2010 - Natural Colours Flavours and Thickeners - Spain1

Diunggah oleh

Trần Tâm PhươngHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2010 - Natural Colours Flavours and Thickeners - Spain1

Diunggah oleh

Trần Tâm PhươngHak Cipta:

Format Tersedia

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

CBI MARKET SURVEY

THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Publication date: March 2010

Report summary

This CBI market survey discusses, amongst others, the following highlights for the natural

colours, flavours and thickeners market in Spain:

Spain is a medium-sized market for natural colours, flavours and thickeners in the EU.

Several food ingredient producers have facilities in Spain.

Spanish producers are strong competitors on products such as natural colours, citrus oils

and specific thickeners, including locust bean and agar-agar.

Spain is a medium-sized importer of natural colours, flavours and thickeners in the EU,

with imports amounting to 147 million in 2008. Between 2004 and 2008, the value of

imports increased by 7.2% annually. Spain is a net exporter of natural colours and agaragar.

Developing countries play an important role in Spanish imports, as they accounted for a

share of 50% in total imports. Moreover, imports from developing countries increased by

14% annually during the review period.

This survey provides exporters of natural colours, flavours and thickeners with sector-specific

market information related to gaining access to Spain. By focusing on a specific country, this

survey provides additional information, complementary to the more general information and

data provided in the CBI market survey The natural colours, flavours and thickeners market in

the EU, which covers the EU market in general. That survey also contains an overview and

explanation of the selected products dealt with, some general remarks on the statistics used as

well as information on other available documents for this sector. It can be downloaded from

http://www.cbi.eu/marketinfo.

1.

Market description: industrial demand and production

Industrial demand

Total market size

Spain is a medium-sized market for natural colours, flavours and thickeners in the EU. This is

largely due to the presence of several production facilities of multinational food ingredient

companies in the country, particularly flavour manufacturers. The Spanish food additive sector,

organised in the Spanish Association of Manufacturers and Traders of Food Additives, consisted

of 119 companies in 2009.

Spain has the fifth largest food industry in the EU, accounting for 9.7% of the total turnover of

the EU food industry. In 2007, the turnover of the Spanish food and drink industry was

estimated at 97 billion.

Table 1.1

Manufacturing of food products, beverages and tobacco in Spain

Food and drink

industry sectors

Total

Meat

Beverages

Oils and fats

Dairy

Share in EU food

industry, 2006

Share in Spanish

food industry, 2007

100%

*19.1%

14.1%

4.4%

12.7%

100%

19.6%

18.0%

11.2%

9.8%

Average annual

change in Spanish

food industry, 20032007

5.7%

6.6%

5.1%

10.3%

5.4%

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 1 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Food and drink

industry sectors

Share in EU food

industry, 2006

Animal feeds

Fruit and vegetables

Fish

Grain mill products

and starch

Tobacco

Other food products

Share in Spanish

food industry, 2007

*5.5%

5.6%

2.4%

3.5%

9.3%

7.6%

4.7%

3.4%

Average annual

change in Spanish

food industry, 20032007

5.2%

7.0%

4.6%

5.8%

7.1%

24.7%

0.9%

15.6%

-10.1%

3.8%

Source: Eurostat (2009)

* Data from 2005

Compared to other EU countries, the Spanish food industry achieves relatively much of the

turnover with the production of beverages, oils and fats, animal feed, fruit and vegetables and

fish. The market for specific natural colours, flavours and thickeners, which are used in these

segments, is thus estimated to be relatively large in Spain.

Growth in demand for many natural colours, flavours and thickeners slowed down during the

first year of the economic crisis, as traders and users reduced their stocks and working capital,

and shortened their contracts. According to the Spanish Federation of Food industries (FIAB),

however, the Spanish food industry has been affected less by the global economic crisis than

other economic sectors and still registered slight growth in 2008. The food additive and

supplements sector even grew by an estimated 6% in 2008. Moreover, since the second half of

2009, trade has picked up again, as inventories ran low and had to be replenished.

Between 2004 and mid-2005, Spain had the third highest number of new product releases

labelled as all natural or without preservatives or additives, after the UK and Germany

(Mintel, 2005). It is expected that industrial and consumer demand will at least remain stable

in the near future.

Product groups

Colours

Spain is estimated to be the fifth largest EU market for colours (synthetic and natural),

accounting for 10% of the total EU market. However, compared to other EU countries, Spain is

a relatively small market for natural colours, as opposed to synthetic colours. The interest in

natural colours, which are generally perceived to be healthier, is still low, due to the generally

higher costs of natural colours than synthetic and nature-identical colours. However, this

pattern is changing in favour of natural colours. The rapid increase in consumption of organic

products confirms the trend to natural products.

Flavours

Spain is estimated to be a medium-sized market for natural flavours in the EU. Several

multinational flavour manufacturers, such as Givaudan and Lucta, have production locations in

Spain. Most of the leading multinational flavour producing companies, however, have their

production facilities in other EU countries.

Citrus oils have for many years formed an especially important part of Spains gastronomic

traditions.

Thickeners

Spain is a large market for agar-agar and other thickeners in the EU. Industry sources indicate

that Spain has a strong demand for agar-agar, largely influenced by the agar-agar industry in

the country and by the national preference for this product. Demand is also strong for locust

bean gum and carrageenan. Locust bean gum is processed by several companies, including

Cargill. Carrageenan is mainly processed by the company CEAMSA.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 2 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Market segmentation

The market segmentation in Spain is similar to the market segmentation in other EU countries.

Therefore, please refer to the CBI survey on The natural colours, flavours and thickeners

market in the EU for an elaborate description of the market segmentation.

Spain is only the eight largest market for organic food products in the EU. In 2008, the total

sales of organic products amounted to 600 million or 0.6% of the total food market in Spain.

The average per capita consumption amounted to 13, compared to the EU average of 34.

Trends in industrial demand

Industrial demand for raw materials for natural colours and flavours is expected to further

harmonize with the rest of the EU. This will lead to more industrial demand for natural

colours and flavours, as opposed to synthetic products.

There is an increasing demand for convenience food with an attractive appearance and

similar in taste as catered or home-made food. The product formulations of these foods

must often include food additives to achieve these goals.

Demand for functional foods is increasing. Spanish consumers are particularly interested in

superfruits which contain vitamins, anti-oxidants and other nutrients. They are also

interested in fibre content. The Spanish food industry consequently uses increasing

amounts of functional ingredients in foods.

