First Morning Technical Call 3rd February 2015

Diunggah oleh

Just ChillHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

First Morning Technical Call 3rd February 2015

Diunggah oleh

Just ChillHak Cipta:

Format Tersedia

FIRST MORNING TECHNICAL CALL

Tuesday, February 03, 2015

T E C H N I C A L S

MARKET OUTLOOK

MARKETM

NIFTY(8797) CNX NIFTY opened flat to negative on the first trading session of February and broke the crucial support of 8870 level. It observed directionless move

throughout the day as it was swinging between the negative and positive territory and formed a DOJI candlestick pattern showing indecisiveness. It snapped the gains it

made recently, filling the previous gap and settled the day with the loss of 12 points. Now it needs to hold above 8900 levels to break the trend and start fresh rally

towards new higher levels while on immediate basis it has to hold above 8770 zone to bounce back and regain its momentum. On downside major support exists at 8750

zones below that it may drift down towards 8700 levels. Traders are required to remain cautious as market is expected to be volatile ahead of RBI policy and UNION

budget.

CNX NIFTY

COMMENTS

SENSEX (29122)BSE Sensex opened negative and fell down below its

psychological 29000 levels led by losses in FMCG and metal sector stocks.

It remained volatile with negative bias throughout the trading session and

closed with the loss of 61 points. On the downside the immediate support

is at psychological 29000 followed by 28850 levels, whereas on the upside

resistance levels exist at 29350 zones followed by 29500 levels.

S&P BSE~SENSEX

PIVOT TABLE

NIFTY

SENSEX

BANK NIFTY

CNX IT

HIGH

8841

29268

19991

11973

LOW

8751

28959

19565

11848

CLOSE

8797

29122

19866

11944

PIVOT

8796

29116

19807

11921

R1

8842

29274

20050

11995

R2

8886

29426

20234

12046

S1

8752

28964

19623

11870

S2

8707

28807

19380

11797

FIRST MORNING TECHNICAL CALL

Tuesday, February 03, 2015

TECHNICAL CALLS

IDFC: Rs 176

EXECUTION PRICE RANGE

Buy Between Rs. 172 To Rs. 174

STOP LOSS

169.00

TARGET

181.00

IDFC is moving after consolidation of last couple of trading session and

gave multiple breakout on daily, weekly and yearly chart. It has been

forming higher top-higher bottom formation on daily and weekly chart

and gave the highest daily close. Thus, it is showing the potential to

move towards 181 and 190 levels. Traders can buy the stock with stop

loss of 169 for the upside target of 181 levels.

AUROPHARMA: Rs 1264

EXECUTION PRICE RANGE

Buy Between Rs. 1239 To Rs. 1251

STOP LOSS

1220.00

TARGET

1295.00

AUROPHARMA is trading in momentum from last eighteen months and

forming higher highs- higher lows price formation from last four trading

sessions on daily chart. It is registering record lifetime highs even after

selling pressure being witnessed in the broader market and gave the

highest daily close. Traders can buy the stock with stop loss of 1220 for

the upside target of 1295 levels.

FIRST MORNING TECHNICAL CALL

Tuesday, February 03, 2015

TOP OUTPERFORMERS

INDIAN INDICES

INDICES

SENSEX

NIFTY

CHANGE

-60.68

-11.50

CLOSE

29122

8797

SENSEX

% CHG

-0.21

-0.13

SYMBOL

Hindalco

Wipro

L&T

DLF

Sun Pharma

TURNOVER & MARKET CAP

BSE Cash

YEST'DAY

4050

3744

% CHG

8.16

NSE Cash

Derviatives(bn)

21334

1969

24551

5808

-13.10

-66.11

Rs. (Cr.)

