Accounting for Long-Term Liabilities

Diunggah oleh

Edmond KeraDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting for Long-Term Liabilities

Diunggah oleh

Edmond KeraHak Cipta:

Format Tersedia

Revised Fall 2012

CHAPTER 10

ACCOUNTING FOR LONG-TERM

LIABILITIES

Key Terms and Concepts to Know

Present Value:

There is an old saying that time is money. Applied to accounting, it means that a dollar

today is worth more to an investor or company than a dollar to be received in the future.

The sooner the dollar is received, the longer it can be invested and used to generate

more dollars. Therefore in order to properly compare a series of cash inflows and

outflows occurring in various years, present value must be used to restate all of the cash

inflows and outflows in current period dollars.

Present value is based on compound interest, that is, current period interest is

based on the principal amount plus the interest for all prior periods.

Future cash flows are discounted back to the year when the bond was issued.

The term discounting is appropriate because the future cash flows are worth less

than their full amount today because we had to wait to receive them.

Certain future cash flows may be annuities if they consist of equal amounts

received of paid with equal frequency. Annuities are discounted using the Present

value of an Annuity of $1 table.

All other future cash flows are considered single payment cash flows. Single

payments are discounted using the Present Value of $1 table.

Bonds:

Bonds are a medium to long-term financing alternative to issuing stock.

Bonds are issued or sold face amount or par, at a discount if they pay less than

the current market rate of interest or a premium if they pay more than the current

market interest rate.

Bonds typically pay interest twice a year, i.e., semi-annually.

The price of a bond is stated as a percent of face value, although the percent sign

is not used.

o If a $1,000 bond is selling at 101, it is selling at 101% of face value or $1,010.

The extra $10 received when the bond is issued or sold represents the

premium.

o If a $1,000 bond is selling at 99, it is selling at 99% of face value or $990. The

$10 not received when the bond is issued or sold represents the discount.

Page 1 of 27

Revised Fall 2012

Required journal entries include

o issuing the bond at par, discount or premium

o calculating and recording the bond interest payments

o calculating and recording amortization of the discount or premium

o retiring the bonds at maturity

o retiring the bonds prior to maturity and calculating the gain or loss on

retirement

Calculate the interest expense for the year including the amortization of the

premium or discount.

Long-term Notes Payable:

Installment notes are loans that are repaid in a series of equal payments over a

number of years.

The payment amounts generally remain constant, with each successive payment

made up of a decreasing amount going toward interest expense and an increasing

amount going toward principal repayment.

If the notes are to be repaid in a series of equal payments over a number of

years, the principal amount of the note must be divided by the present value of an

annuity factor to calculate the amount of each payment. The interest portion of

each payment is the notes interest rate X the balance of the note outstanding for

the prior period.

Leases:

Leases are rental agreements.

Operating leases provide use of the property to the lessee with the lessor

retaining the risks and rewards of ownership during and after the lease. Lease

payments are expense to the lessee.

Capital leases transfer the risks and rewards of ownership to the lessee. These

leases are less like a rental and more like a purchase agreement which provides

for periodic payments over a specified time period. The lessee records the capital

lease as debt and records the leased asset as a fixed assets as if it had been

purchased.

Compute the debt-to-equity ratio

Page 2 of 27

Revised Fall 2012

Key Topics to Know

Present Value

Present Value of a Lump Sum

A lump sum is an amount expected to be received or paid in the future

The unknown is what the amount is worth in todays dollars

To solve, the following information must be known:

o the number of interest compounding periods

o the interest rate per compounding period

Use the Present Value of $1 Table by selecting the row equal to the number of periods

and the column equal to the interest rate

Example #1:

If the current rate of interest is 10% and interest is compounded semiannually, what is the

present value of receiving $10,000 at the end of 7 years?

Solution #1:

There are 14 interest compounding periods (7 years x 2)

The interest rate per compounding period is 5% (10% / 2)

Rate from the PV of $1 Table = .50507

Present value =

10,000 x .50507 =

$5,050.70

Present Value of an Annuity

An annuity is a series of equal payments expected to be received or paid at regular

future intervals

The unknown is what the series of payments or receipts is worth in todays dollars?

To solve, the following information must be known:

o the number of interest compounding periods

o the interest rate per compounding period

Use the Present Value of an Annuity of $1 Table by selecting the row equal to the

number of periods and the column equal to the interest rate

Page 3 of 27

Revised Fall 2012

Example #2:

If the current interest rate is 12% and interest is compounded semiannually, what is the

present value of receiving $5,000 each year for 10 years?

Solution #2:

There are 20 interest compounding periods (10 years x 2)

The interest rate per compounding period is 6% (12% / 2)

Rate from the PV of $1 Table = 11.46992

Present value =

5,000 x 11.46992 =

$57,349.60

Practice Problem #1

a. Alpha Company is considering prepaying their rent for the next 4 years to avoid a price

increase. Currently they pay $8,000 per year. Calculate the present value of the rent

payments to determine what amount Alpha should pay today if current interest rates

are 12% and interest is compounded annually.

b. Omega, Inc. won a lawsuit and will be receiving $400,000 at the end of 5 years.

Calculate the present value of this award if interest is compounded semiannually and

the current interest rate is 1) 18% and 2) 10%.

c. Bonnie has just received news of an inheritance. She will be receiving $10,000 per

year for the next 20 years and a lump sum payout after 20 years of $200,000.

Calculate the present value of her inheritance if the current interest rate is 9% and it is

compounded annually.

