Report

Diunggah oleh

Mohammed Zahidul IslamDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Report

Diunggah oleh

Mohammed Zahidul IslamHak Cipta:

Format Tersedia

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Preface

Internship Report is a scope for acquiring substantial knowledge after perfecting of academic

classes. BBA is the academic degree of our educational life. Before joining the substantial

field we need to acquire knowledge about the planning, staffing, motivating, directing,

control, administration, organization & different managerial activities. It is scoped for

observing and learning how the theoretical matters are related with substantial tasks. The

necessity of the internship program is increasing day by day with growing complexity of the

business environment.

Internship program is a part and parcel of BBA curriculum. So after completion the BBA

examination every student should require to attach with an organization to carryout

internship as a part fulfillment of BBA program. Considering the wide range of activities of

Commercial bank, I have decided to complete my internship on private commercial bank.

Accordingly I have deputed to accomplish my work of internship in Standard Bank Limited,

Agrabad Branch, Chittagong. Under the topic of Bank Fund Management Performance A

study of SBL I have thoroughly examine the operations of the Branch and tried my level best.

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Acknowledgement At first I like to pay my gratitude to Almighty God who has

given me the strength and capability to complete the Internship Report. Besides this I am

grateful some particular persons who have helped and encouraged me at each and every step. At

the very outset I extend my heartiest gratitude to my honorable teacher Mohammad Alamgir,

Assistant professor, Department of marketing studies & International marketing for his massive

support & cooperation. I would like express my heartiest gratitude to Mr. Mosharaf Hossain,

Managing Director, Standard bank Limited and Mr. Mahmud Sharif, Executive Vice President of

SBL to allow me to conduct internship in the standard Bank Limited. I am also greatly indebted

Mr. Nururssafa, Vice President and in charge of Agrabad Branch and Mr. Lutfur Rahman

Bhuyian, Officers Mr. Saiful Hasan, Mr. Mizanur Rahman and Md. Monirul Islam, Assistant

officers Ms Rozi Akter, Pullak Dutta,& Mr. Ershad Ullah Faruqe , Trainee Assistant officers

Masum Kamal, Anisur Rahman, Probationary officers Md. Kamrul Hasan for their intimate care

and supervision I like to thank all Officers and Staff who shared their suggestions and views with

me. Standard Bank Limited Setting a New Standard in Banking 3

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Table of Contents Chapter Particulars Page No.

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Chapter-1 Introduction Statement of the Problem Objectives of the Study Scope of

the study Methodology of the Study Organizations of the Study Limitations of the

Study Chapter-2 Introduction Policy Statement for Fund Management Fund

Management Strategy Mission Objective and Goal Statement of SBL Risk Factor

Chapter-3 Introduction Product and Services of the Bank Deposit Mix Deposit

Performance of SBL Deposit and Profit Relationship Chapter-4 Productivity of

deposit for the year 2006 Productivity and Profitability of Sample Bank Chapter-5

Problems of the Fund Management Suggestions for the Bank Chapter-6 Findings and

Summary Conclusion Reference Standard Bank Limited Setting a New Standard in

Banking 4

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Chapter: 1

1.1 INTRODUCTION

1.2 STATEMENT OF THE PROBLEM

1.3 OBJECTIVES OF THE STUDY

1.4 SCOPE OF THE STUDY

1.5 METHODOLOGY OF THE STUDY

1.6 ORGANIZATIONS OF THE STUDY

1.7 LIMITATIONS OF THE STUDY Standard

in Banking 5

Bank Limited Setting a New Standard

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.1 INTRODUCTION Banks are the major financial institution which intermediate

between actual lenders and actual borrowers. For this intermediation, banks are to pay actual

lenders and charge actual borrowers. At present situation banking model has been developed all

over the world as well as Bangladesh Bank. So now a day manager will have to be more

knowledge of about national global economy. In response to this situation traditional

management knowledge has diversified by the modern managers, through different universities

and institutions are creating the modern manager through the business administration program.

Each university of the world has a program of substantial experienced called internship Report.

With this program the students come to the substantial situation of the business and

administration. The students are become aware about the official correspondents, managerial

behavior, decision-making process, motivation system, coordination system, Supervision,

interpersonal relation and many more. Generally fund management practice is an important

concept for Banking sector & used word widely. Mobilization of fund means to collect deposit

from different sources and disbursed it in several ways to earn profit Banker means to accept

deposits from the public repayable on demand, withdrawal by cheque for the purpose of lending.

