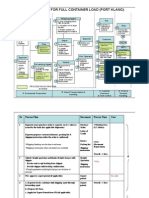

Assessment Process Flowchart

Diunggah oleh

Maria Reylan GarciaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Assessment Process Flowchart

Diunggah oleh

Maria Reylan GarciaHak Cipta:

Format Tersedia

LETTER OF AUTHORITY

Informs the taxpayer that the Bureau of

Internal Revenue is authorized to

examine its books for a certain taxable

year.

PRELIMINARY

FINDINGS

Initial computations

by the Revenue

Officer

NOTICE OF INFORMAL

CONFERENCE

Taxpayer

- Informs the taxpayer of the

Failed

preliminary findings of the revenue to Reply

examiner

-invites the taxpayer or its

representative for a conference with

the examiner within 10 to 15 days

from receipt of the letter

BIR

BIR &

& T

Taxpayer

axpayer come

come

to an agreement?

YES

BIR accepts the explanation of the

taxpayer assessment

process/payment by TP. Assessment

process ends.

Exceptions to Notice of Informal Conference and PAN (Issuance of

FAN is sufficient)

1. The finding for any deficiency tax is the result of mathematical error in

the tax computation appearing on the face of the tax return filed by

the taxpayer;

2. A discrepancy has been determined between the tax withheld and the

amount actually remitted by the withholding agent;

3. A taxpayer who opted to claim a refund or tax credit of excess CWT for

a taxable period was determined to have carried over and

automatically applied the same amount claimed against the estimated

tax liabilities for the taxable quarter/s of the succeeding taxable year;

4. Excise tax due on excisable articles has not been paid;

5. An article purchased locally or imported by an exempt person, such as,

but not limited to, vehicles, capital equipment, machineries & spare

PRELIMINARY ASSESSMENT NOTICE

- Notifies the taxpayer of the findings

made by the examiner and the

deficiency taxes assessed

- Shows in detail, the facts and the law,

rules and regulations, or jurisprudence

on which the proposed assessment is

based.

-Time for taxpayer to respond: 15 days

YES

Commissioner

accepts the

explanations

Commissioner

does NOT accept the

explanations

Taxpayer submits a

REPLY w/n 15 days?

END

of

proceedings.

2 Types of Administrative Protest Against the FAN

Request for reconsideration refers to a plea of

reevaluation of the assessment on the basis of existing

records without need of additional evidence. It may

involve a question of fact or law, or both.

Request for reinvestigation refers to a plea of

reevaluation of an assessment on the basis of newly

discovered or additional evidence that a taxpayer intends

to present in the reinvestigation. . It may involve a

FAN & LETTER OF DEMAND

- Sent to the taxpayer only by registered mail or

personal delivery.

- If sent by personal delivery, taxpayer or his

authorized representative shall acknowledge

receipt in the 2nd copy of the letter of demand

showing: (a) name, (b) signature, (c) designation &

authority to ac t for & in behalf of the taxpayer, (d)

date of receipt

NO

YES

Taxpayer responds within 30

days?

END

Assessment becomes final, executory, and

demandable

The government may exercise it remedies

for collection

The case may not be appealed at the CTA

Action of the

Commissioner

Resolution of the

assessment based on

the documents:

- Cancellation of the

entire assessment or

- Issuance of a Revised

Assessment

Inaction of the

Commissioner on the

protest within 180

days from the time of

receipt of the relevant

documents

Denial by the

administrative protest

within 180 days from

the receipt of the

relevant supporting

documents

TP fails to appeal

Appeal to the COURT OF TAX

APPEALS

must be made within 30 days from the

denial but in any case within 30 days

from the lapse of the 180 days

TP accepts the Court

of Tax Appeals

decision

TP accepts the Court of Appeals

decision

Appeal to the COURT OF

APPEALS

Appeal to the SUPREME COURT

Anda mungkin juga menyukai

- Tax Remedies SummaryDokumen6 halamanTax Remedies Summarypja_14100% (2)

- BusinessWorld - Marinated Meat and Fish Products No Longer VAT-exemptDokumen2 halamanBusinessWorld - Marinated Meat and Fish Products No Longer VAT-exemptPJ NavarroBelum ada peringkat