Page 4 of 27

Revised Fall 2012

Basic Relationships for Premiums and Discounts

The relationship between the current market interest rate and the stated or contract interest

rate for the bonds determines or influences the bond price, cash proceeds from issuance,

carrying value and interest expense. The following three tables summarize these

relationships:

If the current market interest rate is the same as the contract

interest rate:

1. Bond sells at face value or par

2. Cash proceeds from issuance will be the same as the face value

3. Price of the bonds will be 100

4. Carrying value of the bonds will be the same as face value throughout

term of the bonds

5. Cash paid for interest will be equal to interest expense

If the current market interest rate is greater than the contract

interest rate:

1. Bond sells at a discount

2. Cash proceeds from issuance will be less than the face value

3. Price of the bonds will be less than 100

4. Carrying value of the bonds will be less than face value throughout the

term of the bonds

5. Cash paid for interest will be less than interest expense because of the

amortization of the discount

If the current market interest rate is less than the contract

interest rate:

1. Bond sells at a premium

2. Cash proceeds from issuance will be greater than the face value

3. Price of the bonds will be greater than 100

4. Carrying value of the bonds will be greater than face value throughout

the term of the bonds

5. Cash paid for interest will be greater than interest expense because of

amortization of the premium

Page 5 of 27

Revised Fall 2012

Selling Price of a Bond

Calculating the Selling Price of a Bond

Companies usually pay interest to the bondholder semiannually and repay the face

value of the bond at maturity.

The series of interest payments represents an annuity.

The repayment of face value at maturity represents a lump sum or single payment

The selling price of a bond is calculated as:

The present value of the face value (lump sum) +

The present value of the interest payments (annuity)

Interest payments are calculated using the contract interest rate

The present value of the future cash outflows is calculated using the current market

interest rate

The bond sells at a premium if the present value exceeds the face value.

The bond sells at a discount if the present value is less than the face value.

Selling price is frequently expressed as a percentage (without the % sign) of face

value: (selling price / face value) x 100 = price.

Selling Bonds at a Premium

When a bond sells at a premium a price greater than face value a credit is recorded in

Premium on Bonds Payable for the amount of the premium. The carrying value of the bond

is the face amount recorded in bonds payable plus the unamortized premium recorded in the

premium on bonds payable account.

Example #3:

Beta Company issued $4,000,000 of 10-year, 11% bonds on January 4. The Bonds pay

interest semiannually on June 30 and December 31. If the current market rate of interest is

10%, at what price will the bonds sell for?

Solution#3:

Interest payment

$4,000,000 x 11% x year =

Number of periods

10 years x 2 =

Interest rate per period 10% / 2 =

PV of face amount

PV of interest

Selling price of bond

$4,000,000 x .37689

220,000 x 12.46221

Page 6 of 27

$220,000

20

5%

$1,507,560

2,741,686

$4,249,246

Revised Fall 2012

This bond is selling at a premium a price higher than its face value. The premium on this

bond is $249,246 ($4,000,000 4,249,246).

The price of the bond is 108.23 = 4,249,246 / 4,000,000.

Journal Entry for Issuance of Bonds:

Cash

4,249,246

Bonds payable

Premium on bonds payable

4,000,000

249,246

Selling Bonds at a Discount

When a bond sells at a discount a price less than face value a debit is made to Discount

on Bonds Payable for the amount of the discount. The carrying value of the bond is the face

amount recorded in bonds payable less the unamortized discount recorded in the discount on

bonds payable account.

Example #4

The next year, Beta Company issued $4,000,000 of 10-year, 11% bonds on January 4. The

Bonds pay interest semiannually on June 30 and December 31. If the current market rate of

interest is 12%, at what price will the bonds sell for?

Solution#4:

Interest payment

$4,000,000 x 11% x year =

Number of periods

10 years x 2 =

Interest rate per period 12% / 2 =

PV of face amount

PV of interest

Selling price of bond

$4,000,000 x .31180

220,000 x 11.46992

$220,000

20

6%

$1,247,200

2,523,382

$3,770,582

This bond is selling at a discount a price less than its face value. The discount on this bond

is $229,418 ($4,000,000 3,770,582).

The price of the bond is 94.26 = 3,770,582 / 4,000,000.

Page 7 of 27

Revised Fall 2012

Journal Entry for Issuance of Bonds:

Cash

3,770,582

Bonds payable

Discount on bonds payable

4,000,000

229,418

Amortizing Premiums and Discounts

Since the premium or discount is due to the difference in interest rates, it must be amortized

over the life of the bonds to adjust the interest expense paid to the interest expense per the

current market interest rate.

A bond premiums represents a reduction in interest expense

A bond discount represents an increase in interest expense

A portion of the premium or discount must be amortized to interest expense each

period

Amortization is recorded either at the end of the fiscal year or each time interest is

paid.

From Example #3:

Since these were 10-year bonds, the amortization on each interest payment date, using the

straight-line method, would be as follows:

$249,246 premium

20 periods

= $12,462.30/period

Journal Entry for Amortization of Premium:

Premium on Bonds Payable

Interest Expense

12,462.30

12,462.30

The debit to Premium on Bonds Payable reduces that account and reduces the

carrying value of the bonds.

The credit to Interest Expense reduces interest expense.

Page 8 of 27

Revised Fall 2012

From Example #4:

Since these were 10-year bonds, the amortization on each interest payment date, using the

straight-line method, would be as follows:

$229,418 discount

20 periods

= $11,470.90/period

Journal Entry for Amortization of Discount:

Interest Expense

Discount on Bonds Payable

11,470.90

11,470.90

The credit to Discount on Bonds Payable reduces that account and increases the

carrying value of the bonds.

The debit to Interest Expense increases interest expense.

Interest Expense

As shown in Examples #3 and #4, interest PAID is calculated as:

Principal

Interest payment

x Rate x Time

$4,000,000 x 11% x year =

$220,000

If the bonds are issued at par, that is, when the market and contract interest rates are the

same, then the interest expense is equal to the interest paid.