Standard Bank Limited Setting a New Standard in Banking 6

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.2 STATEMENT OF THE PROBLEM In this concept of fund management

Fund is a scare resource. It is not available in the world. So as there is a fund constraint in these

management concepts, there are some reasons behind it. These are a) Saving behavior of people

b) Poverty in policy making of fund mobilization c) Different Government policy d) Fiscal and

monetary policy. e) Institutional weakness f) Assets- Liability mismatch problem g) Strategic

problem h) Several micro and macro factors affecting the fund management process. Standard

Bank Limited Setting a New Standard in Banking 7

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.3 OBJECTIVE OF THE STUDY Every work has its own objectives. So the

main objective is to evaluate the fund management Performance of the Standard Bank Limited.

More specifically the objectives of the study are: a) To highlight the policies of sample bank for

mobilization of fund. b) To evaluate the performance of fund management of sample bank. c) To

access the impact of fund mgt on profitability and productivity of the bank. d) To identify the

problem with fund management of the sample bank. e) To provide suggestion of the problem. I

have tried my best to touched and discussed about all of above- mentioned point in my report and

give the report to a complete shape. So that anyone can understand banking system of Standard

Bank Limited to go through this report. 1.4 SCOPE OF THE STUDY

Department

Period of data use

Customer Service

Accounts

Loan And Advance

General Banking

Name of the bank

2003-2007

Standard Bank Limited Standard Bank Limited Setting a New Standard in Banking 8

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.5 METHODOLOGY OF THE STUDY Every program should follow some

basic form of procedures. For this purpose we can divide this part in two ways:- 1.5.1 Collection

of data 1.5.2 Analysis of data 1.5.1 Collection of data There are several ways of collecting the

appropriate data which differ considerably in context of money costs, time and other resources.

To prepare this report the data collected by two ways: 1) Primary Data: Primary data collected by

By observation

Personal Interview

By Questionnaires

2) Secondary Data: Secondary data collected from

Annual report of the SBL

Right Share offer document

Statement of affairs

Balance Sheet

Financial Statement

Different journals

Different Text of BBA & BBA Program

1.5.2 Analysis of Data After the data have been collected, the must be analyzed. The analysis of

data requires a number of closely related operations such as establishment of categories, the

application of these categories to raw data through coding, tabulation and then drawing the

statistical inference. I use the following statistical tools to analyze the data:

Mean

Standard Deviation

Correlation

Regression analysis

Bar diagram

Pie chart

Standard Bank Limited Setting a New Standard in Banking 9

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.6 ORGANIZATIONS OF THE STUDY

In this report first chapter covered the policy, strategy, mission, objective, goal of fund

management. Second chapter covered types of deposits of sample bank, deposit performance,

seven years activities at a glance, five years deposits status of the sample bank. Third chapter

covered the productivity and profitability position of the sample bank. Fourth and Fifth chapters

covered problems and suggestions of fund management of the sample bank. Finally the sixth

chapter covered the findings and conclusion of the study. Standard Bank Limited Setting

a New Standard in Banking 10

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

1.7 LIMITATIONS OF THE STUDY

In every program or activities have some limitations and constraints. I have also faced several of

limitation during my internship. If I could overcome these constraints, my research and finding

would be appropriate and logical, but I could not overcome this factors. I have mentioned here

some of this limitation.

1. The bank has no adequate quantity of readymade data and information

2. It is impossible to know everything for time constraint

3. Most of the responsible officer was so busy that they could not provide sufficient time to us

4. Short range of data analysis

5. Insufficient investigation in all departments due to secrecy

There are some major limitations, which have created many problems during my internship

program. In spite of these constraints I tried to make my report best. Standard Bank

Limited Setting a New Standard in Banking 11

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Chapter: 1

2.1 INTRODUCTION

2.2 POLICIES IMPLEMENTED BY THE SAMPLE BANK FOR FUND MOBILIZATION

2.3 STRATEGIES OF FUND MANAGEMENT

2.4 MISSION OBJECTIVE GOAL OF THE SAMPLE BANK

2.5 RISK FACTORS Standard Bank Limited Setting a New Standard in Banking 12

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

2.1 INTRODUCTION Today banks are highly complex organizations-offering

multiple services different groups of individuals inside the bank usually make the decisions on

what customers are to receive loans, what securities the bank should add to its investment

portfolio, what terms should be quoted to the public on deposits and other services the bank

offers and what sources of capital the bank should draw upon. However, bankers today realize

that all of these management decisions are intimately linked each other. In a well-management

bank all of these management decisions must be coordinated across the whole bank to ensure that

they do not clash with each other, leading to inconsistent actions that damage the banks earnings

and value. Today bankers have learned to look at their asset and liability portfolios as an

integrated whole, considering how the banks total portfolios contributed to its broad goals of

adequate profitability and acceptable risk. This type of coordinated and integrated bank decisionmaking is known as Fund Management. The purpose of asset- liability management is to

formulate strategies and take actions that shape a banks balance sheet as a whole in a way that

contributes to its desired goals. Usually, the principal goals of asset-liability management are- a)

