Timeline of The Lehman Brothers Collapse

Diunggah oleh

Jonas Mondala0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

230 tayangan3 halaman.

Judul Asli

Timeline of the Lehman Brothers Collapse

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

230 tayangan3 halamanTimeline of The Lehman Brothers Collapse

Diunggah oleh

Jonas Mondala.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

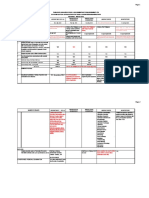

2003 2004 Lehman acquired five mortgage lenders, among which were

the subprime lender BNC mortgage and Aurora Loan Services,

known for its Alt-A Loans.

2004 2006 The firm experienced a great surge in business activities,

such as securitizing a $146 billion of mortgages in 2006, and

reported profits from 2005 2007. The firm reported profit of $4.2

billion on revenue of $19.3 billion.

February 2007 (First Quarter) Amidst a closing price of $86.18 and a

market capitalization of $60 billion, the company is experiencing

adverse conditions due to the increasing cracks in the U.S. housing

market.

March 14, 2007 The firm still recorded revenues and profits for the first

quarter. Lehmans CFO assured the public that the situation is under

control and that the subprime market is of no threat.

August 2007 The companys stocks fell sharply due to the failure of two

Bear Stearns hedge funds. The company eliminated 2,500

mortgage-related jobs and shut down its BNC unit. Lehman, in

response, underwrote ore mortgage-backed securities, accumulating

an $85 billion portfolio, which resulted in their stock prices rebound,

in addition to the favorable global market conditions.

March 17, 2008 Lehmans shares fell as much as 48% due to the nearcollapse of bear Sterns.

April 2008 Confidence in the company returned when they raised $4

billion through the issuance of convertible preferred stock, but the

stock resumed its decline when the hedge fund managers

questioned the valuation of Lehmans mortgage portfolio.

June 9 2008 Lehman sustained a second-quarter loss of $2.8 billion and

reported that it has raised another $6 billion from its investors.

During the year, the company tried to remedy the situation by

boosting its liquidity pool, decreasing gross assets to lower its

operating leverage.

September 9 2008 The stocks plunged 77%. Korea Development Bank

halted its intention to take a stake in the bank.

September 10, 2008 - Lehman pre-announced dismal fiscal third-quarter

results that underscored the fragility of its financial position. The firm

reported a loss of $3.9 billion, including a write-down of $5.6 billion,

and also announced a sweeping strategic restructuring of its

businesses.

September 11, 2008 The stocks led another 42% plunge in stock price

because of their credit standing reviews.

September 13, 2008 The firm has only $1 billion cash left, and tried to

have a last-ditch effort by coordinating with Barclay PLC and Bank of

America to have a takeover of Lehman, but to unfavorable results.

September 15, 2008 Lehman Brothers filed bankruptcy. The 4 th largest

investment banker in the world became one of the largest victims of

the U.S. subprime mortgage-induced financial crisis in 2008. Stock

prices plunged another 93% because of the said action/

Anda mungkin juga menyukai

- Lehman Brother FallDokumen3 halamanLehman Brother FallswetaBelum ada peringkat

- Lehman Brothers' Collapse and the 2008 Financial CrisisDokumen3 halamanLehman Brothers' Collapse and the 2008 Financial CrisisHitesh BachaniBelum ada peringkat

- A Case Study On The Lehman BrothersDokumen22 halamanA Case Study On The Lehman BrothersAnne Reyes100% (1)

- Lehman BrothersDokumen4 halamanLehman BrothersgopalushaBelum ada peringkat

- Shaheed Sukhdev College of Business Studies Report on Lehman Brothers BankruptcyDokumen28 halamanShaheed Sukhdev College of Business Studies Report on Lehman Brothers Bankruptcynavs_anandBelum ada peringkat

- Bankruptcy Worldcom Enron Subprime Mortgage: Who Is To Blame For The Subprime CrisisDokumen3 halamanBankruptcy Worldcom Enron Subprime Mortgage: Who Is To Blame For The Subprime Crisisrose30cherryBelum ada peringkat

