E-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement Slip

Diunggah oleh

Biswajit Sarkar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

2K tayangan2 halamanfyi

Judul Asli

E-FILING OF RETURN FOR VAT-Return for Vat- Acknowledgement Slip

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inifyi

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

2K tayangan2 halamanE-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement Slip

Diunggah oleh

Biswajit Sarkarfyi

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

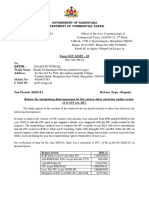

E-FILING OF RETURN FOR VAT- Acknowledgement Slip.

http://wbcomtax.wb.nic.in/Return_14/AcknowledgementSlip14.jsp

"THE WEST BENGAL VALUE ADDED TAX RULES, 2005"

Form14e

Acknowledgement for electronic filing of return in *Form 14

[see sub-rule (2) of rule 34A]

Acknowledgement

20140900575044R

26-Jan-2015

Date

No

P.BROTHERS & CO.

Trade Name

TIN No

19700295026

Return Period

201409

Charge Name

SHIBPUR

Group Code

05

Abstract of return as per data transmitted electronically

Turnover/CTP

(excluding VAT)

Purchase of goods within West Bengal against tax invoices:

Particulars

TAX etc

(i)goods taxable @ 1%

0.00

0.00

(ii)goods taxable @ 4%(upto 31/03/2013)

/ @5%(on & after 01/04/2013)

334195.00

16710.00

(iii)goods taxable @ 13.5

%(upto 31/03/2013) / @14.5%(on & after 01/04/2013)

5887.00

854.00

Total Claim of Input Tax Credit :

17564.00

Net Tax Credit :

Turnover of purchase not from registered dealers

and tax u/s 12

56529.00

0.00

Goods purchased or received from outside West

Bengal

116605.00

Aggregate of sale price (excluding VAT)

659219.00

Turnover of sales

659219.00

Break-up of turnover of sales and tax payable u/s 16 :

(i)of goods taxable @ 1%

(ii)of goods taxable @ 4% (upto 31/03/2013)

/ @5%(on & after 01/04/2013)

(iii)of goods taxable @ 13.5

%(upto 31/03/2013) / @14.5%(on & after 01/04/2013)

(iv)of goods on which tax is paid on MRP u/s 16(4)

0.00

0.00

327580.00

16379.00

0.00

0.00

0.00

0.00

(v)sales on which tax is payable u/s 16(6)

(vi)sales on which tax is payable at any other rate

(vii)Excess Output Tax due to Sales Return

Contractual transfer price (CTP)

0.00

0.00

0.00

Break-up of taxable CTP taxable u/s 18 r/w rule *30(1)/30(2):

(i)of goods taxable @ 4% (upto 31/03/2013)

/ @5%(on & after 01/04/2013)

(ii)of other goods taxable @ 13.5

%(upto 31/03/2013) / @14.5%(on & after 01/04/2013)

0.00

0.00

0.00

0.00

Signature of the Dealer ___________________

Status ____________________

Page 1 of 2

1 of 2

1/26/2015 9:55 PM

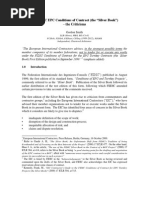

E-FILING OF RETURN FOR VAT- Acknowledgement Slip.

http://wbcomtax.wb.nic.in/Return_14/AcknowledgementSlip14.jsp

"THE WEST BENGAL VALUE ADDED TAX RULES, 2005"

Form14e

Acknowledgement for electronic filing of return in *Form 14

[see sub-rule (2) of rule 34A]

Acknowledgement

20140900575044R

26-Jan-2015

Date

No

P.BROTHERS & CO.

Trade Name

19700295026

TIN No

Return Period 201409

Charge Name

Group Code

SHIBPUR

05

Abstract of return as per data transmitted electronically

Particulars

1st Month

2nd Month

3rd Month

Total Output Tax

16324.00

55.00

0.00

Net Tax Payable

0.00

0.00

0.00

Interest Payable

0.00

0.00

0.00

Late fee payable

0.00

Tax deducted at source u/s

40, if any

0.00

0.00

0.00

Tax paid in excess earlier

now adjusted

0.00

0.00

0.00

Total amount of tax, interest

0.00

or late fee paid by challans:-

0.00

0.00

Short payment made, if any :Tax

0.0

Interest

0.0

Late fee

No of Records

Amount(excluding

VAT)