Spanish food manufacturers are removing fats from their product formulations, to respond

to increased demand from Spanish consumers for low-fat products. This favours the

replacement of gelatine and other fats by other texturising systems, which often contain

natural thickeners.

For more information on trends, please also refer to the CBI survey covering the EU market for

natural colours, flavours and thickeners.

Production

The production described here focuses on the production of raw materials, since the processing

into end-products has already been described in the previous section.

Total production

Spain is a leading producer of natural colours, flavours and thickeners in the EU. Essential oils

and thickeners are, in particular, produced in relatively large amounts. Industry sources

indicate that production of natural colours, flavours and thickeners is expected to increase, in

response to a growing demand for natural food ingredients.

Product groups

Colours

Spain is a large producer of natural colours in the EU, as indicated by industry sources. Spain

is a particularly large producer of paprika. Spain also has some cochineal production (30

tonnes annually) on the Canary Islands, and saffron production. The company Vitatene

(http://www.vitatene.com/) produces natural lycopenes and beta-carotenes. However, other

important products like anthocyanins are produced in other countries, and subsequently

supplied to Spain.

Flavours

Spain is a large producer of essential oils of oranges, grapefruits, mandarins, lemons and

bergamot oil. The citrus processing industry is of considerable size. Despite the strong

competition from other growing areas, the Mediterranean region produced more than one third

of the total lemon essential oil on the global market in 2006. Many buyers also prefer the

characteristics of the citrus oil produced in Spain. It is expected that Spanish production of

citrus fruits will continue to grow in the near future. The increased production of citrus fruits,

however, does not necessarily entail an increased production of citrus oils. Due to the higher

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 3 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

prices paid in the fresh fruit sector, an increasing share of the lemon production has been

diverted from the essential oils market to the fresh fruit market (Perfumer & Flavourist, 2005).

Table 1.2

Estimated production of essential oils in Spain, 2008

Product

Production size (tonnes)

Orange

800

Lemon

700

Mandarin

150

Rosemary

80

Spike Lavender

70

Lavendin

45

Thyme

40

Spanish Sage

30

Cypress

25

Labdanum oil

20

Spanish Oregano

20

Fennel (sweet)

15

Fennel (bitter)

8

Anise

6

Cade

5

Petitgrain

5

Grapefruit

5

Cistus

3

Rue

2

Bitter Orange

2

Narol

2

Eucalyptus

1

Lemon petitgrain

0.5

Source: Presentation Un "sojour" nel mondo delgi oli essenziali e degli estrattiof SISTE, 2008

Natural gum and seaweed thickeners

Spain is a leading producer of selected thickeners, such as locust bean gum, carrageenan and

agar-agar. Locust beans, which are used for the production of locust bean gum, can, in

Europe, only be found in the Mediterranean region. Spain is the largest producer of locust bean

gum in the EU, accounting for approximately half of the locust bean production. Between 2003

and 2007, Spanish production increased by 2% annually to an estimated 72 thousand tonnes

of locust beans (FAOstat, 2009). The locust bean gum is produced by around 5 companies. It

is expected that, in the near future, production of locust bean gum will further increase, in

order to meet the market demand.

The same industry sources indicate that Spain is also a large producer of carrageenan,

compared to other EU countries. The carrageenan is partly made from Chondrus seaweed

cultivated along the Spanish coast and partly from imported seaweeds. Furthermore, it is

expected that production of carrageenan will increase in the near future, as a result of

increased applications for hydrocolloids in the food industry.

Spain is the largest producer of agar-agar in the EU. For a great part, this is due to the fact

that the raw material for agar-agar is present along the Spanish coast line. Three companies

produce most of the agar-agar in Spain. Industry experts indicate that production has been

constant over recent years and it is expected that it will remain constant in the near future,

due to a stable supply of raw material.

Furthermore, Spain is a small producer of potato starch in the EU, as it has a production quota

of this product of 1.9 thousand tonnes for the marketing year 2008/2009. Potato starch could

be a competitive product to manioc starch. The country also manufactures corn and wheat

starch.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 4 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Finally, Spain does not produce significant amounts of alginates, pectins, xanthan gum, guar

gum or gum Arabic.

Major players

Herbes del Moli - http://www.herbesdelmoli.com - producer of essential oils.

Carbonnel - http://www.carbonnel.com - Producer of essential oils.

Destilaciones Bordas Chinchurreta - http://www.bordas-sa.com Producer of essential oils.

Ingredientes Naturales - http://www.ingrenat.com Producer of paprika oleoresin, paprika

powder, Rosemary, annatto and chlorophyll. Formerly part of Chr. Hansen.

Carob SA - http://www.carob.es - leading producer of locust bean gum and tara gum.

Ceamsa SA - http://www.ceamsa.com - producer of carrageenan and locust bean gum.

Roko SA - http://www.rokoagar.com - leading producer of agar-agar in the EU.

Hispanagar - http://www.hispanagar.com - producer of agar and carrageenan.

Iberagar - http://www.iberagar.com - producer of hydrocolloids.

Productos Giro - http://www.productosgiro.com/ - processor of locust vean gum, guar gum

and tara gum.

Compaia Espaola de Algas Marinas S.A. (CEAMSA) - producer of carrageenan.

Roquette - http://www.roquette.com French starch manufacturer, has a production

facility in Spain.

Syral - http://www.syral.com French starch manufacturer, has a production facility in

Spain.

Cargill http://www.cargill.es American company, has a cereal starch production facility

in Spain.

Trends in production

New developments in the production of agar-agar and QSA (Quick Soluble Agar) and

carrageenan have considerably extended their fields of applications across the whole food

industry, replacing gelatine and meeting Halal and kosher norms.

For more information on trends, please also refer to the CBI survey covering the EU market for

natural colours, flavours and thickeners.

Opportunities and threats

- Spain is a leading producer of natural colours, flavours and thickeners in the EU.

Particularly the production of paprika, citrus oils, and several thickeners (in particular

locust bean and agar-agar) could form a threat to developing country suppliers of these

products.

+ Spain has a leading food and drink industry with a strong demand for natural flavours and

thickeners. Moreover, demand for natural food ingredients in Spain is increasing, thus

offering opportunities for developing country suppliers.

+ Developing country suppliers can benefit most from the increased demand for functional

foods by promoting the functional characteristics of their products (e.g. anti-oxidant

content).