PREV.DAY

NIFTY

CLOSE

145.4

625.0

1733.3

172.5

928.8

%

4.01

3.08

1.95

1.59

1.40

SYMBOL

HCL TECH

SIEMENS

AXIS BANK

HINDALCO

WIPRO

CLOSE

1891.0

1096.6

617.3

145.3

625.1

%

5.54

5.22

4.97

3.97

3.06

TOP UNDERPERFORMERS

SENSEX

NIFTY

INSTITUTIONAL ACTIVITIES

DII Equity

FII Equity

FII F&O

-38

-772

-79

-1680

1724

2258

SYMBOL

-97.76

-144.76

-103.52

Bharti Airtel

HUL

ICICI Bank

Jindal Steel

ITC

ADVANCES & DECLINES

EXCHANGE

BSE

NSE

ADV

1628

904

DECLINES

1669

595

CLOSE

34.62

60.00

13.09

12.68

13.66

54.00

PREV.CLOSE

34.08

56.98

12.86

12.01

13.18

50.47

TOP OUTPERFORMERS

% CHG

-1.56

-5.03

-1.76

-5.28

-3.51

-6.54

SECTORAL INDICES

BSE

INDICES

CNX Bank

CNX IT

CNX Reality

CNX FMCG

CNX Infra

CNX Pharma

BSE Auto

BSE Metal

CNX MNC

BSE 500

Nifty Midcap

BSE 100

CLOSE

19866

11944

238

20840

3305

11628

20078

10142

9699

11354

3517

8895

NSE

%

0.11

1.01

0.55

-1.54

0.31

-0.56

0.46

-0.47

-0.36

0.07

-0.36

-0.09

INDICES

BSE MIDcap

BSE SmallCap

BSE 200

CLOSE

10799

11457

3641

%

0.56

1.13

0.00

OTHER IMP.DATA

10 Yr Gsec yield

RS/$

$ Index

Brent Crude ($)

Gold ($)

Silver ($)

PE

NIFTY

%

-3.54

-2.63

-2.60

-2.46

-2.17

SYMBOL

BHARTI

JINDAL STEEL

ICICI Bank

ACC

ITC

CLOSE

359.3

154.8

351.9

1525.0

360.7

%

-3.85

-2.46

-2.45

-2.27

-2.14

BSE 500

TOTAL

3297

1499

INDIAN ADR's

ADR

Infosys

HDFC Bank

Wipro

ICICI Bank

Sterlite Inds.

