2023 1683079984Dokumen1 halamanRINA S FLEET GROWS Y O Y by 15 7 IN MARCH 2023 1683079984Kittipong SookchaiBelum ada peringkat

- Industrial - Statistics Key Indi Jan 2021Dokumen5 halamanIndustrial - Statistics Key Indi Jan 2021CuriousMan87Belum ada peringkat

- Spain: Population (July 2017) - 46,468, 102 (30) Density - 92/ (238.3/sq Mi.)Dokumen17 halamanSpain: Population (July 2017) - 46,468, 102 (30) Density - 92/ (238.3/sq Mi.)Olga SîrbuBelum ada peringkat

- Bank of Japan: Monthly Report On The Corporate Goods Price IndexDokumen8 halamanBank of Japan: Monthly Report On The Corporate Goods Price IndexHong AnhBelum ada peringkat

- MFR Period Ended 29 October 2021-LockedDokumen69 halamanMFR Period Ended 29 October 2021-LockedChoon Fong LeeBelum ada peringkat

- LEE Manual LT17 - EXTDokumen4 halamanLEE Manual LT17 - EXTZoran PilipovićBelum ada peringkat

- Morning MetalsDokumen2 halamanMorning Metalslitwiniuk8336Belum ada peringkat

- 2 - Teenage Pregnancy Statistical Table - wONSDokumen1 halaman2 - Teenage Pregnancy Statistical Table - wONSArlyn AyagBelum ada peringkat

- LOM Exam PrepDokumen8 halamanLOM Exam PrepPaul EshanBelum ada peringkat

- Bias Forward Dioda: 0 0 V (Volt) I ( A)Dokumen6 halamanBias Forward Dioda: 0 0 V (Volt) I ( A)TomyBelum ada peringkat

- PE Pipes and WeightsDokumen2 halamanPE Pipes and WeightsSandesh PoudelBelum ada peringkat

- Strategy of Deutsche Bahn Group: Beijing - Tokyo - Hong Kong - SingaporeDokumen40 halamanStrategy of Deutsche Bahn Group: Beijing - Tokyo - Hong Kong - SingaporemelisaBelum ada peringkat

- Correlations & Efficient FrontierDokumen4 halamanCorrelations & Efficient FrontierkirsurkulkarniBelum ada peringkat

- Pages From CatelogDokumen21 halamanPages From CatelogMoAmen AtlamBelum ada peringkat

- B2C E-Commerce StatisticsDokumen20 halamanB2C E-Commerce StatisticsMaihong NguyenBelum ada peringkat

- Iecmd - November 2021Dokumen97 halamanIecmd - November 2021Siti Hutami pratiwiBelum ada peringkat

- Pipes - Water ContentDokumen2 halamanPipes - Water ContentHassan SleemBelum ada peringkat

- FY2012 Financial Forecast and Management Policy: Hiroshi Takenaka, President & CEO May 13, 2011Dokumen34 halamanFY2012 Financial Forecast and Management Policy: Hiroshi Takenaka, President & CEO May 13, 2011Andrew RomanoBelum ada peringkat

- QFR 03-March 2022 LDokumen70 halamanQFR 03-March 2022 LNapolean DynamiteBelum ada peringkat

- 127 Auto Bharat BenzDokumen15 halaman127 Auto Bharat BenzSmita Sawant BholeBelum ada peringkat

- Pchome PresentationDokumen38 halamanPchome Presentationecommerce zenBelum ada peringkat

- Hardware SectionsDokumen5 halamanHardware SectionsMohammed AlryaniBelum ada peringkat

- Tube Bundle Technical Data - Bending Radius CLX0068UDokumen1 halamanTube Bundle Technical Data - Bending Radius CLX0068Uxdanielleye_98868485Belum ada peringkat

- Trade Deficit (Net Exports) NX Exports (X) - Imports (M) in Relation To Un-Employment and Inflation For Last 20-Years Performance-Hongkong & DenmarkDokumen4 halamanTrade Deficit (Net Exports) NX Exports (X) - Imports (M) in Relation To Un-Employment and Inflation For Last 20-Years Performance-Hongkong & DenmarkShabab MansoorBelum ada peringkat

- Book 1Dokumen13 halamanBook 1Sabab MunifBelum ada peringkat

- SmeDokumen68 halamanSmevictorBelum ada peringkat

- Power Cable Intern ReportDokumen34 halamanPower Cable Intern ReportParteek KansalBelum ada peringkat