Journal Entry for Each Interest Payment:

Interest Expense

Discount on Bonds Payable

220,000

220,000

Typically the entries for the interest paid and the amortization of the premium or discount

are combined as follows:

Page 9 of 27

Revised Fall 2012

From Example #3:

Premium on Bonds Payable

Interest Expense

Cash

12,462.30

207,537.70

220,000.00

From Example #4:

Interest Expense

Cash

Discount on Bonds Payable

231,470.90

220,000.00

11,470.90

As noted above:

Amortization of a bond premium represents a reduction in interest expense compared

to the interest paid.

Amortization of a bond discount represents an increase in interest expense compared

to the interest paid.

The total interest expense over the life of the bonds is the interest paid plus the discount or

minus the premium:

Interest payment

Number of periods

Interest paid

Premium

Discount

Interest Expense

From Example #3: From Example #4:

$220,000

$220,000

20

20

$4,400,000

$4,400,000

(249,246)

229,418

$4,150,754

$4,629,418

Practice Problem #2:

Gamma, Inc. issued $8,000,000 of 7-year, 9% bonds on January 2. The bonds pay

interest semiannually on June 30 and December 31. The market rate of interest is

12%.

Calculate the selling price of the bonds, rounded to the nearest dollar, and

journalize the entry to issue the bonds at that price.

Journalize the entry to pay interest and to amortize the discount or premium on

June 30.

Page 10 of 27

Revised Fall 2012

Practice Problem #3:

The next year, Gamma, Inc. issued 8,000,000 of 7-year, 9% bonds on January 2. The

bonds pay interest semiannually on June 30 and December 31. The current market rate

of interest is 8%.

Calculate the selling price of the bonds, rounded to the nearest dollar, and

journalize the entry to issue the bonds at that price.

Journalize the entry to pay interest and to amortize the discount or premium on

June 30.

Bond Redemptions

Bond redemptions may occur on the maturity date or on a date prior to the maturity date.

If the bonds are retired or redeemed at maturity the journal entry is:

Bonds Payable

Cash

4,000,000

4,000,000

If all or some of the bonds are redeemed prior to maturity:

The portion of the bond premium or discount related to the bonds redeemed must be

amortized to redemption date.

The bonds payable account will be debited for the face amount of the bonds

redeemed.

The premium account will be debited or the discount account will be credited for the

premium or discount related to the bonds redeemed.

A gain will be recorded if the redemption price is less than the carrying value of the

bonds.

A loss will be recorded if the redemption price is greater that the carrying value of the

bonds

Carrying Value = Bonds Payable + Premium on Bonds Payable OR

Bonds Payable Discount on Bonds Payable

Page 11 of 27

Revised Fall 2012

From Example #3:

At the end of the 6th year, the bonds were redeemed at 102:

Premium on Bonds Payable Balance:

Amortization:

$24,924.60 * 6 years =

Account balance:

$249,246 149,547.60 =

$149,547.60

$99,698.40

Bonds Payable Balance

Redemption Price

Carrying Value

Gain (Redemption < CV)

$4,080,000.00

4,099,698.40

$19,698.40

4,000,000

4,000,000 * 102% =

4,000,000 + 99,698.40 =

Journal Entry

Premium on bonds payable

Bonds payable

Cash

Gain on redemption

99,698.40

4,000,000.00

4,080,000.00

19,698.40

From Example #4:

At the end of the 6th year, the bonds were redeemed at 99:

Premium on Bonds Payable Balance:

Amortization:

$22,941.80 * 6 years =

Account balance:

$229,418 137,650.80 =

$137,650.80

$91,767.20

Bonds Payable Balance

Redemption Price

Carrying Value

Loss (Redemption > CV)

$3,920,000.00

3,908,232.80

$11,767.20

4,000,000

4,000,000 * 98% =

4,000,000 - 91,767.20 =

Journal Entry

Discount on bonds payable

Bonds payable

Cash

Loss on redemption

Page 12 of 27

91,767.20

4,000,000.00

11,767.20

3,920,000.00

Revised Fall 2012

Practice Problem #4:

Journalize the following entries.

2011

July 1

Dec. 31

2012

June 30

July 1

Issued $20,000,000 of 8-year 12% callable bonds dated July 1, 2001

an effective interest rate of 14%, receiving cash of $18,110,780.

Interest is paid semiannually on December 31 and June 30.

Paid the semiannual interest on the bonds.

Recorded the bond discount amortization for 6 months using the

straight-line method.

Closed the interest expense account.

Paid the semiannual interest on the bonds.

Redeemed the bonds at 95.

(Record amortization for six months on July 1)

Practice Problem #5

Journalize the following entries. Round all amounts to the nearest dollar.

2008

Sept 2

Issued $5,000,000 of 10-year, 15% callable bonds at an effective

interest rate of 14% receiving cash of $5,529,704. Interest is

payable semiannually on September 1 and March 1.

Accrued 4 months of interest on the bonds.

Dec. 31

Amortized the bond premium for 4 months.

Closed the interest expense account.

2009

Mar 1

Sept 1

Dec. 31

2010

Feb. 2

Paid the semiannual interest on the bonds.

Paid the semiannual interest on the bonds.

Accrued 4 months of interest on the bonds.

Amortized the bond premium for the year.

Closed the interest expense account

Redeemed the bonds at 108. The balance in the Premium on Bonds

account after amortizing to the date of sale is $454,663.

Page 13 of 27

Revised Fall 2012

Practice Problem #6

On January 1, 2012, Julee Enterprises borrows $30,000 to purchase a new Toyota

Highlander by agreeing to a 6%, 4-year note with the bank. The first installment

payment will be due on January 1, 2013.

Required: Record the issuance of the note payable and the first two annual payments.

Page 14 of 27

Revised Fall 2012

Sample True / False Questions

1.

As a company's level of debt increases, bankruptcy risk increases.

True False

2.

Bonds are the most common form of corporate debt.

True False

3.

Secured bonds are backed by the federal government.

True False

4.

Unsecured bonds are not backed by a specific asset.

True False

5.

A callable bond allows the borrower to repay the bonds before their scheduled

maturity date at a specified call price.