- Case Study: The Collapse of Lehman Brothers: Bankruptcy Worldcom Enron Subprime MortgageDokumen4 halamanCase Study: The Collapse of Lehman Brothers: Bankruptcy Worldcom Enron Subprime Mortgageshinaru04Belum ada peringkat

- Lehman Brothers Case SummaryDokumen4 halamanLehman Brothers Case SummaryJevanBelum ada peringkat

- The History of Lehman BrothersDokumen6 halamanThe History of Lehman BrothersL A AnchetaSalvia DappananBelum ada peringkat

- Lehman Brothers Crash HistoryDokumen4 halamanLehman Brothers Crash HistoryAmit MishraBelum ada peringkat

- Finanace Assignment 1Dokumen13 halamanFinanace Assignment 1waelBelum ada peringkat

- Lehman Brothers BankruptcyDokumen3 halamanLehman Brothers BankruptcyAya KabBelum ada peringkat

- Rise and Fall of Lehman Brothers in 40 CharactersDokumen4 halamanRise and Fall of Lehman Brothers in 40 CharactersMuneer Hussain100% (1)

- Case Study The Collapse of Lehman BrotheDokumen4 halamanCase Study The Collapse of Lehman BrotheAnurag SarrafBelum ada peringkat

- Case Study of Lehman Brothers CollapseDokumen4 halamanCase Study of Lehman Brothers Collapsemukesh chhotala100% (1)

- The Last Days of Lehman BrothersDokumen19 halamanThe Last Days of Lehman BrothersSalman Mohammed ShirasBelum ada peringkat

- Case Study Lehman BrothersDokumen9 halamanCase Study Lehman BrothersAris Surya PutraBelum ada peringkat

- Becg Assingment On "Lehman Bankruptcy"Dokumen12 halamanBecg Assingment On "Lehman Bankruptcy"Sachin BabbiBelum ada peringkat

- What Is SUBPRIME?: SUBPRIME MORTGAGE - It Is The Mortgage For People With Shaky CreditDokumen35 halamanWhat Is SUBPRIME?: SUBPRIME MORTGAGE - It Is The Mortgage For People With Shaky CreditAliasgar SuratwalaBelum ada peringkat

- MANACC - Lehman Brothers History and CollapseDokumen13 halamanMANACC - Lehman Brothers History and CollapseChristian AribasBelum ada peringkat

- Bern Stern Case Study LiquidityDokumen6 halamanBern Stern Case Study LiquidityVina AdrianaBelum ada peringkat

- The Collapse of Lehman BrothersDokumen16 halamanThe Collapse of Lehman BrothersAkash BafnaBelum ada peringkat

- NDokumen6 halamanNAnonymous ZsGfRcvH2SBelum ada peringkat

- Lehman Brothers (Analysis) - FinalDokumen33 halamanLehman Brothers (Analysis) - FinalAhmed RefaatBelum ada peringkat

- Lehman Brothers: Ankit Purohit B.E. (ET&T) 4 Semester Section - A Bhilai Institute of TechnologyDokumen31 halamanLehman Brothers: Ankit Purohit B.E. (ET&T) 4 Semester Section - A Bhilai Institute of TechnologyAnkit PurohitBelum ada peringkat

- Failure of Lehman Brothers: Jitendra SoniDokumen4 halamanFailure of Lehman Brothers: Jitendra Sonijitu222soni3386Belum ada peringkat

- Case 3 Lehman BrothersDokumen19 halamanCase 3 Lehman BrothersYusuf UtomoBelum ada peringkat

- Perry Q2 LetterDokumen6 halamanPerry Q2 Lettermarketfolly.com100% (4)

- Bankruptcy of Lehman BrothersDokumen9 halamanBankruptcy of Lehman BrothershornzzBelum ada peringkat

- The Fall of Lehman BrothersDokumen5 halamanThe Fall of Lehman BrothersDr. Sanjeev KumarBelum ada peringkat