Dr. Reddy's Lab

CLOSE

359.6

908.3

351.8

154.9

360.6

7.65

61.86

94.67

52.54

1274.59

17.04

CURRENT

AVG

20.4

19.7

SYMBOL

CLOSE

Monsanto India Ltd

3583.9

McNally Bharat Engineering Co Ltd 110.8

Future Retail Ltd

131.6

Jai Balaji Industries Ltd

16.9

Delta Corp Ltd

98.8

Titagarh Wagons Ltd

395.9

Sun Pharma Advanced Research Co361.2

Ltd

IFCI Ltd

40.7

Electrosteel Castings Ltd

17.8

National Fertilizers Ltd

39.2

United Phosphorus Ltd

393.3

S Kumars Nationwide Ltd

3.5

Manappuram Finance Ltd

34.1

Gujarat Fluorochemicals

772.8

Ansal Properties & Infrastructure Ltd 28.2

Sujana Towers Ltd

15.8

HCL Technologies Ltd

1893.5

Hexaware Technologies Ltd

238.0

Siemens India Ltd

1095.2

Whirlpool of India Ltd

710.0

Chennai Petroleum Corp Ltd

81.2

MAX India Ltd

499.2

GVK Power & Infrastructure Ltd

11.1

Shiv-Vani Oil & Gas Exploration Services

10.6

C Mahendra Exports Ltd

13.6

TOP UNDERPERFORMERS

%

13.15

13.12

12.53

11.22

10.46

10.34

9.99

7.96

7.88

7.85

6.88

6.75

6.74

6.69

5.82

5.70

5.54

5.50

5.32

5.27

5.25

5.21

5.09

4.96

4.95

SYMBOL

CLOSE

TVS Motor Co Ltd 286.3

Bilcare Ltd

59.5

Shree Global Tradefin

16.7

Ltd

Asian Paints Ltd 808.2

United Spirits Ltd 3261.7

Magma Fincorp Ltd 98.7

Info Edge India Ltd 807.9

Pidilite Industries Ltd545.1

Mphasis Ltd

347.8

MVL Ltd

0.7

REI Agro Ltd

1.0

Kansai Nerolac Paints

2335.9

Ltd

Bayer CropScience Ltd/India

3465.2

Hindustan Petroleum631.8

Corp Ltd

Bharti Airtel Ltd

359.6

Yes Bank Ltd

832.3

Mangalore Refinery 56.8

& Petrochemicals Ltd

Prestige Estates Projects

266.7Ltd

Divi's Laboratories Ltd

1687.1

Havells India Ltd 251.3

Dr Reddy's Laboratories

3138.5

Ltd

Gujarat State Petronet

116.7

Ltd

Bombay Rayon Fashions

125.8Ltd

Bank of Baroda

187.9

Berger Paints India Ltd

222.8

%

-7.11

-7.04

-6.44

-5.75

-5.60

-5.24

-4.41

-4.32

-4.23

-4.05

-3.88

-3.83

-3.67

-3.63

-3.54

-3.51

-3.48

-3.34

-3.18

-3.10

-3.04

-2.95

-2.93

-2.84

-2.81

FIRST MORNING TECHNICAL CALL

Tuesday, February 03, 2015

TRENDER+ OF NIFTY 50 STOCKS

SCRIP NAME

ACC

AMBUJA CEMENT

ASIAN PAINTS

AXIS BANK

BAJAJ AUTO

BHARTI AIRTEL

BHEL

BPCL

CAIRN INDIA

CIPLA

COAL INDIA

DLF

Dr.REDDY'S LABS

GAIL INDIA

GRASIM INDS

HCL TECH

HDFC

HDFC BANK

HERO MOTOCORP

HINDALCO

HINDUSTAN UNILEVER

ICICI BANK

IDFC

INDUSIND BANK

INFOSYS

ITC

JINDAL STEEL & PWR

JP ASSOCIATES

KOTAK MAHINDRA BANK

LARSEN & TOUBRO

MAHINDRA & MAHINDRA

MARUTI SUZUKI

NMDC

NTPC

ONGC

POWERGRID

PUNJAB NATIONAL BANK

RANBAXY LABS

RELIANCE INDS

RELIANCE POWER

SAIL

SBI

SESA STERLITE

SIEMENS

SUNPHARMA

TATA MOTORS

TATA POWER

TATA STEEL

TCS

WIPRO

OPEN

HIGH

LOW

CLOSE

PIVOT

R1

R2

S1

S2

1555

250

850

586

2390

370

291

746

237

698

354

171

3180

423

3828

1800

1263

1069

2878

140

926

360

173

865

2142

367

159

29

1320

1696

1265

3647

140

144

355

147

190

715

916

65

77

310

200

1042

925

588

91

390

2482

612

1560

251

856

622

2421

373

297

767

238

707

357

174

3184

434

3878

1900

1285

1093

2889

146

930

361

179

879

2152

369

160

29

1360

1740

1285

3725

143

144

358

149

194

729

920

67

78

312

205

1105

944

596

92

395

2521

628

1513

244

804

584

2325

357

290

735

234

691

350

168

3130

423

3800

1796

1244

1052

2810

140

905

350

171

856

2126

359

154

28

1304

1695

1234

3620

140

142

349

146

188

706

906

65

75

305

198

1039

922

581

89

382

2462

609

1525

249

808

617

2349

359

294

749

236

696

355

173

3139

430

3808

1891

1269

1082