To maximize or at least stabilize, the banks margin or spread between interest revenues and

interest expenses and b) To maximize or at least protect, the value (stock price) of the bank, at an

acceptable level of risk Standard Bank Limited Setting a New Standard in Banking 13

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

2.2 POLICY STATEMENT FOR FUND MANAGEMENT Board or

management committee of the Bank should set out the policy statement in at least for the

followings and annual review should be done taking into considerations of changes in the balance

sheet and market dynamics. 2.2.1 Loan Deposit ratio (LD) The Ad ratio should be 80% to 85%.

However, the loan deposit ratio of the bank should go up to 110%. The loan deposit ratio=Loan/

(Deposit + Capital + Funded Reserve). The ratio will be fixed based on the banks capital, banks

reputation in the market and overall depth of the money market. 2.2.2 Wholesale Borrowing

Guideline The guideline should be set in absolute amount depending on banks borrowing

capacity, historic market liquidity. The limit should be capped at the banks highest level of past

borrowings. However, this limit can be increased based on the match funding basis. 2.2.3

Commitments The commitments Guideline should not exceed200% of the unused wholesale

borrowing capacity of the last twelve months. The limit can be increased if there are natural

limitations on customer discretion to draw against committed lines or a bank access to additional

funds via realization of surplus statutory holdings. 2.2.4 Medium Term Funding Ratio (MTF)

The MTF of a bank should not be less than 30%. The ideal scenario should be 45%. Given, the

overall scenario of current market, it will be suitable to move towards the MTF limit of 45% as

we progress. Standard Bank Limited Setting a New Standard in Banking 14

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

2.2.5 Maximum Cumulative Outflow MCO up to 1 month bucket should not exceed 20% of the

balance sheet. 2.2.6 Liquidity Contingency Plan A liquidity contingency plan needs to be

approved by the board. A contingency plan needs to be prepared keeping in mind that enough

liquidity is available to meet the fund requirements in liquidity crisis situation. An annual review

of the contingency planning should be made. 2.2.7 Local Regulatory Compliance There should

be a firm policy on compliance to the Bangladesh Bank in respect of CRR, SLR, Capital

adequacy etc. 2.3 FUND MANAGEMENT STRATEGY The maturing of

liability management techniques, coupled with more volatile interest rates and greater banking

risk, eventually gave birth to the fund management approach, which dominates banking today.

This view is a much more balanced approach to asset and liability management that stresses

several key objectives.

1. Bank management should exercise as a much control as possible over the volume, mix and

return or cost of both assets liabilities in order to achieve the banks short run and long run goals

2. Management control over assets must be coordinated with its control over liabilities. So that

assets and liability management are internally consistent and do not pull against each other

3. Revenues and costs arise from both sides of the banks balance sheet (i.e. from both assets and

liabilities). Bank policies need to be developed that maximize returns and

Standard Bank Limited Setting a New Standard in Banking 15

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

minimize costs from bank services that result in assets (e.g. the making of loans) or in liabilities

(e.g. the sale of deposits)

2.4 MISSION, OBJECTIVE AND GOAL STATEMENT OF STANDARD

BANK LIMITED 2.4.1 Mission To be the premier financial institution in the country

providing high quality products and services backed latest technology and a team of highly

motivated personnel to deliver excellence in banking and exploring a new horizon of innovative

banking Slogan Setting a New Standard in Banking 2.4.2 Objective of the Bank Long-term

objective To be the market leader both in term of deposits and good advances among private

commercial banks by 2010. Short-Term objective To increase current market shares by 2007

and providing high quality product services backed by latest technology Financial Objective To

reduce the existing cost of Fund by 1%, that currently stands at 2.4.3 Goals

Become the leading profitable bank

Provide highest level of satisfaction to customers by the means of Excellence in banking