- The Story of Lehman Brothers: Nidhi Dalmia Mba Semester - I Section - A 1001563908 NiecDokumen27 halamanThe Story of Lehman Brothers: Nidhi Dalmia Mba Semester - I Section - A 1001563908 NiecAnthony RakotobeBelum ada peringkat

- Lehman ResearchDokumen7 halamanLehman ResearchFreya DaiBelum ada peringkat

- Lehman's Risky Real Estate Bets and Regulatory FailureDokumen2 halamanLehman's Risky Real Estate Bets and Regulatory Failureathirah jamaludinBelum ada peringkat

- Analysis of The Bank of America and FleetBoston MergerDokumen21 halamanAnalysis of The Bank of America and FleetBoston MergerAmar GanguBelum ada peringkat

- Lehman Brothers Holdings IncDokumen17 halamanLehman Brothers Holdings Incrachit1993Belum ada peringkat

- BMAN33000 Lehman Brothers Case PackDokumen9 halamanBMAN33000 Lehman Brothers Case Packpouria11Belum ada peringkat

- Lehman BrothersDokumen5 halamanLehman BrothersArslan_Gul_667Belum ada peringkat

- Case Study - Fall of Lehman BrothersDokumen29 halamanCase Study - Fall of Lehman Brotherskisan_compBelum ada peringkat

- The Four Factors that Heightened the Financial Crisis CollapseDokumen5 halamanThe Four Factors that Heightened the Financial Crisis CollapseDivyen PatelBelum ada peringkat

- Bankruptcy of Lehman BrothersDokumen12 halamanBankruptcy of Lehman Brothersavinash2coolBelum ada peringkat

- Bankruptcy of Lehman BrothersDokumen6 halamanBankruptcy of Lehman BrothersNickBelum ada peringkat

- Case Study Analysis Financial LeverageDokumen10 halamanCase Study Analysis Financial LeverageSarah Jane OrillosaBelum ada peringkat

- Written Statement of Richard S. Fuld, Jr. Before The Financial Crisis Inquiry CommissionDokumen8 halamanWritten Statement of Richard S. Fuld, Jr. Before The Financial Crisis Inquiry Commissionccomstock3459Belum ada peringkat

- Scandal FRAPPTDokumen31 halamanScandal FRAPPTUtkarsh SinghBelum ada peringkat

- Bankruptcy of Lehman BrothersDokumen12 halamanBankruptcy of Lehman BrothersMihir MehtaBelum ada peringkat

- Fall of Lehman Brothers: A Case of Unbridled Greed and Risky Mortgage BetsDokumen2 halamanFall of Lehman Brothers: A Case of Unbridled Greed and Risky Mortgage BetsPratik LaudBelum ada peringkat

- Lehman Brothers DownfallDokumen17 halamanLehman Brothers DownfallAli ImranBelum ada peringkat

- Lehman's Aggressive Repo 105 TransactionsDokumen19 halamanLehman's Aggressive Repo 105 Transactionsed_nycBelum ada peringkat

- Assignment-1 Collapsed Bank Lehman BrothersDokumen3 halamanAssignment-1 Collapsed Bank Lehman BrothersAditya SawantBelum ada peringkat

- Bankruptcy of Lehman Brothers Is TheDokumen11 halamanBankruptcy of Lehman Brothers Is Themanas_samantaray28Belum ada peringkat

- Corporate Governance Failures Led to Lehman Brothers BankruptcyDokumen18 halamanCorporate Governance Failures Led to Lehman Brothers BankruptcyAzhar AkhtarBelum ada peringkat

- Remadial Assignment FinalDokumen6 halamanRemadial Assignment FinalWael Al AridiBelum ada peringkat

- Lehman Brothers - Never Too Big To FailDokumen10 halamanLehman Brothers - Never Too Big To FailPredit SubbaBelum ada peringkat

- Global FInancial CrisisDokumen51 halamanGlobal FInancial CrisisRajesh Naidu0% (1)

- Lehman Brothers BankruptcyDokumen8 halamanLehman Brothers BankruptcyOmar EshanBelum ada peringkat