True False

6.

Convertible bonds allow the investor to convert each bond into a specified

number of shares of common stock.

True False

7.

The market interest rate does not change over time.

True False

8.

Bonds issued below face amount are said to be issued at a discount.

True False

9.

The amount reported on the balance sheet for bonds payable is equal to the

carrying value at the balance sheet date.

True False

10. When bonds are issued at a discount (below face amount), the carrying value

and the corresponding interest expense increase over time.

True False

11. When bonds are issued at a premium (above face amount), the carrying value

and the corresponding interest expense increase over time.

True False

Page 15 of 27

Revised Fall 2012

12. Interest expense is calculated as the carrying value times the market rate.

True False

13. The market value of bonds moves in the opposite direction of interest rates.

True False

14. At the maturity date, the carrying value will equal the face amount of the

bond.

True False

15. Losses/gains on the early extinguishment of debt are reported as part of

operating income in the income statement.

True False

16. Monthly installment payments on a note payable include both an amount that

represents interest and an amount that represents a reduction of the

outstanding loan balance.

True False

17. A gain or loss is recorded on bonds retired at maturity.

True False

18. The stated interest rate is the rate quoted in the bond contract used to

calculate the cash payments for interest.

True False

19. Interest expense incurred when borrowing money, as well as dividends paid to

stockholders, are tax-deductible.

True False

20. A gain or loss is always recorded on bonds retired prior to maturity.

True False

Page 16 of 27

Revised Fall 2012

SAMPLE MULTIPLE CHOICE QUESTIONS

1.

Number of times interest charges earned is computed

a) Income before income taxes less Interest Expense divided by Interest

Expense.

b) Income before income taxes divided by Interest Expense.

c) Income before income taxes plus Interest Expense divided by Interest

Revenue.

d) Income before income taxes plus Interest Expense divided by Interest

Expense.

2.

One potential advantage of financing corporations through the use of bonds

rather than common stock is:

a) The interest on bonds must be paid when due

b) The interest expense is deductible for tax purposes by the corporation.

c) The corporation must pay the bonds at maturity.

d) A higher earnings per share is guaranteed for existing common

shareholders.

3.

When the contract rate of interest on bonds is higher than the market rate of

interest, the bonds sell at:

a) their face value

b) their maturity value

c) a discount

d) a premium

4.

Sinking Fund Cash would be classified on the balance sheet as:

a) a current asset

b) a plant asset

c) an investment

d) an intangible asset

5.

Bonds Payable has a balance of $2,000,000 and Discount on Bonds Payable

has a balance of $15,000. If the issuing corporation redeems the bonds at 99,

what is the amount of gain or loss on redemption?

a) $20,000 loss

b) $20,000 gain

c) $5,000 gain

d) $5,000 loss

Page 17 of 27

Revised Fall 2012

6.

On June 1, $1,000,000 of bonds were purchased as a long-term investment at

99 plus accrued interest and $1,000 was paid as the brokerage commission.

If the bonds bear interest at 12%, which is paid semiannually on January 1

and July 1, what is the total cost to be debited to the investment account?

a) $1,100,000

b) $1,000,000

c) $991,000

d) $990,000

7.

The balance in Discount on Bonds Payable:

a) Should be reported on the balance sheet as an asset because it has a debit

balance

b) Would be subtracted from the related bonds payable on the balance sheet

c) Would be added to the related bonds payable to determine the carrying

amount of the bonds.

d) Should be allocated to the remaining periods for the life of the bonds by

the straight-line method, if the results obtained by that method materially

differ from the results that would be obtained by the interest method.

8.

The journal entry a company records for the payment of interest, interest

expense, and amortization of bond discount is:

a) debit Interest Expense, credit Cash

b) debit Interest Expense and Discount on Bonds Payable, credit Cash

c) debit Interest Expense, credit Interest Payable and Discount on Bonds

Payable

d) debit Interest Expense, credit Cash and Discount on Bonds Payable

9.

The journal entry a company records for the payment of interest, interest

expense, and amortization of bond premium is:

a) debit Interest Expense, credit Cash

b) debit Interest Expense and Premium on bonds Payable, credit Cash

c) debit Interest Expense, credit Interest Payable and Premium on Bonds

Payable

d) debit Interest Expense, credit Cash and Premium on Bonds Payable

10. $100,000, 10-year, 9% Bonds that pay interest semiannually were issued

when the market interest rate was 10%. The annual amortization of the Bond

Discount using the straight-line method will be (Hint: First calculate the

selling price of the bond):

a) $450.00

b) $498.49

c) $500.00

d) $621.30

Page 18 of 27

Revised Fall 2012

11. When a bond is sold at a premium it is reported on the balance sheet at its

a) Face value

b) Maturity value

c) Carrying value

d) Market value

12. Amortizing a bond discount

a) Decreases bond interest expense.

b) Increases the carrying value of the bond.

c) Has no effect on the bond interest expense.

d) Decreases the maturity value of the bond.

13. On January 1, 2001, $5,000,000, 10-year, 8% bonds were issued at

$5,150,000. Interest is paid each semiannually. If the straight-line method is

used to amortize the premium, the amortization for the first year is:

a) $7,500

b) $15,000

c) $150,000

d) $250,000

14. A 10%, 5-year, $100,000 bond that sells when the market rate of interest is

12% will sell at

a) face value

b) a premium

c) a discount

d) par

15. Bonds with a face value of $2,000,000 are sold at 97. The entry to record the

issuance is

a) Debit Cash $2,000,000; Credit Discount on Bonds Payable $60,000 and

Bonds Payable $1,940,000

b) Debit Cash $1,940,000; Credit Bonds Payable $1,940,000

c) Debit Cash $2,060,000; Credit Discount on Bonds Payable $60,000 and

Bonds Payable $2,000,000

d) Debit Cash $1,940,000 and Discount on Bonds Payable $60,000; Credit

Bonds Payable $2,000,000

16. A $500,000 bond liability is retired at 97 when the carrying value of the bond

is $483,000. The entry to record the retirement would include a

a) $2,000 loss

b) $15,000 gain

c) $15,000 loss

d) $2,000 gain

Page 19 of 27

Revised Fall 2012

17. Bonds with a face value of $800,000 and interest rate of 8% are issued at 105

on January 2, 2002. The bonds pay interest semiannually on January 1 and

July 1 and mature in 5 years. What is the total interest expense in 2002?