Optimize the return on Shareholders investments

Strategic Intent To ensure that customers receive a consistent standard quality of service in

comparison to that of the private commercial banks in Bangladesh. Standard Bank

Limited Setting a New Standard in Banking 16

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Corporate Governance Mechanism They have board of directors and an executive committee

formed by the board for overlooking the operations and management of the bank. They also

appoint auditors to look over the financial statements. Appointment of auditors is subjects to

approval of annual general meeting. Ethical codes They have an environmental management

policy that stipulates adherence with environmental, health and safety regulations and guidelines,

refraining from business impair the ability of future generations to meet their own needs,

assessing and mitigating risks concerning environment, health andsafety6 issues in business that

they undertake. Their policies with regard to safety, health and environment management is being

observed in their lending decisions. Several measures have also been introduced within the bank

ranging from declaring all Standard Bank branches and officer as Smoking Free Zones to

conservation of energy. Corporate Social Responsibility Standard Bank recognizes its

responsibilities as a corporate entity of the country and stands aside the community whenever

required. Standard Bank has always extended its to the development of the community though

promotion of sports, culture, research, environmental projects and disaster aids. Standard

Bank Limited Setting a New Standard in Banking 17

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

2.5 RISK FACTOR

a) The risk is inherent to all equity securities and is not specific to Standard Bank Limited (SBL).

b) Systematic risks are uncontrollable to SBL and have equal impact to other industries in the

economy. Some of the unsystematic risks outlined above are usual in the banking industry. SBL

scrutinizes all its clients and the associated risks systematically using up to date risk evaluation

techniques and thereby have been able to maintain its asset quality so far and expects the same.

c) Every bank carries some contingent liability in their books as it is generic to the nature of SBL

carries contingent liability in its books as a natural course of business and the quality of

contingent liability is high as demonstrated by almost no default till date. Also the amount of

contingent liability carried by SBL at any point of time is not significantly high compared to the

size of its balance sheet in general and reserves in particular.

d) Recognizing the risks, SBL has focused on a diversified client base since its inception with an

innovative and differentiated product structure. This strategy has been rewarding for the bank,

which plans to remain innovative in the future also by way of creating new markets for its

products.

e) Should one or more bank in the country fail to perform or become bankrupt at any point of

time, a general lack of confidence in the market may affect SBL business negatively. This risk is

absolutely external to SBL and could affect any financial institution operating within the country.

f) Adequate technology is a comparative issue. SBL feels that it has adequate technology for the

time being would enhance its technology level with the demand of time. Market access is a

function of innovation. SBL has accessed the market successfully till date being one of the

pioneer entrants in the market. Availability of skilled human resources is a national constraint but

SBL has been addressing this aspect by focusing on imparting of training to its manpower to

cultivate the skill and efficiency.

g) SBL is going to full automation. It has already established online banking transaction facility

with all its 10 branches across the country.

Standard Bank Limited Setting a New Standard in Banking 18

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Chapter: 1

EVALUATION OF PERFORMANCE OF FUND

MANAGEMENT

3.1 INTRODUCTION

3.2 TYPES OF DEPOSIT OF SAMPLE BANK

A) TYPES OF DEPRSIT

B) DEPOSIT MIX

3.3 DEPOSIT PERFORMANCE OF THE SAMPLE BANK

A) SEVEN YEARS ACTIVITY AT A GLANCE

B) FIVE YEARS DEPOSIT STATUS OF SBL

3.4 DEPOSIT PROFIT RELATIONSHIP OF THE YEAR 2007 Standard

Limited Setting a New Standard in Banking 19

Internship Report-2009, BBA, Southern University.

Bank

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

3.1 INTRODUCTION In banking deposits are given by the customer and received by

the banker through the account. So the account is a well-established or well-devised system

agreed upon by the banker and customer within the limits of law. Deposits are collected from

different sources.

Public source

Government source

Institutional sources

Club

Individual source

Organizational sources:

Sole proprietorship

Partnership

Joint Stock Company

Standard Bank Limited Setting a New Standard in Banking 20

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

3.2 PRODUCT AND SERVICES OF THE BANK 3.2 a) Types of deposit

Current Account One can maximize flexibility and convenience when he/she opens a current

account with SBL. This account offers:

The account can be opened by both individuals and business concerns including

Non-profit making organizations

Opening of a Current Account requires proper introduction

Unlimited transactions a day, no minimum balance fee & free cheque book.

No interest is allowed on current account

Bank Statement to be dispatched on a monthly basis or as may be requested by the customer

Features of current account:

According to this account, account holders can easily deposit and with draw money.

The payment is done whenever depositors want to with draw money.

Depositors will not get any interest.

No pass book is issued.

Bank cannot use depositors fund for investing in other profitable sectors.

This account gives maximum utility to its customers.

Advantage of Current Account

It is a secured account.

It is helpful for export and import business.

Bank gives advice and facilities to its customers.

