Jeevan Saathi 89

Diunggah oleh

Vidya AdsuleHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Jeevan Saathi 89

Diunggah oleh

Vidya AdsuleHak Cipta:

Format Tersedia

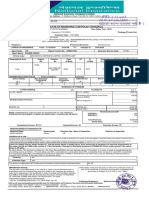

Presentation Details

Plan

89

Plan Name

Term

/ PPT

Sum

Assured

Bonus

Mode

*Premium

Total

Prem's Paid

Maturity

Year

Maturity

Amount

Jeevan Saathi (Profits)

21/21

1000000

48

Yly

54854

1151934

2034

2108000

54854

1151934

Total:

1000000

Note: The above Statements are based on certain assumptions, which are liable to change according to Government / Corporation's Policies.

* Rider Premiums are included in Premium.

* NI is number of installments.

Rider Details

Plan

89

Total

Term

21

PPT Rider Name

21 Double Accident Benefit

Rider Sum

Rider

Term

Rider

Premium

Total Prem's

Paid

1000000

21

2000

42000

2000

42000

LIC OF INDIA - MANISH SHAH

INSURANCE ADVISOR

402, Rajendra Vihar, 12th Khetwadi Cross lane, Grant Road, Mumbai -4

Mobile No. : 9820934872 , Web : www.licglobal.com, Email. : sales@licglobal.com

Name: Mr Sachin Tendulkar

Date: 11/02/2013

Age: 30

Annual Premium, Risk Cover and Loan Availability Details

Tax Slab: 20%

Year

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

Total

Age

Normal

Risk Cover

Accidental

Risk Cover

Annual

Premium

Tax

Saved

Net

Premium

Returns

From LIC

New Loan

Available

Total Loan

Available

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

0

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

0

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

0

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

0

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2108000

0

0

31076

47222

30086

34221

38855

43992

49668

56078

63057

71000

71117

80088

90461

102909

117421

142789

161123

181999

205130

0

0

0

31076

78298

108384

142605

181460

225453

275120

331199

394256

465256

536373

616461

706923

809831

927253

1070042

1231164

1413163

1618294

0

1151934

230391

921543

2108000

Note: The above Statements are based on certain assumptions, which are liable to change according to Government / Corporation's Policies.

Calculation includes Bonus and Final Additional Bonus as per present Rates.

(*) In Jeevan Saathi (Plan 89), On the unfortunate death of either husband / wife , survivor gets SA immediately and

the premium payment stops. once again, the survivor will get SA + Bonus at maturity if he/she survives till the end of

term. If the survivor dies before maturity, then the nominee will get the SA + Bonus upto that period. Please see

description for details.

This Presentation is Prepared for Private Circulation only.

You can't sip soup with a knife

LIC OF INDIA - MANISH SHAH

INSURANCE ADVISOR

402, Rajendra Vihar, 12th Khetwadi Cross lane, Grant Road, Mumbai -4

Mobile No. : 9820934872 , Web : www.licglobal.com, Email. : sales@licglobal.com

Name: Mr Sachin Tendulkar

Date: 11/02/2013

Age: 30

Return's Spreadsheet

Tax Slab: 20%

Year

Age

Normal

Lifecover

Accident

Lifecover

Annual

Premium

Tax

Saved

Net

Premium

Returns

from LIC

Net Returns

Surrender

Value

Total Loan

Available

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

1000000

0

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

2000000

0

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

54854

0

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

10971

0

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

43883

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2108000

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

-43883

2108000

0

0

34529

86997

120427

158450

201623

250503

305689

367999

438062

516951

595970

684957

785469

899813

1030281

1188935

1367960

1570182

1798104

0

0

0

31076

78298

108384

142605

181460

225453

275120

331199

394256

465256

536373

616461

706923

809831

927253

1070042

1231164

1413163

1618294

0

1151934

230391

921543

2108000

1186457

Total:

Note: (1)

(2)

(3)

(4)

The above Statements are based on certain assumptions, which are liable to change according to Government / Corporation's Policies.

Calculation includes Bonus and Final Additional Bonus as per present Rates.

* Available Total Money.

we are showing annual returns. in case of payment in arrears, half yearly installmant starts 6 months after maturity and yearly installment

starts 1 year after maturity. in case of payment in advance, yearly and half yearly installments starts immediately from maturity date.

Please refer circular no: Actl / 2015 / 4 for details about settlement options.

(*) The above illustration gives an effective yield of 7.38% with tax benefit.

(*) The above illustration gives an effective yield of 5.51% without tax benefit.

(*) In Jeevan Saathi (Plan 89), On the unfortunate death of either husband / wife , survivor gets SA immediately and

the premium payment stops. once again, the survivor will get SA + Bonus at maturity if he/she survives till the end of

term. If the survivor dies before maturity, then the nominee will get the SA + Bonus upto that period. Please see

description for details.

This Presentation is Prepared for Private Circulation only.