2833

145

908

352

176

875

2137

361

155

29

1352

1735

1241

3669

141

142

350

148

192

720

908

66

76

308

198

1097

929

593

91

384

2514

625

1533

248

823

608

2365

363

294

750

236

698

354

172

3151

429

3829

1862

1266

1076

2844

144

914

354

176

870

2138

363

156

29

1339

1723

1253

3671

141

143

352

148

191

718

911

66

76

308

200

1080

932

590

91

387

2499

621

1552

252

842

631

2405

370

297

766

238

704

358

176

3172

435

3858

1929

1288

1099

2878

148

924

359

180

884

2151

367

159

29

1373

1752

1273

3723

143

144

356

149

194

731

917

67

77

311

203

1121

941

599

93

392

2536

632

1580

255

875

645

2461

380

300

782

240

713

361

178

3205

439

3907

1966

1307

1117

2924

150

939

365

184

893

2164

373

163

30

1395

1768

1305

3776

145

146

361

150

197

742

925

68

78

315

208

1146

953

605

94

400

2559

639

1505

245

789

594

2309

353

290

734

233

689

351

169

3118

424

3779

1825

1247

1058

2799

141

899

348

172

861

2125

357

152

28

1318

1707

1222

3618

140

141

346

146

189

707

903

65

75

304

196

1055

920

584

89

379

2477

614

1486

241

770

570

2269

346

287

718

231

682

347

166

3097

419

3751

1758

1225

1035

2765

137

889

343

168

847

2112

353

149

27

1283

1678

1202

3566

138

140

343

145

185

695

897

63

74

301

193

1014

910

575

88

374

2440

602

TRENDER+

Down

UP

Down

UP

UP

Down

Down

UP

Down

UP

Down

Down

UP

UP

Down

UP

Down

UP

Down

Flat

Down

Down

UP

UP

Down

Down

Down

UP

Flat

UP

Down

Down

UP

Down

Down

Down

Down

UP

Down

UP

Down

Down

Down

UP

UP

Down

UP

Down

Down

UP

DAILY PROJECTED RANGE

1542 - 1496

250 - 243

832 - 780

638 - 601

2385 - 2289

366 - 349

299 - 292

774 - 742

237 - 232

701 - 686

360 - 353

177 - 171

3162 - 3108

437 - 427

3843 - 3765

1948 - 1844

1298 - 1256

1108 - 1067

2861 - 2782

149 - 142

919 - 894

356 - 345

180 - 172

888 - 865

2144 - 2118

365 - 355

158 - 151

29 - 28

1384 - 1328

1760 - 1715

1263 - 1212

3750 - 3645

144 - 140

143 - 140

354 - 345

150 - 147

196 - 190

736 - 713

914 - 900

68 - 65

77 - 74

310 - 303

202 - 194

1134 - 1068

947 - 926

602 - 587

92 - 89

389 - 377

2548 - 2488

636 - 617

FIRST MORNING TECHNICAL CALL

Tuesday, February 03, 2015

HOW TO TRADE USING THE TRENDER+

CLOSING PRICES

Closing price is the price at which scrip closes on the date mentioned in the report. Traders may initiate their intraday trade on this level. The stock or index should sustain above or below the pivot else you should exit the trade.

TREND

Trend is the level at which the tendency of stocks can be identified. For best results, you can use the 'trender' to trade. A 'weak' trend denoted by DOWN means that traders can trade with a negative bias. If the trend is 'strong',denoted by UP, one can trade with a positive

bias on the long side. Base price should be the pivot point price.

IF THE TREND IS UP

Ideally, for a buy position, buy at the pivot point and use S1 as the stop loss for a target of levels around R2 and higher.

IF THE TREND IS DOWN

Ideally, for a sell position, sell at the pivot point and use R1 as a stop loss and S2 or lower levels as a target level.

TRENDER + : This is a broad based technical trend of the stock prevailant, may or may not be necessarily for the day.

DAILY PROJECTED RANGE : Projected Daily high and low are indicative range for the day, if the price moves out of the range the trend in that side may accelerate and turn bullish or bearish.