Standard Bank Limited Setting a New Standard in Banking 21

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

By this account money can be transferred to one account to another, one city to another city

within a minute.

Disadvantage of current account

Too many formalities for opening an account

There is no interest earned from this savings

It is not suitable for low income people

Saving account The savings Account allows one to have interest income on his/her deposit

whilst the account can be used for transaction purpose. One can draw a maximum number of two

cheques per week, exceeding this number will forfeit the interest for the month. SBL offers a

competitive interest rate of 7% on the account and there is no requirement for a minimum

balance to maintain in the account to be eligible for the interest. Interest is applied to the account

on half-yearly rates. The savings Account also offers:

Can be opened by individuals for saving purposes depositing amounts over a period of time

Requires proper introduction

No minimum balance fee and free cheque book

Statement of account at a quarterly basis

But a penalty is also charged to the customer, each time a cheque is returned unpaid for want

of funds in the account

Short Term Deposit

The short term deposit account of SBL is a unique blend of flexibility and high return on

deposits. This account can be used like a current account whilst earn interest on the account when

the stipulated minimum balance is maintained in the account. Standard Bank Limited

Standard Bank Limited Setting a New Standard in Banking 22

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

offers a very competitive interest rate of 5.0% and the interest is calculated on a daily product

basis. Deposit should be kept for at least seven days to get interest. Prior notice is required for the

withdrawal of money from STD account. The account holder must give notice seven days before

the withdrawal that is why STD is called Seven-Day-Notice Current A/C. In addition, the

clients also enjoy the following:

Unlimited number of withdrawals, no minimum balance fee and free cheque book

Statement of account at desired frequency

Fixed Deposit In Standard Bank Limited only three terms of fixed Deposits are available, which

are as follows along with their respective rates; 1 month FDR @ 9% per annum. 3 months FDR

@ 11.5% annum. 9 months FDR @ 12% per annum and 1 year FDR @ 12.5% annum. At the

time of opening the deposit account, the banker issues a receipt acknowledging the receipt of

money on deposit account. In any case, any client of the bank opens a fixed deposit account with

the bank for an amount of Tk. 50 Lac or over; the management of DBL will be pleased to honour

the clients by providing a fixed rate of 13% to 14% per annum. The fixed deposit interest

earnings can be instructed to be deposited automatically to any preferred account of the client

with the bank and the FDR can be automatically renewed for the next period after maturity as per

the instructions of the client. Features of Fixed Deposits

It is a deposit account

Here is money is deposited for a fixed time

Interest is paid on deposits. Interest rate is fixed by bank

No transaction can be made thus banker doesnt provide pass book or cheque

A person can deposit any sum of money

Standard Bank Limited Setting a New Standard in Banking 23

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Introductory reference is not need to open an account

Banker give documents to depositor, the documents is not negotiable, if it is negotiable the

new owner will not get such facilities

After the interval of six month the interest is paid, the interest is calculated as day product

Depositors can withdrawn by after showing documents provides by bank

Advantage of Fixed Depositors

By providing a smart amount a person can open it

This account help in long-term planning of the deposited account

The amount of fixed deposit can invest in long-term productive scheme

The amount of fixed deposit is invest in development sector of a country for long-term

Depositors get higher interest compare to others

Deposits are save and less risky

Deposits are not taxable interest and interests are also non-taxable

Depositor can withdraw real amount and interest at a time

After the contractual agreement the deposits can reinvest in bank

Depositors get 80% loan facilities from his deposited amount

Disadvantage of fixed Depositors

Lower class people are not always able to open such account

Depositors have to deposit full amount at a time

Money can be withdrawn after maturity

Sometimes Government charge tax from the deposited amount

Standard Bank Limited Setting a New Standard in Banking 24

Internship Report-2009, BBA, Southern University.

Standard Bank Limited

Setting New Standard in Banking

A Study on Fund Management of SBL

Standard Bank Special Saving Scheme This scheme allows for getting attractive fixed amount

at the end of the specified term through depositing monthly installment of Tk. 500 to Tk.

2,500.00 over a period of 5 and 10 years. Annual profit @ 11% for 5 years and 12% for 10 years

is allowed under this scheme. The depositor should deposit his/her monthly installment by the

10th day of each month. If the 10th day is a public holiday, then deposit in the next working day is

allowed. A single depositor may open more than one of such SSSS account. Another advantage

of the scheme is that the depositor may take loan of maximum 80% on the deposited amount. The

depositor can have one or more nominee(s) for claiming the deposited money after his death. In

the case of more than one nominee, the depositor can determine the portion of amount of money

for each nominee. No joint account is allowed in this scheme.