- General Data: Table 4. Modulating Valve Selections For Horizontal Concealed UnitsDokumen1 halamanGeneral Data: Table 4. Modulating Valve Selections For Horizontal Concealed UnitsSaul CerveraBelum ada peringkat

- Colpitts GraphDokumen1 halamanColpitts GraphPrabhanjan HolikarBelum ada peringkat

- Date Cemexcpo IpycDokumen25 halamanDate Cemexcpo IpycthalibritBelum ada peringkat

- Banking Sector Update: 2QCY10 Report Card - Lower Impairment Allowances For Loans Help Beat Forecasts - 02/09/2010Dokumen14 halamanBanking Sector Update: 2QCY10 Report Card - Lower Impairment Allowances For Loans Help Beat Forecasts - 02/09/2010Rhb InvestBelum ada peringkat

- Portfolio Analysis (Risk, Return, Sharpe, Beta) : Step 1 Creating A PortfolioDokumen4 halamanPortfolio Analysis (Risk, Return, Sharpe, Beta) : Step 1 Creating A PortfolioBakhori AhidBelum ada peringkat

- International Standard AtmosphereDokumen3 halamanInternational Standard AtmosphereJames HeatherBelum ada peringkat

- TOS GenMathDokumen10 halamanTOS GenMathJANIECEL ANNE DELA TORREBelum ada peringkat

- Impact of Lehman Brothers Bankruptcy On Post-Trade System in JapanDokumen14 halamanImpact of Lehman Brothers Bankruptcy On Post-Trade System in JapanShabber AhmedBelum ada peringkat

- America, Japan & Asia Pacific: America, Japan & Asia PacificDari EverandAmerica, Japan & Asia Pacific: America, Japan & Asia PacificBelum ada peringkat

- Equity Weekly: Equity Research - Monday, December 14, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, December 14, 2009naudaslietasBelum ada peringkat

- SWB53EquityWeekly04 01Dokumen5 halamanSWB53EquityWeekly04 01naudaslietasBelum ada peringkat

- Olympic Entertainment GroupDokumen35 halamanOlympic Entertainment GroupnaudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 23, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 23, 2009naudaslietasBelum ada peringkat

- SWB43EquityWeekly26 10Dokumen5 halamanSWB43EquityWeekly26 10naudaslietasBelum ada peringkat

- City Service AB PresentationDokumen17 halamanCity Service AB PresentationnaudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 09, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 09, 2009naudaslietasBelum ada peringkat

- Winners and LosersDokumen3 halamanWinners and LosersnaudaslietasBelum ada peringkat

- Company Presentation: October 2009Dokumen16 halamanCompany Presentation: October 2009naudaslietasBelum ada peringkat

- SWB29 Equity Weekly 20072009Dokumen5 halamanSWB29 Equity Weekly 20072009naudaslietasBelum ada peringkat

- SEB Eastern European Outlook October 2009 (English)Dokumen22 halamanSEB Eastern European Outlook October 2009 (English)SEB GroupBelum ada peringkat

- Equity Weekly: Equity Research - Monday, November 2, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, November 2, 2009naudaslietasBelum ada peringkat

- Equity WeeklyDokumen5 halamanEquity WeeklynaudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, September 21, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, September 21, 2009naudaslietasBelum ada peringkat

- Equity WeeklyDokumen5 halamanEquity WeeklynaudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, August 31, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, August 31, 2009naudaslietasBelum ada peringkat

- SWB36EquityWeekly07 09 2009Dokumen5 halamanSWB36EquityWeekly07 09 2009naudaslietasBelum ada peringkat

- Swedbank EquityWeekly - 03.08.2009Dokumen5 halamanSwedbank EquityWeekly - 03.08.2009naudaslietas100% (2)

- SEB Baltijas Akciju Rīta Apskats - 10.08.2009Dokumen2 halamanSEB Baltijas Akciju Rīta Apskats - 10.08.2009naudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, July 27, 2009Dokumen5 halamanEquity Weekly: Equity Research - Monday, July 27, 2009naudaslietasBelum ada peringkat

- Redefining Ways To Deliver AdviceDokumen56 halamanRedefining Ways To Deliver AdvicenaudaslietasBelum ada peringkat

- Equity Weekly: Equity Research - Monday, May 11, 2009Dokumen6 halamanEquity Weekly: Equity Research - Monday, May 11, 2009naudaslietasBelum ada peringkat