THE TREND AND THE DAILY PROJECTED RANGE IS BASED ON CERTAIN SIMPLE CALCULATIONS WHICH IS PROVIDED BY BLOOMBERG,

EXCLUSIVELY USED BY ANAND RATHI

Disclaimer:-Thisreport has been issued by Anand Rathi Share and Stock Brokers Limited (ARSSBL), which is regulated by SEBI. The informationherein was obtained from various sources; we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes an offer, or an

invitation to make an offer, to buy or sell any securities or any options, futures or other derivatives related to such securities ("related investments"). ARSSBL and its affiliatesmay trade for their own accounts as market maker / jobber and/or arbitrageur in any securities of this issuer(s) or in related investments, and may

be on the opposite side of public orders. ARSSBL, its affiliates, directors, officers, and employees may have a long or short position in any securities of this issuer(s) or in related investments. ARSSBL or its affiliatesmay from time to time perform investment banking or other services for, or solicit investment banking or

other business from, any entity mentioned in this report. This research report is prepared for private circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the

ppropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's price or value may

rise or fall. Past performance is not necessarily a guide to future performance. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report.

ANAND RATHI SHARE AND STOCK BROKERS LIMITED

4 th Floor , Silver Metropolis, Jaicoach Compound Opposite Bimbisar Nagar,Goregaon(East), Mumbai - 400063.

Tel No: +91 22 4001 3700 | Fax No: +91 22 4001 3770 | Website: www.rathi.com

Anda mungkin juga menyukai

- Day Trading Strategies Using Indicators: Profitable Trading Strategies, #2Dari EverandDay Trading Strategies Using Indicators: Profitable Trading Strategies, #2Penilaian: 5 dari 5 bintang5/5 (1)

- Nse Top 5 Gainers: Dear Must Take Tis in Ur PresentationDokumen7 halamanNse Top 5 Gainers: Dear Must Take Tis in Ur Presentationomi159Belum ada peringkat

- High Probability Scalping Strategies: Day Trading Strategies, #3Dari EverandHigh Probability Scalping Strategies: Day Trading Strategies, #3Penilaian: 4.5 dari 5 bintang4.5/5 (4)

- Get Daily Nifty Market News - 08 Oct 2015Dokumen8 halamanGet Daily Nifty Market News - 08 Oct 2015Pranjali UpadhyayBelum ada peringkat

- Day Trading Strategies For Beginners: Day Trading Strategies, #2Dari EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2Belum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-210648926Belum ada peringkat

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Dari EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Belum ada peringkat

- Weekly Equity Market Report For 14 MayDokumen8 halamanWeekly Equity Market Report For 14 MayTheequicom AdvisoryBelum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-210648926Belum ada peringkat

- Bitcoin Day Trading Strategies: Highly Profitable Bitcoin Day Trading and Scalping Strategies That Work in 2022: Profitable Trading Strategies, #1Dari EverandBitcoin Day Trading Strategies: Highly Profitable Bitcoin Day Trading and Scalping Strategies That Work in 2022: Profitable Trading Strategies, #1Penilaian: 5 dari 5 bintang5/5 (1)

- Investment TipsDokumen38 halamanInvestment TipsPartha PratimBelum ada peringkat

- Equity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Market Updates 18 MayDokumen8 halamanEquity Market Updates 18 MayRahul SolankiBelum ada peringkat

- Premarket MorningReport Dynamic 20.12.16Dokumen7 halamanPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Weekly Equity Market Data 30 May To 3rd JuneDokumen6 halamanWeekly Equity Market Data 30 May To 3rd JuneRahul SolankiBelum ada peringkat

- DailycallsDokumen18 halamanDailycallsumaganBelum ada peringkat

- T I M E S: Market Yearns For Fresh TriggersDokumen22 halamanT I M E S: Market Yearns For Fresh TriggersDhawan SandeepBelum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-210648926Belum ada peringkat