+ Demand for semi-refined, relatively cheap carrageenan is increasing. Moreover Spanish

cultivation of seaweed for carrageenan production consists only of Chondrus Crispus.

Developing countries supply most of the other types of seaweeds.

- The strong Spanish production of locust bean gum poses a threat to suppliers of guar gum,

which can be substituted by locust bean gum in several applications.

+/- Tara gum is being increasingly used as a substitute for locust bean gum, offering

opportunities for suppliers in developing countries of tara gum, but a threat to suppliers of

locust bean gum.

+/-Although the organic food market is expected to grow in the coming years, it is still

relatively small compared to other EU countries. Moreover, the steadily growing domestic

production of organic food forms a threat to DC exporters.

Exporters should take into account that the same trend can be an opportunity for one exporter

and a threat to another. Please review these opportunities and threats according to your own

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 5 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

situation. Chapter 7 of the CBI market survey The market for natural colours, flavours and

thickeners in the EU presents an example of an analysis of whether a trend/development is an

opportunity or a threat.

Useful sources

FIAB - http://www.fiab.es - Spanish Federation of Food and Drink Industries

AEFAA - http://www.aefaa.com - Spanish Food Flavours and Fragrances Association

FiBL - http://www.fibl.org/ - Research Institute for Organic Agriculture

2.

Trade channels for market entry

Trade channels

Natural colours, flavours and thickeners are traded at an EU level. A small number of

compounders, traders and agents internationally trade most of the Spanish and EU production.

The Spanish trade structure has to be viewed in conjunction with EU trade structure. Please

refer to the CBI survey on The natural colours, flavours and thickeners market in the EU.

Compounders

The market for colours and flavours is dominated by compounders, which supply the largest

food manufacturers. These multinational compounders are often vertically integrated including

import, production/processing, marketing and sales. Moreover, they are often integrated

horizontally as well, to include different products within the group of food additives (i.e.

colours and flavours).

Although production facilities are located in just one or only a few locations, sales offices of

compounders are spread out more widely. They are located in many different countries, in

order to cover specific countries or regions. International Flavours and Fragrances Inc. (IFF),

for example, has sales offices in 11 EU countries. Whereas smaller markets are often covered

by sales offices located in other countries, larger markets such as Spain are generally covered

by one office, dedicated solely to that market. By having offices in many different countries,

compounders are able to increase their market coverage and their knowledge of customer

requirements. In this manner, they can also reach more buyers and gather more information

about national, regional and company specific requirements. This enables them to compete

more successfully with other suppliers.

Distributors

The multinationals sometimes use a separate distributor. There are two main reasons for the

existence of distribution intermediaries in the market for ready-to-use natural colours, flavours

and thickeners: the need for readily available customer service and for just-in-time delivery.

Distributors enable exporters to enter a foreign market without specific operational knowledge

or experience in this market, and to provide customers with a consistent, quality supply of raw

materials.

Traders and agents

Smaller food manufacturers in Spain are, in many cases, supplied by independent traders and

agents. Similar to compounders, some traders have set up local offices in different countries

from where they sell their products. Local sales offices sometimes have their own purchasing

department. They basically operate independently, but under the same flag as the mother

trading company.

The EU-wide scope of the multinational compounders, traders and agents requires that

developing country exporters carefully assess the channels through which country and

company products reach end-users. The location of end-users is often different from where the

products are actually imported. Products sold by the sales office of IFF in Spain, for example,

might come from one of the production facilities in France, The Netherlands, Sweden or the

UK. This means that products from a developing country exporter, aiming to supply large food

manufacturers in Spain, might first have to go through these countries.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 6 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Major compounders, traders and agents active in the Spanish market for colours, flavours and

thickeners are listed below. Many of the major players are multinational companies which are

mentioned in the survey covering the EU market. For each company, an indication is given of

the location of the headquarters, production facilities or sales offices. Only offices and facilities

active in this market are shown:

Cosmos Aromtica Internacional - http://www.cosmosaromatica.es - manufacturer of

flavours based in Spain.

Lucta S.A. - http://www.lucta.com - manufacturer of flavours.

Cargill Espaa S.A. - http://www.cargill.com - supplier of flavours and thickeners.

Evesa - http://www.evesa.com - manufacturer of colours and flavours, based in Spain.

Givaudan Ibrica S.A - http://www.givaudan.com - manufacturer of flavours. It has a

creative office and 3 sales offices in Spain.

Deprovesa WILD S.A - http://www.wildflavors.com - manufacturer of flavours,

headquartered in the USA with a manufacturing facility in Spain.

Lluche - http://www.lluche.com trader of essential oils and oleoresins.

Ecoarome - http://www.ecoarome.com/ - flavour manufacturer.

Sancolor - http://www.sancolor.com colour manufacturer.

Ventos - http://www.ventos.com distributor of flavours.

Fraginter - http://www.fraginter.es - distributor of flavours.

Carob SA - http://www.carob.es - leading producer of locust bean gum and tara gum and

trader of guar gum and xanthan gum.

Univar Food Ingredients - http://www.univareurope.com distributor of colours, flavours

and thickeners.

De luque - http://www.deluque.com/ - flavour manufacturer.

Derivados Esenciales de Limn - http://www.delsa.es/ - flavour manufacturer.

Boix & Domnech - http://www.boix-domenech.es/ - trader of natural colours, flavours and

thickeners.

Coralim - http://www.coralim.com/ - trader of natural colours, flavours and thickeners.

Trades - http://www.trades-sa.com distributor of natural colours, flavours and

thickeners.

Other companies active in the Spanish market for natural colours, flavours and thickeners are:

Sensient Food Colors Europe (through distributors Vents and IMPEX Quimica), Symrise,

Firmenich, Danisco, Dhler, International Flavours & Fragrances, Robertet, Mane,

Eurofragrance, Destilaciones Bordas Chinchuretta, Dauper, Hausmann, Lluch Essence,

Brenntag, Curt Georgi, Crop Iberica, Functional Ingredients, Guzman Segui, Helm Iberica, and

Monteloeder.

Price structure

Different prices and margins apply throughout the various trade channels. In general, margins

in Spain follow those in the EU. Prices paid for materials increase significantly along the value

chain. However, the market is not transparent at the different levels, thus making impossible

to provide margins.

The margins charged by different intermediaries in the trade of natural colours, flavours and

thickeners are influenced by many different factors. These include the product type, the

current and expected future harvest situation, the availability or number of sources for the

particular product, the level of demand and the trend in prices.