The

500.00

1000.00

1500.00

2000.00

2500.00

depositors

amount

After 5 years

37,000.00

78,000.00

1,11,000.00

1,48,000.00

1,85,000.00

the bank pays

Internship Report-2009, BBA, Southern University.

Anda mungkin juga menyukai

- Report On Credit Risk Management On National Bank LTDDokumen48 halamanReport On Credit Risk Management On National Bank LTDms694200% (1)

- Chapter One: Introduction: 1.1 Origin of The StudyDokumen55 halamanChapter One: Introduction: 1.1 Origin of The StudyGolpo MahmudBelum ada peringkat

- Report of BCBLDokumen52 halamanReport of BCBLTakia FerdousBelum ada peringkat

- Prime BankDokumen77 halamanPrime BanktauhidzihadBelum ada peringkat

- Internship Report On Credit Adminitraation of Mutual Trust BankDokumen140 halamanInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibBelum ada peringkat

- Credit Managment of United Commercial Bank LimitedDokumen54 halamanCredit Managment of United Commercial Bank LimitedMethela Barua100% (3)

- Jamuna Bank LimitedDokumen98 halamanJamuna Bank LimitedAli Sabbir Somu100% (1)

- Assignment of Financial Management With GraphDokumen27 halamanAssignment of Financial Management With Graphakhtar140Belum ada peringkat

- Origin of The ReportDokumen5 halamanOrigin of The Reporttonmoy63Belum ada peringkat

- Internship Report On: "Loan Disbursement" A Case Study On First Security Islami Bank LimitedDokumen38 halamanInternship Report On: "Loan Disbursement" A Case Study On First Security Islami Bank LimitedBishnu Sutra DharBelum ada peringkat

- Banking Sectors in BangladeshDokumen69 halamanBanking Sectors in BangladeshTanvir Ahmed RanaBelum ada peringkat

- CRM ProposalDokumen4 halamanCRM ProposalSharwarJahanBelum ada peringkat

- Main PartDokumen44 halamanMain PartSharifMahmudBelum ada peringkat

- Report of MBL (Bank Purpose)Dokumen60 halamanReport of MBL (Bank Purpose)ray rayBelum ada peringkat

- Final TopicDokumen123 halamanFinal TopicSonet IslamBelum ada peringkat

- Risk Management of JBL: A Panel Analysis For Financial StabilityDokumen58 halamanRisk Management of JBL: A Panel Analysis For Financial StabilityJasina Jahan NeetuBelum ada peringkat

- Internship ReportDokumen59 halamanInternship ReportMonisanker BiswasBelum ada peringkat

- Credit Risk Management On UCBLDokumen77 halamanCredit Risk Management On UCBLঅচেনা একজন100% (1)

- Table of Contens (2 Files Merged)Dokumen53 halamanTable of Contens (2 Files Merged)Md Khaled NoorBelum ada peringkat

- Chapter OneDokumen49 halamanChapter OneAnjum ShifaBelum ada peringkat

- Bank EvolutionDokumen8 halamanBank EvolutionNishit Acherzee PalashBelum ada peringkat

- Chapter 1 of Internship Report WritingDokumen4 halamanChapter 1 of Internship Report WritingSazedul Ekab0% (1)

- MercantileDokumen313 halamanMercantileShohan_1234100% (1)

- INTERNSHIP REPORT On HRM of SBLDokumen65 halamanINTERNSHIP REPORT On HRM of SBLAsibur RahmanBelum ada peringkat

- New ReportDokumen66 halamanNew ReportঅচেনামানুষBelum ada peringkat

- An Analysis of Deposit Scheme of Shahjalal Islami Bank LTDDokumen55 halamanAn Analysis of Deposit Scheme of Shahjalal Islami Bank LTDMonjur ShajibBelum ada peringkat

- Standard Chartered BankDokumen31 halamanStandard Chartered BankSumon AkhtarBelum ada peringkat

- Mercantile 1Dokumen313 halamanMercantile 1Ziaul HuqBelum ada peringkat

- Assignment For HR (Modified) Prime Bank Ltd.Dokumen54 halamanAssignment For HR (Modified) Prime Bank Ltd.death_heavenBelum ada peringkat

- Internship ReportDokumen58 halamanInternship ReportLenin Azad100% (1)

- "Borrower's Perception On Prime Bank Limited": University of Liberal Arts BangladeshDokumen57 halaman"Borrower's Perception On Prime Bank Limited": University of Liberal Arts BangladeshFahim RizwanBelum ada peringkat