- Daily Digest: A Destimoney PublicationDokumen7 halamanDaily Digest: A Destimoney PublicationTalipattechnologiesBelum ada peringkat

- Tech Derivatives DailyReport 200416Dokumen5 halamanTech Derivatives DailyReport 200416xytiseBelum ada peringkat

- Derivative Report 02 May UpdateDokumen6 halamanDerivative Report 02 May UpdateDEEPAK MISHRABelum ada peringkat

- HaiDokumen8 halamanHaiPrajesh SrivastavaBelum ada peringkat

- Capitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MDokumen8 halamanCapitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MNehaSharmaBelum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-210648926Belum ada peringkat

- Daily Report: 29 OCTOBER. 2013Dokumen7 halamanDaily Report: 29 OCTOBER. 2013api-212478941Belum ada peringkat

- Equity Tips and News For TradingDokumen9 halamanEquity Tips and News For TradingRahul SolankiBelum ada peringkat

- Special Report by Epic Reseach 26 August 2013Dokumen7 halamanSpecial Report by Epic Reseach 26 August 2013EpicresearchBelum ada peringkat

- Equity Analysis Equity Analysis - Daily Daily: Weekly Newsletter Ly Newsletter-EquityDokumen8 halamanEquity Analysis Equity Analysis - Daily Daily: Weekly Newsletter Ly Newsletter-EquityTheequicom AdvisoryBelum ada peringkat

- Weekly Premium Equity Tips For TradersDokumen6 halamanWeekly Premium Equity Tips For TradersRahul SolankiBelum ada peringkat

- Weekly View:: Nifty Likely To Trade in Range of 6600-6800Dokumen14 halamanWeekly View:: Nifty Likely To Trade in Range of 6600-6800Raya DuraiBelum ada peringkat

- T I M E S: Markets Turn VolatileDokumen18 halamanT I M E S: Markets Turn Volatileswapnilsalunkhe2000Belum ada peringkat

- Weekly Stock Market Research ReportDokumen6 halamanWeekly Stock Market Research ReportRahul SolankiBelum ada peringkat

- Daily Equity ReportDokumen5 halamanDaily Equity ReportJijoy PillaiBelum ada peringkat

- Daily Nifty Market Views - 12 OCT 2015Dokumen8 halamanDaily Nifty Market Views - 12 OCT 2015Pranjali UpadhyayBelum ada peringkat

- Daily Equity ReportDokumen3 halamanDaily Equity ReportAditya JainBelum ada peringkat

- Nifty News Letter-01 October 2015Dokumen8 halamanNifty News Letter-01 October 2015Purvi MehtaBelum ada peringkat

- Equity Analysis - WeeklyDokumen8 halamanEquity Analysis - WeeklyTheequicom AdvisoryBelum ada peringkat

- Market Outlook Market Outlook: Dealer's DiaryDokumen12 halamanMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- MoneytimesDokumen19 halamanMoneytimesArijitNathBelum ada peringkat

- Daily Calls: January 29, 2016Dokumen17 halamanDaily Calls: January 29, 2016BharatBelum ada peringkat

- Special Report 19-09-2013 by Epic ResearchDokumen7 halamanSpecial Report 19-09-2013 by Epic ResearchNidhi JainBelum ada peringkat

- Special Report by Epic Reseach 08 August 2013Dokumen4 halamanSpecial Report by Epic Reseach 08 August 2013EpicresearchBelum ada peringkat

- Equity Analysis - WeeklyDokumen8 halamanEquity Analysis - WeeklyTheequicom AdvisoryBelum ada peringkat

- Premarket Technical&Derivative Angel 17.11.16Dokumen5 halamanPremarket Technical&Derivative Angel 17.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Premarket MorningReport Dynamic 19.12.16Dokumen7 halamanPremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Financial Edge - A Monthly NewsletterDokumen29 halamanFinancial Edge - A Monthly Newsletterkushagra_84Belum ada peringkat