Importers and traders generally take a margin of 10-25%, while agents take a margin of 510% in any market. However, due to the often very specific expertise needed in this sector,

the margins for these trade channels might be higher when compared to other sectors.

Moreover, the margins differ widely between the different product groups. In general, margins

at processing level by compounders are larger for flavours and colours than for thickeners.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 7 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Finding a suitable trading partner

Finding a trading partner in Spain does not deviate from the general EU method as described

in the CBI survey on The natural colours, flavours and thickeners market in the EU. Spanish

importers look for new suppliers in developing countries by visiting the country of interest,

through recommendations or through trade fairs. The most common ways for developing

country exporters to approach Spanish customers are through direct (e-)mail, personal visits

as follow-up, inviting potential Spanish customers to visit them, building a network and visiting

international trade fairs.

After obtaining contacts, evaluating potential trade partners should be done according to

criteria such as information quality, geographic coverage; the kind of trade relation the partner

is interested in, the position of the partner and the financial status and credibility.

The following websites can be of use when finding a trading partner in Spain:

For more suppliers of colours, flavours and thickeners - http://www.thomasglobal.com.

AEFAA - http://www.aefaa.com - Spanish Food Flavours and Fragrances Association

Ingredients Directory - http://www.ingredientsdirectory.com

Food Ingredients suppliers search engine - http://www.food-ingredients.com

Kompass - http://www.kompass.com/ - Supplier directory

3.

Trade: imports and exports

Imports

Total imports

Spain is the fifth largest EU importer of natural colours, flavours and thickeners, accounting for

7.2% of total EU imports. In 2008, Spain imported 147 million or 32 thousand tonnes of

natural colours, flavours and thickeners. Between 2004 and 2008, imports increased by 7.2%

annually in terms of value, but decreased by 3.2% annually in terms of volume. The decrease

in volume was mainly caused by a sharp decrease in the volume of locust bean imports. The

increase in value coincides with the increasing consumer interest in natural food ingredients, in

combination with the demand coming from the manufacturing industry in Spain.

Developing countries accounted for 50% of the supplies, which was a large share compared to

the average in the EU of 37%. Moreover, the value of imports from developing countries

increased by 14% annually in the period 2004-2008. The leading supplier was China,

accounting for 21% of the imports. Between 2004 and 2008, supplies from China increased at

an annual rate of 24% in terms of value. Supplies from India, the fourth largest supplier, also

increased at a high rate of 15% in this period. The Philippines is an emerging supplier, while

several other developing countries also supply significant amounts of natural colours, flavours

and thickeners.

Imports by product group

In terms of value, the imports of Spain consisted primarily of gum and seaweed thickeners

(40%) and essential oils (37%), followed by natural colours (18%), menthol, liquorice and

locust beans (4.7%) and manioc starch (0.3%). Imports of manioc starch are negligible and

are therefore not discussed in detail.

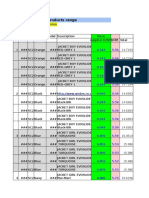

Table 3.1

Product

Total market

sector

Imports by and leading suppliers to Spain

2004 - 2008, share in % of value

2004

mln

2006

mln

2008

mln

60

67

7.0

7.6

44

56

Leading suppliers in 2008

Share in %

68 Intra-EU: France (13), Denmark (8.4), The

Netherlands (6.7), Germany (6.1), Portugal

(3.5), Italy (3.2)

6.1 Extra-EU ex. DC*: USA (2.1), U.A.

Emirates (0.6)

73 DC*: China (21), India (7.1), Philippines

Share

(%)

46

4

50

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 8 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

Product

Natural food

colours

Menthol,

liquorice and

locust beans

Essential oils

Manioc

starch

Natural gum

and seaweed

thickeners

2004

mln

2006

mln

2008

mln

5.4

5.7

7.7

0.3

0.5

0.2

15

18

19

2.0

1.9

3.2

0.1

0.3

0.3

2.5

3.8

3.4

19

21

21

5.3

5.9

4.8

19

20

28

0.2

0.1

0.2

0.0

0.0

0.0

0.0

0.0

0.3

34

38

35

1.3

0.9

0.8

7.0

14

23

Leading suppliers in 2008

Share in %

(5.1), Brazil (2.3), Indonesia (2.3), Peru

(2.2), Morocco (1.5), Malaysia (1.3), Haiti

(1.2), Chile (1.1)

Intra-EU: Ireland (9.1), Italy (7.0),

Germany (5.3), France (3.2), The

Netherlands (2.1),

Extra-EU ex. DC*: USA (1.5), Norway

(0.1), Japan (0.1)

DC*: China (53), India (9.0), Peru (6.4),

Zambia (0.5)

Intra-EU: Portugal (15), Germany (12),

France (9.8), Netherlands (4.0), Italy (2.1)

Extra-EU ex. DC*: Switzerland (2.3), Israel

(1.5), Japan (0.9)

DC*: India (23), China (16), Morocco

(5.9), Algeria (3.4), Tunisia (1.1)

Intra-EU: The Netherlands (13), France

(13), United Kingdom (3.3), Germany

(2.7), Italy (2.6)

Extra-EU ex. DC*: USA (5.0), U.A.

Emirates (1.6), Australia (0.7), Canada

(0.5)

DC*: China (18), India (8.2), Brazil (5.3),

Indonesia (5.3), Haiti (3.4), South Africa

(2.3), Morocco (1.8), Egypt (1.4),

Paraguay (1.3), Argentina (1.2)

Intra-EU: Germany (29), France (4.5), The

Netherlands (1.9)

Extra-EU ex. DC*: DC*: Thailand (35), Brazil (24), Colombia

(2.2), Paraguay (1.5), Bolivia (1.2), Peru

(0.8)

Intra-EU: Denmark (20), France (17),

Germany (8.7), Portugal (5.6), The

Netherlands (3.1)

Extra-EU ex. DC*: South Korea (0.7), USA

(0.4)

DC*: Philippines (13), China (11), India

(3.3), Malaysia (3.3), Chile (2.4), Peru

(2.4), Morocco (1.2), Pakistan (1.0),

Indonesia (0.9), Brazil (0.8)

Share

(%)

29

1

70

46

5

49

40

9

51

35

0

65

59

1

39

Source: Eurostat (2009)

*Developing Countries

Natural food colours

Spain is the fifth largest EU importer of natural colours, with imports amounting to 27 million

or 2.5 thousand tonnes in 2008, representing 11% of the total EU imports in that year.

