Assignment

Diunggah oleh

Rana RazaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Assignment

Diunggah oleh

Rana RazaHak Cipta:

Format Tersedia

Assignment

Introduction:

Berger is well known brand established two centuries ago and now considered world

large paint manufacturer. In Pakistan Berger starts operations in 1950s now becoming

the most popular brand among all.

Berger become public limited when a Pakistani investor bought 49.3% of equity shares

whereas 50.6% owned by Jan sons and Nicholson Limited.

Initially Berger started its manufacturing operation in Karachi in 1955. It grow

economically and industrially but maintaining quality and expansion of its product.

Berger Plc (public limited) also start its operation in Lahore in 2006, it was comparative

move to take (advantage) edge over market share.

Berger grow by meeting its customer demand. It is arguably said that they are

manufacturing by focusing customers. Traits of Berger maintain quality.

All the operations they are carrying out are quality focus.

Analytically Berger has focused on different market quality and price wise by

differentiating products.

Quality is maintained through consistent skills and technology that cause success over

its competitors.

Berger is paint manufacturing company and it entered in many contracts of technical

nature with leading international manufacturing like Japan who make Berger capable of

automotive, vehicle, refinishes.

Berger has entered into a number of technical collaboration arrangements with leading

international manufacturers. These include the largest paint company in Japan, which

enables Berger to develop Automotive, Vehicle Refinishes and Industrial Paints

conforming to international standards; a Japanese chemical company, for Bumper

Paints; PCS Powders, UK for Powder Coatings; DPI Sendirian Berhad, Malaysia for

Road & Runway Markings; Cerachem for Construction Chemicals and Asian Paints for

Assignment

Decorative Paints. Recently, Berger acquired distribution rights of DuPont for Pakistans

vehicle refinish paint segment.[reference ..]

Mission

Despite many challenges, Berger Paints has succeeded in staying at the forefront of

Pakistans paint industry.

Innovation and technological development has enabled the company to achieve

corporate success through its

commitment to provide products of the highest quality and ensuring the ultimate

satisfaction of customers.

The companys employees are constantly encouraged to pursue the Corporate Mission

Statement:

We will stay at the forefront of innovation and technological development in the paint

industry.

We will achieve corporate success through an unwavering commitment to provide our

customers high quality

products to their ultimate satisfaction.

We will vigorously promote and safeguard the interests of our employees, our

shareholders, our suppliers and all

business associates.

We will play our role as a good corporate citizen and serve community where we do

business.[Reference]

Certificate

As an ISO-9001-2000 certified company Berger continues to upgrade and improve its

range by introducing innovative products in line with consumer needs.

Berger is not only a paint company it also provide different home solution

such as construction, free color solutions and professional color scheme

to make your home looking different.

Assignment

Berger is providing advice for color selection that consumer should use for

their products. It is ethical work they are giving to their consumer to show

their loyalty.

Health and safety is main concern. Safe employees work with concern

and diligence and the good thing is that they have make it part of the

objective. In Pakistan where health and safety are legal obligation but

many companies do not observe it. Berger makes sure that their

employees are safe and working in good environment. Ecologically they

are maintaining their standards as legal and constructive obligation.

Berger organize safety training programs to make their employees safety

handlers and in case of safety hazards their employees can deal such

situations.

For all safety measures they ensure through safety control officers and

safety auditors, such things give confidence to their working team. Team

is like family working and carrying their operations.

Assignment

Proposed Project Data

HDW Co is a listed company which plans to meet increased demand for its

products by buying new machinery costing

$5 million. The machinery would last for four years, at the end of which it would

be replaced. The scrap value of the

machinery is expected to be 5% of the initial cost. Capital allowances would be

available on the cost of the machinery

on a 25% reducing balance basis, with a balancing allowance or charge claimed

in the final year of operation.

This investment will increase production capacity by 9,000 units per year and all

of these units are expected to be

sold as they are produced. Relevant financial information in current price terms is

as follows:

Forecast inflation

Selling price $650 per unit 40% per year

Variable cost $250 per unit 55% per year

Incremental fixed costs $250,000 per year 50% per year

In addition to the initial cost of the new machinery, initial investment in working

capital of $500,000 will be required.Investment in working capital will be subject

to the general rate of inflation, which is expected to be 47% per year. HDW Co

pays tax on profits at the rate of 20% per year, one year in arrears. The company

has a nominal (money terms) after-tax cost of capital of 12% per year.

Net Cash flow of company in five years time will be:

$000

3423

3083

3102

3387

(379)

Assignment

Payback Period (PBP)

Payback period is the basic technique of capital investment appraisal and can be

defined as, time period to recover the initial investment.

