Clarkston - Trade Marketing

Diunggah oleh

arianna_001Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Clarkston - Trade Marketing

Diunggah oleh

arianna_001Hak Cipta:

Format Tersedia

Trade Marketing &

Demand Planning Alignment

for Improved Sales Forecasting

Consumer Products companies today have a wealth of

information, capabilities, knowledge and technology to

generate demand forecasts. So, why is it so hard to generate an accurate and agreed upon forecast?

There are typically two organizational groups within a consumer products company that have the visibility, insight and

responsibility to create the sales forecast trade marketing

and demand planning. The two groups have unique processes,

vantage points, organizational structures, data and methodologies, and therefore generate different versions of the forecast. Since the best forecasts leverage information from both

of these groups, the key to success is to overcome the

challenges that keep these organizational units out of sync.

The following pages outline four basic challenges that organizations face in aligning Trade Marketing and Demand Planning.

Each challenge covers the perspectives of both groups and

provides recommendations on how organizations can tackle

these common challenges.

1

2

Clarkston Consulting

What is the forecast? The What & When of Selling

What the company will sell and when it will sell it is often defined differently between

trade marketing and demand planning, and since they do not plan at the same

levels, translating between the two cannot be solved by a simple math equation.

Who does what? Two Cooks in the Kitchen

The challenge is not that Trade Marketing and Demand Planning are

duplicating efforts it is, instead, understanding how each of their inputs

can be best understood and leveraged.

How can we agree? The Consensus Number

Differences in levels of information, methods, timing, and how trade

marketing and demand planning are organizationally aligned make

creating a well-defined forecasting process complicated.

How do we merge it all together? Data, Data Everywhere

Different information, from different groups, from different systems at

different levels can often make data feel like the enemy and not the answer.

TRADE MARKETING & DEMAND PLANNING ALIGNMENT

The What & When of Selling

The Challenge

Trade Marketing

Demand Planning

Recommendation

It is unlikely that anyone from Trade

For commercial organizations, dollars

are most often the preferred unit of

measure for what the organization

is going to sell. Depending on pricing,

promotions, SKU mix, and other

factors, the translation of these

monetary sales numbers to shipped

product can vary widely. Even when

sales and trade marketing talk about

demand in units to manage and

analyze promotions, they are often

talking about demand at a product

family or promoted group level

rarely at a SKU or UPC level which

is needed for demand planning.

For the demand planning group, the

definition of what the company is

going to sell is relatively simple it is

the number of units of each SKU the

company expects to sell to its direct

customers. This gets complicated,

though, when a demand planner tries

to incorporate input from other sources

that are provided at a different level

or with different units of measure.

For example, when a demand planner

receives promotional data in dollars,

it is often very challenging to make

this information actionable.

The different ways that each group

looks at a demand plan are important

to the overall health of a company.

Understanding how to use the

different forecasts together allows

a company to generate a more

complete and accurate demand

plan. Trade marketing and demand

planning groups that do not define,

understand and leverage these differences not only nullify their value, but

create confusion and distrust between

the groups. At the end of the day,

the demand plan needs to be able to

predict what the company is going to

sell and when it will sell it. The following pages outline some of the tactical

ways to execute these goals.

Marketing or Demand Planning

would dispute that the ultimate

goal is to generate an accurate

projection of what the company is

going to sell and when they will sell

it. However, problems arise when

the what and when of selling need

to be defined and measured. Since

each group plans differently based

on their activities, and translating

between the two cannot be solved

by a simple math equation.

Clarkston Consulting

The when question for trade marketing is also a bit complex. Trade spend

is often based on the sale of product

at the retailer, and therefore, many trade

forecasts are based on point-of-sale

data or other retailer information.

Depending on the levels of stock

carried by the retailers, these POS

driven forecasts may or may not

correlate with the companys sales

and therefore the demand planning

forecasts. Additionally, the periods

used for trade promotion volume

forecasts often do not correlate with

the demand planning periods. When

this happens, forecasts can be diluted

for the period.