Between 2004 and 2008, imports increased by 6.3% annually. China was by far the leading

supplier, accounting for 53% of the supplies. The value of Spanish imports from China

increased by 19% annually in the period under review. The imports from India, another

leading supplier, fluctuated, resulting in a net increase of 47%. In contrast, supplies by Peru

decreased by 4.9% annually on average.

Menthol, liquorice and locust beans

Spain is the sixth largest importer of menthol, liquorice and locust beans in the EU, accounting

for 5.0% of the total EU imports. In 2008, Spain imported 6.9 million or 10 thousand tonnes

of this product group. Between 2004 and 2008, the value of imports increased at an annual

rate of 11%.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 9 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

The value of supplies from developing countries increased by 7.9% annually during the review

period. The leading suppliers were India and China. Their supplies increased at annual rates of

64% and 16% respectively during the review period. China supplies mainly liquorice, while

India mainly supplies menthol. Supplies from Algeria peaked in 2006, and then decreased

rapidly.

In terms of value and compared to other EU countries, the Spanish imports consisted for a

relatively large part (24%) of locust beans, while liquorice comprised a relatively small part

(35%) of the imports.

Essential oils

Spain is a medium-sized importer of essential oils, accounting for 6.7% of total EU imports in

2008. Between 2004 and 2008, the value of imports increased by 5.5% annually on average.

The leading suppliers are China, The Netherlands and France. Between 2004 and 2008,

imports from China and The Netherlands increased rapidly, at annual rates of 20% and 41%

respectively. During the same period, imports from France decreased by 4.2% annually. China

mainly supplies spice and herb oils. Imports from all developing countries combined increased

by 9.3% annually during the review period.

In terms of value and compared to other EU countries, the Spanish imports consisted for a

relatively large part (18%) of orange oil, lemon oil (15%) and other citrus oils (17%). This

confirms the importance of citrus oils in Spanish gastronomy. The sources of the citrus oils are

diverse, including countries in Europe, Latin America, North America and Africa.

Natural gum and seaweed thickeners

Spain is a medium-sized EU importer of gum and seaweed thickeners, accounting for 7.0% of

total EU imports. Between 2004 and 2008, imports increased by 9.0% annually to 59 million

/ 12 thousand tonnes. The leading suppliers are the EU countries Denmark and France.

However, in the period 2004-2008, the value of imports from EU countries fluctuated, resulting

in a small net increase of 4.2%, while imports from developing countries increased rapidly at

35% annually.

The leading developing country suppliers are the Philippines and China. The value of imports

from these countries increased at annual rates of 83% and 62% respectively between 2004

and 2008. Other emerging suppliers are India, Malaysia, Chile and Peru.

The Spanish imports of natural gums and seaweeds consisted for a relatively large part of

carrageenan and alginates. Imports from the Philippines, Malaysia, Chile and Peru are

estimated to consist almost entirely of raw material supplies for carrageenan production. As

demand for carrageenan in the EU is increasing and raw material production in Spain is stable,

imports are rapidly increasing.

Exports

Spain is the third largest EU exporter of natural colours, flavours and thickeners. Between

2004 and 2008, the value of exports increased by 5.8% annually on average to 209 million /

45 thousand tonnes in 2008, representing 13% of total EU exports. The main countries of

destination are the USA, other West-European countries and Japan.

The exports primarily comprise domestically produced locust bean gum, carrageenan and agar.

Re-exports are small. In 2008, exports consisted for 52% of thickeners of natural gums and

seaweeds, for 23% of essential oils, and for 22% of natural food colours. The value of exports

of natural gum and seaweed thickeners, and essential oils both increased by 9.1% annually.

The value of exports of natural colours decreased by 1.4% annually during the review period.

Opportunities and threats

- Spain is a major competitor to suppliers in developing countries of many products under

review, including natural colours, lemon oil, locust bean gum, agar-agar and carrageenan.

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 10 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

+

+

+

+

Spain is a net exporter of these products and substitutes, which compete with these

products.

Developing countries still have a major role to play in the supply of raw materials for

several of the above-mentioned products, such as citrus oils, agar-agar and carrageenan.

The raw materials are processed in Spain and largely re-exported to other EU countries.

Developing countries supply a substantial part of the Spanish market for citrus oils.

Domestic production, which is relatively big, compared to other EU countries, is still not

sufficient.

The Spanish market for menthol, liquorice and locust beans offers particularly good

opportunities for developing country suppliers, as domestic production of menthol and

liquorice is small and demand is growing.

The market for manioc starch from developing countries is negligible. Domestic starch

production is significant and imports are very small.

The markets for gum Arabic and guar gum are small. These products face fierce competition

from locust bean gum and various seaweed-based thickeners.

The market for pectins offers good opportunities, as Spain does not produce pectins.

Moreover, pectins are the thickener of choice in many fruit preparations. The Spanish fruit

processing segment is considerable and the increase in pectins imports shows that interest

in pectins is growing.

Exporters should take into account that the same trend can be an opportunity for one exporter

and a threat to another. Please, review these opportunities and threats according to your own

situation. Chapter 7 of the CBI market survey The natural colours, flavours and thickeners

market in the EU presents an example of an analysis of whether a trend/development is an

opportunity or a threat.

Useful sources

EU Expanding Exports Helpdesk - http://exporthelp.europa.eu

go to: trade statistics

Eurostat http://epp.eurostat.ec.europa.eu - official statistical office of the EU

go to themes on the left side of the home page

go to external trade

go to data full view

go to external trade - detailed data

Understanding Eurostat: Quick guide to easy comext http://epp.eurostat.ec.europa.eu/newxtweb/assets/User_guide_Easy_Comext_20090513.pdf

4.

Price developments

Please refer to the CBI survey on The natural colours, flavours and thickeners market in the

EU for prices regarding this sector. The price indications given there are the best reference

point for prices in Spain. If any price differences exist, they are the result of differences in

transport costs and individual buyer preferences for product origin, quality, packaging, etc.

These differences are considerable, both between countries and within countries. Nonetheless,

global market prices as mentioned in the CBI market survey The natural colours, flavours and

thickeners market in the EU are the basis for price calculations in every country. Actual prices

are dependent on negotiation with partner companies.