- Credit Risk Management of United Commercial BDokumen45 halamanCredit Risk Management of United Commercial Bএকজন নিশাচরBelum ada peringkat

- Amar Ashol ReportDokumen126 halamanAmar Ashol ReportMorshedul HasanBelum ada peringkat

- Md. Abdullah Al Mahmud, School of BusinessDokumen4 halamanMd. Abdullah Al Mahmud, School of BusinessSaif Ahmed Khan RezvyBelum ada peringkat

- General MidlandDokumen65 halamanGeneral MidlandTauhid ZamanBelum ada peringkat

- SME Banking of Agrani Bank LTD PDFDokumen49 halamanSME Banking of Agrani Bank LTD PDFjoyBelum ada peringkat

- Final Silk Bank ReportDokumen58 halamanFinal Silk Bank ReportMujahid Gill100% (1)

- New One PDFDokumen39 halamanNew One PDFDeshi GamerBelum ada peringkat

- Jilani Final Report PDFDokumen40 halamanJilani Final Report PDFNafeun AlamBelum ada peringkat

- Al Arafa Islami BankDokumen65 halamanAl Arafa Islami BankSsilent Ssoul50% (2)

- A STUDY ON THE DIVIDEND POLICY OF GLOBAL IME BANK - Proposal Made by Sujina GauchanDokumen8 halamanA STUDY ON THE DIVIDEND POLICY OF GLOBAL IME BANK - Proposal Made by Sujina GauchanGolden FutureBelum ada peringkat

- Report On Credit Management of Janata BankDokumen75 halamanReport On Credit Management of Janata Bankazad100% (2)

- Chapter-1 Overview of The Study: Internship Report - 1Dokumen93 halamanChapter-1 Overview of The Study: Internship Report - 1Shuvo Taufiq AhmedBelum ada peringkat

- Chapter #01: Page 1 of 95Dokumen95 halamanChapter #01: Page 1 of 95sohelrana36Belum ada peringkat

- Internship Report On Loan & Advances of Bank Asia Limited: Submitted ToDokumen45 halamanInternship Report On Loan & Advances of Bank Asia Limited: Submitted ToNafiz FahimBelum ada peringkat

- Intro Paper PDFDokumen35 halamanIntro Paper PDFDeshi GamerBelum ada peringkat

- Report Janata BankDokumen53 halamanReport Janata BankEhasanul Hamim100% (1)

- Internship ReportDokumen80 halamanInternship ReportAhmed Imran KabirBelum ada peringkat

- Chapter - ONEDokumen37 halamanChapter - ONEDeshi GamerBelum ada peringkat

- Analysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedDokumen68 halamanAnalysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedPratikBhowmickBelum ada peringkat

- Report JanatabankDokumen95 halamanReport JanatabankManiul IslamBelum ada peringkat

- Performance AppraisalDokumen54 halamanPerformance AppraisalAbu BakrBelum ada peringkat

- General Banking System of NBLDokumen59 halamanGeneral Banking System of NBLsadhinBelum ada peringkat

- Critical Analysis of Credit Approval Process of The National Bank LimitedDokumen62 halamanCritical Analysis of Credit Approval Process of The National Bank Limitedekab88Belum ada peringkat

- Internship Report On Jamuna BankDokumen152 halamanInternship Report On Jamuna BankAnamul Huq BappyBelum ada peringkat

- Faizan KhanDokumen59 halamanFaizan KhanTalha Iftekhar Khan SwatiBelum ada peringkat

- Internship Report On Recruitment and Selection Policy of The City Bank Ltd.Dokumen39 halamanInternship Report On Recruitment and Selection Policy of The City Bank Ltd.Marshal Richard60% (5)

- Sustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersDari EverandSustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersBelum ada peringkat

- Job Satisfaction of Bank Employees after a Merger & AcquisitionDari EverandJob Satisfaction of Bank Employees after a Merger & AcquisitionBelum ada peringkat

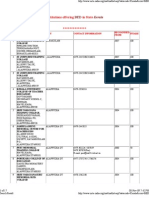

- Salary Sheet PBL Sales Aug-17Dokumen153 halamanSalary Sheet PBL Sales Aug-17Mohammed Zahidul Islam100% (7)

- Zahid - Customer Service With Sevice Marketing PerespectiveDokumen78 halamanZahid - Customer Service With Sevice Marketing PerespectiveMohammed Zahidul IslamBelum ada peringkat

- Political Economy of Regional Integration in South AsiaDokumen36 halamanPolitical Economy of Regional Integration in South AsiaMohammed Zahidul IslamBelum ada peringkat