The when products are going to be

sold question is also usually simple for

a demand planner. They need to know

when products should be shipped to

meet customers orders. Again, when

grows unclear depending on the granularity of the forecast whether in

weeks, months, or some other time

frame. The right time period is

usually driven by the operational

needs of the supply chain, but it is

also important to understand for what

periods forecast data is available.

TRADE MARKETING & DEMAND PLANNING ALIGNMENT

Two Cooks in the Kitchen

The Challenge

Trade Marketing

Demand Planning

Recommendation

Both Trade Marketing and De-

Trade marketing is typically part of

the commercial or sales organization

and is therefore closest to the customer and the competition. They are

most connected to, aware of, or in

many cases drive the factors that

shape demand. Using this knowledge,

their biggest contributions to generating the best forecast can come by

focusing on the following:

Demand Planning is traditionally part

of a companys supply chain organization. They have knowledge of how

factors within the supply chain can

affect demand (e.g., supply shortages, satisfying demand through

alternate DCs). They also have ultimate responsibility for the forecast

that is used for supply chain planning. Demand planners can best

contribute to the following areas:

It is important to clearly define roles

and responsibilities to prevent

duplicate work and promote an

integrated, not parallel, process.

While there is not a right way to divide

up responsibility, the goal is to use

the best inputs from each group to

drive the best forecast possible. For

example, who can provide the most

accurate changes in demand due to

a change in customer base? Sales

and trade marketing are typically

good at forecasting demand increases generated by new customers, as

they are working closely with the new

accounts to predict demand. However, they are typically not as good at

identifying customers with declining

buying patterns, as customers rarely

call sales reps to say they are going

elsewhere. In contrast, a demand

planner can analyze buying habits at

the customer level and flag customers

that have not bought anything for a

period of weeks or months. The only

way to manage these two cooks in

the kitchen is to outline detailed inputs

required for the forecast, consider the

visibility of each group and assign

responsibilities based on their insights.

mand Planning generate sales

forecasts by using historical data,

outside input, and their individual

experiences, sales. On the surface,

it might appear that these groups

are duplicating efforts. However,

in reality, these groups are not

doing the same thing, but instead

providing different inputs from

different angles to improve the final

output. The key is ensuring that the

right group is responsible for the

right inputs based on their organizational role, visibility and insight.

Providing account based forecast

information (voice in the field)

Predicting adjustments to base

demand considering account

changes (e.g., new stores)

Reviewing aggregate brand

or family forecast based on

consumption data

Generating demand impacts

for trade activity (e.g., lifts,

cannibalization)

Generating initial statistical baseline

forecast based on historical data

Adjusting statistical models based

on exceptions

Setting-up new SKUs

Leading the integration of inputs

from all demand creation organizations into the forecast

Validating significant changes

in forecasted demand

Forecasting other lift projections for

marketing demand creation actions

(e.g., new product introduction)

Communicating forecast changes

and issues to appropriate

stakeholders

Adding input based on new

customers or new channels

Driving forecast accuracy

measurements

Identifying customers with

declining buying patterns

Clarkston Consulting

TRADE MARKETING & DEMAND PLANNING ALIGNMENT

The Consensus Number

The Challenge

Trade Marketing

Demand Planning

Recommendation

Given the different reporting

Trade marketing is generally organized

around channels and customers by

business units. Normally trade promotion planning occurs on a yearly

planning cycle in conjunction with

the Customer Business Planning

performed with key accounts. During

this time, promotional calendars are

created with macro events and programs, many of which are refined

on a later basis for execution based

on actual data and the account and

market conditions. Channel plans are

often created during this time that

may encompass traditional customers (e.g. mom and pop stores).

The demand planning group is often

organized around a brand or product

line at a global level. Demand planners

typically work on a monthly cycle

to support the S&OP process while

making sure any short term changes

in demand are made visible to the

supply chain in a timely fashion. In

addition to providing their own forecast

analysis, they usually are responsible

for pulling together the data from all

of the various input sources and

providing data back to the various

groups for further analysis and refinement. This can often be a challenge

because they struggle to aggregate

or disaggregate data to a consistent

level to be integrated. Additionally,

because of differences in organizational structures, demand planners

often have to work across many

trade planners to obtain the data that

is needed. Therefore, the integration

of the various inputs is often only

done when needed just once a

month or less, minimizing the

amount of cross-functional analysis

that can be done.