When your work speaks for itself, don't interrupt

LIC OF INDIA - MANISH SHAH

INSURANCE ADVISOR

402, Rajendra Vihar, 12th Khetwadi Cross lane, Grant Road, Mumbai -4

Mobile No. : 9820934872 , Web : www.licglobal.com, Email. : sales@licglobal.com

Name: Mr Sachin Tendulkar

Date: 11/02/2013

Age: 30

Table Showing Benefits of Jeevan Saathi

Following table shows benefits available to second partner in case of unfortunate death of first partner

after 5 years from date of commencement of policy. In case of unfortunate death of first partner

(husband or wife) survivor get sum assured immediately and Premium is waived. Riskcover of second

partner continues and Maturity is paid at the end of Term.

Year

Age

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

Total

First Partner

Normal

RiskCover

Accidental

RiskCover

1000000

1000000

1000000

1000000

1000000

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2000000

2000000

2000000

2000000

2000000

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Annual

Premium

Tax

Saved

Net

Premium

Returns

From LIC

54854

54854

54854

54854

54854

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

10971

10971

10971

10971

10971

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

43883

43883

43883

43883

43883

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1000000

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2108000

274270

54855

219415

3108000

This Presentation is Prepared for Private Circulation only.

Those we hurt the most are often those we love the most

Second Partner

Normal

RiskCover

1048000

1096000

1144000

1192000

1240000

1288000

1336000

1384000

1432000

1480000

1528000

1576000

1624000

1672000

1740000

1793000

1846000

1899000

1962000

2030000

2108000

0

Accidental

RiskCover

2048000

2096000

2144000

2192000

2240000

2288000

2336000

2384000

2432000

2480000

2528000

2576000

2624000

2672000

2740000

2793000

2846000

2899000

2962000

3030000

3108000

0

LIC OF INDIA - MANISH SHAH

INSURANCE ADVISOR

402, Rajendra Vihar, 12th Khetwadi Cross lane, Grant Road, Mumbai -4

Mobile No. : 9820934872 , Web : www.licglobal.com, Email. : sales@licglobal.com

Name: Mr Sachin Tendulkar

Date: 11/02/2013

Age: 30

Summary

Maximum Risk Cover (Normal) 1000000

Maximum Risk Cover (Accidental) 2000000

Total Premium Paid 1151934

Total Tax Saved u/s 80C 230391

NetPremium 921543

Returns (Maturity and Survival) 2108000

Compounded Value Of Returns 2108000

Additional Gain by Loan Recycling 0

Net Amount In Hand On 11/02/2034 2108000

Yield WithOut Tax Benefit 5.51

Yield With Tax Benefit 7.38

Breakup of Returns

Sum Assured & Survival's

Bonus

Final Additional Bonus

100000

1000000

1008000

100000

1000000

1008000

This Presentation is Prepared for Private Circulation only.

The greatest failure is the failure to try

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- English Diary 2019 PDFDokumen149 halamanEnglish Diary 2019 PDFVidya AdsuleBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- INSURANCE - Finals ReviewerDokumen6 halamanINSURANCE - Finals Reviewerkatreena ysabelle100% (8)

- Presentation On General InsuranceDokumen17 halamanPresentation On General InsuranceNishita ShahBelum ada peringkat

- C.H. Robinson Contract Addendum and Carrier Load Confirmation - #398513919Dokumen3 halamanC.H. Robinson Contract Addendum and Carrier Load Confirmation - #398513919даріна єленюкBelum ada peringkat

- The Bombay Environment Action Vs State of Maharashtra and Ors On 29 July 2015Dokumen23 halamanThe Bombay Environment Action Vs State of Maharashtra and Ors On 29 July 2015Vidya AdsuleBelum ada peringkat

- Note On GST For Builders and Developers CA Yashwant KasarDokumen30 halamanNote On GST For Builders and Developers CA Yashwant KasarVidya AdsuleBelum ada peringkat

- Metropolitan Region Development Authority: Dr. Amit Saini, District Collector, KolhapurDokumen24 halamanMetropolitan Region Development Authority: Dr. Amit Saini, District Collector, KolhapurVidya AdsuleBelum ada peringkat

- Vidya A PDFDokumen13 halamanVidya A PDFVidya AdsuleBelum ada peringkat

- DECLARATION Cum Indemnity - Shital MoreDokumen4 halamanDECLARATION Cum Indemnity - Shital MoreVidya AdsuleBelum ada peringkat

- 12 Chapter 6Dokumen67 halaman12 Chapter 6Vidya AdsuleBelum ada peringkat

- Family Law NotesDokumen18 halamanFamily Law NotesVidya Adsule67% (3)

- Deed Contents 2011Dokumen24 halamanDeed Contents 2011Vidya Adsule100% (1)

- 2016 Chief Legal Officer Survey: An Altman Weil Flash SurveyDokumen44 halaman2016 Chief Legal Officer Survey: An Altman Weil Flash SurveyVidya AdsuleBelum ada peringkat

- THIS AGREEMENT OF TRANSFER OF TENANCY Is Made at - OnDokumen3 halamanTHIS AGREEMENT OF TRANSFER OF TENANCY Is Made at - OnVidya AdsuleBelum ada peringkat