VAT Involved

Annexure A

0.00

0.0

Annexure B - Part I,Section I [for

purchases]

230107.00

11505.0

Annexure B - Part II,Section I [for

sales]

326488.00

16324.0

Annexure B - Part III,Section I [for

sales]

0.00

0.0

Outside WB :

0.00

Within WB :

0.00

Annexure B - Part IV [dispatch of goods otherwise than by sale]

Signature of the Dealer ____________________

Status ____________________

Page 2 of 2

2 of 2

1/26/2015 9:55 PM

Anda mungkin juga menyukai

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDari EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesBelum ada peringkat

- Tax Code and Period CodeDokumen1 halamanTax Code and Period CodeThiruBelum ada peringkat

- 0027 PDFDokumen1 halaman0027 PDFThiru RajaBelum ada peringkat

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDokumen5 halamanNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Belum ada peringkat

- Basic Features of Value Added Tax (VAT) For ItesDokumen24 halamanBasic Features of Value Added Tax (VAT) For ItesDebashishDolonBelum ada peringkat

- List of Specific GuideDokumen1 halamanList of Specific Guideshirad anuarBelum ada peringkat

- IT-2 2011 With Formula and Surcharge and Annex DDokumen15 halamanIT-2 2011 With Formula and Surcharge and Annex DPatti DaudBelum ada peringkat

- Swiggy DFDokumen2 halamanSwiggy DFhemanth1234Belum ada peringkat

- Notice 138Dokumen13 halamanNotice 138Farhan AliBelum ada peringkat

- GST Notice for DiscrepanciesDokumen69 halamanGST Notice for DiscrepanciesPrashant ZawareBelum ada peringkat

- Goods & Services Tax (GST) News and Updates 2Dokumen1 halamanGoods & Services Tax (GST) News and Updates 2Terin IsaacBelum ada peringkat

- Step-by-Step Guide to Claim GST RefundDokumen34 halamanStep-by-Step Guide to Claim GST Refunddhruv MahajanBelum ada peringkat

- GST One LinersDokumen36 halamanGST One LinersSonali PalBelum ada peringkat

- CAF I Nal GST & Customs Amendments For Dec 2021 Exams by Ca Brindavan Giri (BG S I R)Dokumen50 halamanCAF I Nal GST & Customs Amendments For Dec 2021 Exams by Ca Brindavan Giri (BG S I R)Meet DalalBelum ada peringkat

- Exemption Poly Pac Valid Up To 31.12.2020 (2) - 1Dokumen1 halamanExemption Poly Pac Valid Up To 31.12.2020 (2) - 1khawarBelum ada peringkat

- Field Training Report 127411Dokumen7 halamanField Training Report 127411deepak mauryaBelum ada peringkat

- Report of the Comptroller and Auditor General of India on Revenue Receipts for the year ended 31 March 2012Dokumen172 halamanReport of the Comptroller and Auditor General of India on Revenue Receipts for the year ended 31 March 2012SanjayThakkarBelum ada peringkat

- Ca Education: 8 EditionDokumen478 halamanCa Education: 8 Editionankit singhBelum ada peringkat

- Witholding TaxDokumen68 halamanWitholding TaxReynante GungonBelum ada peringkat

- Understanding GSTR-1 Changes - Impact of Tables 14 & 15 On E-Commerce Supplies - Taxguru - inDokumen4 halamanUnderstanding GSTR-1 Changes - Impact of Tables 14 & 15 On E-Commerce Supplies - Taxguru - inAkashBelum ada peringkat

- DJBBillDokumen2 halamanDJBBillAshish KhantwalBelum ada peringkat

- Circular No.32/2020-Customs: Initiatives For Contactless CustomsDokumen3 halamanCircular No.32/2020-Customs: Initiatives For Contactless CustomsPrashant BharthiBelum ada peringkat

- ADPPB7911B - Show Cause Notice For Proceedings Us 148A - 1041291139 (1) - 23032022Dokumen2 halamanADPPB7911B - Show Cause Notice For Proceedings Us 148A - 1041291139 (1) - 23032022nirmalku2061Belum ada peringkat

- b3Dokumen5 halamanb3YesBroker InBelum ada peringkat

- Final Ready SampleDokumen15 halamanFinal Ready SampleachsamirksBelum ada peringkat

- BIR Ease of Doing BusinessDokumen25 halamanBIR Ease of Doing BusinessCess MelendezBelum ada peringkat

