Country Environmental Analysis in BD

Diunggah oleh

Emran Hossain NilHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Country Environmental Analysis in BD

Diunggah oleh

Emran Hossain NilHak Cipta:

Format Tersedia

2008-09

2009-10

2008-09

2005-06

2007-08

2008-09

2009-10

(Tk.)

2006-07

221,572

150,724

168,671

2007-08

2008-09

2009-10

(000Tk.)

Earnings Per Share

Turnover

Page 20

2008-09

2005-06

2006-07

2007-08

2008-09

(000Tk.)

(000Tk.)

Gross Profit

Operating Profit

2009-10

2005-06

2008-09

(7,842)

(8,693)

2009-10

2007-08

13,420

16,817

7,194

8,552

45,314

27,477

32,651

2007-08

855

2006-07

97

2005-06

20,879

23,267

30,334

15,761

Market Price of Share

2005-06

151,581

149,197

2006-07

(Tk.)

Shareholders' Equity

0.48

0.05

2009-10

(4.39)

2007-08

(4.87)

2006-07

165

124

55

2005-06

(000Tk.)

53

2007-08

190,322

192,429

200,507

2006-07

51

2005-06

175,361

183,203

8.82

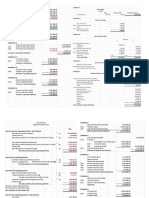

KEY PERFORMANCE INDICATORS

2006-07

(000Tk.)

Net Profit

2009-10

FIVE YEARS AT A GLANCE

Financial Position:

2009-2010

2008-2009

2007-2008

2006-2007

2005-2006

Authorized Capital

000'Tk

200,000

200,000

200,000

200,000

200,000

Paid up Share Capital

000'Tk

178,678

178,678

178,678

178,678

178,678

Reserves and Surplus

000'Tk

11,644

13,751

21,830

(3,317)

(4,525)

Shareholders' Equity

000'Tk

190,322

192,429

200,508

175,361

183,203

Total Assets

000'Tk

543,487

414,511

360,995

315,368

326,168

Fixed Assets - Cost

000'Tk

578,985

444,476

382,890

322,343

309,367

Fixed Assets - Carrying Value

000'Tk

403,877

286,756

239,201

161,902

165,924

Net Working Capital

000'Tk

(142,354)

(2,406)

(5,355)

8,334

(9,511)

Net Profit for the year

000'Tk

15,761

855

97

(7,842)

(8,693)

Revenue from Sales

000'Tk.

221,572

150,725

168,672

151,581

149,197

Gross Profit Margin

20.45%

18.23%

19.36%

13.77%

15.60

Operating Profit

13.69%

8.90%

9.97%

4.75%

5.73

Net Profit /(Loss)

7.11%

0.57%

0.06%

-5.17%

(5.83)

Earning per Share

Tk.

8.82

0.48

0.05

(4.39)

(4.87)

Dividend per Share

Tk.

10.00

5.00

5.00

5.00

Current Ratio

Times

0.49: 1

0.98 : 1

0.96 : 1

1.08 : 1

0.93:1

Inventory Turnover

Times

2.83

1.95

2.79

2.75

1.96

Debtors Turnover

Days

112.96

142.46

112.54

127.17

153.90

Debt Equity Ratio

Tk.

38:62

54:46

44:56

44:56

44:56

Results of Operation:

Key Financial Ratios:

Return on Investment

2.90%

0.21%

0.03%

-2.49%

-2.67%

Net Assets Value per Share

Tk.

106.52

107.70

112.22

98.14

102.53

Market Value of Share (as on 30th June)

Tk.

165

124

53.00

35.25

55.00

Dividend Yield

6.06%

4.03%

9.43%

9.09%

0.65

0.87

2.12

2.78

1.86

Price Book Value Ratio

Times

Other Information:

Total Shares

No.

1,786,780

1,786,780

1,786,780

1,786,780

1,786,780

Total Shareholders

No.

4,218

4,265

4,392

4,539

4,645

Number of Employees

No.