a) $32,000

b) $56,000

c) $64,000

d) $72,000

18. Samson Enterprises issued a ten-year, $20 million bond with a 10% interest

rate for $19,500,000. The entry to record the bond issuance would have what

effect on the financial statements?

a) Increase assets

b) Increase liabilities

c) Increase equity

d) a) and b)

19. Samson Enterprises issued a ten-year, $20 million bond with a 10% interest

rate for $19,500,000. The entry to record the bond retirement would have

what effect on the financial statements?

a) Increase assets

b) Increase liabilities

c) Increase equity

d) a) and b)

20. Megginson, Inc. issued a five-year corporate bond of $300,000 with a 5%

interest rate for $330,000. What effect would the bond issuance have on

Megginson, Inc.'s accounting equation?

a) Increase assets and liabilities

b) Increase and decrease assets

c) Increase assets and equity

d) Increase and decrease liabilities

Page 20 of 27

Revised Fall 2012

Solutions to Practice Problems

Practice Problem #1

a)

Annuity Factor

4 periods at 12%

3.03735 =

$24,299

$400,000 x

Present Value of $1

10 periods at 5%

.42241 =

$168,964

$400,000 x

Present Value of $1

10 periods at 9%

.61391 =

$245,564

$8,000 x

b)

c)

$10,000 x

$200,000 x

Practice Problem #2

$360,000 x

$8,000,000 x

Annuity Factor

20 periods at 9%

9.12855 =

Present Value of $1

20 periods at 9%

.17843 =

Annuity Factor

14 periods at 6%

9.29498 =

Present Value of $1

14 periods at 6%

.44230 =

Cash

Discount on Bonds Payable

Bonds Payable

$91,286

$35,686

$126,972

$3,346,193

$3,538,400

$6,884,593

6,884,593

1,115,407

8,000,000

Interest Expense

Discount on Bonds Payable

Cash

Page 21 of 27

439,672

79,672

360,000

Revised Fall 2012

Practice Problem #3

$360,000 x

$8,000,000 x

Annuity Factor

14 periods at 4%

10.56312 =

Present Value of $1

14 periods at 4%

.57748 =

Cash

$3,802,724

$4,619,804

$8,422,528

8,422,528

Premium on Bonds Payable

Bonds Payable

Interest Expense

Premium on Bonds Payable

Cash

422,528

8,000,000

329,819

30,181

360,000

Practice Problem #4

2011

July 1

Dec 31

Cash

Discount on Bonds Payable

Bonds Payable

Interest expense

Cash

18,110,780

1,89,220

1,200,000

1,200,000

(20,000,000 * .12 * year)

Dec 31

Interest expense

Discount on Bonds Payable

118,076

(1,889,220/8 years * year = 118,076)

Dec 31

20,000,000

Income summary

Interest expense

Page 22 of 27

1,318,076

118,076

1,318,076

Revised Fall 2012

2012

Jun 30

Interest expense

Cash

1,200,000

1,200,000

(20,000,000 * .12 * year)

Jun 30

Interest expense

Discount on Bonds Payable

118,076

Bonds payable

Discount on bonds payable

Loss on redemption

Cash

20,000,000

118,076

(1,889,220/8 years * year = 118,076)

July 1

653,068

1,653,068

19,000,000

Balance in the discount account on the date of redemption is

1,889,220 - 118,076 - 118,076 = 1,653,068

Redemption price: 20,000,000 * 95% = 19,000,000 cash paid

Loss: 19,000,000 18,346,932 = 653,068

Practice Problem #5

2008

9/2

Cash

Premium on Bonds Payable

Bonds Payable

12/31 Interest Expense

Interest Payable

Premium on Bonds Payable

Interest Expense

Income Summary

Interest Expense

Page 23 of 27

5,529,704

250,000

17,657

232,343

529,704

5,000,000

250,000

17,657

232,343

Revised Fall 2012

2009

3/1

Interest Expense

Interest Payable

Cash

Premium on Bonds Payable

Interest Expense

9/1

Interest Expense

Cash

Premium on Bonds Payable

Interest Expense

12/31 Interest Expense

Interest Payable

Premium on Bonds Payable

Interest Expense

12/31 Income Summary

Interest Expense

125,000

250,000

8,828

375,000

26,485

250,000

17,657

697,030

375,000

8,828

375,000

26,485

250,000

17,657

697,030

2010

2/2

Bonds Payable

Premium on Bonds Payable

Cash

Gain on Redemption

Page 24 of 27

5,000,000

454,663

5,400,000

54,663

Revised Fall 2012

Practice Problem #6

2012

1/1

Cash

30,000

Notes Payable

2013

1/1

30,000

Interest Expense

Notes Payable

Cash

1,800.00

6,857.74

Interest Expense

Notes Payable

Cash

1,388.53

7,269.21

30,000 x 6% = 1,800

2014

1/1

(30,000 6,857.74) x 6% = 1,388.53

$30,000 /

Note Payable

Balance on

January 1

30,000.00

23,142.26

15,873.05

8,167.68

Annuity Factor

4 periods at 6%

3.46511 =

Interest

Expense

1,800.00

1,388.54

952.38

490.06

Annual

Payment

8,657.74

8,657.74

8,657.74

8,657.74

Page 25 of 27

8,657.74

8,657.74

$8,657.74

Principal

Payment

6,857.74

7,269.21

7,705.36

8,167.68

Note Payable

Balance on

December 31

23,142.26

15,873.05

8,167.68

-

Revised Fall 2012

Solutions to True / False Questions

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

True

True

False - Secured bonds are supported by specific assets the issuer has

pledged as collateral.