Useful sources

The Public Ledger - http://www.public-ledger.com - prices for selected colours, flavours and

thickeners

MCX India - http://www.mcxindia.com - prices for menthol and guar

Organic Trade Services - http://www.organicts.com - prices for organic products

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 11 of 12

CBI MARKET SURVEY: THE NATURAL COLOURS, FLAVOURS AND THICKENERS

MARKET IN SPAIN

5.

Market access requirements

As a manufacturer in a developing country preparing to access Spain, you should be aware of

the market access requirements of your trading partners and the Spanish government.

Requirements are demanded through legislation and through labels, codes and management

systems. These requirements are based on environmental, consumer health and safety and

social concerns. You need to comply with EU legislation and have to be aware of the additional

non-legislative requirements that your trading partners in the EU might request.

For information on legislative and non-legislative requirements, go to Search CBI database at

http://www.cbi.eu/marketinfo, select food ingredients, and Spain in the category search,

click on the search button and click on market access requirements.

Packaging requirements are different for each type of product that you export, so please refer

to the CBI market survey covering the EU market for more information on this. Additional

information on packaging can be found at the website of ITC on export packaging:

http://www.intracen.org/ep/packit.htm

Information on tariffs and quota can be found at http://exporthelp.europa.eu

6.

Doing business

General information on doing business like approaching potential business partners, building

up a relationship, drawing up an offer, handling the contract (methods of payment, and terms

of delivery) can be found in CBIs export manuals Export Planner and Your image builder.

Furthermore, cultural awareness is a critical skill in securing success as an exporter.

Information on cultural differences in the EU can be found in chapter 3 of CBIs export manual

Exporting to the EU. These manuals can be downloaded from http://www.cbi.eu/marketinfo go to search publications.

In Chapter 2, the importance of networks, trade fairs and company visits was expressed in

terms of promoting your company and finding trade partners. Trade fairs also offer useful

information on trends, potential competitors and the products and services they offer. Trade

press should not be underestimated, both as a source of information (e.g. trends and

companies) and as a means of promoting your company and your products.

Trade associations

Spanish Federation of Food and Beverage Industries / Federacin Espaola de Industrias de

la Alimentacin y Bebidas - http://www.fiab.es

Spanish Association of Manufacturers and Traders of Food Additives - http://www.afcaaditivos.org

Trade press

On-line information tool on the Spanish Food Industry - http://www.marketuno.com

Tecnifood - http://www.tecnifood.com/ - Magazine on food technology

Trade fairs

Alimentaria Barcelona - http://www.alimentaria-bcn.com - International trade fair for the

food industry. The most recent event was held in March 2010.

Biocultura - http://www.biocultura.org - an organic trade fair annually held in November in

Madrid and Barcelona.

Qualimen - http://www.feriazaragoza.com/qualimen.aspx - International food market fair.

The next event will be held 1 to 3 March, 2011.

This survey was compiled for CBI by ProFound Advisers In Development

Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer

Source: CBI Market Information Database URL: www.cbi.eu Contact: marketinfo@cbi.eu www.cbi.eu/disclaimer

Page 12 of 12

Anda mungkin juga menyukai

- Feeding future generations: How finance can boost innovation in agri-food - Executive SummaryDari EverandFeeding future generations: How finance can boost innovation in agri-food - Executive SummaryBelum ada peringkat

- Hemp: Industrial Production and UsesDari EverandHemp: Industrial Production and UsesPierre BoulocBelum ada peringkat

- 2009 - Exotic Vegetable Oils For Cosmetics1Dokumen20 halaman2009 - Exotic Vegetable Oils For Cosmetics1quartzzBelum ada peringkat

- Exporter Guide Madrid Spain 12-31-2019Dokumen10 halamanExporter Guide Madrid Spain 12-31-2019RRSBelum ada peringkat

- Exporting Fresh Avocados To Europe: Contents of This PageDokumen15 halamanExporting Fresh Avocados To Europe: Contents of This PageZaira RamirezBelum ada peringkat

- Exporting Fresh Avocados To Europe: Contents of This PageDokumen16 halamanExporting Fresh Avocados To Europe: Contents of This PageGaitan YiselaBelum ada peringkat

- Exporting Fresh Table Grapes To Europe: Contents of This PageDokumen15 halamanExporting Fresh Table Grapes To Europe: Contents of This PageDhanaaBelum ada peringkat

- 2 Spice SHDokumen149 halaman2 Spice SHSusi UmifarahBelum ada peringkat

- Albania Pomegranate Market Opportunities 12-19-21 1Dokumen21 halamanAlbania Pomegranate Market Opportunities 12-19-21 1Ajo2000Belum ada peringkat

- Food Industry in FranceDokumen9 halamanFood Industry in FrancecsbwoodBelum ada peringkat

- Market Insider Essential Oils Report-AprilDokumen16 halamanMarket Insider Essential Oils Report-AprilNilamdeen Mohamed ZamilBelum ada peringkat

- Pharmaceutical Sector ProfileDokumen1 halamanPharmaceutical Sector Profilevipul tutejaBelum ada peringkat

- ArgentinafinalDokumen28 halamanArgentinafinalAkansha VermaBelum ada peringkat

- Food Processing Ingredients Poland 2019Dokumen9 halamanFood Processing Ingredients Poland 2019Mera Samir100% (1)

- UK FNB Market ProfileDokumen18 halamanUK FNB Market ProfileTaofiq AbiolaBelum ada peringkat

- Functional FoodsDokumen8 halamanFunctional Foodsmokshgoyal2597Belum ada peringkat

- Europe SpecificationDokumen10 halamanEurope SpecificationCallisBelum ada peringkat

- The Spices and Herbs Market in The Eu 2009Dokumen49 halamanThe Spices and Herbs Market in The Eu 2009Vlad KitaynikBelum ada peringkat

- 5-Spain-IM PROJECT - GROUP 5Dokumen13 halaman5-Spain-IM PROJECT - GROUP 5Antony LawrenceBelum ada peringkat

- Halal Market in FranceDokumen12 halamanHalal Market in FranceFikri Haikal HakimBelum ada peringkat

- ApiHoney Business Plan Integra1Dokumen21 halamanApiHoney Business Plan Integra1Imane ZouhouredineBelum ada peringkat

- CBI - Centre For The Promotion of Imports From Developing Countries - Exporting Pepper To Europe - 2018-09-04Dokumen15 halamanCBI - Centre For The Promotion of Imports From Developing Countries - Exporting Pepper To Europe - 2018-09-04Joe ThampiBelum ada peringkat