295

278

274

229

230

Page 21

Anlima Yarn Dyeing Limited

Balance Sheet

As on June 30, 2010

ASSETS:

Non-Current Assets

Property, Plant and Equipment - Net Book Value

Long Term Advances & Deposits

Current Assets

Inventories

Advances, Deposits & Receivables

Cash and Cash Equivalents

TOTAL ASSETS

EQUITY AND LIABILITIES:

Shareholders Equity

Issued Share Capital

Tax Holiday Reserve

Dividend Equalization Reserve

Accumulated Profit/(Loss) - as per the Statement of Changes in Equity

Non-Current Liabilities

Term Loans

Current Liabilities and Provisions

Short Term Loan

Liabilities for Expense

Liabilities for Other Finance

Proposed Dividend

TOTAL EQUITY AND LIABILITIES

Net Assets Value per share

Accounting Policies (Note - 5).

Contingent Liabilities and Commitments (Note - 34 & 35).

Accompanying notes are integral part of the Financial Statements.

Approved by the Board on October 30, 2010 and signed on its behalf by:

Notes

9

10

30.06.2010

30.06.2009

404,721,663

287,600,628

403,876,849

844,814

286,755,814

844,814

138,765,821

126,910,342

62,840,545

74,284,958

1,640,318

61,720,585

62,286,268

2,903,489

11

12

13

Tk.

14

15

16

17

18

19

20

Tk.

543,487,484

Tk.

414,510,970

190,322,179

192,429,353

178,678,000

8,162,461

2,802,178

679,540

178,678,000

8,162,461

4,302,178

1,286,714

72,045,208

92,765,412

72,045,208

92,765,412

281,120,097

129,316,205

254,051,301

4,446,147

4,754,849

17,867,800

109,475,877

8,710,903

2,195,525

8,933,900

543,487,484

106.52

Tk.

414,510,970

107.70

Mahmudul Hoque

Hubbun Nahar Hoque

Managing Director

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October

30, 2010

Ata Khan & Co.

Chartered Accountants

Page 24

Anlima Yarn Dyeing Limited

Profit and Loss Account

For the year ended June 30, 2010

Notes

NET REVENUE (TURNOVER) FROM SALES

Cost of Sales

GROSS PROFIT

OPERATING EXPENSES

Administrative Expenses

Marketing Expenses

PROFIT FROM OPERATIONS

Financing Cost

21

2009-2010

TK.

22

Basic Earning Per Share (Par value Tk. 100/-)

Number of shares used to compute EPS

Accounting Policies (Note - 5).

Accompanying notes are integral part of the Financial Statements.

Approved by the Board on October 30, 2010 and signed on its behalf by:

221,571,751

TK.

150,724,959

(176,257,401)

(123,247,478)

45,314,351

27,477,481

26

(12,009,376)

(11,546,032

27

(2,970,805)

(2,511,184)

(14,980,181)

(14,057,216)

28

Other Income

Contribution to Workers Profit Participation / Welfare Fund

NET PROFIT BEFORE TAX

Provision for Income Tax

NET PROFIT AFTER TAX FOR THE YEAR

2008-2009

29

31

30,334,170

13,420,265

(13,585,773)

(13,163,522)

16,748,397

256,743

2,720,222

799,751

19,468,619

1,056,494

926,706

50,310

18,541,913

1,006,184

2,781,287

150,298

15,760,626

855,256

TK.

8.82

1,786,780

TK.

0.48

1,786,780

Mahmudul Hoque

Hubbun Nahar Hoque

Managing Director

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 30, 2010

Ata Khan & Co.

Chartered Accountants

Page 25

Anlima Yarn Dyeing Limited

Statement of Changes in Equity

For the year ended June 30, 2010

Balance as on June 30, 2009

Tk.

Transferred from Dividend Equalisation Reserve

Net Profit for the year transferred from

Profit and Loss Account

Proposed Dividend for 2009-10

Balance as on June 30, 2010

Tk.

Share

Tax Holiday

Dividend Equal-

Retained

Total

Capital

Reserve

ization Reserve

Earnings

Equity

178,678,000

8,162,461

4,302,178

1,286,714

1,500,000

192,429,353

(1,500,000)

15,760,626

15,760,626

(17,867,800)

(17,867,800)

679,540

190,322,179

178,678,000

8,162,461

2,802,178

Statement of Changes in Equity

For the year ended June 30, 2009

Share

Tax Holiday

Dividend

Retained Earn-

Total

Capital

Reserve

Equalization

ings

Equity

Reserve

Balance as on June 30, 2008

Tk.