True

True

True

False - Market rates change continuously. Announcements by the

Federal Reserve regarding its intentions to increase the federal funds

rate, political unrest, an increase in the price of oil, and fears of growing

inflation can all cause an increase in market interest rates.

True

True

True

False - When bonds are issued at a premium (above face amount), the

carrying value and the corresponding interest expense decrease over

time.

True

True

True

False - Losses/gains on the early extinguishment of debt are reported as

non-operating items in the income statement.

True

False - No gain or loss is recorded on bonds retired at maturity, as the

carrying value at maturity is equal to the face amount of the bond.

True

False Dividends are not tax deductible.

False A gain or loss is recorded only when the carrying value does not

equal the cash paid at redemption.

Page 26 of 27

Revised Fall 2012

Solutions to Multiple Choice Questions

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

D

B

D

C

C

C

B

D

B

D

C

B

B

C

D

A

B

D

D

A

Page 27 of 27

Anda mungkin juga menyukai

- E-14 AfrDokumen5 halamanE-14 AfrInternational Iqbal ForumBelum ada peringkat

- Ias 7 Cash Flow Statement ContinuedDokumen8 halamanIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- Comparative Balance Sheet: MeaningDokumen64 halamanComparative Balance Sheet: MeaningRahit MitraBelum ada peringkat

- CH 11Dokumen51 halamanCH 11Nguyen Ngoc Minh Chau (K15 HL)Belum ada peringkat

- Ril Case StudyDokumen2 halamanRil Case StudyHema Sharist100% (1)

- HBL Products: Domestic Banking: Service LineDokumen13 halamanHBL Products: Domestic Banking: Service LineSalman RahmanBelum ada peringkat

- Banking CompaniesDokumen68 halamanBanking CompaniesKiran100% (2)

- Ratio Analysis of Eastern Bank LtdDokumen19 halamanRatio Analysis of Eastern Bank LtdshadmanBelum ada peringkat

- FCF Valuation ModelDokumen8 halamanFCF Valuation ModelDemi Tugano BernardinoBelum ada peringkat

- Forward Rate AgreementDokumen8 halamanForward Rate AgreementNaveen BhatiaBelum ada peringkat

- Sri Lanka Accounting StandardDokumen6 halamanSri Lanka Accounting StandardYoosuf Mohamed IrsathBelum ada peringkat

- Double Entry Accounting ExplainedDokumen6 halamanDouble Entry Accounting ExplainedKarthikacauraBelum ada peringkat

- ACCT-312:: Exercises For Home Study (From Chapter 6)Dokumen5 halamanACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasBelum ada peringkat

- Sujit 1-134-380 PDFDokumen247 halamanSujit 1-134-380 PDFŞâh ŠůmiťBelum ada peringkat

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDokumen4 halamanHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Problems SAPMDokumen4 halamanProblems SAPMSneha Swamy100% (1)

- Toa 41 42 PDFDokumen22 halamanToa 41 42 PDFspur iousBelum ada peringkat

- Global Finance Exam - 2 Fall 2012Dokumen6 halamanGlobal Finance Exam - 2 Fall 2012mauricio0327Belum ada peringkat

- PGDTDokumen68 halamanPGDTFahmi AbdullaBelum ada peringkat

- Accounting For LeasesDokumen4 halamanAccounting For LeasesSebastian MlingwaBelum ada peringkat

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDokumen43 halamanCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajBelum ada peringkat

- Topic 4 - Accounting For Derivative Instruments - A211Dokumen94 halamanTopic 4 - Accounting For Derivative Instruments - A211Xiao Xuan100% (1)

- SKANS School of Accountancy Midterm Exam ReviewDokumen4 halamanSKANS School of Accountancy Midterm Exam ReviewMuhammad ArslanBelum ada peringkat

- Analyzing Depreciation MethodsDokumen2 halamanAnalyzing Depreciation MethodsMartono TampubolonBelum ada peringkat

- EBIT-EPS analysis for financing plan decisionsDokumen6 halamanEBIT-EPS analysis for financing plan decisionsSthephany GranadosBelum ada peringkat

- Ebit Eps AnalysisDokumen11 halamanEbit Eps Analysismanish9890Belum ada peringkat

- Financial Statements: Analysis of Attock Refinery LimitedDokumen1 halamanFinancial Statements: Analysis of Attock Refinery LimitedHasnain KharBelum ada peringkat

- UnderwritingDokumen3 halamanUnderwritingkalidharBelum ada peringkat

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokumen38 halamanPrepared by Coby Harmon University of California, Santa Barbara Westmont Collegee s tBelum ada peringkat

- Chapter 10 - Fixed Assets and Intangible AssetsDokumen94 halamanChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaBelum ada peringkat

- Chap 5Dokumen52 halamanChap 5jacks ocBelum ada peringkat

- Costing System at Plastim CorporationDokumen10 halamanCosting System at Plastim CorporationKumar SunnyBelum ada peringkat

- CHAPTER 4 - AssociatesDokumen11 halamanCHAPTER 4 - AssociatesSheikh Mass JahBelum ada peringkat

- Chap 017 AccDokumen47 halamanChap 017 Acckaren_park1Belum ada peringkat

- Distributions To Shareholders: Dividends and Share RepurchasesDokumen33 halamanDistributions To Shareholders: Dividends and Share RepurchasesPrincess EngresoBelum ada peringkat

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDokumen10 halamanChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosBelum ada peringkat

- Investments TheoryDokumen8 halamanInvestments TheoryralphalonzoBelum ada peringkat