Company have uneven cash flows so, payback period will be calculated by using

cumulative cash flow table.

$000

Net Cash

Flows

(5000)

3423

3083

3102

3387

(379)

Cumulative (5000)

1577

Cash Flow

1577 x12months= 1 year and six month

3083

Acceptance Criteria

There are two type Acceptance Criteria:

1. If more than one project than take a project which has shorter payback period.

2. If only one project is given than company target should be considered if project is

within company target than accept the project otherwise reject.

Assignment

The company has only a one project so in a calculation if companys intension to

recover its initial investment within three years, the proposal should be accepted

because project recover initial investment in one year and six month.

Advantage of Payback period and disadvantage of payback period

Advantage

Disadvantage

It is simple and easy to understand.

It ignore time value of money.

It gives focus on liquidity to making

It paid more attention on liquidity and

decision about the investment proposals.

ignore profitably.

Payback period deals with risk so project

Only cash flow before payback period is

which has short payback period is

taking into account while cash flow

considered as less risky as compared to

occurred after payback period is ignored.

project which has large payback period.

Assignment

NPV of Investment in new machinery

Year

$000

$000

$000

$000

$000

6084

6327

6580

6844

(2374)

(2504)

(2642)

(2787)

Contribution

3710

3823

3938

4057

Fix Cost

(263)

(276)

(289)

(304)

Cash Flow

3447

3547

3649

3753

Taxation

(689)

(709)

(730)

(751)

250

188

141

372

3447

3108

3128

3164

(379)

(24)

(25)

(26)

(27)

Sales

Income

Variable

Cost

Capital

Allowance

Tax Benefit

After Tax

Cash Flows

Working

Capital

Scrap Value

Net Cash

250

3423

3083

3102

3387

(379)

.098

.797

.712

.636

.567

Flows

Discounted

@12%

Assignment

Present

3057

2457

2208

2154

(215)

Value

Present Value of Future Cash Flows

9662

Initial investment

(5000)

Working Capital

(500)

NPV

4162

Workings

Workings

Year

Selling

67600

70304

73116

76041

Sales

(units/year)

9,000

9,000

9,000

9,000

Sales income

($000)

6,084

6,327

6,580

6,844

price ($/unit)

Year

Variable cost

($/unit)

26375

27826

29356

30971

Sales

(units/year)

9,000

9,000

9,000

9,000

Variable cost

($000)

2,374

2,504

2,642

2,787

Year

$000

$000

$000

$000

Assignment

Capital

allowance

1,2500

9375

7031

1,8594

Tax benefit

250

188

141

372

$000

$000

$000

$000

Working capital

52350

54811

57387

60084

Incremental

24

25

26

27

Year

Acceptance Criteria

As the NPV of $4.161 million is positive, the expansion can be recommended as

financial acceptable.

Discussion about NPV

NPV is the advance technique of capital investment appraisal, it can be defined as, the

sum of the discounted cash flows less initial investment.

However, when calculating NPV of a project following things should be considered,

Relevant costing to calculate NPV

Future

Cash

Incremental

Cash flows connected with implementation of decision

Exception

Opportunity cost (scarification of future benefit)

Include,

Purchase price

Material cost

Wages cost

Assignment

Variable overhead

Fix overhead (only incremental FOH)

Irrelevant cost

Sunk cost

Committed cost

Notional cost

Un-avoidable cost

These cost are irrelevant to calculate NPV.

Advantage of NPV

The main advantage of NPV is that it evaluates projects in the same way as,

shareholders would do. It focus on how individual projects would affect shareholders

wealth this means only those projects with positive NPV will be accepted that will

increase shareholders wealth.

Also it considered time value of money and taking into account all cash flows.

Explanation of calculation

In the calculation of net present value in part a company is using money cash flow

technique due to inflation.it is a approach to investment appraisal discounts nominal

cash flows with a nominal cost of capital.

Nominal cash flow are founded by inflating forecast value from current price estimates

i.e. using a specific inflation.

Applying a specific inflation means that different projects cash flows are inflated by

different inflation rates in order to generate nominal project cash flows.

NPV Graph

NPV profile is a graph that shows a project NPV against variance discount rate.