Many organizations facilitate demand

planning by creating group-specific

forecasts, and thereafter, hashing out

a consensus demand plan. A more

effective approach is to have an

integrated demand planning process where data is shared across

groups throughout the creation of

the forecast. This involves having

processes and tools (covered in the

next section) to harmonize data that

comes in at different levels of granularity. Each group can then review

and analyze the data at a level that

makes sense to them and provide

meaningful and actionable data to

others. All of this allows the team to

arrive at a consensus number rather

than agree on a consensus number.

While this difference might be subtle,

the integrated nature of the process

leads to a more efficient process and

better results.

structures, accessible information

and activities of trade marketing

and demand planning, the process of generating a consensus

demand plan is at best, painful,

and at worst, completely dysfunctional. As outlined earlier, one

step is to have defined roles and

responsibilities. The other step

is to establish a well defined

process that ensures that those

roles and responsibilities are put

into action, with the right inputs,

outputs, time constraints and

business rules. The process

should ultimately pull together

the disparate pieces from various

groups to be able to analyze and

arrive at a consensus forecast.

Clarkston Consulting

Trade plans are developed at various

levels, often based on customer structure between headquarters and retail

outlets. The planning is either completed top down, bottom up or middle

out. Promotions can be at various brand

or product levels, and can be done at

monthly, weekly or even daily levels.

After trade plans go through an approval process, typically with various

reviews, each key account or channel

can operate differently and have

different planning cycles. These

cycles may or may not be aligned

with the S&OP planning cycles.

TRADE MARKETING & DEMAND PLANNING ALIGNMENT

Data, Data Everywhere

The Challenge

Trade Marketing

Demand Planning

Recommendation

Multiple systems, with different

Trade promotion systems encompass

a variety of functions that can help

Trade Marketing with budgeting and

tracking; promotional planning and

execution; settlements and deductions; and pre/post event analytics.

At minimum, a trade system will allow

the trade planner to input their budgets and plans, and then track program status. Enhanced trade promotion systems allow the planner to

forecast baseline, lift and cannibalization based on past sales history or

consumption data and compare

different what-if scenarios. Leading

edge technology will allow the planner to put in a goal and the system

will optimize the trade plans to determine the maximum return.

A good demand tool has statistical

forecast modeling tools that allow the

demand planner to generate and

evaluate a forecast. It includes the

ability to incorporate outside adjustments such as promotional lift or new

product activity, and can aggregate or

disaggregate data received from

outside sources. When used most

effectively, the demand planning tool

can use a combination of these functionalities to automate the integration

of data from various sources in nearreal time, no matter the level of the

data. For example, if the trade marketing group provides the forecast for

a promotional event by brand and

region, the demand planning tool can

use the historical break down of that

brand and region to disaggregate the

promotional event down to the SKUDC level. It can also roll other inputs

up to the brand/region level to provide

back to the trade marketing system.

Demand Planning and Trade Promotion planning tools each have their

own respective value. Like discussed

above, their value when appropriately

integrated is greater than the sum of

their parts. Having clear definitions

of the roles of the systems, just like

the roles of the organizations, allows the company to take advantage of the strengths of each tool.

It also allows for integration of different

data elements and helps define the

flow of information between those

systems. Additionally, having robust

Demand Planning and Trade Promotion Management systems makes the

aggregation and disaggregation of

data more straight forward. It also

allows the planners from each respective group to work with the data at the

levels that are most effective for them,

without having to go to great lengths to

make that data useful to other groups.

information coming from different

groups, at different levels is confusing enough. Figuring out what

data is generated in what system,

where it gets passed and how it

is aggregated and disaggregated

often feels impossible. Based on

this complexity, is there a need for

separate demand planning and

trade promotion tools, and if so,

how can all this data disparity

best be leveraged?