- Return of Total Income and Tax ComputationDokumen7 halamanReturn of Total Income and Tax ComputationOmer PashaBelum ada peringkat

- Taxation Laws - Ms. de CastroDokumen54 halamanTaxation Laws - Ms. de CastroCC100% (1)

- Dec 2023 Compliance DeadlinesDokumen2 halamanDec 2023 Compliance DeadlinesGab Ocoma Dela CruzBelum ada peringkat

- STP 07 - 2020Dokumen1 halamanSTP 07 - 2020Fiza. MNorBelum ada peringkat

- 6Dokumen5 halaman6MarkLouiseSumugatOlandresBelum ada peringkat

- 27 Aug 2014 Circular NoDokumen3 halaman27 Aug 2014 Circular NockzeoBelum ada peringkat

- Agency Commission - Summary 226: Mahesh CH - Tewari C-2071/4 INDIRA NAGAR Lucknow Lucknow 0Dokumen3 halamanAgency Commission - Summary 226: Mahesh CH - Tewari C-2071/4 INDIRA NAGAR Lucknow Lucknow 0SiaYadavBelum ada peringkat

- Sec 183Dokumen1 halamanSec 183goelshubham92Belum ada peringkat

- MR Gomez Bradly Blones Apt/Blk 620 Woodlands Drive 52 #02-90 SINGAPORE 730620Dokumen2 halamanMR Gomez Bradly Blones Apt/Blk 620 Woodlands Drive 52 #02-90 SINGAPORE 730620Bradly Blones GomezBelum ada peringkat

- GSTR-3B Filing On GST Portal - Step by Step Return Filing ProcedureDokumen26 halamanGSTR-3B Filing On GST Portal - Step by Step Return Filing ProcedureCA Naveen Kumar BalanBelum ada peringkat

- TaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsDokumen5 halamanTaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsAmit AgrawalBelum ada peringkat

- GST Invoice Details I Essential InformationDokumen7 halamanGST Invoice Details I Essential InformationShaik MastanvaliBelum ada peringkat

- E Invoice Under GST - NovDokumen2 halamanE Invoice Under GST - NovVishwanath HollaBelum ada peringkat

- E InvoiceDokumen23 halamanE Invoicenallarahul86Belum ada peringkat

- Guidelines For VAT Deduction at Source and VAT Rate For 2021-22Dokumen30 halamanGuidelines For VAT Deduction at Source and VAT Rate For 2021-22Masum GaziBelum ada peringkat

- GST Automated NoticesDokumen6 halamanGST Automated NoticesMaunik ParikhBelum ada peringkat

- GST E InvoiceDokumen23 halamanGST E Invoicenallarahul86Belum ada peringkat

- GST LatestAmendments Issues 01072023Dokumen85 halamanGST LatestAmendments Issues 01072023Selvakumar MuthurajBelum ada peringkat

- Tax Invoice/Receipt: S/No Payment Mode Description Submission No Reference No Net Amount GST (7% GST) Gross AmountDokumen1 halamanTax Invoice/Receipt: S/No Payment Mode Description Submission No Reference No Net Amount GST (7% GST) Gross AmountDaren RitonBelum ada peringkat

- Vietnam VAT ReturnDokumen1 halamanVietnam VAT ReturnkompokoBelum ada peringkat

- GST 9th Edition BookDokumen542 halamanGST 9th Edition BookLalli DeviBelum ada peringkat

- Customs Circular-No-18-2023Dokumen1 halamanCustoms Circular-No-18-2023Raja SinghBelum ada peringkat

- Reprint HOReceiptDokumen1 halamanReprint HOReceiptAlen Matthew AndradeBelum ada peringkat

- Form16Dokumen5 halamanForm16er_ved06Belum ada peringkat

- VDS Guideline and VAT Rate For The FY 2020-2021 in Comparison With The FY 2019-2020Dokumen9 halamanVDS Guideline and VAT Rate For The FY 2020-2021 in Comparison With The FY 2019-2020Masum GaziBelum ada peringkat

- Friends Cable Network 24539 COMMDokumen3 halamanFriends Cable Network 24539 COMMKanishk YadavBelum ada peringkat

- Source Code: Govt. ServantDokumen6 halamanSource Code: Govt. ServantmujebaliBelum ada peringkat

- Order1522814 Ultra ConstructionDokumen2 halamanOrder1522814 Ultra Constructionmeuh54uhBelum ada peringkat

- RBI Master Circular On Collection of Direct Tax - OLTASDokumen6 halamanRBI Master Circular On Collection of Direct Tax - OLTASSrinivaasBelum ada peringkat

