Continental Carriers

Diunggah oleh

Vishwas NandanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Continental Carriers

Diunggah oleh

Vishwas NandanHak Cipta:

Format Tersedia

Group-2, (Dimple Yadav pgp30310, Kanika Aneja pgp30312, Khu

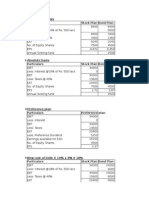

Not considering sinking fund deduction

Figures in $ '000

EBIT

Less: Interest @10% of $ 50 M

EBT

Less: Taxes @ 40%

EAT

No. of Equity Shares

EPS

Mkt value of equity

Book value of equity

ROE (Mkt value of equity)

ROE (Book value of equity)

Stock Plan

Bond Plan

34,000

34,000

0

5,000

34,000

29,000

13,600

11,600

20,400

17,400

7,500

4,500

2.72

3.87

125,625

75,375

336,833

202,100

16.2%

23.1%

6.1%

8.6%

Considering sinking fund deduction

Figures in $ '000

EBIT

Less: Interest @10% of $ 50 M

EBT

Less: Taxes @ 40%

Less : Sinking Fund

EAT

No. of Equity Shares

EPS

Mkt value of equity

Book value of equity

ROE (Mkt value of equity)

ROE (Book value of equity)

Stock Plan

Bond Plan

34,000

34,000

0

5,000

34,000

29,000

13,600

11,600

2,500

20,400

14,900

7,500

4,500

2.72

3.31

125,625

75,375

336,833

202,100

16.2%

19.8%

6.1%

7.4%

cost of debt (interest + sinking fund)

Total cost in %

Preference shares

Figures in $ '000

EBIT

Less: Interest

EBT

Less: Taxes

EAT

Less: Preference Dividend

9,167

18.3%

34,000

0

34,000

13,600

20,400

5,250 $10.5/ share and 500,00

Earnings available for equity shareholders

No. of Equity Shares

EPS

Mkt value of equity

Book value of equity

ROE (Mkt value of equity)

ROE (Book value of equity)

Book Value

EBIT

Less: Interest

EBT

Less: Taxes @ 40%

EAT

No. of Equity Shares

EPS

Book value of equity @ $45/share

ROE

15,150

4,500

3.37

75,375

202,100

20.1%

7.5%

34,000

34,000

13,600

20,400

5,611

3.64

252,001

8.1%

Continental Carriers

neja pgp30312, Khushbu Bhartiya pgp30315, Nidhi Verma pgp30322, Vishwas R pgp30353)

Market value per share

Book value per share

16.75

44.91 Stockholder's equity (in Balance sheet)/No.o

Breakeven point

EPS

1

EBIT

12,500

Equity financed

Debt financed

Equating EPS to find break-even point

EBIT(1-T) / 7500

=

{(EBIT - Int )*(1-t)}/4500

Leverage is favourable from EBIT $12.5 million onwards

Breakeven point

EPS

1.83

EBIT

22,916

Equity financed

Debt financed

Equating EPS to find break-even point

EBIT(1-T) / 7500

=

[{(EBIT - Int )*(1-t)} - Sinking Fund]/4500

Leverage is favourable from EBIT $22.9 million onwards. Below $22.9 m EBIT , EPS highe

0.5/ share and 500,000 shares

pgp30322, Vishwas R pgp30353)

tockholder's equity (in Balance sheet)/No.of shares outstanding

)*(1-t)}/4500

on onwards

)*(1-t)} - Sinking Fund]/4500

on onwards. Below $22.9 m EBIT , EPS higher for equity finance (stock) plan .

Anda mungkin juga menyukai

- Continental Carriers financing options analysisDokumen11 halamanContinental Carriers financing options analysisNatalie E Wilson100% (3)

- Continental Carriers Case AnalysisDokumen2 halamanContinental Carriers Case AnalysisCharlene100% (3)

- Dividend Decision at Linear TechnologyDokumen8 halamanDividend Decision at Linear TechnologyNikhilaBelum ada peringkat

- Joint Cost SignatronDokumen8 halamanJoint Cost SignatronGloryBelum ada peringkat

- Loewen Group CaseDokumen2 halamanLoewen Group CaseSu_NeilBelum ada peringkat

- OM Scott Case AnalysisDokumen20 halamanOM Scott Case AnalysissushilkhannaBelum ada peringkat

- Case BBBYDokumen7 halamanCase BBBYgregordejong100% (1)

- Case Study Debt Policy Ust IncDokumen10 halamanCase Study Debt Policy Ust IncWill Tan80% (5)

- BKI's Capital Structure and Payout PoliciesDokumen4 halamanBKI's Capital Structure and Payout Policieschintan MehtaBelum ada peringkat

- Deluxe Corporation's Debt Policy AssessmentDokumen7 halamanDeluxe Corporation's Debt Policy Assessmentankur.mastBelum ada peringkat

- Stuart Daw questions costing approach transaction basisDokumen2 halamanStuart Daw questions costing approach transaction basisMike ChhabraBelum ada peringkat

- Continental Carriers IncDokumen3 halamanContinental Carriers IncEnrique Garcia25% (4)

- Finance Case - Blaine Kitchenware - GRP - 11Dokumen4 halamanFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- Continental Carriers, Inc.: Suggested Questions For Class DiscussionDokumen2 halamanContinental Carriers, Inc.: Suggested Questions For Class DiscussionVidya Sagar Kona0% (1)

- Case: Blaine Kitchenware, IncDokumen5 halamanCase: Blaine Kitchenware, IncWilliam NgBelum ada peringkat