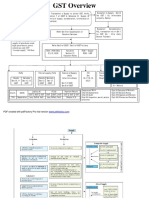

A Representative Technology Landscape

DP System

Statistical

Baseline

Generated

Total Demand

Plan

Forecast

Reviewed at

Operational Level

TPM System

Baseline,

Forecast

Baseline Verified

& Adjusted if

Needed

Baseline,

New Distribution

New Distribution, Added

Promotions

Promotion

History

Promotional

Events Added

Consensus

Forecast

Clarkston Consulting

Trade systems often integrate with

other key systems including the

demand planning system to share

forecasts; ERP systems for pricing,

orders, sales and settlement functions; Business Intelligence tools for

analytics; and broker/retail execution

tools for promotion execution.

The demand planning tool is also

usually integrated to, if not part of,

the supply chain planning tool. This

allows updated forecast data provided

from other groups to be analyzed and

easily passed through the supply chain

planning group so they can respond

to changes in demand as soon as

they are available.

TRADE MARKETING & DEMAND PLANNING ALIGNMENT

Join the Discussion

About the Authors

Chris Striffler is a manager with Clarkston

Consulting and a leader

in the firms Consumer

Products practice. Chris

has over 10 years of experience working

with some of Clarkstons largest Consumer Products clients to improve their

forecasting and supply chain processes.

Kristine Pettoni is a

solution advisor with

Clarkston Consulting

and a leader in Clarkstons sales, marketing

and trade management

practice. Kristine has

over 10 years of experience working

in Consumer Products and has expertise in sales and retail execution, trade

promotion and pricing, trade promotion

optimization, customer segmentation

and downstream data and analytics.

Aligning Trade Marketing and Demand Planning for more accurate forecasting requires Consumer Products Companies to

tackle four key challenges: facilitate forecast understanding

between the two groups, integrate the forecasting process, define clear roles and responsibilities and establish tools that facilitate data integration and analysis. By taking steps forward in

each of these areas, companies will improve the effectiveness,

efficiency, and responsiveness of their demand planning processes, leading to more effective planning teams, higher forecast

accuracy and quicker dissemination of demand changes to the

supply chain.

Clarkston Related Reading

Predictive Trade Promotion Planning

Cutting Costs with S&OP without

Cutting Corners

Want Successful S&OP,

Its the Soft Stuff that Matters

Clarkston has helped many companies in the Consumer Products

industry better integrate their supply and demand functions. Even

with the sophisticated demand planning and trade promotion

tools and techniques of today, we continue to see CP companies

specifically struggle with bringing together trade marketing and

demand planning groups to effectively contribute to the S&OP

process. For further discussion on how to integrate these functions

to improve your demand planning process, contact us at

info@clarkstonconsulting.com

For more information, contact Chris:

cstriffler@clarkstonconsulting.com.

About Clarkston Consulting

Headquarters

Research Triangle Park

1007 Slater Road, Suite 400

Durham, NC 27703

Phone: 800-652-4274

www.clarkstonconsulting.com

Copyright 2014 Clarkton Consulting. All rights reserved. 00931_0414

Clarkston Consulting is a different kind of management and technology consulting firm. We deliver a unique experience for

market leaders within the Consumer Products and Life Sciences industries. Considering professionalism, expertise, and value

as prerequisites, we take service a step further through our unyielding commitment to the success of people as individuals,

both our clients and our employees. By combining integrity, adaptability, and a whatever-it-takes attitude, we have achieved

an extremely high rate of referral and repeat business and a 10-year average client satisfaction rating of 96%.