- Daily Calls: November 8, 2016Dokumen18 halamanDaily Calls: November 8, 2016SathishKumarBelum ada peringkat

- Momentum PicksDokumen20 halamanMomentum PicksxytiseBelum ada peringkat

- Premarket Technical&Derivatives Angel 16.11.16Dokumen5 halamanPremarket Technical&Derivatives Angel 16.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Equity Report 16 Aug To 19 AugDokumen6 halamanEquity Report 16 Aug To 19 AugzoidresearchBelum ada peringkat

- Equity Analysis - WeeklyDokumen8 halamanEquity Analysis - Weeklysandeshsp1Belum ada peringkat

- Daily Calls: ICICI Securities LTDDokumen16 halamanDaily Calls: ICICI Securities LTDpathanfor786Belum ada peringkat

- Premarket MorningReport Dynamic 03.11.16Dokumen6 halamanPremarket MorningReport Dynamic 03.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-210648926Belum ada peringkat

- Special Report by Epic Reseach 27 August 2013Dokumen7 halamanSpecial Report by Epic Reseach 27 August 2013EpicresearchBelum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-221305449Belum ada peringkat

- Daily Equity Newsletter: Indian MarketDokumen4 halamanDaily Equity Newsletter: Indian Marketapi-196234891Belum ada peringkat

- Special Report 13 Sep 2013 by Epic ResearchDokumen7 halamanSpecial Report 13 Sep 2013 by Epic ResearchNidhi JainBelum ada peringkat

- Capital Builder WeeklyDokumen5 halamanCapital Builder WeeklyCapital Buildr Financial ServicesBelum ada peringkat

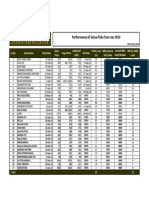

- Performance of Value Pick Since 2014-2Dokumen1 halamanPerformance of Value Pick Since 2014-2Just ChillBelum ada peringkat

- India Morning Bell 5th December 2014Dokumen18 halamanIndia Morning Bell 5th December 2014Just ChillBelum ada peringkat

- India Morning Bell 4th December 2014Dokumen14 halamanIndia Morning Bell 4th December 2014Just ChillBelum ada peringkat

- Gopeekrishnan Pillai Retail ManagementDokumen1 halamanGopeekrishnan Pillai Retail ManagementJust ChillBelum ada peringkat

- Links SlideshareDokumen4 halamanLinks SlideshareJust ChillBelum ada peringkat

- 1600 Amphitheatre Parkway Mountain View California: Google IncDokumen7 halaman1600 Amphitheatre Parkway Mountain View California: Google IncJust ChillBelum ada peringkat

- Presentation Title Impact Assessment Of: 1. Sports Education 2. Jan Jagruti Aabhiyan 3. Project With Magic BusDokumen16 halamanPresentation Title Impact Assessment Of: 1. Sports Education 2. Jan Jagruti Aabhiyan 3. Project With Magic BusJust ChillBelum ada peringkat

- Privatization of Coal Mines in IndiaDokumen2 halamanPrivatization of Coal Mines in IndiaJust ChillBelum ada peringkat

- BimaruDokumen2 halamanBimaruJust ChillBelum ada peringkat

- Problems Faced by Agriculture in IndiaDokumen5 halamanProblems Faced by Agriculture in IndiaJust ChillBelum ada peringkat

- Marginal Cost Analysis: Short-Run Alternative Choice DecisionsDokumen21 halamanMarginal Cost Analysis: Short-Run Alternative Choice DecisionsJust ChillBelum ada peringkat

- Usm 1Dokumen47 halamanUsm 1Abhishek KumarBelum ada peringkat

- TW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Dokumen3 halamanTW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Anonymous edvYngBelum ada peringkat

- Ymrtc LogDokumen26 halamanYmrtc LogVinicius Silveira0% (1)