- ApiHoney Business Plan Integra1 PDFDokumen21 halamanApiHoney Business Plan Integra1 PDFMoki RibolovBelum ada peringkat

- Product Factsheet Europe Fresh Sweet Potatoes 2015Dokumen15 halamanProduct Factsheet Europe Fresh Sweet Potatoes 2015Bebo Gomez BruBelum ada peringkat

- The Food & Beverage Industry in GermanyDokumen16 halamanThe Food & Beverage Industry in Germanymarcus0% (1)

- Market and Legislation: Essential OilsDokumen10 halamanMarket and Legislation: Essential OilsKarina Ariana MariniBelum ada peringkat

- Industry NetherlandsDokumen3 halamanIndustry Netherlandsvictoriaavalos0902Belum ada peringkat

- The European Model of Agriculture - The Future of Modern FarmingDokumen6 halamanThe European Model of Agriculture - The Future of Modern FarmingfauzifaBelum ada peringkat

- Fepex GermanyDokumen5 halamanFepex GermanyNancy NurinasariBelum ada peringkat

- Case Study GrapesDokumen2 halamanCase Study GrapesHaripriya BBelum ada peringkat

- Food Processing Ingredients: Report NameDokumen10 halamanFood Processing Ingredients: Report NameAreti MalkogianniBelum ada peringkat

- Production of Fresh Fruits and Vegetables in GermanyDokumen15 halamanProduction of Fresh Fruits and Vegetables in GermanyRavi KumarBelum ada peringkat

- Stepin Analysis of SpainDokumen13 halamanStepin Analysis of SpainSandeep NairBelum ada peringkat

- The United States Market For Organic Food and Beverages: International Trade CentreDokumen40 halamanThe United States Market For Organic Food and Beverages: International Trade CentreGurpreet SainiBelum ada peringkat

- Report On Biofach 2015 PDFDokumen40 halamanReport On Biofach 2015 PDFTuan VuBelum ada peringkat

- Market Brief Tara Gum FinalDokumen20 halamanMarket Brief Tara Gum FinalNguyen PhungBelum ada peringkat

- PR InglesDokumen2 halamanPR InglesBioComercioPeruBelum ada peringkat

- Spices and Aromatic Plants in MoroccoDokumen17 halamanSpices and Aromatic Plants in Moroccoelm_lamraniBelum ada peringkat

- Organic Europe - Country Report About Organic Agriculture in PortugalDokumen19 halamanOrganic Europe - Country Report About Organic Agriculture in PortugalJosé Maria de AzeredoBelum ada peringkat

- JRC Food Fraud Summary January 2017Dokumen3 halamanJRC Food Fraud Summary January 2017rajashekhar asBelum ada peringkat

- Retail Foods - The Hague - Netherlands - 06-30-2020Dokumen10 halamanRetail Foods - The Hague - Netherlands - 06-30-2020sb AgrocropsBelum ada peringkat

- Ma Global Flavours Industry en PDFDokumen11 halamanMa Global Flavours Industry en PDFDhanupriya Suresh KumarBelum ada peringkat

- CBI Channel and Segments:: Honey in EuropeDokumen5 halamanCBI Channel and Segments:: Honey in EuropeArjun AhujaBelum ada peringkat

- FRANCE 2010 - Confectionery, Chocolate & Gum Products - ShortDokumen4 halamanFRANCE 2010 - Confectionery, Chocolate & Gum Products - ShortMonica BîldeaBelum ada peringkat

- Barilla - CaseDokumen14 halamanBarilla - CaseSevana YadegarianBelum ada peringkat

- Industry05 TheFoodIndustryDokumen10 halamanIndustry05 TheFoodIndustryVinny RlzBelum ada peringkat

- Inbread enDokumen130 halamanInbread encristinanton7Belum ada peringkat

- Retail Foods Netherlands 2018 PDFDokumen9 halamanRetail Foods Netherlands 2018 PDFAreti MalkogianniBelum ada peringkat

- Introduction and Scope of The StudyDokumen6 halamanIntroduction and Scope of The StudyTeeJyyBelum ada peringkat

- Essential Oils For Cosmetics in The NetherlandsDokumen4 halamanEssential Oils For Cosmetics in The NetherlandsGiuseppe G.100% (1)

- Comercio InternacionalDokumen10 halamanComercio InternacionalIvan Santiago Amaya BlancoBelum ada peringkat

- Bio Agricultural Product Market in Romania and Europe: Bulletin of Series V: Economic Sciences - Vol. 9 (58) No. 1 - 2016Dokumen8 halamanBio Agricultural Product Market in Romania and Europe: Bulletin of Series V: Economic Sciences - Vol. 9 (58) No. 1 - 2016Cristina NicolaeBelum ada peringkat

- Protectionist Policies Case Study Indian WineDokumen7 halamanProtectionist Policies Case Study Indian Wineyogeshbherwani260691100% (1)

- SIPPO Manual 18.04.2011 FinalDokumen148 halamanSIPPO Manual 18.04.2011 FinalJosé Salazar MedinaBelum ada peringkat

- 19.01.20201 Table Description: (195 Words)Dokumen2 halaman19.01.20201 Table Description: (195 Words)Nguyễn Phương NgọcBelum ada peringkat

- Political: PESTLE Analysis of RAW PresseryDokumen6 halamanPolitical: PESTLE Analysis of RAW PresseryRakeshbhai PatelBelum ada peringkat

- Brewing Industry Case Study Part AnsDokumen5 halamanBrewing Industry Case Study Part AnsRohail SiddiqueBelum ada peringkat

- Exporting Cinnamon To Europe CBIDokumen1 halamanExporting Cinnamon To Europe CBIDra Perwira PurbaBelum ada peringkat

- Varietals of Capitalism: A Political Economy of the Changing Wine IndustryDari EverandVarietals of Capitalism: A Political Economy of the Changing Wine IndustryBelum ada peringkat

- Costs and Margins in The Retail Supply Chain: Patrick D'Arcy, David Norman and Shalini ShanDokumen10 halamanCosts and Margins in The Retail Supply Chain: Patrick D'Arcy, David Norman and Shalini ShanTrần Tâm PhươngBelum ada peringkat

- Beyond CAnningDokumen195 halamanBeyond CAnningTrần Tâm Phương100% (8)

- Local For Local - Han2015Dokumen364 halamanLocal For Local - Han2015Trần Tâm PhươngBelum ada peringkat

