7 Years Statement 2014-2020 15

Diunggah oleh

bharathaninHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

7 Years Statement 2014-2020 15

Diunggah oleh

bharathaninHak Cipta:

Format Tersedia

In addition to support for reserve-sharing arrangements, both the PDO and the Abu Dhabi interconnections

could potentially support commercial imports in the future based on the relative costs of generation in the

respective systems.

Several industries with captive power plants are connected with the MIS and have surplus power that is

purchased by OPWP. Chief among these is OPWPs agreement with Sohar Aluminium Co. (LLC), whereby

Sohar Aluminium exports up to 300 MW to the MIS during the summer, and imports a like amount of energy

from OPWP during the winter on an annually determined schedule. The schedule and operations are managed

to assure that energy exports balance with energy imports. This arrangement benefits both parties: Sohar

Aluminium is better able to schedule the maintenance of its generating units and gains reliability of supply,

while OPWP gains an efficient generating resource during the summer and improves the system Load Factor.

Agreements with other industries range from economic purchases of surplus generation as available to

scheduled purchases of surplus peaking capacity (when available). These agreements have generally been for

short terms (one to three years) and are considered renewable so long as the surplus capacity remains

available, and both economic and operational terms are agreeable.

The agreement with Sohar Aluminium (300 MW) was renewed in 2013 for three years. OPWP is negotiating

with Oman Mining Co. (20 MW) and Oman Refineries and Petrochemicals Company (ORPIC) (15 MW) to renew

the contracts on an availability basis. Furthermore, OPWP has economic purchase arrangements with Oman

Cement Co. (SAOG), Oman India Fertilizer Co. (SAOC) and the Ministry of Defense, which are expected to be

available for renewal annually. These latter three agreements are considered as energy purchases (at tariffs

beneficial to the system) with no capacity benefit.

Access to the captive power generation resources is useful in two respects. Firstly, the Sohar Aluminium and

Oman Mining Co. contracts provide a source of contingency reserve for the MIS, over and above the reserve

margin provided by OPWPs portfolio of contracted capacity. And secondly, they provide an economical

source of energy by providing low cost energy to the MIS in place of higher cost energy from contracted

generation capacity, the overall cost of energy for the MIS can be reduced. The agreements in place with the

respective parties are specifically designed to allow both of these benefits to be obtained.

Prospective Resources

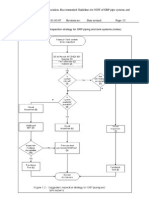

Toward considering how to meet generation capacity requirements as projected power demand overtakes

contracted capacity, OPWP assesses various prospective resources. These resources include the following:

Contract extensions, such as for generation units that are scheduled to fall out of contract

Planned capacity additions, not yet contracted

Temporary generation

Capacity purchases from interconnected power systems or industrial self-generation

Prospective contract extensions correspond to capacity that is scheduled to fall out of contract, but that may

be offered to OPWP by the plant owner for extension of the contract term (subject to satisfaction of relevant

regulatory requirements and commercial terms being agreed). OPWP considers such extensions alongside

options to contract for new capacity.

7-Year Statement (2014-2020)

Page 11

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 29Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 29bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 18Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 18bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 30Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 30bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 29Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 29bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 17Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 17bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 22Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 22bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 26Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 26bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 21Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 21bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 24bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 2Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 2bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 25Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 25bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 23Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 23bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 21Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 21bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 20Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 20bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 13Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 13bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 19Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 19bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 11Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 11bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 12Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 12bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 15Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 15bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 15Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 15bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 14Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 14bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 12Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 12bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 10Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 10bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 11Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 11bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 9Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 9bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 8Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 8bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 8Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 8bharathaninBelum ada peringkat

- 055 - Guidelines For NDT of GRP Pipe Systems and Tanks 7Dokumen1 halaman055 - Guidelines For NDT of GRP Pipe Systems and Tanks 7bharathaninBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Breaking The Myths of Nuclear Energy:Dr.D.N.Sharma, Member, NDMADokumen3 halamanBreaking The Myths of Nuclear Energy:Dr.D.N.Sharma, Member, NDMANdma IndiaBelum ada peringkat

- AtmosRadCh1 3 PDFDokumen73 halamanAtmosRadCh1 3 PDFmohsinusufBelum ada peringkat

- Mechanical Engineering Undergraduate-ManualDokumen27 halamanMechanical Engineering Undergraduate-ManualabyzenBelum ada peringkat

- How To Make A 220V To 110V Converter Circuit - Homemade Circuit ProjectsDokumen1 halamanHow To Make A 220V To 110V Converter Circuit - Homemade Circuit ProjectsChanna PrasadBelum ada peringkat