- Taxpayer Tax Assessment Process BIR IssuesDokumen3 halamanTaxpayer Tax Assessment Process BIR IssuesPetrovich Tamag50% (4)

- Tax Remedies ReviewerDokumen9 halamanTax Remedies ReviewerheirarchyBelum ada peringkat

- Tax Judicial Remedies of GovernmentDokumen34 halamanTax Judicial Remedies of GovernmentNoullen Banuelos100% (5)

- Flowchart Remedies of A TaxpayerDokumen2 halamanFlowchart Remedies of A TaxpayerRab Thomas BartolomeBelum ada peringkat

- Tax Remedies Flowchart (Revised)Dokumen6 halamanTax Remedies Flowchart (Revised)GersonGamas0% (1)

- Taxation - 7 Tax Remedies Under LGCDokumen3 halamanTaxation - 7 Tax Remedies Under LGCcmv mendozaBelum ada peringkat

- Sample PANDokumen5 halamanSample PANArmie Lyn Simeon100% (1)

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Dokumen5 halamanArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Tax Rev GenPrinciplesDokumen8 halamanTax Rev GenPrinciplesAngela AngelesBelum ada peringkat

- Notice of DiscrepancyDokumen4 halamanNotice of DiscrepancyMartin PagtanacBelum ada peringkat

- Tax Flowchart Remedies (Tokie)Dokumen9 halamanTax Flowchart Remedies (Tokie)Tokie TokiBelum ada peringkat

- RR 4-86Dokumen2 halamanRR 4-86Mico Maagma CarpioBelum ada peringkat

- Multiple choice questions on negotiable instruments, contracts, corporations and partnershipsDokumen11 halamanMultiple choice questions on negotiable instruments, contracts, corporations and partnershipsJinx Cyrus RodilloBelum ada peringkat

- BP 22 NotesDokumen5 halamanBP 22 NotesBetson CajayonBelum ada peringkat

- Remedies Under Local Government CodeDokumen15 halamanRemedies Under Local Government Codecmv mendoza100% (3)

- TERCERIADokumen14 halamanTERCERIAiris_irisBelum ada peringkat

- BIR Ruling 293-2015 - Productivity Incentive (De Minimis)Dokumen5 halamanBIR Ruling 293-2015 - Productivity Incentive (De Minimis)Jerwin DaveBelum ada peringkat

- Voting Trust Agreement (Template)Dokumen2 halamanVoting Trust Agreement (Template)Nina Natividad100% (2)

- Price Tag Laws in The PhilippinesDokumen2 halamanPrice Tag Laws in The PhilippinesCjhay MarcosBelum ada peringkat

- AUDIT OF CashDokumen24 halamanAUDIT OF CashMr.AccntngBelum ada peringkat

- Preferential Taxation For Senior CitizensDokumen53 halamanPreferential Taxation For Senior CitizensNddejBelum ada peringkat

- Section 11-16Dokumen6 halamanSection 11-16Jane Gonzales100% (1)

- Tax Remedies Under The NircDokumen119 halamanTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- 9 Negotiable Instruments Law and Anti Bouncing Checks Law and EstafaDokumen13 halaman9 Negotiable Instruments Law and Anti Bouncing Checks Law and EstafaLeo Sandy Ambe CuisBelum ada peringkat

- Tax Reviewer - Transfer TaxesDokumen21 halamanTax Reviewer - Transfer TaxesFrances Lipnica Pabilane100% (2)

- Philippine Accounting StandardsDokumen4 halamanPhilippine Accounting StandardsElyssa100% (1)

- RemediesDokumen45 halamanRemediesCzarina100% (1)

- Answers To Quiz No 12Dokumen4 halamanAnswers To Quiz No 12Your Public ProfileBelum ada peringkat

- REALIZATION PRINCIPLEDokumen15 halamanREALIZATION PRINCIPLEPaula BitorBelum ada peringkat

- Taxation of Non-Bank Financial Intermediaries PhilippinesDokumen12 halamanTaxation of Non-Bank Financial Intermediaries Philippinesjosiah9_5Belum ada peringkat