Anda mungkin juga menyukai

- What Makes A Great Manager - GoogleDokumen1 halamanWhat Makes A Great Manager - Googlearianna_001Belum ada peringkat

- Cover Letter GuidelinesDokumen1 halamanCover Letter Guidelinesarianna_001Belum ada peringkat

- The Entrepreneur's Business Model - Toward A Unified Perspective (PDF Download Available) PDFDokumen15 halamanThe Entrepreneur's Business Model - Toward A Unified Perspective (PDF Download Available) PDFarianna_001Belum ada peringkat

- What Is The Difference Between LTCS and Carbon SteelDokumen2 halamanWhat Is The Difference Between LTCS and Carbon Steelarianna_001Belum ada peringkat

- Eng-Tips - Mechanical Engineering Other Topics - Design Greater Than 3000psiDokumen2 halamanEng-Tips - Mechanical Engineering Other Topics - Design Greater Than 3000psiarianna_001Belum ada peringkat

- Truearth Market Entry Analysis PDFDokumen17 halamanTruearth Market Entry Analysis PDFMohsen KfBelum ada peringkat

- IESA MBA - Cronograma Lunes Martes Miercoles Jueves Viernes Sabado DomingoDokumen8 halamanIESA MBA - Cronograma Lunes Martes Miercoles Jueves Viernes Sabado Domingoarianna_001Belum ada peringkat

- CR4 - Thread - Pressure Vessel Shell To Elliptical Weld Head JointDokumen3 halamanCR4 - Thread - Pressure Vessel Shell To Elliptical Weld Head Jointarianna_001Belum ada peringkat

- IESA MBA - Cronograma Lunes Martes Miercoles Jueves ViernesDokumen4 halamanIESA MBA - Cronograma Lunes Martes Miercoles Jueves Viernesarianna_001Belum ada peringkat

- 0132211BBMD2400 Rev0Dokumen19 halaman0132211BBMD2400 Rev0arianna_001Belum ada peringkat

- ATB Riva Calzoni (High Pressure Vessels)Dokumen3 halamanATB Riva Calzoni (High Pressure Vessels)arianna_001Belum ada peringkat

- What Is The Difference Between LTCS and Carbon SteelDokumen2 halamanWhat Is The Difference Between LTCS and Carbon Steelarianna_001Belum ada peringkat

- COADE Mechanical Engineering News Bulletin August 1992Dokumen16 halamanCOADE Mechanical Engineering News Bulletin August 1992sabi_shiBelum ada peringkat

- SidewallPropeller Catalog2009Dokumen40 halamanSidewallPropeller Catalog2009arianna_001Belum ada peringkat

- Building Ventilation and Pressurization As A Security ToolDokumen7 halamanBuilding Ventilation and Pressurization As A Security Toolrogel_ganaBelum ada peringkat

- Fixed LaddersDokumen7 halamanFixed LaddersDhimas ZakariaBelum ada peringkat

- FumehoodDokumen20 halamanFumehoodfelipecam5Belum ada peringkat

- Hoja de Datos Bomba PrincipalDokumen6 halamanHoja de Datos Bomba Principalarianna_001Belum ada peringkat

- 2070Dokumen8 halaman2070arianna_001Belum ada peringkat

- API Tank DesignDokumen189 halamanAPI Tank DesignDD3NZ91% (11)

- Heat Gain ComputersDokumen7 halamanHeat Gain Computersarianna_001Belum ada peringkat

- Hoja de Datos Bomba PrincipalDokumen6 halamanHoja de Datos Bomba Principalarianna_001Belum ada peringkat

- CB PlateDokumen8 halamanCB PlatenadhabindhuBelum ada peringkat

- 2070Dokumen8 halaman2070arianna_001Belum ada peringkat

- COADE Mechanical Engineering News Bulletin August 1992Dokumen16 halamanCOADE Mechanical Engineering News Bulletin August 1992sabi_shiBelum ada peringkat

- News Release HC Piper Aug 2011 WeightDokumen2 halamanNews Release HC Piper Aug 2011 Weightarianna_001Belum ada peringkat

- 2070Dokumen8 halaman2070arianna_001Belum ada peringkat

- Heat Losses On Electrical Equipment IEEE 141-1993 10.1.3Dokumen2 halamanHeat Losses On Electrical Equipment IEEE 141-1993 10.1.3arianna_001Belum ada peringkat

- Heat Losses On Electrical Equipment IEEE 141-1993 10.1.3Dokumen2 halamanHeat Losses On Electrical Equipment IEEE 141-1993 10.1.3arianna_001Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Government AccountsDokumen36 halamanGovernment AccountskunalBelum ada peringkat