- Horizontal Boundary of RFL Plastic LTDDokumen8 halamanHorizontal Boundary of RFL Plastic LTDMohammed Zahidul IslamBelum ada peringkat

- Sample Project Proposal For New Product Development To CommercializationDokumen3 halamanSample Project Proposal For New Product Development To CommercializationMohammed Zahidul Islam50% (2)

- A&P: The Digestive SystemDokumen79 halamanA&P: The Digestive SystemxiaoBelum ada peringkat

- Percy Bysshe ShelleyDokumen20 halamanPercy Bysshe Shelleynishat_haider_2100% (1)

- Service and Maintenance Manual AFPX 513 PDFDokumen146 halamanService and Maintenance Manual AFPX 513 PDFManuel Amado Montoya AgudeloBelum ada peringkat

- K9G8G08B0B SamsungDokumen43 halamanK9G8G08B0B SamsungThienBelum ada peringkat

- Practice Test 4 For Grade 12Dokumen5 halamanPractice Test 4 For Grade 12MAx IMp BayuBelum ada peringkat

- Etta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Dokumen44 halamanEtta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Peter M. HeimlichBelum ada peringkat

- Origin of "ERP"Dokumen4 halamanOrigin of "ERP"kanika_bhardwaj_2Belum ada peringkat

- Romanian Oil IndustryDokumen7 halamanRomanian Oil IndustryEnot SoulaviereBelum ada peringkat

- ObliCon Digests PDFDokumen48 halamanObliCon Digests PDFvictoria pepitoBelum ada peringkat

- 1.quetta Master Plan RFP Draft1Dokumen99 halaman1.quetta Master Plan RFP Draft1Munir HussainBelum ada peringkat

- Annexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsDokumen1 halamanAnnexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsMannepalli RamakrishnaBelum ada peringkat

- Balezi - Annale Générale Vol 4 - 1 - 2 Fin OkDokumen53 halamanBalezi - Annale Générale Vol 4 - 1 - 2 Fin OkNcangu BenjaminBelum ada peringkat

- Prepositions French Worksheet For PracticeDokumen37 halamanPrepositions French Worksheet For Practiceangelamonteiro100% (1)

- The Training Toolbox: Forced Reps - The Real Strength SenseiDokumen7 halamanThe Training Toolbox: Forced Reps - The Real Strength SenseiSean DrewBelum ada peringkat

- Acts 1 Bible StudyDokumen4 halamanActs 1 Bible StudyPastor Jeanne100% (1)

- Module 3 - Lesson 3.1Dokumen2 halamanModule 3 - Lesson 3.1Cj RomoBelum ada peringkat

- Indg 264.3 w02Dokumen15 halamanIndg 264.3 w02FrauBelum ada peringkat

- Department of Chemistry Ramakrishna Mission V. C. College, RaharaDokumen16 halamanDepartment of Chemistry Ramakrishna Mission V. C. College, RaharaSubhro ChatterjeeBelum ada peringkat

- Del Monte Usa Vs CaDokumen3 halamanDel Monte Usa Vs CaChe Poblete CardenasBelum ada peringkat

- List of Saturday Opened Branches and Sub BranchesDokumen12 halamanList of Saturday Opened Branches and Sub BranchesSarmad SonyalBelum ada peringkat

- Hercules Industries Inc. v. Secretary of Labor (1992)Dokumen1 halamanHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelBelum ada peringkat

- Influencing Factors Behind The Criminal Attitude: A Study of Central Jail PeshawarDokumen13 halamanInfluencing Factors Behind The Criminal Attitude: A Study of Central Jail PeshawarAmir Hamza KhanBelum ada peringkat

- Proper AdjectivesDokumen3 halamanProper AdjectivesRania Mohammed0% (2)

- 01ESS - Introducing Siebel ApplicationsDokumen24 halaman01ESS - Introducing Siebel ApplicationsRajaBelum ada peringkat

- Time Interest Earned RatioDokumen40 halamanTime Interest Earned RatioFarihaFardeenBelum ada peringkat

- The Changeling by Thomas MiddletonDokumen47 halamanThe Changeling by Thomas MiddletonPaulinaOdeth RothBelum ada peringkat

- Hilti Product Technical GuideDokumen16 halamanHilti Product Technical Guidegabox707Belum ada peringkat

- Reported Speech StatementsDokumen1 halamanReported Speech StatementsEmilijus Bartasevic100% (1)

- BedDokumen17 halamanBedprasadum2321Belum ada peringkat

- Power and MagicDokumen40 halamanPower and MagicSandro AmoraBelum ada peringkat