- Tax Assessment ProcessDokumen1 halamanTax Assessment ProcessMarie MoralesBelum ada peringkat

- Additonal Disclosure RR 15 2010Dokumen5 halamanAdditonal Disclosure RR 15 2010Emil A. MolinaBelum ada peringkat

- Corp de Jure, de FactoDokumen3 halamanCorp de Jure, de FactoSong OngBelum ada peringkat

- Revenue Regulations No 12-99Dokumen3 halamanRevenue Regulations No 12-99Zoe Dela CruzBelum ada peringkat

- Summary of Final Income: Tax TableDokumen3 halamanSummary of Final Income: Tax TableRealEXcellence71% (7)

- 2009 Taxation Law Bar QuestionsDokumen4 halaman2009 Taxation Law Bar QuestionsMowanBelum ada peringkat

- SEC's Reportorial Requirements for CorporationsDokumen2 halamanSEC's Reportorial Requirements for Corporationssirrhouge100% (1)

- RR 16-05Dokumen32 halamanRR 16-05matinikki100% (1)

- Chapter 06 Donor's TaxDokumen16 halamanChapter 06 Donor's TaxNikki Bucatcat0% (2)

- Atty. Israel Lay-At by Edwin SiyDokumen58 halamanAtty. Israel Lay-At by Edwin SiyRyan de LeonBelum ada peringkat

- BIR Rulings On Change of Useful LifeDokumen6 halamanBIR Rulings On Change of Useful LifeCarlota Nicolas VillaromanBelum ada peringkat

- Nature and Extent of GuarantyDokumen5 halamanNature and Extent of GuarantyNikka GloriaBelum ada peringkat

- Tax Judicial RemediesDokumen10 halamanTax Judicial RemediesSCYLLABelum ada peringkat

- Remedies Under NIRCDokumen14 halamanRemedies Under NIRCcmv mendoza100% (3)

- Donor's Tax A) Basic Principles, Concept and DefinitionDokumen4 halamanDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDBelum ada peringkat

- Tax Exemption Granted Under Consti and Tax Code With ProblemsDokumen11 halamanTax Exemption Granted Under Consti and Tax Code With ProblemsOSCAR VALERO100% (1)

- Requirements To Be Accredited As Tax AgentDokumen3 halamanRequirements To Be Accredited As Tax AgentAvril Reina0% (1)

- Bar Question SRCDokumen9 halamanBar Question SRChypholaphamusBelum ada peringkat

- Reviewer in Taxation by AmponganDokumen3 halamanReviewer in Taxation by AmponganTB0% (3)

- 1.) Who Are Eligible To Register As Bmbes?: AnswerDokumen6 halaman1.) Who Are Eligible To Register As Bmbes?: AnswerHazel Seguerra BicadaBelum ada peringkat

- Due Process Requirements for Tax Deficiency AssessmentsDokumen4 halamanDue Process Requirements for Tax Deficiency AssessmentsLab Lee0% (1)

- Revenue Regulations No. 9-2000Dokumen4 halamanRevenue Regulations No. 9-2000Ramon T. De VeraBelum ada peringkat

- UNIT II Tax RemediesDokumen17 halamanUNIT II Tax RemediesAl BertBelum ada peringkat

- Taxpayer Remedies Before and After PaymentDokumen7 halamanTaxpayer Remedies Before and After PaymentChrisMartinBelum ada peringkat

- Tax Remedies and IncrementsDokumen16 halamanTax Remedies and Incrementscobe.johnmark.cecilioBelum ada peringkat

- Assessment Process Flowchart GuideDokumen3 halamanAssessment Process Flowchart Guideattymaneka100% (1)

- GROUP 1 Tax RemediesDokumen6 halamanGROUP 1 Tax RemediesEunice Kalaw VargasBelum ada peringkat

- Tax RemediesDokumen5 halamanTax RemediesNoroBelum ada peringkat

- Pauline 1. Application FormDokumen3 halamanPauline 1. Application FormMaria Reylan GarciaBelum ada peringkat

- Rule 11 evidence in photos and videosDokumen1 halamanRule 11 evidence in photos and videosMaria Reylan GarciaBelum ada peringkat