- Shukrullah Assignment No 2Dokumen4 halamanShukrullah Assignment No 2Shukrullah JanBelum ada peringkat

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Dokumen4 halamanSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Ahmed El KhateebBelum ada peringkat

- Cma August 2013 SolutionDokumen66 halamanCma August 2013 Solutionফকির তাজুল ইসলামBelum ada peringkat

- Reflection - Investments and InventoriesDokumen2 halamanReflection - Investments and InventoriesJohn Christopher GozunBelum ada peringkat

- Budgeting and Variance AnalysisDokumen43 halamanBudgeting and Variance AnalysisADITYAROOP PATHAKBelum ada peringkat

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDokumen31 halamanPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamBelum ada peringkat

- Investments: Learning ObjectivesDokumen52 halamanInvestments: Learning ObjectivesElaine LingxBelum ada peringkat

- Homework Chapter 18 and 19Dokumen7 halamanHomework Chapter 18 and 19doejohn150Belum ada peringkat

- Investment Companies ChapterDokumen16 halamanInvestment Companies Chaptertjarnob13100% (1)

- Rais12 SM ch13Dokumen32 halamanRais12 SM ch13Edwin MayBelum ada peringkat

- Financial Reporting and Changing PricesDokumen6 halamanFinancial Reporting and Changing PricesFia RahmaBelum ada peringkat

- Equivalent Annual AnnuityDokumen10 halamanEquivalent Annual Annuitymohsin_ali07428097Belum ada peringkat

- Chicago Valve TemplateDokumen5 halamanChicago Valve TemplatelittlemissjaceyBelum ada peringkat

- Corporations-Organization and Capital Stock TransactionsDokumen68 halamanCorporations-Organization and Capital Stock TransactionsZara ShoukatBelum ada peringkat

- Latihan Budget 2014 - 2015Dokumen48 halamanLatihan Budget 2014 - 2015Elizabeth DeeBelum ada peringkat

- Tax Problem SolutionDokumen5 halamanTax Problem SolutionSyed Ashraful Alam RubelBelum ada peringkat

- Accounting For Foreign Currency TransactionsDokumen2 halamanAccounting For Foreign Currency Transactionskeith niduelanBelum ada peringkat

- Bonds Valuation 2017 STUDokumen4 halamanBonds Valuation 2017 STUAnissa GeddesBelum ada peringkat

- UntitledDokumen34 halamanUntitledXoan DươngBelum ada peringkat

- Chapter 2Dokumen22 halamanChapter 2Tiến ĐứcBelum ada peringkat

- The Valuation of Bonds PPT at Bec Doms FinanceDokumen37 halamanThe Valuation of Bonds PPT at Bec Doms FinanceBabasab Patil (Karrisatte)Belum ada peringkat

- BondDokumen44 halamanBondSumit VaishBelum ada peringkat

- Understanding Interest RatesDokumen38 halamanUnderstanding Interest RatesSonia P.Belum ada peringkat

- Nichqvanderbiltassessment-Full 1Dokumen10 halamanNichqvanderbiltassessment-Full 1api-354377776Belum ada peringkat

- Lifting Technician EPA Practical Test Tower Crane October 2017Dokumen21 halamanLifting Technician EPA Practical Test Tower Crane October 2017Edmond KeraBelum ada peringkat

- Tower Crane Preshift InspectionDokumen1 halamanTower Crane Preshift InspectionEdmond KeraBelum ada peringkat

- ABCs of Fall ProtectionDokumen24 halamanABCs of Fall ProtectionEdmond KeraBelum ada peringkat

- Safe Use of Top Slew Tower CranesDokumen59 halamanSafe Use of Top Slew Tower CranesJoh TheerawutBelum ada peringkat

- Whitelist Ba015790Dokumen10 halamanWhitelist Ba015790Rizwan AhmedBelum ada peringkat

- Tower Crane Technical Information Note: Construction Plant-Hire AssociationDokumen3 halamanTower Crane Technical Information Note: Construction Plant-Hire AssociationLyle KorytarBelum ada peringkat

- Safe Use of Top Slew Tower CranesDokumen59 halamanSafe Use of Top Slew Tower CranesJoh TheerawutBelum ada peringkat

- Lifting Technician EPA Practical Test Tower Crane October 2017Dokumen21 halamanLifting Technician EPA Practical Test Tower Crane October 2017Edmond KeraBelum ada peringkat

- Cpa Tcig Tin 044 Issue B 170703Dokumen2 halamanCpa Tcig Tin 044 Issue B 170703Edmond KeraBelum ada peringkat

- Safe Use of Top Slew Tower CranesDokumen59 halamanSafe Use of Top Slew Tower CranesJoh TheerawutBelum ada peringkat

- Luffing Tower Crane Preshift InspectionDokumen1 halamanLuffing Tower Crane Preshift InspectionEdmond KeraBelum ada peringkat

- 00D IndexDokumen11 halaman00D IndexEdmond KeraBelum ada peringkat

- Checklist of Mandatory Documentation Required by ISO 45001 enDokumen12 halamanChecklist of Mandatory Documentation Required by ISO 45001 enashraf90% (10)

- RRC UK Enrolment Form: ABA Business Center, Office No.: 1204, "Papa Gjon Pali II" Street, Tirana, AlbaniaDokumen4 halamanRRC UK Enrolment Form: ABA Business Center, Office No.: 1204, "Papa Gjon Pali II" Street, Tirana, AlbaniaEdmond KeraBelum ada peringkat

- January 2019iduaDokumen19 halamanJanuary 2019iduaDarius DsouzaBelum ada peringkat

- Living Working GermanyDokumen56 halamanLiving Working GermanyRenato SirovinaBelum ada peringkat

- Nebosh Igc1 QaDokumen21 halamanNebosh Igc1 Qaadshahid89% (9)

- Procedura e NjohjesDokumen1 halamanProcedura e NjohjesEdmond KeraBelum ada peringkat