- Chem Resist ChartDokumen13 halamanChem Resist ChartRC LandaBelum ada peringkat

- BS en Iso 06509-1995 (2000)Dokumen10 halamanBS en Iso 06509-1995 (2000)vewigop197Belum ada peringkat

- Eng21 (Story of Hamguchi Gohei)Dokumen9 halamanEng21 (Story of Hamguchi Gohei)Alapan NandaBelum ada peringkat

- Flying ColorsDokumen100 halamanFlying ColorsAgnieszkaAgayo20% (5)

- Geotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonDokumen7 halamanGeotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonJuan PerezBelum ada peringkat

- IG Deck Seal PumpDokumen3 halamanIG Deck Seal PumpSergei KurpishBelum ada peringkat

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Dokumen94 halamanN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESBelum ada peringkat

- Business Statistic Handout Bba - Sem 2Dokumen7 halamanBusiness Statistic Handout Bba - Sem 2hanirveshBelum ada peringkat

- Restaurant Report Card: February 9, 2023Dokumen4 halamanRestaurant Report Card: February 9, 2023KBTXBelum ada peringkat

- Internet Bill FormatDokumen1 halamanInternet Bill FormatGopal Singh100% (1)

- Discovery and Integration Content Guide - General ReferenceDokumen37 halamanDiscovery and Integration Content Guide - General ReferencerhocuttBelum ada peringkat

- DxDiag Copy MSIDokumen45 halamanDxDiag Copy MSITạ Anh TuấnBelum ada peringkat

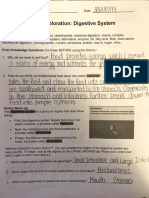

- Student Exploration: Digestive System: Food Inio Simple Nutrien/oDokumen9 halamanStudent Exploration: Digestive System: Food Inio Simple Nutrien/oAshantiBelum ada peringkat

- HAYAT - CLINIC BrandbookDokumen32 halamanHAYAT - CLINIC BrandbookBlankPointBelum ada peringkat

- Assignment 3Dokumen2 halamanAssignment 3Debopam RayBelum ada peringkat

- 1"a Study On Employee Retention in Amara Raja Power Systems LTDDokumen81 halaman1"a Study On Employee Retention in Amara Raja Power Systems LTDJerome Samuel100% (1)

- 10 Essential Books For Active TradersDokumen6 halaman10 Essential Books For Active TradersChrisTheodorou100% (2)

- Lego Maps ArtDokumen160 halamanLego Maps ArtВячеслав КозаченкоBelum ada peringkat

- Research Paper On Air QualityDokumen4 halamanResearch Paper On Air Qualityluwahudujos3100% (1)

- Optimal Dispatch of Generation: Prepared To Dr. Emaad SedeekDokumen7 halamanOptimal Dispatch of Generation: Prepared To Dr. Emaad SedeekAhmedRaafatBelum ada peringkat

- Rare Malignant Glomus Tumor of The Esophagus With PulmonaryDokumen6 halamanRare Malignant Glomus Tumor of The Esophagus With PulmonaryRobrigo RexBelum ada peringkat

- Audi R8 Advert Analysis by Masum Ahmed 10PDokumen2 halamanAudi R8 Advert Analysis by Masum Ahmed 10PMasum95Belum ada peringkat

- Activity Evaluation Form: "Where Children Come First"Dokumen1 halamanActivity Evaluation Form: "Where Children Come First"TuTitBelum ada peringkat

- MCQs - Chapters 31 - 32Dokumen9 halamanMCQs - Chapters 31 - 32Lâm Tú HânBelum ada peringkat

- Project Manager PMP PMO in Houston TX Resume Nicolaas JanssenDokumen4 halamanProject Manager PMP PMO in Houston TX Resume Nicolaas JanssenNicolaasJanssenBelum ada peringkat

- Will Smith BiographyDokumen11 halamanWill Smith Biographyjhonatan100% (1)

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Dokumen9 halamanISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602Belum ada peringkat