- Q1 W7 To 9 EntrepreneurshipDokumen9 halamanQ1 W7 To 9 EntrepreneurshipNovalyn RamosBelum ada peringkat

- Case Study 1 Fin745Dokumen11 halamanCase Study 1 Fin745nieyoot0% (1)

- Moving Average Guide Handout FinalDokumen9 halamanMoving Average Guide Handout FinalSaurabh Jain100% (1)

- AltaCorp PDFDokumen4 halamanAltaCorp PDFzBelum ada peringkat

- What Are The Kinds of Bill of Exchange?Dokumen3 halamanWhat Are The Kinds of Bill of Exchange?AireyBelum ada peringkat

- Bahasa Inggris Semester 3 PT Gudang Garam-1Dokumen6 halamanBahasa Inggris Semester 3 PT Gudang Garam-1Abdul M RohmanBelum ada peringkat

- Fin 332 HW 3 Fall 2021Dokumen5 halamanFin 332 HW 3 Fall 2021Alena ChauBelum ada peringkat

- 2015-KINGSB Complete PackagesDokumen8 halaman2015-KINGSB Complete PackagesArvind Sanu MisraBelum ada peringkat

- Capital Adequacy Ratio - ReportDokumen11 halamanCapital Adequacy Ratio - ReportAllex JackBelum ada peringkat

- Zerodha Profit CalculatorDokumen4 halamanZerodha Profit CalculatorvvpvarunBelum ada peringkat

- An Introduction To Computational Finance Without Agonizing PainDokumen109 halamanAn Introduction To Computational Finance Without Agonizing PainCarolyn Matthews100% (1)

- (FRT) Financial Analysis & Assessment, Recom - DeMODokumen8 halaman(FRT) Financial Analysis & Assessment, Recom - DeMONguyễn Minh ChâuBelum ada peringkat

- 6-Analisis Solvabilitas Jangka PanjangDokumen25 halaman6-Analisis Solvabilitas Jangka PanjangAdly WijaksanaBelum ada peringkat

- 5021 Solutions 7Dokumen7 halaman5021 Solutions 7karsten_fdsBelum ada peringkat

- Model Paper Financial ManagementDokumen6 halamanModel Paper Financial ManagementSandumin JayasingheBelum ada peringkat

- Risk Management An Analysis of Issues in Islamic Financial Industry by Tariqullah Khan Habib AhmedDokumen189 halamanRisk Management An Analysis of Issues in Islamic Financial Industry by Tariqullah Khan Habib AhmedRifaldy MajidBelum ada peringkat

- Marketing 2Nd Edition Hunt Test Bank Full Chapter PDFDokumen67 halamanMarketing 2Nd Edition Hunt Test Bank Full Chapter PDFihlemadonna100% (11)

- List of Branches of Brokerage Firms 09.04.2019Dokumen87 halamanList of Branches of Brokerage Firms 09.04.2019Muhammad AtharBelum ada peringkat

- Mock Exam On InvestmentDokumen5 halamanMock Exam On InvestmentDhaneshBelum ada peringkat

- Chapter15 BuenaventuraDokumen10 halamanChapter15 BuenaventuraAnonnBelum ada peringkat

- Blackstone Private CreditDokumen36 halamanBlackstone Private CreditwutBelum ada peringkat

- AFM 132 Unit 8 - Marketing - Tues. Nov. 1 - LEARNDokumen17 halamanAFM 132 Unit 8 - Marketing - Tues. Nov. 1 - LEARNiyengar.amoghBelum ada peringkat

- Financial Institutions Management,: by Anthony SaundersDokumen17 halamanFinancial Institutions Management,: by Anthony SaundersDexter ShahBelum ada peringkat

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and Convertibles PDFDokumen24 halamanTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and Convertibles PDFsky dela cruzBelum ada peringkat

- ProfipipsHunter Scalping With IndicatorsDokumen9 halamanProfipipsHunter Scalping With IndicatorsSon GokuBelum ada peringkat

- Oil and Gas Asset Backed SecuritizationsDokumen9 halamanOil and Gas Asset Backed SecuritizationsCDBelum ada peringkat

- Fiinratings Monthly Report January 2024Dokumen7 halamanFiinratings Monthly Report January 2024ducnguyentcbBelum ada peringkat

- Books-Investing in Stock MarketsDokumen2 halamanBooks-Investing in Stock MarketsRitesh TiwariBelum ada peringkat