- QUA04354 Form16Dokumen3 halamanQUA04354 Form16rajanBelum ada peringkat

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokumen4 halamanForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelBelum ada peringkat

- Form 16: Wipro LimitedDokumen5 halamanForm 16: Wipro Limiteddeepak9976Belum ada peringkat

- AnkitDokumen4 halamanAnkitsitBelum ada peringkat

- Waqas Sales DataDokumen2 halamanWaqas Sales Datasaif azimiBelum ada peringkat

- Legacy Systems The Inconvenient Truth and The Cost of Doing NothingDokumen40 halamanLegacy Systems The Inconvenient Truth and The Cost of Doing Nothingrf_12380% (1)

- Joy Global Inc: FORM 10-QDokumen44 halamanJoy Global Inc: FORM 10-QfiahstoneBelum ada peringkat

- Pages From Filed ComplaintDokumen9 halamanPages From Filed Complaintmbamman-1Belum ada peringkat

- Kesan Hair Oil 1Dokumen27 halamanKesan Hair Oil 1AlpeshBelum ada peringkat

- 9609 s17 QP 32 PDFDokumen8 halaman9609 s17 QP 32 PDFvictorBelum ada peringkat

- Allianz SE (ALVG - De) Understanding Buy-Back CapabilitiesDokumen13 halamanAllianz SE (ALVG - De) Understanding Buy-Back CapabilitiesYang LiBelum ada peringkat

- November 21, 2014 Strathmore TimesDokumen28 halamanNovember 21, 2014 Strathmore TimesStrathmore TimesBelum ada peringkat

- Optimize General Ledger TitleDokumen1 halamanOptimize General Ledger TitleMinn TunBelum ada peringkat

- BondAnalytics GlossaryDokumen4 halamanBondAnalytics GlossaryNaveen KumarBelum ada peringkat

- Substance Over FormDokumen4 halamanSubstance Over FormAnyta TiarmaBelum ada peringkat

- Buss Law AsinmentDokumen27 halamanBuss Law AsinmentAnupam Kumar ChaudharyBelum ada peringkat

- TAX NOTES (LEGAL GROUNDDokumen103 halamanTAX NOTES (LEGAL GROUNDyani ora100% (3)

- TRIAL E Commerce Financial Model Excel Template v.4.0.122020Dokumen68 halamanTRIAL E Commerce Financial Model Excel Template v.4.0.122020DIDIBelum ada peringkat

- Tata Vs HyundaiDokumen49 halamanTata Vs HyundaiAnkit SethBelum ada peringkat

- S. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Dokumen10 halamanS. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Scribd Government DocsBelum ada peringkat

- Quick Company Analysis PVR Limited: ShikshaDokumen10 halamanQuick Company Analysis PVR Limited: ShikshaSuresh PandaBelum ada peringkat

- Edgar Detoya, Tax ConsultantDokumen12 halamanEdgar Detoya, Tax ConsultantPauline Bianca93% (30)

- TOCAO Vs CADokumen3 halamanTOCAO Vs CAJane Sudario100% (3)

- Adampak AR 09Dokumen74 halamanAdampak AR 09diffsoftBelum ada peringkat

- Topic 6 - Strategic ChoicesDokumen70 halamanTopic 6 - Strategic ChoicesJamilah EdwardBelum ada peringkat

- Clarkson QuestionsDokumen5 halamanClarkson QuestionssharonulyssesBelum ada peringkat

- Auditing-Review Questions Chapter 13Dokumen5 halamanAuditing-Review Questions Chapter 13meiwin manihingBelum ada peringkat

- Accounting for Manufacturing CostsDokumen81 halamanAccounting for Manufacturing CostsAdrian Faminiano100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartBelum ada peringkat

- CH 456Dokumen8 halamanCH 456Syed TabrezBelum ada peringkat

- Chapter 16 - AnswerDokumen16 halamanChapter 16 - AnswerAgentSkySkyBelum ada peringkat

- Answers To Essay QuestionsDokumen17 halamanAnswers To Essay QuestionsDarren LimBelum ada peringkat

- FIDIC (Silver Book)Dokumen15 halamanFIDIC (Silver Book)a74engBelum ada peringkat

- All Template Chapter 6 As of September 10 2019Dokumen32 halamanAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Corporate Finance: Topic: Company Analysis "Infosys"Dokumen6 halamanCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghBelum ada peringkat