178,678,000

Transferred from Dividend Equalisation Reserve

8,162,461

5,802,178

7,865,358

(1,500,000)

1,500,000

200,507,997

-

Net Profit for the year transferred

from Profit and Loss Account

Proposed Dividend for 2008-2009

Balance as on June 30, 2009

Figures in brakets indicate deductions.

Tk.

178,678,000

8,162,461

4,302,178

855,256

855,256

(8,933,900)

(8,933,900)

1,286,714

192,429,353

Accompaying notes are integral part of the Financial Statements.

Approved by the Board on October 30, 2010 and signed on its behalf by:

Mahmudul Hoque

Hubbun Nahar Hoque

Managing Director

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 30, 2010

Ata Khan & Co.

Chartered Accountants

Page 26

Anlima Yarn Dyeing Limited

Cash Flow Statement

For the year ended June 30, 2010

30.06.2010

Cash Flow from Operating Activities:

Cash Collection from Customers

Cash Payment for Cost and Expenses

Cash Generated from Operations

Interest paid

Income Tax Paid

Tk.

Net Cash Generated from Operations

Cash Flow from Investing Activities:

Construction of Factory Building

Purchase of Plant & Machinery

Purchase of Electrical & Office Equipment

Net Cash Used in Investing Activities

Cash Flow from Financing Activities:

Short Term Loan - Cash Credit Received

Long Term Loan Repayment

Payment of Dividend (Note-33)

Net Cash Generated from Financing Activities

Net Increase/(Decrease) in Cash and Cash Equivalent

212,293,283

144,751,104

(174,969,951)

(121,997,566)

37,323,332

22,753,538

(17,965,291)

(382.772)

(12,255,554)

-

18,975,269

10,497,984

(16,095,370)

(55,500)

(115,463,664)

(60,752,917)

(2,949,374)

(1,863,762)

(134,508,408)

(62,672,179)

144,575,424

(329,371)

(20,720,204)

58,582,605

(9,585,252)

(3,718,543)

114,269,968

54,534,691

(1,263,171)

2,360,496

2,903,489

Cash and Cash Equivalent at the beginning of year

Tk.

Cash and Cash Equivalent at the closing of year

1,640,318

Net Operating Cash Flow per Share

Figures in braket indicate deductions.

Accompanying notes are integral part of the Financial Statements.

Approved by the Board on October 30, 2010 and signed on its behalf by:

Mahmudul Hoque

30.06.2009

Tk.

Hubbun Nahar Hoque

542,993

Tk.

2,903,489

10.62

5.88

M. Abul Kalam Mazumdar

Managing Director

Director

Director

As per our report of even date.

Dhaka

October 30, 2010

Ata Khan & Co.

Chartered Accountants

Page 27

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Accountancy Project Workbook - 1 PDFDokumen32 halamanAccountancy Project Workbook - 1 PDFmadhav agarwal88% (8)

- Financial Mangement McqsDokumen23 halamanFinancial Mangement Mcqsowaishazara67% (3)

- Restaurant-Feasibility-Report-in-Pakistan ZaheerDokumen12 halamanRestaurant-Feasibility-Report-in-Pakistan ZaheerzaheerBelum ada peringkat

- Integrated Siting SystemDokumen8 halamanIntegrated Siting SystemSahrish Jaleel Shaikh100% (4)

- Short Questions FMDokumen21 halamanShort Questions FMsultanrana100% (1)

- Mobile AccessoriesDokumen27 halamanMobile AccessoriesDiya BoppandaBelum ada peringkat

- World CupDokumen2 halamanWorld CupEmran Hossain NilBelum ada peringkat

- Standard Bank Limited Head OfficeDokumen1 halamanStandard Bank Limited Head OfficeAbhijit SahaBelum ada peringkat

- Garment Unrest in BDDokumen81 halamanGarment Unrest in BDKanak DasBelum ada peringkat