- Continental CarriersDokumen8 halamanContinental CarriersYaser Al-Torairi100% (3)

- Airthread DCF Vs ApvDokumen6 halamanAirthread DCF Vs Apvapi-239586293Belum ada peringkat

- Airthread Connections Case Work SheetDokumen45 halamanAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Updated Stone Container PaperDokumen6 halamanUpdated Stone Container Paperonetime699100% (1)

- JKhoggesDokumen6 halamanJKhoggesDegrace NsBelum ada peringkat

- Continental Carriers Debt vs EquityDokumen10 halamanContinental Carriers Debt vs Equitynipun9143Belum ada peringkat

- Continental CarriersDokumen2 halamanContinental Carrierschch917100% (1)

- Continental CarriersDokumen4 halamanContinental CarriersNIkhil100% (2)

- Continental CarrierDokumen10 halamanContinental CarrierYetunde James100% (1)

- Blaine Kitchenware IncDokumen4 halamanBlaine Kitchenware IncUmair ahmedBelum ada peringkat

- Jones Electrical DistributionDokumen4 halamanJones Electrical Distributioncagc333Belum ada peringkat

- Dividend Policy at Linear TechnologyDokumen9 halamanDividend Policy at Linear TechnologySAHILBelum ada peringkat

- Hospital Corporation Of America Maintains A RatingDokumen16 halamanHospital Corporation Of America Maintains A RatingDhruv Kalia50% (2)

- SpyderDokumen3 halamanSpyderHello100% (1)

- Debt Policy at Ust IncDokumen18 halamanDebt Policy at Ust InctutenkhamenBelum ada peringkat

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDokumen2 halamanMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7Belum ada peringkat

- case-UST IncDokumen10 halamancase-UST Incnipun9143Belum ada peringkat

- Hampton Machine Tool CompanyDokumen2 halamanHampton Machine Tool CompanySam Sheehan100% (1)

- HAMPTON MACHINE TOOL Case - PresentationDokumen7 halamanHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Dokumen6 halamanAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Glaxo ItaliaDokumen11 halamanGlaxo ItaliaLizeth RamirezBelum ada peringkat

- UST IncDokumen16 halamanUST IncNur 'AtiqahBelum ada peringkat

- Case Background: Kaustav Dey B18088Dokumen9 halamanCase Background: Kaustav Dey B18088Kaustav DeyBelum ada peringkat

- LinearDokumen6 halamanLinearjackedup211Belum ada peringkat

- Airthread ValuationDokumen19 halamanAirthread Valuation45ss28Belum ada peringkat

- American Home Products CorporationDokumen7 halamanAmerican Home Products Corporationpancaspe100% (2)

- Case Study CCI11Dokumen11 halamanCase Study CCI11Jennifer Bello AraquelBelum ada peringkat

- Financial analysis of company shares and earningsDokumen1 halamanFinancial analysis of company shares and earningsRoderick Jackson JrBelum ada peringkat

- Marriott Cost of Capital Analysis for Lodging DivisionDokumen3 halamanMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoBelum ada peringkat

- Case Study On Tottenham Hotspur PLCDokumen5 halamanCase Study On Tottenham Hotspur PLCClaudia CarrascoBelum ada peringkat

- Massey Ferguson CaseDokumen6 halamanMassey Ferguson CaseMeraSultan100% (1)

- AirThread Valuation SheetDokumen11 halamanAirThread Valuation SheetAngsuman BhanjdeoBelum ada peringkat

- Frequent FliersDokumen4 halamanFrequent Fliersarchit_shrivast908467% (3)

- Should Industrial Grinders Produce Plastic RingsDokumen6 halamanShould Industrial Grinders Produce Plastic RingsCarrie Stevens100% (1)

- Financial analysis of American Chemical Corporation plant acquisitionDokumen9 halamanFinancial analysis of American Chemical Corporation plant acquisitionBenBelum ada peringkat

- Destin Brass FinalDokumen10 halamanDestin Brass FinalKim Garver100% (2)

- FM Problem SolvingDokumen31 halamanFM Problem SolvingAbhishek Jaiswal100% (1)

- Cedro Bsa41kb2Dokumen12 halamanCedro Bsa41kb2Leah Hope CedroBelum ada peringkat

- Complete Equity Method Workpaper Entries - Year 2010Dokumen14 halamanComplete Equity Method Workpaper Entries - Year 2010jeankoplerBelum ada peringkat

- Complex capital structure EPS calculationDokumen1 halamanComplex capital structure EPS calculationSivakumar KanchirajuBelum ada peringkat

- Continental Carrier Abhishek Singh Pgp30006Dokumen4 halamanContinental Carrier Abhishek Singh Pgp30006Abhishek SinghBelum ada peringkat

- Maximizing EPS for ABC Ltd's new factoryDokumen4 halamanMaximizing EPS for ABC Ltd's new factoryAtulit AgarwalBelum ada peringkat

- Dividend Policy - Residual Decision Policy (All Amount Is in Thousand)Dokumen5 halamanDividend Policy - Residual Decision Policy (All Amount Is in Thousand)UmairIUGCBelum ada peringkat

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDokumen8 halamanExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryBelum ada peringkat

- To Receive Advanced Notification of Performance Bond (Margin) Changes, Through Our Free Automated Mailing List, Go ToDokumen56 halamanTo Receive Advanced Notification of Performance Bond (Margin) Changes, Through Our Free Automated Mailing List, Go ToZerohedgeBelum ada peringkat