- Territorial Jurisdiction of Courts in IloiloDokumen1 halamanTerritorial Jurisdiction of Courts in IloiloMaria Reylan Garcia100% (1)

- Testimonial of Good Moral CharacterDokumen1 halamanTestimonial of Good Moral CharacterZendy PastoralBelum ada peringkat

- Revised Rules For The Issuance of Co CsDokumen25 halamanRevised Rules For The Issuance of Co CsMaria Reylan GarciaBelum ada peringkat

- Revised Rules On Summary ProcedureDokumen7 halamanRevised Rules On Summary Procedurejimart10Belum ada peringkat

- Certified True Copy TextDokumen1 halamanCertified True Copy TextMaria Reylan GarciaBelum ada peringkat

- Pauline 1. Application FormDokumen3 halamanPauline 1. Application FormMaria Reylan GarciaBelum ada peringkat

- Voluntary Surrender Loose FirearmDokumen4 halamanVoluntary Surrender Loose FirearmMaria Reylan GarciaBelum ada peringkat

- 2004 Rules on Notarial Practice ApprovedDokumen20 halaman2004 Rules on Notarial Practice ApprovedirditchBelum ada peringkat

- Certified True Copy TextDokumen1 halamanCertified True Copy TextMaria Reylan Garcia100% (1)

- 2004 Rules on Notarial Practice ApprovedDokumen20 halaman2004 Rules on Notarial Practice ApprovedirditchBelum ada peringkat

- SPA PRCDokumen2 halamanSPA PRCMaria Reylan Garcia100% (1)

- Certified True Copy CertificateDokumen1 halamanCertified True Copy CertificateMaria Reylan GarciaBelum ada peringkat

- Jurisprudence - Child AbuseDokumen6 halamanJurisprudence - Child AbuseMaria Reylan GarciaBelum ada peringkat

- LTO Med - Cert PDFDokumen1 halamanLTO Med - Cert PDFPaul BalbinBelum ada peringkat

- Legal forms for People vs Rufina Caliwan caseDokumen1 halamanLegal forms for People vs Rufina Caliwan caseMaria Reylan GarciaBelum ada peringkat

- Singapore 2016 Date/Time Destination How To Get There: China TownDokumen4 halamanSingapore 2016 Date/Time Destination How To Get There: China TownMaria Reylan GarciaBelum ada peringkat

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokumen11 halamanBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMaria Reylan GarciaBelum ada peringkat

- Fast Craft Rates and SchedDokumen1 halamanFast Craft Rates and SchedMaria Reylan GarciaBelum ada peringkat

- Practicability SpeechDokumen3 halamanPracticability SpeechMaria Reylan GarciaBelum ada peringkat

- Resolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEDokumen3 halamanResolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEMaria Reylan GarciaBelum ada peringkat

- PRESIDENTIAL DECREE No. 1606Dokumen3 halamanPRESIDENTIAL DECREE No. 1606Maria Reylan GarciaBelum ada peringkat

- Republic Act No. 8369 Family CourtsDokumen6 halamanRepublic Act No. 8369 Family CourtsNylinad Etnerfacir ObmilBelum ada peringkat

- Pretrial BriefDokumen3 halamanPretrial BriefMaria Reylan GarciaBelum ada peringkat

- Counter AffidavitDokumen8 halamanCounter AffidavitMaria Reylan GarciaBelum ada peringkat

- Practicability SpeechDokumen3 halamanPracticability SpeechMaria Reylan GarciaBelum ada peringkat

- Japan Trip June 2017 - Tokyo, Mt Fuji, Kyoto & Osaka SightsDokumen2 halamanJapan Trip June 2017 - Tokyo, Mt Fuji, Kyoto & Osaka SightsMaria Reylan GarciaBelum ada peringkat

- Property List of CasesDokumen10 halamanProperty List of CasesMaria Reylan GarciaBelum ada peringkat

- Wicked TripDokumen1 halamanWicked TripMaria Reylan GarciaBelum ada peringkat

- Ax 2012 KB Article ListDokumen158 halamanAx 2012 KB Article ListniravmodyBelum ada peringkat

- Master Production SchedulingDokumen36 halamanMaster Production SchedulingAnan AghbarBelum ada peringkat