- National Automated Clearing House)Dokumen3 halamanNational Automated Clearing House)santhosh sBelum ada peringkat

- MGT 490 Case Study 2Dokumen14 halamanMGT 490 Case Study 2Hasan AveeBelum ada peringkat

- Homework 5 - Gabriella Caryn Nanda - 1906285320Dokumen9 halamanHomework 5 - Gabriella Caryn Nanda - 1906285320Cyril HadrianBelum ada peringkat

- CH 2 POP PRACTICE EXAMDokumen9 halamanCH 2 POP PRACTICE EXAMErik WeisenseeBelum ada peringkat

- DBB2104 Unit-08Dokumen24 halamanDBB2104 Unit-08anamikarajendran441998Belum ada peringkat

- RM Unit 2Dokumen18 halamanRM Unit 2VickyBelum ada peringkat

- Information Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsDokumen4 halamanInformation Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsPeter BensonBelum ada peringkat

- Financial Accessibility of Women Entrepreneurs: (W S R T W P W E)Dokumen5 halamanFinancial Accessibility of Women Entrepreneurs: (W S R T W P W E)Vivi OktaviaBelum ada peringkat

- DMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDokumen10 halamanDMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDMA Capital GroupBelum ada peringkat

- Airbus A3XX PowerpointDokumen31 halamanAirbus A3XX PowerpointRashidBelum ada peringkat

- ENTR510 Final Assignment KeyDokumen5 halamanENTR510 Final Assignment Keystar nightBelum ada peringkat

- Case Study LawDokumen3 halamanCase Study Lawabdul waleed100% (3)

- Essay About MonopolyDokumen15 halamanEssay About MonopolyNguyễn Lan HươngBelum ada peringkat

- Break Even Point Summer Trining ReportDokumen27 halamanBreak Even Point Summer Trining ReportMohit SinghBelum ada peringkat

- Buyer Seller RelationDokumen16 halamanBuyer Seller RelationMirza Sher Afgan BabarBelum ada peringkat

- Controversies and conflicts of the Jacksonian EraDokumen2 halamanControversies and conflicts of the Jacksonian EraDaniel CoteBelum ada peringkat

- The Benefits of Free TradeDokumen30 halamanThe Benefits of Free TradeBiway RegalaBelum ada peringkat

- PROBATIONARY EMPLOYMENT CONTRACT - Elyan TambongDokumen4 halamanPROBATIONARY EMPLOYMENT CONTRACT - Elyan TambongBeeboi SeetBelum ada peringkat

- Chapter 7 Process ApproachDokumen12 halamanChapter 7 Process Approachloyd smithBelum ada peringkat

- Ms-4 Combined BookDokumen380 halamanMs-4 Combined Bookanandjaymishra100% (1)

- Insead AmpDokumen23 halamanInsead AmpJasbir S RyaitBelum ada peringkat

- GST OverviewDokumen17 halamanGST Overviewprince2venkatBelum ada peringkat

- Uganda National Fertilizer Policy April23-2016Dokumen33 halamanUganda National Fertilizer Policy April23-2016Elvis100% (1)

- Securities and Exchange Commission: Sec Form 17-QDokumen3 halamanSecurities and Exchange Commission: Sec Form 17-QJamil MacabandingBelum ada peringkat

- Community Development Fund in ThailandDokumen41 halamanCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Ram Singam - Electro LogicDokumen2 halamanRam Singam - Electro Logictrsingam67% (3)

- Case-8, Group-8Dokumen59 halamanCase-8, Group-8njtithiBelum ada peringkat

- Children's Book Financials for Year Ended May 1997Dokumen3 halamanChildren's Book Financials for Year Ended May 1997fazatiaBelum ada peringkat

- Batumi State Maritime Academy Faculty of Navigation: Makharadze Handmade GuitarsDokumen15 halamanBatumi State Maritime Academy Faculty of Navigation: Makharadze Handmade GuitarsSulxani NataridzeBelum ada peringkat