- Decathlon Hanoi Outlet: Sport For All - All For SportDokumen19 halamanDecathlon Hanoi Outlet: Sport For All - All For SportTrần Tâm PhươngBelum ada peringkat

- Salute Test Report (Second Test)Dokumen3 halamanSalute Test Report (Second Test)Trần Tâm PhươngBelum ada peringkat

- Ourse Objectives: To Gain An Understanding of The Following ConceptsDokumen2 halamanOurse Objectives: To Gain An Understanding of The Following ConceptsTrần Tâm PhươngBelum ada peringkat

- Parcel To DOMANCY - FrancoisDokumen1 halamanParcel To DOMANCY - FrancoisTrần Tâm PhươngBelum ada peringkat

- Chemical Comp Web 14509Dokumen1 halamanChemical Comp Web 14509Trần Tâm PhươngBelum ada peringkat

- RS - CPMDokumen5 halamanRS - CPMTrần Tâm PhươngBelum ada peringkat

- The Effects of Using Seaweed On The Quality of Asian NoodlesDokumen4 halamanThe Effects of Using Seaweed On The Quality of Asian NoodlesTrần Tâm PhươngBelum ada peringkat

- ProcedureDokumen1 halamanProcedureTrần Tâm PhươngBelum ada peringkat

- Market Research On Value-Added Seaweed ProductsDokumen23 halamanMarket Research On Value-Added Seaweed ProductsTrần Tâm PhươngBelum ada peringkat

- A 2 Snu 354 GDDokumen20 halamanA 2 Snu 354 GDTrần Tâm Phương50% (2)

- 50ml TitrationDokumen1 halaman50ml TitrationTrần Tâm PhươngBelum ada peringkat

- Job Number Sample Name Na (%) F (%) - ISE05V F (%) - XRF76V P (%)Dokumen12 halamanJob Number Sample Name Na (%) F (%) - ISE05V F (%) - XRF76V P (%)Trần Tâm PhươngBelum ada peringkat

- Anggun-Neni-Dadan FORMULATION AND EVALUATION OF SHEET MASK FROM RED RICEDokumen6 halamanAnggun-Neni-Dadan FORMULATION AND EVALUATION OF SHEET MASK FROM RED RICENeni Sri GunartiBelum ada peringkat

- Michem™ Dispersion Urethane 2012: Technical Data SheetDokumen3 halamanMichem™ Dispersion Urethane 2012: Technical Data Sheetsriatul2006Belum ada peringkat

- College For Research and TechnologyDokumen3 halamanCollege For Research and Technologyjudea dizonBelum ada peringkat

- Fillers Fill Out The Size of A Tablet or CapsuleDokumen5 halamanFillers Fill Out The Size of A Tablet or CapsuleHazel TongsonBelum ada peringkat

- COOKERY10 - 2 - 3rd QuarterDokumen20 halamanCOOKERY10 - 2 - 3rd QuarterApril LiwanagBelum ada peringkat

- Clean Label Ingredients BrochureDokumen8 halamanClean Label Ingredients BrochureIngredion Knowledge Bank100% (1)

- Pigmente Katalog Oktober 2013 FinalwebDokumen12 halamanPigmente Katalog Oktober 2013 FinalwebRatih AriyaniBelum ada peringkat

- 14 - Printing PresentationDokumen81 halaman14 - Printing PresentationVinalee Seneviratne100% (1)

- FT Cellosize Er 100m QuimidrogaDokumen2 halamanFT Cellosize Er 100m QuimidrogaJose Garcia MartinezBelum ada peringkat

- Food Additives Report 2010 FINALDokumen64 halamanFood Additives Report 2010 FINALMinh Nguyen MinhBelum ada peringkat

- Flour Alternatives PDFDokumen10 halamanFlour Alternatives PDFHugo AzzolinaBelum ada peringkat

- Q3 Module4 G10-CookeryDokumen8 halamanQ3 Module4 G10-CookeryJayzi Vicente100% (1)

- Acrysol Acrysol ACRYSOL Rheology Modifiers: Product Solutions GuideDokumen12 halamanAcrysol Acrysol ACRYSOL Rheology Modifiers: Product Solutions GuidePquim S.A.S. EmpresaBelum ada peringkat

- Polygel HPDokumen2 halamanPolygel HPDaniel RoldánBelum ada peringkat

- Level 2 I561-005!2!2022 Food PreparationDokumen168 halamanLevel 2 I561-005!2!2022 Food PreparationMuhammad AminBelum ada peringkat

- BSS Sem Ii PDFDokumen361 halamanBSS Sem Ii PDFvSravanakumarBelum ada peringkat

- Tle10 - Week 4Dokumen13 halamanTle10 - Week 4Lorry ManuelBelum ada peringkat

- Texturizantes EngDokumen24 halamanTexturizantes EngDaniel NikolovBelum ada peringkat

- Starch and CerealsDokumen30 halamanStarch and CerealsGraceBelum ada peringkat

- PC 4 Product List 2020Dokumen26 halamanPC 4 Product List 2020Sh100% (1)

- Ciba Product BrochureDokumen18 halamanCiba Product Brochuremicrobiologist125100% (4)

- Food AdditivesDokumen8 halamanFood AdditivesLingaraj KumarBelum ada peringkat

- Thicken ErDokumen3 halamanThicken ErErnesto Vicuña IslasBelum ada peringkat

- Food Additives - ClassificationDokumen6 halamanFood Additives - Classificationpruebas123123Belum ada peringkat

- Food Bioscience: Digambar Kavitake, Sujatha Kandasamy, Palanisamy Bruntha Devi, Prathapkumar Halady ShettyDokumen11 halamanFood Bioscience: Digambar Kavitake, Sujatha Kandasamy, Palanisamy Bruntha Devi, Prathapkumar Halady ShettyAlexandruBelum ada peringkat

- LPLP PDFDokumen12 halamanLPLP PDFAnand100% (1)

- 3RD PT Cookery 10Dokumen3 halaman3RD PT Cookery 10abie manuelcariagaBelum ada peringkat

- TDS-294 Carbopol Aqua SF-1Dokumen9 halamanTDS-294 Carbopol Aqua SF-1adriana Liñan100% (1)

- Making Soy ConvenientpdfDokumen4 halamanMaking Soy ConvenientpdfHuonglemaiBelum ada peringkat

- Food Processing Lab 1Dokumen19 halamanFood Processing Lab 1Vanessa LimBelum ada peringkat