- Salary Structure GuideDokumen67 halamanSalary Structure Guiderishikesh kumarBelum ada peringkat

- Family Dollar Paystub 24-04-2020 PDFDokumen1 halamanFamily Dollar Paystub 24-04-2020 PDFLuis MartinezBelum ada peringkat

- Amaris HotelDokumen5 halamanAmaris HotelkristoforusBelum ada peringkat

- TALO - 21Q - Listening Unit 2 - Phan Thị Hoài Thu30Dokumen17 halamanTALO - 21Q - Listening Unit 2 - Phan Thị Hoài Thu30Mi HíBelum ada peringkat

- AR Technical FoundationDokumen2 halamanAR Technical Foundationsandeep__27Belum ada peringkat

- Business Report On TCSDokumen25 halamanBusiness Report On TCSMutahhir KhanBelum ada peringkat

- EXPORT MANIFEST CLOSING TIMEDokumen1 halamanEXPORT MANIFEST CLOSING TIMERamuni GintingBelum ada peringkat

- Bill Payment: Details On Breb (Prepaid) ConfigurationDokumen12 halamanBill Payment: Details On Breb (Prepaid) ConfigurationMd Tanvir Hossain100% (1)

- Account Statement From 1 Feb 2022 To 31 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen15 halamanAccount Statement From 1 Feb 2022 To 31 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAarti ThdfcBelum ada peringkat

- WM Transaction CodesDokumen15 halamanWM Transaction CodesRanganath BattagiriBelum ada peringkat

- Invoice 376328925 PDFDokumen4 halamanInvoice 376328925 PDFVenugopal PattipakaBelum ada peringkat

- UOB Personal Loan - Application FormDokumen6 halamanUOB Personal Loan - Application FormmohdaziehanBelum ada peringkat

- Receiving and Put-AwayDokumen11 halamanReceiving and Put-Awaypgdm1315Belum ada peringkat

- BIT - Integrated Time Ticket: How Much Does It Cost?Dokumen2 halamanBIT - Integrated Time Ticket: How Much Does It Cost?FabianBelum ada peringkat

- Nepal Income Tax Slab Rates For FY 2077-78 B.S. (2020-21)Dokumen7 halamanNepal Income Tax Slab Rates For FY 2077-78 B.S. (2020-21)Sajjal GhimireBelum ada peringkat

- ZEE5 Invoice 09 09 2022Dokumen1 halamanZEE5 Invoice 09 09 2022223 journeys and vlogs 223 journeys and vlogsBelum ada peringkat

- Export Process Flow-FCLDokumen8 halamanExport Process Flow-FCLjconner76Belum ada peringkat

- Zipit Awareness Flyer 16 17Dokumen2 halamanZipit Awareness Flyer 16 17Tatenda Madzingira0% (1)

- Your Electricity Bill at A Glance: Total Due 238.77Dokumen2 halamanYour Electricity Bill at A Glance: Total Due 238.77Midhun JohnBelum ada peringkat

- Inter-state Bus Terminal in VaranasiDokumen3 halamanInter-state Bus Terminal in VaranasiMOHD NAZEEF KHANBelum ada peringkat

- Bengaluru To Jaipur Lurkmv: Air Asia I5-1576Dokumen3 halamanBengaluru To Jaipur Lurkmv: Air Asia I5-1576maneeshBelum ada peringkat

- Bank Statement ICICI NOvember 2009Dokumen2 halamanBank Statement ICICI NOvember 2009Deidra PowellBelum ada peringkat

- Branches in Sarawak: Kuching Laksamana MiriDokumen1 halamanBranches in Sarawak: Kuching Laksamana MiridomromeoBelum ada peringkat

- Import Export DocumentsDokumen21 halamanImport Export Documentsshehzaib tariqBelum ada peringkat

- Reminder T&GDokumen3 halamanReminder T&Gammu_66Belum ada peringkat

- Life Station Medical Alert BrochureDokumen7 halamanLife Station Medical Alert Brochuremhs2822Belum ada peringkat

- Business Partner BalanceDokumen34 halamanBusiness Partner BalanceMin JeeBelum ada peringkat

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokumen5 halamanStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal JainBelum ada peringkat