- In Depth Study On Different International StandardsDokumen108 halamanIn Depth Study On Different International StandardsAhsan HabibBelum ada peringkat

- Labor Unrest in Banglades H RMG SectorDokumen58 halamanLabor Unrest in Banglades H RMG Sectorzafar71100% (1)

- In Depth Study On Different International StandardsDokumen108 halamanIn Depth Study On Different International StandardsAhsan HabibBelum ada peringkat

- Online ShopingDokumen9 halamanOnline ShopingEmran Hossain NilBelum ada peringkat

- Contribution of Labor Law in Garments Industries of BangladeshDokumen12 halamanContribution of Labor Law in Garments Industries of BangladeshEmran Hossain NilBelum ada peringkat

- Recruitment and Selection Process" by SHAHJALAL ISLAMI BANK LIMITEDDokumen48 halamanRecruitment and Selection Process" by SHAHJALAL ISLAMI BANK LIMITEDEmran Hossain NilBelum ada peringkat

- Online ShopingDokumen9 halamanOnline ShopingEmran Hossain NilBelum ada peringkat

- Reading 32 Working Capital - LiquidityDokumen13 halamanReading 32 Working Capital - LiquidityNeerajBelum ada peringkat

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperDokumen8 halaman7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperShehroze Ali JanBelum ada peringkat

- Quest 3Dokumen14 halamanQuest 3Koja AabiiBelum ada peringkat

- Cash BudgetDokumen8 halamanCash BudgetKei CambaBelum ada peringkat

- Exercise Dan Jawaban Lab 5 - Merchandising InventoryDokumen14 halamanExercise Dan Jawaban Lab 5 - Merchandising InventoryNOVITA AIBOYBelum ada peringkat

- CH 7 Vol 1 Answers 2014Dokumen18 halamanCH 7 Vol 1 Answers 2014Jamie Catherine GoBelum ada peringkat

- Home Work One - MBADokumen2 halamanHome Work One - MBAIslam SamirBelum ada peringkat

- Good Times Burgers Strategic AnalysisDokumen55 halamanGood Times Burgers Strategic AnalysisimamniftBelum ada peringkat

- Commercial Banking in The US Industry ReportDokumen40 halamanCommercial Banking in The US Industry ReportPpham100% (1)

- Cost Acconting LecturesDokumen64 halamanCost Acconting LecturesAamir Raza100% (2)

- PNBN LK TW I 2021Dokumen242 halamanPNBN LK TW I 2021Achmad SalsabilBelum ada peringkat

- SHELLDokumen6 halamanSHELLAbdullah QureshiBelum ada peringkat

- Assignment 3Dokumen5 halamanAssignment 3Shubham DixitBelum ada peringkat

- MY Project - WCM of Tata Steel LTD and SAILDokumen22 halamanMY Project - WCM of Tata Steel LTD and SAILrakeshraj mahakud50% (2)

- Sale Tax ReportDokumen10 halamanSale Tax ReportRENJITH K NAIRBelum ada peringkat

- Ratio Analysis - Easy To RememberDokumen3 halamanRatio Analysis - Easy To RememberKhushbuJ100% (5)

- zMSQ-07 - Financial Statement AnalysisDokumen13 halamanzMSQ-07 - Financial Statement AnalysisHania M. CalandadaBelum ada peringkat

- Sandip Voltas ReportDokumen43 halamanSandip Voltas ReportsandipBelum ada peringkat

- NamakkalDokumen97 halamanNamakkaldevapriya3009Belum ada peringkat

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDokumen4 halamanThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresBelum ada peringkat

- Capital Expenditure VS Revenue ExpenditureDokumen5 halamanCapital Expenditure VS Revenue ExpenditureRonan FerrerBelum ada peringkat

- Aluminum Household Utensil Making PlantDokumen43 halamanAluminum Household Utensil Making PlantmelkamuBelum ada peringkat

- Excel-Based Model To Value Firms Experiencing Financial DistressDokumen4 halamanExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaBelum ada peringkat

- Business ModelsDokumen3 halamanBusiness ModelsSteven KimBelum ada peringkat