- Business Analyst JobDokumen9 halamanBusiness Analyst JobEdmond KeraBelum ada peringkat

- 00D IndexDokumen11 halaman00D IndexEdmond KeraBelum ada peringkat

- 0D - Drugs and AlcoholDokumen12 halaman0D - Drugs and AlcoholEdmond KeraBelum ada peringkat

- Whitelist Ba015790Dokumen10 halamanWhitelist Ba015790Rizwan AhmedBelum ada peringkat

- 0 - Health and Safety at Work Etc. ACT 1974Dokumen18 halaman0 - Health and Safety at Work Etc. ACT 1974Edmond KeraBelum ada peringkat

- Construction Health and Safety Manual: Guide To The June 2010 AmendmentsDokumen1 halamanConstruction Health and Safety Manual: Guide To The June 2010 AmendmentsEdmond KeraBelum ada peringkat

- Info Rente Im Ausland Eng Nicht Vertragsstaaten DataDokumen40 halamanInfo Rente Im Ausland Eng Nicht Vertragsstaaten DataEdmond KeraBelum ada peringkat

- Construction Health and SafetyDokumen13 halamanConstruction Health and SafetyEdmond KeraBelum ada peringkat

- Libër Mësuesi - Gjuha 4 PDFDokumen328 halamanLibër Mësuesi - Gjuha 4 PDFMirelaPacaniBelum ada peringkat

- VAF1 GuidanceDokumen5 halamanVAF1 GuidanceNarcisa OrtizBelum ada peringkat

- Procedura e NjohjesDokumen1 halamanProcedura e NjohjesEdmond KeraBelum ada peringkat

- NRB Monetary Policy 2020-21 Review Focuses on Loan Relief and Economic RecoveryDokumen3 halamanNRB Monetary Policy 2020-21 Review Focuses on Loan Relief and Economic Recoveryaswin adhikariBelum ada peringkat

- 110AB0064 李少珠 1.) Dark Pool 暗池Dokumen4 halaman110AB0064 李少珠 1.) Dark Pool 暗池李少珠 AnanchaBelum ada peringkat

- Anirban Chakraborty Project ReportDokumen51 halamanAnirban Chakraborty Project Reportsandeepagarwal_83Belum ada peringkat

- Its Just Time Martin ArmstrongDokumen87 halamanIts Just Time Martin ArmstrongkgsbhavaniprasadBelum ada peringkat

- Money and Credit Important Questions and Answers PDFDokumen12 halamanMoney and Credit Important Questions and Answers PDFAkkajBelum ada peringkat

- Microsoft'S Financial Reporting Strategy Case Study: Individual AssignmentDokumen6 halamanMicrosoft'S Financial Reporting Strategy Case Study: Individual AssignmentchetandasguptaBelum ada peringkat

- Bodie Investments 12e IM CH04Dokumen4 halamanBodie Investments 12e IM CH04lexon_kbBelum ada peringkat

- Buscom SPDokumen16 halamanBuscom SPCatherine Joy Vasaya100% (1)

- CRS Index & FormatsDokumen24 halamanCRS Index & FormatsVenkat UppalapatiBelum ada peringkat

- Group - 3 - Assignment (Term Paper)Dokumen13 halamanGroup - 3 - Assignment (Term Paper)Biniyam YitbarekBelum ada peringkat

- (FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5Dokumen6 halaman(FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5mBelum ada peringkat

- Class 03Dokumen3 halamanClass 03Aasim Bin BakrBelum ada peringkat

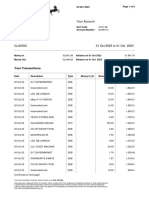

- BillDokumen7 halamanBillstanciucorinaioanaBelum ada peringkat

- Methods of Note IssueDokumen8 halamanMethods of Note IssueNeelabh KumarBelum ada peringkat

- Acct500 Mock Final Exam QuestionsDokumen177 halamanAcct500 Mock Final Exam QuestionsDalal KwtBelum ada peringkat

- ACCA F9 Study GuideDokumen4 halamanACCA F9 Study GuidedeepakBelum ada peringkat

- Chapter 11 AISDokumen4 halamanChapter 11 AISMyka ManalotoBelum ada peringkat

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDokumen4 halamanClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989Belum ada peringkat

- Working CapitalDokumen72 halamanWorking CapitalSyaapeBelum ada peringkat

- EFSL Annual Report FY2011-12Dokumen184 halamanEFSL Annual Report FY2011-12ranokshivaBelum ada peringkat

- How To Increase A Credit Score QuicklyDokumen15 halamanHow To Increase A Credit Score QuicklyJoel Curtis100% (2)

- Banking Law - PDF ProjectDokumen18 halamanBanking Law - PDF ProjectNilotpal RaiBelum ada peringkat

- E 14-6 Acquisition-Excess Allocation and Amortization EffectDokumen13 halamanE 14-6 Acquisition-Excess Allocation and Amortization EffectRizkina MoelBelum ada peringkat

- Lloyds Bank 1Dokumen8 halamanLloyds Bank 1KabanBelum ada peringkat

- Nirmal Bang On CCL Products - Upside of 20%Dokumen7 halamanNirmal Bang On CCL Products - Upside of 20%Alok DashBelum ada peringkat

- ForeignDokumen70 halamanForeignadsfdgfhgjhkBelum ada peringkat

- CIA4U Final Exam ReviewDokumen15 halamanCIA4U Final Exam ReviewkolaowlejoshuaBelum ada peringkat

- PledgeDokumen14 halamanPledgeShareen AnwarBelum ada peringkat

- Study Guide - Chapter 10Dokumen6 halamanStudy Guide - Chapter 10Peko YeungBelum ada peringkat

- Optimize 50-stock portfolio using 1,890 estimatesDokumen4 halamanOptimize 50-stock portfolio using 1,890 estimatesnotebook99Belum ada peringkat