- FinTech Rising: Navigating the maze of US & EU regulationsDari EverandFinTech Rising: Navigating the maze of US & EU regulationsPenilaian: 5 dari 5 bintang5/5 (1)

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaDari EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaBelum ada peringkat

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyDari EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyBelum ada peringkat

- 30 Increment 52week Money ChallengeDokumen2 halaman30 Increment 52week Money ChallengeCaitlin BacallanBelum ada peringkat

- Battle of The Voices Season 3 Blind AuditioneesDokumen1 halamanBattle of The Voices Season 3 Blind AuditioneesJonas MondalaBelum ada peringkat

- Press ReleaaaaaaseDokumen2 halamanPress ReleaaaaaaseJonas MondalaBelum ada peringkat

- Sec 35 of NIRCDokumen1 halamanSec 35 of NIRCjonas_1229Belum ada peringkat

- CVDokumen5 halamanCVMuhammad AdityaBelum ada peringkat

- Rupaul WinnersDokumen1 halamanRupaul WinnersJonas MondalaBelum ada peringkat

- Sample BitchDokumen1 halamanSample BitchJonas MondalaBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Itinerary PDFDokumen5 halamanItinerary PDFJonas MondalaBelum ada peringkat

- Get A Grip, Get A Life, and Et Over ItDokumen1 halamanGet A Grip, Get A Life, and Et Over ItJonas MondalaBelum ada peringkat

- Transportation ExpensesDokumen9 halamanTransportation ExpensesJonas MondalaBelum ada peringkat

- Session 5 Capital BudgetingDokumen6 halamanSession 5 Capital BudgetingKevin PhamBelum ada peringkat

- Grab Receipt ADR-2335218-2-036Dokumen1 halamanGrab Receipt ADR-2335218-2-036Jonas MondalaBelum ada peringkat

- Date Time Charge CodeDokumen2 halamanDate Time Charge CodeJonas MondalaBelum ada peringkat

- Love Will Find A Way Chords TabDokumen2 halamanLove Will Find A Way Chords TabJonas MondalaBelum ada peringkat

- Kimi No NawaDokumen1 halamanKimi No NawaJonas MondalaBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- XXXXXXXDokumen17 halamanXXXXXXXJonas MondalaBelum ada peringkat

- Income Statement For MeatDokumen36 halamanIncome Statement For MeatJonas MondalaBelum ada peringkat

- Resume Mondala JonathanDokumen5 halamanResume Mondala JonathanJonas MondalaBelum ada peringkat

- MANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSDokumen7 halamanMANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSJonas MondalaBelum ada peringkat

- WORKING CAPITAL MANAGEMENT ADVISORY SERVICESDokumen9 halamanWORKING CAPITAL MANAGEMENT ADVISORY SERVICESJonas Mondala80% (5)

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- PRC List of RequirementsDokumen24 halamanPRC List of RequirementscharmainegoBelum ada peringkat

- XXXXXXXDokumen17 halamanXXXXXXXJonas MondalaBelum ada peringkat

- CCH Axcess Paperless and Data Rich White PaperDokumen6 halamanCCH Axcess Paperless and Data Rich White PaperJonas MondalaBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Letter For WalwalanDokumen1 halamanLetter For WalwalanJonas MondalaBelum ada peringkat

- Thomasian Resume FormatDokumen5 halamanThomasian Resume FormatJonas MondalaBelum ada peringkat

- Rachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaDokumen2 halamanRachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaJonas MondalaBelum ada peringkat

- CH 11Dokumen59 halamanCH 11Shubham GuptaBelum ada peringkat

- Toward A Theory of BusinessDokumen27 halamanToward A Theory of BusinessMuhammed Dursun ErdemBelum ada peringkat

- Insulation HandbookDokumen8 halamanInsulation HandbookSanket PujariBelum ada peringkat

- Effect of Global Financial Meltdown on NigeriaDokumen13 halamanEffect of Global Financial Meltdown on NigeriaMorrison Omokiniovo Jessa SnrBelum ada peringkat