- EY Step Up To Ind AsDokumen35 halamanEY Step Up To Ind AsRakeshkargwalBelum ada peringkat

- India Business Law DirectoryDokumen41 halamanIndia Business Law DirectoryVidya AdsuleBelum ada peringkat

- EGovernance in Maharashtra 2013Dokumen206 halamanEGovernance in Maharashtra 2013Amit Chatterjee100% (1)

- Main File 1Dokumen348 halamanMain File 1Vidya Adsule67% (3)

- Central Government Act: Section 433 in The Companies Act, 1956Dokumen2 halamanCentral Government Act: Section 433 in The Companies Act, 1956Vidya AdsuleBelum ada peringkat

- Consumer RefDokumen5 halamanConsumer RefVidya Adsule0% (1)

- Summer Internship Project With Prudent Corporate Advisory Services LTD Comparison of Kotak Mahindra ULIP With Other Private Insurance PlayersDokumen40 halamanSummer Internship Project With Prudent Corporate Advisory Services LTD Comparison of Kotak Mahindra ULIP With Other Private Insurance Playersk3k.k3kBelum ada peringkat

- 1 Overview of Financial MarketsDokumen35 halaman1 Overview of Financial MarketsAiro RidhoBelum ada peringkat

- Bintang Haposan Persada - DC - CoalDokumen22 halamanBintang Haposan Persada - DC - CoalLydia ElviraBelum ada peringkat

- DirectoryDokumen52 halamanDirectoryNickBelum ada peringkat

- To 10,000 Taxpayers To Be Expanded To 20,000Dokumen1 halamanTo 10,000 Taxpayers To Be Expanded To 20,000macyaelBelum ada peringkat

- FaqsDokumen1 halamanFaqsAndy GambleBelum ada peringkat

- Dwnload Full Using Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Test Bank PDFDokumen36 halamanDwnload Full Using Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Test Bank PDFrosellesnidervip2936100% (8)

- Riders To CP Dona LibraDokumen3 halamanRiders To CP Dona Libra030160645Belum ada peringkat

- Digest 11Dokumen81 halamanDigest 11John Lester LantinBelum ada peringkat

- EDI Message TypesDokumen14 halamanEDI Message TypesZoltan KerekesBelum ada peringkat

- Pitmanshorthandw00harr BWDokumen228 halamanPitmanshorthandw00harr BWRakesh Thadiwal71% (7)

- MBNO658 Service Management: Assignment Top Ten Service Companies in The World Submitted BY D.Ragul 3511110622 'J'' SECDokumen5 halamanMBNO658 Service Management: Assignment Top Ten Service Companies in The World Submitted BY D.Ragul 3511110622 'J'' SECVishal PranavBelum ada peringkat

- Agreement For PropertyDokumen3 halamanAgreement For PropertyAshok HegdeBelum ada peringkat

- ISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedDokumen1 halamanISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedAnil SharmaBelum ada peringkat

- B-TACT Catalogue 2013Dokumen38 halamanB-TACT Catalogue 2013Chris BuysBelum ada peringkat

- Mizuho Bank (Malaysia) Berhad 201001039768 (923693-H) : RequestedDokumen2 halamanMizuho Bank (Malaysia) Berhad 201001039768 (923693-H) : RequestedThuận TrầnBelum ada peringkat

- QT Nil P 0281201503151442615Dokumen51 halamanQT Nil P 0281201503151442615Dinesh MuruganBelum ada peringkat

- Sales BedaDokumen37 halamanSales BedaAnthony Rupac EscasinasBelum ada peringkat

- Format - Issuance of Duplicate Cheque by MDIndiaDokumen3 halamanFormat - Issuance of Duplicate Cheque by MDIndiabasheer_vthuBelum ada peringkat

- 10 7959f 2 Fill - 012317Dokumen2 halaman10 7959f 2 Fill - 012317Princess Mae JaneaBelum ada peringkat

- Riverhead News-Review Classifieds and Service Directory: Jan 11., 2018Dokumen8 halamanRiverhead News-Review Classifieds and Service Directory: Jan 11., 2018TimesreviewBelum ada peringkat

- 2 (1) The Indian Stamp Act, 1899 (As Applicable To Uttrakhand)Dokumen106 halaman2 (1) The Indian Stamp Act, 1899 (As Applicable To Uttrakhand)Pooja Marilyn ThomasBelum ada peringkat

- Questions 34nosDokumen21 halamanQuestions 34nosAshish TomsBelum ada peringkat

- Heavenly Nails Business Plan: Heaven SmithDokumen13 halamanHeavenly Nails Business Plan: Heaven Smithapi-285956102Belum ada peringkat

- Marine Insurance: DefinitionsDokumen4 halamanMarine Insurance: DefinitionsRahat KhanBelum ada peringkat

- Unified Business Permit Application FormDokumen2 halamanUnified Business Permit Application FormCatherine Castro0% (1)

- HR Director OD in Michigan MI Resume Cynthia AllistonDokumen3 halamanHR Director OD in Michigan MI Resume Cynthia AllistonCynthiaAllistonBelum ada peringkat