Construction

Assignment

To construct a graph of NPV profile first calculate NPV using different cost of capital

assumptions and then plot these figures on graph i.e. NPV on Y-axis, cost of capital on

X-axis.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Lecture 04 - Considerations When Developing A NPD StrategyDokumen27 halamanLecture 04 - Considerations When Developing A NPD StrategyAiyas AboobakarBelum ada peringkat

- HBDF MK2 - Instruction Manual 013 UK PDFDokumen17 halamanHBDF MK2 - Instruction Manual 013 UK PDFHernando Gómez HómezBelum ada peringkat

- Magna Carta For S and T PersonnelDokumen3 halamanMagna Carta For S and T PersonnelElena LlasosBelum ada peringkat

- Password Recovery Procedure For The Cisco 3600 and 3800 Series Routers - CiscoDokumen9 halamanPassword Recovery Procedure For The Cisco 3600 and 3800 Series Routers - CiscoDani Kirky YlaganBelum ada peringkat

- Mark Anthony CondittDokumen14 halamanMark Anthony CondittCBS Austin WebteamBelum ada peringkat

- Technical Data: NPN Power Silicon TransistorDokumen2 halamanTechnical Data: NPN Power Silicon TransistorJuan RamírezBelum ada peringkat

- Solid Waste Pollution in Ho Chi Minh CityDokumen33 halamanSolid Waste Pollution in Ho Chi Minh CityLamTraMy13Belum ada peringkat

- Diabetic Diagnose Test Based On PPG Signal andDokumen5 halamanDiabetic Diagnose Test Based On PPG Signal andAl InalBelum ada peringkat

- Solar CarsDokumen30 halamanSolar Carsnaallamahesh0% (1)

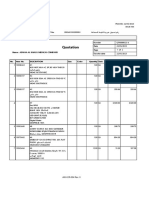

- QuotationDokumen2 halamanQuotationMahmoud Sadaka SafiaBelum ada peringkat

- CSE376 - Lec5 GuardsDokumen25 halamanCSE376 - Lec5 GuardsKeith FUBelum ada peringkat

- 7025-f40 Manual PDFDokumen245 halaman7025-f40 Manual PDFVivian AspdinBelum ada peringkat

- Openixp Tech DetailDokumen2 halamanOpenixp Tech DetailYusuf J. KuproyBelum ada peringkat

- Berkeley Multimedia WorkshopDokumen7 halamanBerkeley Multimedia WorkshopVisual EditorsBelum ada peringkat

- Chapter 2 Concrete ManualDokumen10 halamanChapter 2 Concrete ManualnguyenkhachiepvnBelum ada peringkat

- Assignment 3 OSDokumen5 halamanAssignment 3 OSValerie ThompsonBelum ada peringkat

- Class-good-Designing Distribution Network and Application To E-BusinessDokumen37 halamanClass-good-Designing Distribution Network and Application To E-BusinessReshma Mariya TomyBelum ada peringkat

- 1 PDFDokumen109 halaman1 PDFWalter Bernardo100% (1)

- Form ADT-1Dokumen3 halamanForm ADT-1Aashishh PatilBelum ada peringkat

- OPM3Dokumen49 halamanOPM3Ali Mukhtar ShigriBelum ada peringkat

- Evaluation of Non-Chemical Treatment Technologies For Cooling Towers at Select California FacilitiesDokumen68 halamanEvaluation of Non-Chemical Treatment Technologies For Cooling Towers at Select California FacilitiesCarlos GamarraBelum ada peringkat

- Commerzbank Tower Merupakan Sebuah Pencakar Langit Yang Terletak Di FrankfurtDokumen6 halamanCommerzbank Tower Merupakan Sebuah Pencakar Langit Yang Terletak Di FrankfurtHandikaBelum ada peringkat

- Rankine Regenerative CycleDokumen4 halamanRankine Regenerative CyclePhúc BạchBelum ada peringkat

- Akron Zero Torque NozzleDokumen2 halamanAkron Zero Torque NozzleJo Ca DoBelum ada peringkat

- Aerospace Standard: Hose Assemblies, Metal, Medium Pressure, High TemperatureDokumen3 halamanAerospace Standard: Hose Assemblies, Metal, Medium Pressure, High TemperatureRangaBelum ada peringkat

- Edmund Optics CatalogueDokumen52 halamanEdmund Optics Cataloguetester1972Belum ada peringkat

- Lec 4 - Aerated Lagoons & Secondary Clarifier (Compatibility Mode)Dokumen7 halamanLec 4 - Aerated Lagoons & Secondary Clarifier (Compatibility Mode)Muhammad FarhanBelum ada peringkat

- Cure Matters - Epo-TekDokumen4 halamanCure Matters - Epo-TekCelia ThomasBelum ada peringkat

- Vojagovipobo Volt White Documentation MidijiDokumen5 halamanVojagovipobo Volt White Documentation Midiji이희창0% (1)

- Operation of A Typical,: Batch-Homogenizing SystemDokumen2 halamanOperation of A Typical,: Batch-Homogenizing SystemKwameOpareBelum ada peringkat