- Dictionary of The History of Ideas CrisisDokumen41 halamanDictionary of The History of Ideas CrisisThais GonçalvesBelum ada peringkat

- Managing Sino American Crises: Case Studies and AnalysisDokumen535 halamanManaging Sino American Crises: Case Studies and AnalysisCarnegie Endowment for International Peace100% (3)

- Annual Report Hornbach PDFDokumen164 halamanAnnual Report Hornbach PDFDritero JashariBelum ada peringkat

- The Open Economy Revisited: The Mundell-Fleming Model and The Exchange-Rate RegimeDokumen44 halamanThe Open Economy Revisited: The Mundell-Fleming Model and The Exchange-Rate RegimeOğuz GülsünBelum ada peringkat

- Case DescriptionDokumen6 halamanCase DescriptionNamra ZaheerBelum ada peringkat

- Cushman & Wakefield - Office Space Across The WorldDokumen29 halamanCushman & Wakefield - Office Space Across The Worlddnigri7509Belum ada peringkat

- Impact of US Subprime Mortgage Crisis on Indonesian Sharia Banking 2006-2009Dokumen13 halamanImpact of US Subprime Mortgage Crisis on Indonesian Sharia Banking 2006-2009pasman caniagoBelum ada peringkat

- BCG-How To Address HR Challenges in Recession PDFDokumen16 halamanBCG-How To Address HR Challenges in Recession PDFAnkit SinghalBelum ada peringkat

- BASELpap 52Dokumen402 halamanBASELpap 52sdhakal89Belum ada peringkat

- Effect of Basel III On Indian BanksDokumen52 halamanEffect of Basel III On Indian BanksSargam Mehta50% (2)

- China Property CollapseDokumen9 halamanChina Property Collapseel_generalBelum ada peringkat

- Strange Parallels Southeast Asia in Global Context, C. 800-1830Dokumen1 halamanStrange Parallels Southeast Asia in Global Context, C. 800-1830insightsxBelum ada peringkat

- Continuing Higher Education News InformationDokumen12 halamanContinuing Higher Education News InformationSayani BhattacharyaBelum ada peringkat

- PDFDokumen29 halamanPDFAmil AjithBelum ada peringkat

- Stock Market Crash and BoomDokumen5 halamanStock Market Crash and Boomveda sai kiranmayee rasagna somaraju AP22322130023Belum ada peringkat

- Skills Needed and Develop in Social AdvocacyDokumen8 halamanSkills Needed and Develop in Social AdvocacyRozina ImtiazBelum ada peringkat

- Share Prices8Dokumen1 halamanShare Prices8AsifNoorBelum ada peringkat

- U.S Recession and Its Impact On Indian EconomyDokumen45 halamanU.S Recession and Its Impact On Indian EconomyAbhishek RampalBelum ada peringkat

- Summary of Macroeconomic Performance of Bangladesh (Dummy Final)Dokumen38 halamanSummary of Macroeconomic Performance of Bangladesh (Dummy Final)h_sadman9100% (1)

- The Nuclear Energy OptionDokumen185 halamanThe Nuclear Energy Optionagusdn21100% (1)

- Nordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Dokumen7 halamanNordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Glenn ViklundBelum ada peringkat

- Mortgage Rates 10-24-2007Dokumen1 halamanMortgage Rates 10-24-2007ConsumerMortgageReports100% (1)

- EcoSurvey 20130905024213 PDFDokumen520 halamanEcoSurvey 20130905024213 PDFyingoluBelum ada peringkat

- The Painful Reality of Adrenaline Addiction in LeadersDokumen4 halamanThe Painful Reality of Adrenaline Addiction in LeadersФилип МладеновићBelum ada peringkat

- Inflation & Its Impact On Pakistan EconomyDokumen25 halamanInflation & Its Impact On Pakistan EconomyMuhammadHammadBelum ada peringkat

- A Less Perfect Union Europe After The Greek Debt Crisis PDFDokumen3 halamanA Less Perfect Union Europe After The Greek Debt Crisis PDFEl JuancezBelum ada peringkat