- Progress of The Weston Unit 4 Supercritical Project in Wisconsin PDFDokumen6 halamanProgress of The Weston Unit 4 Supercritical Project in Wisconsin PDFktsnlBelum ada peringkat

- ScienceDokumen84 halamanScienceParas PatharBelum ada peringkat

- VỊ TRÍ CÁC THÀNH PHẦN TRONG HỆ THỐNG ĐIỆN MẶT TRỜIDokumen1 halamanVỊ TRÍ CÁC THÀNH PHẦN TRONG HỆ THỐNG ĐIỆN MẶT TRỜIMai LinhBelum ada peringkat

- MF72 Aug 2018Dokumen4 halamanMF72 Aug 2018Charles SteblinaBelum ada peringkat

- SD 0100CT1502 Sec-06Dokumen18 halamanSD 0100CT1502 Sec-06royvindasBelum ada peringkat

- Unit 4 Human Value & EthicsDokumen20 halamanUnit 4 Human Value & EthicsElaiyarjaBelum ada peringkat

- Day 02 Design of LPG System Part 01Dokumen28 halamanDay 02 Design of LPG System Part 01kmas1612100% (1)

- Power Quality Monitoring and Classification: Sjef CobbenDokumen26 halamanPower Quality Monitoring and Classification: Sjef CobbenManivannanBelum ada peringkat

- DPS2400B-48 Fact Sheet PDFDokumen2 halamanDPS2400B-48 Fact Sheet PDFmazenkhodr1983Belum ada peringkat

- Map of Nigeria Oil FieldDokumen1 halamanMap of Nigeria Oil Fieldriddi12350% (10)

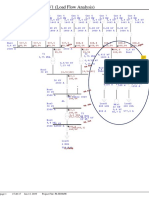

- OLV1 (Load Flow Analysis)Dokumen1 halamanOLV1 (Load Flow Analysis)Alry PurwariyadiBelum ada peringkat

- Chiller - How It Works - Single EffectDokumen4 halamanChiller - How It Works - Single EffectMian Kashif NazBelum ada peringkat

- EDAANS CONSULTANCY Offers 13KW On-Grid Solar System for SchoolDokumen1 halamanEDAANS CONSULTANCY Offers 13KW On-Grid Solar System for SchoolTopak KhanBelum ada peringkat

- Shunt Active PowerDokumen8 halamanShunt Active PowerKafeelKhanBelum ada peringkat

- Active Load Management EnergyGuard - manage power efficientlyDokumen1 halamanActive Load Management EnergyGuard - manage power efficientlywmcBelum ada peringkat

- TH - Single - R32 - 220 - 240V - 50Hz - V24API1Dokumen2 halamanTH - Single - R32 - 220 - 240V - 50Hz - V24API1Duy ChuBelum ada peringkat

- GT8 - Oil Regeneration PPT - Conditioning - Case StudyDokumen17 halamanGT8 - Oil Regeneration PPT - Conditioning - Case StudyBentoJahezBelum ada peringkat

- Instrument TransformersDokumen47 halamanInstrument TransformersabwarisBelum ada peringkat

- SN2 Sces3163 2018122340079Dokumen7 halamanSN2 Sces3163 2018122340079Syahmi RifqiBelum ada peringkat

- Buderus G115 Oil Fired Hot Water Boiler BrochureDokumen4 halamanBuderus G115 Oil Fired Hot Water Boiler Brochuree-ComfortUSABelum ada peringkat

- MV SWGR & CGR - Inspn & Test Procedure IECDokumen9 halamanMV SWGR & CGR - Inspn & Test Procedure IECMohammed Madi100% (2)

- Work Energy TheoremDokumen12 halamanWork Energy TheoremJother AmutanBelum ada peringkat

- Coal Mill & Fan PerformanceDokumen52 halamanCoal Mill & Fan PerformanceManohar TatwawadiBelum ada peringkat

- Navigating Out of The Static - On The Ultimate Stream of ConsciousnessDokumen61 halamanNavigating Out of The Static - On The Ultimate Stream of Consciousnesstina_4979017820% (1)

- Energy, Work & Power 09 QPDokumen10 halamanEnergy, Work & Power 09 QPRahat RizwanBelum ada peringkat

- Power Electronics For Renewable Energy SystemsDokumen33 halamanPower Electronics For Renewable Energy SystemssrilakshmisiriBelum ada peringkat